Awe-Inspiring Examples Of Info About Statement Of Changes In Equity Formula

Written by last editedjul 2021 — 2 min read what is a statement of changes in equity?

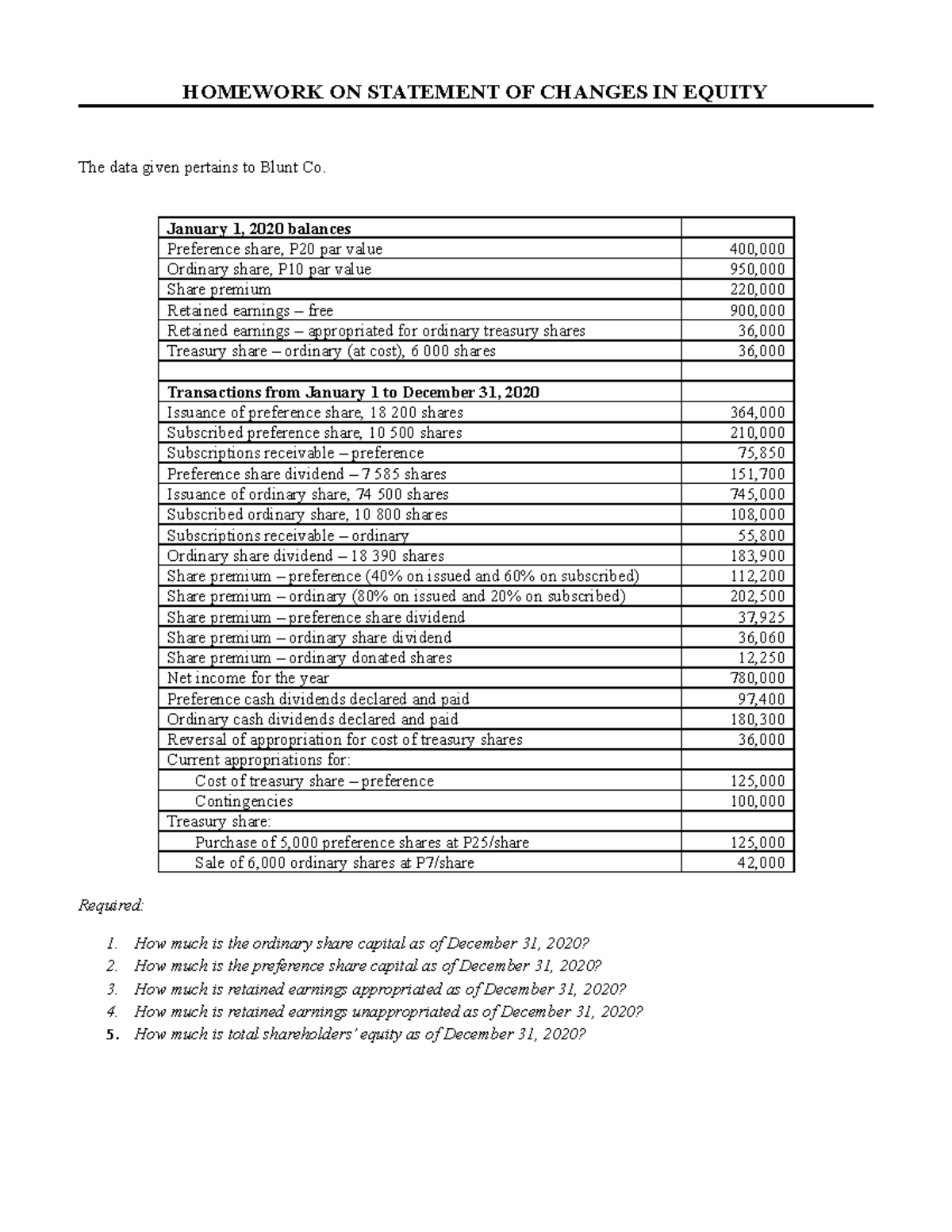

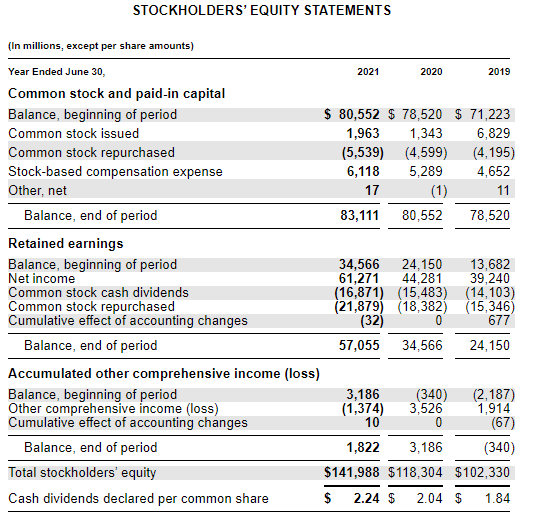

Statement of changes in equity formula. Ending retained earnings = beginning retained earnings − dividends paid + net income this equation is necessary to use to find the profit before tax to use in the cash flow statement under operating activities when using the indirect method. This typically includes changes to share capital, reserves, and retained earnings. Contents of the statement of changes in equity.

Rate of change is exactly what it sounds like: How quickly (or slowly) something changes over time. Financial statements report financial data;

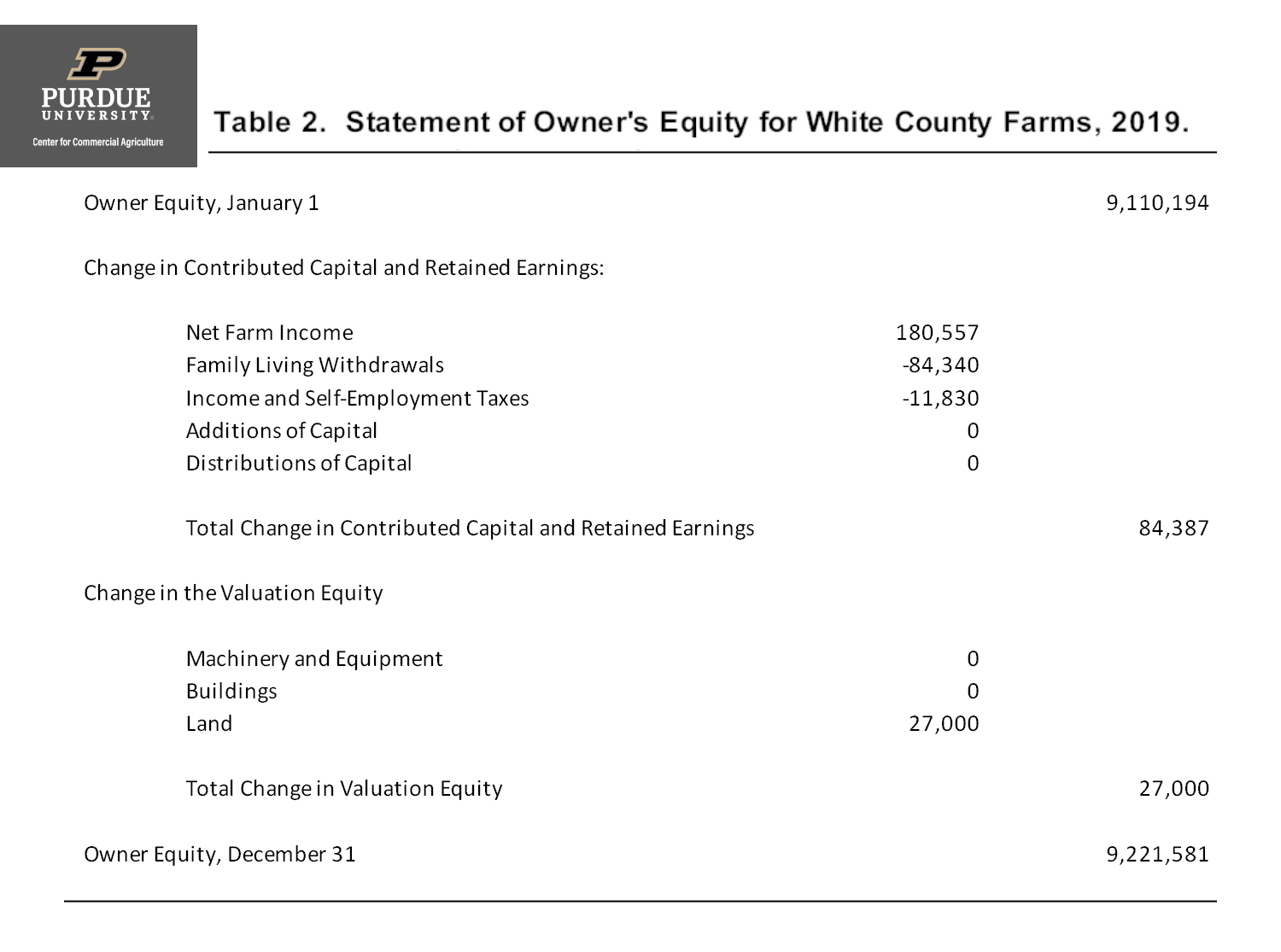

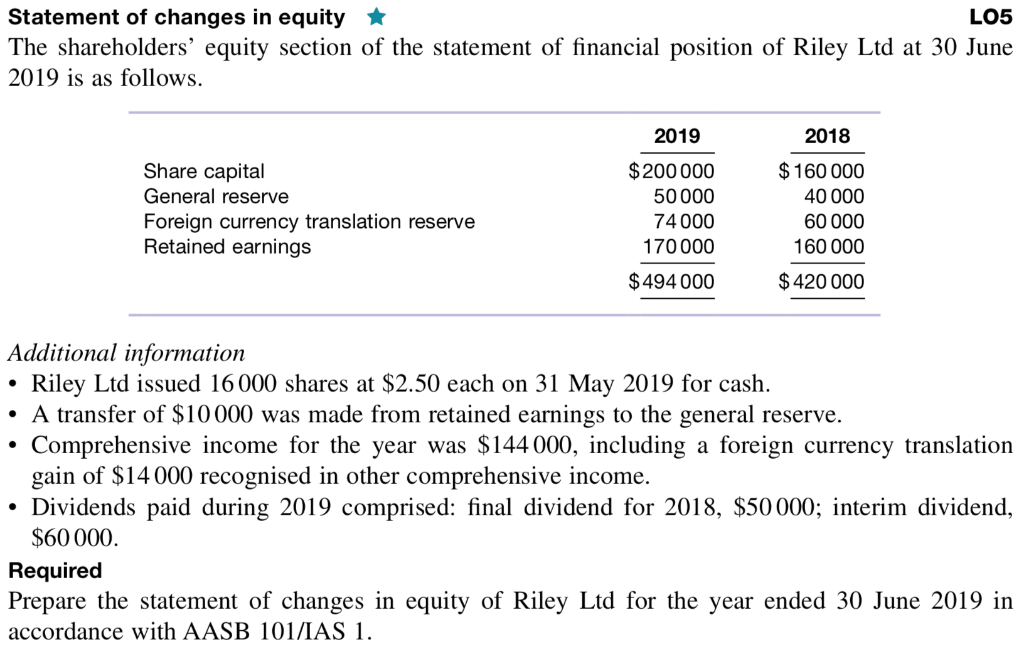

Regular and accurate reporting is crucial to maintaining good financial health. Statement of changes in equity is the reconciliation between the opening balance and closing balance of shareholder’s equity. For ifrs companies, each account from the equity section of the sfp is to be reported in the statement of changes in equity.

In this regard, the statement of changes in equity can be calculated using the following formula: When a new york judge delivers a final ruling in donald j. Shareholders equity movement over an accounting period are as follows:

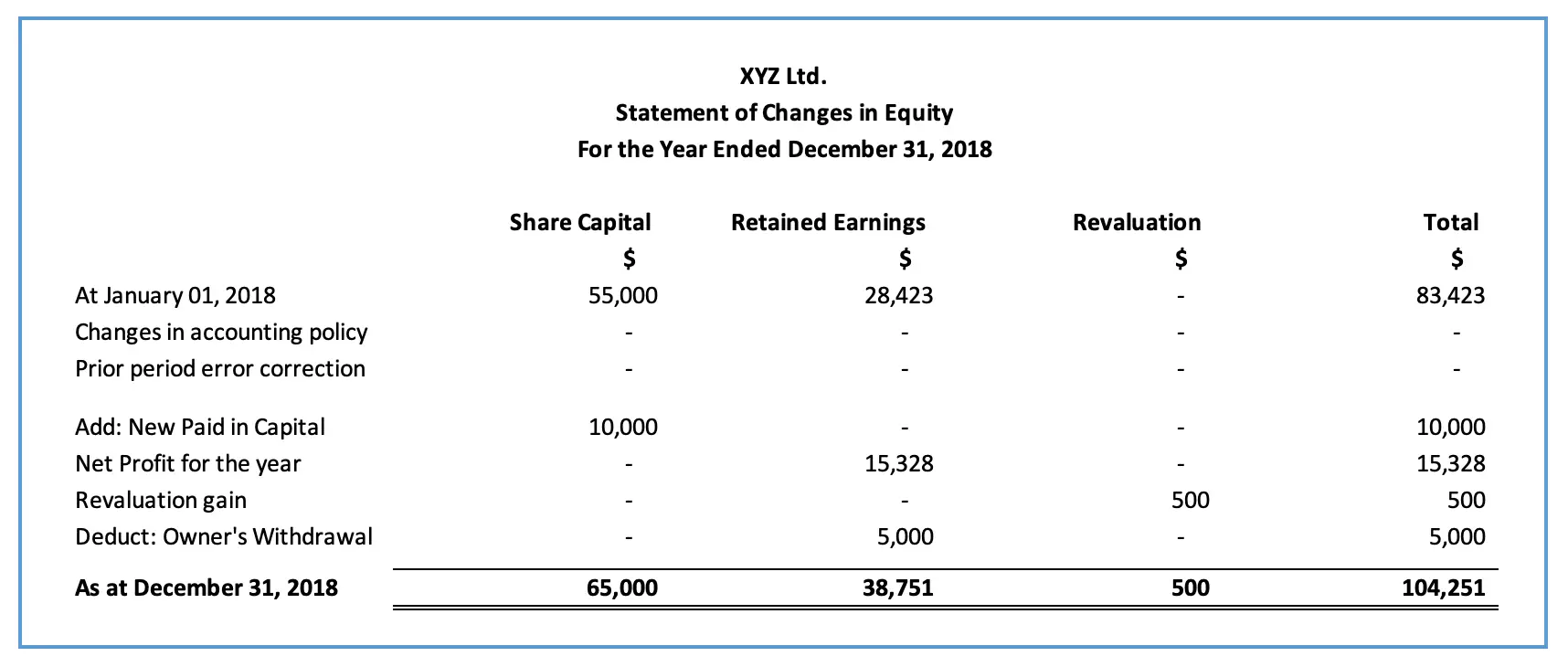

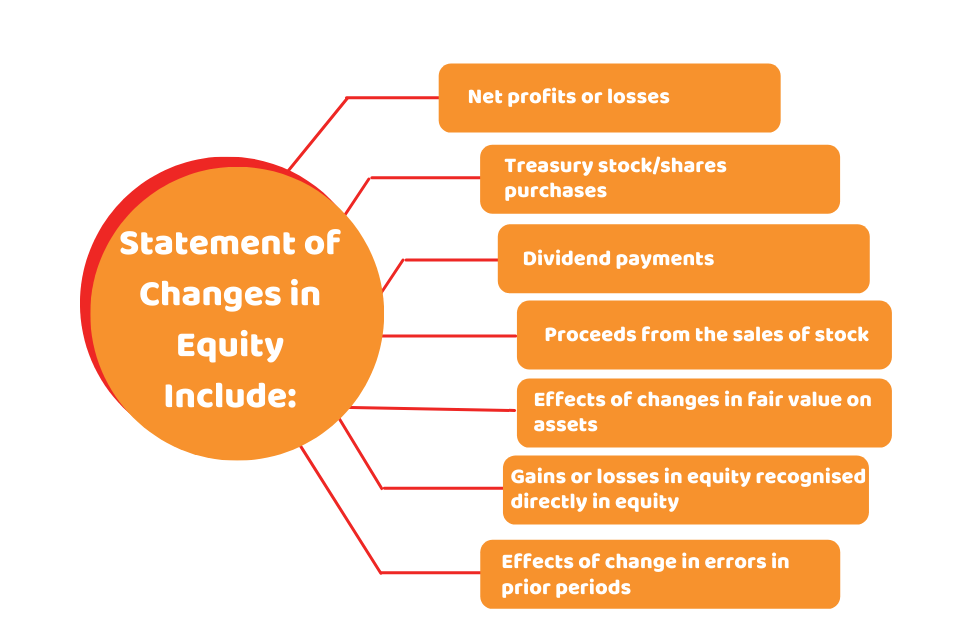

The general equation can be expressed as following: Statement of changes in equity, often referred to as statement of retained earnings in u.s. The formula for a statement of changes in equity includes the opening and closing value of the equity, net income for the year, dividends paid, and other changes.

Creating a statement of changes in equity amanda white. According to ias, the statement must include: In this step, you will need to find out the value of the company’s equity, which was available at the start of the financial period.

3.6 analysis of statement of income and statement of changes in equity financial statement analysis is an evaluative process of determining the past, current, and projected performance of a company. Statement of changes in equity. Gaap, details the change in owners' equity over an accounting period by presenting the movement in reserves comprising the shareholders' equity.

In this lesson we will explore the statement of changes. Net profit or loss after tax during the income year attributable to shareholders. Therefore in broad terms, assets minus liabilities equal equity.

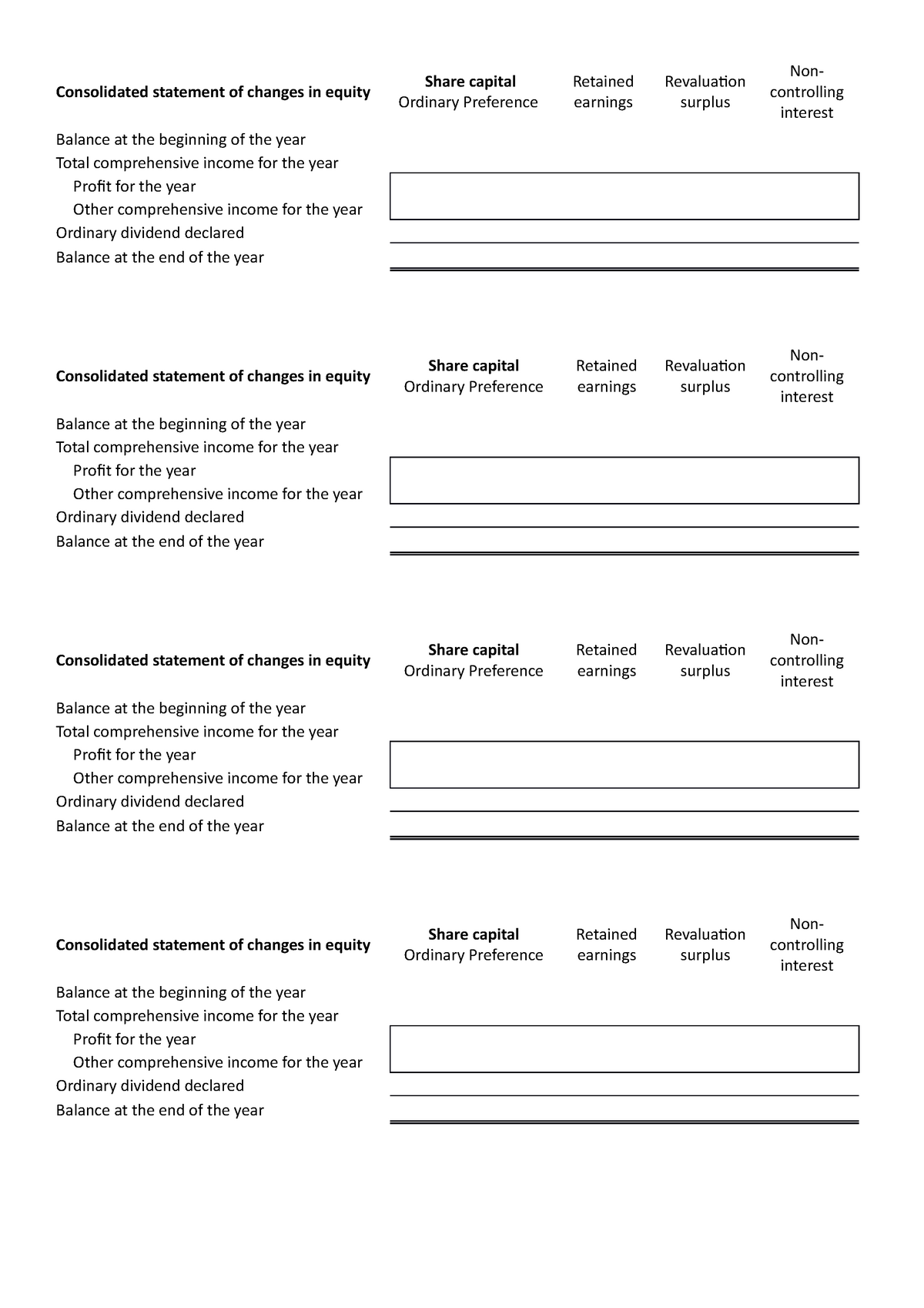

The amount of the change in a reporting entity's net assets is equivalent to the amount of the change in its equity. The following is an example of the statement of changes in equity for an ifrs company, velton ltd.,. The above consolidated statements of changes in equity should be read in conjunction with the accompanying notes.

The statement of changes in equity explains the changes in a company's equity over a reporting period. It presents the beginning balance of equity, details the changes during the reporting period, and shows the ending balance. 1:47 steps 5 & 6.

/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)