First Class Info About Retained Earnings Liabilities

Earnings per share:

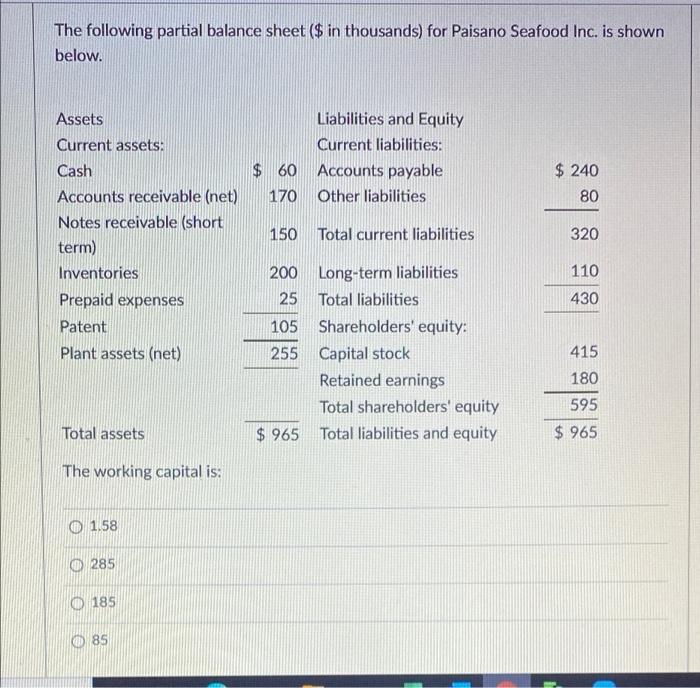

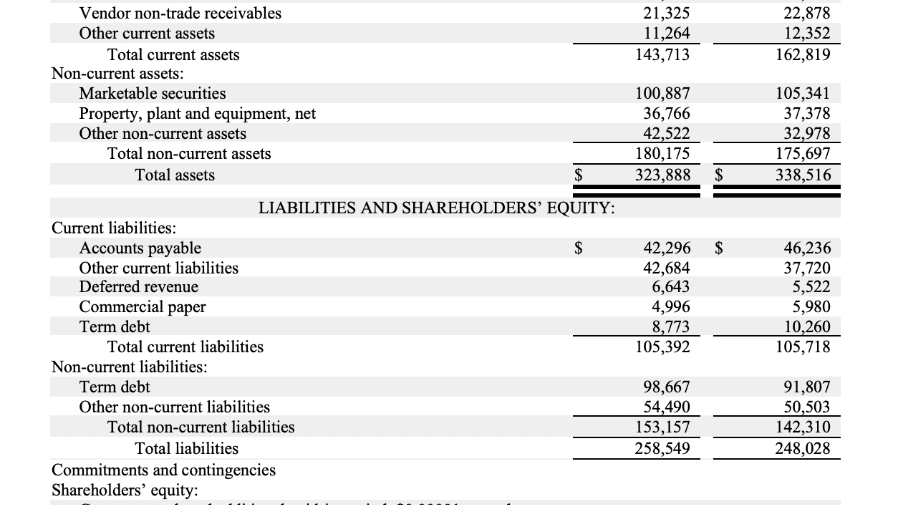

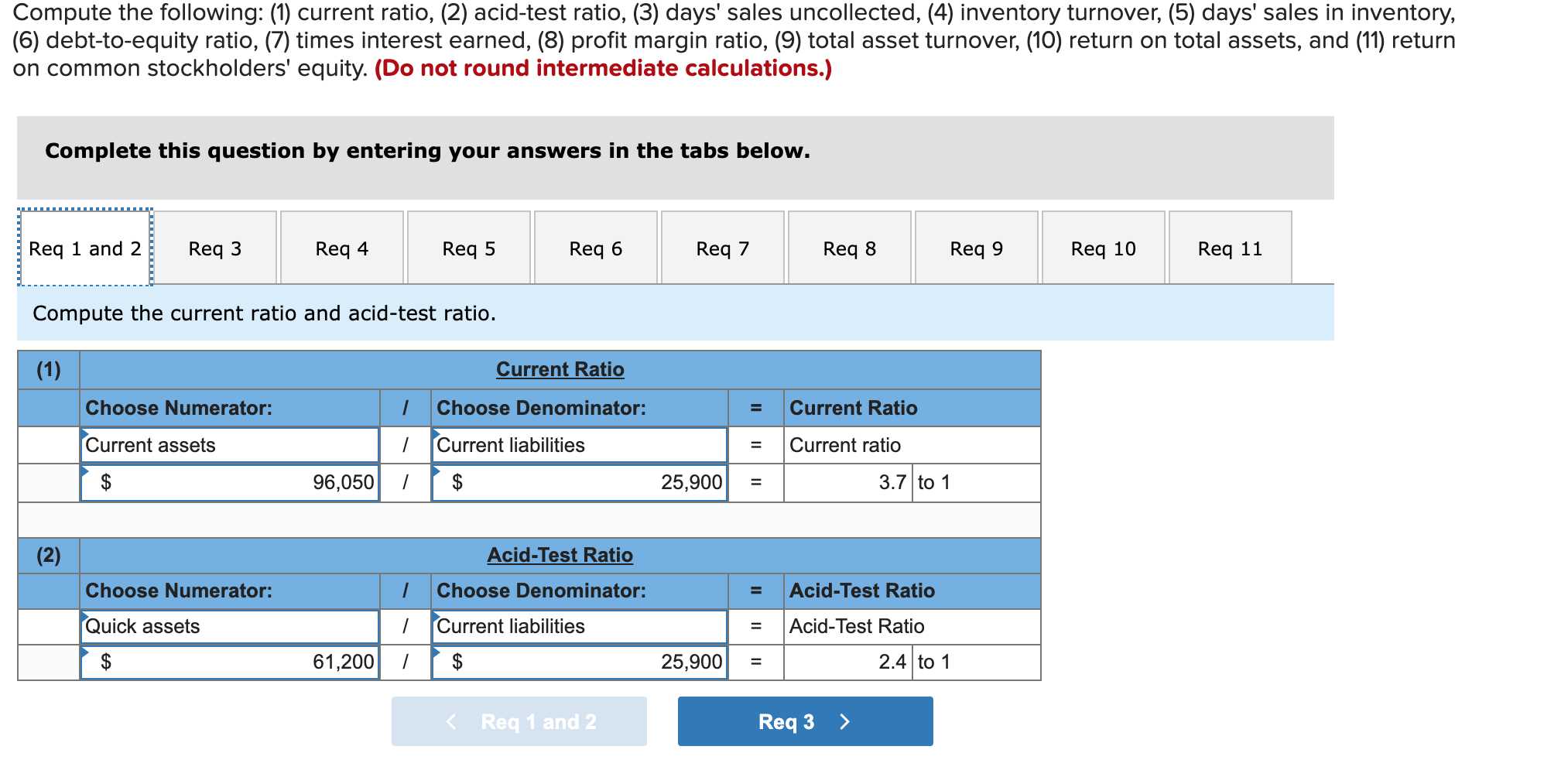

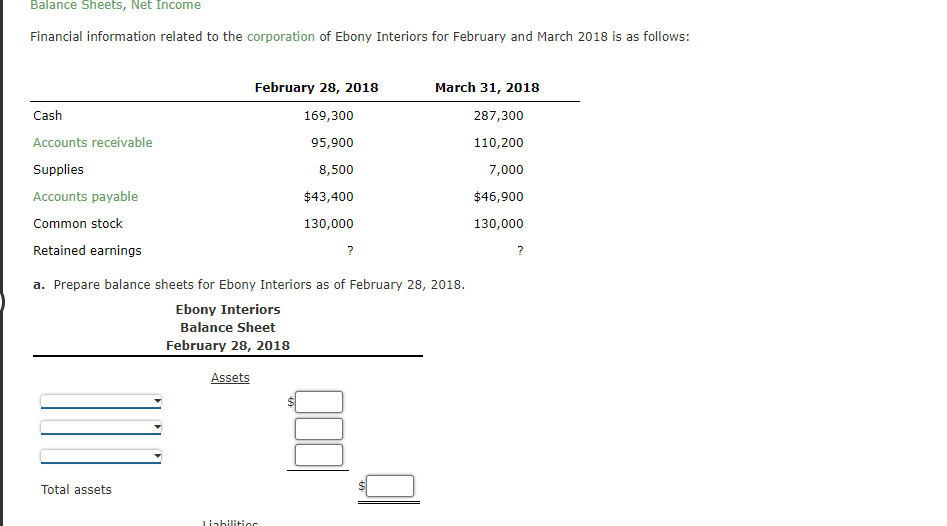

Retained earnings liabilities. They’re in liabilities because net income as shareholder equity is. To calculate retained earnings subtract a company’s liabilities from its assets to get your stockholder equity, then find the common stock line item in your. Now that we’ve recorded the expense on the income statement and the corresponding entry in liabilities, our balance sheet is unbalanced.

That is, it's money that's retained or kept in the company's accounts. Reviewed by dheeraj vaidya, cfa, frm full bio follow what are retained earnings? Retained earnings are a source of internal finance for companies.

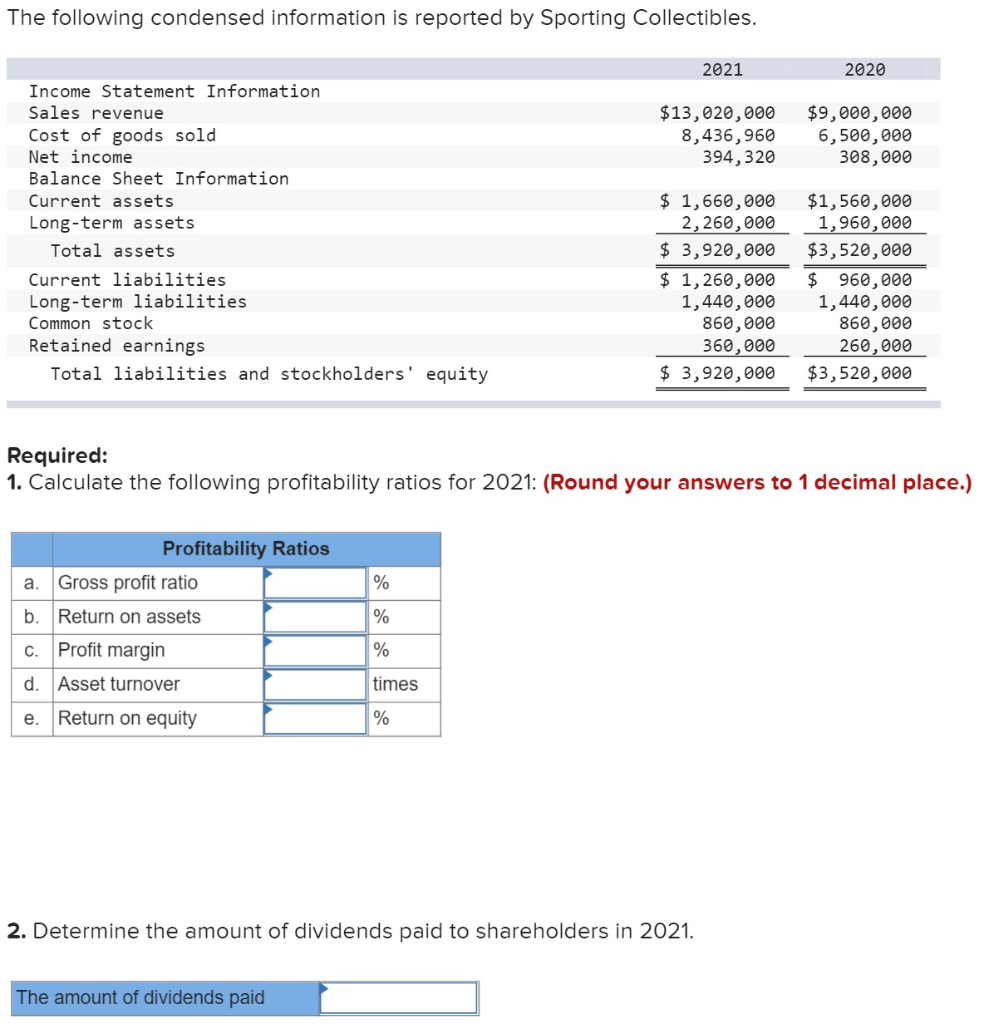

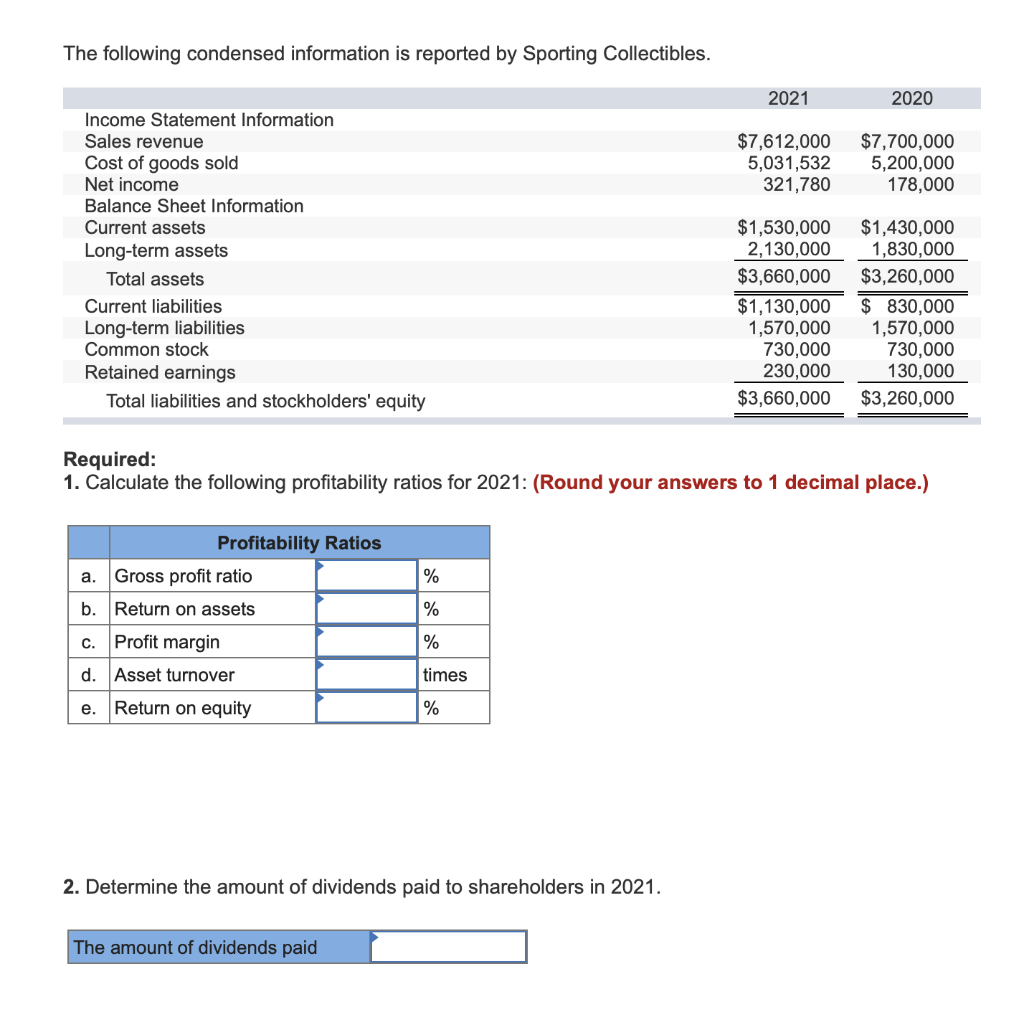

To calculate retained earnings using asset and liability data from your company’s balance sheet, follow these steps: Diluted earnings per share was $0.55 for the fourth quarter of 2023, compared to $3.61 for the fourth quarter of 2022. Net income for the year ended december 31, 2021:

Revenue is an accumulation of earnings from. Retained earnings refer to a company’s net profit after paying out dividends to. On top of that, retained earnings are ultimately the right of a company’s shareholders.

Therefore, some people may confuse them for assets. Advertisement how to calculate retained earnings copied the formula to calculate retained earnings is simple: Retained earnings are corporate income or profit that is not paid out as dividends.

The formula to calculate retained. Retained earnings are actually considered a liability to a company because they are a sum of money set aside to pay stockholders in the event of a sale or buyout of the. Companies must pay these to shareholders after liquidation.

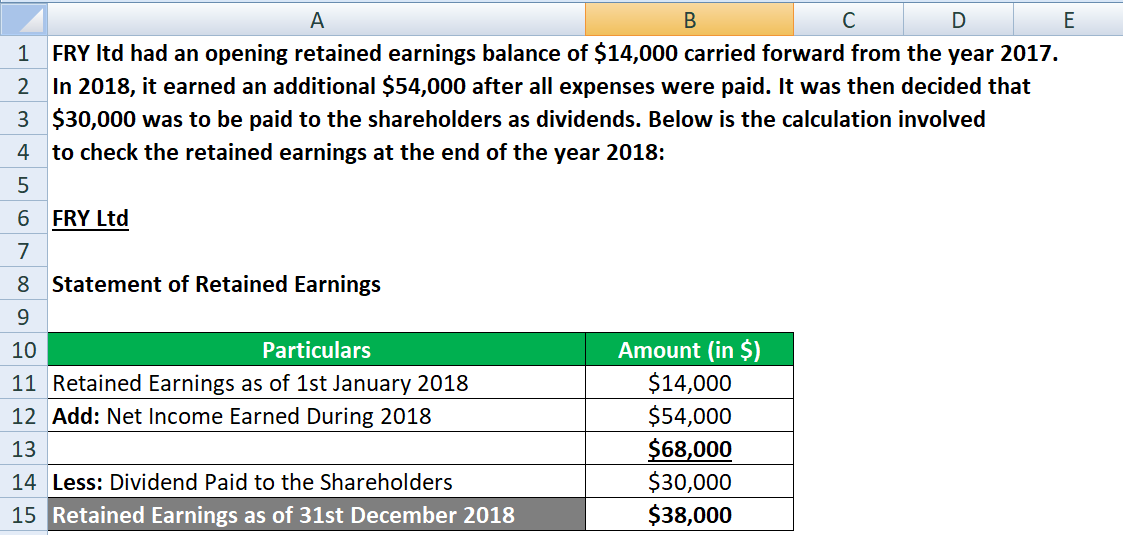

Retained earnings = beginning retained. In this case, some people may confuse retained. Retained earnings are listed under liabilities in the equity section of your balance sheet.

But when it makes new profits, the retained earnings increase. What is the retained earnings formula and calculation? When you complete your separate calculations for assets, liabilities, retained earnings and stock, you can check to ensure you include the correct accounts within each.

Retained earnings are a key component of shareholder equity and the calculation of a company’s book value. In some cases, the corporation will use the cash from the retained earnings to reduce its liabilities. As a result, it is difficult to identify exactly where the retained earnings are.