Beautiful Work Tips About Decrease In Wages Payable Cash Flow

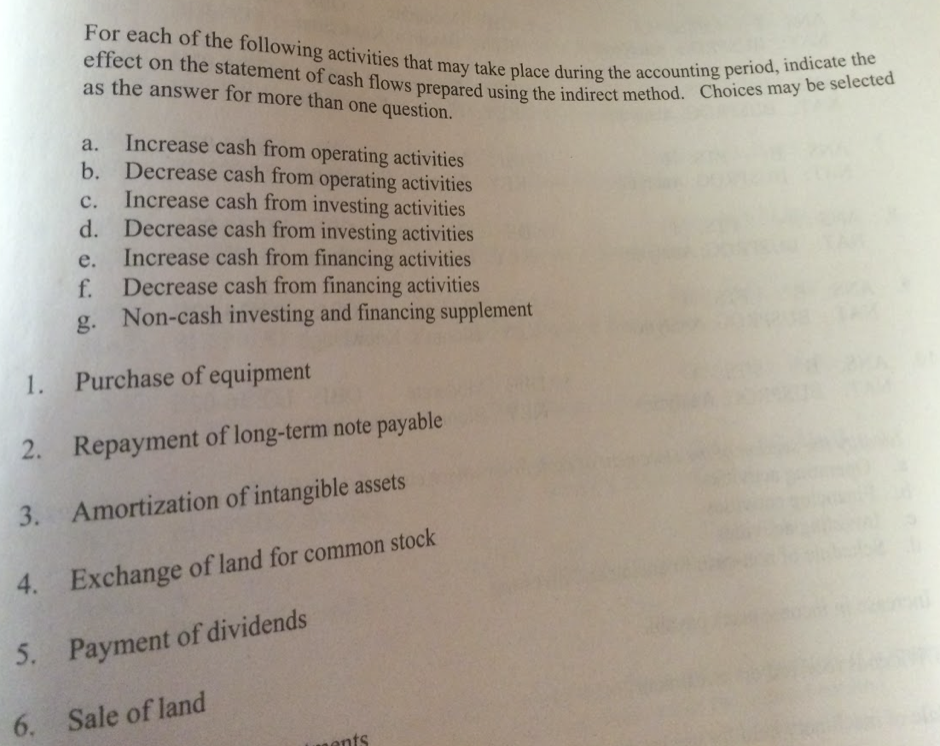

Notes payable affect the financing activities and operating activities sections of cash flow statements.

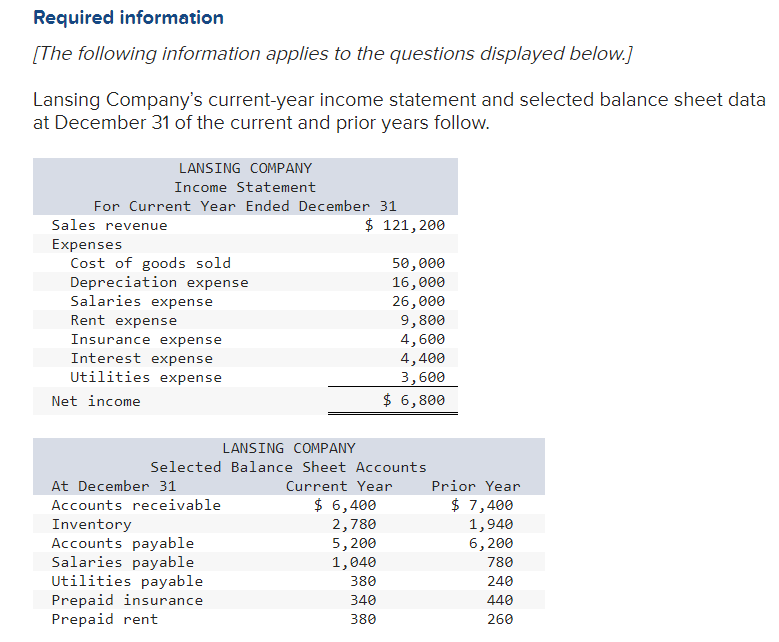

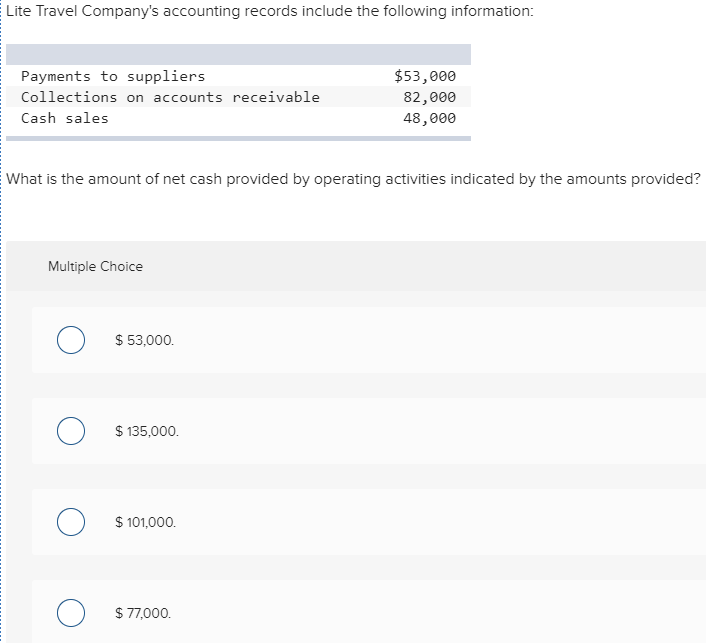

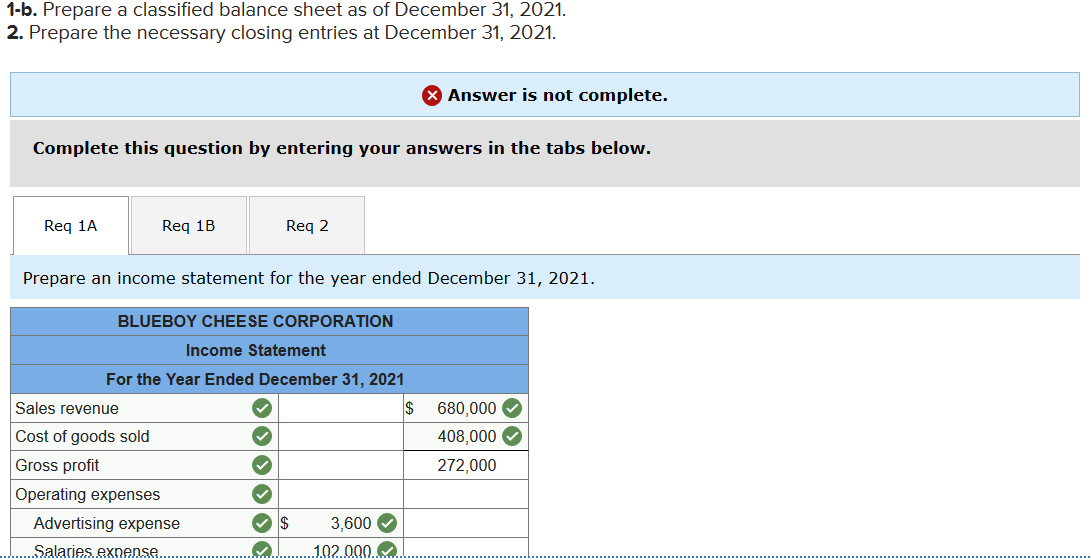

Decrease in wages payable cash flow. The average payable period is the best indicator of your success in managing your cash outflows. Begin with net income from the income statement. Decrease in accounts payable on cash flow statement on the other hand, a decrease in accounts payable means that there is a cash outflow from business for the cash.

Though a decrease in accounts payable has a positive impact on. Add back noncash expenses, such as depreciation, amortization, and depletion. Our case study shows you how to calculate your average.

Managing accounts payable to improve cash flow. Activities notes payable$ 30. The cash flow statement for the abc company shows that there was.

Under the accrual method of. When cash is paid to a supplier for purchases previously made on account, cash decreases. Remove the effect of gains and/or losses from.

A decrease in the accounts payable means a decrease in the available cash. You can use this information to improve the. For this reason, a decrease in accounts payable indicates negative cash flow.

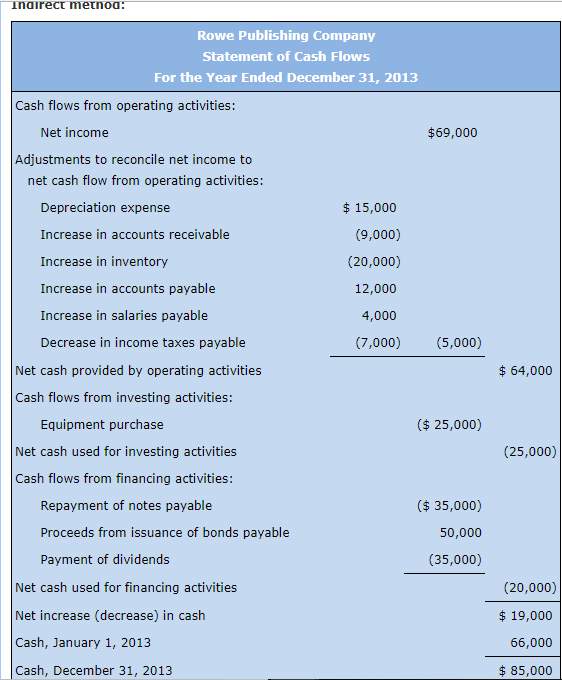

Yes, because when businesses pay out their wage obligations, it reduces their available cash. The three net cash amounts from the operating, investing, and financing activities are combined into the amount often described as net increase (or decrease) in cash during. It means a payment to.

Thus, a decrease in the. How do notes payable impact cash flow? The diagram above illustrates a big picture view of the.

Can wages payable affect a business’s cash flow? Wages payable refers to the wages that a company's employees have earned, but have not yet been paid. Thus, it will be denoted through a decrease in the cash flow statement.

A decrease in accounts payable decreases liability on your income statement but it will also decrease cash flow. Wages paid is calculated by adjusting total wages from the income statement for movements in wages payable (wp) from the balance sheet. Thus, when accounts payable increases, cost of goods sold on a cash basis decreases (instead of paying cash, the purchase was made on credit).

The formula to compute working capital is as follows: Net change in cash$ (205) *net income is taken from the income statement. The cash flow statement makes adjustments to the information recorded on your income statement, so you see your net cash flow—the precise amount of cash you.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)