Outrageous Info About Finance Cost In P&l

Finance professionals often use p&l statements in investment banking, corporate finance, accounting, and small business decisions.

Finance cost in p&l. In this p&l tutorial / article, you’ll learn the most important aspects of the p&l. All companies need to generate revenue to stay in business, making the p&l statement essential. Hence the investors use the following formula to calculate financing costs:

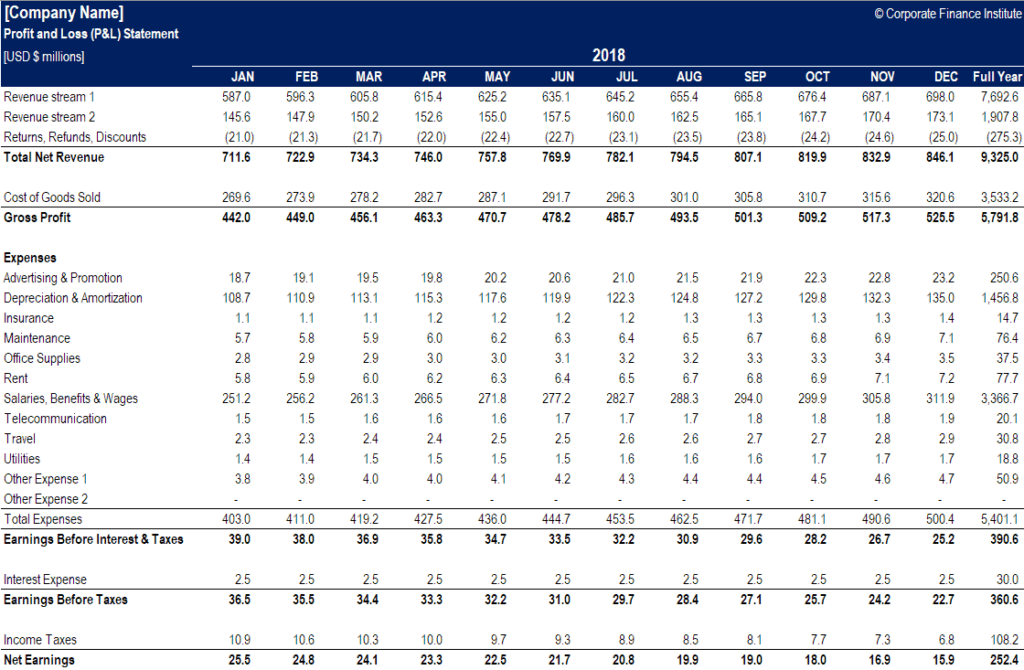

The profit and loss statement (p&l) serves as a comprehensive financial snapshot, encapsulating a company's revenue, expenses, and overall profitability over a specific period. It is also known as the income statement or the statement of operations. The next line item is the “finance cost / finance charges/ borrowing costs”.

It gives you a financial snapshot of how much money you’re making (or losing) and can make accurate projections about your business’s future. Usually, borrowing costs are calculated using the annual percentage rate (apr). A profit and loss (p&l) statement, also known as the income statement, is one of the three financial statements that companies prepare.

Finance cost is interest costs and other costs that an entity pays when it borrows funds. These are ongoing, critical costs to business operation (utilities, rent, advertising, etc). This report helps you understand what’s behind a company’s profitability by categorizing revenues and expenses.

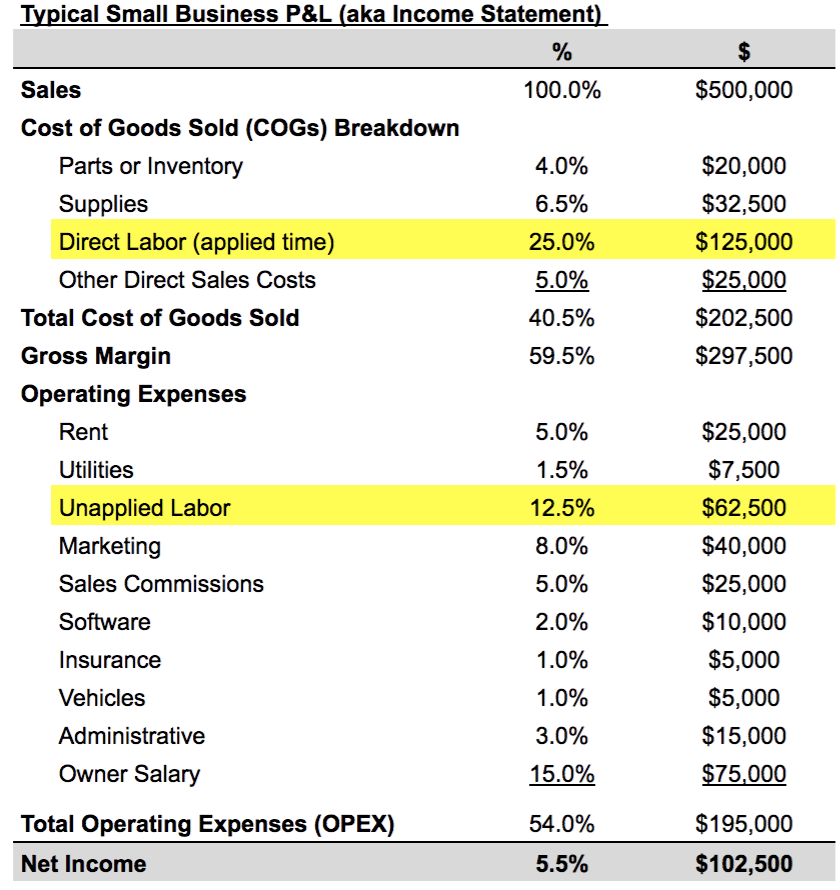

Operating expenses (aka opex or operating costs). Calculation of financing cost with examples. What is a profit and loss (p&l) statement?

What is the profit and loss statement (p&l)? Table of contents hide 1 what is the p&l / profit and loss statement? A profit and loss statement (p&l) is an effective tool for managing your business.

A p&l statement, also known as a profit and loss statement or income statement, is a financial document that explains a company’s financial health for a given accounting period. Companies do not only need to know the costs of different products, but they also need to know whether they gain a profit or realize a loss. The profit and loss (p&l) statement is a financial statement that summarizes the revenues,.

Many p&ls break expenses down into two categories: The p&l shows gross profit or loss, which is income minus cost of goods sold. A profit and loss statement (p&l) is a financial statement that summarizes the revenues, costs, and expenses incurred during a specific period of time, usually a fiscal quarter or year.

How to read a profit and loss statement Usually, interest rates for finance costs are not published by the companies. Revenues are used to pay expenses, interest payments on debt, and taxes.

1.1 jargon buster 2 what are the p&l. Its primary purpose is to assess a company's ability to generate profit by increasing revenue, reducing costs, or both. Gross profit measures revenue minus the cost of goods sold, showing how well a.