Awe-Inspiring Examples Of Info About Complete Income Statement

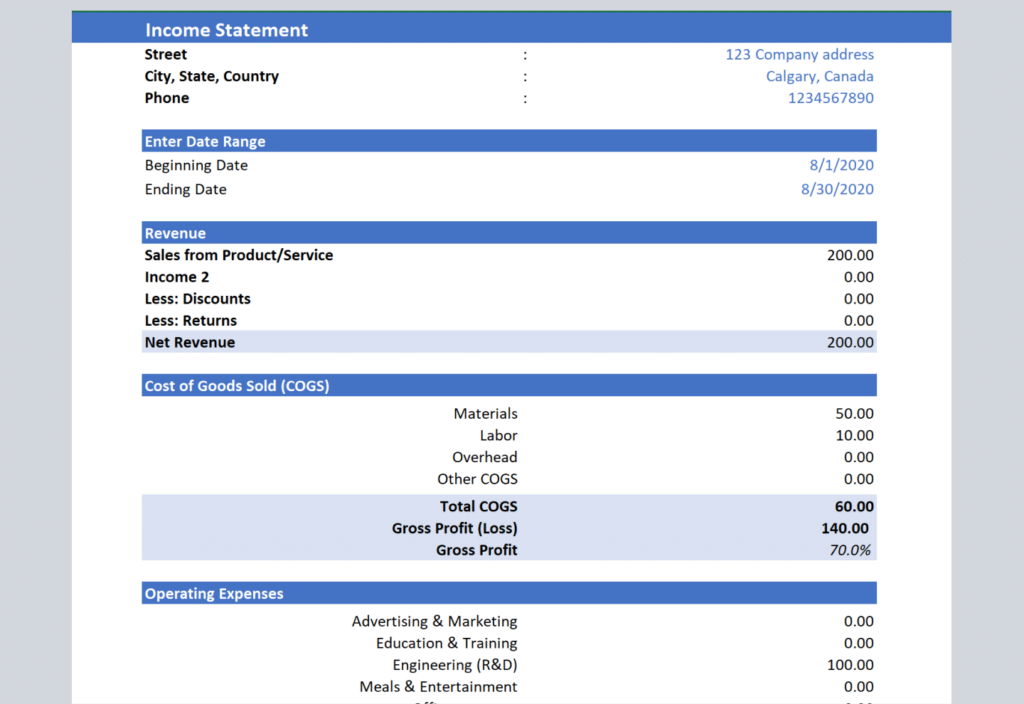

An income statement is a financial statement that shows you how profitable your business was over a given reporting period.

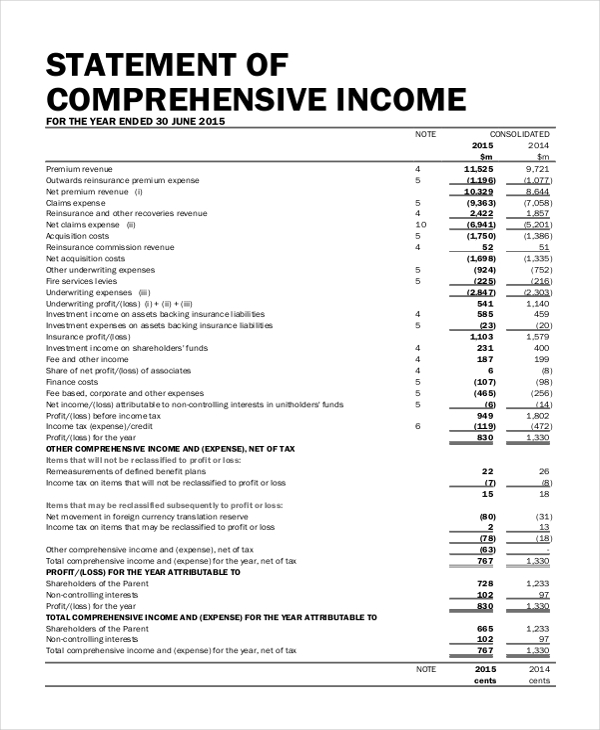

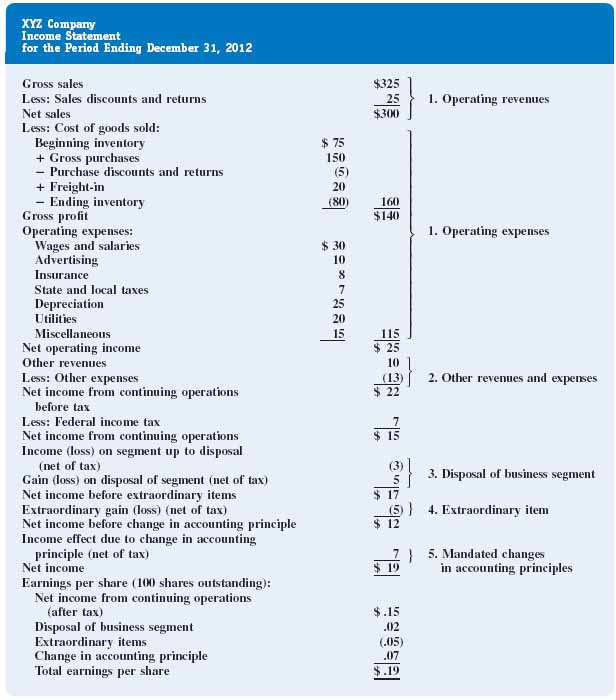

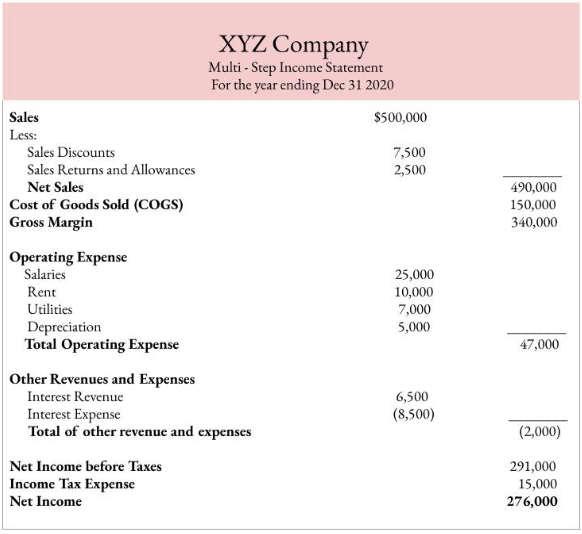

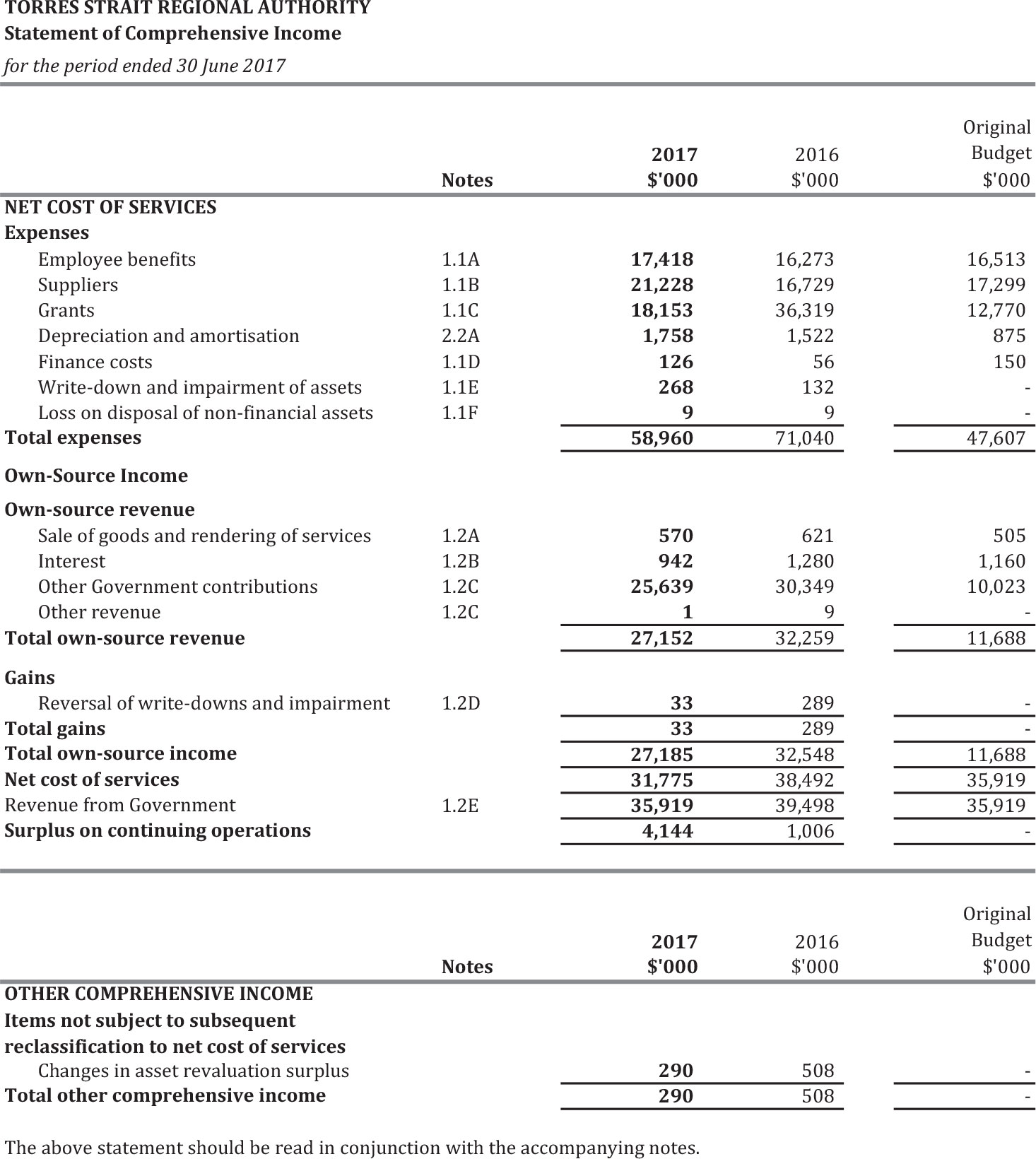

Complete income statement. Record adjusted ebitda margin fourth. The income statement is used to calculate the net income of a business. After a long period of high inflation following the covid‑19 pandemic, many canadians are feeling financial strain.

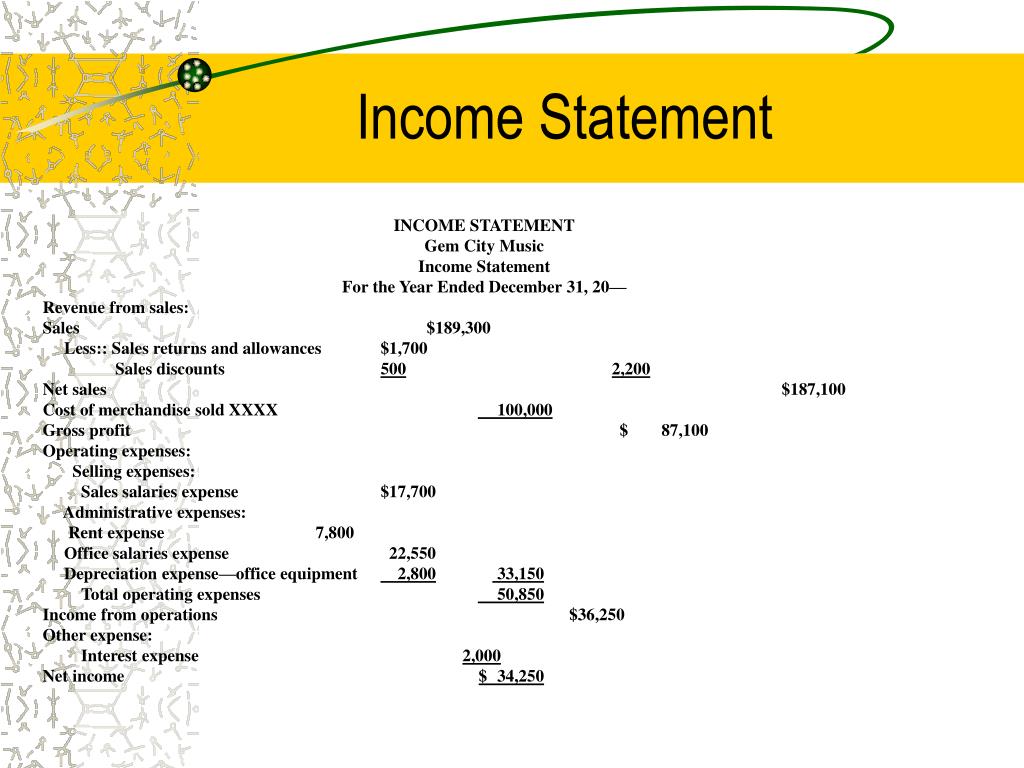

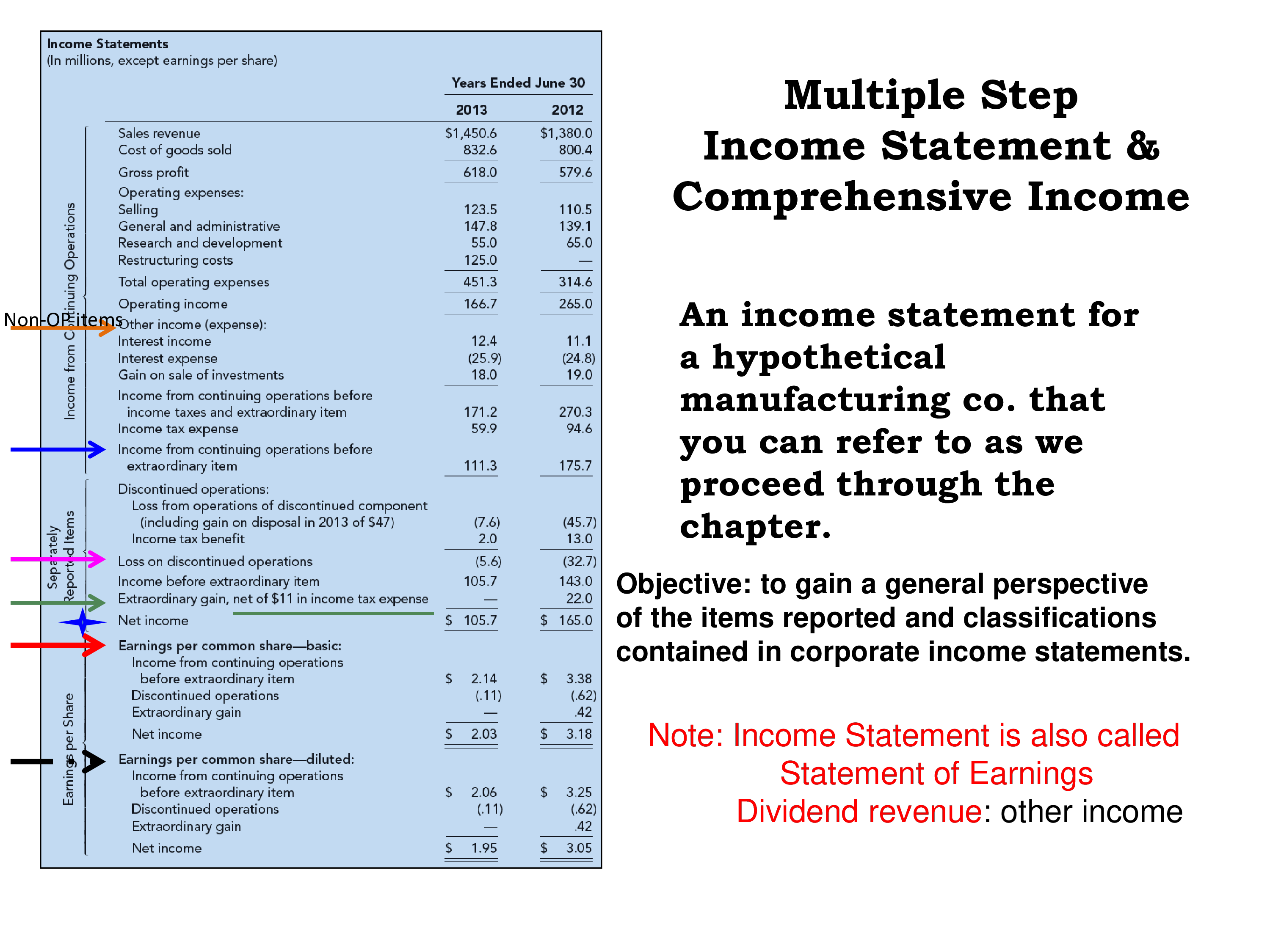

Revenue is always shown at the top of income statements, and this is referred to as the company's top line. Watch budget 2024 statement. The income statement calculates the company’s net income or net profit by taking into account its earnings, gains, expenses, and losses over a period.

It calculates final profit after tax by tallying revenues revenues revenue is the amount of money that a business can earn in its normal course of business by selling its goods and services. The income statement is also known. 16.4 prepare the completed statement of cash flows using the indirect method;

If the company is a service business, cogs is also known as the cost of sales. Income statement and free cash flow. If revenue is higher than expenses, the company is profitable.

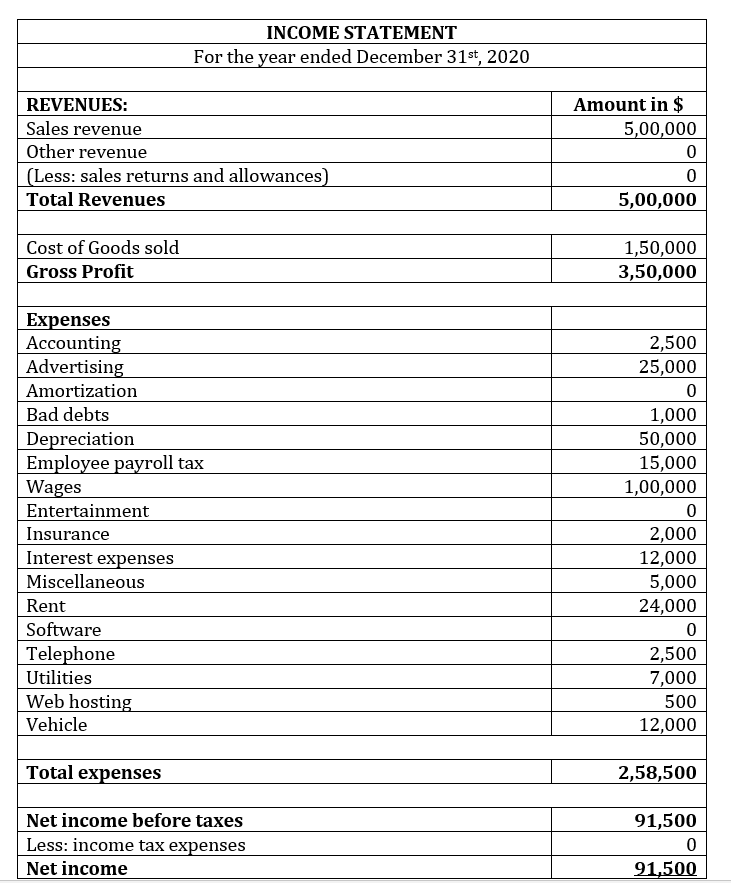

In your income statement, put the figure in the last line item. Vary by state and apartment type. The most basic income statement components are:

An income statement is one of the most common, and critical, of the financial statements you’re likely to encounter. 16.5 use information from the statement of cash flows to prepare ratios to assess liquidity and solvency; Identify company expenses and losses incurred over the same period.

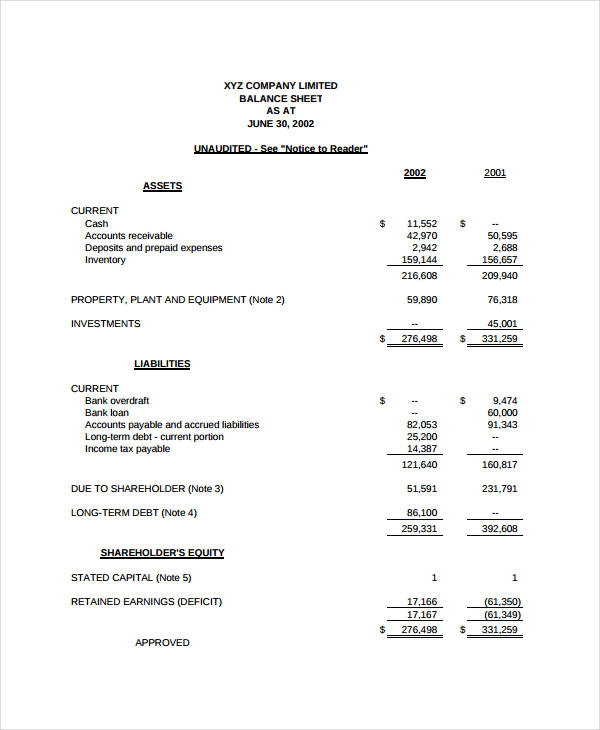

The income statement, along with balance sheet and cash flow statement, helps you understand the financial health of your business. It shows your revenue, minus your expenses and losses. 2.2 define, explain, and provide examples of current and noncurrent assets, current and noncurrent liabilities, equity, revenues, and expenses;

A balance sheet, on the other hand, only lists the fiscal situation on a specific date. In an economic context [book] Revenue, expenses, gains, and losses.

This will offer you a broad picture of your company's success and allow you to assess how lucrative it has been. An income statement is a financial statement that reports the revenues and expenses of a company over a specific accounting period. If you file on paper, you should receive your income tax package in the mail by this date.

The net income of the firm is listed at the bottom. If revenue is lower than expenses, the company is unprofitable. A complete income statement: