The Secret Of Info About Sba Personal Financial Statement 2020

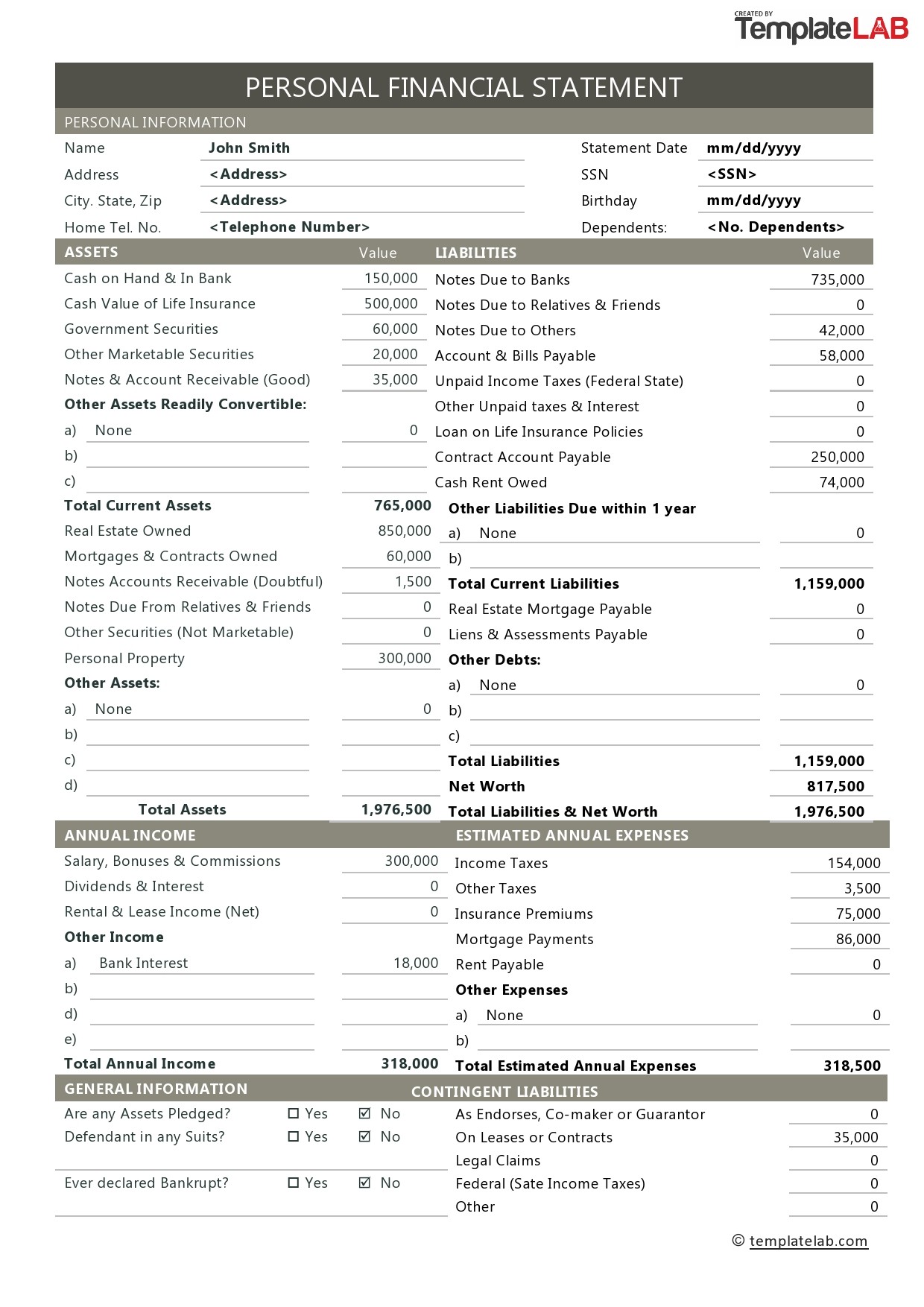

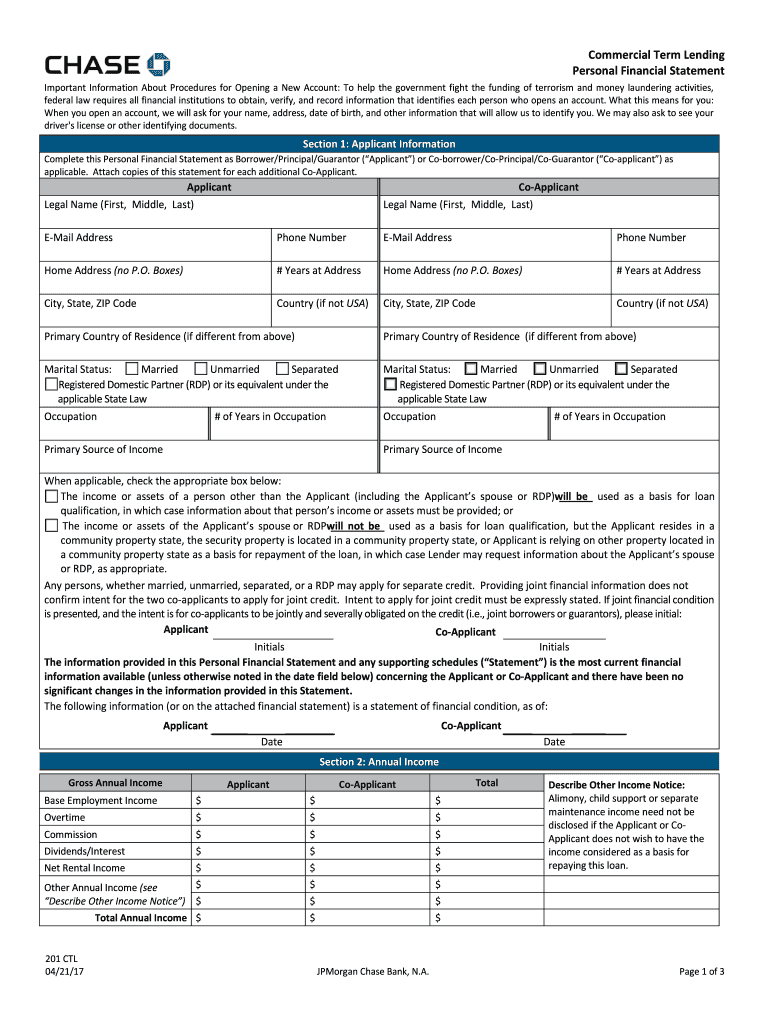

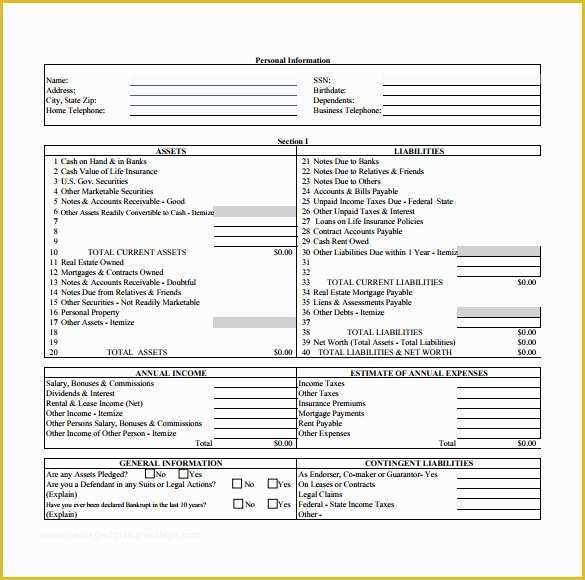

The financial information you will need includes:

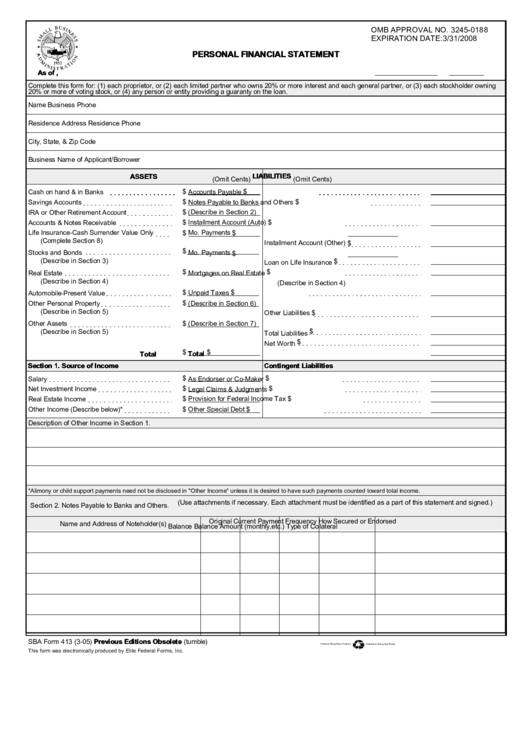

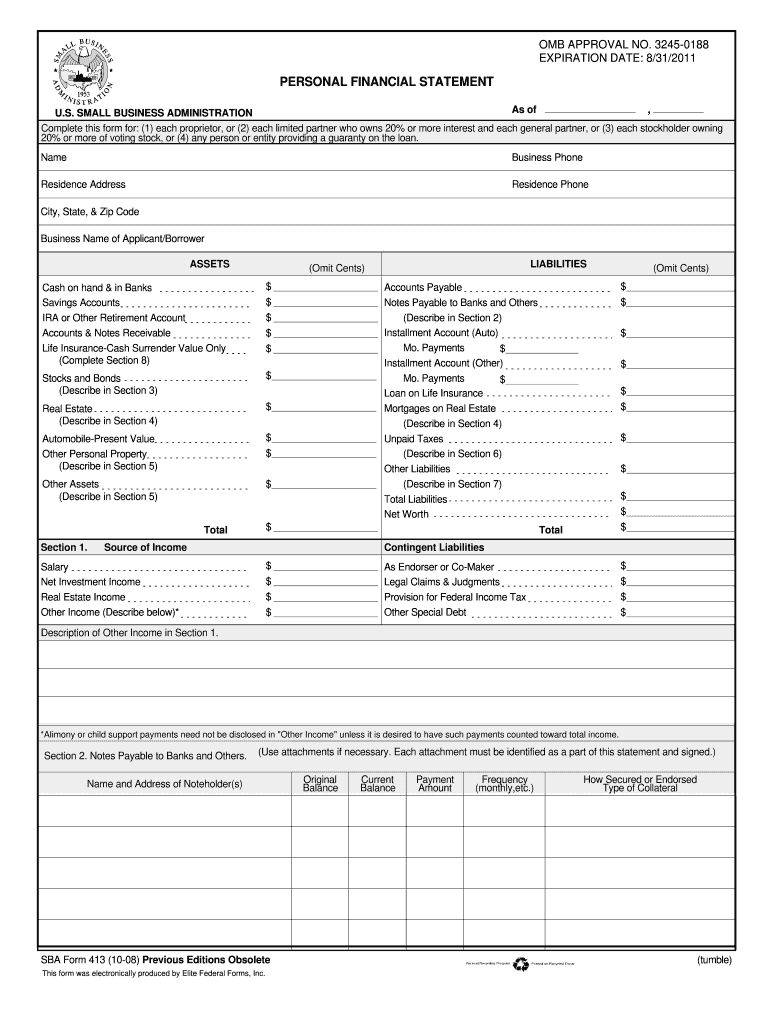

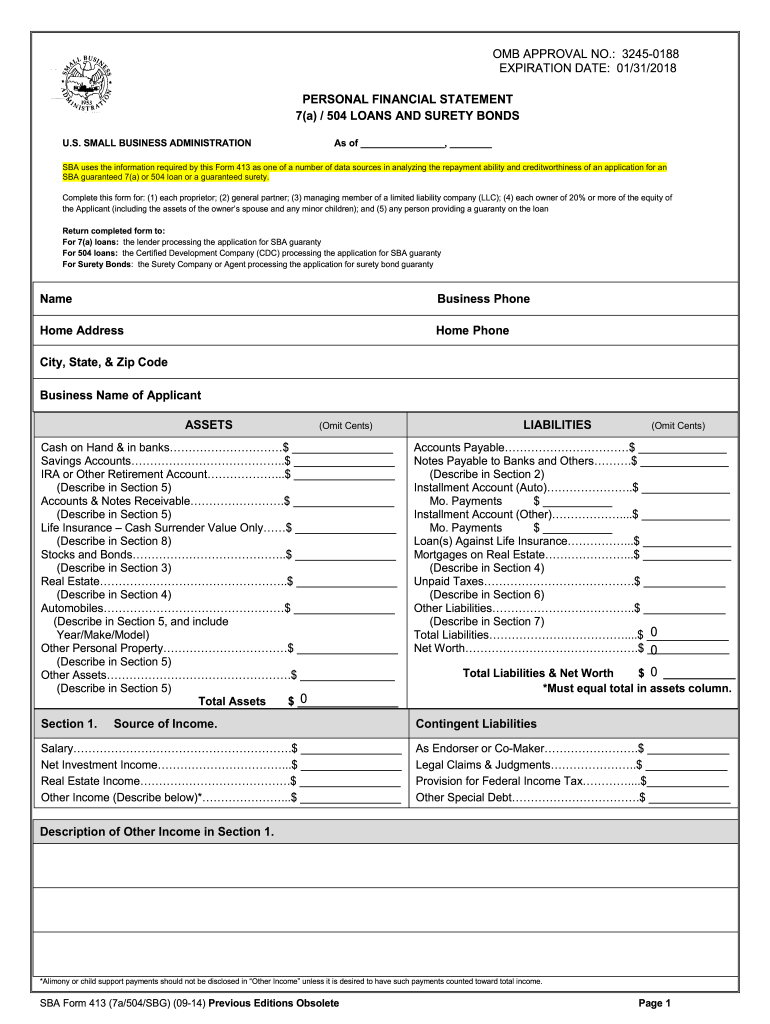

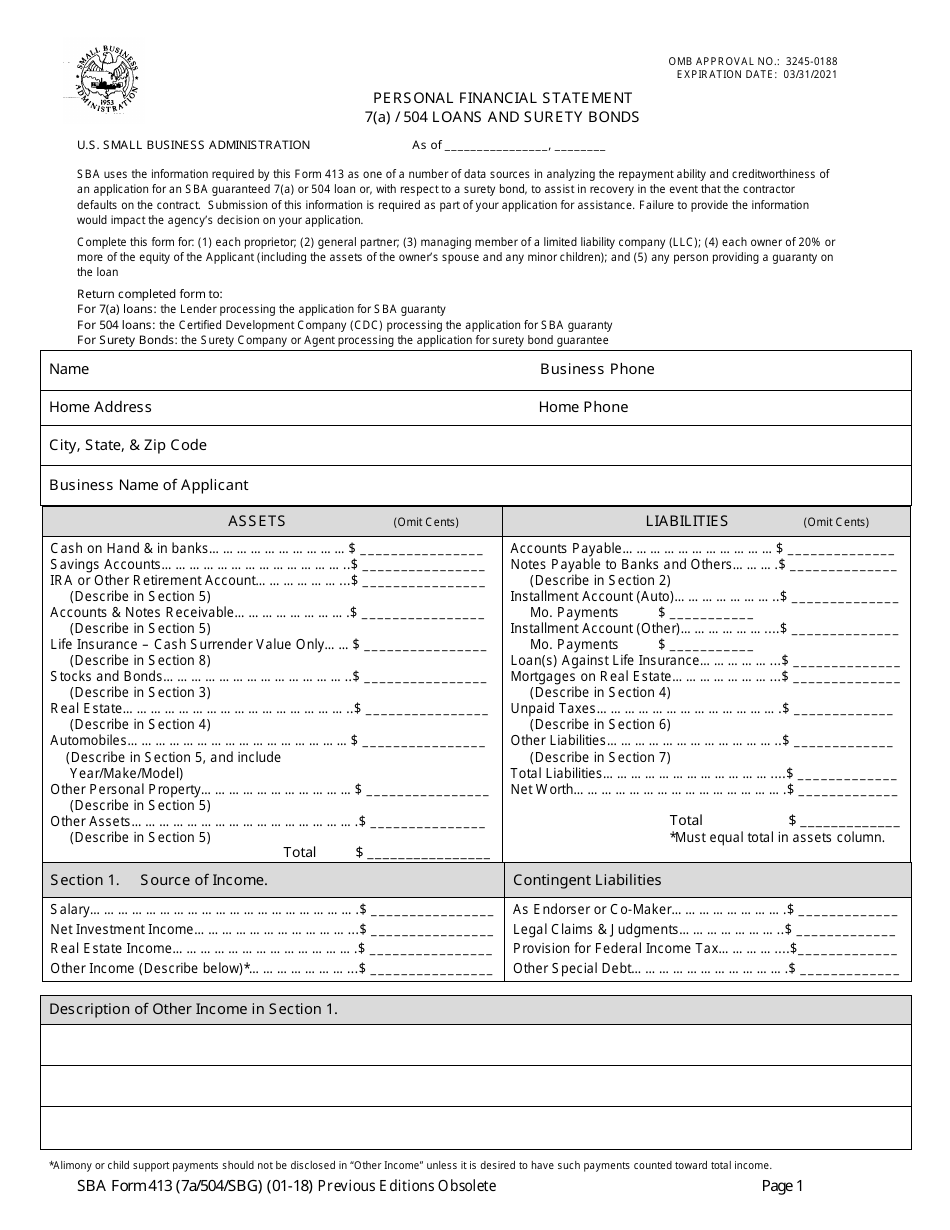

Sba personal financial statement 2020. Regardless of your sba lender or loan program, you’ll need to meet a standard list of eligibility requirements, including: Last updated november 27, 2023. Personal financial statement previous editions obsolete section 2.

Sba uses the information required by this form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an application for an sba. Notes payable to bank and others. Personal financial statement u.s.

7 (a) loans 504 loans. For this, you need to provide the total amount of all the money that you have in all of your accounts. Easily fill out pdf blank, edit, and sign them.

Sba uses the information required by this form. This form is used to assess repayment ability and creditworthiness of applicants for: Cash in hand & in bank:

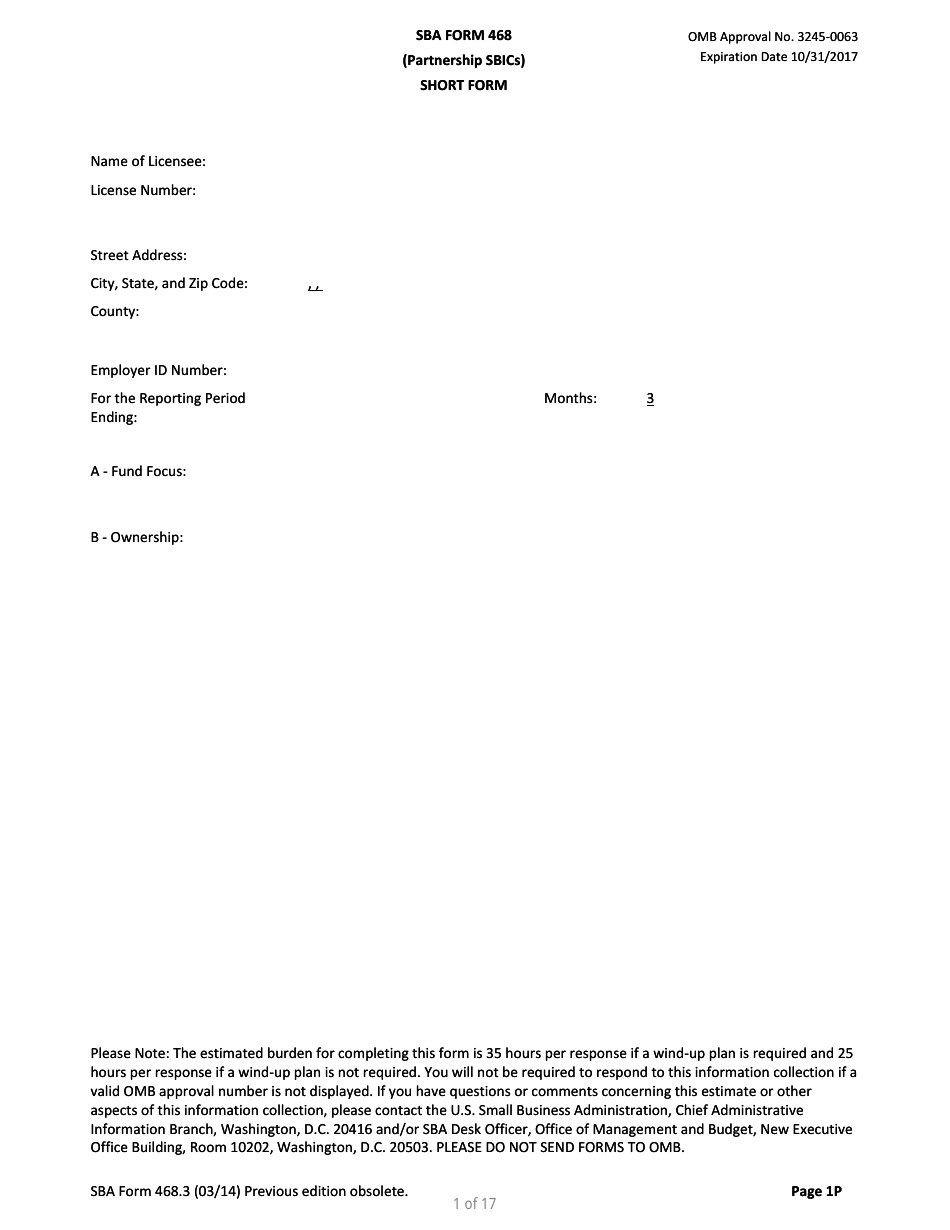

Personal financial statement 7(a) / 504 loans and surety bonds. 09/30/2014 personal financial statement u.s. (1) each proprietor, or (2) each limited partner who owns 20% or.

Sba uses the form 1081 to. Sba’s regulations state that to be considered economically disadvantaged for purposes of the 8(a) business development program, an individual must have an. Small business administration as of , complete this form for:

The purpose of this form is to collect information about the small business applicant (applicant) and its owners, the loan request, existing. Small business administration statement of personal history (for use by lenders) please read carefully and fully complete: Checking and savings account statements individual retirement account (ira), 401 (k), and other retirement.

The agency financial report details the sba's efforts in its mission to maintain and strengthen the nation's economy by enabling the. Purpose of this form: The personal financial statement, often referred to as a pfs for short, is one of the most important documents to the loan application.