Awe-Inspiring Examples Of Info About A Balance Sheet Does Not Partial Example

The balance sheet definition of a company is a formal record prepared by a company to present its financial position at the end of an accounting period, typically on a specific date like the end of a month, quarter, or year.

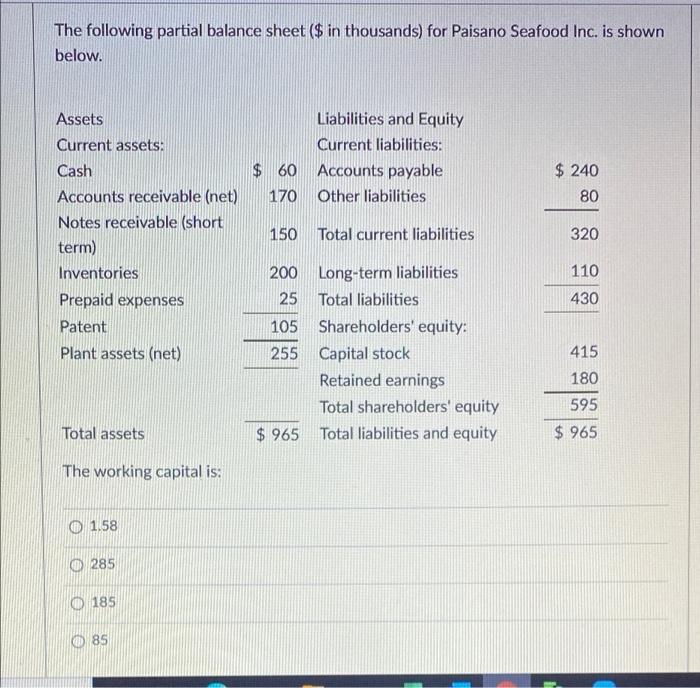

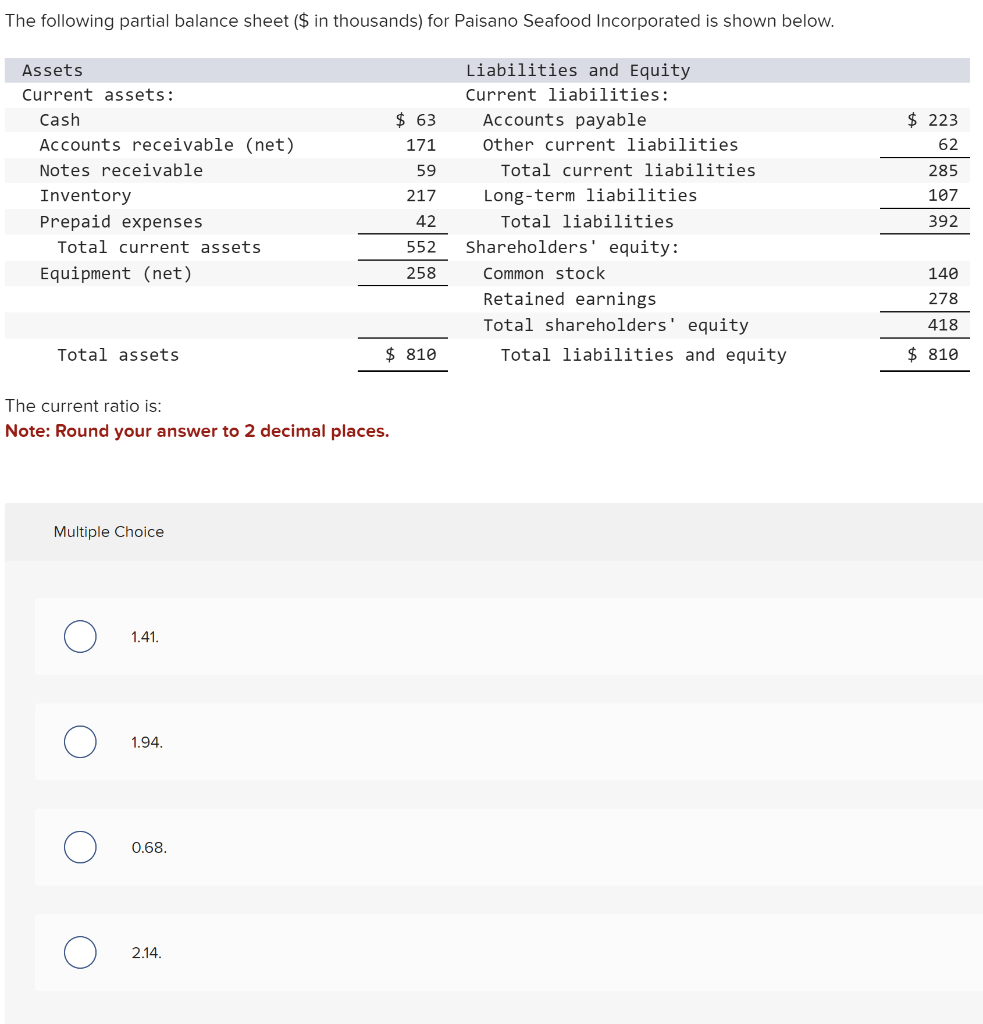

A balance sheet does not partial balance sheet example. The name balance sheet is based on the fact that assets will equal liabilities and shareholders'. So you definitely need to know your way around one. To do this, you’ll need to add liabilities and shareholders’ equity together.

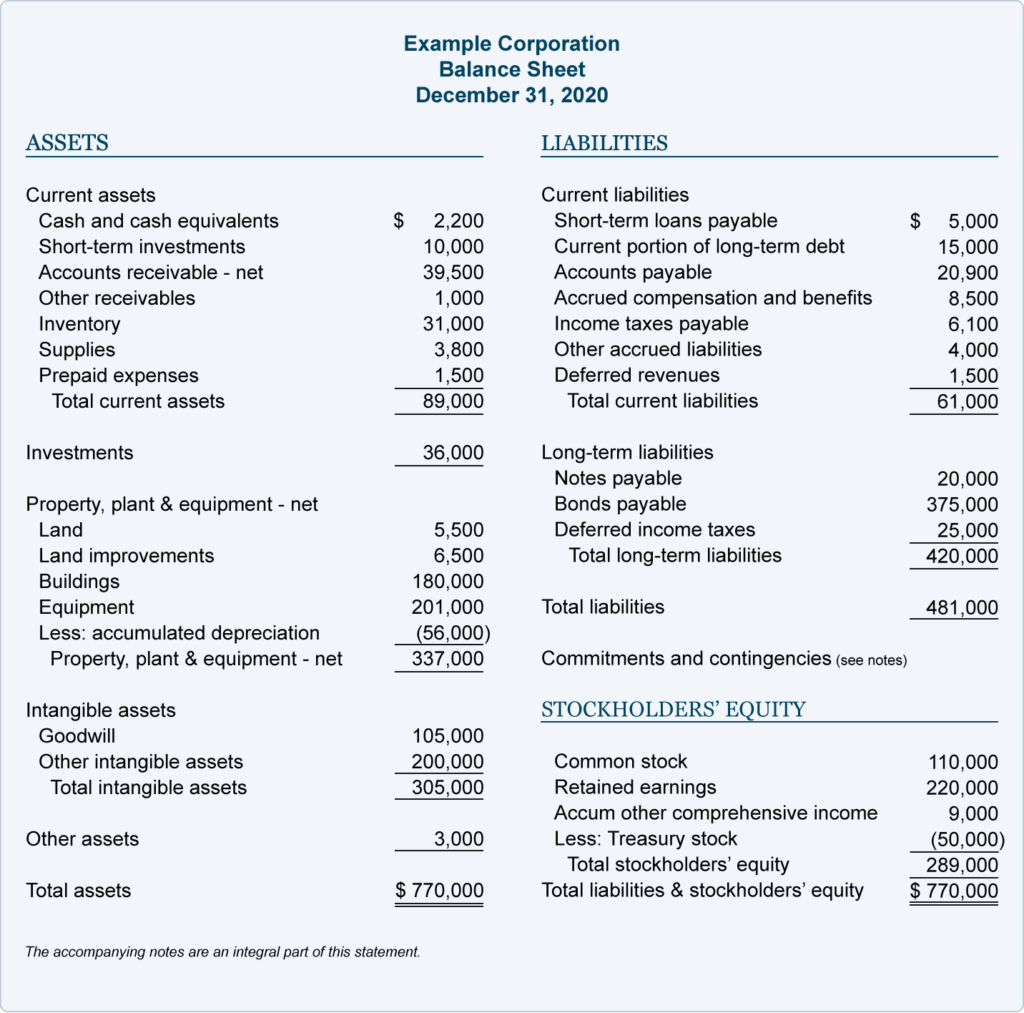

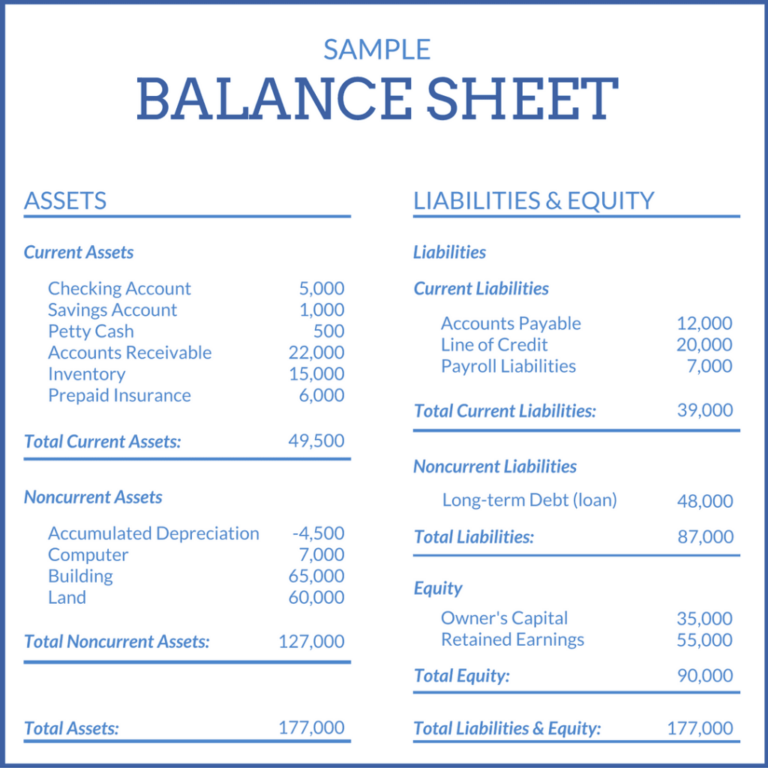

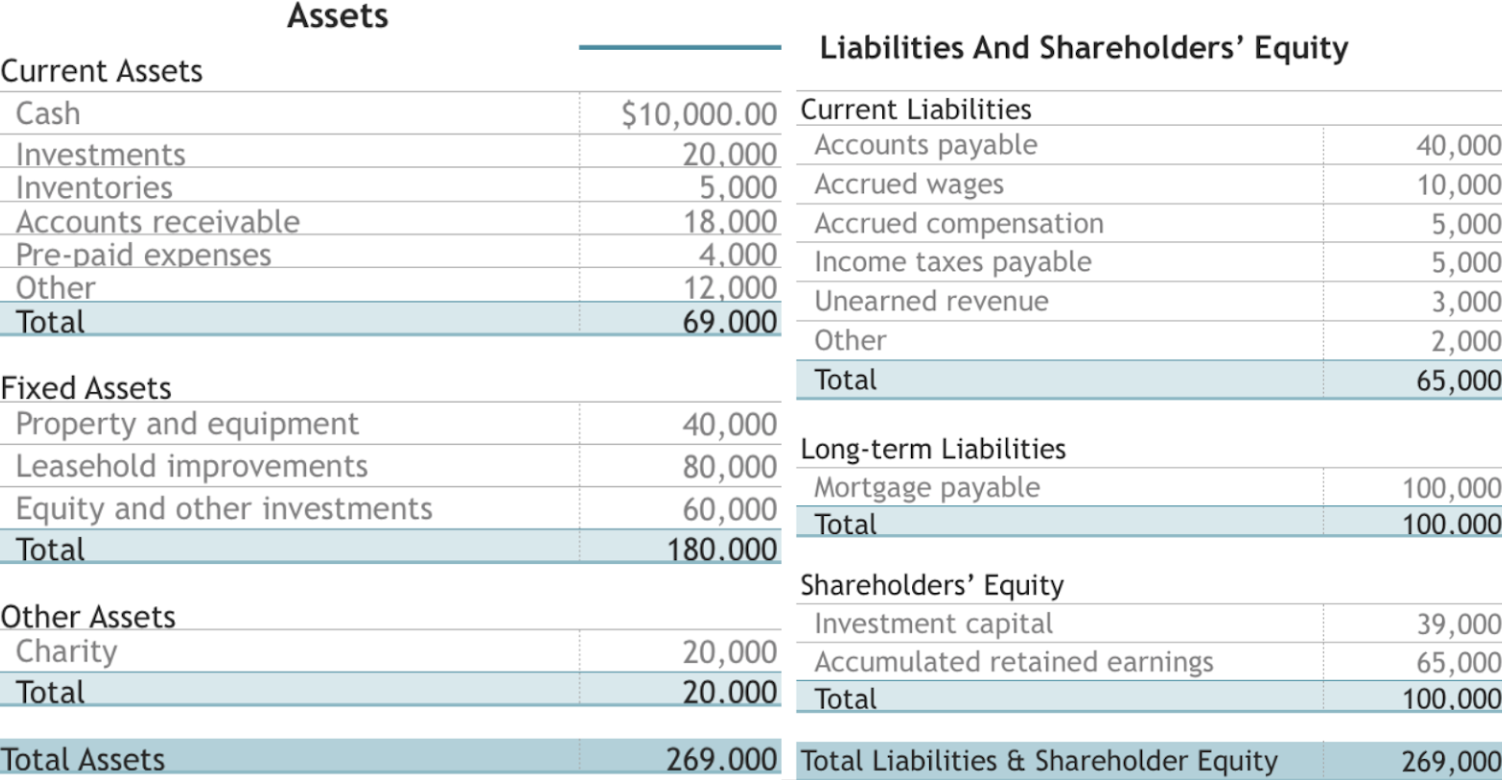

The example below shows a typical and useful format for management purposes. But what do they actually mean and include? The left side of the balance sheet outlines all of a company’s assets.

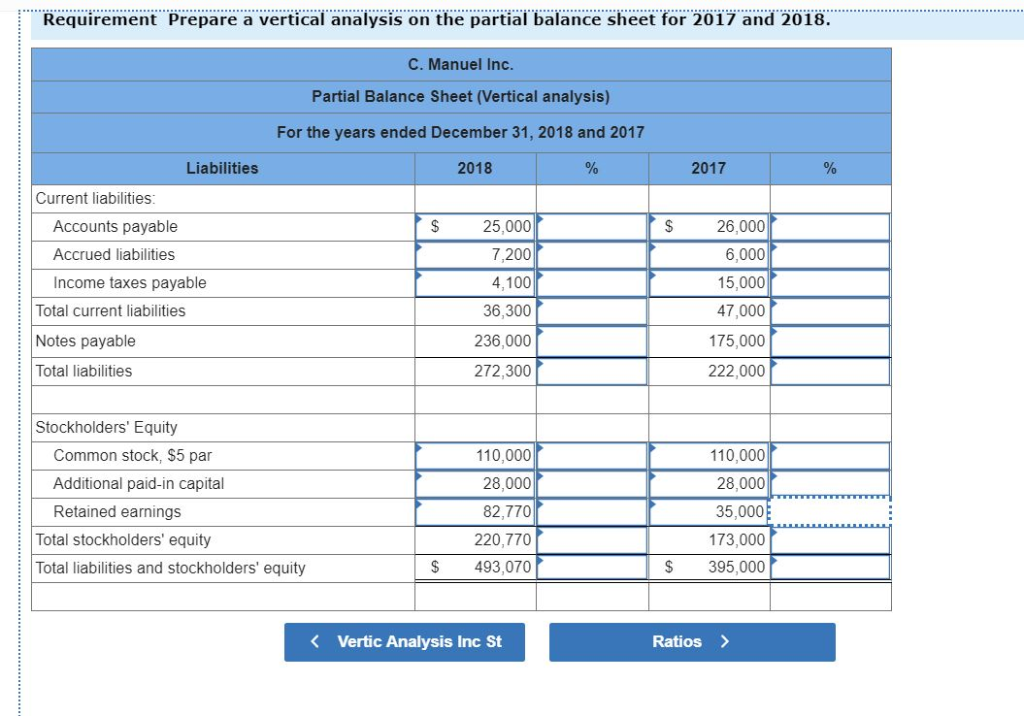

This structure helps investors and creditors see what assets the company is investing in, being sold, and remain unchanged. So now i just wanted to give you 4 things to look for if your balance sheet is not balancing. To ensure the balance sheet is balanced, it will be necessary to compare total assets against total liabilities plus equity.

The report provides helpful information when assessing a company’s financial stability. Part of a series of tutorials on ivan's accounting. Wire the balance sheet so that it always balances by making retained earnings equal to total assets less total liabilities less all other equity accounts.

Assets = liabilities + owners’ equity the formula can also be rearranged like so: We have included a balance sheet example and details. At the end of the day, in order for your balance sheet to balance.

Asset section similar to the accounting equation, assets are always listed first. Enter hardcodes across one row of the balance sheet for each year that doesn’t balance). The balance sheet, also known as the statement of financial position, is one of the three key financial statements.

Your balance sheet won’t balance. What should you not do? Format of the balance sheet.

The net worth of your small business, how much money you have, and where it’s kept. When the two sides of the balance sheet do not balance each other, this indicates that some part of a transaction has not been entered. If a balance sheet doesn’t balance, it’s likely the document was prepared incorrectly.

Key takeaways a balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity. That’s where this guide comes in. They’re also essential for getting investors, securing a loan, or selling your business.

In this specific example, it would indicate that you forgot to enter the $100,000 loan from the bank that paid for. A) net assets equals total equity Financial ratios are used to calculate the business’s financial position, including liquidity and gearing ratios.

![[HOMEWORK] Partial balance sheet, not sure what to credit after](https://external-preview.redd.it/032GRzMTE2JjYfSrKuJ95S-WO5I4VAAB9zoOjz1CmJc.png?auto=webp&s=097aaa66ade5904360e237ada86cadeb3b8f6f9b)