Simple Tips About Profit And Loss Summary Account

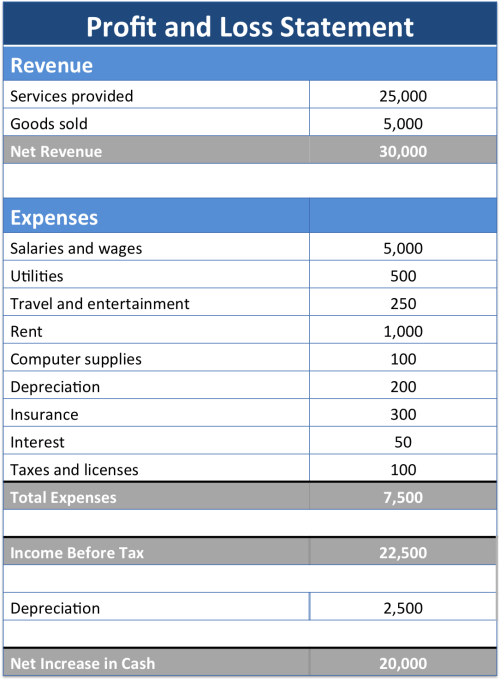

A profit and loss account shows the revenue and costs of a business and these are used to work out whether or not the business has made a profit.

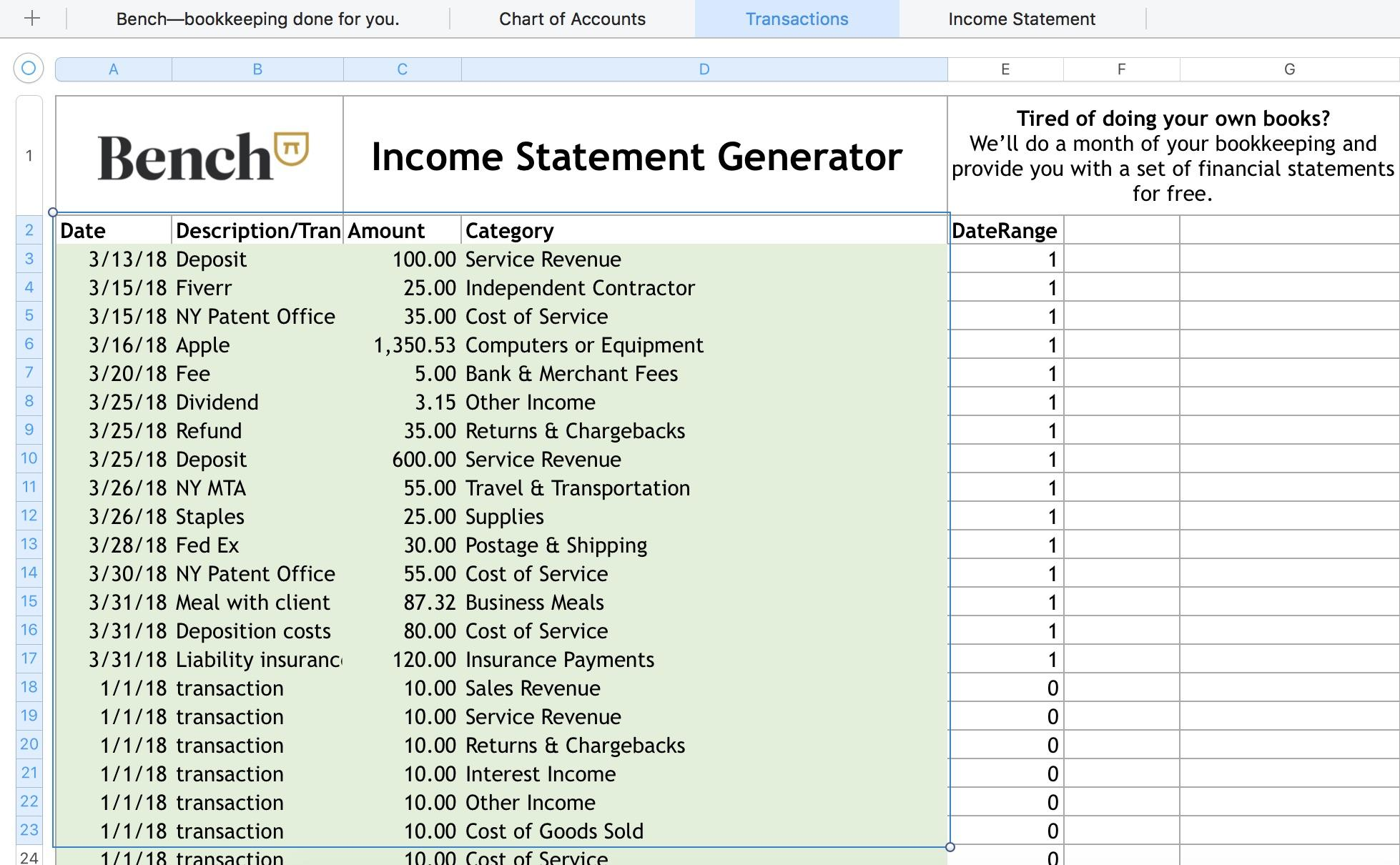

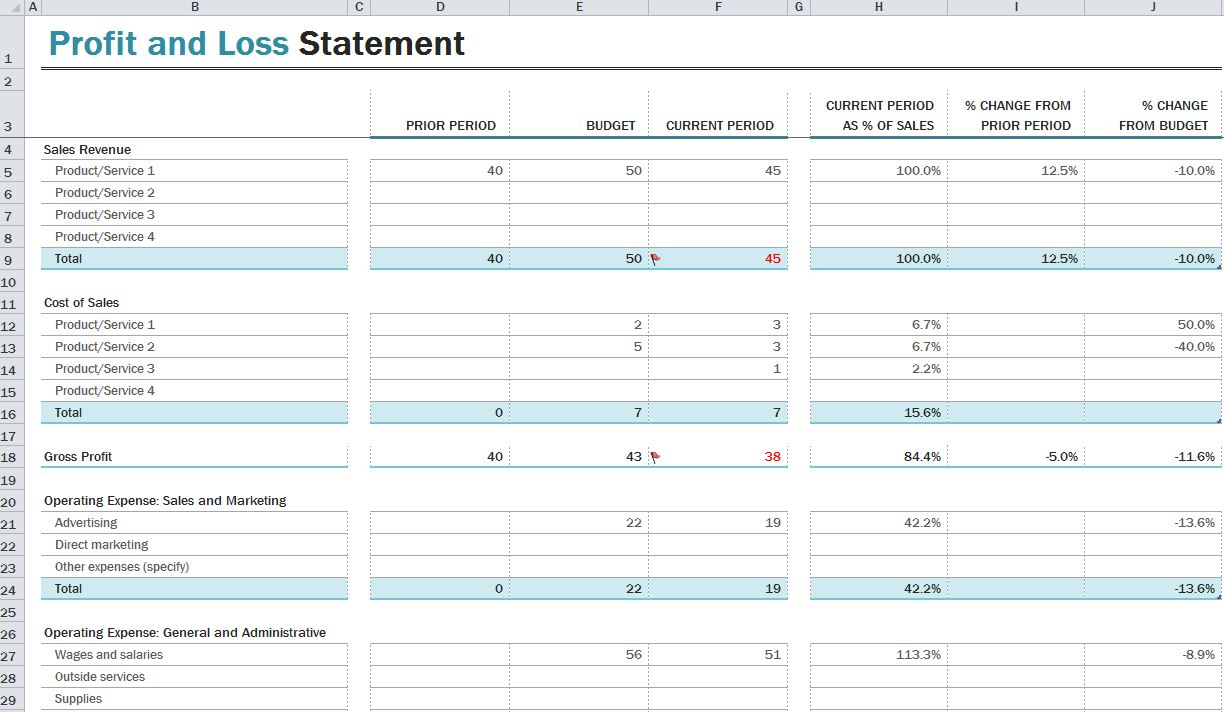

Profit and loss summary account. Your p&l statement shows your revenue, minus expenses and losses. You may be selling your goods at 50% higher than you are buying them, but you are making a loss when considering all the overheads. Profit and loss accounting is when companies prepare the profit and loss statements to figure out their financial performance for a fiscal quarter or year.

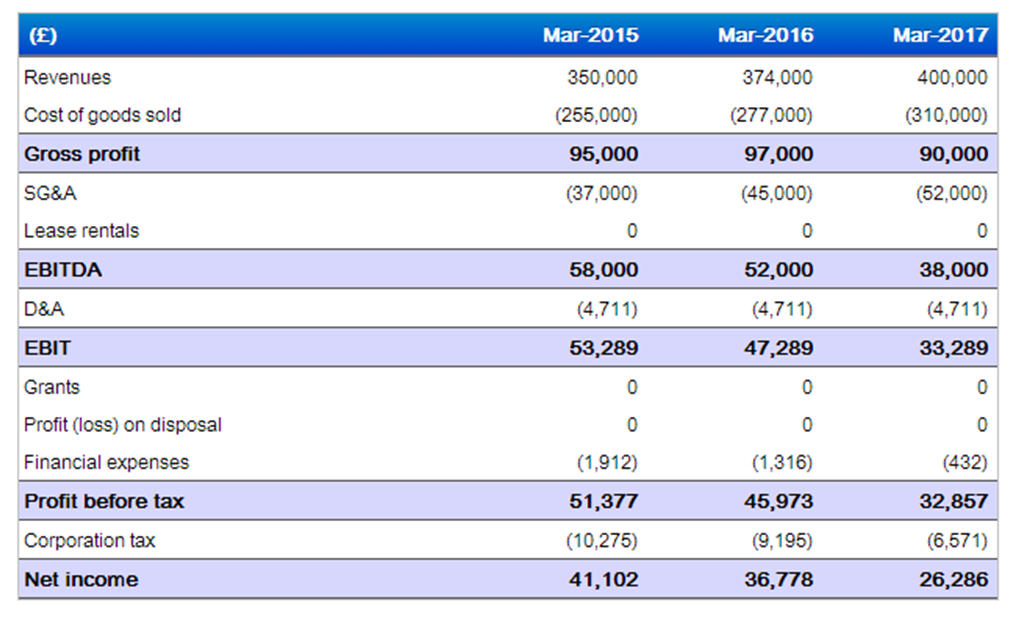

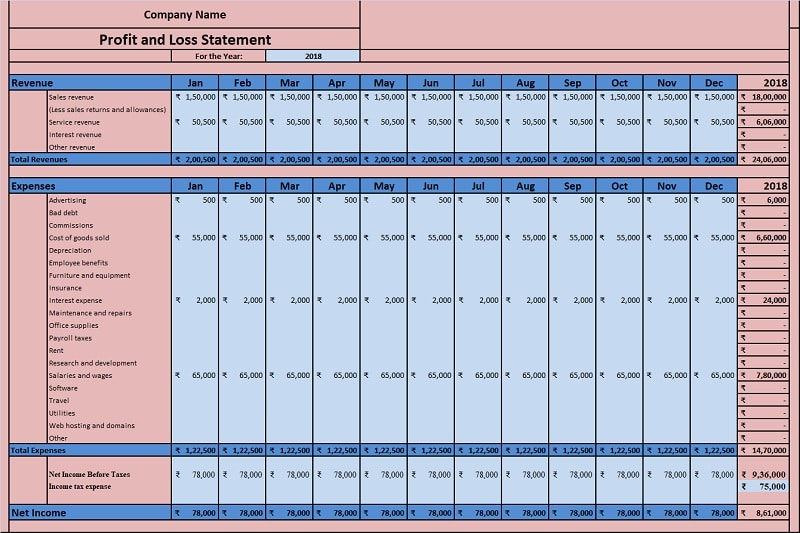

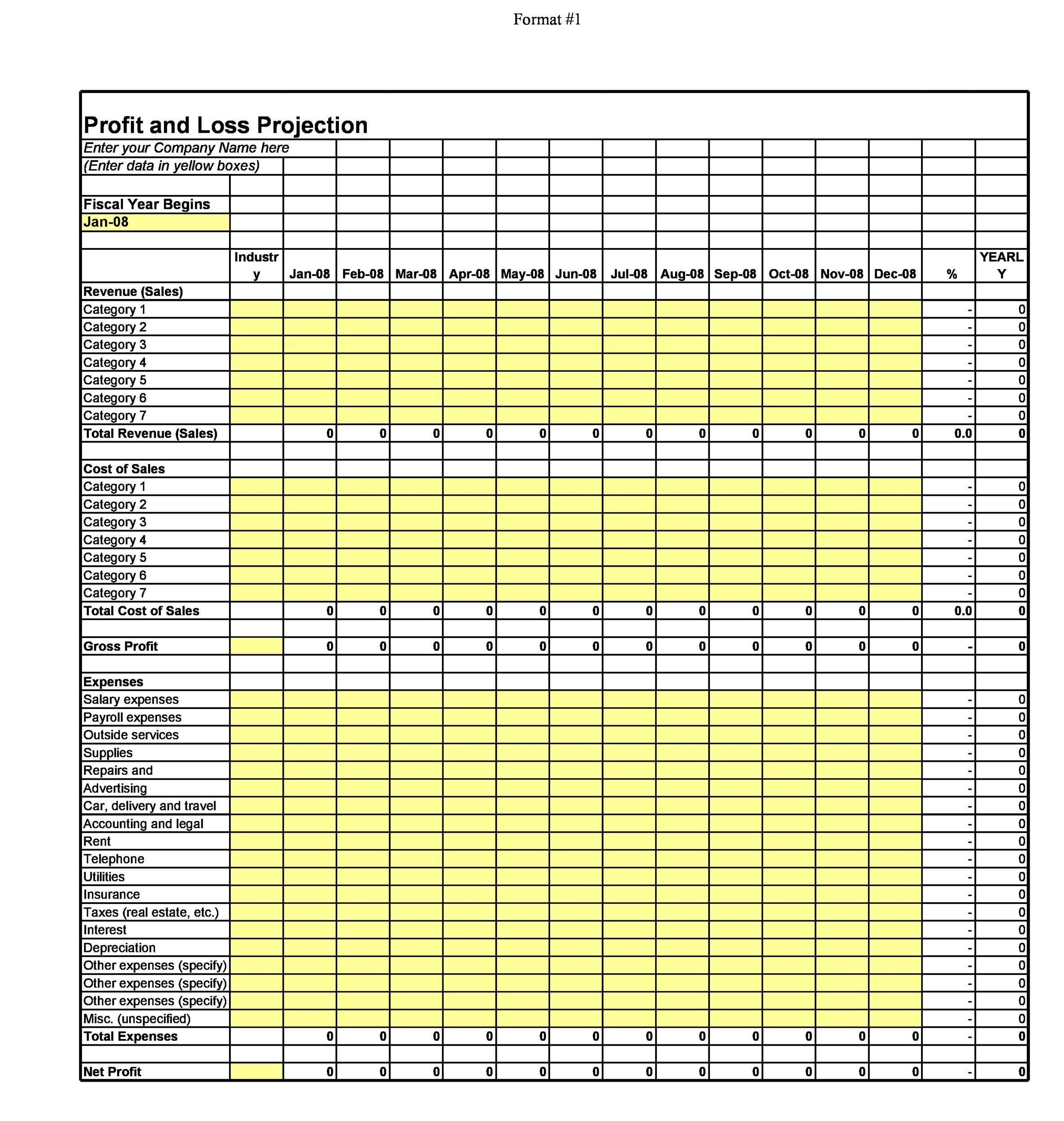

Fy profit attributable 465.8 million baht versus loss 8.03 billion baht. They are usually created on a monthly, quarterly or annual basis. More advanced profit and loss statements also include operating profit and earnings before interest, taxes, depreciation, and amortization (ebitda).

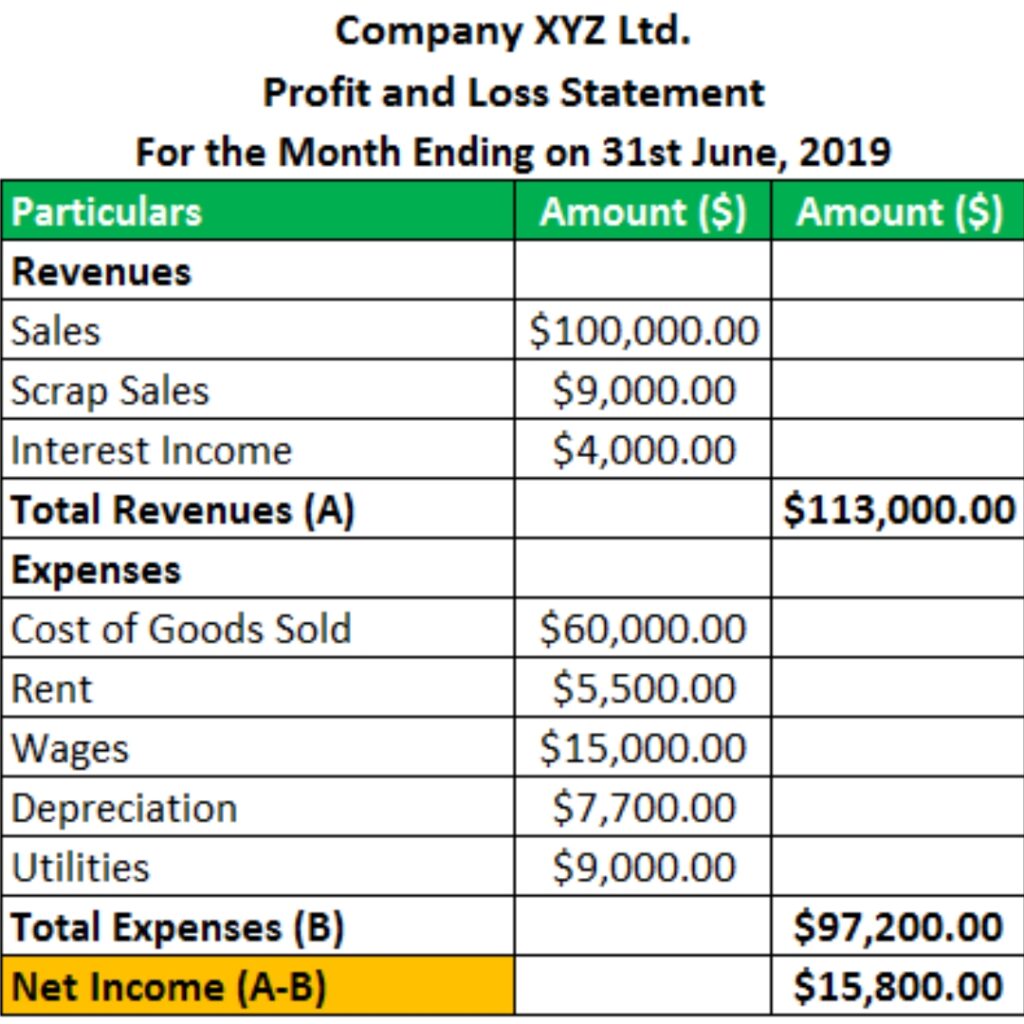

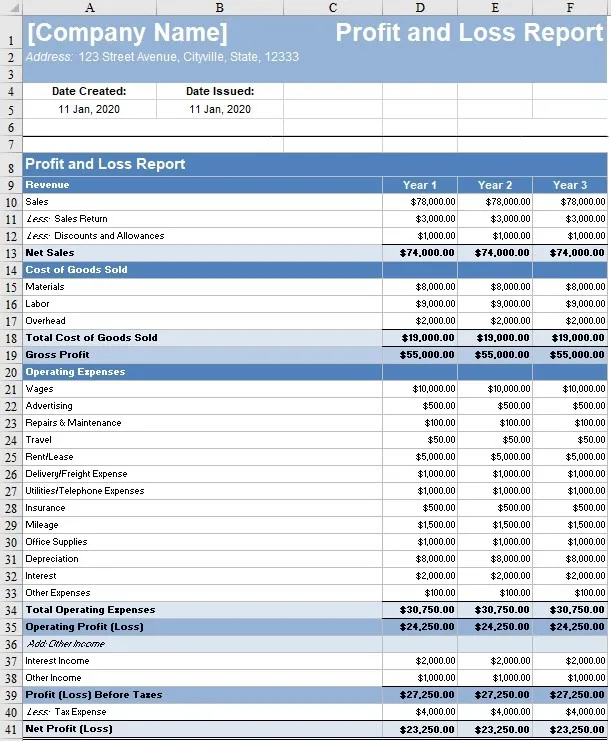

Revenue, expenses, and net income. The profit and loss statement: A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time.

The profit and loss statement (p&l), also referred to as the income statement, is one of three financial statements that companies regularly produce. The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. The p&l account is a component of final accounts.

Basic income statements contain the following elements: Calculate revenue the first step in creating a profit and loss statement is to calculate all the revenue your business has received. The order goes like this:

The p&l statement is one of three financial. The period may be for a month, a quarter, or a year. The result is either your final profit (if.

The outcome is either your final profit or loss. The account allows the merchandiser to easily determine its overall gross profit and gross. Jean carroll, that means trump has been fined roughly $438 million over the past four weeks.

The profit and loss account shows all indirect expenses incurred and indirect revenue earned during the particular period. A profit and loss statement contains three basic elements: Profit and loss statement is the financial report of the company, which provides a summary of the revenues and expenses of the company over a period of time to arrive at profit or loss for the period.

Understand the concept of trading account here in detail. The income summary account is a temporary account into which all income statement revenue and expense accounts are transferred at the end of an accounting period. Profit and loss summaries include three main parts:

Electric carmaker rivian plans to cut 10% of its salaried workforce. The trading account is particularly useful for a merchandising business or trading business involved in the buying and selling of finished products. It is frequently generated by computer accounting.

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Yearly-Profit-Loss-Statement-Template-TemplateLab-790x1101.jpg)