Build A Info About Short Term Investment In Cash Flow Statement

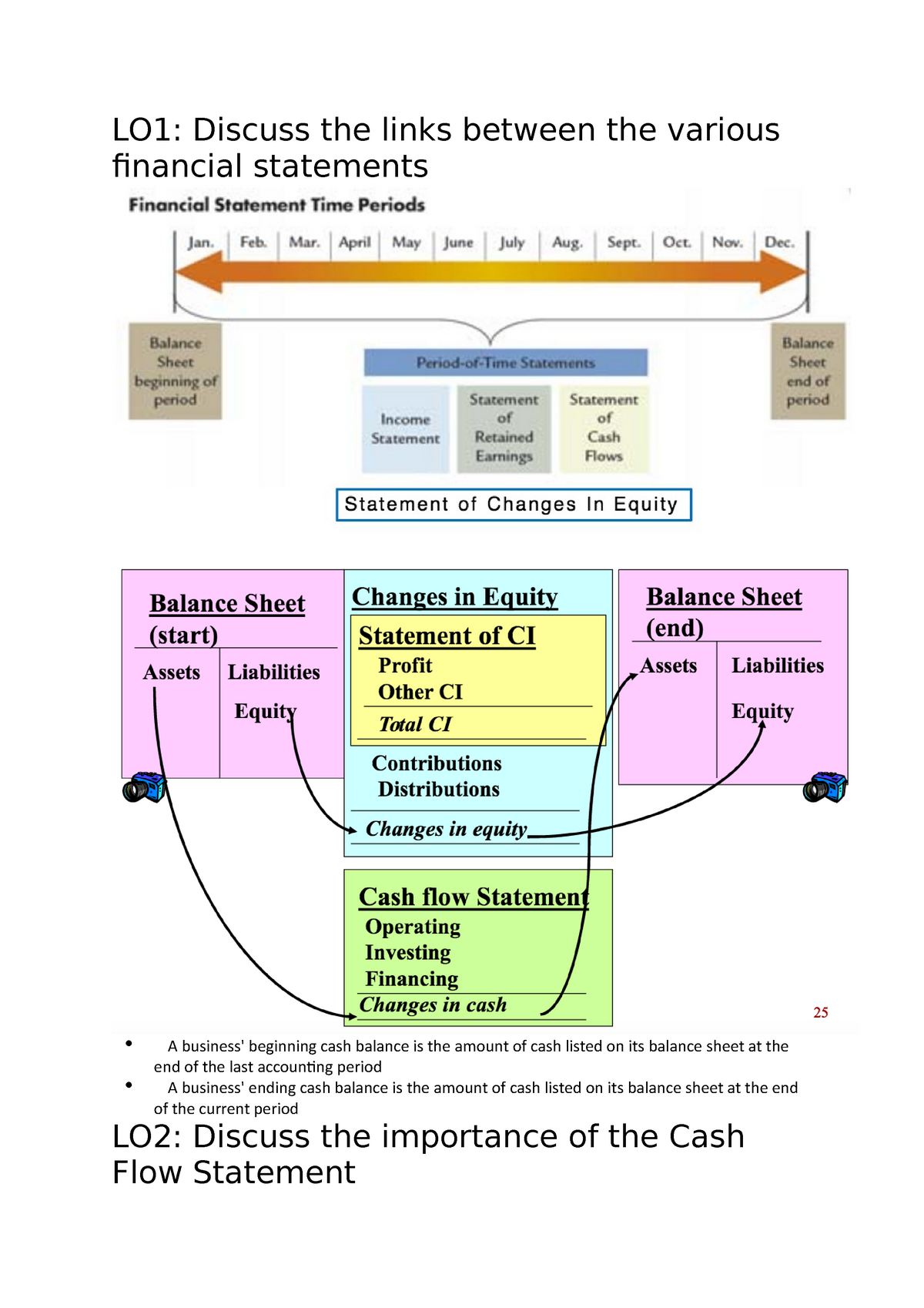

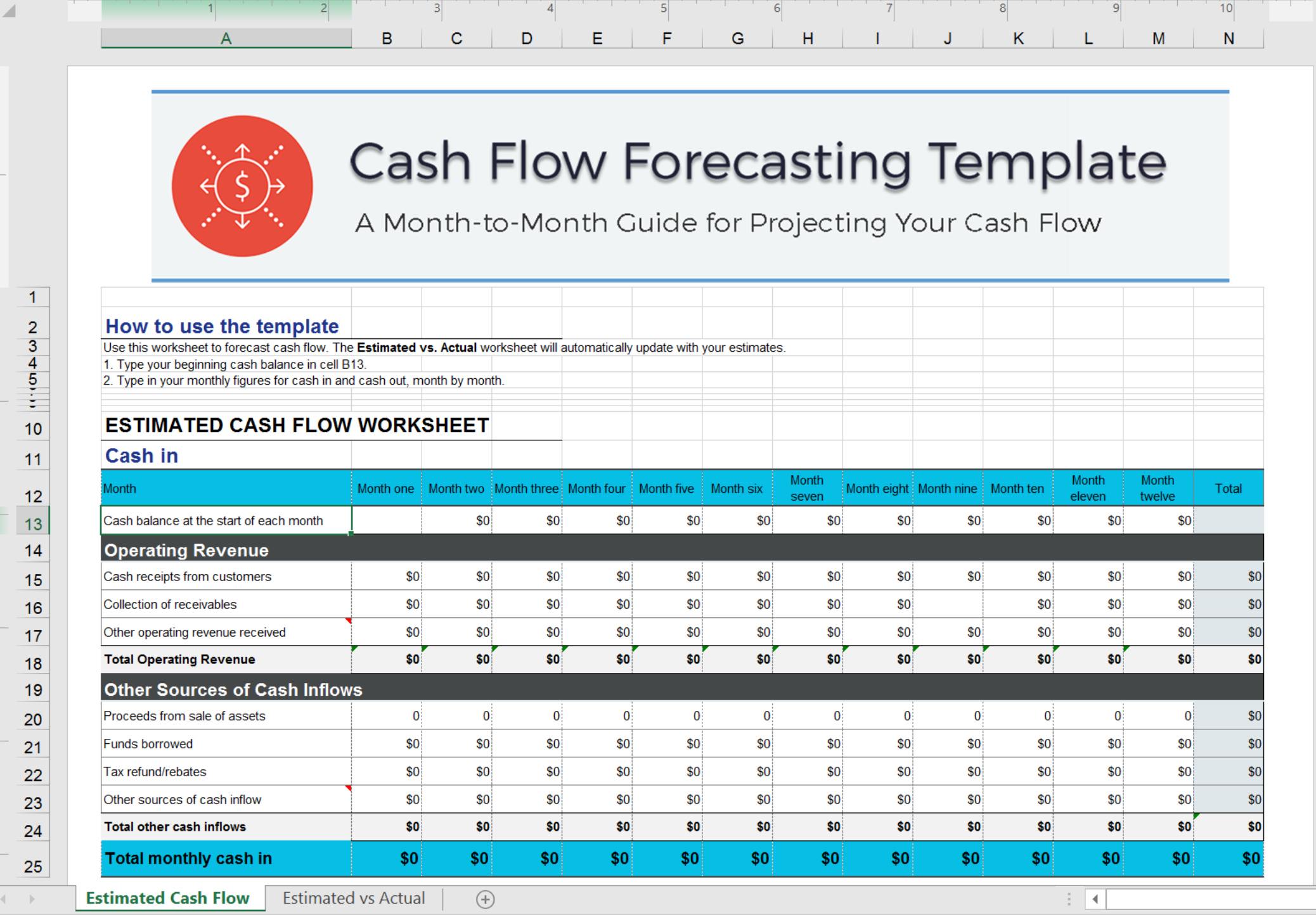

The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period.

Short term investment in cash flow statement. Such an amount earned interest for the firm. Ias 7 cash flow statements replaced ias 7 statement of changes in financial position (issued in. One of the most important features to look for in a potential investment is the company's ability to produce cash.

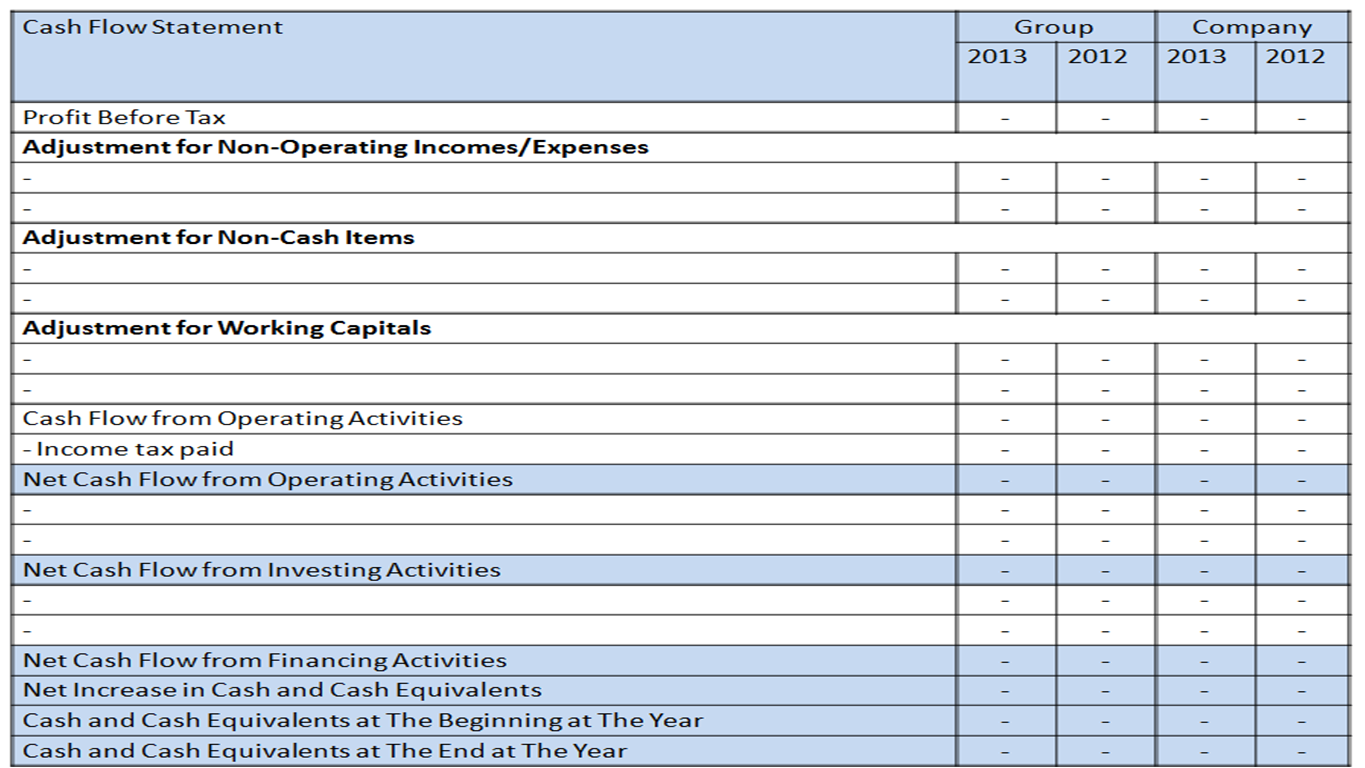

The objective of ias 7 is to require the presentation of information about the historical changes in cash and cash equivalents of an entity by means of a statement of cash flows, which classifies cash flows during the period according to operating, investing, and financing activities. A negative overall cash flow is not necessarily a bad. Statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements, which had originally been issued by the international accounting standards committee in december 1992.

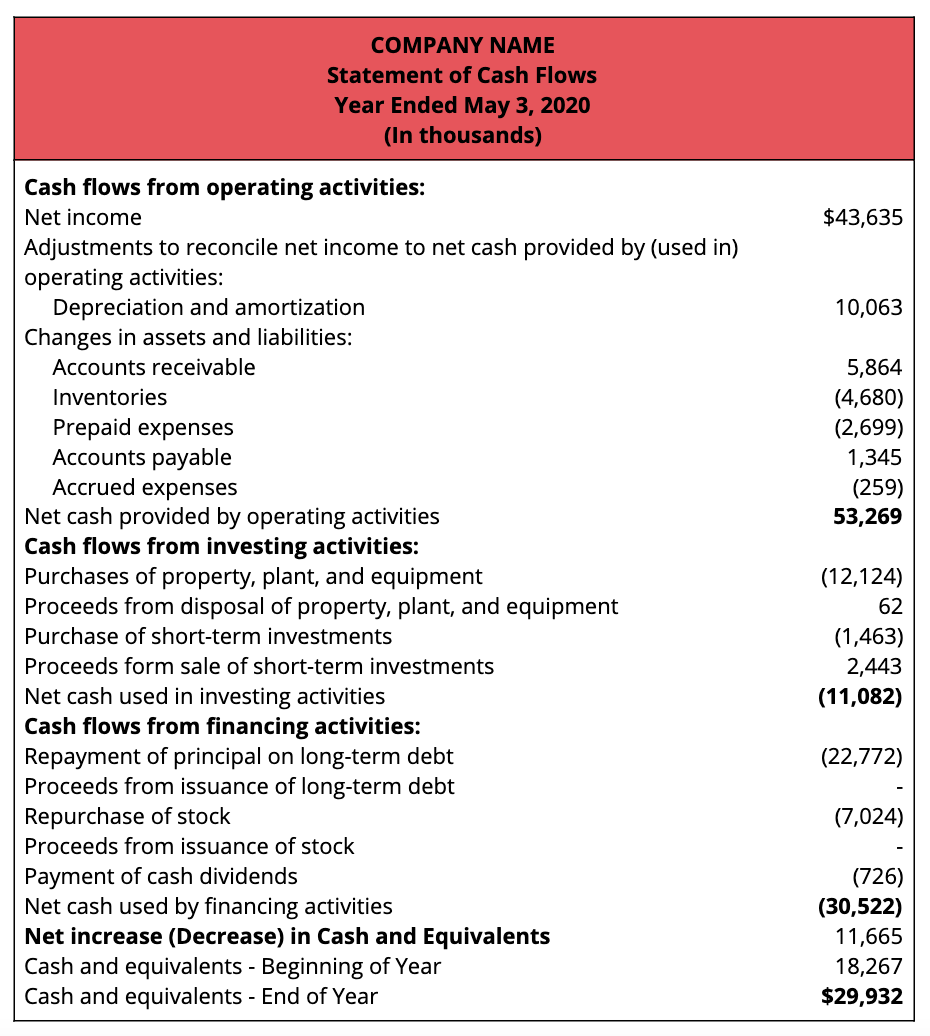

Cash flows from financing activities: Now let us have a look at a few more sophisticated cash flow statements for companies that are listed entities on nyse. Cash flows from investing activities:

The cash flow statement looks at the inflow and outflow of cash within a company. Net cash from investing activities. Cash flow from investment activities shows the flow of cash from activity in financial markets, operating subsidiaries, and capital assets.

It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of the. Repayment of the $40 million existing debt is a $40 million financing outflow. Also known as the statement of cash flows, the cfs helps its creditors determine how much cash is available (referred to as liquidity) for the company to fund its operating expenses and pay.

While we’ve already talked a bit about some investing activities that might be included in this section of your cash flow statement, let’s take a closer look at some of them: Ias 7.7 goes on to explain that for an investment to qualify. If a company's business operations can generate positive cash flow, negative overall cash flow.

The cash flow statement should reflect a financing inflow of $100 million. 0.00 (45,000.00) (increase)/decrease in prepaid expenses: Although it is restricted cash, it is part of the change in cash, cash equivalents, and restricted cash.

Changes in working capital (increase)/decrease in inventory: Cfi is an outflow of $20,000. Net cash from operating activities.

What is a cash flow statement? Pensions and other employee benefits. In example corporation the net increase in cash during the year is $92,000 which is the sum of $262,000 + $ (260,000) + $90,000.

Statement of cash flows for the year ended december 31, 2020: Net cash from financing activities Cash flows from operating activities.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)