Inspirating Tips About Balance Sheet Prepaid Rent

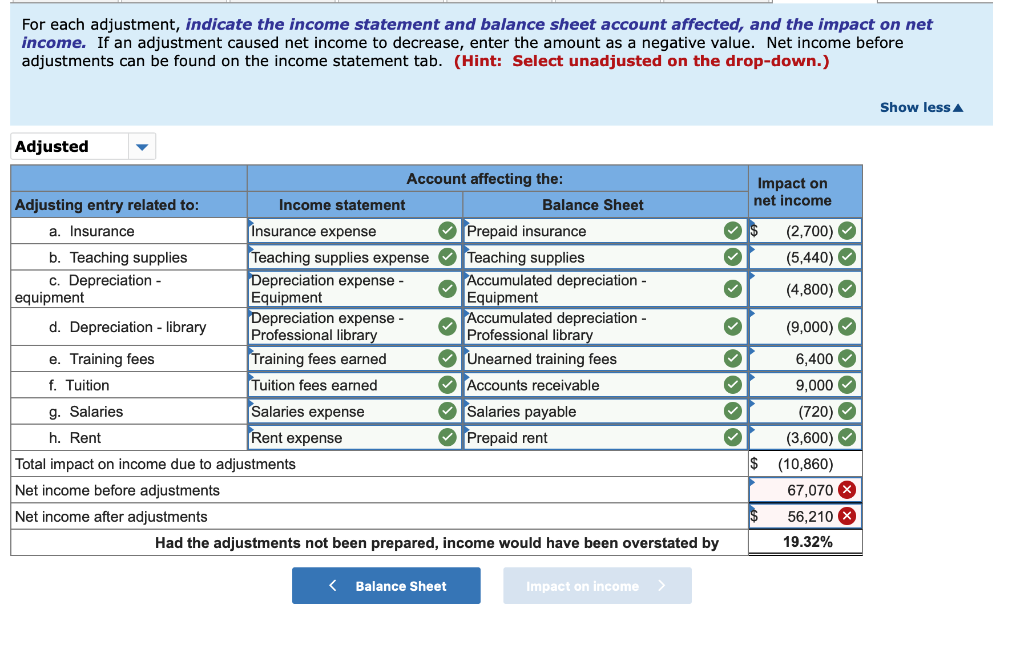

In order to deal with this situation, the balance sheet must include a deferred rent asset or liability account.

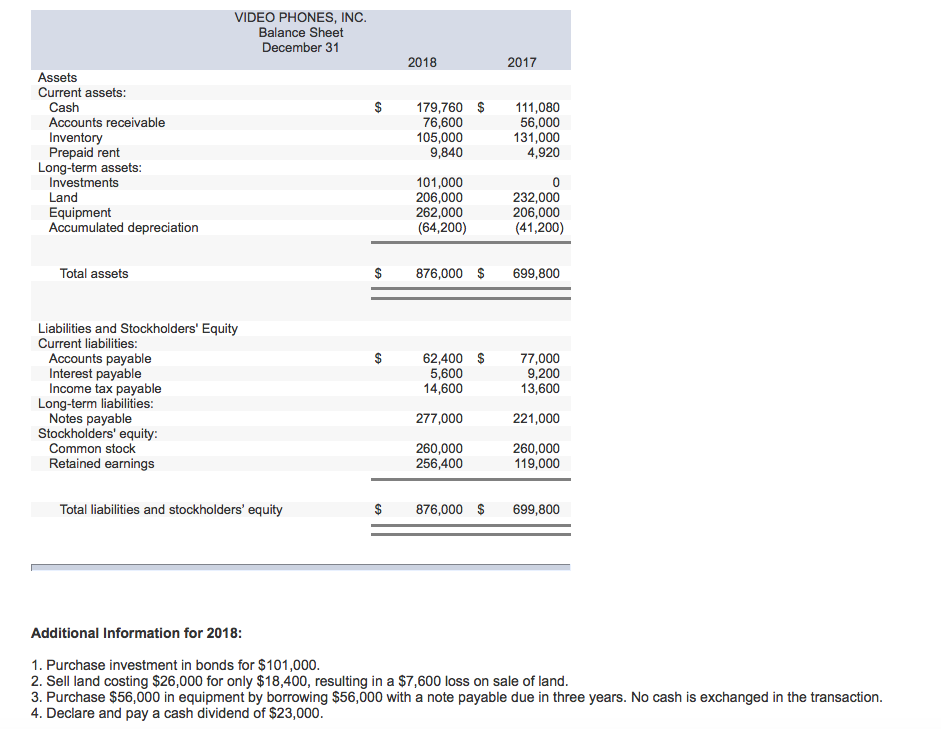

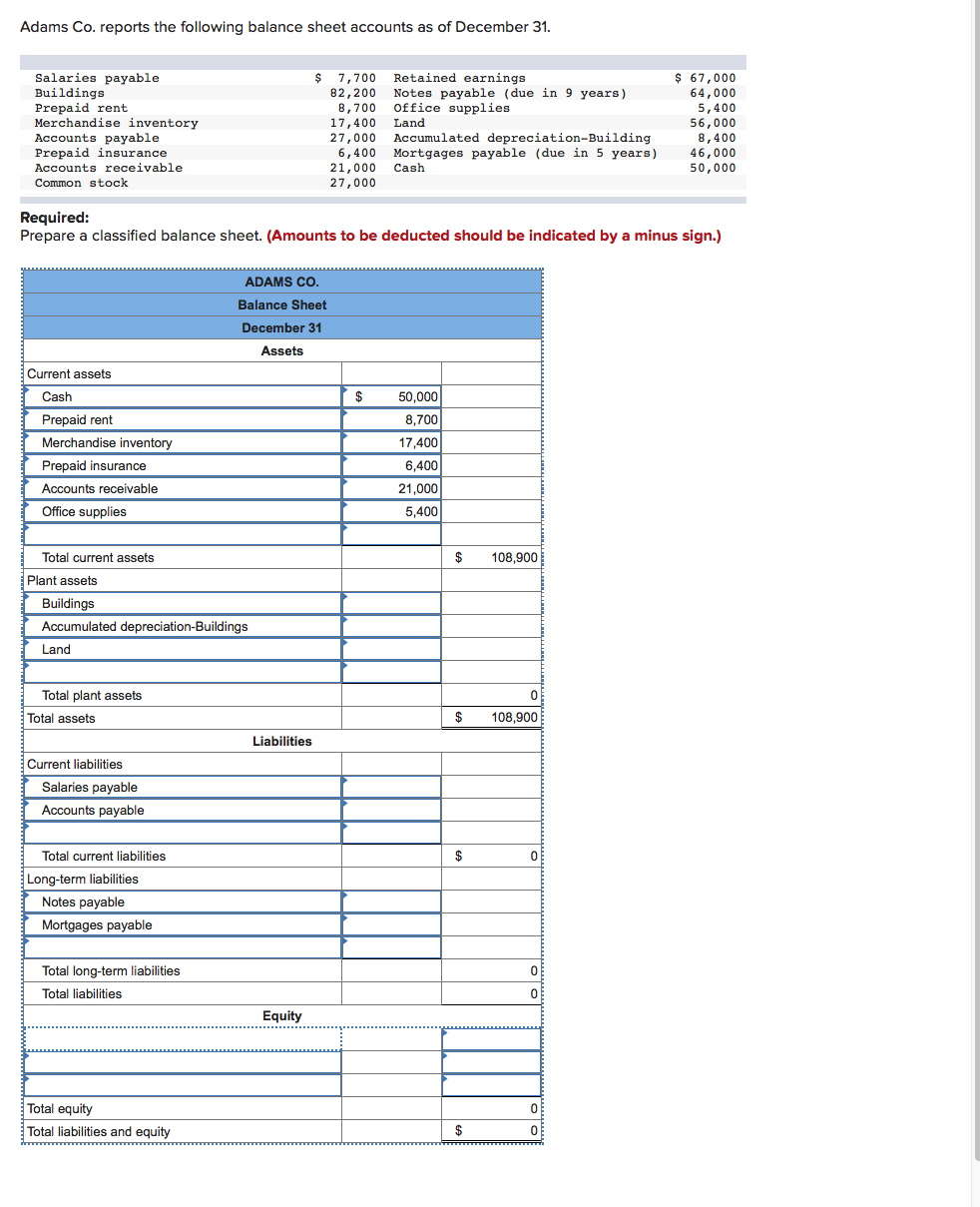

Balance sheet prepaid rent. These are both asset accounts and do not increase or decrease a company’s balance sheet. Where is prepaid rent on the balance sheet published: This practice is a common feature in many businesses, including those that lease commercial spaces or rent equipment for long periods.

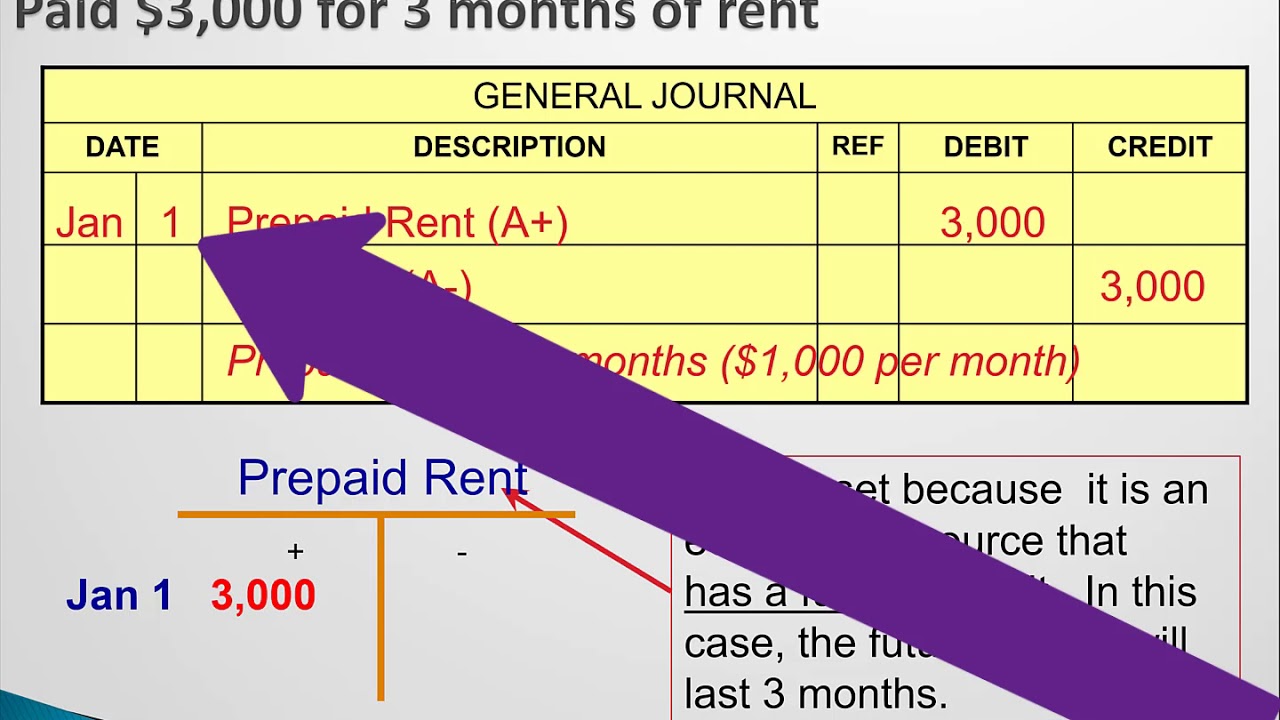

When the future rent period occurs, the prepaid is relieved to rent expense with a credit to prepaid rent and a debit to rent expense. This is because it represents a future benefit that the company will receive within its operating cycle or one year. To ensure the accounting balance is maintained, we need to have a second account in our journal entry.

On the first day of the next month, the period the rent check was intended for, the prepaid rent asset is reclassed to rent expense. In business accounting, prepaid rent is recorded as an asset on the balance sheet until it is consumed, at which point it is recognized as an expense. However, under the new lease accounting pronouncements , the guidance eliminates recognizing prepaid assets on the balance sheet related to leases exceeding a total lease term of 12 months.

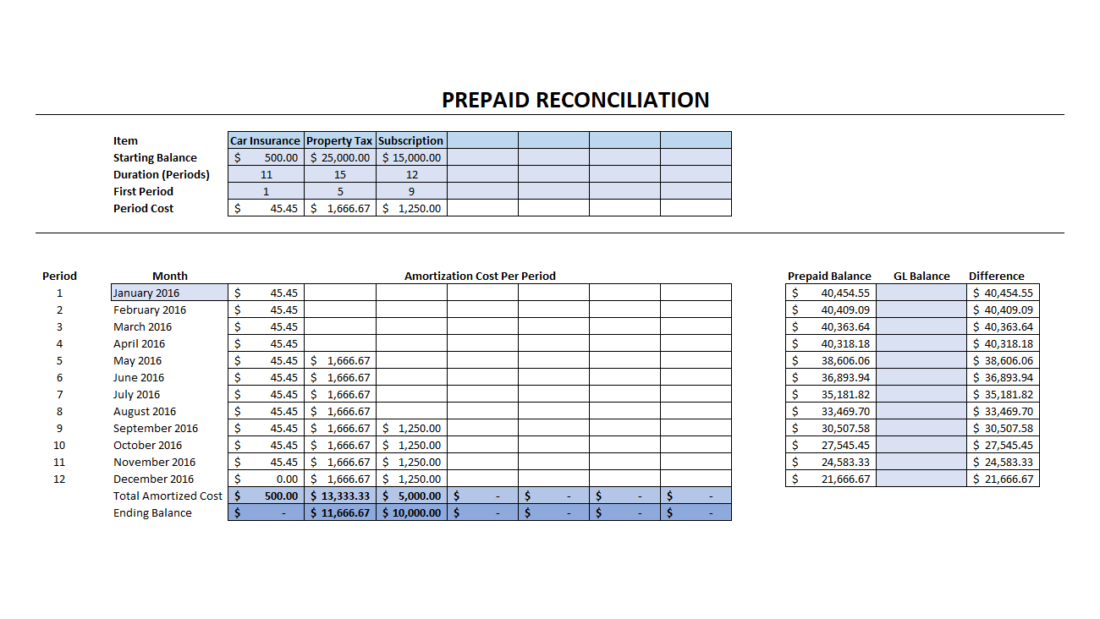

Is prepaid rent an asset? Under the previous accounting standard, asc 840, prepaid rent was recognized as an asset on the balance sheet and expensed over time. Determine the cost of the lease for its entire period, including free months, discounted months, or months that go up because of inflation

Balance sheet (many of the links in this article redirect to a specific reviewed product. Prepaid rent is recorded at time of payment as a credit to cash and a debit to prepaid rent. Recall that prepaid expenses are considered an asset because they provide future economic benefits to the company.

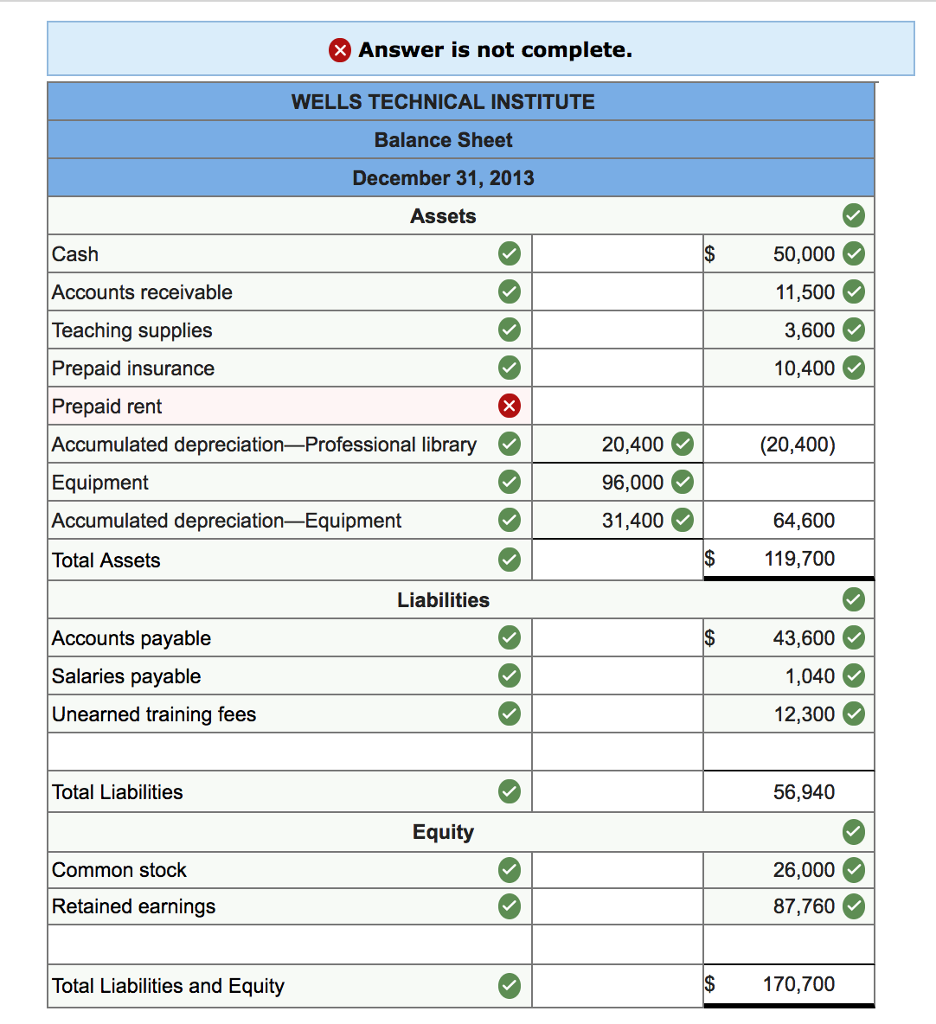

Prepaid rent is a balance sheet account, and rent expense is an income statement account. A concern when recording prepaid rent in this manner is that one might forget to shift the asset into an expense account in the month when rent is. Here’s how accountants usually record prepaid rent:

While you can prepay rent ahead of time, the only time this will be. Rent expense on the income statement rent expense on the balance sheet 6. Prepaid rent is not recognized as such under asc 842.

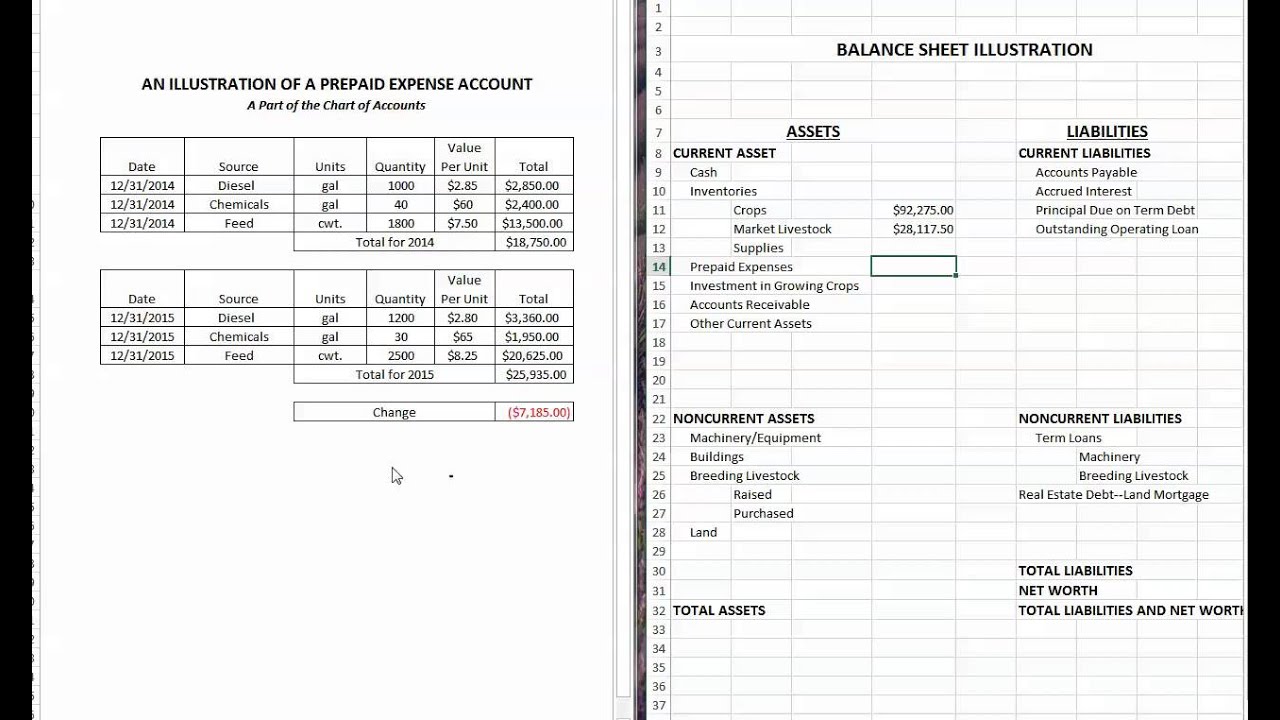

The gaap matching principle prevents expenses from being recorded on the income statement before they. Prepaid expenses in the balance sheet by its definition, an asset is considered resource resourceful for the organization since it helps render profits shortly. So, a prepaid account will always be represented on the balance sheet as an asset or a liability.

In essence, there is no such account named “prepaid rent” on the balance sheet under the rules of asc 842. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. For example, the following screenshot from the balance sheet of tesla (tsla) for fiscal year 2022 illustrates where to find prepaid expenses.

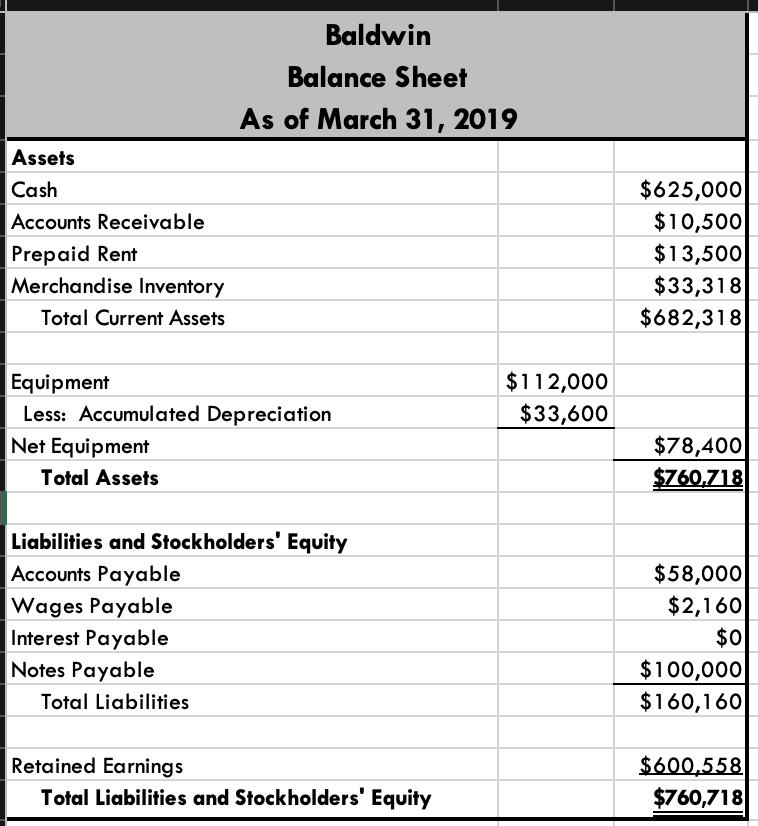

Prepaid expenses are first recorded in the prepaid asset account on the balance sheet. If you would prepare a balance sheet at the end of may, you would report $4,800 under prepaid rent. The prepaid rent amount is recorded as an asset on the tenant's balance sheet until it is gradually expensed over the lease agreement term

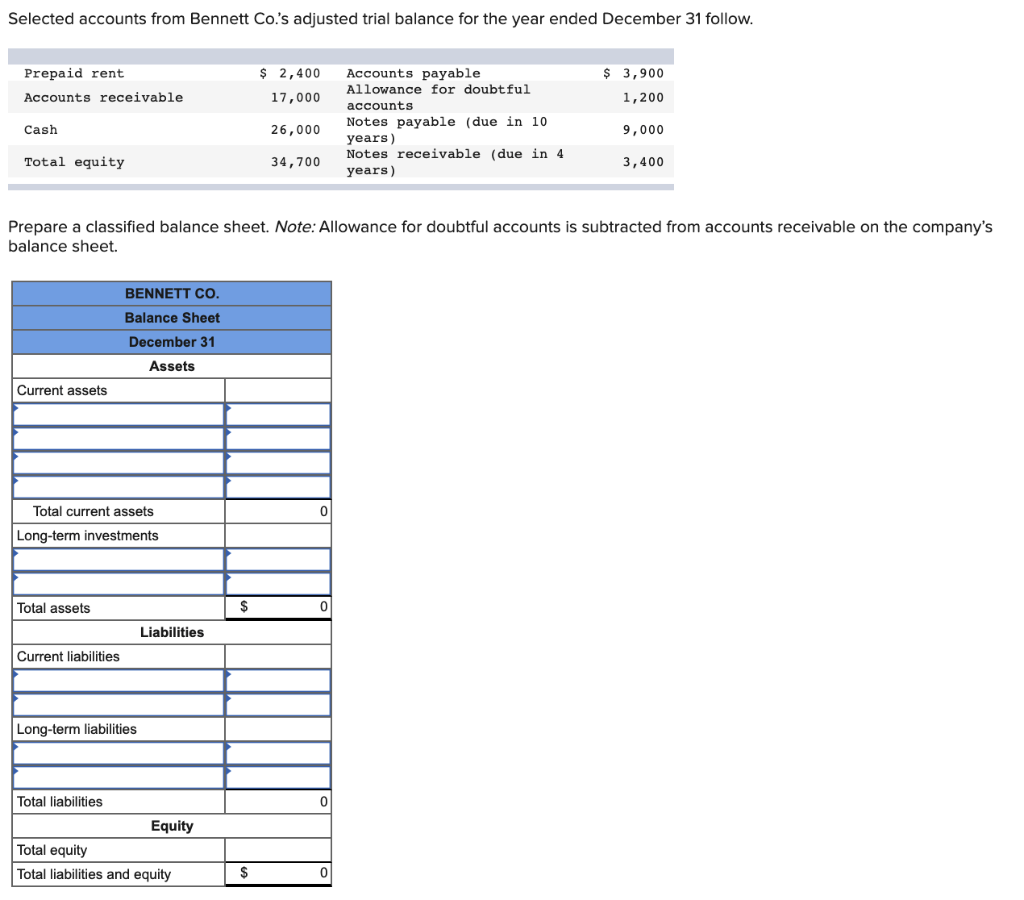

![[Solved] The classified balance sheet and selected SolutionInn](https://s3.amazonaws.com/si.experts.images/questions/2022/11/636a720c3544d_396636a720c25008.jpg)