Amazing Tips About Vertical Common Size Income Statement

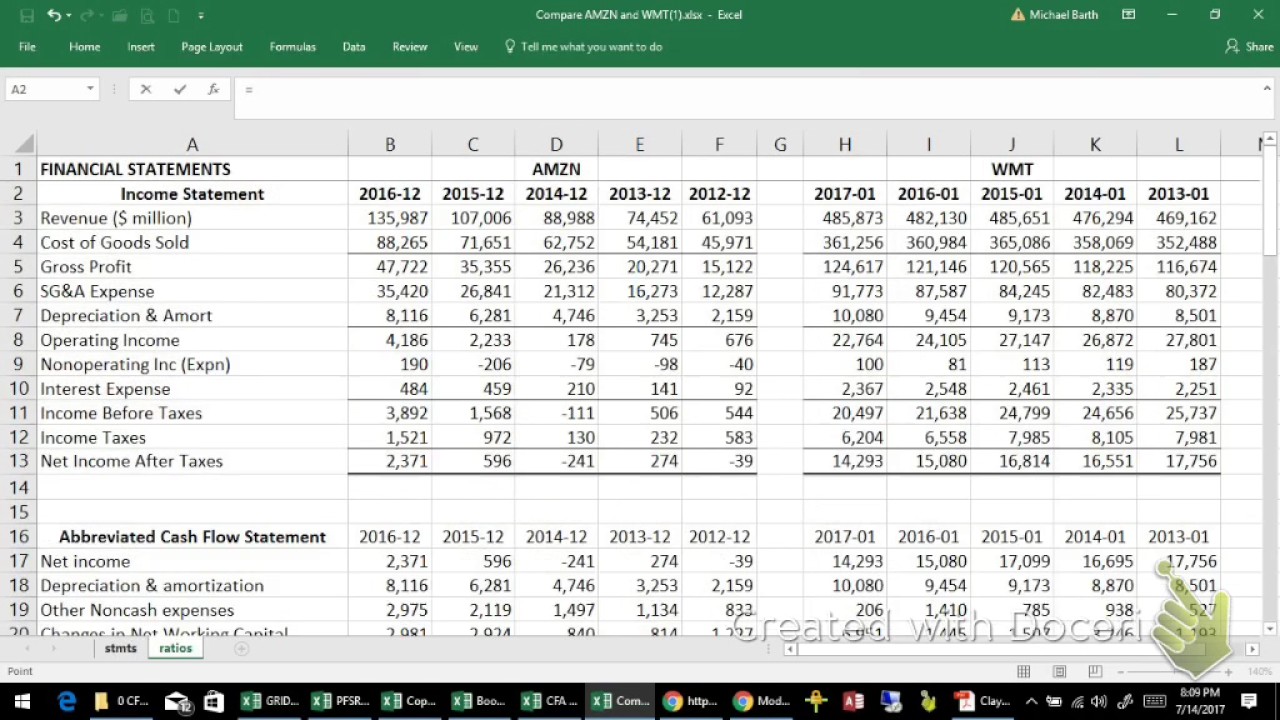

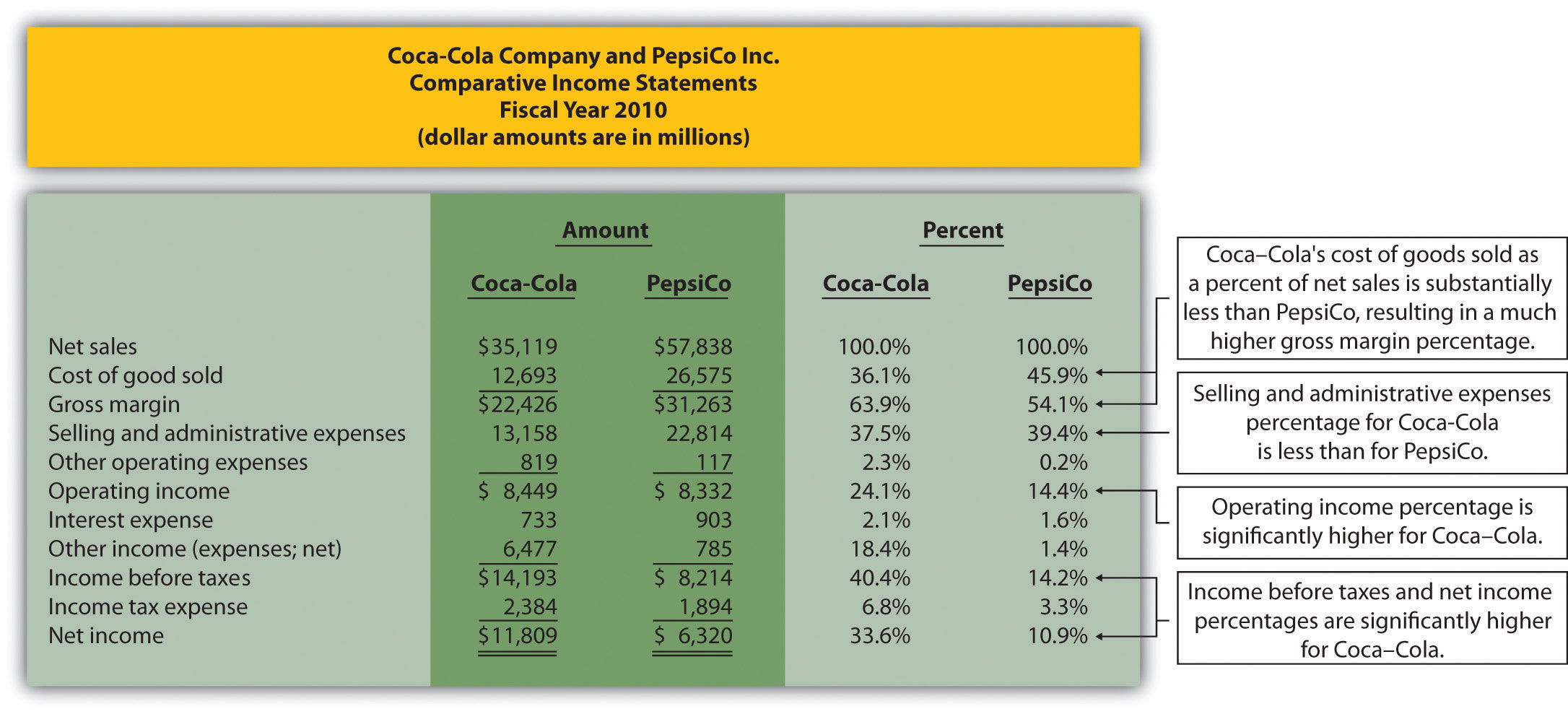

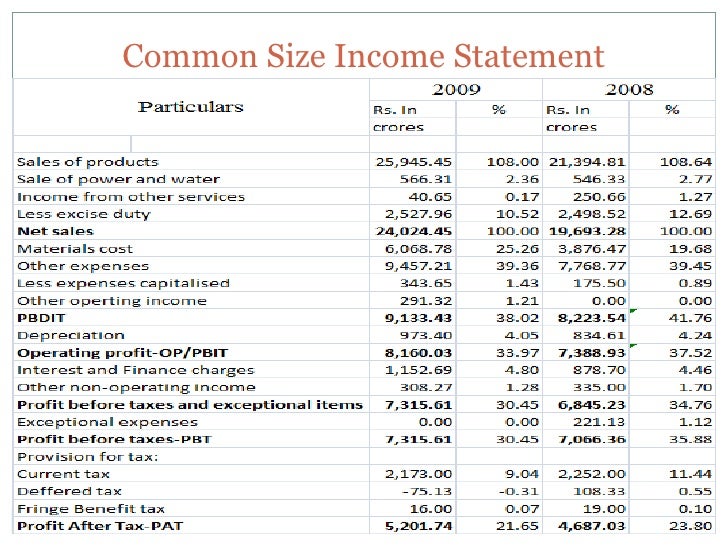

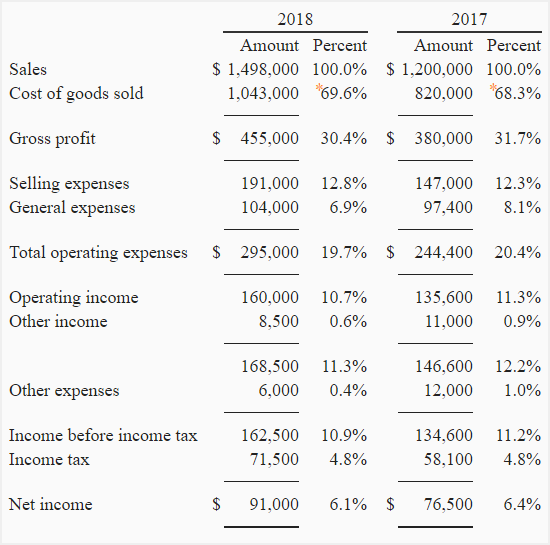

Common size analysis is used to calculate net profit margin, as well as gross and operating margins.

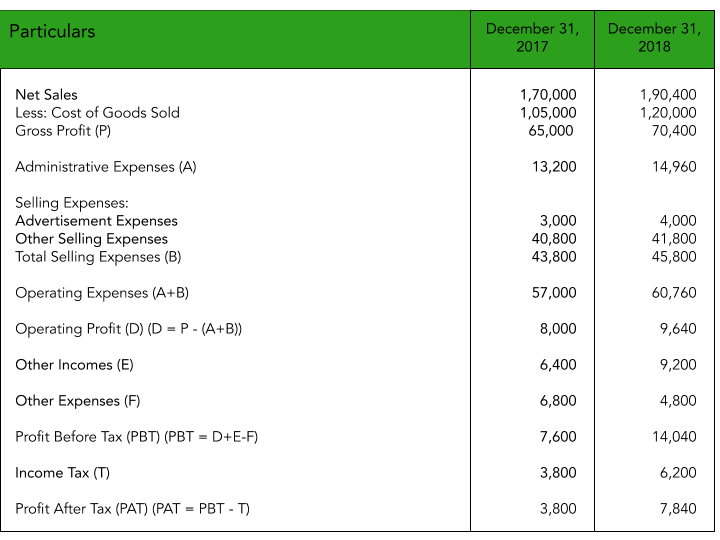

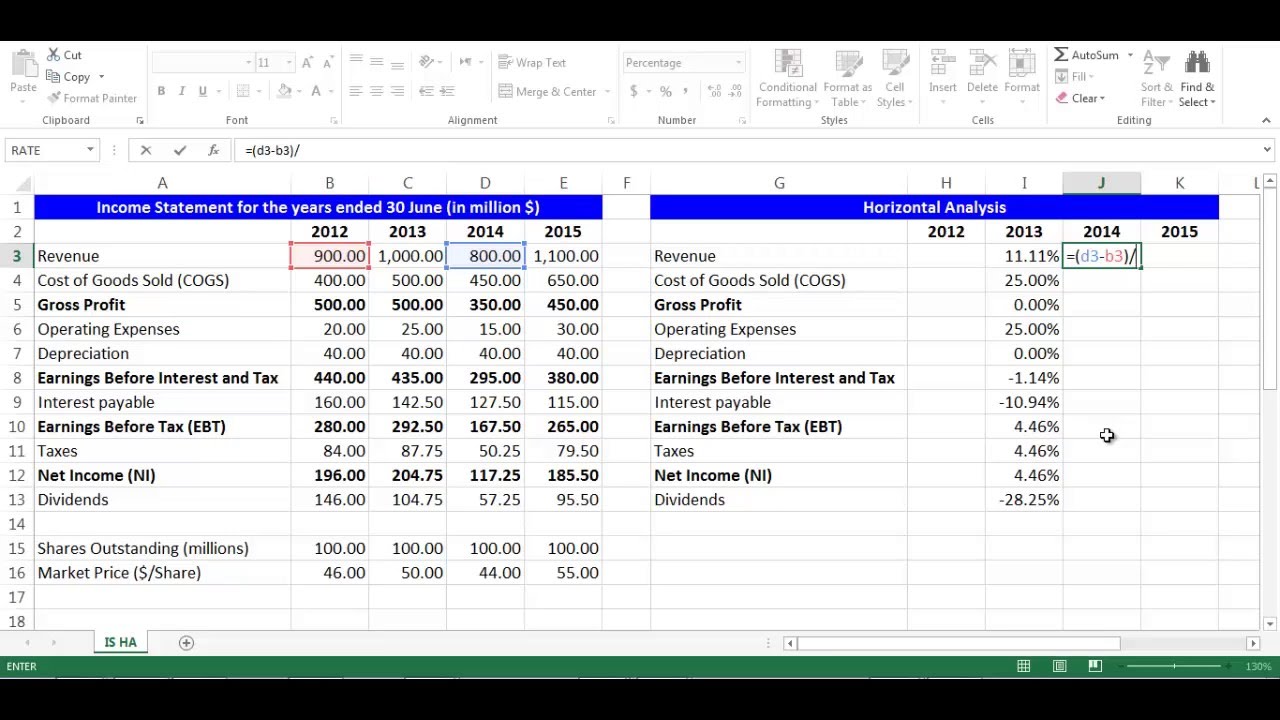

Vertical common size income statement. Example of common size income statement—vertical analysis. Last editeddec 2020 — 2 min read. The ratios tell investors and finance managers how the company is doing in terms of revenues, and can be used to make.

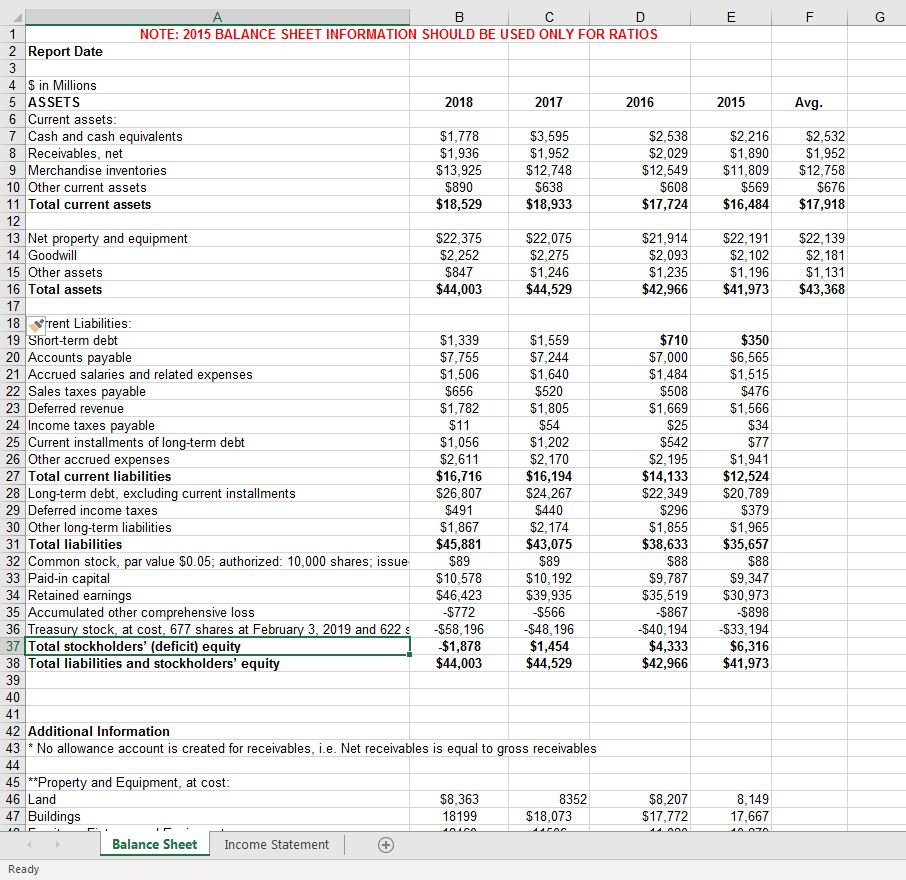

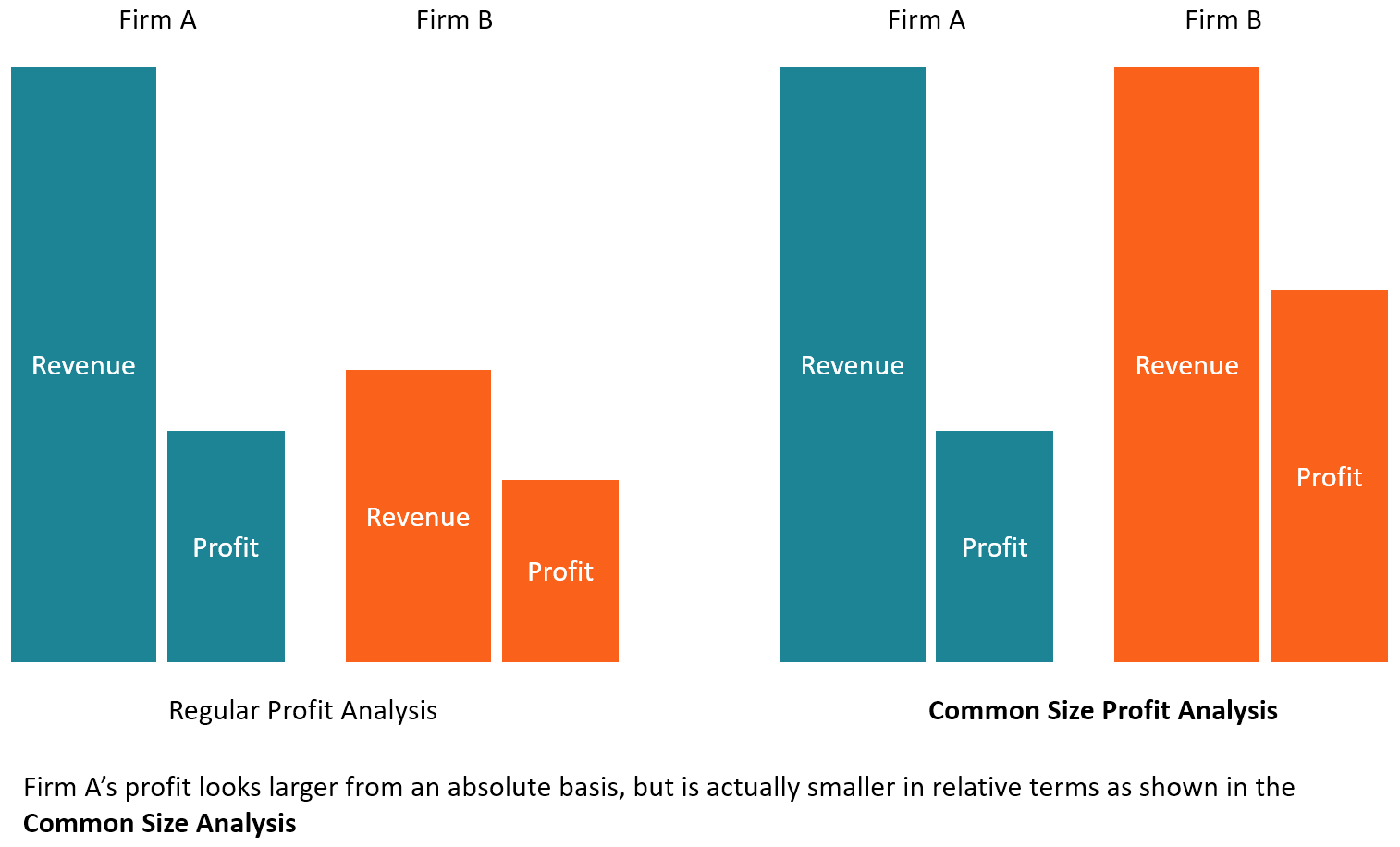

The base item in the income statementis usually the total sales or total revenues. Updated may 3, 2021 the practice of common sizing financial statements allows you to compare two companies that are of different sizes. In the balance sheet, assets, liabilities, and shareholder equity are expressed as.

The common size financials are. A common size financial statement is a specific type of statement that outlines and presents items as a. For example, a vertical common size analysis may look at.

Common size financial statement analysis, which is also called a vertical analysis, is a technique that financial managers use to analyze their financial. What is a common size financial statement? Here is a hypothetical example of how a common size income statement can be used in vertical.

The balance sheet and the income statement.

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

:max_bytes(150000):strip_icc()/CommonSizeIncomeStatement_v1-6d2a9c4def2449168cbd16525632bbd1.jpg)