Simple Tips About About Trial Balance In Accounting

A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle.

About trial balance in accounting. A company prepares a trial balance. Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company. This means that it states the total for each asset, liability, equity, revenue, expense, gain, and loss account.

His appearance was met with loud boos as well as. Trump was penalized $355 million, plus millions more in interest, and banned for three years from serving in any top roles at a new. A trial balance is a worksheet that lists all general ledger ending account balances into two columns either a debit or a credit.

It compiles all ledger accounts and details their balances as either debits or credits by following the core principle that. Creating a trial balance is the first step in closing the books at the end of an accounting period. It is usually prepared at the end of an accounting period to assist in the drafting of financial statements.

A trial balance is a summary of balances of all accounts recorded in the ledger. A trial balance sheet is a report that lists the ending balances of each account in the chart of accounts in balance sheet order. The announcement came one day after a new york judge ordered trump and the trump organization to pay over $355 million as part of a civil fraud case.

It is prepared at the end of a particular period to indicate the correct nature of the balances of various accounts. The total of both should be equal. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that are equal.

Trial balance is the report of accounting in which ending balances of the different general ledgers of the company are available; A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. 16, 2024 updated 9:59 a.m.

14, 2024 3:16 pm pt. Trial balances are a vital auditing technique used to ensure whether the total debit equals the total credit in the general ledger accounts, which plays a crucial role in creating the balance sheet and other financial statements. It is typically prepared at the end of an accounting period, such as a month or a year, to ensure that the total debit balances equal the total credit balances in the company’s ledger.

(often the accounts with zero balances will not be listed.) the debit balance amounts are listed in a column with the heading debit balances and the credit balance amounts are listed in another column with the. All the ledger accounts (from your chart of accounts) are listed on the left side of the report. The debits and the credits are then totaled to verify their balance.

It’s used at the end of an accounting period to ensure that the entries in a company’s accounting system are mathematically correct. The general ledger accounts ' debit and credit column sums must equal one another to. This list will contain the name of each nominal ledger account in the order of liquidity and the value of that nominal ledger balance.

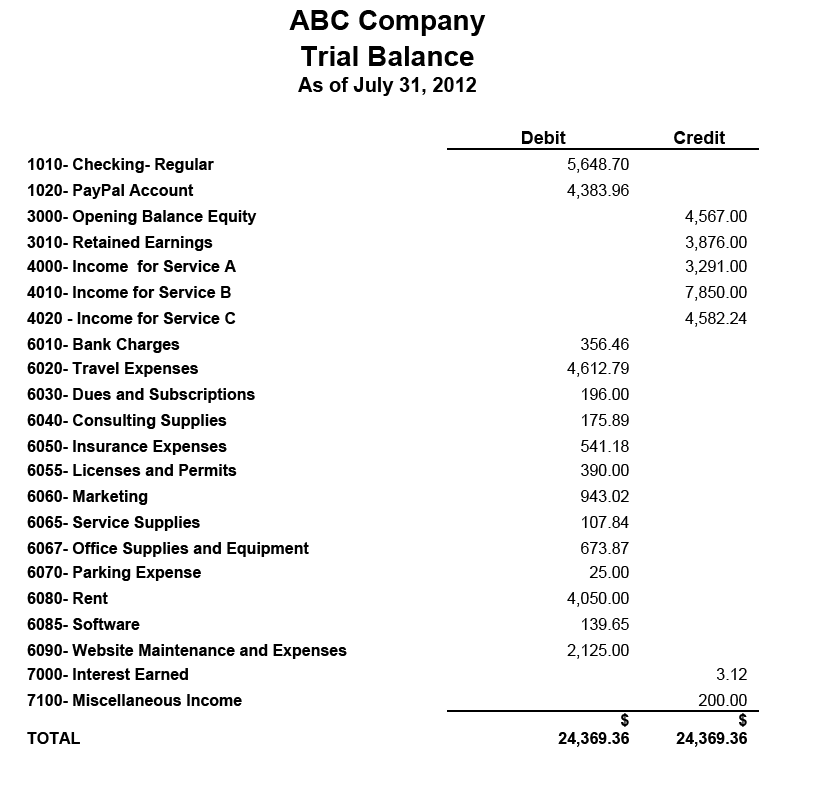

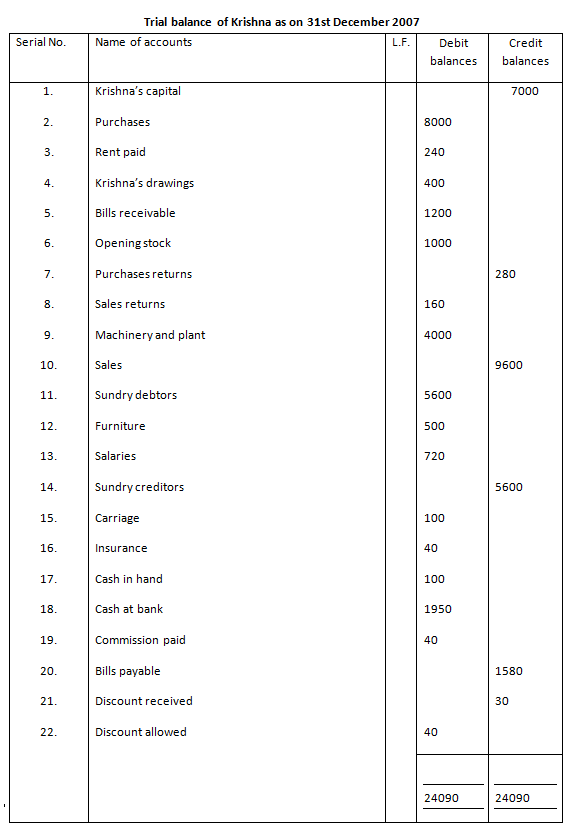

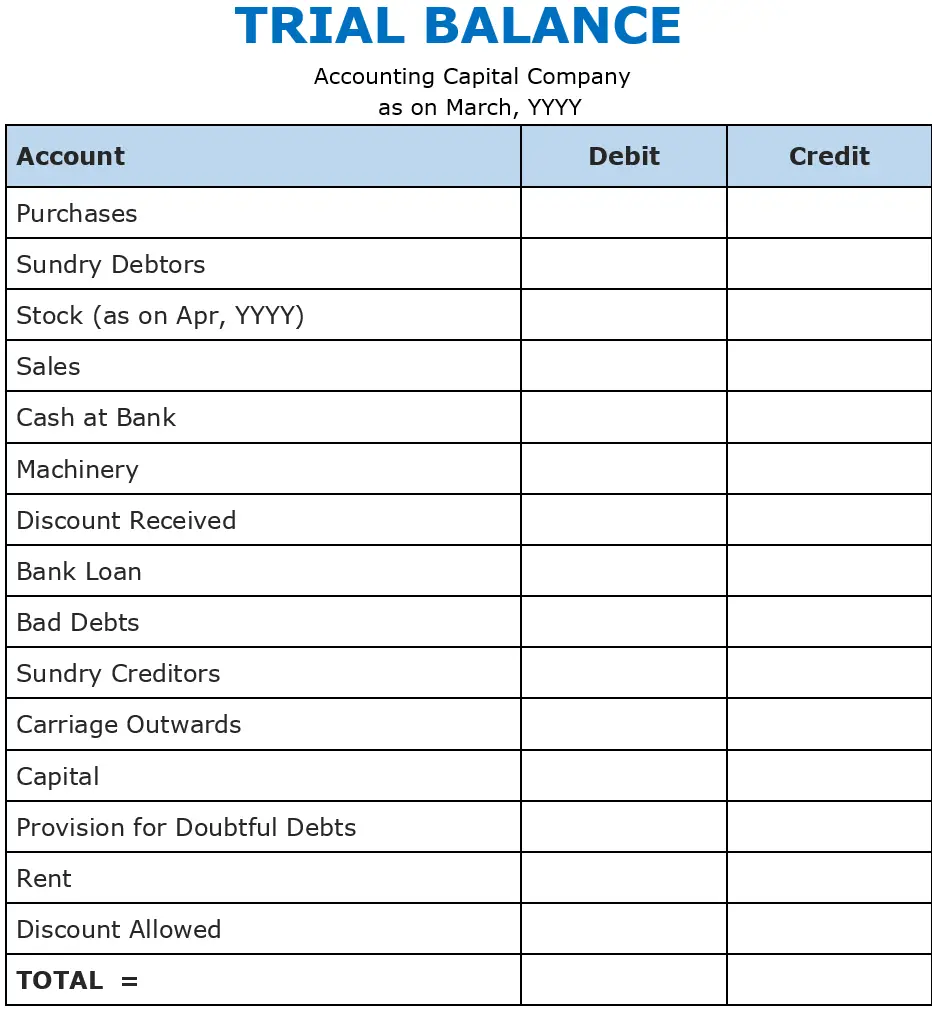

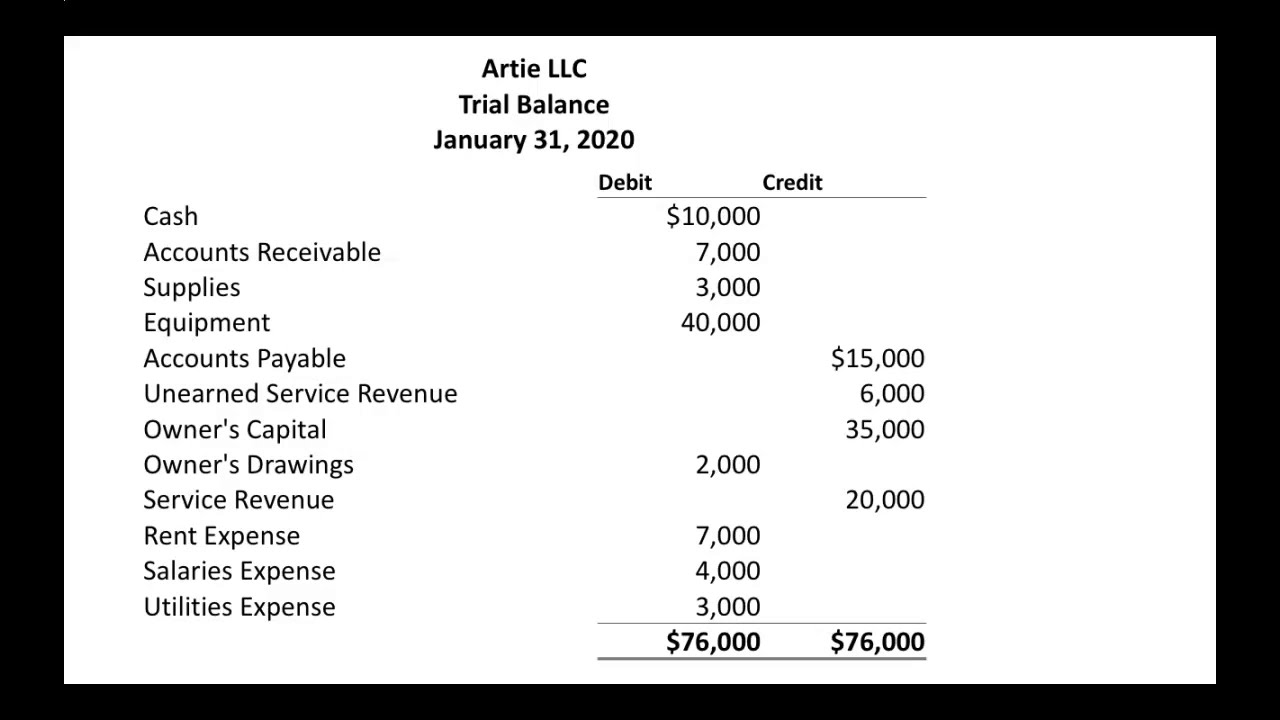

An organisation prepares a trial balance at the end of the accounting year to ensure all entries in the bookkeeping system are accurate. Example of a trial balance document The total sum of both should be the same and needs to place in their respective columns of the trial balance.