Inspirating Info About In General Consolidated Financial Statements

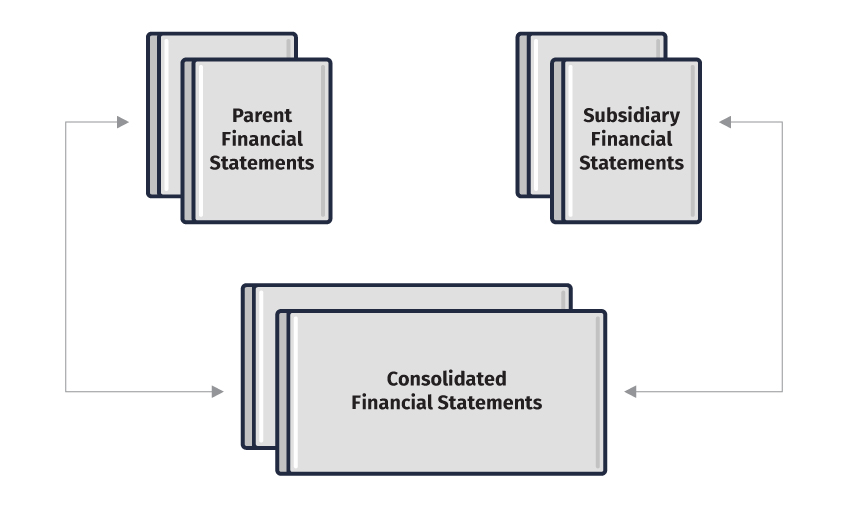

Consolidated financial statements include the accounts of a reporting entity and all other legal entities in which it holds a controlling financial interest (i.e., subsidiaries of the reporting entity).

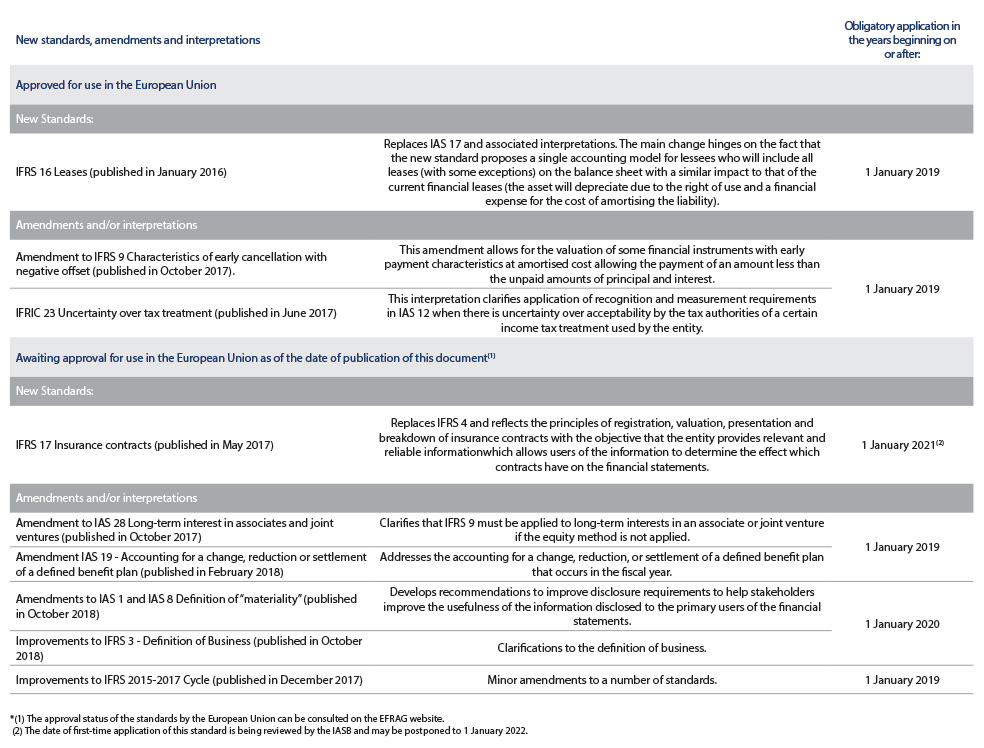

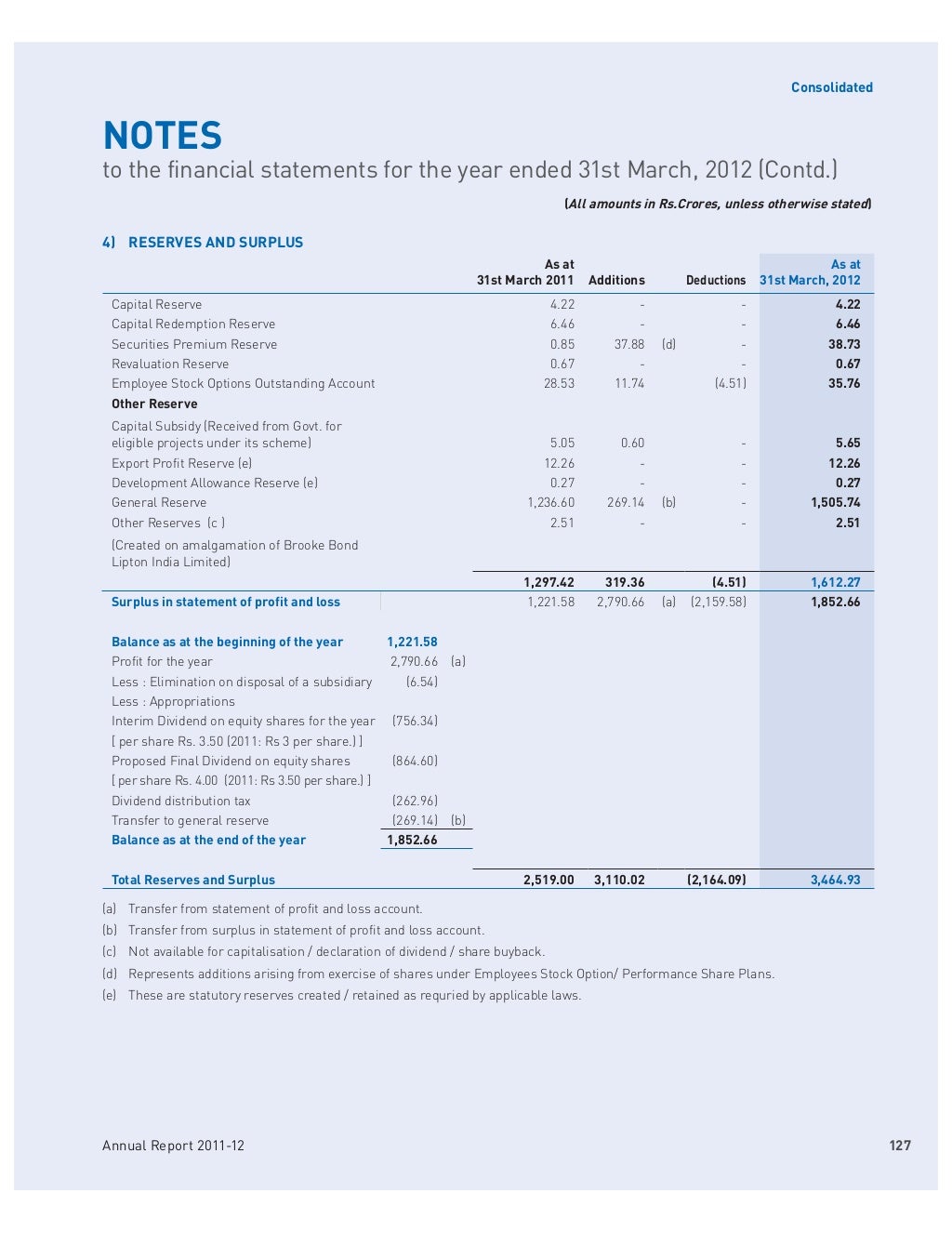

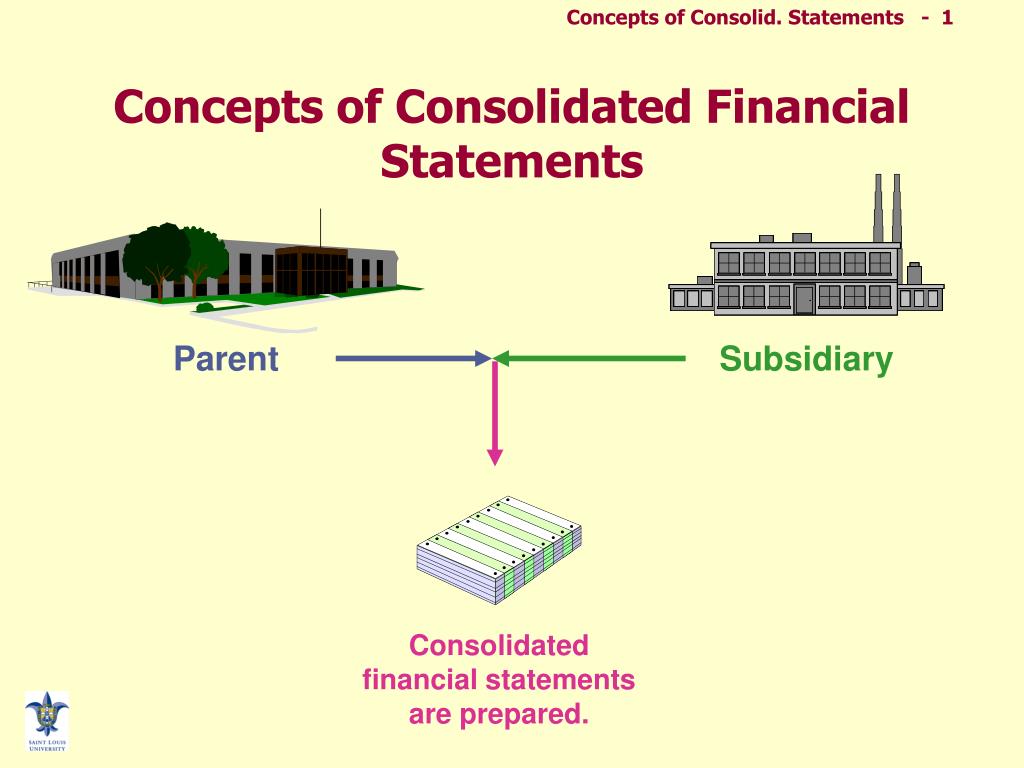

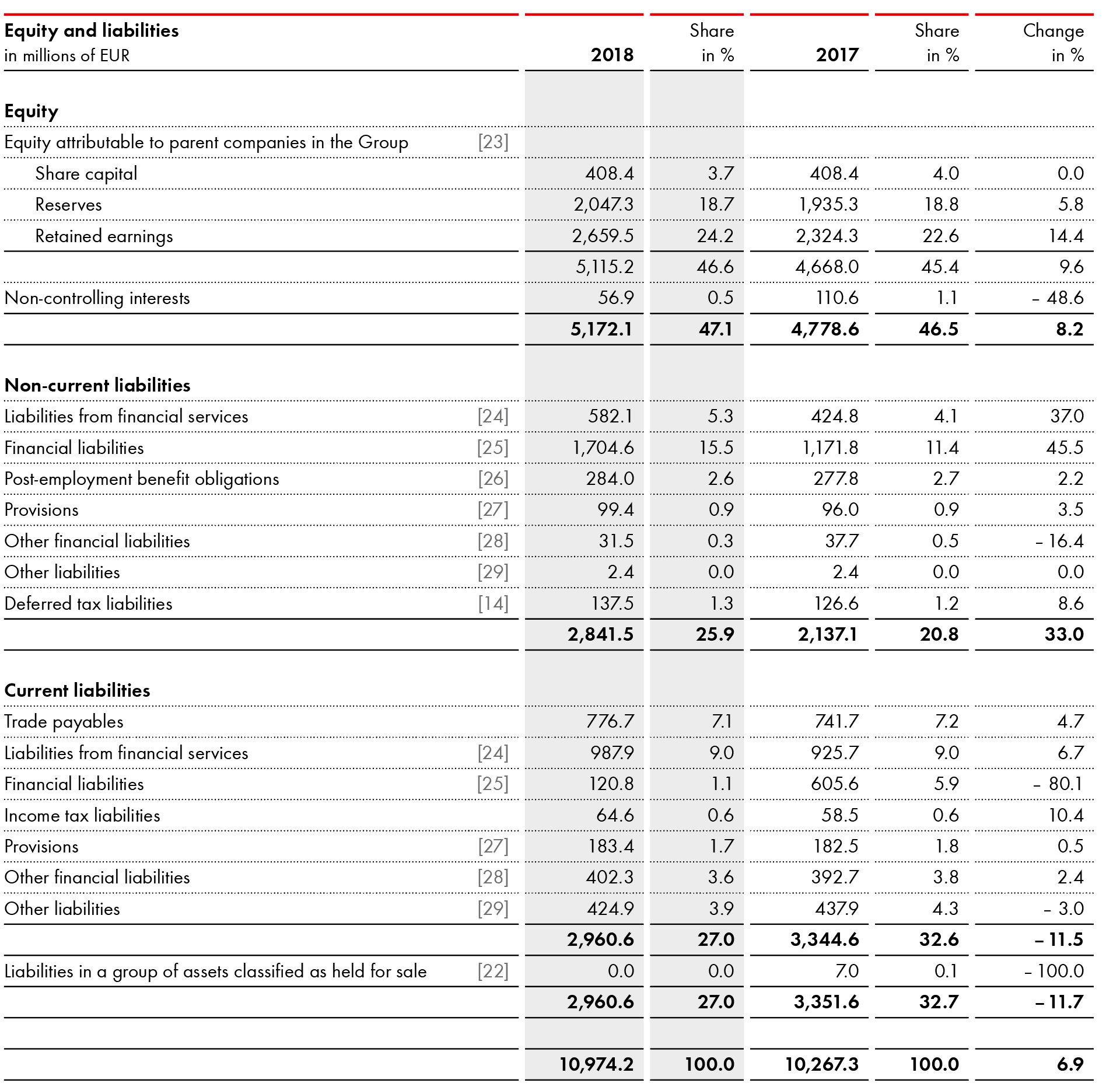

In general consolidated financial statements. Ifrs 10 consolidated financial statements in april 2001 the international accounting standards board (board) adopted ias 27 consolidated financial statements and accounting for investments in subsidiaries, which had originally been issued by the international accounting standards committee in april 1989. This guide illustrates only consolidated financial statements and does not illustrate separate financial statements. Ias 27 defines consolidated financial statements as ‘the financial statements of a group in which the assets, liabilities, equity, income, expenses and cash flows of the parent and its subsidiaries are presented as those of a single economic entity.’ the diagram below shows an example of a typical group structure:

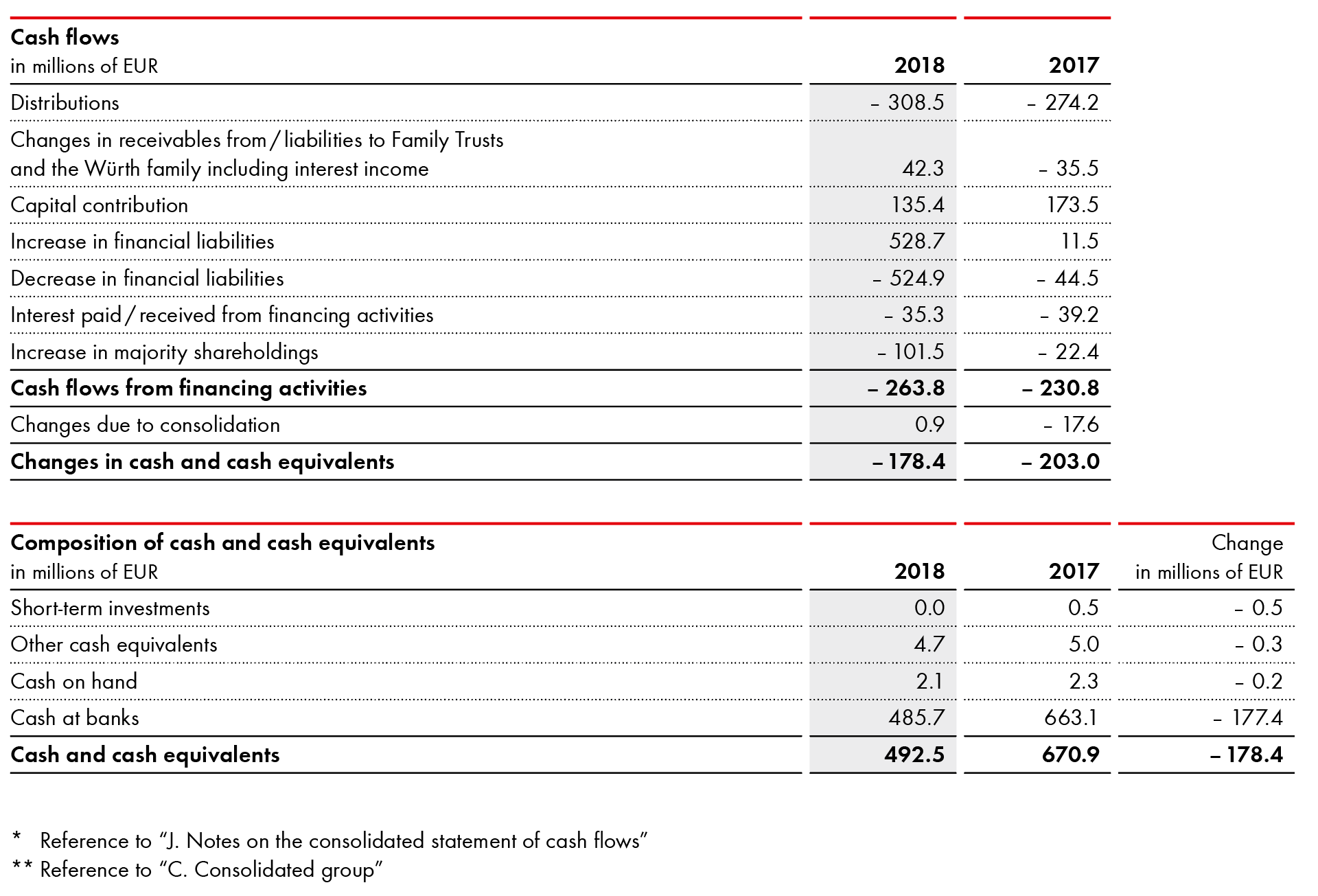

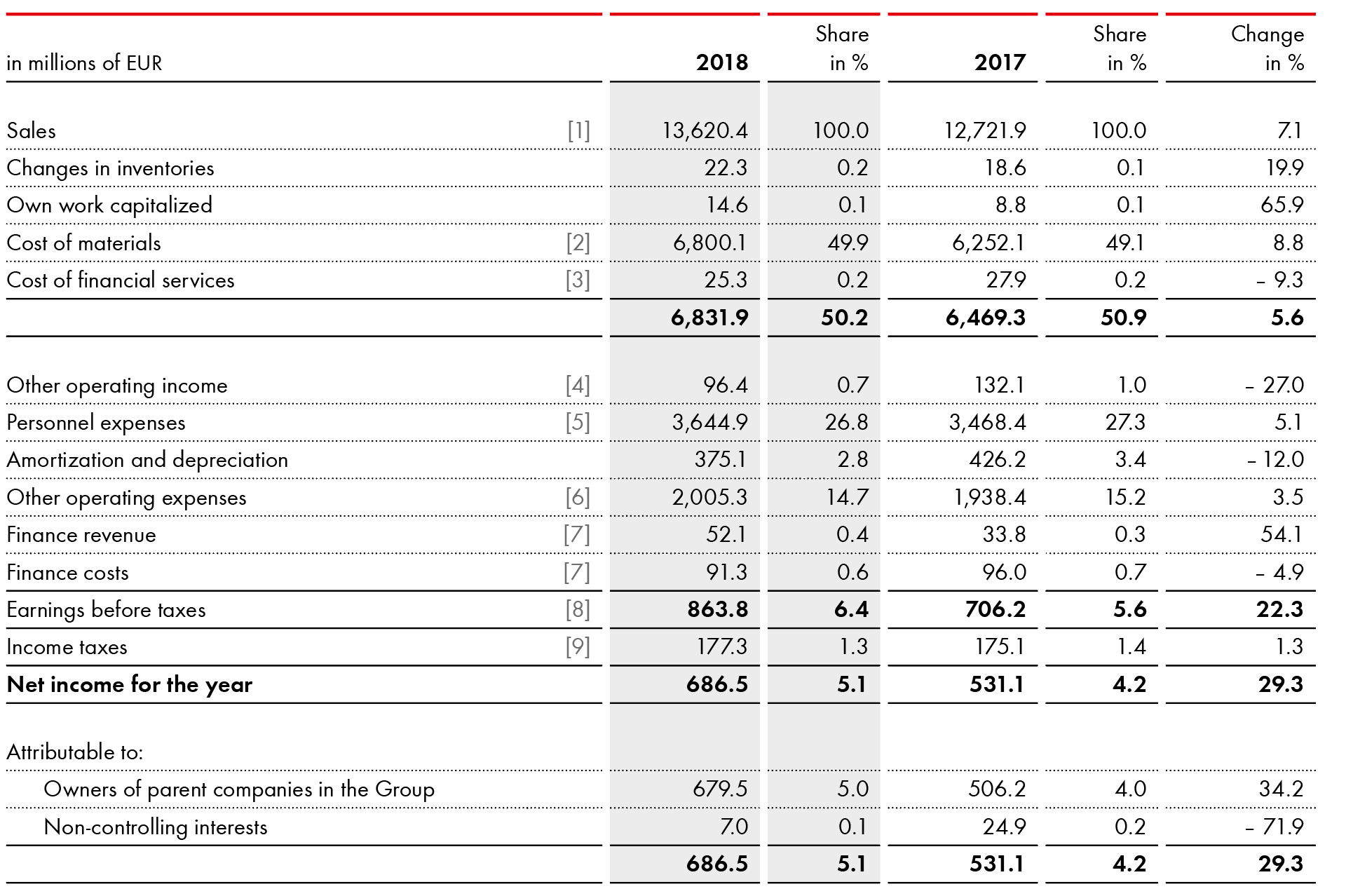

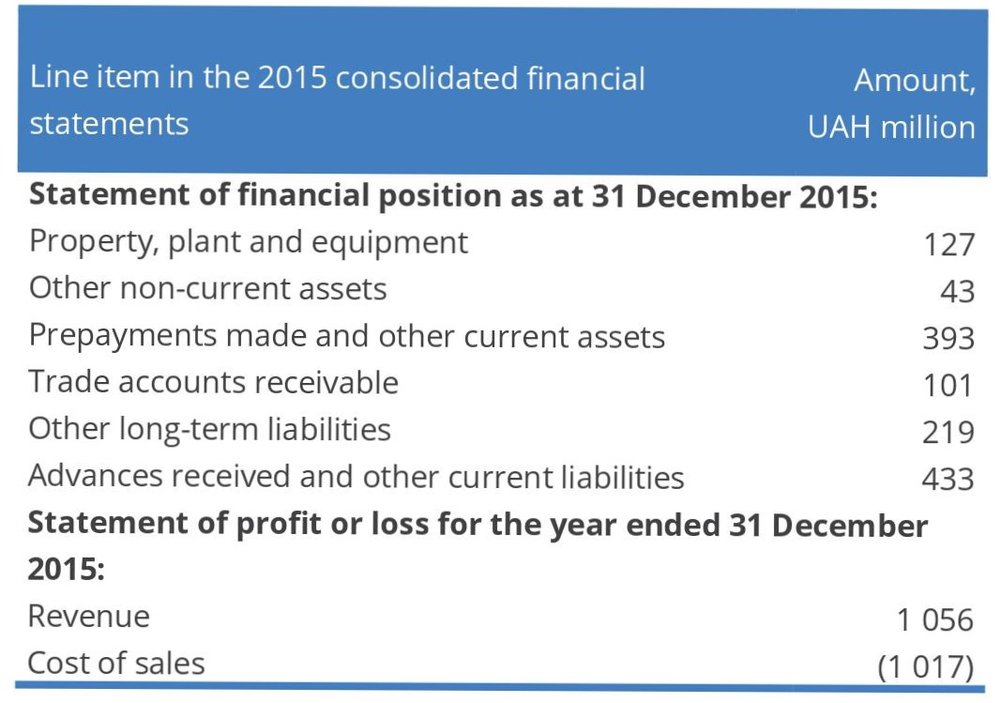

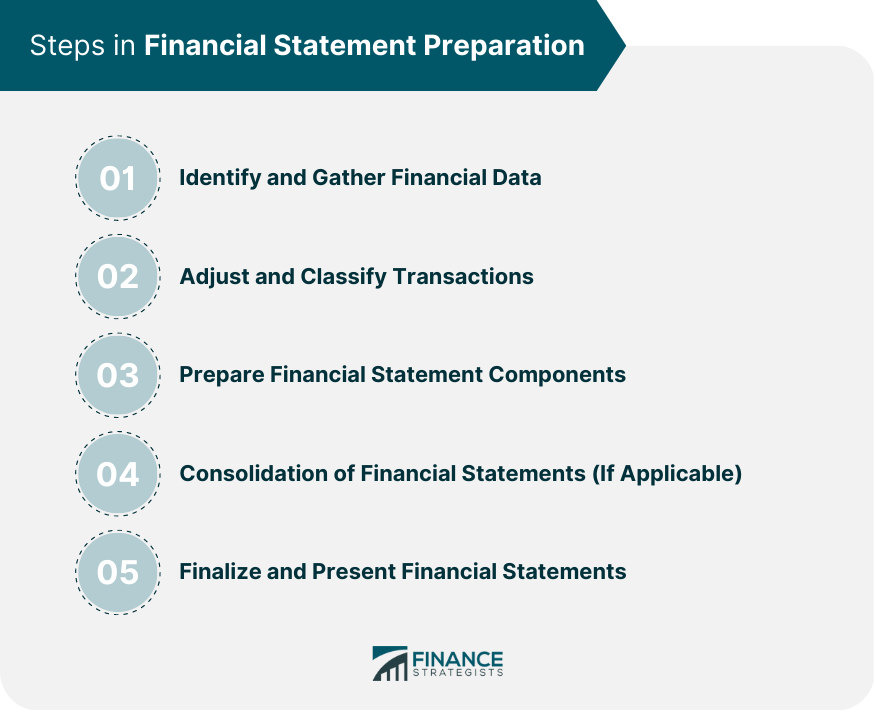

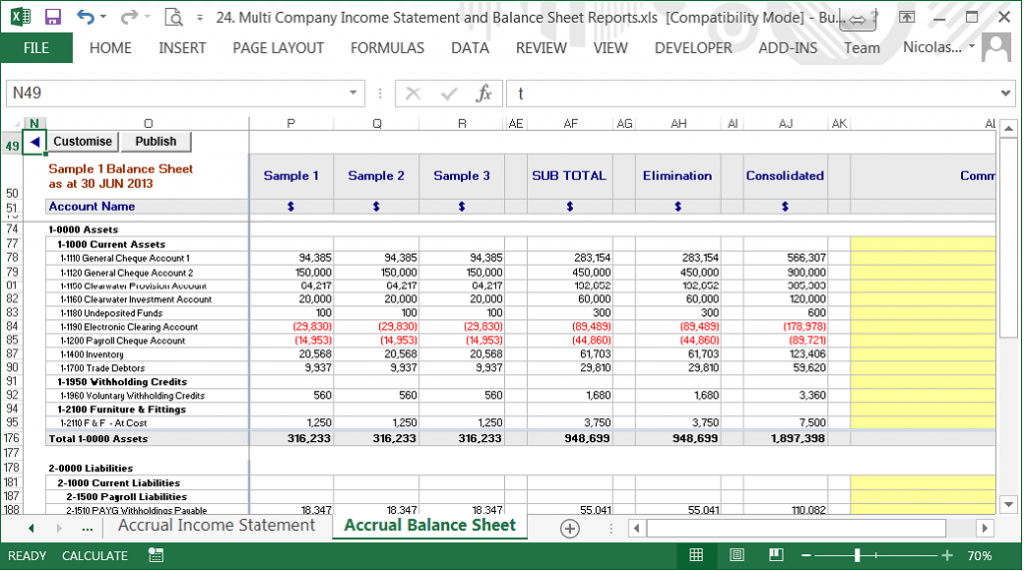

This publication is intended to help preparers in the preparation and presentation of consolidated financial statements in accordance with indian accounting standards (ind as) and schedule iii to the companies act, 2013 by illustrating a format for consolidated financial statements for a hypothetical multinational company involved in general. Consolidated financial statements present assets, liabilities, equity, income, expenses, and cash flows of a parent entity and its subsidiaries as if they were a single economic entity. In general, consolidated financial statements should be prepared:

London stock exchange | london stock exchange. In general, consolidated financial statements should be prepared a. Explanations regarding material losses, extraordinary income and expenses, as well as.

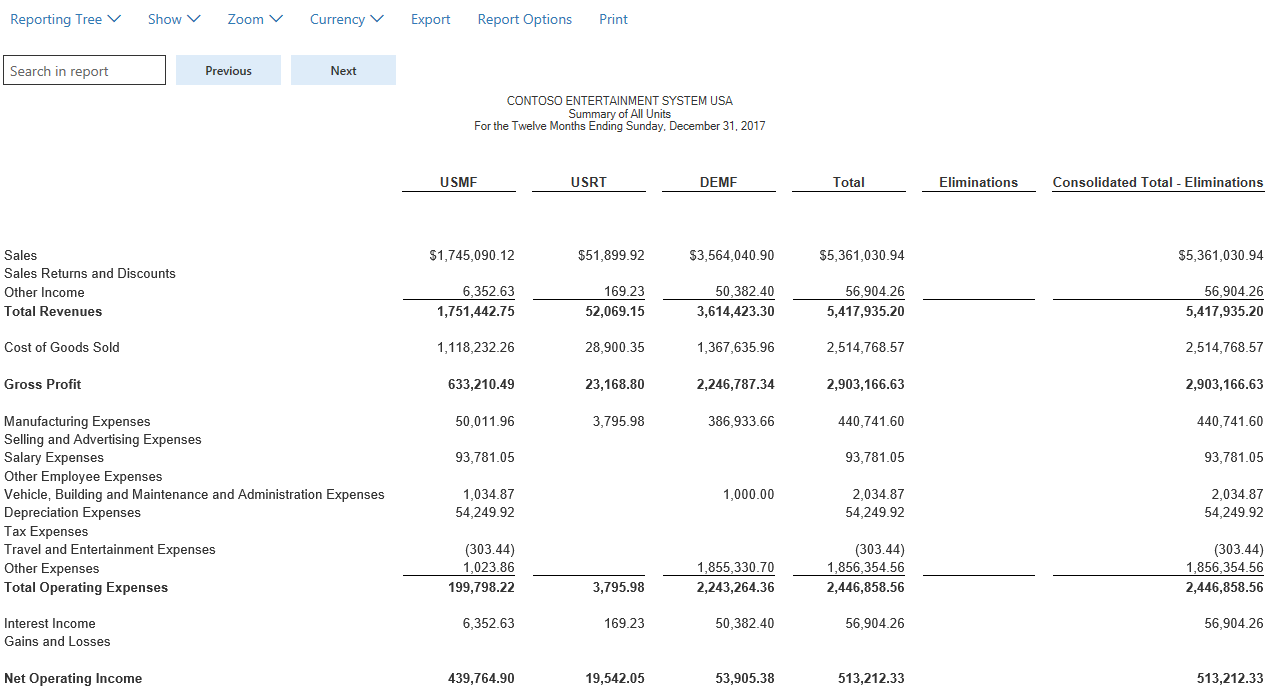

In general, the consolidated report should read like the financial statements of one company. Ifrs 10 outlines the requirements for the preparation and presentation of consolidated financial statements, requiring entities to consolidate entities it controls. This loss takes into account the full release of the provision for financial risks, amounting to €6,620 million, which.

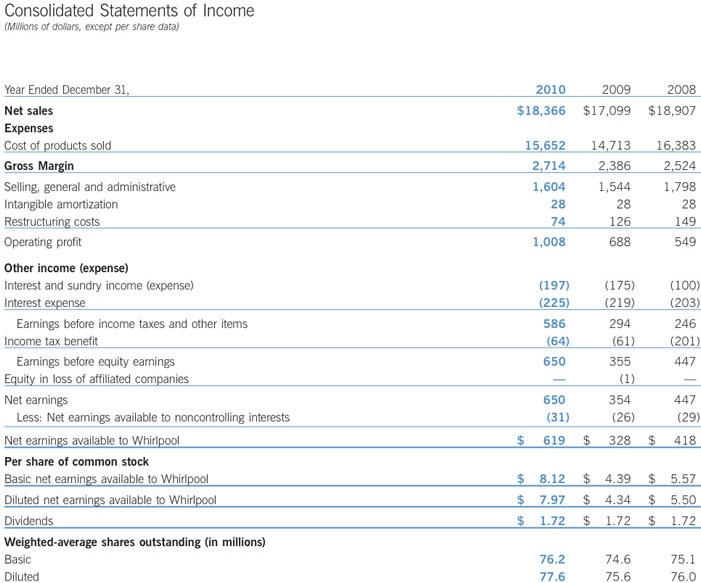

When a corporation owns more than 50% of the common stock of another company c. Companies often use the word consolidated loosely in financial statement. (in millions of euros) notes 2023 2022 % change net sales 6.1 83,270 81,385 2.3% loyalty program costs (993) (842) 18.0%

Although the presentation of consolidated subsidiaries in parent company financial statements is similar to the equity method guidance prescribed by asc 323, investments—equity method and joint ventures, it may not yield the same result because certain items are handled differently under asc 323 than they are in consolidation. Whenever the market value of the stock investment is significantly lower than its cost When a corporation owns more than 20% of the common stock of another company b.

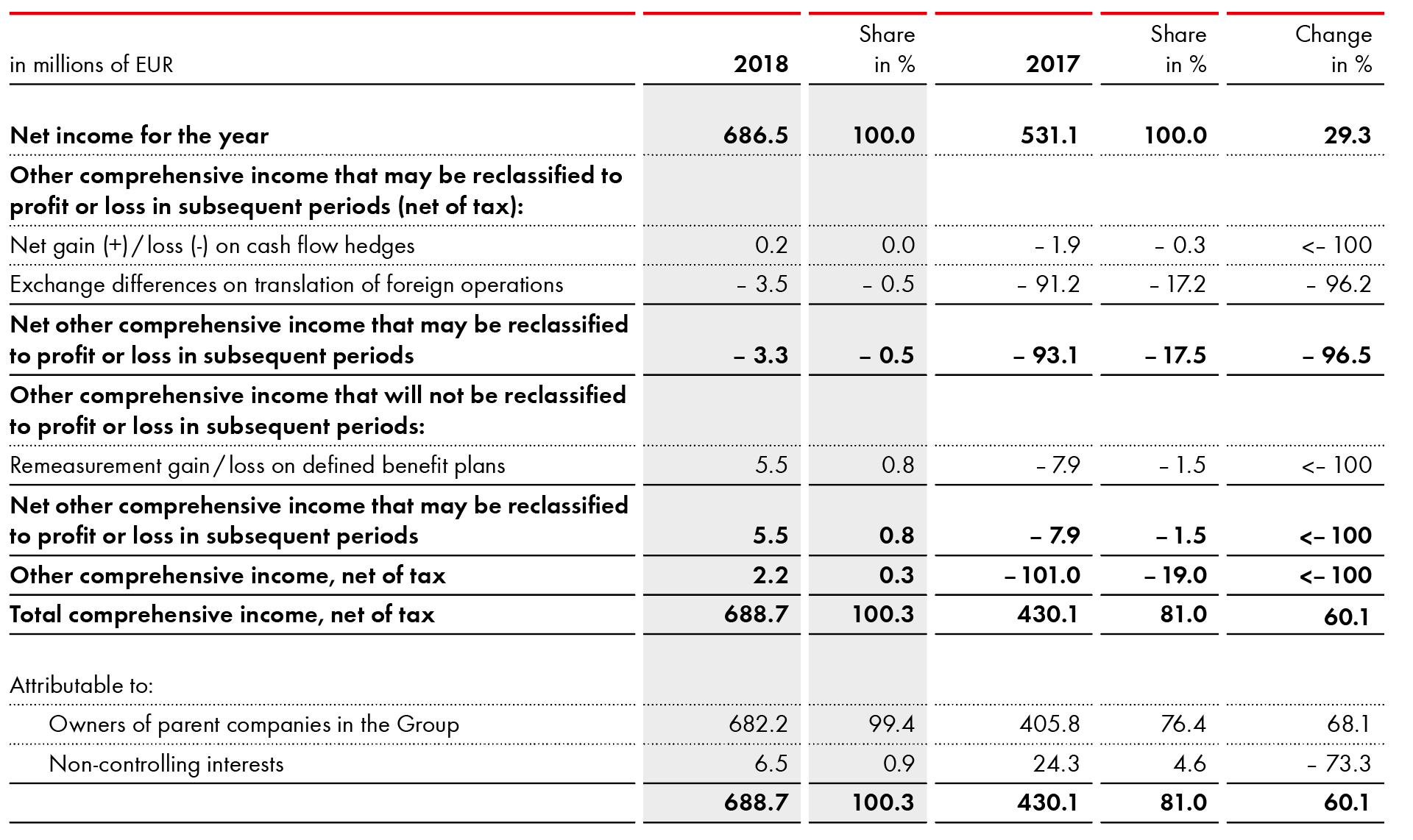

Consolidated financial statements are the financial statements of a group of entities that are presented as being those of a single economic entity. The requirements for consolidated financial statements are fairly similar under both frameworks. What is a consolidated financial statement?

As a result, there may be rounding differences between the amounts reported in the various statements. The consolidated financial statements are presented in millions of euros, rounded to the nearest million. When a corporation owns more than 50% of the common stock of another this problem has been solved!

The terms ‘group’, ‘parent’, and ‘subsidiary’ are used in this context to refer to the. Gao's report on the u.s. This includes their trial balances, general ledgers, and supporting documentation such as transaction records, invoices, and reconciliations.

30 jun 2023 us ifrs & us gaap guide in relation to certain specialized industries, us gaap allows more flexibility for use of different accounting policies within a single set of consolidated financial statements. Consolidated financial statements are financial statements of an entity with multiple divisions or subsidiaries. In general, consolidated financial statements should be prepared by a dedicated team or point person.

:max_bytes(150000):strip_icc()/Consolidatedfinancialstatement_final-1a46c53d5f0d4eca864b30adfe22b048.png)