Stunning Tips About Cash Dividend In Flow Statement

Definition of cash dividends cash dividends are a distribution of a corporation's earnings to its stockholders or shareholders.

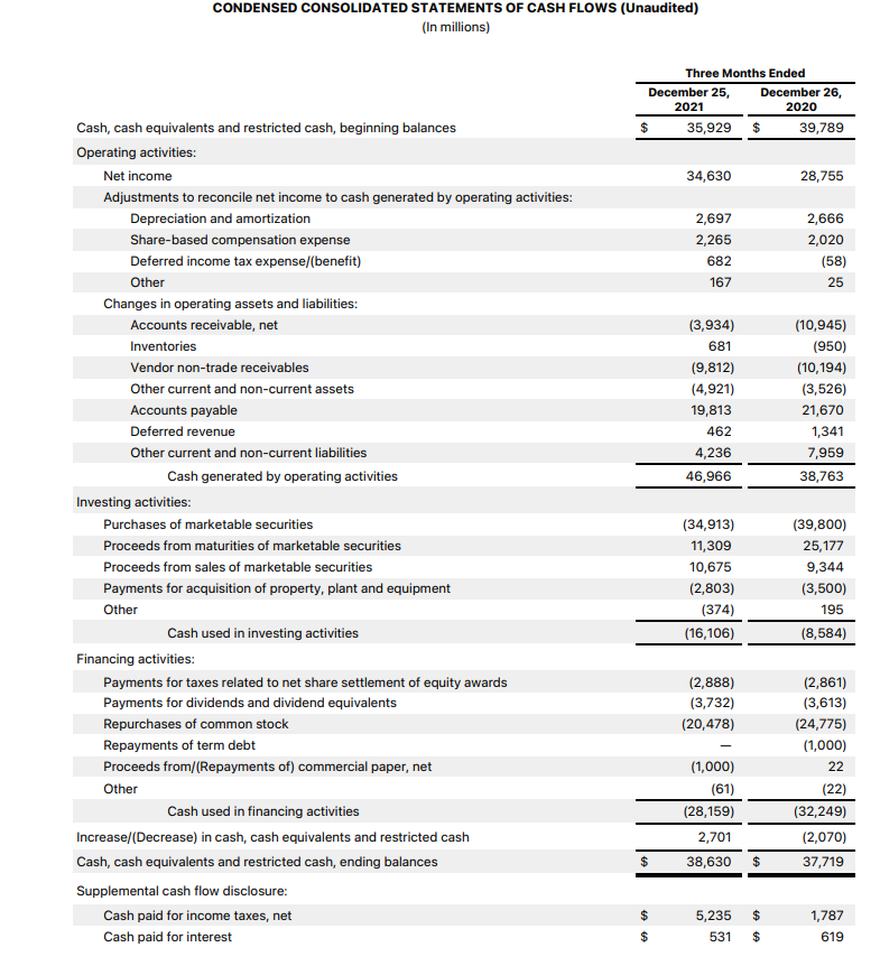

Cash dividend in cash flow statement. How do dividends impact cash flow? This video shows how to calculate the amount of dividends for the financing section of the statement of cash flows. If it is $8,000 in the income statement, adjustments add $2,000, and your operating cash flow is $10,000.

Continuing with the earlier example, if the company pays the cash dividends on june 15, the. The new policy — intended to pay. A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources.

Generated $910 million in q4 and $2.9 billion for the full year. Video of the day step 2 identify the payment of cash dividend line item in the section, and find the dollar amount listed next to it. The stock market has been doing well lately.

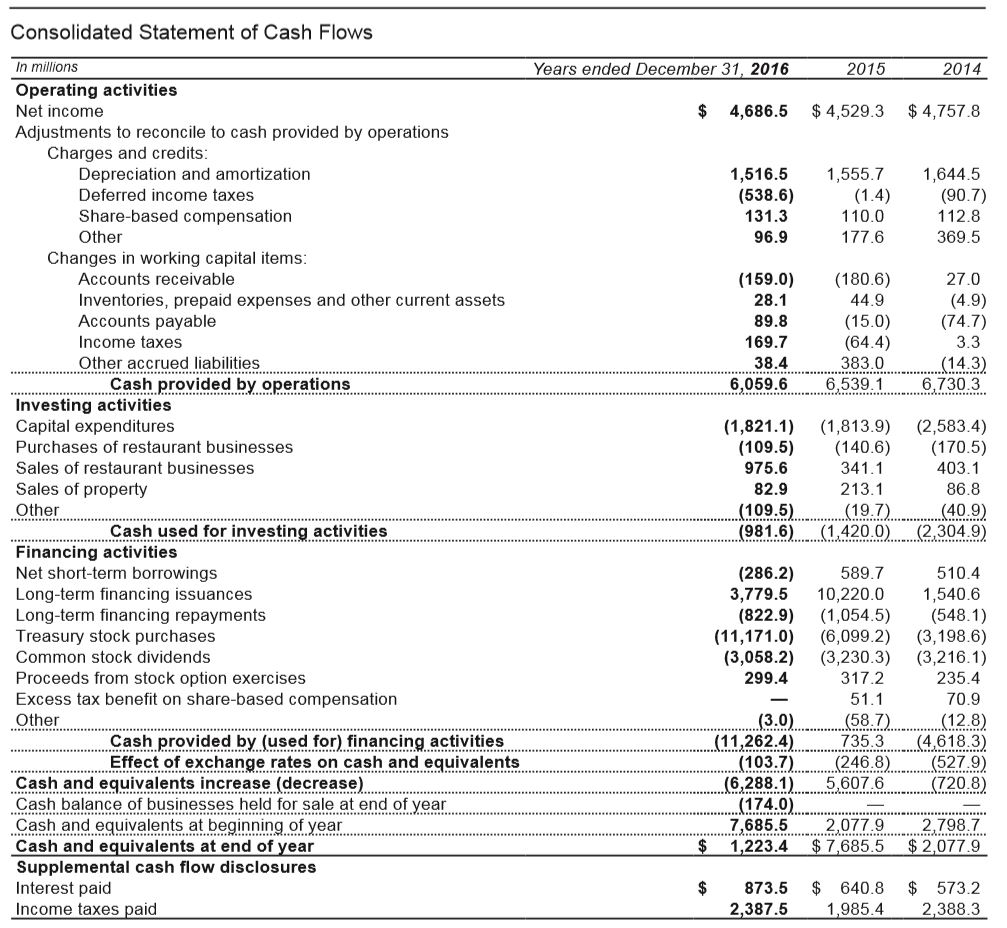

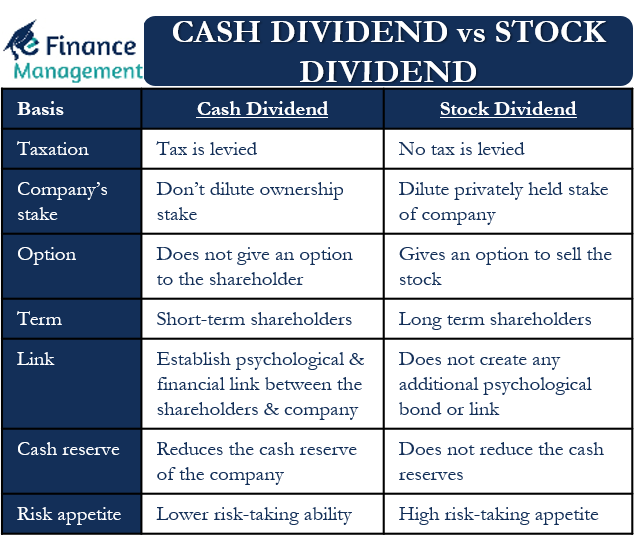

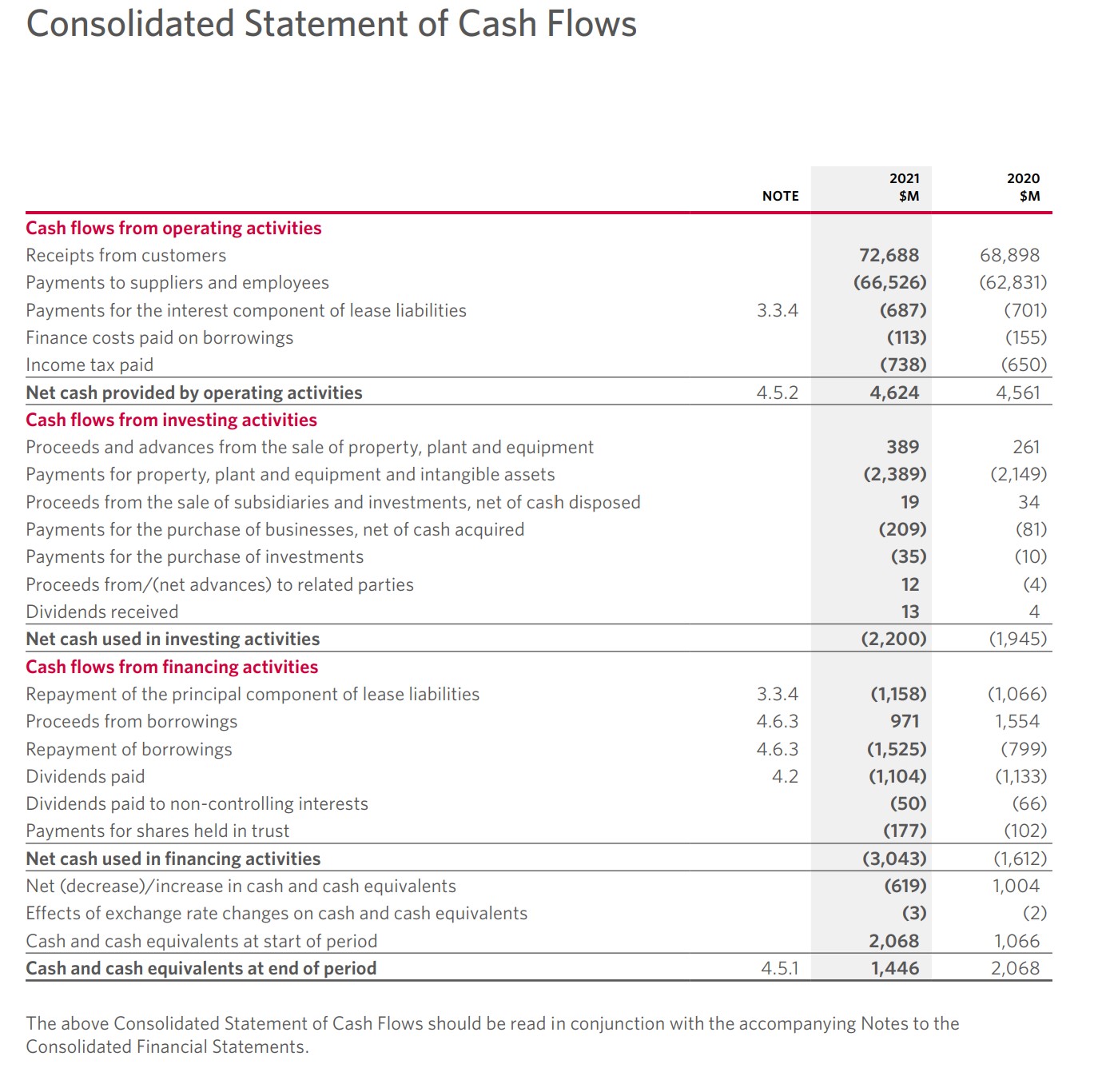

No, dividends are not considered an expense. This part of the cash flow statement shows all your business’s financing activities, including transactions that involve equity, debt, and dividends. Primary financial statements │ classification of interest and dividends in the statement of cash flows page 5 of 19.

Are dividends considered an expense? In very simple terms, the cash flow statement is a report that records how much cash comes in and out of a business over a particular time period. Total of all the cash inflows (added) and cash outflows (deducted) equals net cash flows from financing activities.

Iii wt exp 033128 (plmjw). Cash flow from financing activities: That hasn't lifted all stocks.

On the cash flow statement under financing activities, the company records: The cfs measures how well a. This article considers the statement of cash flows of which it assumes no prior knowledge.

If the company has much higher free cash flows than it pays in dividends, then the company is likely to raise its dividend payments in the near future. The amount of dividends can be determined if you know the net income. The cash flow statement focuses on cash transactions rather than accruals.

Over the last year, the s&p 500 has increased more than 20%. Carrefour , europe's largest retailer, said on tuesday it was confident about this year as it reported record cash flow of 1.62 billion euros ($1.8 billion) for 2023 and operating profit up 18.5%. Dividends are included on the cash flow statement to provide transparency and show the cash outflows resulting from the distribution of profits to shareholders.

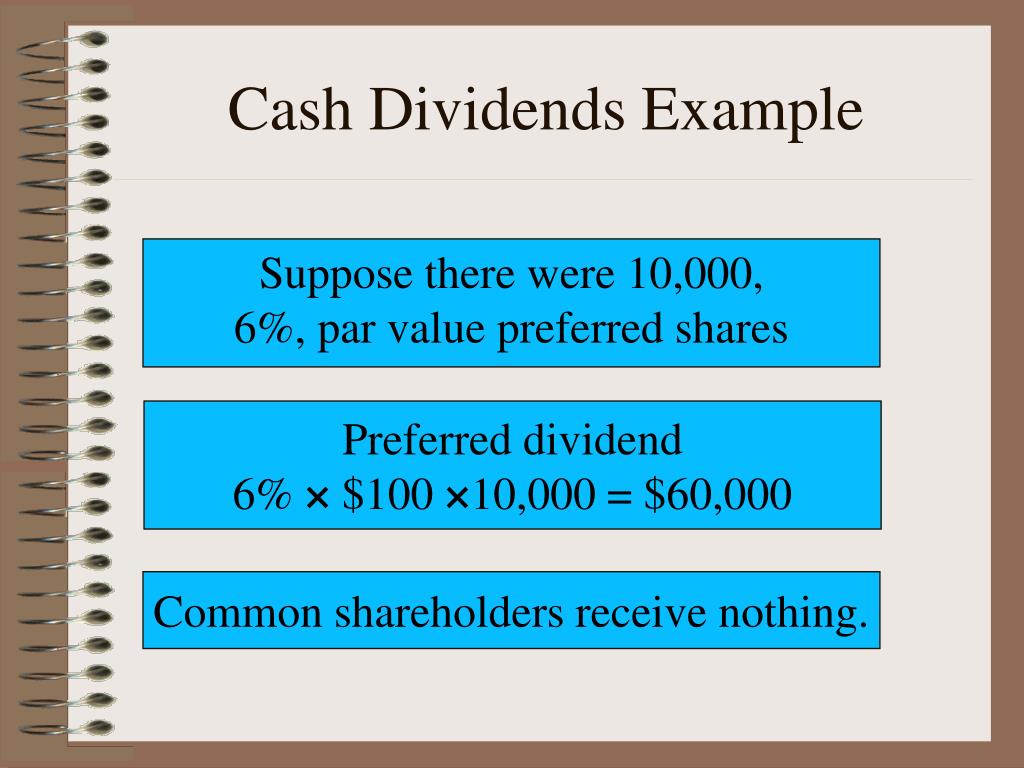

A cash dividend is the distribution of funds or money paid to stockholders generally as part of the corporation's current earnings or accumulated profits. We explain the difference between ifrs and us gaap when accounting for dividends in the cash flow statement. For cash dividends to occur, the corporation's board of directors must declare the dividends.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)