Outrageous Info About Management Accounting Ratios

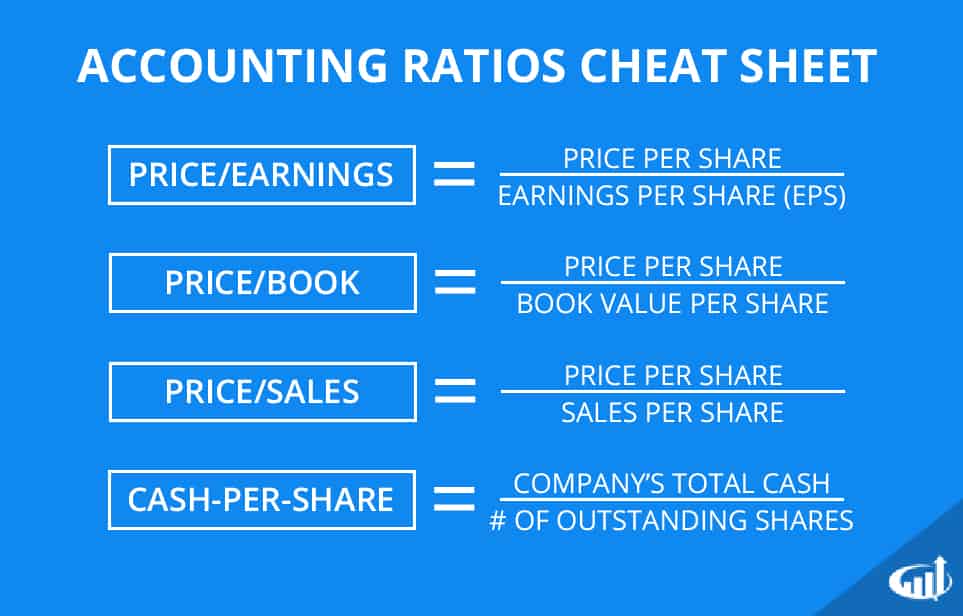

Five common accounting ratios are used in business:

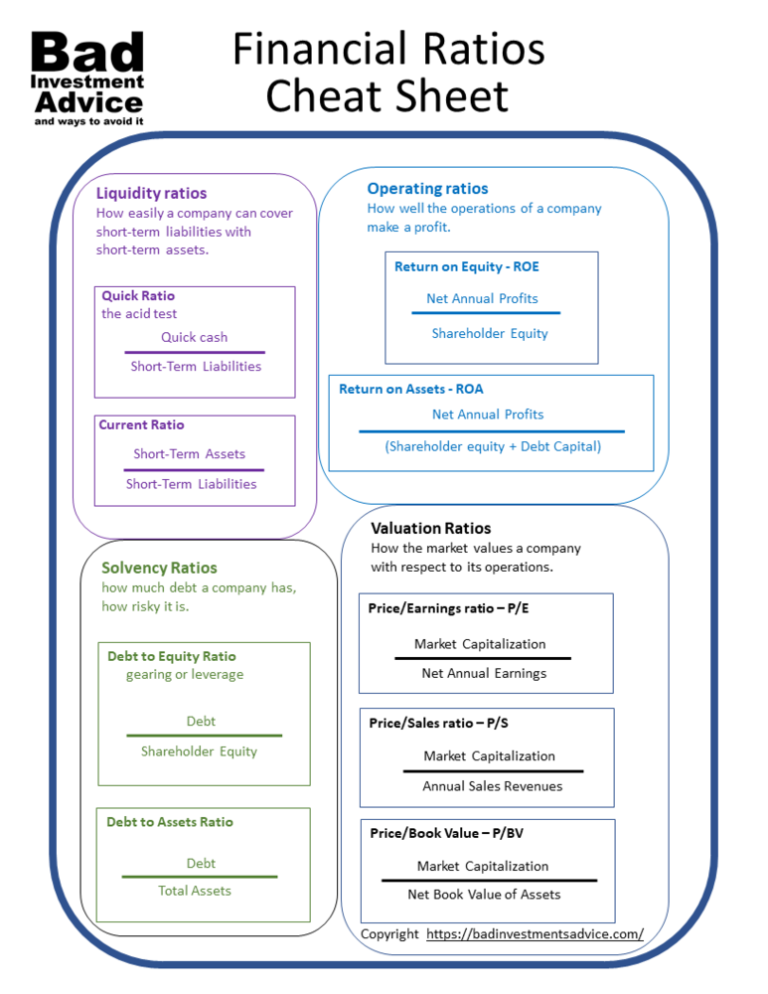

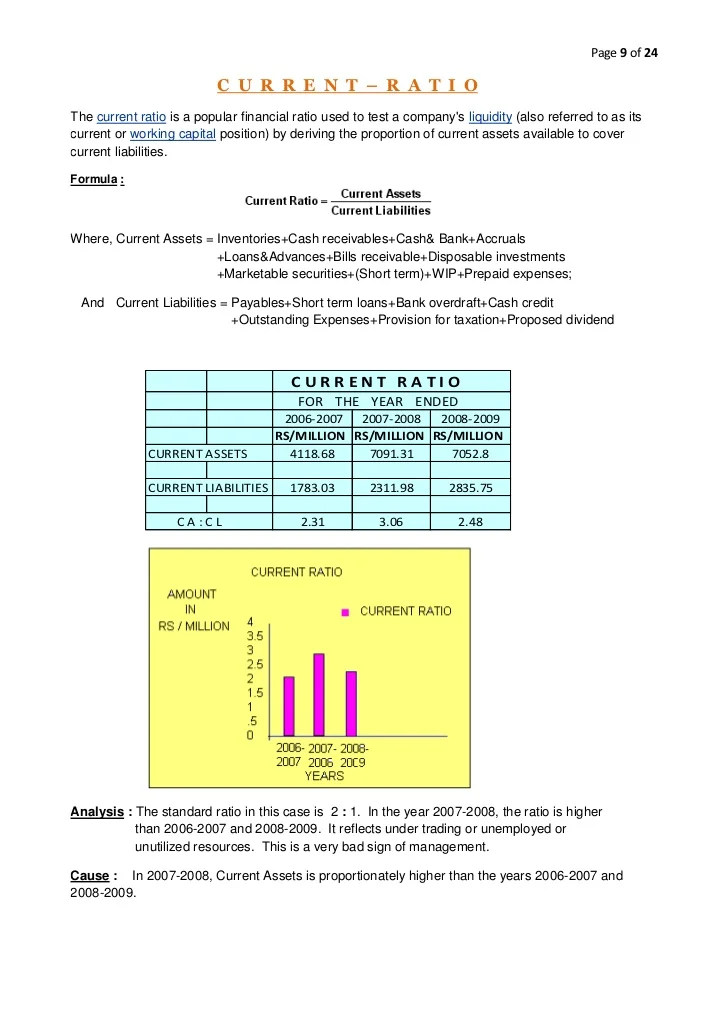

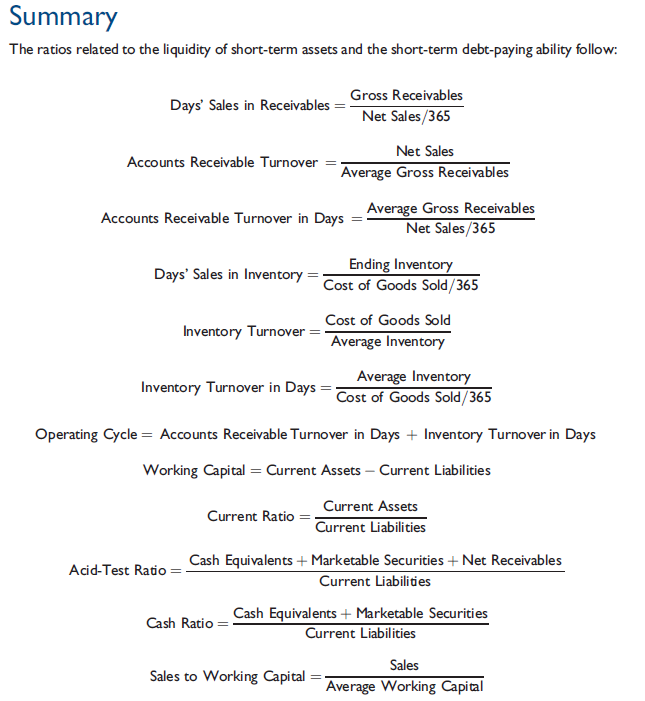

Management accounting ratios. For example, current ratio, liquid ratio, capital gearing ratio, debt equity ratio, and proprietary ratio, etc. Liquidity, profitability, debt, operating performance, cash flow, and investment valuation. Management accountants focus on the ratios that apply to the running of the business.

The three most common types of accounting ratios are debt ratios, liquidity ratios, and profitability ratios. On the basis of function or test, the ratios are classified as liquidity ratios, profitability ratios, activity. This understanding can help managers when controlling the business, and when planning or making decisions about the future.

Types of ratio analysis the various kinds of financial ratios. Shareholders, creditors and other such stakeholders of the company. Common liquidity ratios include the following:

Ratios calculated from taking various data from the balance sheet are called balance sheet ratio. The accounting ratios or ratios in management accounting have four ratios: Accounting ratios aim to provide investors, management, and other interested parties with a snapshot of a company’s financial health.

The resulting ratio can be interpreted in a way that is more insightful than looking at the items separately. Each of these ratios provides a window into a specific aspect of company operations. Introduction financial ratio analysis is performed by comparing two items in the financial statements.

Liquidity ratios, activity ratios, solvency ratios, and profitability ratios. What are accounting ratios? Our recommended advisors taylor kovar, cfp® why we recommend:

Management team, employees, and owners; It will also be regularly used by successful candidates in their future careers. Accounting ratios measure your organization’s profitability and liquidity and can show if it’s experiencing financial problems.

These three classifications are briefly discussed below: Let us learn more about them. List of financial ratios here.

What are accounting ratios? How do accounting ratios help you Explain the meaning of the term accounting ratios classify accounting ratios into profitability, liquidity, efficiency and investment ratios define liquidity ratios

Cash flow statements (nssch) section 1 ratios by the end of this section you should be able to: You can use them quarterly or. They are effective tools of analysis used by the management.

![BYS [FINV3005] Financial Ratios (Level 1) Build Your Skill](https://buildyourskill.co.uk/wp-content/uploads/2019/02/Ratios.jpg)