Out Of This World Tips About Income Statement Meaning In Business

How you calculate this figure will depend on.

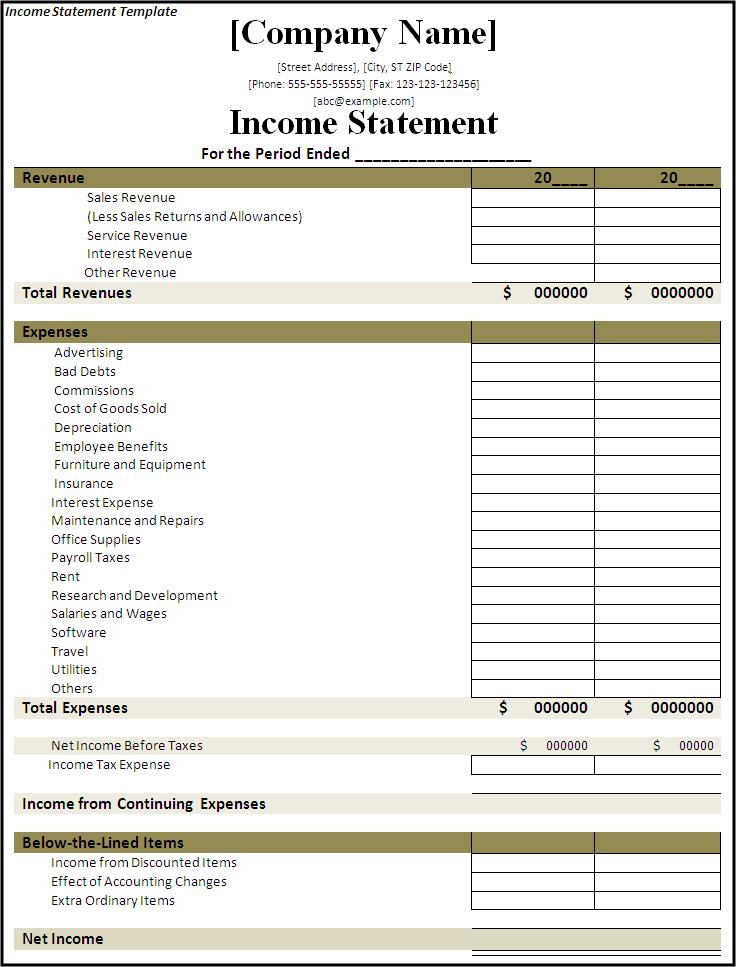

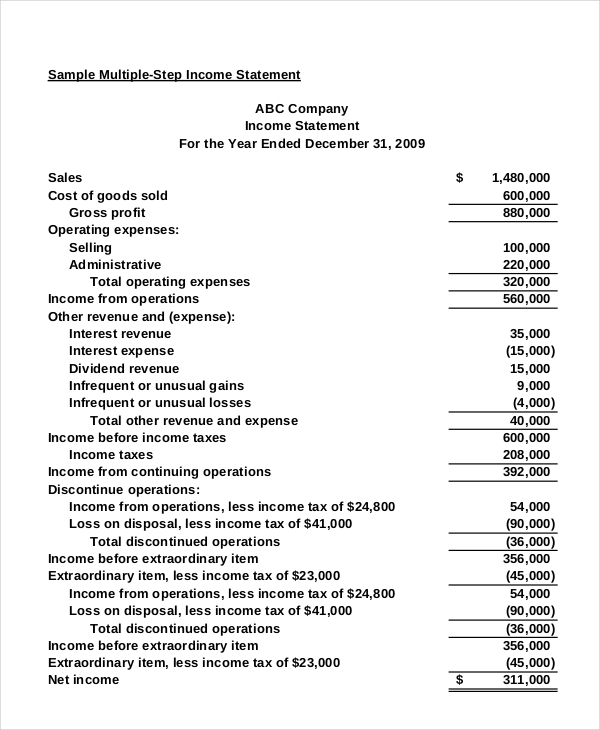

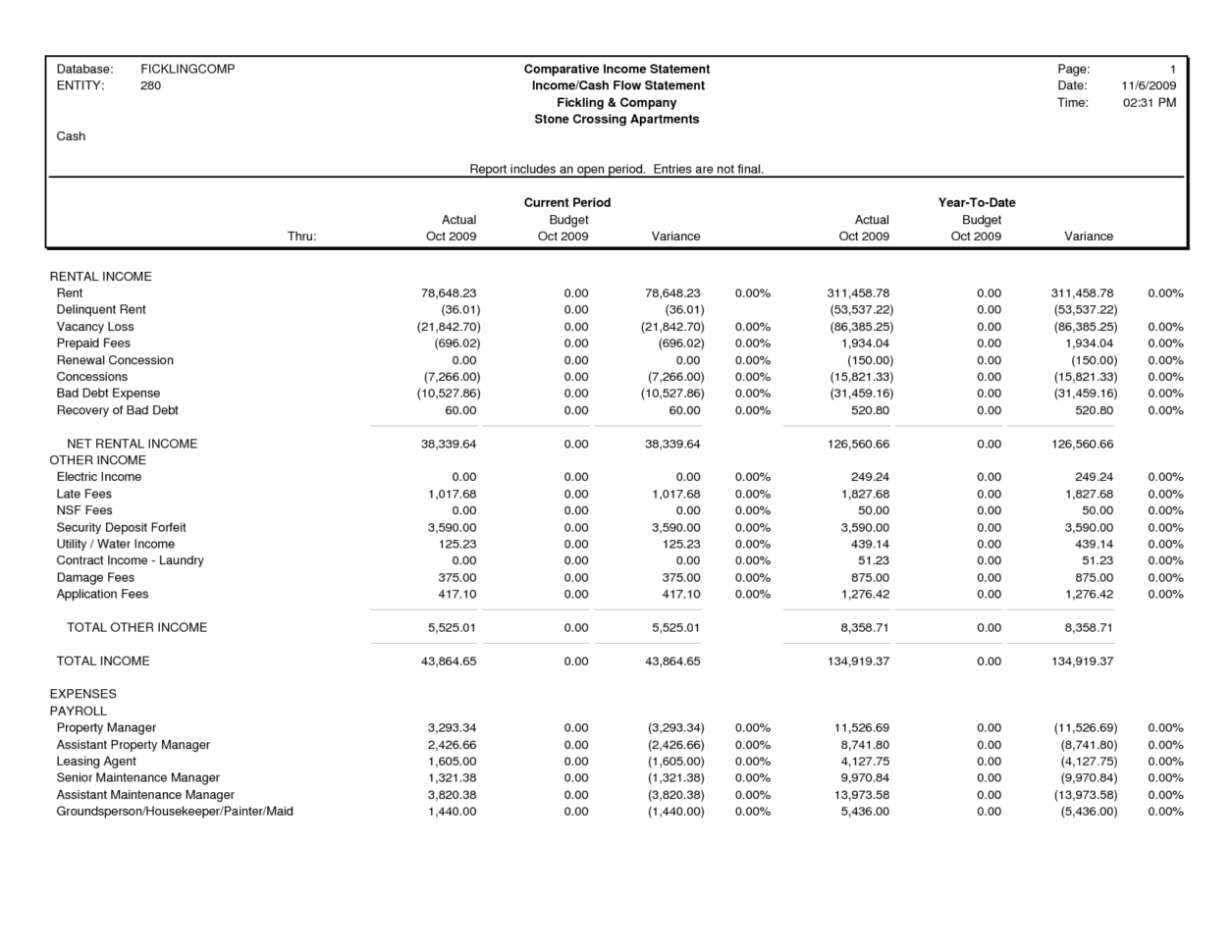

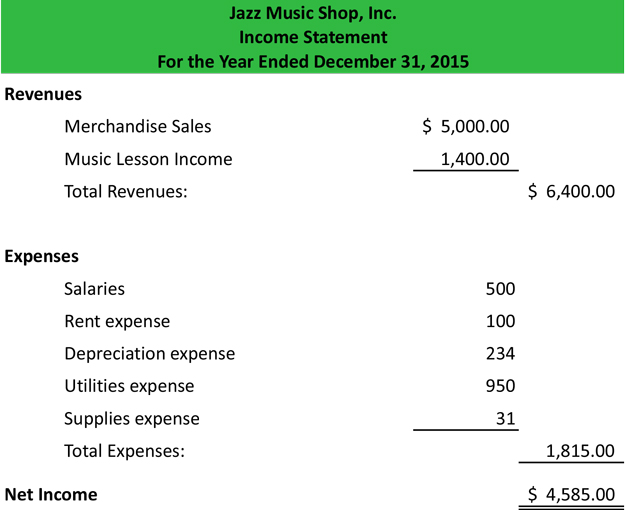

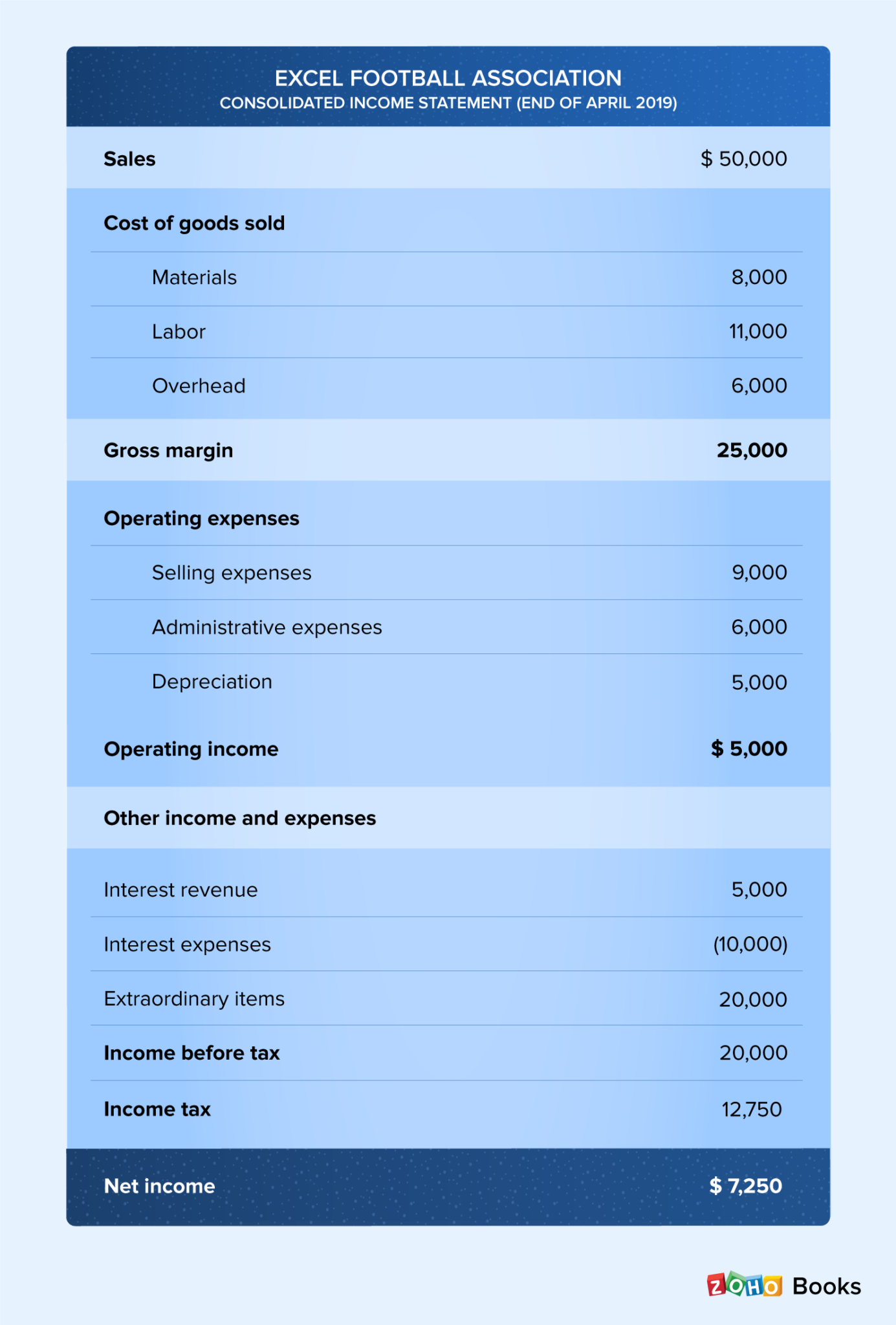

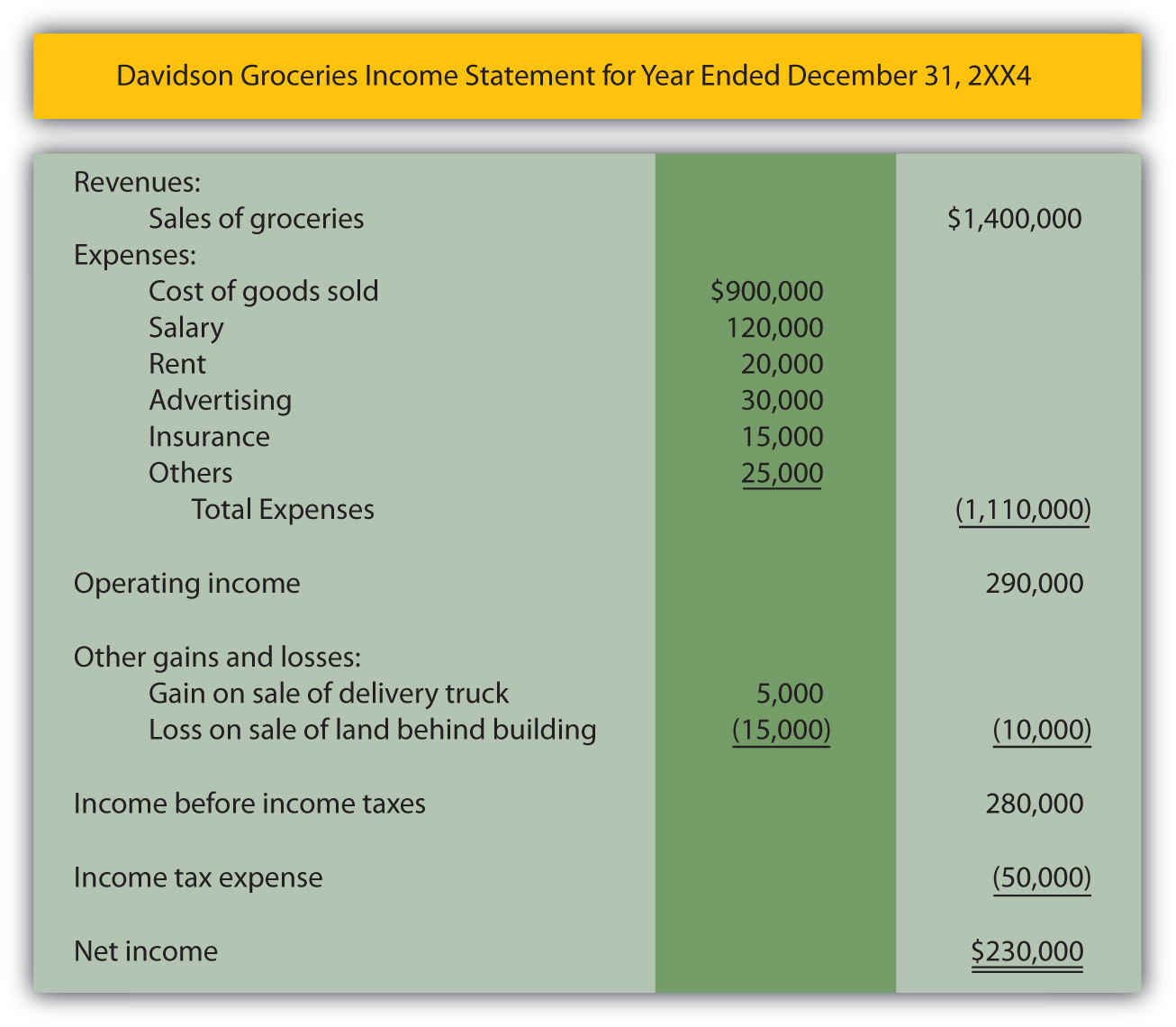

Income statement meaning in business. The income statement follows a specific format. Expenses to generate the revenue and manage your business. The income statement, being a detailed record of a company’s financial performance over a specified period, shows the revenues, costs, and profits (or losses) a company makes.

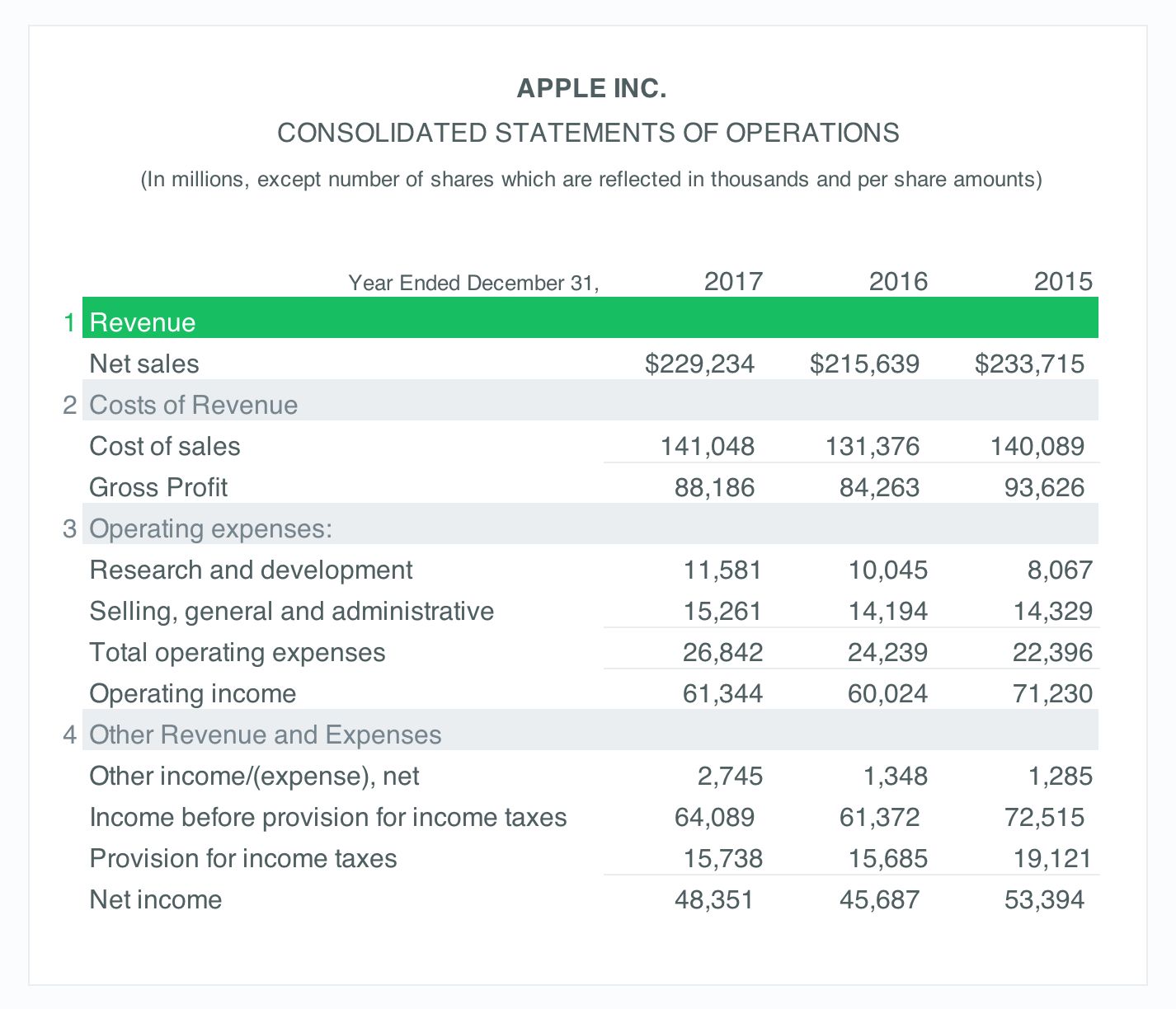

Income statement example sales revenue. This document gauges the financial performance of a business in terms of profits or losses for the accounting period. Shannon stapleton/getty images.

The income statement, along with additional financial documents, is required to be filed with the securities and. An income statement is one of the three major financial statements, along with the balance sheet and the cash flow statement, that report a company’s financial performance over a specific. An income statement shows a company’s revenues, expenses and profitability over a period of time.

The income statement is the first of a business’s three most important financial statements. Revenue from selling products or services. Some investors and analysts use income statements to make investing decisions.

An income statement represents a period of time (as does the cash flow statement ). The income statement presents the financial results of a business for a stated period of time. The income statement shows how much of a profit your business made — or that you assume you will make if it’s a projection — during a specific period of time.

The income statement is a historical record of the trading of a business over a specific period (normally one year). What is an income statement? Within an income statement, you’ll find all revenue and expense accounts for a set period.

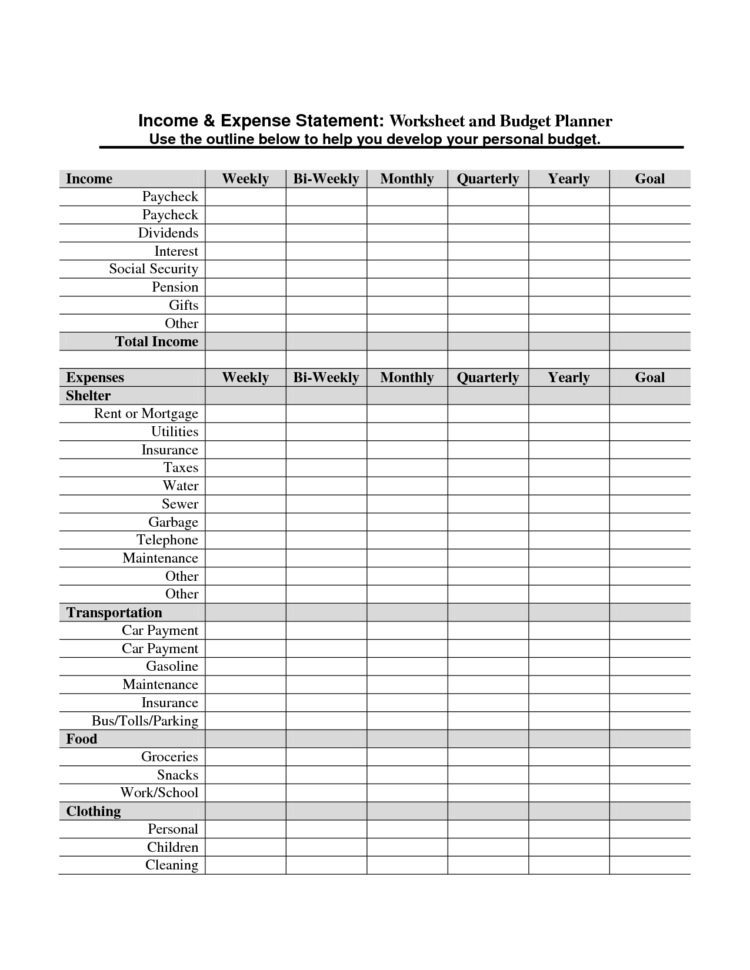

It’s often referred to as an income statement or income and expense summary but can also be called a profit and loss statement (p&l). It also shows whether a company is making profit or loss for a given period. Revenue the revenue number is the income a company generates before any expenses are taken out.

It shows whether a company has made a profit or loss during that period. Qbi is the net amount of qualified items of income, gain, deduction, and loss from any qualified trade or business, including income from partnerships, s corporations, sole proprietorships, and certain trusts. The income statement, also known as the profit and loss statement, is an important tool as it calculates the profitability or loss of a business.

The statement quantifies the amount of revenue generated and expenses incurred by an organization during a reporting period, as well as any resulting net profit or net loss. The income statement most often used by businesses is the accrual basis income statement. An income statement is a financial document that summarises income and expenses over a certain period.

At the most basic level, it. Accountants create income statements using trial balances from any two. Income statement with calculator and pen.

:max_bytes(150000):strip_icc()/TermDefinitions_Incomestatementcopy-9fe294644e634d1d8c6c703dc7642018.png)

:max_bytes(150000):strip_icc()/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)