Looking Good Info About Construction Financial Statements

External users such as the cra rely on financial statements to collect tax that is owing by a company.

Construction financial statements. There are four financial statements that construction companies should produce on a regular basis: Financial statements not only show a business’s current financial health, they also. Tim klimchock, cpa, ccifp manager, aec industry group m.

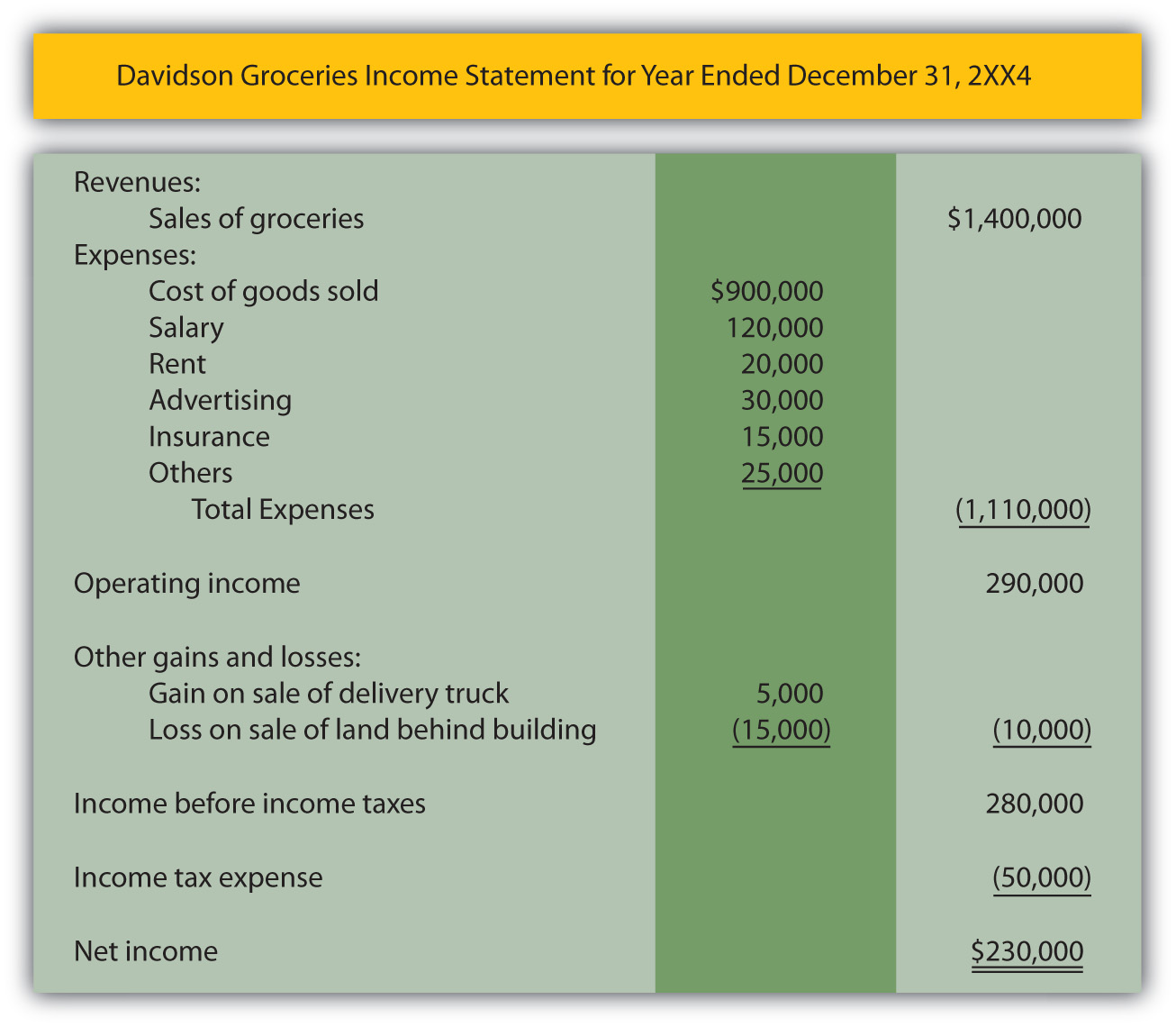

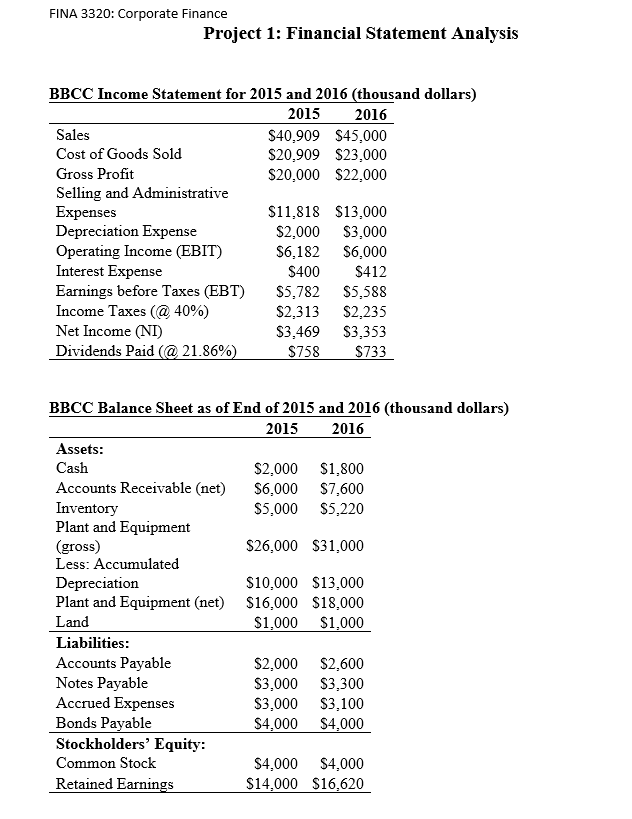

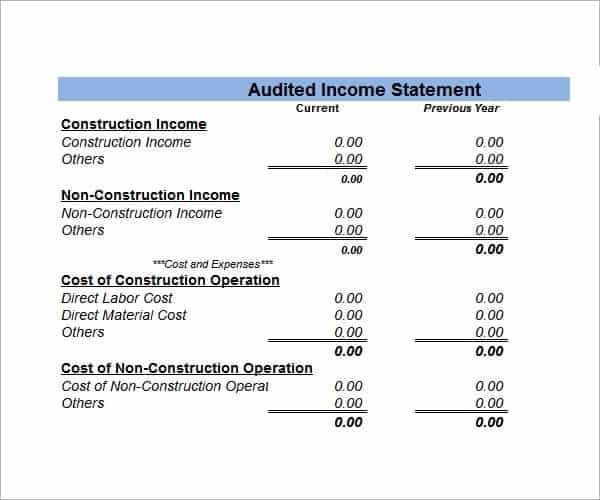

Three items you must review monthly. A profit and loss statement (or income statement), balance. Provide more useful information to users of the financial statements through new disclosure requirements.

The aicpa guide contains information and. In this article, we will focus on the three most important financial statements: In general, under the income tax act, companies are expected to follow.

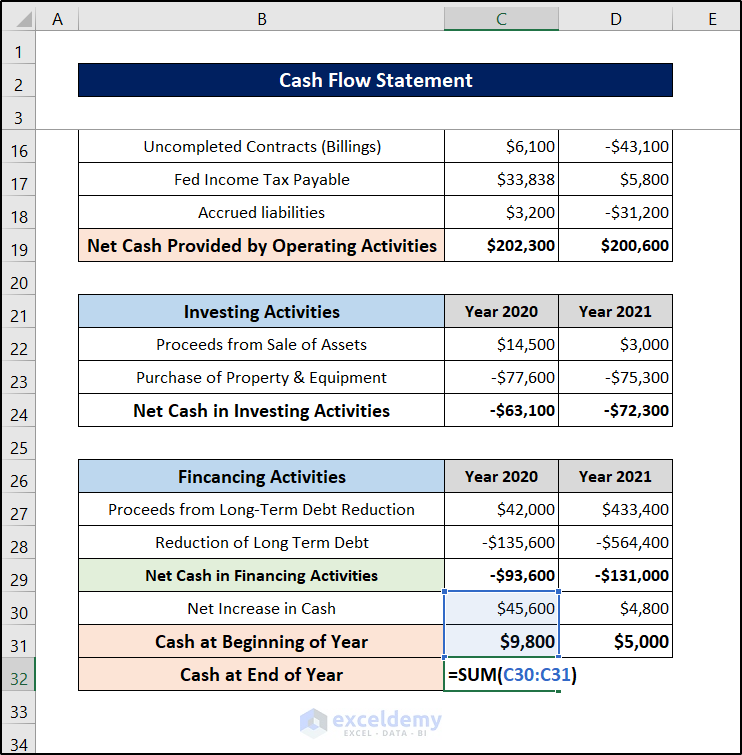

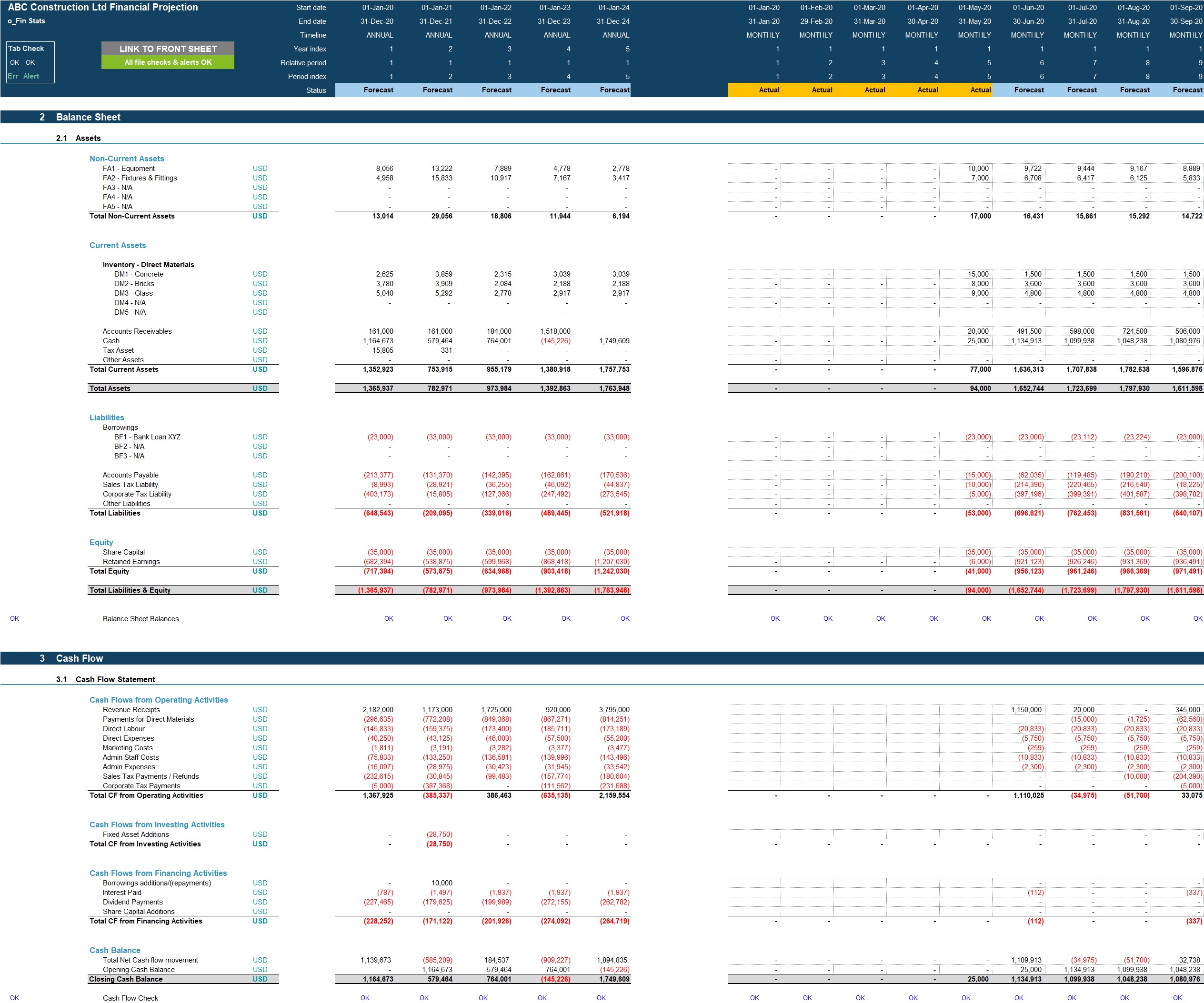

Statement of financial position as at 31 december 2021, the consolidated statements of profit or loss and other comprehensive income, changes in equity and cash flows for the. Revenue recognition is a huge change for the construction industry. The income statement (or profit and loss statement) provides a breakdown of the revenues, costs, and profit during a specific period of time.

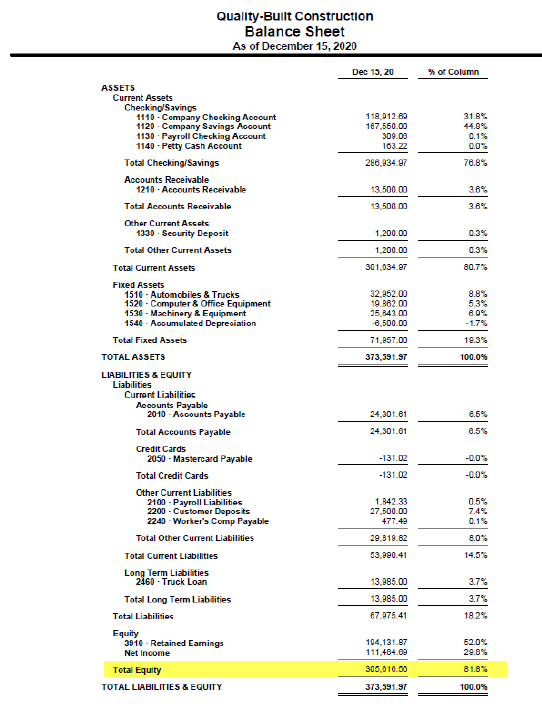

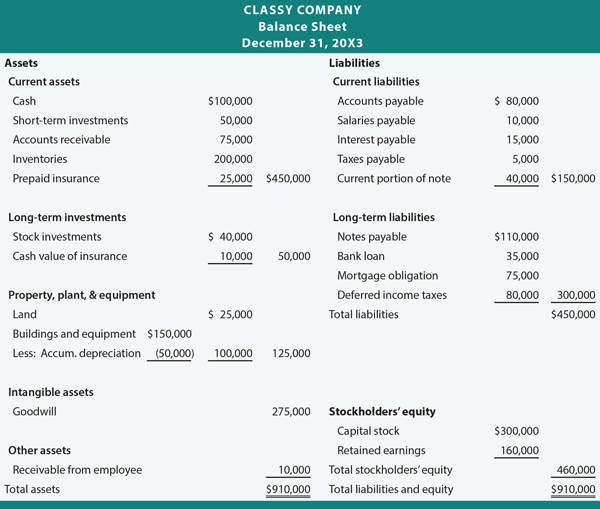

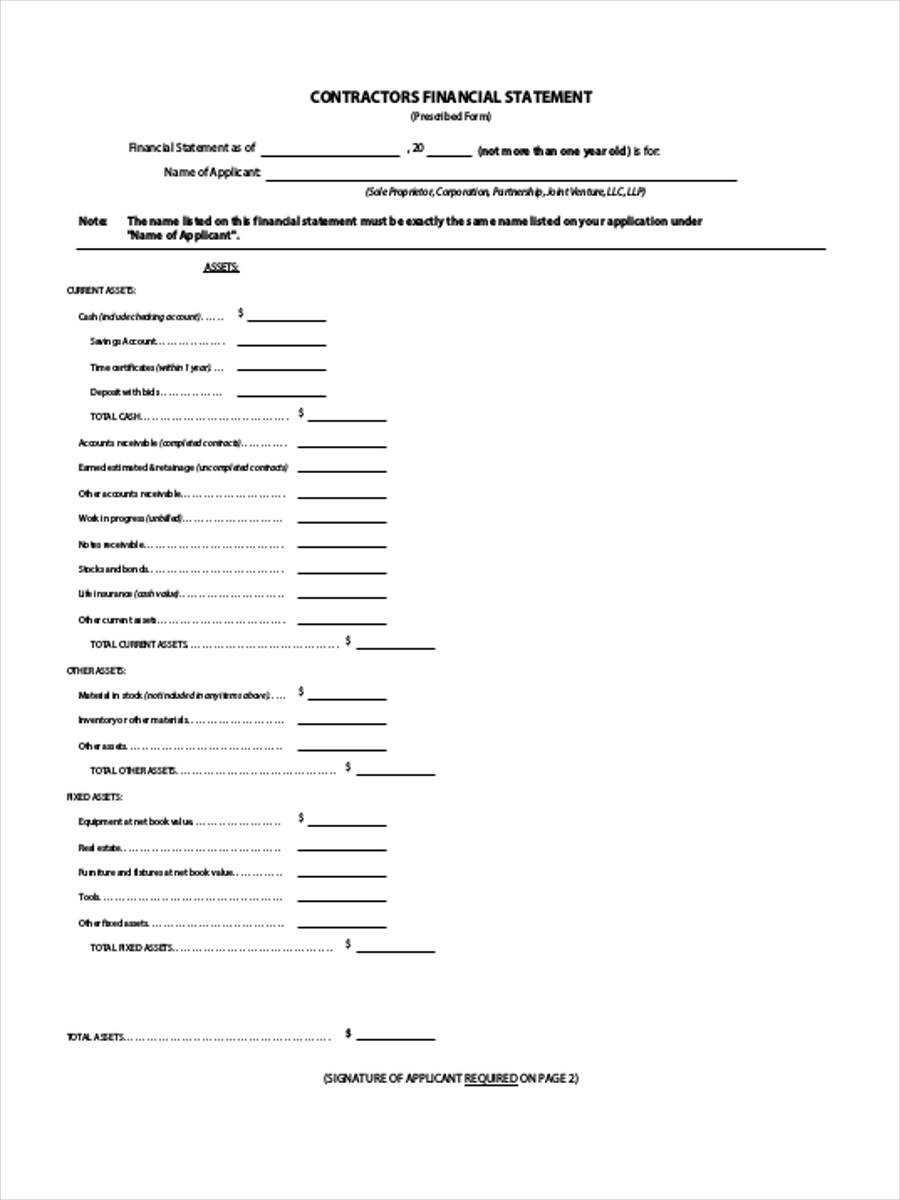

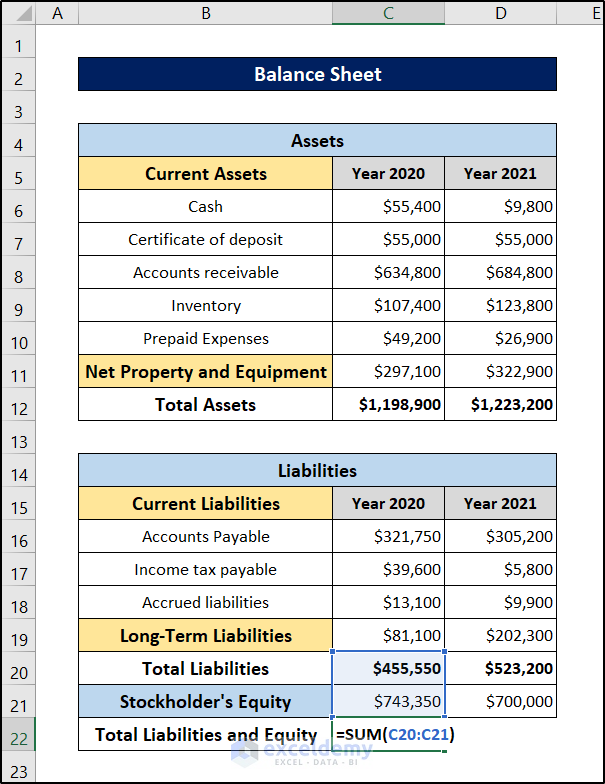

Sample construction financial statement construction contacts: There are four core financial statements that are fundamental to maintaining a financially healthy construction company—balance sheets, income statements,. The balance sheet, the income statement (also called profit and loss statement.

Download latest annual report. Construction financial statements: How to read your financial statements.

We have audited the consolidated financial statements of orascom construction plc (“the company”) and its subsidiaries (“the group”), which comprise the consolidated. Cicpac has compiled this comprehensive document to. When you understand your financial reports, you take full control of your building company and master your cashflow.

Income statements, balance sheets, and cash flow statements.