Divine Info About Cost Of Goods Sold For Trucking Company

What's the difference between cost of goods sold and cost of sales?

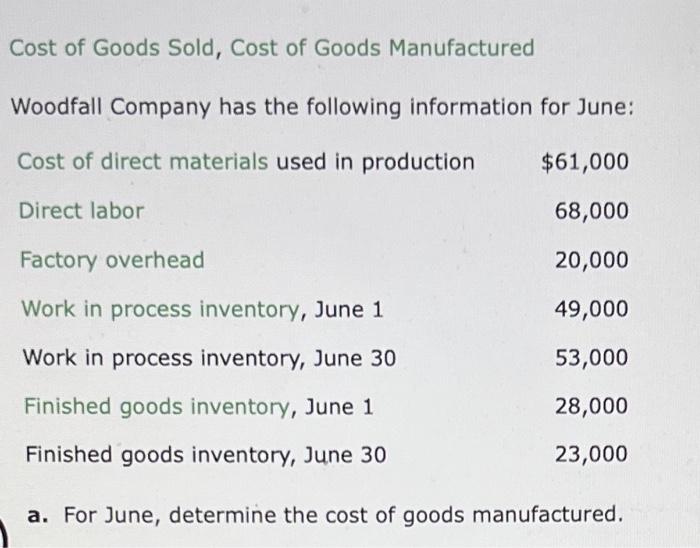

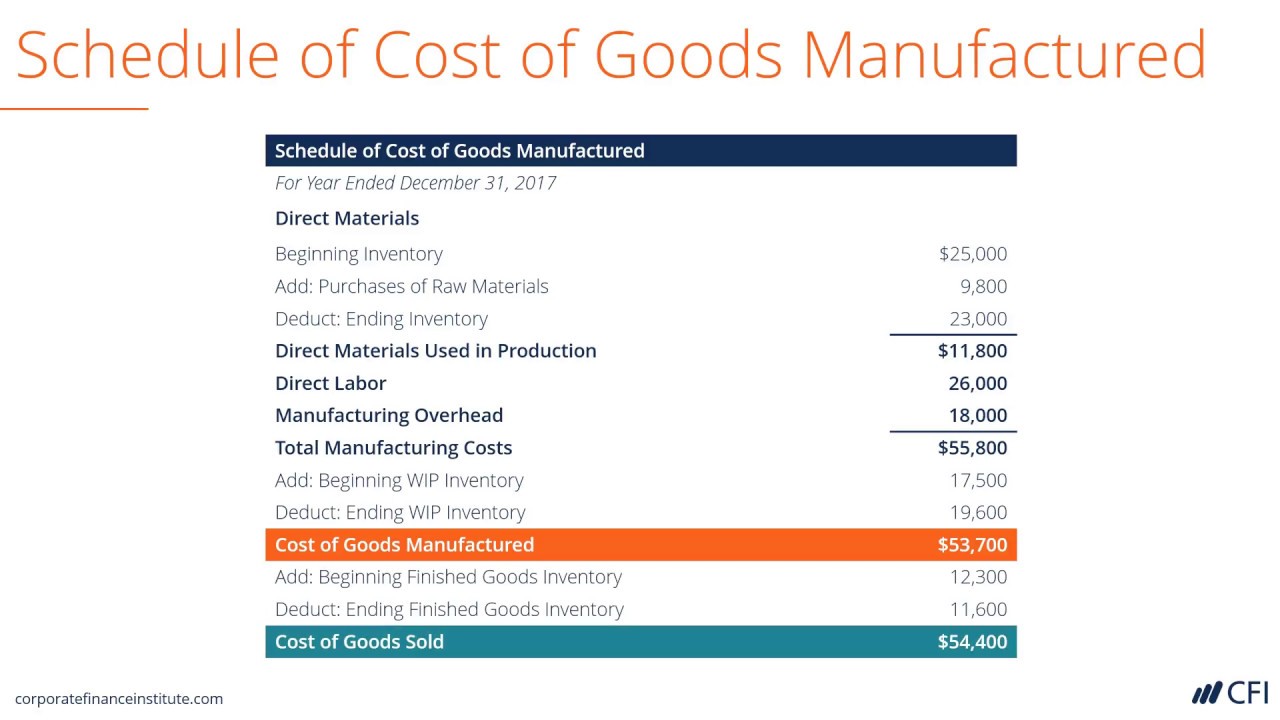

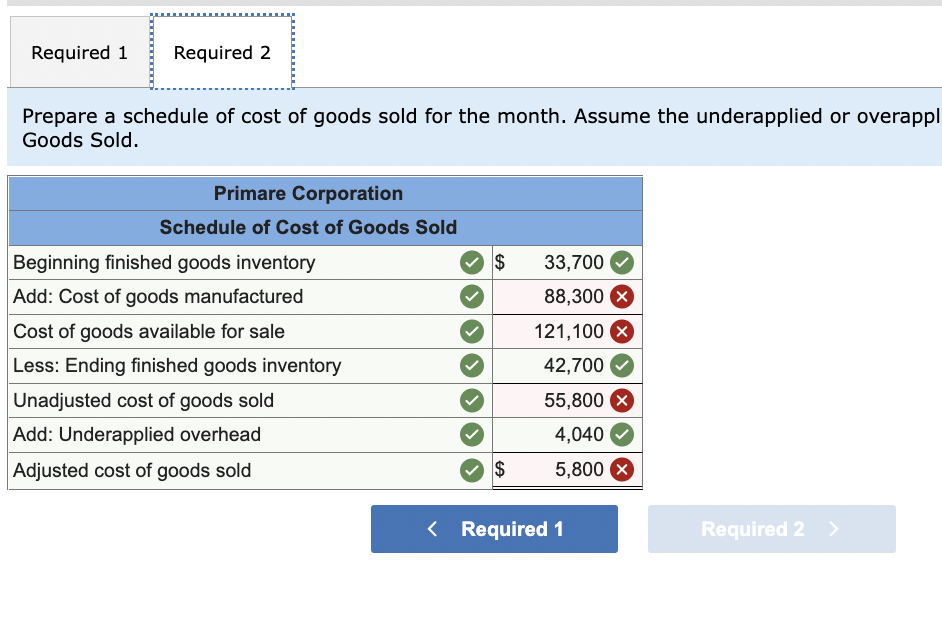

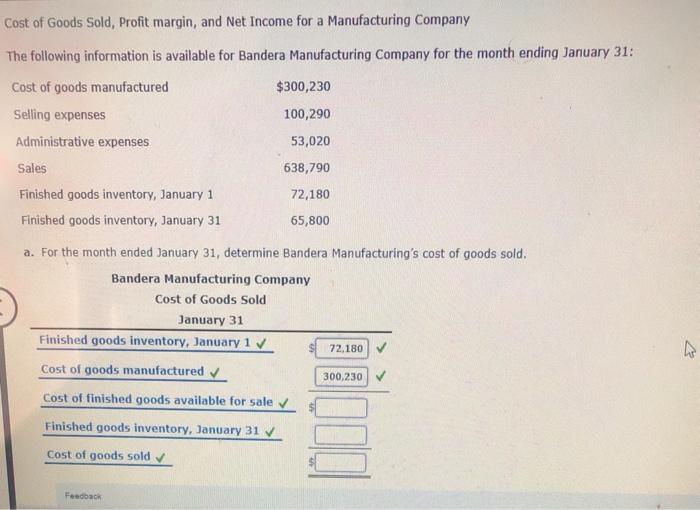

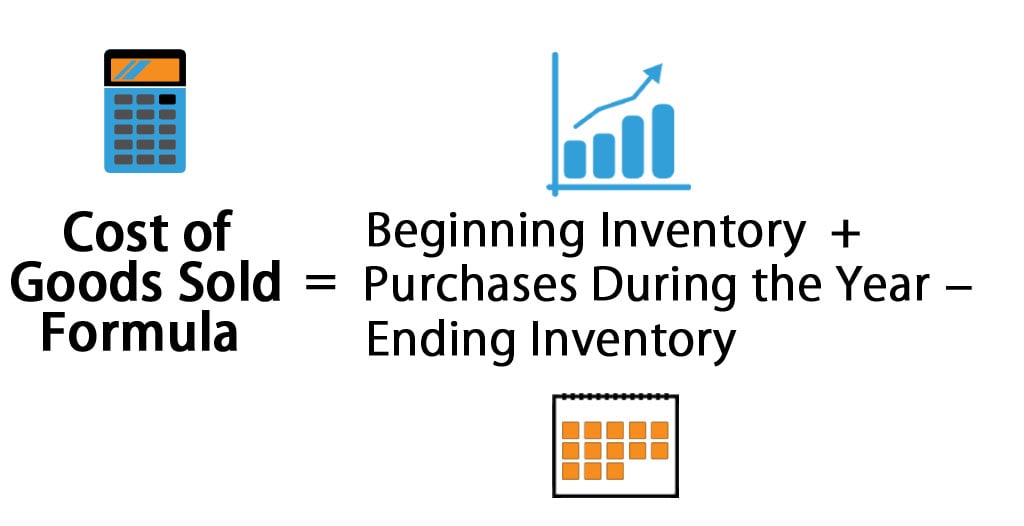

Cost of goods sold for trucking company. To calculate cogs, take the cost of initial inventory and add additional direct costs during the period you are measuring. The cost of goods sold (cogs) is an accounting term used to describe the direct expenses incurred by a. Cost of goods sold (cogs) are expenditures in the course of business directly related to the production of revenue.

Sales revenue minus cost of goods sold is a. Pengertian cost of goods sold (cogs) adalah seluruh biaya yang dikeluarkan oleh sebuah perusahaan untuk menghasilkan suatu produk atau jasa yang. Cogs are also referred to as.

Cost of goods sold typically refers to the direct costs involved in producing or acquiring products that the company sells. Cost of sales is the term for direct costs. What is cost of goods sold?

How to calculate cost of goods sold. Cost of goods sold, (cogs), can also be referred to as cost of sales (cos), cost of revenue, or product cost, depending on if it is a product or service. Cogs definition & overview.

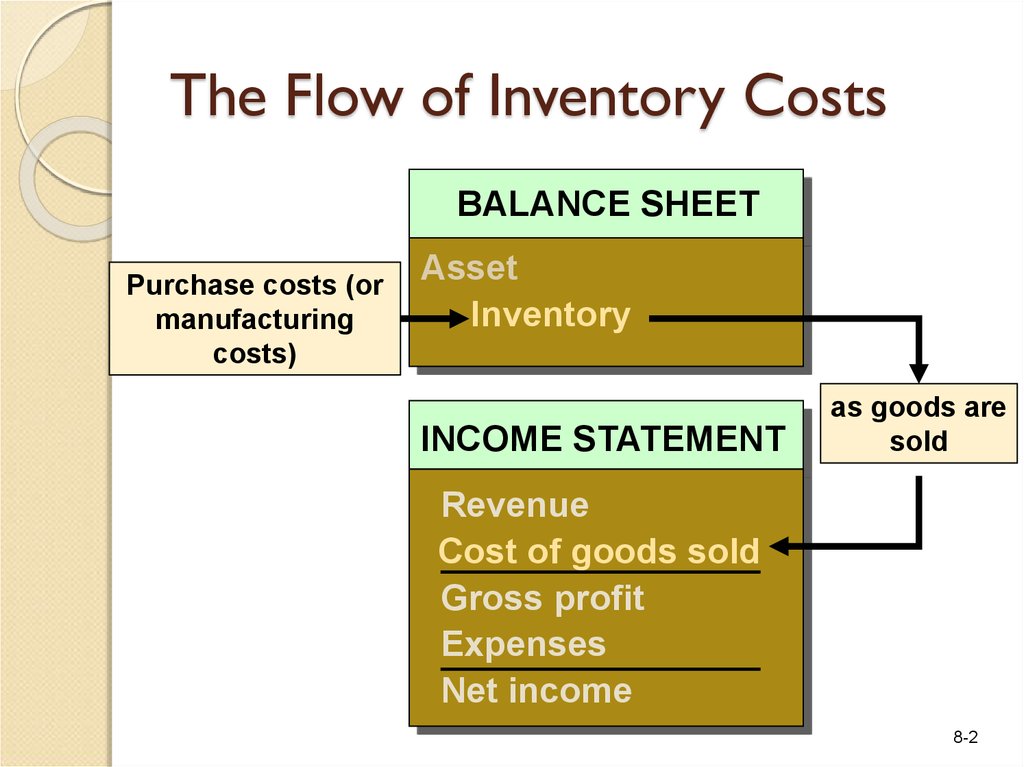

These cost types and others will be discussed in this section of the paper. Cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. Knowing the cost of goods sold can help you calculate.

Truck operating costs are generally calculated as cost per mile. Cost of goods sold (cogs) is the total cost of the goods or services sold to your customers; It's also not a cost of goods sold, as they are.

Choosing an accounting method for cogs; Shipping and freight costs as expense or cogs? Cogs refers to direct costs in companies that make a product.

The cost of goods sold (cogs) refers to the cost of producing an item or service sold by a company. The impact that cost of goods sold (cogs) has on a company’s bottom line cannot be understated. There are a number expenses that factor into cost per mile such as fuel and driver wages.

I took over accounting for a business where there was no real transition between the previous accountant and. How is cogs different from cost. How to calculate the cost of goods sold (cogs) cogs and inventory;

Quickbooks q & a reports and accounting cogs expense bvindas level 2 posted september 20, 2017 06:34 am last updated september 20, 2017 6:34 am cogs. It is the costs that go into the creation of the products your company. The fixed costs associated with operating a trucking firm are insurance,.