Glory Info About Solved Accounting Ratios With Balance Sheet

The financial statements include the profit & loss and balance sheet.

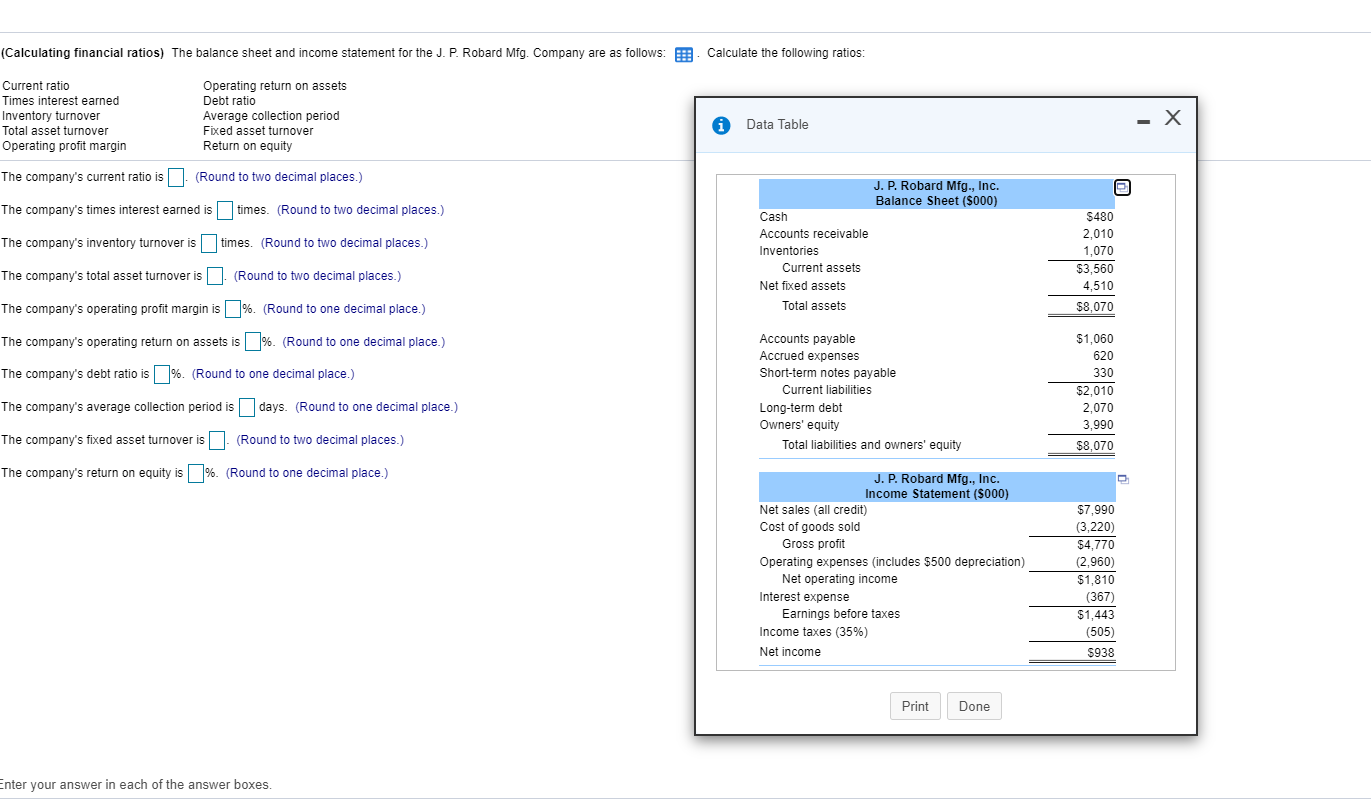

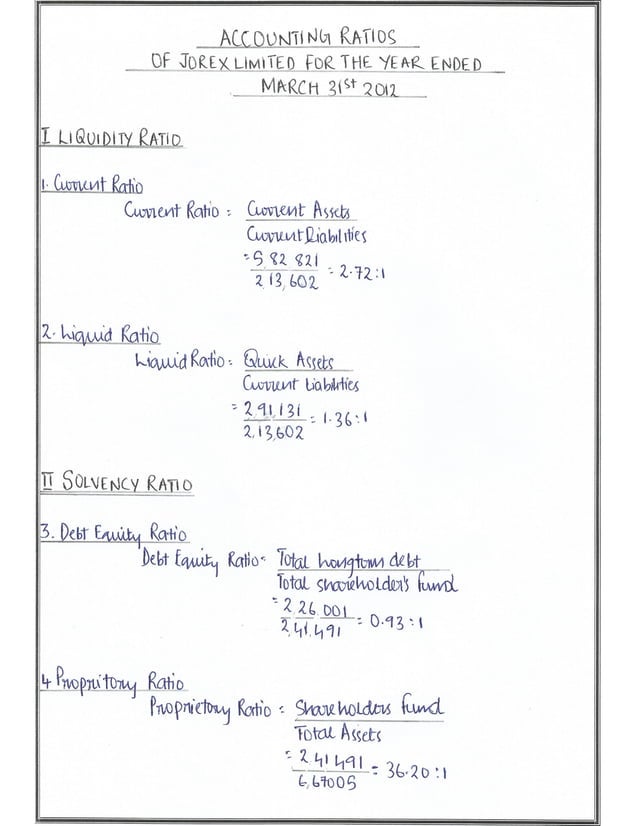

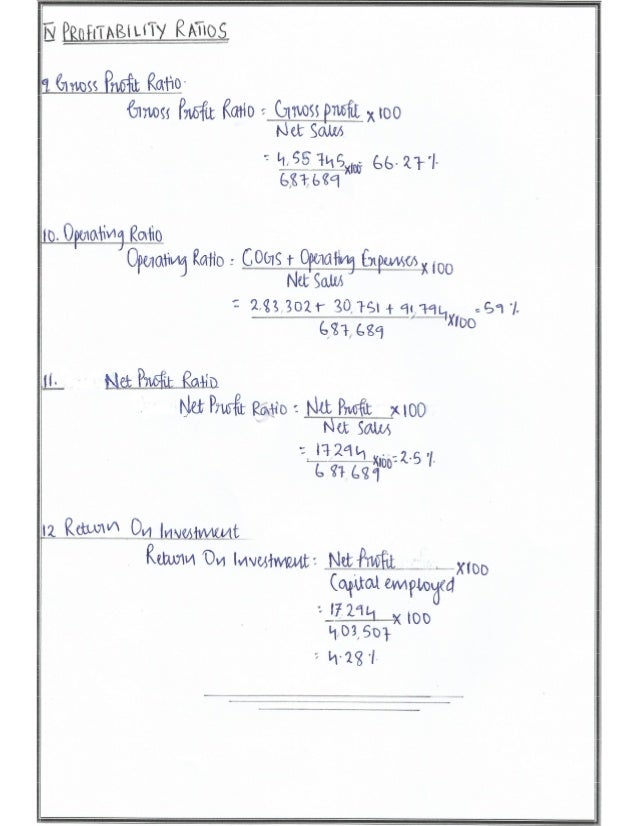

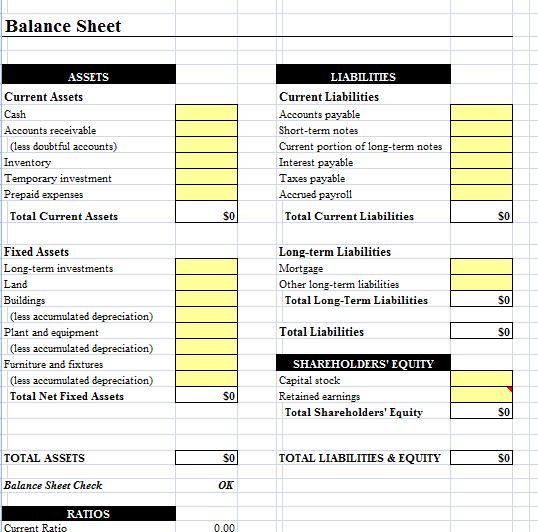

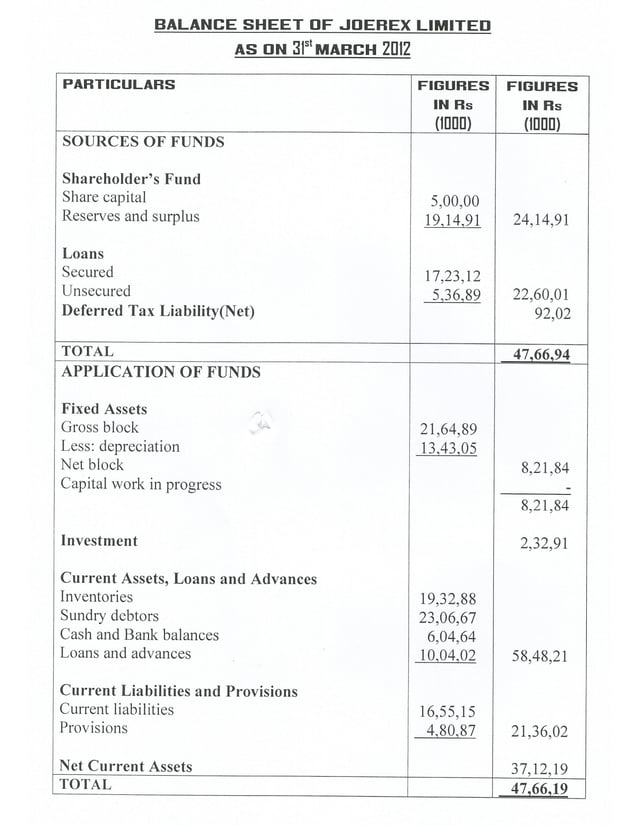

Solved accounting ratios with balance sheet. The information it contains can be used to derive a number of ratios that can be used to infer the liquidity, efficiency, and financial structure of a business. An analyst can generally use the balance sheet to calculate a lot of financial ratios that help determine how well a company is performing, how liquid or solvent a company is, and how efficient it is. N$60 000 (n$4 000 n$6 000.

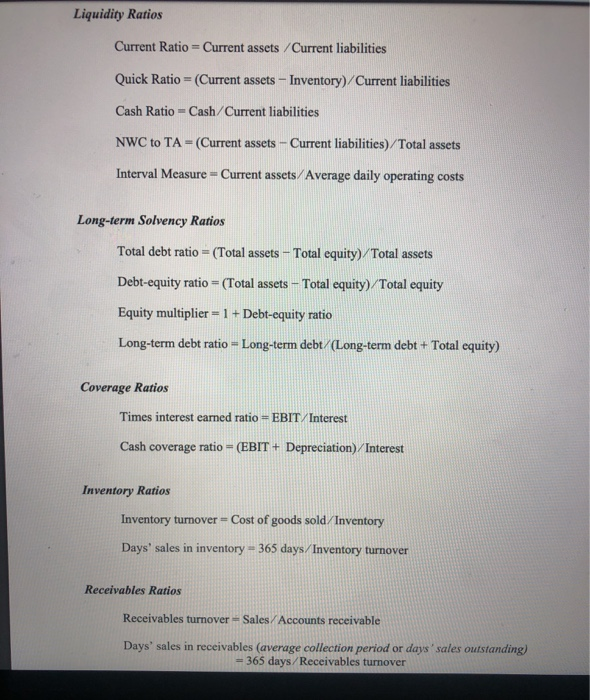

Ratio #10 receivables turnover ratio. Financial ratios can help check the financial health of a business. Balance sheet ratios are formulas you can use to assess your finances based on your balance sheet information.

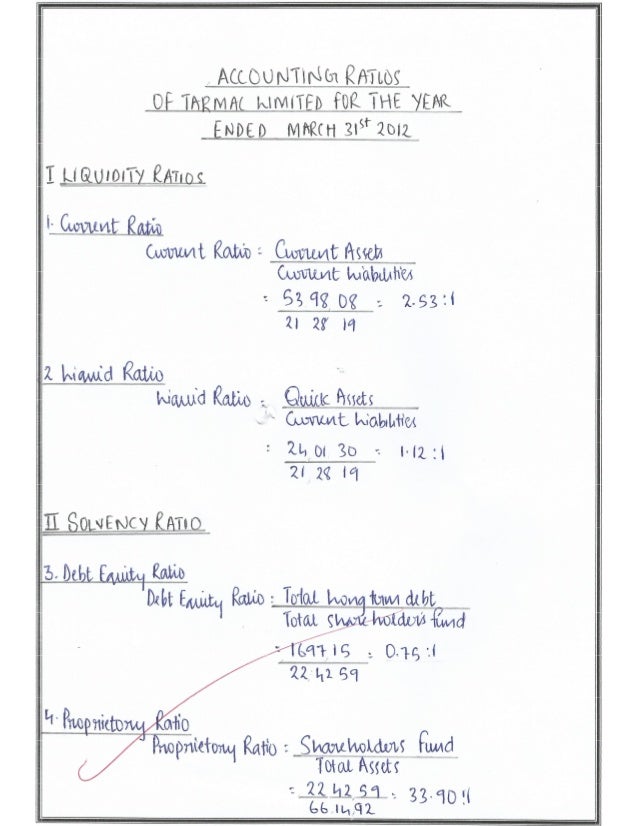

Financial ratios, such as efficiency ratios, liquidity ratios, solvency ratios, quick ratios, and profitability ratios, can be utilized by the managers, stakeholders. Financial ratios using amounts from the balance sheet and income statement. The main objective of any liquidity ratio is to measure the company’s short term solvency status of the company.

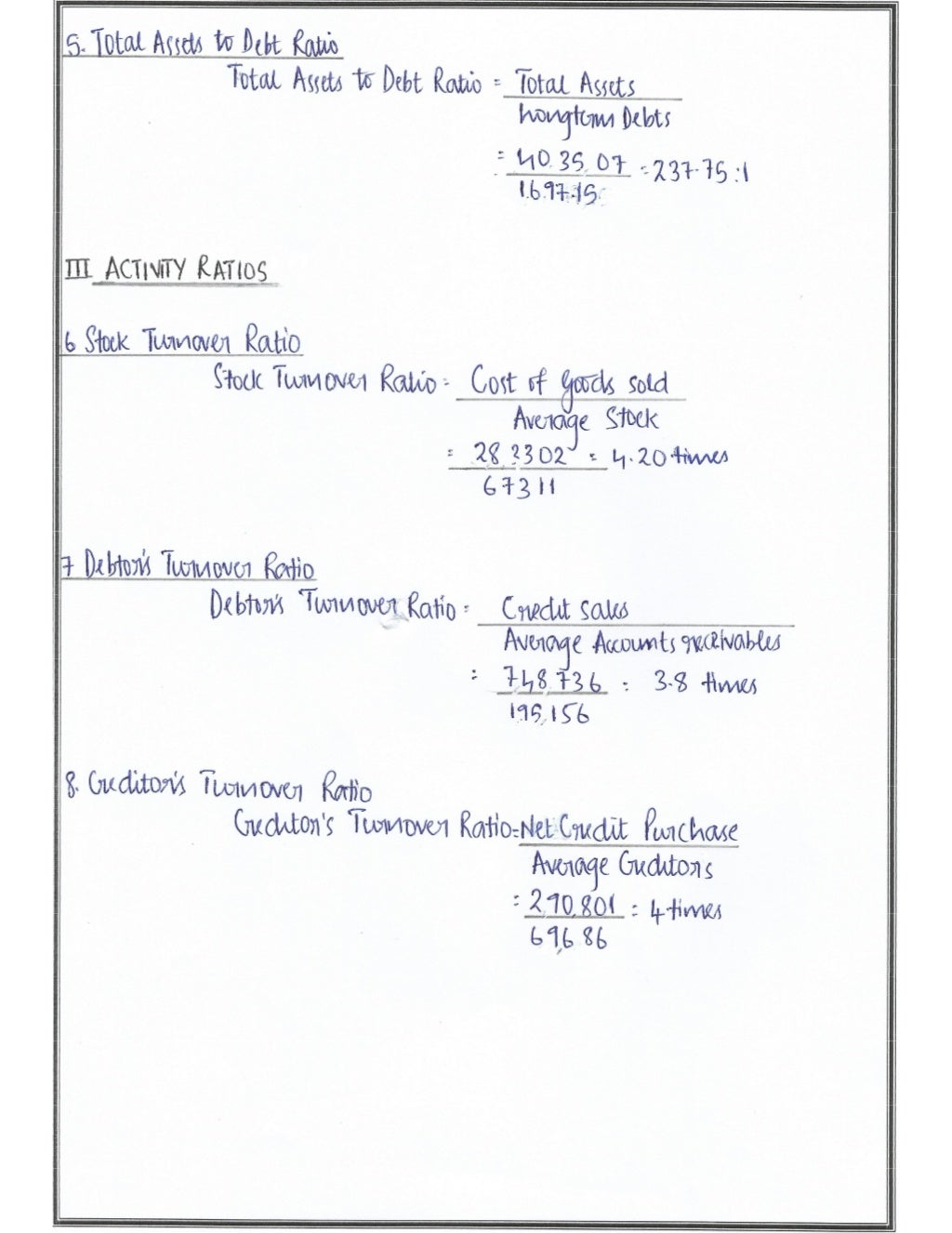

Ratio #5 debt to total assets. Providing a complete interpretation of a company's results quantitatively, balance sheet ratios are used to compare two items on the balance sheet or analyze balance sheet items. Specifically, we will discuss the following:

You have $10,000 in assets and $4,000 liabilities (debt). Return on equity = net income / average shareholder equity 2. The following is the balance sheet of a company as on 31st march:

The cost of goods sold is: Learn for free about math, art, computer programming, economics, physics, chemistry, biology, medicine, finance, history, and more. Also referred to as balance sheet ratios, liquidity ratios are further branched out into the current ratio, quick ratio, and cash ratio.

Take a look at this balance sheet for the great american department store. How to calculate your debt to asset ratio. You can quickly use these steps even in large datasets to find different balance sheet ratio values.

Calculate balance sheet ratios with the balance sheet and income statement in the example above, we can calculate the balance sheet ratios as below: Return on assets = net income/total assets The information required for the calculation is found in the trading account:

Financial ratios are created with the use of numerical values taken from financial statements to gain meaningful information about a company. Using the figures will allow you to compare the business performance from one period to another. My liquidity ratios appear to be sound as both are stable from year to year and similar to the industry averages.

Opening stock + closing stock. This means your debt to asset ratio is 40. Next i move on to the ratio analysis.

![[Solved] (Calculating financial ratios) The balance sheet](https://media.cheggcdn.com/study/275/27582b45-474c-4e89-a70f-1f2139526978/image)