Favorite Info About Preparing Income Statement From Trial Balance

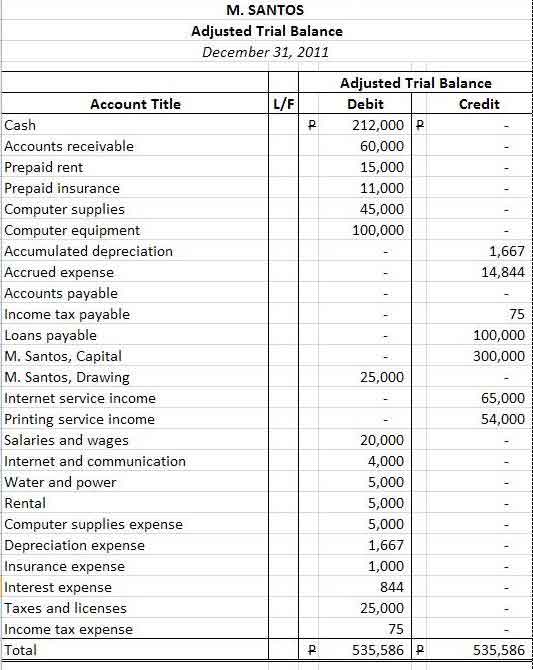

Using information from the asset, liability and equity.

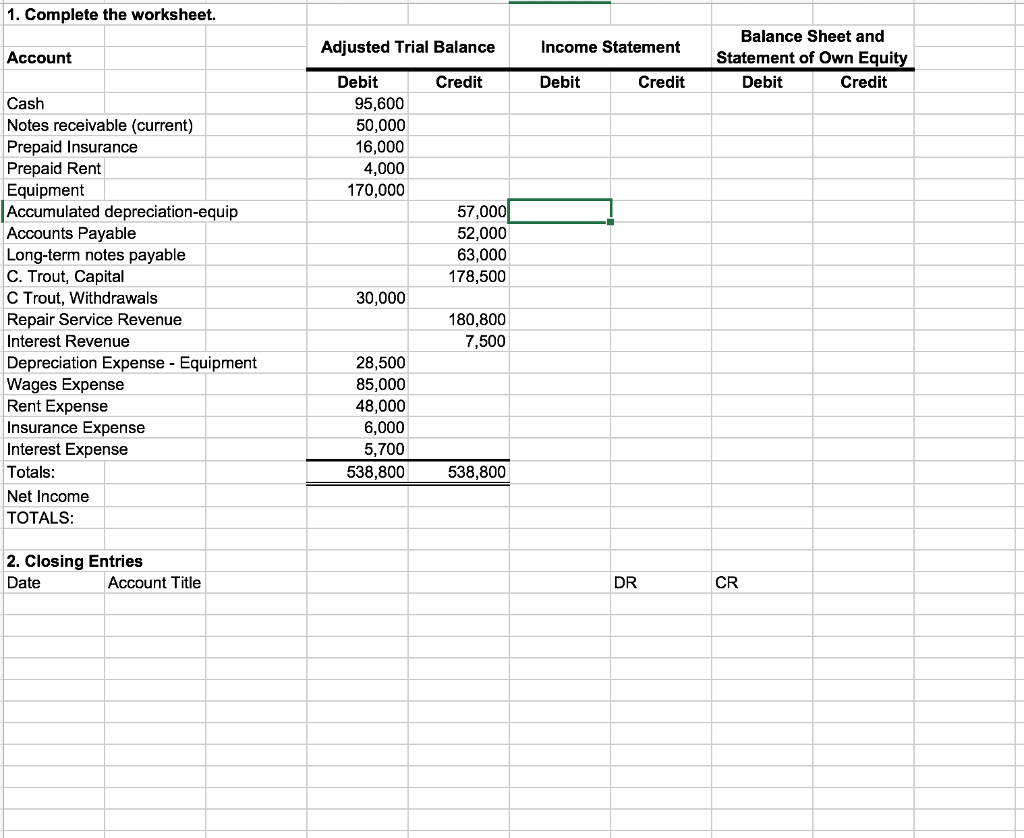

Preparing income statement from trial balance. The statement of change in equity always leads. An income statement shows the organization’s financial performance for a given period of time. What is involved in preparing financial statements from an adjusted trial balance?

The trial balance is prepared. Prepare an income statement; If an income statement is prepared before an entity’s.

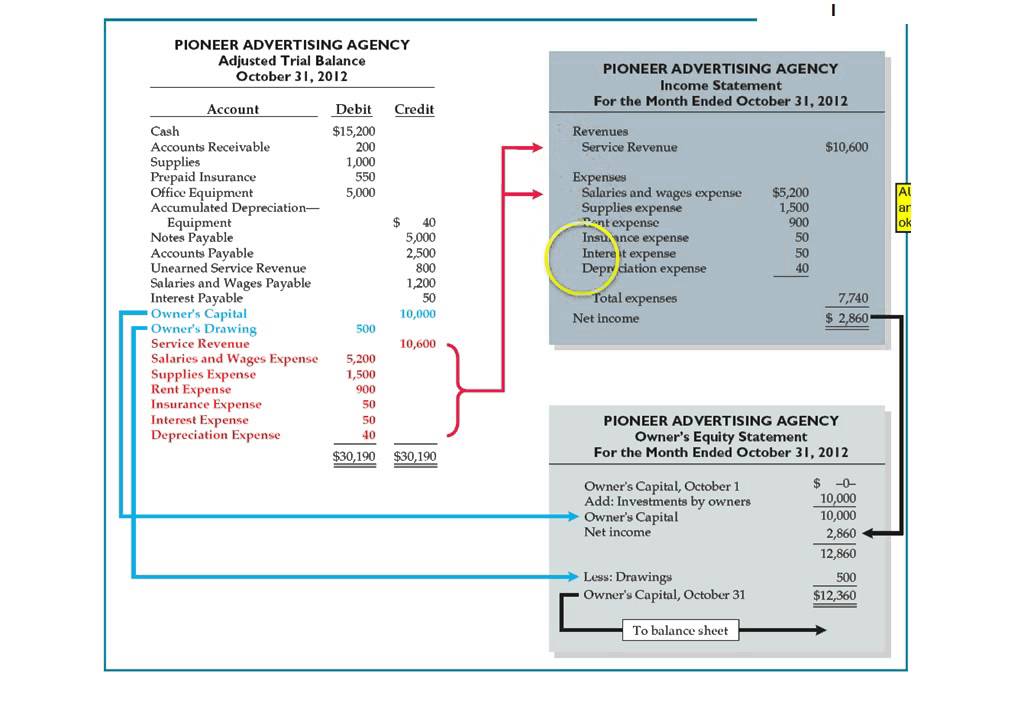

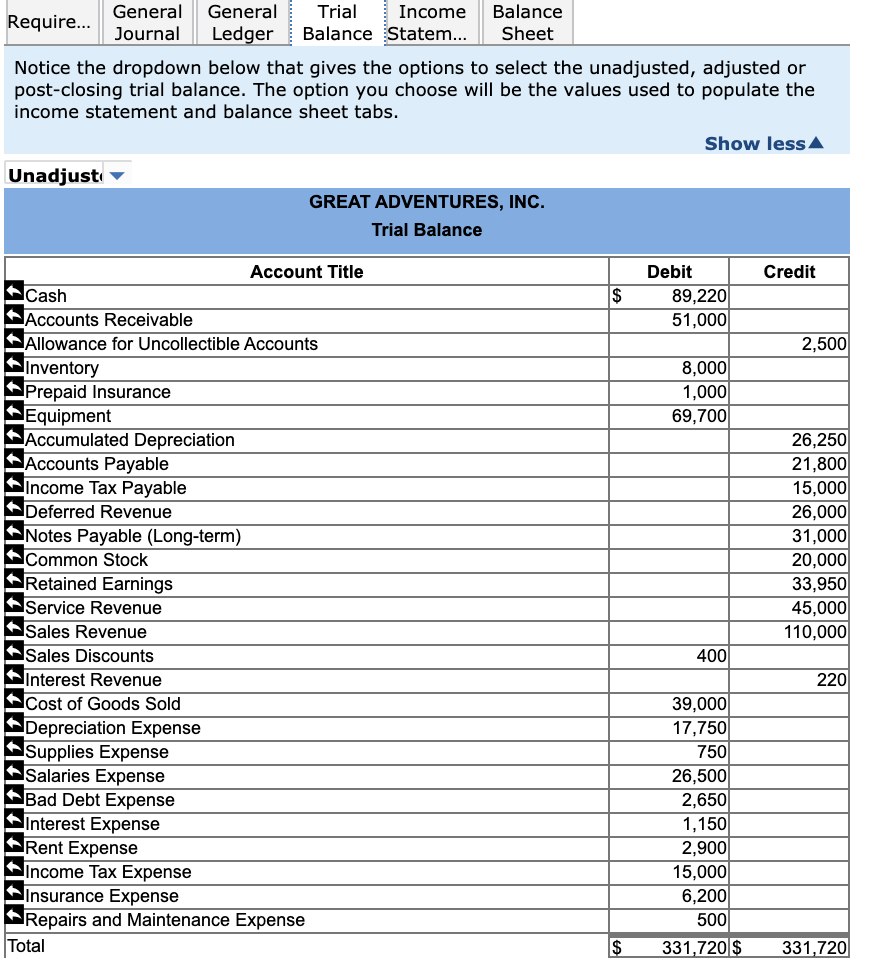

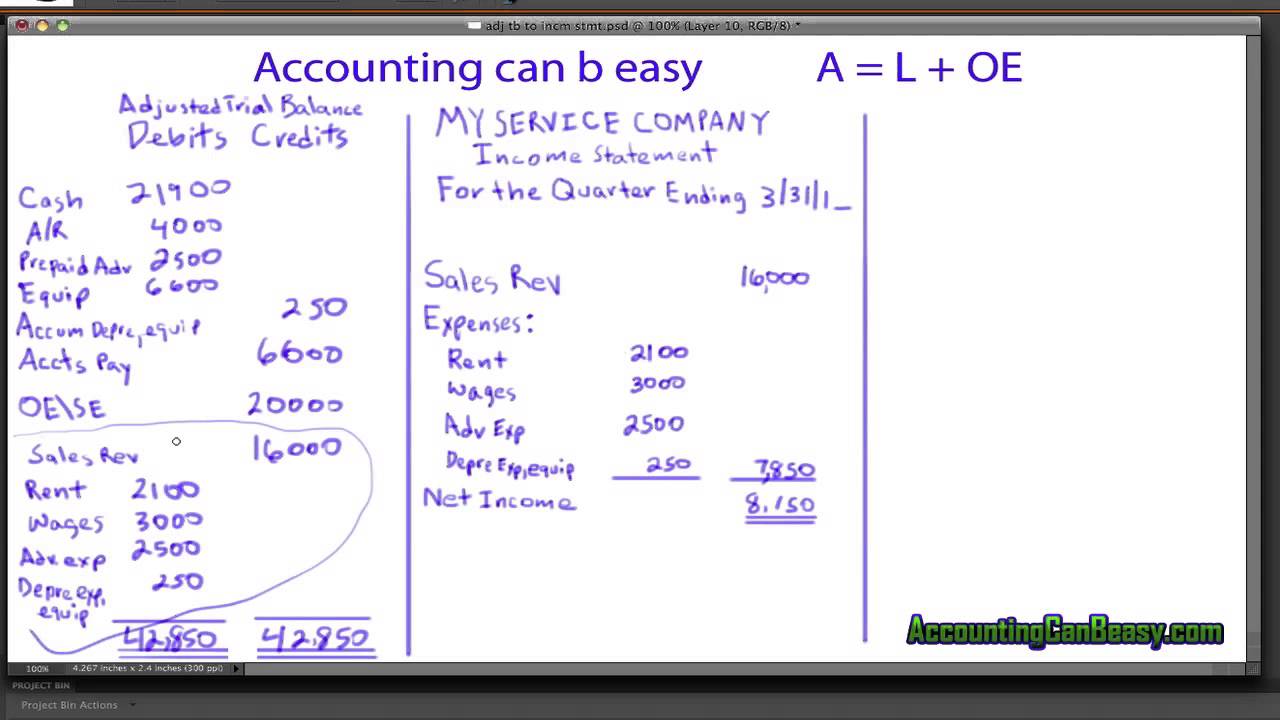

The adjusted trial balance serves as the basis for the preparation of financial statements, such as the income statement, balance sheet, and statement of cash flows. To prepare a trial balance, you will need the closing balances of the general ledger accounts. How do you prepare a trial balance?

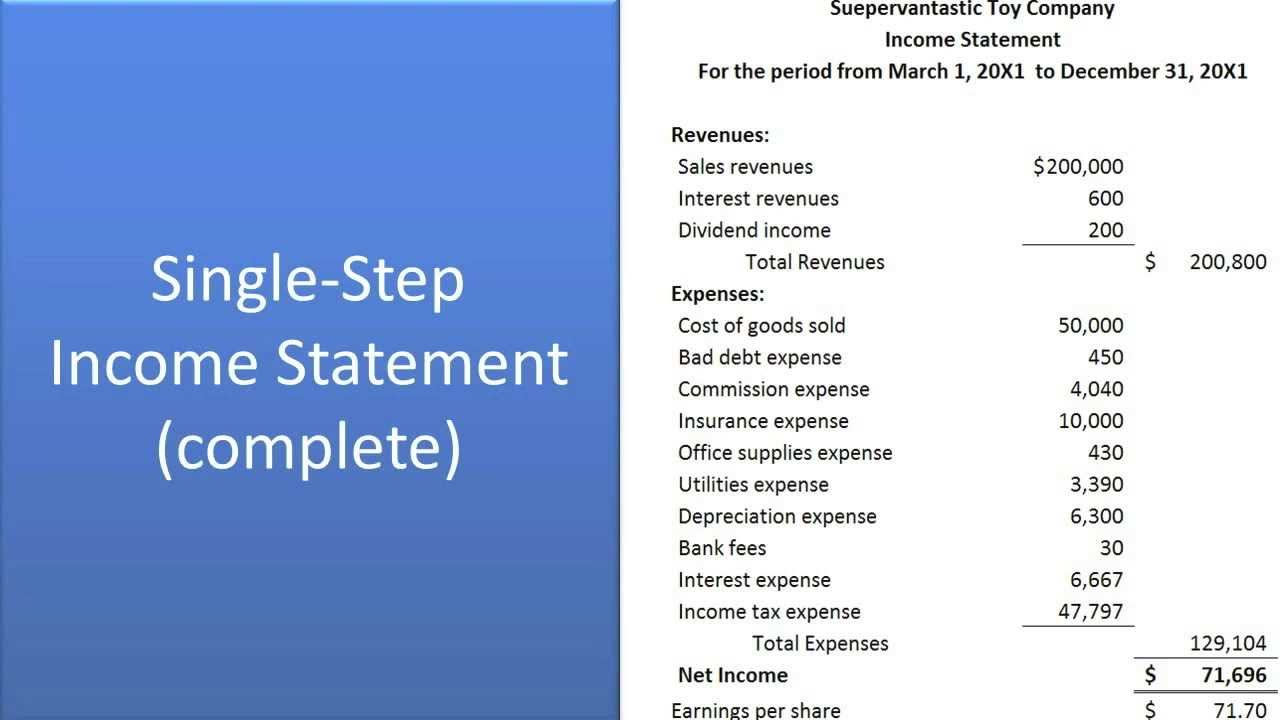

Using information from the revenue and expense account sections of the trial balance, you can create an income statement. Net income information is taken from the income statement, and dividends information is taken from the adjusted trial balance. Why is the trial balance prepared?

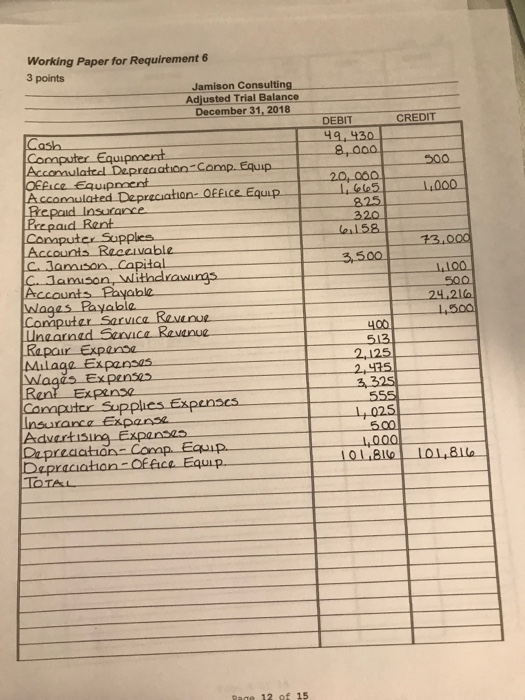

The five column sets are the trial balance, adjustments, adjusted trial balance, income statement, and the balance sheet. Guide to what is adjusted trial balance. The income statement is prepared using the revenue and expense accounts from the trial balance.

In an accounting system, the best tool to take information from would be the adjusted trial balance. 2.1 describe the income statement, statement of owner’s equity, balance sheet, and statement of cash flows, and how they interrelate; As demonstrated in chapter 5 of the aaa textbook, the income statement must be prepared first, followed by the statement of changes in equity and then the balance.

We explain it along with example, accounting, purpose, how to make it, vs unadjusted trial balance. Identify the three main components of the statement of cash. This is the most updated trial balance (i.e.

Prepare a statement of owner’s equity; 2.2 define, explain, and provide.

How to prepare an income statement: