Unbelievable Info About Balance Sheet Of An Individual

What is a personal balance sheet?

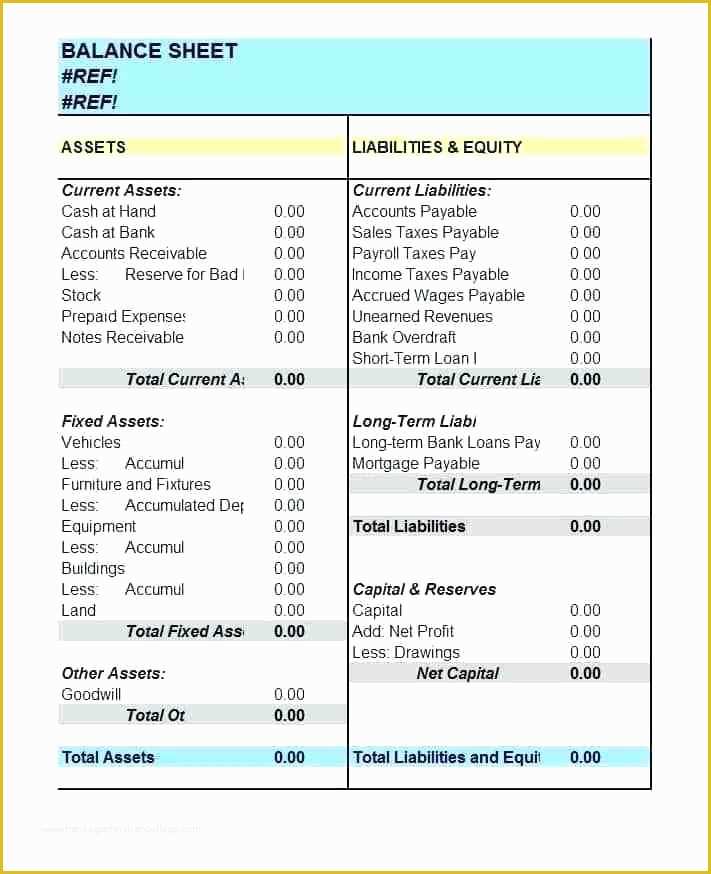

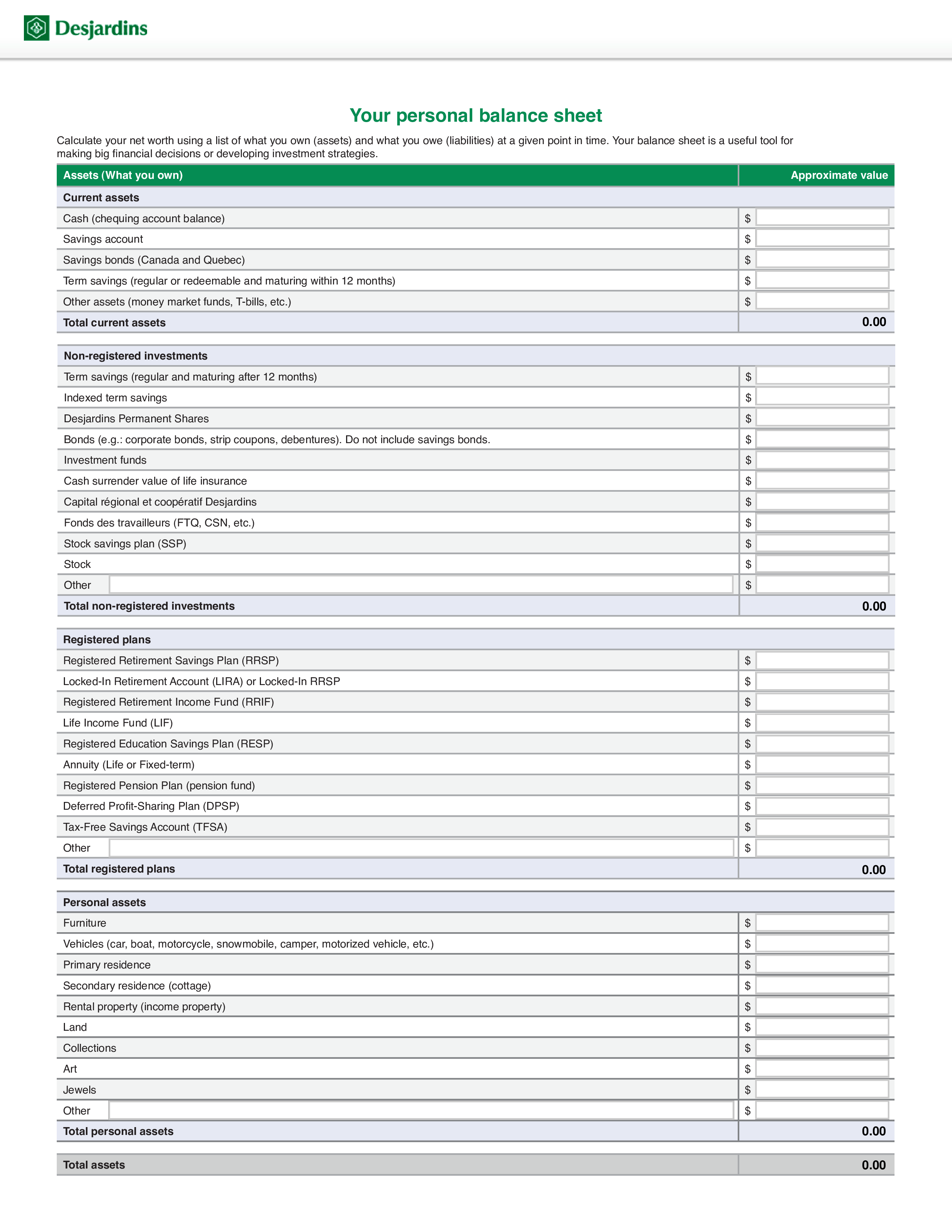

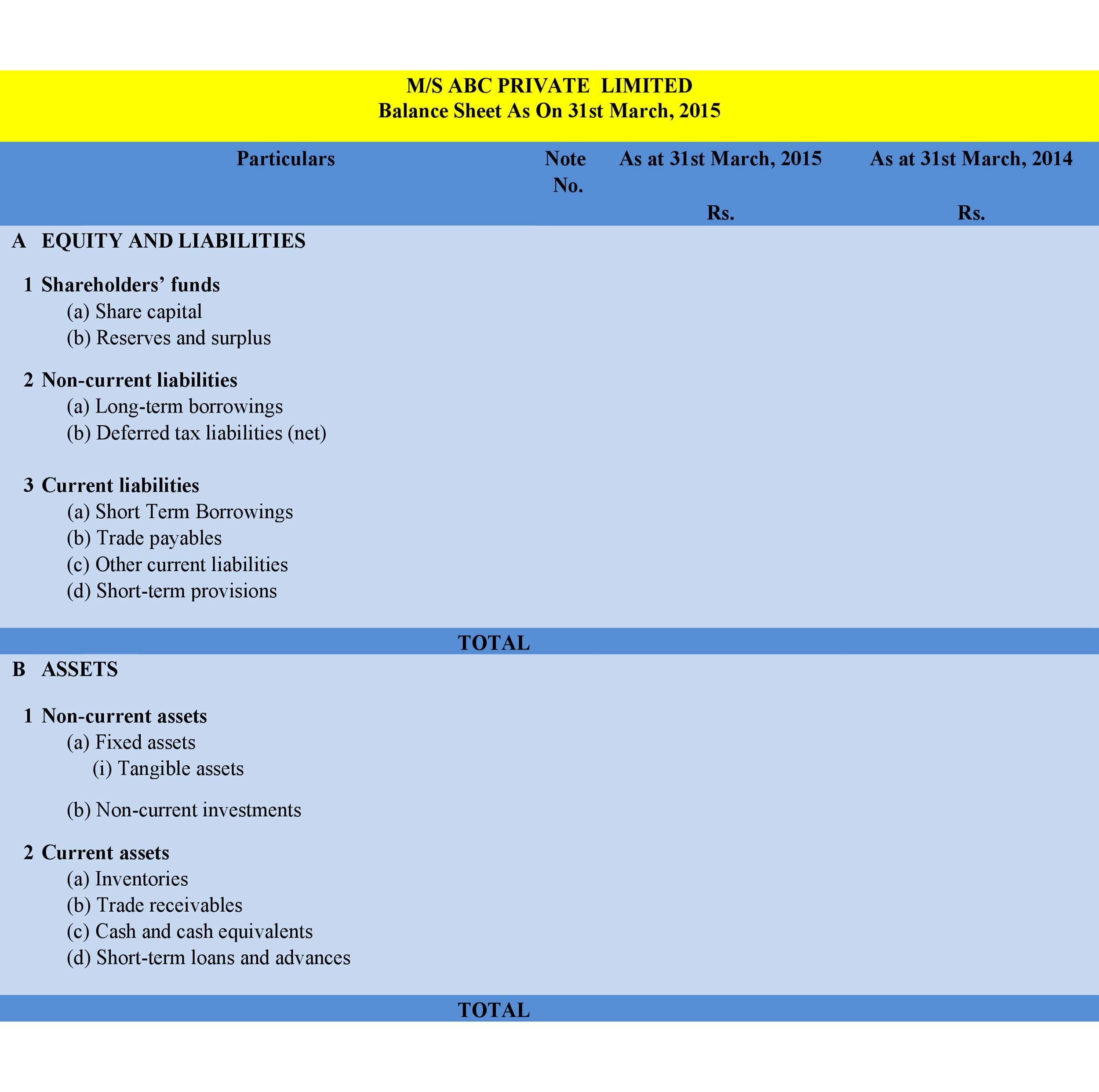

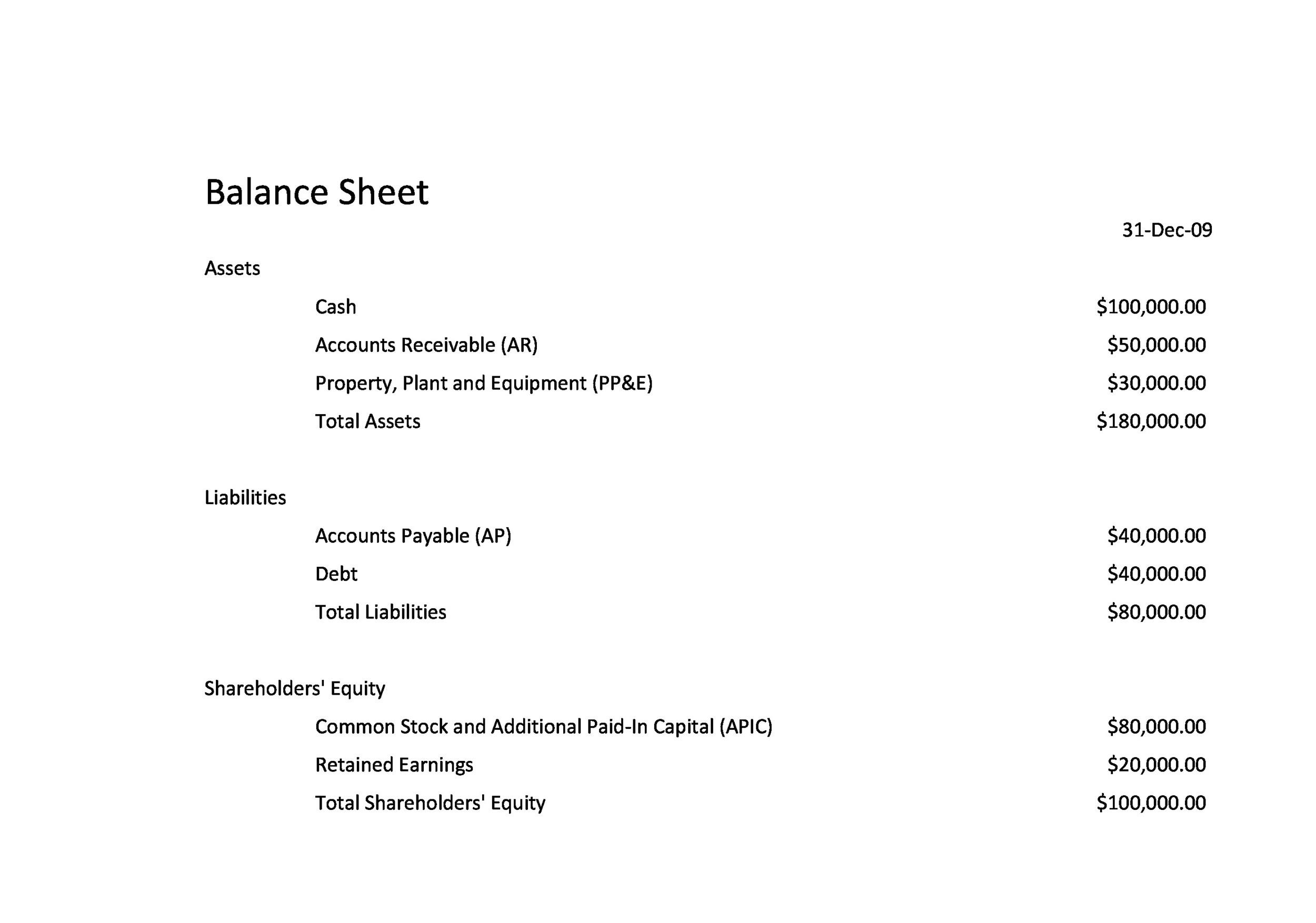

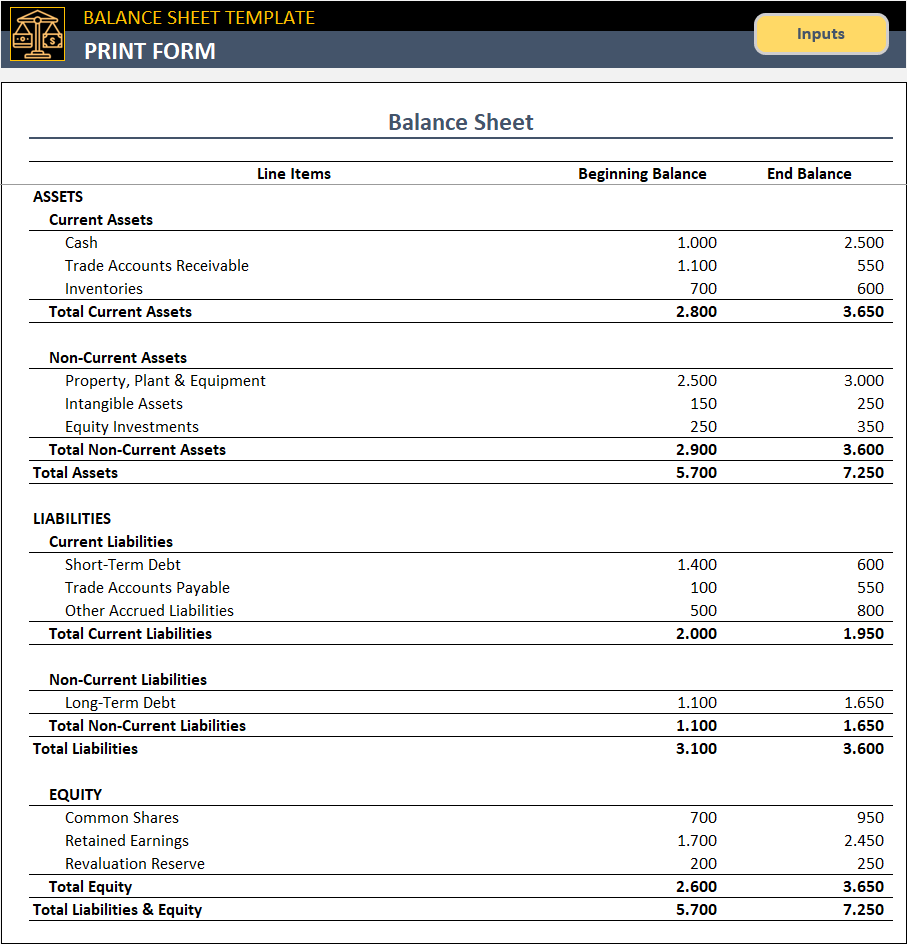

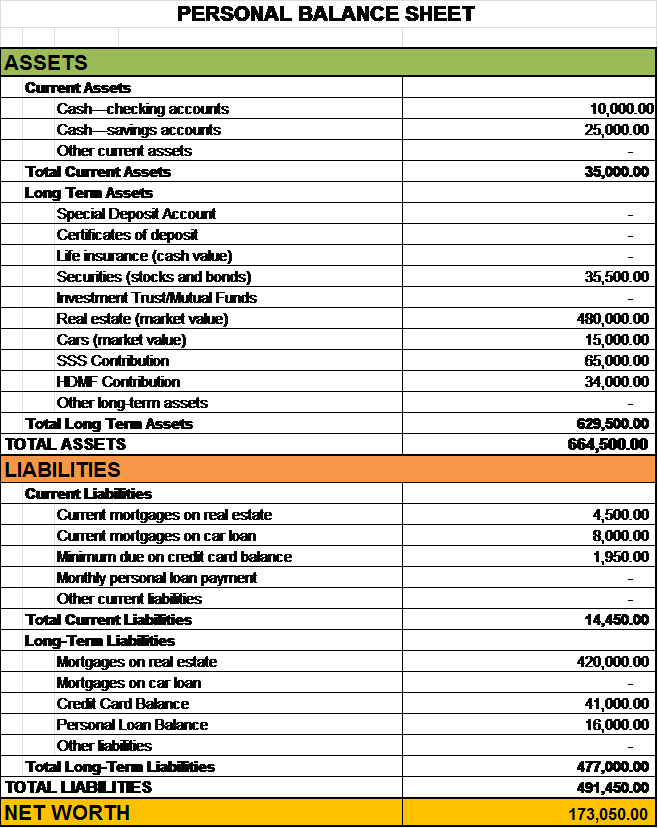

Balance sheet of an individual. An individual must maintain a balance sheet for personal use. A personal balance sheet is a list of everything you own and everything you owe (aka your assets and liabilities) at this very moment all on one sheet. A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity.

A personal financial statement is a document or set of documents that outline an individual’s financial position at a given point in time. All its accounts are divided into debit and credit balances. A balance sheet provides a snapshot of a company’s financial performance at a given point in time.

In this article, we go over what a personal balance sheet is, how to create one and how to use it as an effective tool in your financial planning. Find more balance sheets and accounting templates. A personal financial statement lists all assets and liabilities of an individual or couple.

An economic balance sheet builds on the idea of a traditional balance sheet that many readers are likely already well acquainted with. Individuals use personal balance sheets to monitor their money and debts. Balance sheets are typically prepared and distributed monthly or quarterly depending on the.

Assets = liabilities + equity. A personal balance sheet provides insight into an individual's financial health. Assets = liabilities + shareholders’ equity the equation above includes three broad buckets, or categories, of value which must be accounted for:

The balance sheet is one of the three core financial statements that are used to. A balance sheet is a tool that lists all of your liabilities assets to understand how much you’re worth. Usually, the balance sheet is prepared from a trial balance.

A personal balance sheet is a summary of your overall financial situation at a specific point in time. Balance sheets are useful tools for individual and institutional investors, as well as key stakeholders within an organization, as they show the general financial status of the company. How do you create a personal balance sheet?

What is a personal balance sheet? To do so, we have to create a dataset. The idea in doing so is to plan out.

(1) cash flow report and (2) balance sheet. Gather financial documents getting all your financial documents ensures you have accurate information. For companies, this statement is important for potential stakeholders to determine if they should invest in the company.

The economic balance sheet pertains to individuals and families and goes beyond physical assets to include human capital, planned bequests, and other intangible assets. It is made for the company’s external affairs. This helps them develop financial.