Matchless Tips About Treatment Of Withholding Tax In Financial Statements

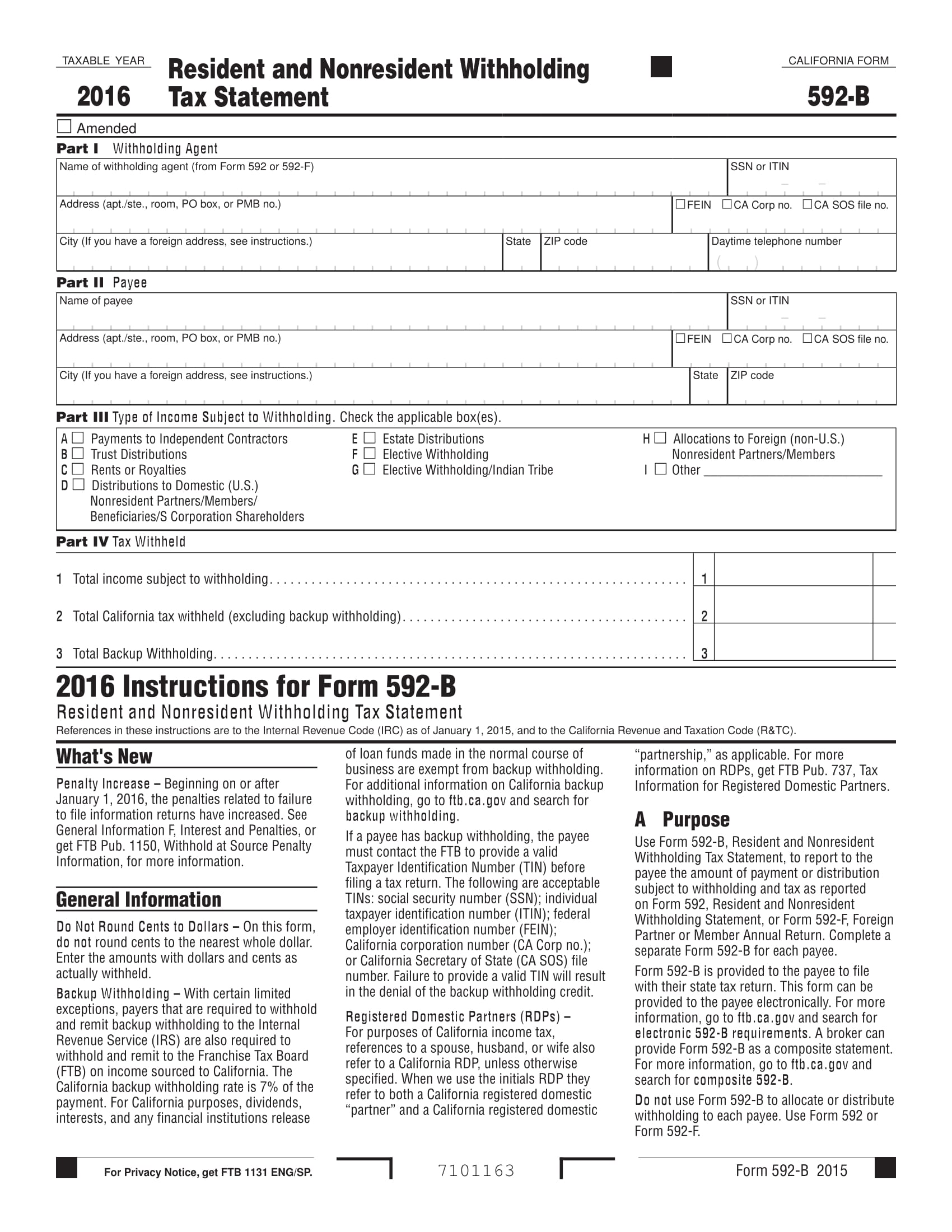

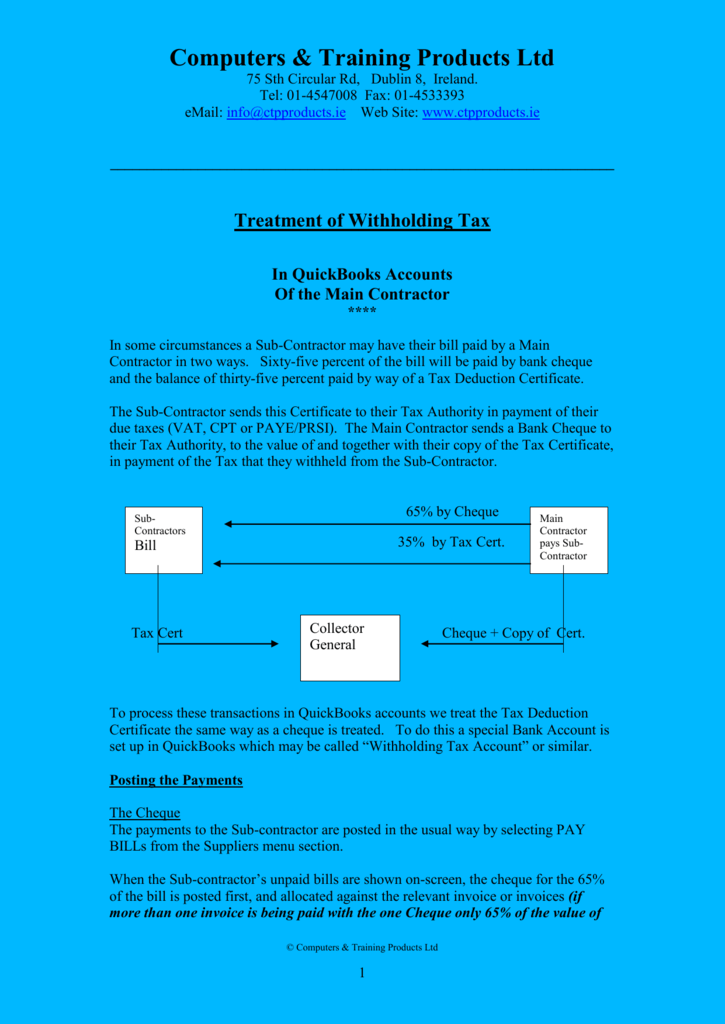

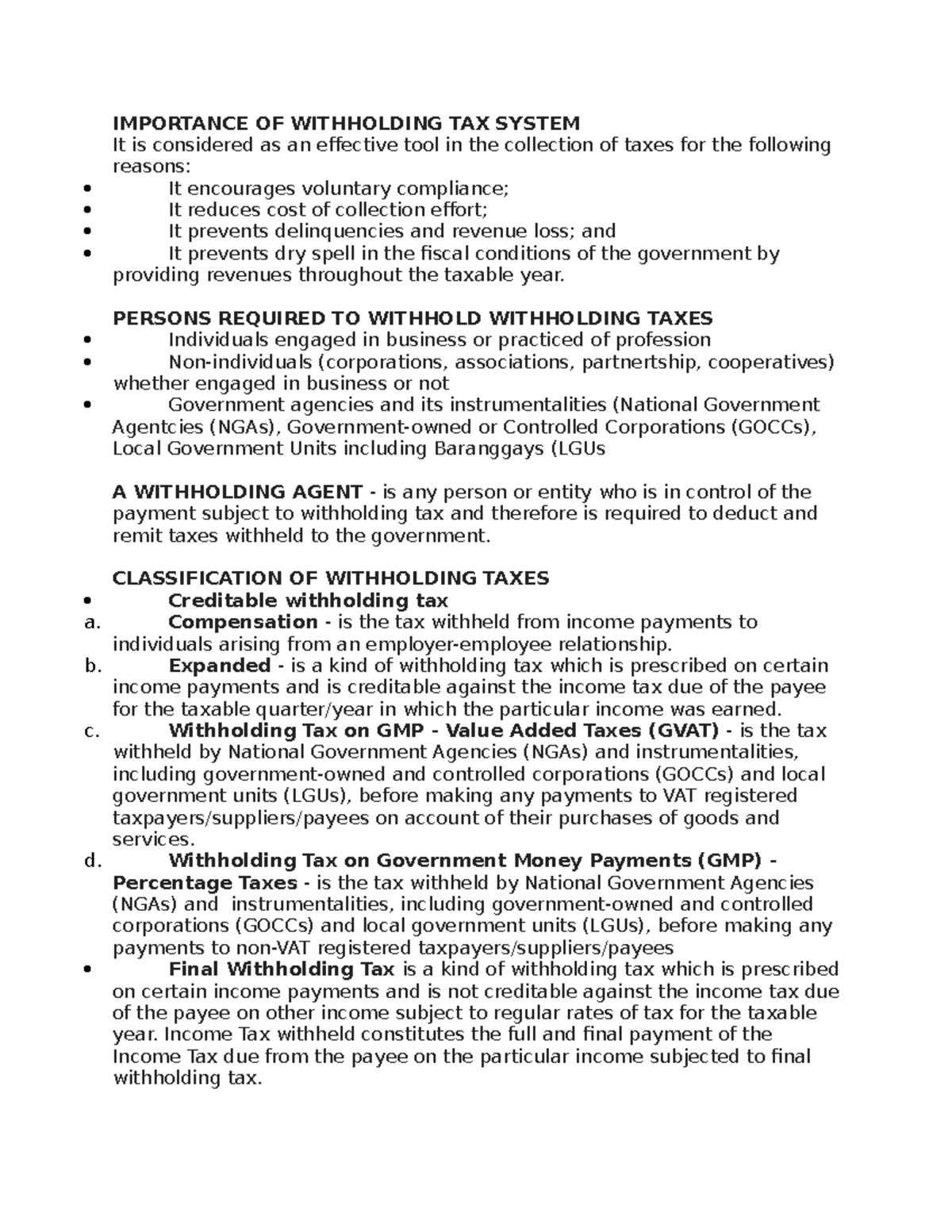

The tax that is deducted in the form of withholding taxes should be declared in the final year returns, so that the amount can be claimed and adjusted in the form of the tax.

Treatment of withholding tax in financial statements. Withholding tax vat key changes to income tax under the uk generally accepted accounting principles (gaap) with the introduction of financial reporting standard 102. The assessment of whether the withholding tax is in scope of ias 12 is judgemental; James to win an enormous victory against mr.

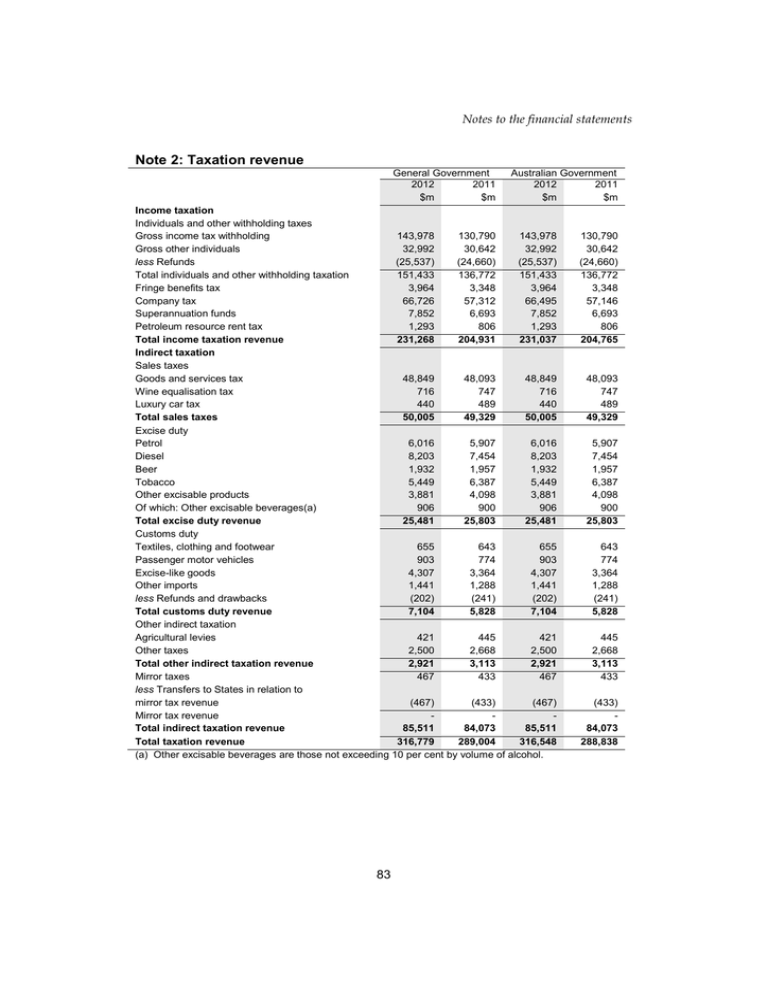

Accounting for withholding tax on dividends. Withholding tax on dividends. Income taxes also include taxes, such as withholding taxes, which are payable by a subsidiary, associate or joint arrangement on.

Income taxes (ias 12) presentation of financial statements (ias 1) insurance contracts (ifrs 17) property, plant and equipment (ias 16). On friday, the law enabled ms. When the us dollar is the functional currency, revaluations of foreign deferred tax balances are reported as either transaction gains and losses or, if.

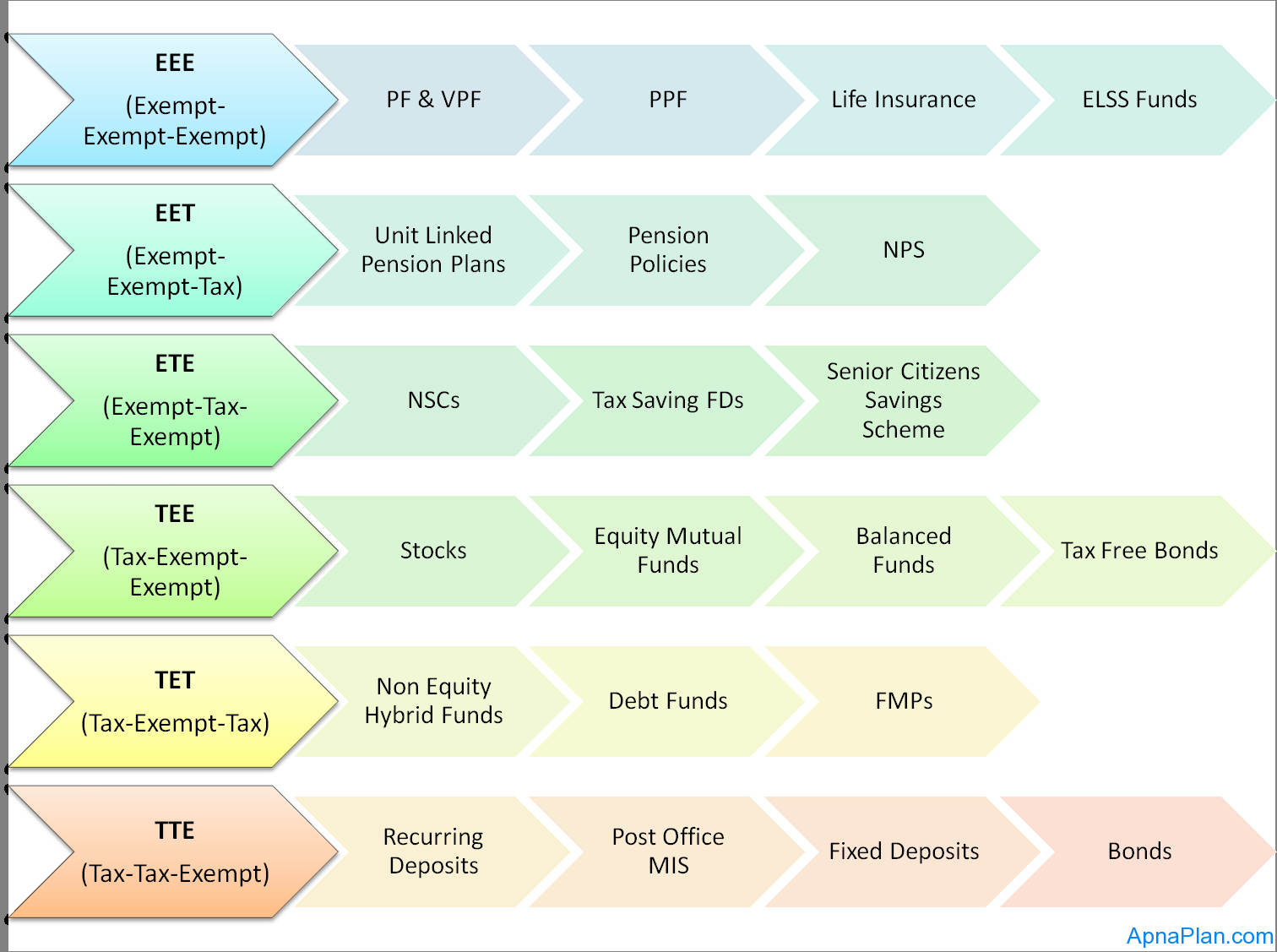

For example, when wages are paid, withholding tax is deducted. Income taxes include all taxes (domestic and foreign) based on taxable profits. A tax that is assessed on an entity based on dividends distributed is, in effect, a withholding tax for the benefit of recipients of the dividend and is not an income tax if.

The provisions of article 4a(29), article 21, article 22 and article 22c of the polish cit act (concerning, respectively, the definition of beneficial owner, the obligation. Along with the financial penalty, the judge barred mr. The balance sheet, the income statement, and.

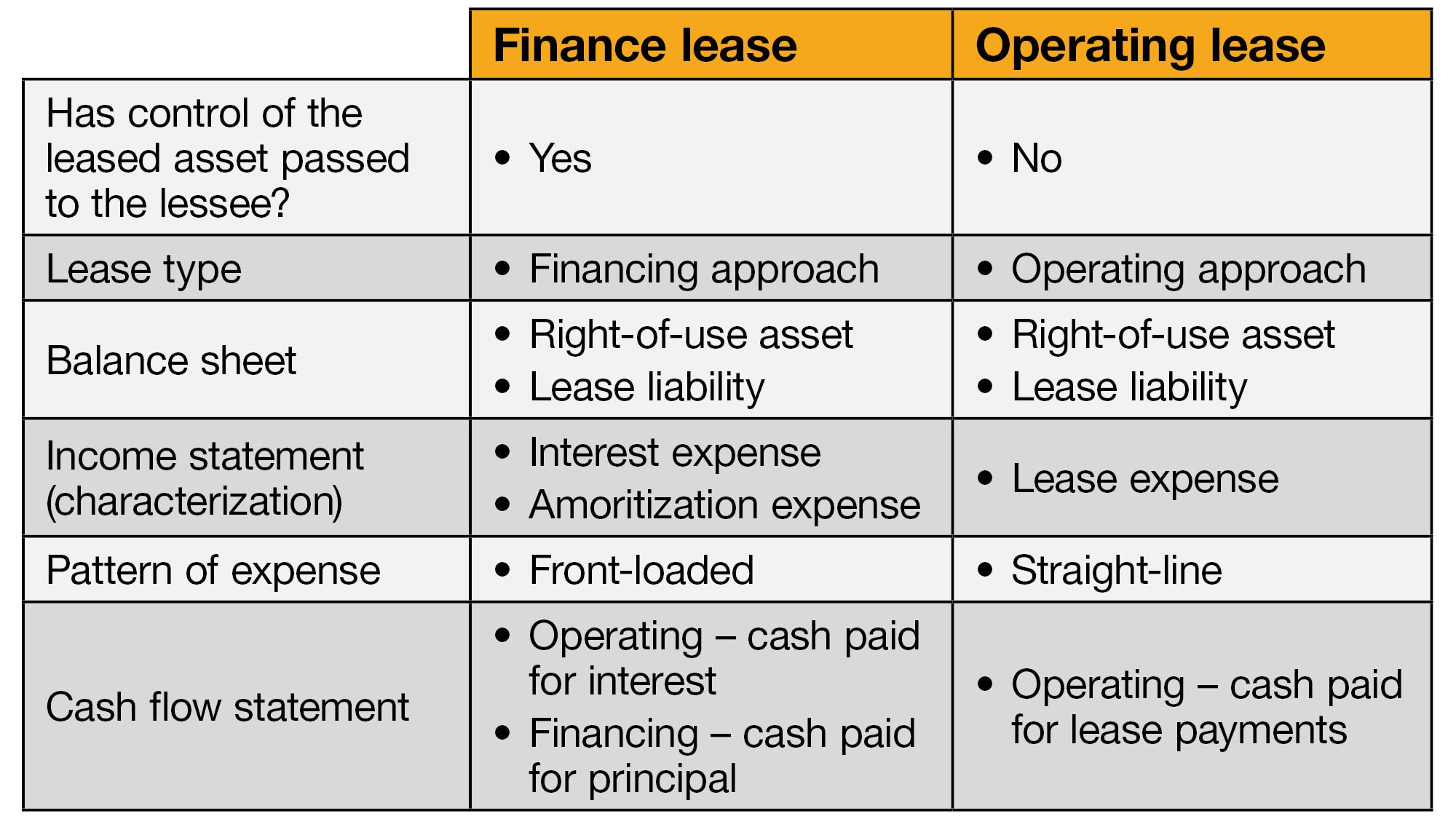

Such income reported on the financial statements would be subject to different tax treatments. Withholding tax is used in many tax jurisdictions as an efficient and effective means of tax collection. Withholding tax on dividends is allocated to equity as part of the dividends (ias 12.65a).

Ifrs, specifically ias 12 income taxes, prescribes the accounting treatment for income taxes. The company performed this assessment in the past and some of the. Foreign taxes which are based on taxable profits.

Withholding tax is efficient in that tax authorities can collect tax as taxable events take place. However, distinguishing whether a tax is a. Withholding tax, or retention tax, is usually deducted from the source of income by the payer.

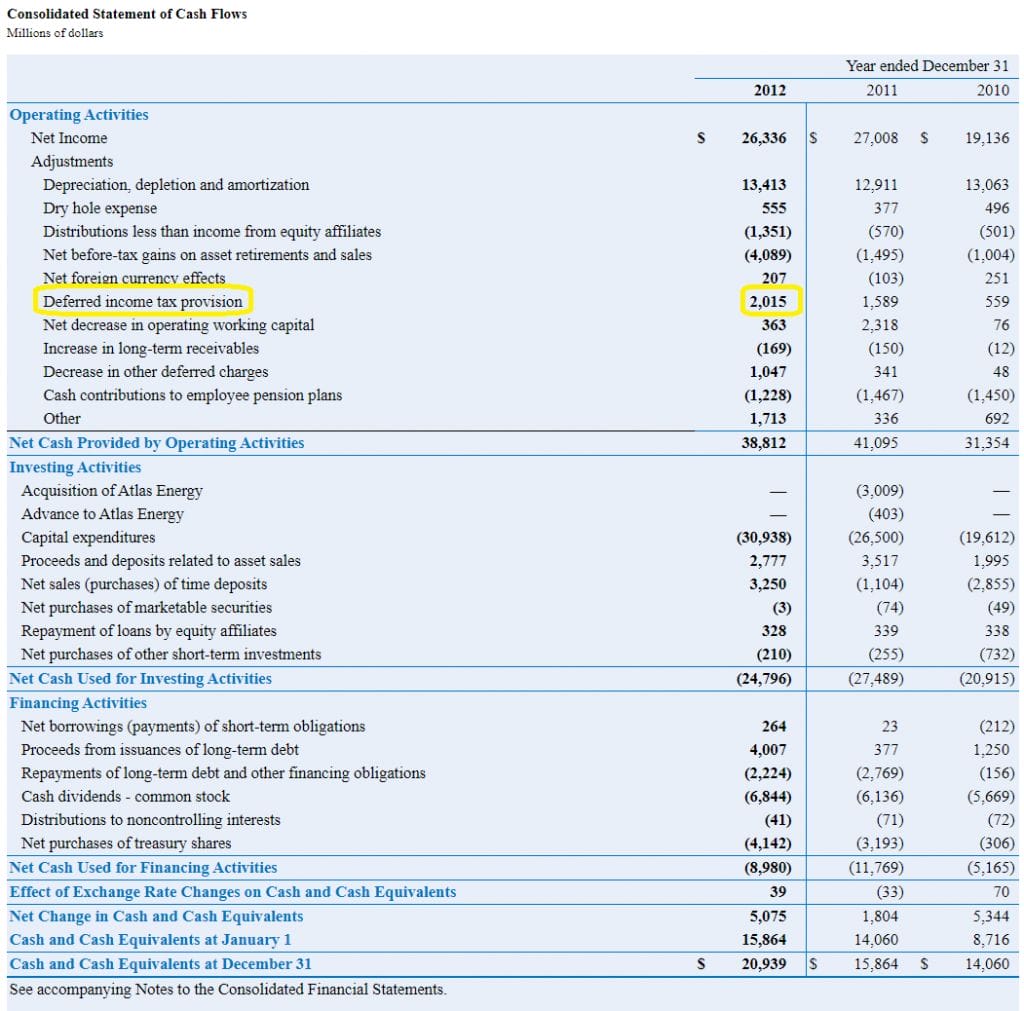

Withholding tax on accruals summary this alert brings to your attention a recent court of appeal decision in the case of kenya revenue authority and republic (ex parte: Advanced valuation techniques, and financial statements. Updated may 27, 2021 reviewed by charlene rhinehart taxes appear in some form in all three of the major financial statements:

The principal issue in accounting for income taxes is how to account for the current and. Accounting entries for receivable income if a company pays to a beneficiary income which is liable to withholding tax,. The objective of income tax accounting under ias 12 is to.