What Everybody Ought To Know About Income Statement Balance Sheet Of Cash Flows

F06b4a6b8259432cbb26d7e41c409b1e) learning outcomes by the end of this section, you will be able to:

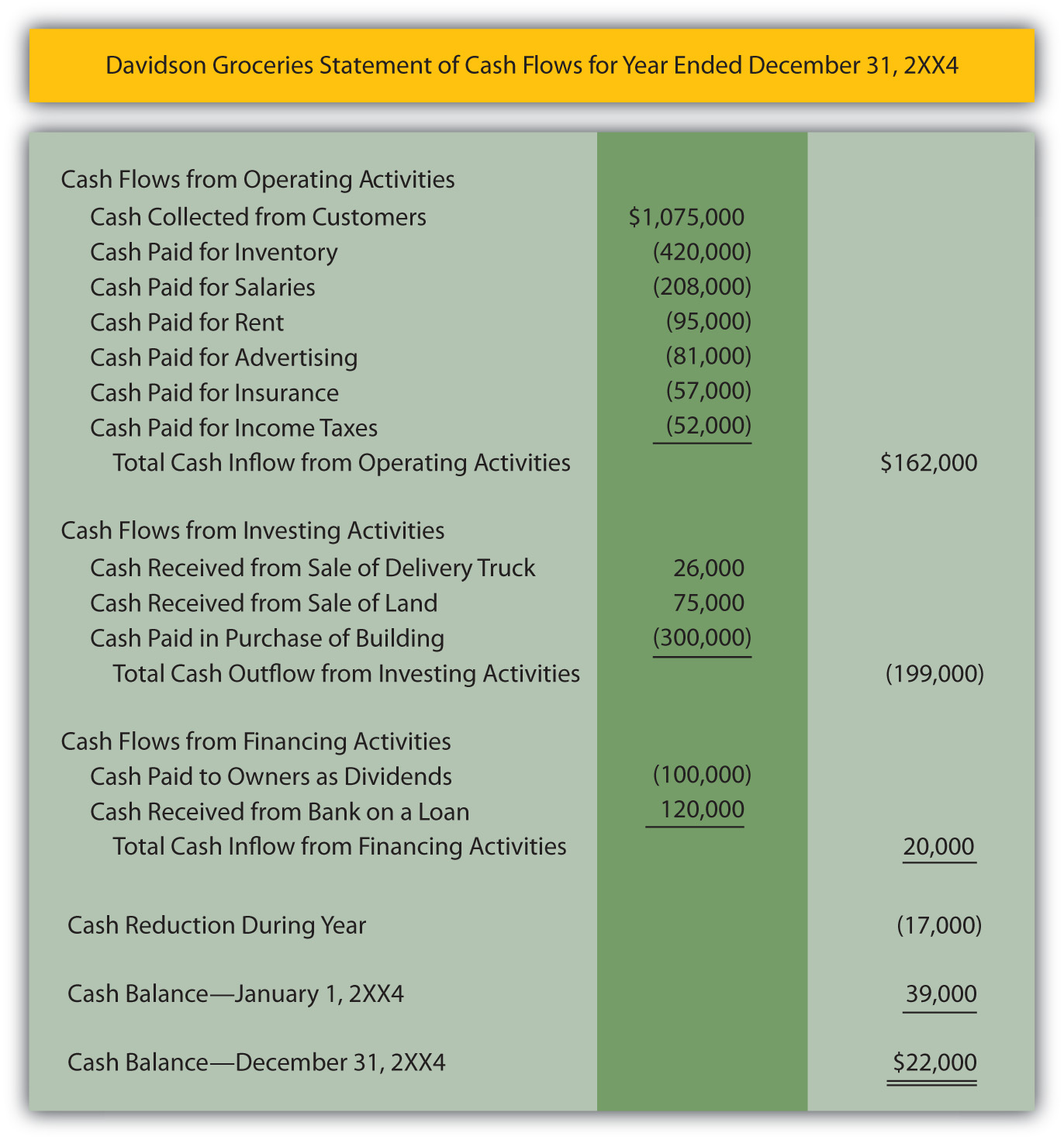

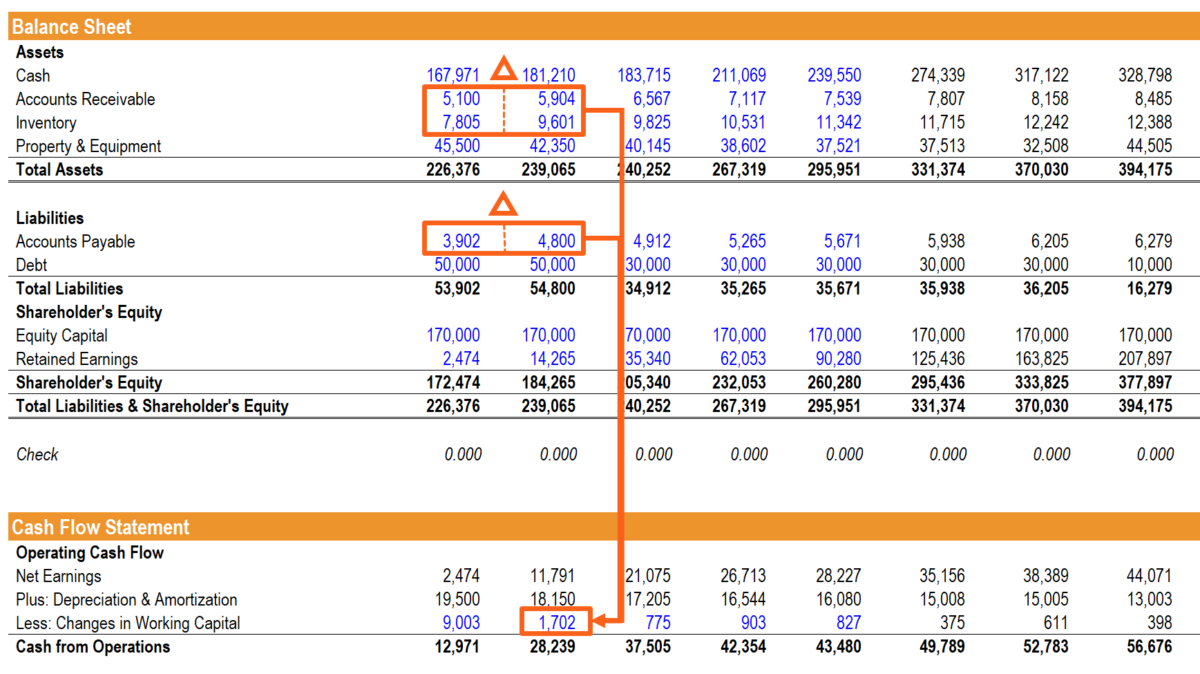

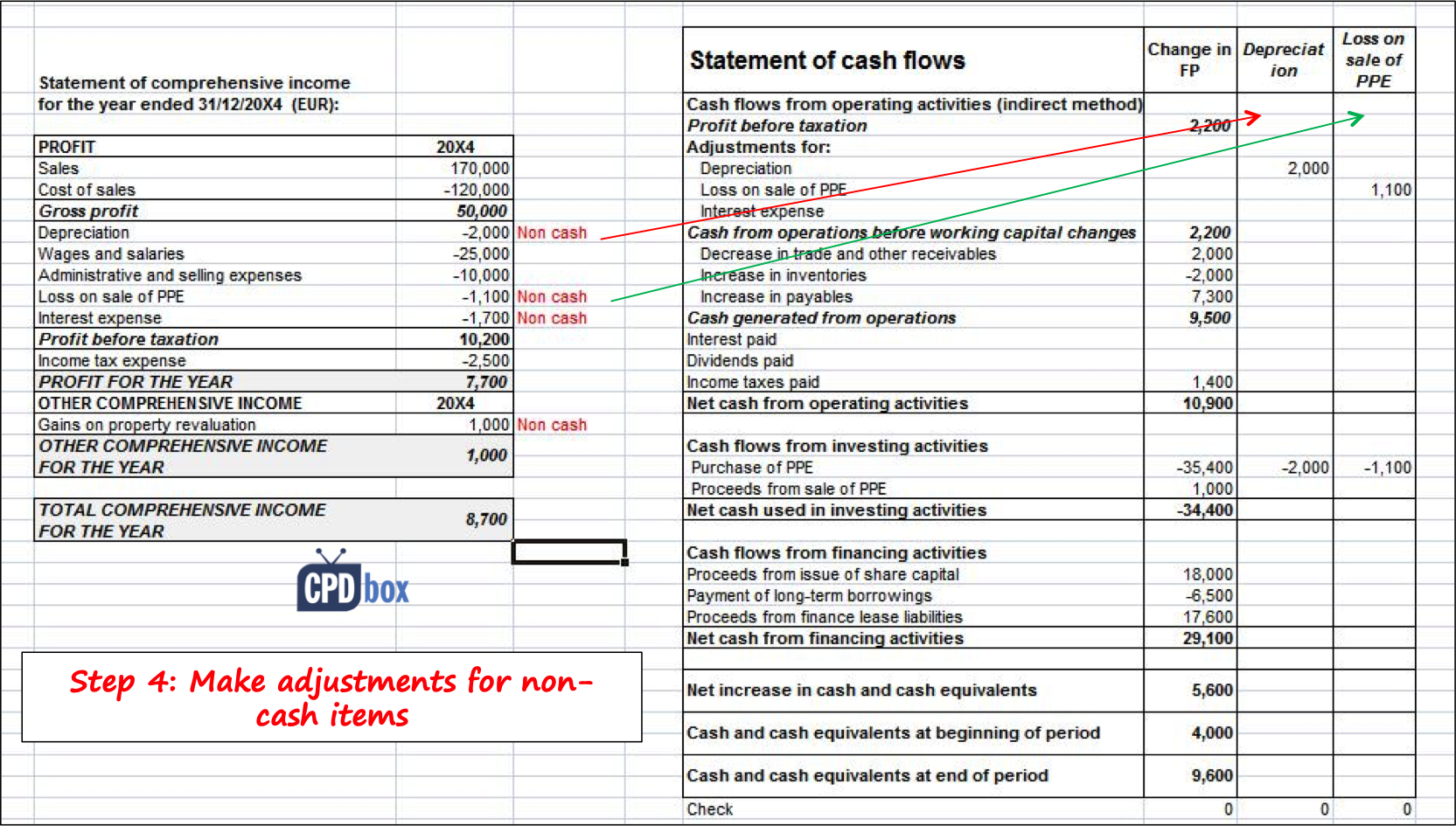

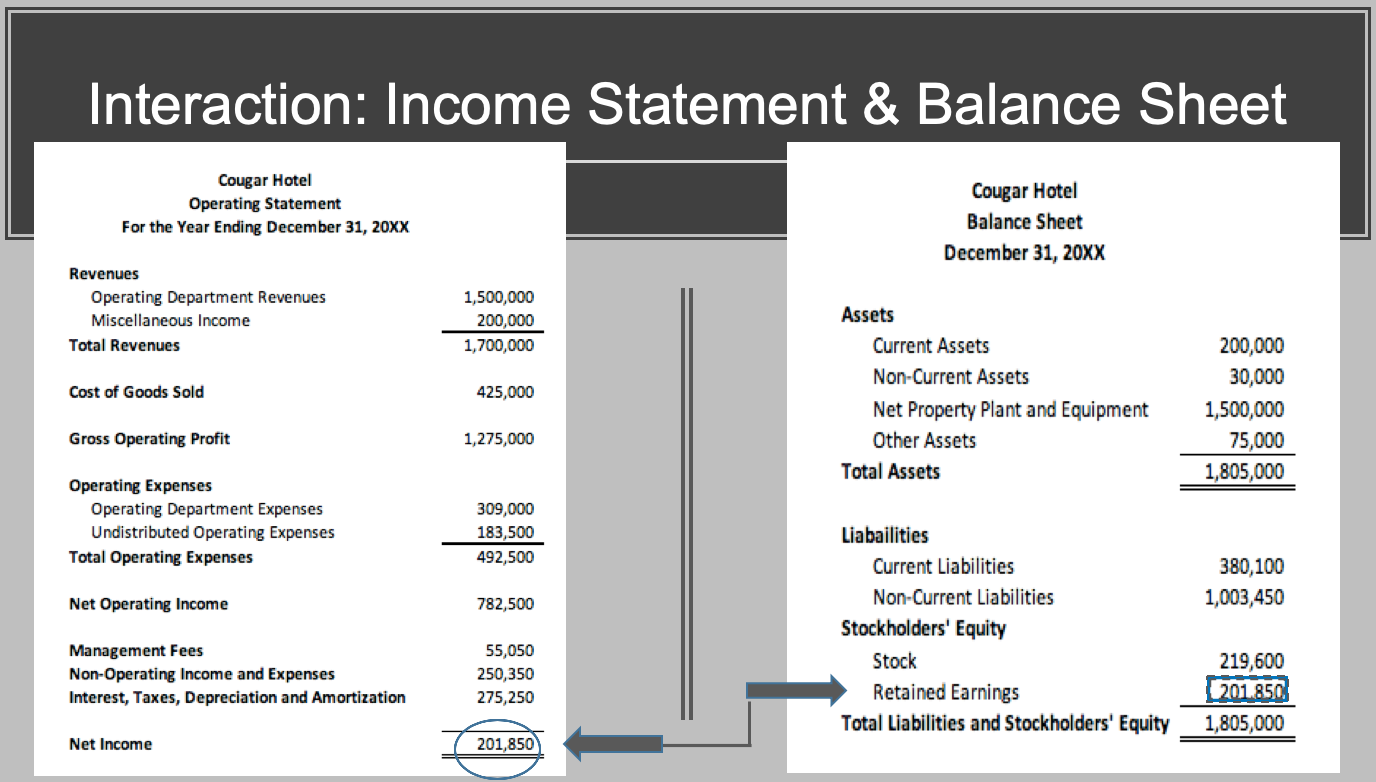

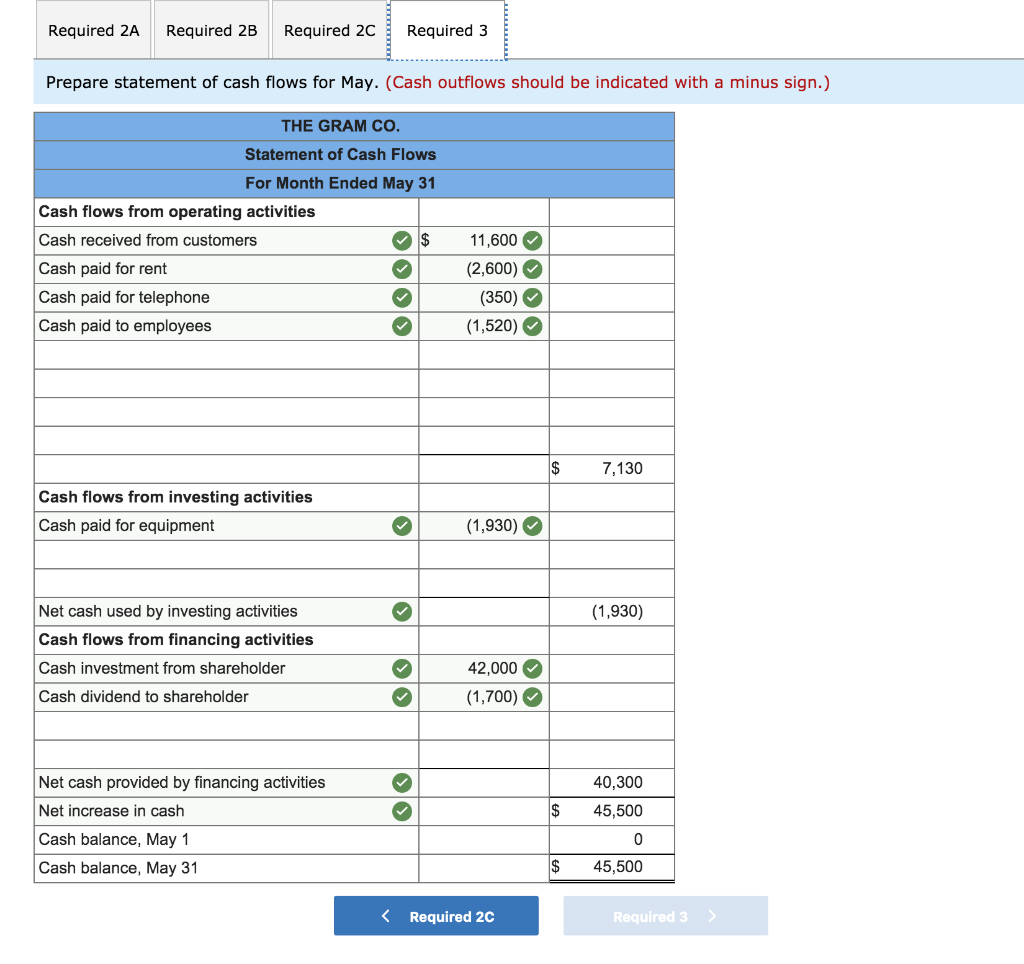

Income statement balance sheet statement of cash flows. Make sure to include all necessary financial documents and reports. We started with the account balances shown in figure 2.10. The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how cash moved in and out of the business.

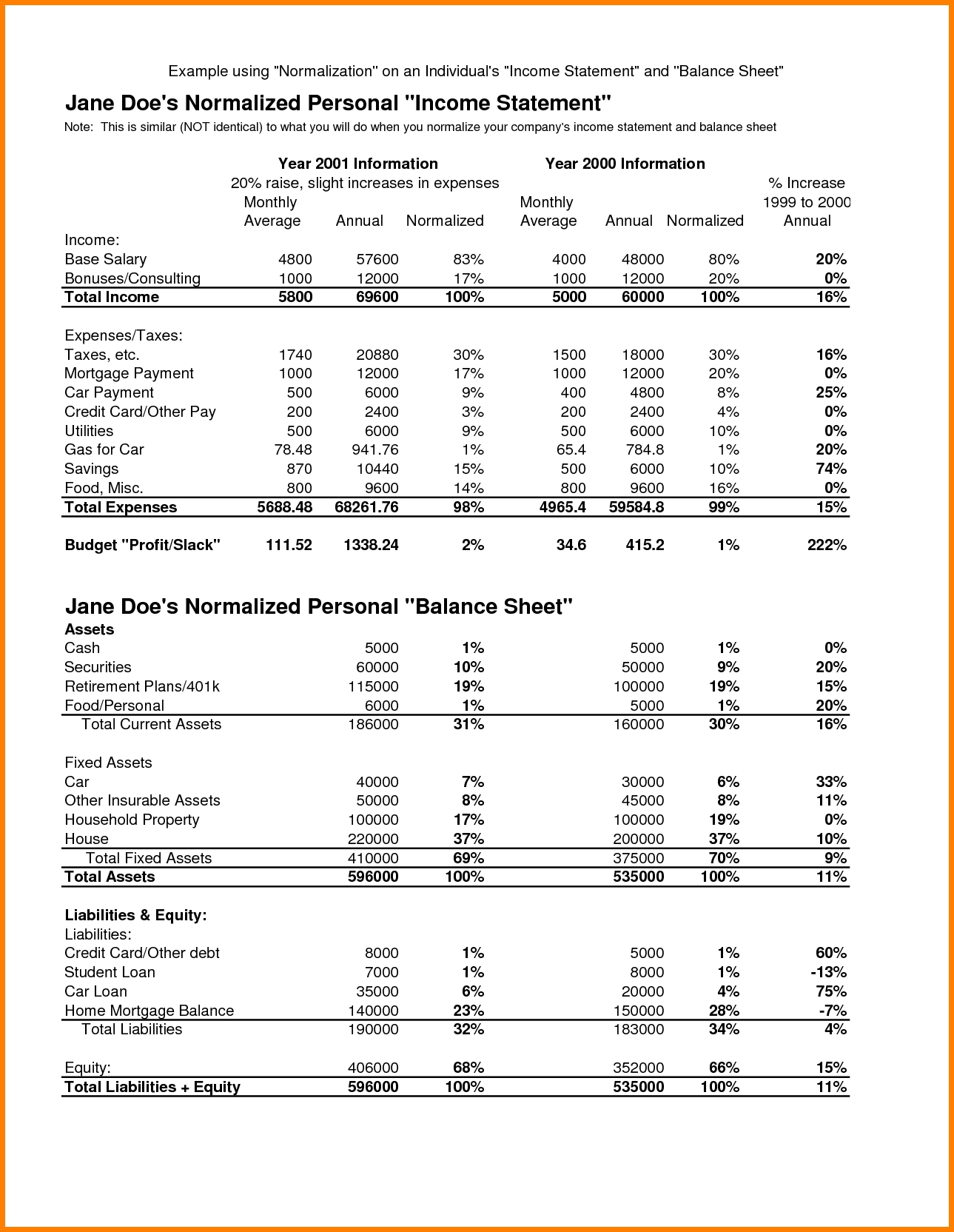

The income statement reflects earnings and profitability, the balance sheet showcases the financial position at a specific time, and the cash flow statement tracks cash movement over a period. Another way to think of the connection between the income statement and balance sheet (which is aided by the statement of owner’s equity) is by using a sports analogy. In accounting and finance, the cash flow statement (cfs), or “statement of cash flows,” matters because the financial statement reconciles the shortcomings of the reporting standards established.

(1) the income statement, (2) the balance sheet, and (3) the cash flow statement. The cash flow statement is linked to the income statement by net profit or net loss, which. Please briefly describe an income statement, statement of cash flows, and balance sheet.

Cash flow tracks the movement of money, whether incoming or outgoing, during a period. This task is crucial as it forms the foundation for the entire process. The three financial statements are:

Balance sheet, and statement of cash flows. The income statement illustrates the profitability of a company under accrual accounting rules. The statement of cash flows reports cash inflows and/or cash outflows in each of three sections:

Income statements and balance sheets provide information for the cash flow statement. A balance sheet shows a company's financial position in terms of how many assets it has, as opposed to liabilities. Figure 2.10 account balances for cheesy chuck’s classic corn.

Please describe the five types of financial ratio analyses, give two examples of each from each type, and. Identify the structure and key elements of the statement of cash flows. It is built based on the information recorded on your income statement and your balance sheet, which is why it’s important to understand those financial documents, too.

These statements, interconnected, provide a holistic view of a company's performance. The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. The cash flow statement shows how well a company manages cash to fund operations and any expansion efforts.

The final financial statement is the statement of cash flows. An inflow occurs when cash is paid to a business. This article will provide a quick overview of the.

7.2.2 cash inflows and outflows. The cash flow statement (cfs), along with the income statement and balance sheet, represent the three core financial statements. Lawn mowing revenue, gas expense, advertising expense, depreciation expense (equipment), supplies expense, and salaries expense.