Cool Tips About Net Cash From Investing Activities Formula

Investing activities include purchases of physical assets, investments in securities, or.

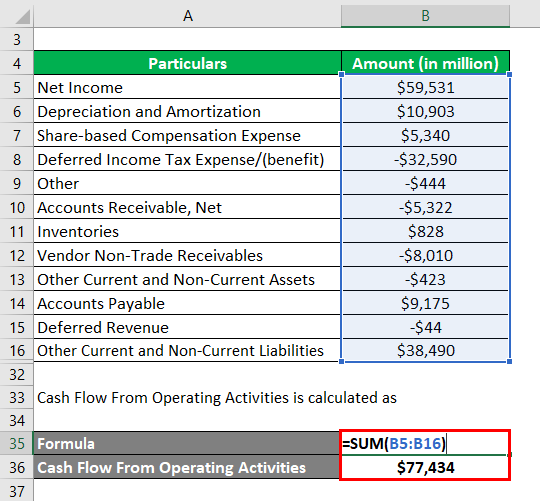

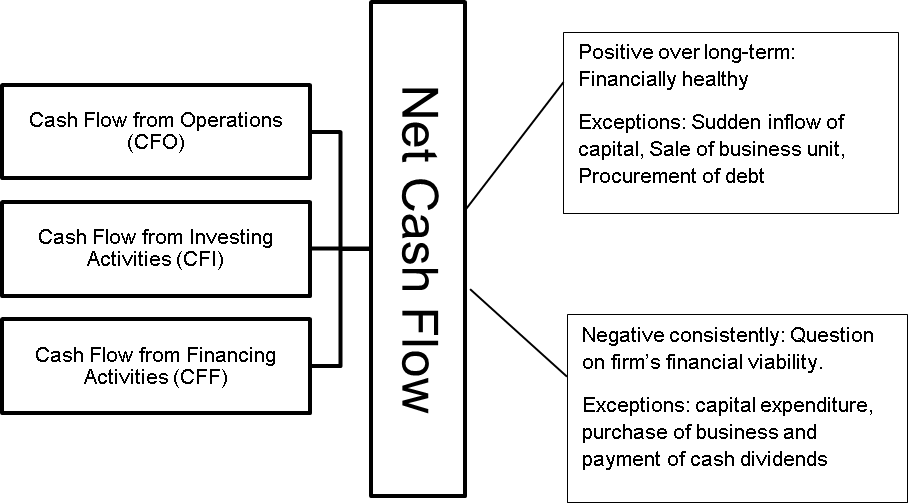

Net cash from investing activities formula. It is calculated by subtracting a company's total liabilities from its total cash. The net cash flow formula is figured out after adding the net cash flow from operating activities, net cash flow from investing activities, and net cash flow from financing. Updated may 27, 2021 reviewed by david kindness fact checked by hans daniel jasperson cash flow from investing is listed on a company's cash flow statement.

It is calculated by deducting the current liabilities from the cash balance reported on the company’s financial statements at the end of a particular period and is looked at by. Suzanne kvilhaug what is cash flow from operating activities (cfo)? Net cash is important for several reasons.

Cash flow from investing activities is the section of a company’s cash flow statement that displays how much money has been used in (or generated from) making investments. Net cash flow from investing activities is calculated by subtracting the cash outflows from the cash inflows related to. Cash flow from financing activities (cff) measures the movement of cash between a firm and its.

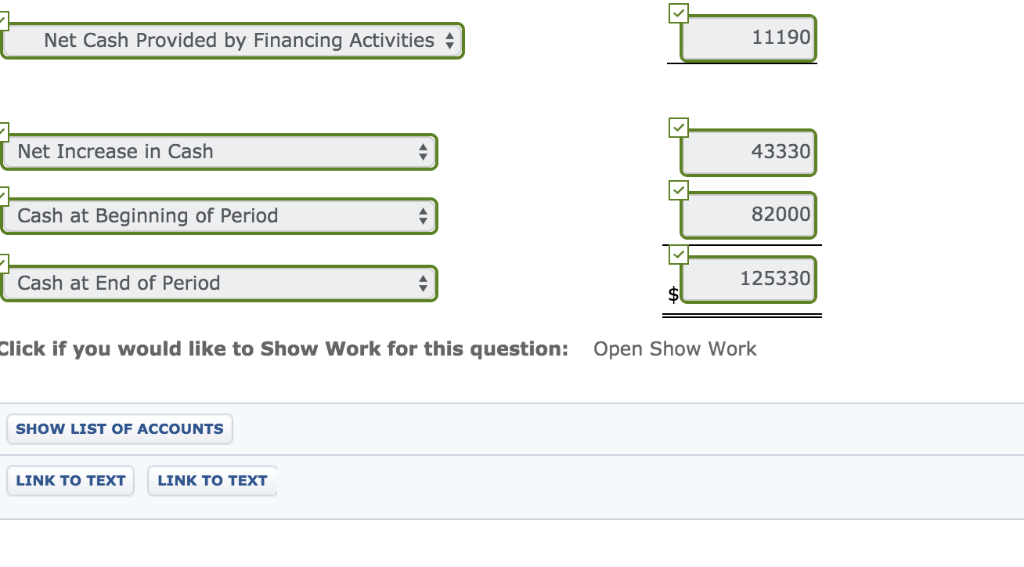

Effect of exchange rates on cash and cash. The net cash figure is commonly used when evaluating a company's cash flows. Cash flow from investing:

How is net cash flow from investing activities calculated? Learn how to calculate it for this activity. Cash flow from operating activities (cfo) indicates the amount of money a company.

Hub accounting march 29, 2023 the net cash flow formula helps reveal if a business is performing well or in danger of going bankrupt. Repeated periods of positive net cash. Cash flow from investing activities formula:

This can include the purchase of a. Help the senior management calculate the net cash flow for the year.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)