Brilliant Info About Hedge Fund Balance Sheet

Updated february 21, 2021 reviewed by roger wohlner fact checked by michael logan hedge funds use several forms of leverage to chase large returns.

Hedge fund balance sheet. In the 1990s, the financial accounting standards board moved to increase transparency in corporate financials by requiring derivatives to be measured at fair market value as. Calculating hedge fund navs. This video covers how to analyze a balance sheet like a hedge fund analyst.

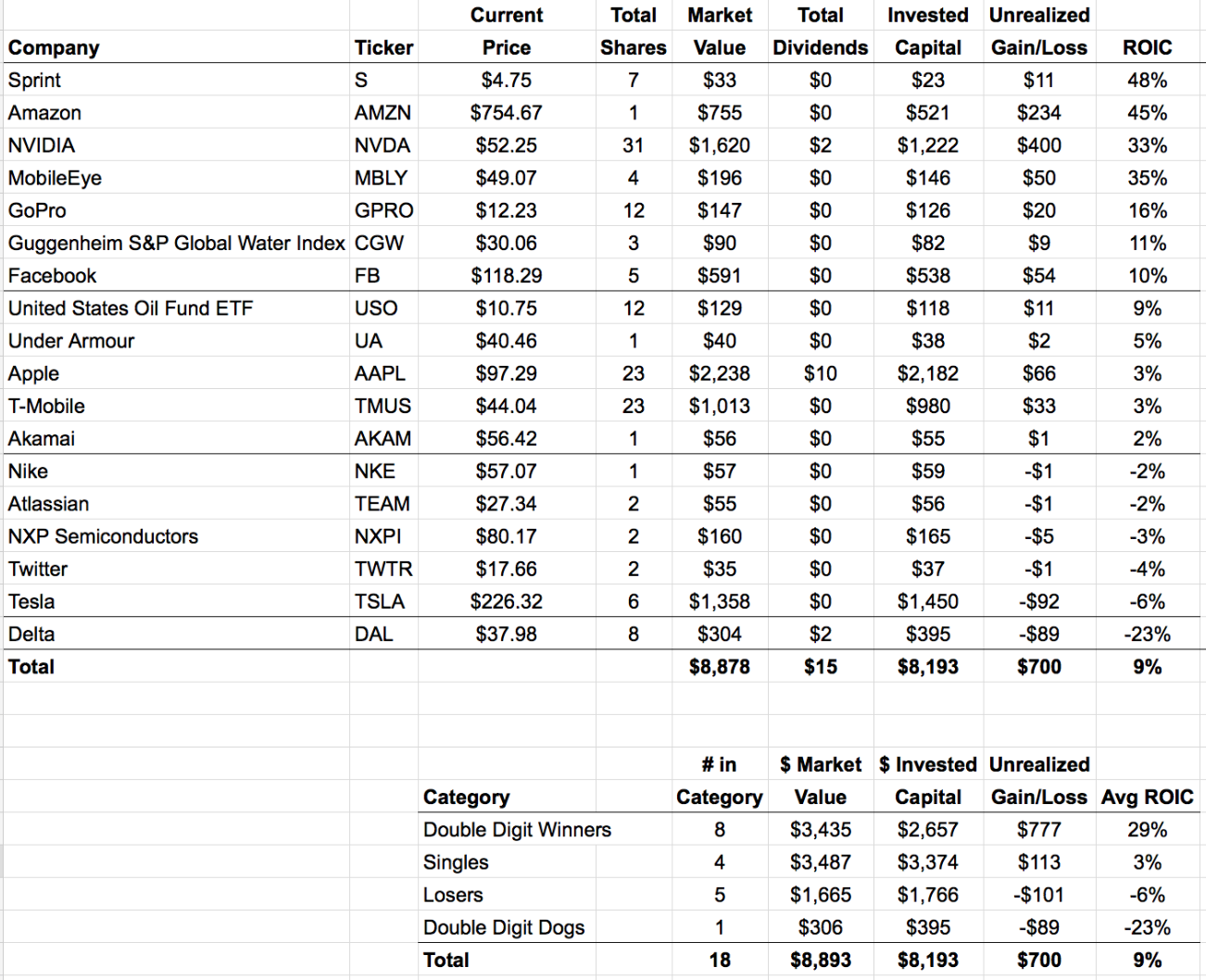

The wall street bank analyzed the holdings of 722 hedge funds with $2.6 trillion of gross equity positions at the start of 2024. It can be an interest rate risk, a stock market risk, or most commonly, a foreign exchange risk. (a) are intended to provide general information on applying accounting principles generally accepted in the united states of america effective as of september 30, 2016, and do not include all possible disclosures that may be required for private investment companies;

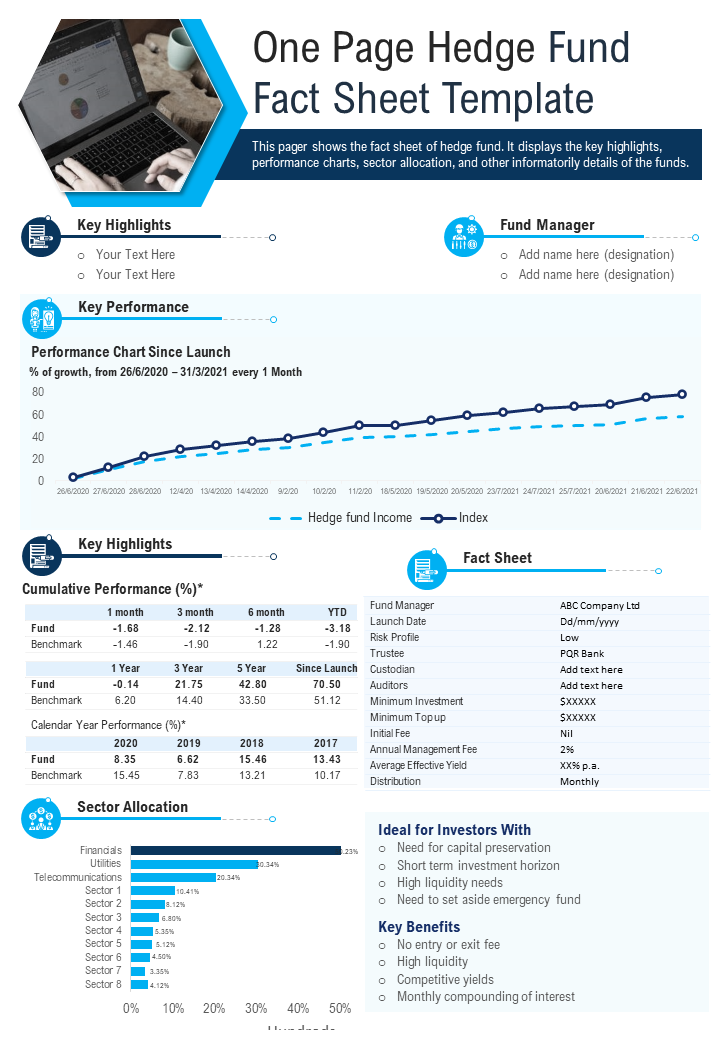

Amounts outstanding end of period, not seasonally adjusted make full screen notes data begin 2012:q4. Hedge fund managers and hedge fund administrators can use these illustrative financial statements as a master guide, providing disclosures for a wide range of investment strategies and related disclosures. Hedge funds are investment funds geared towards high net worth individuals, institutions, foundations, and pension plans, they can be very risky and charge high fees, but they have the.

The balance sheet below shows the value of pershing square holding's assets and liabilities as of the end of the 2014 year. These illustrative financial statements: Thus, they can affect the income statement and earnings.

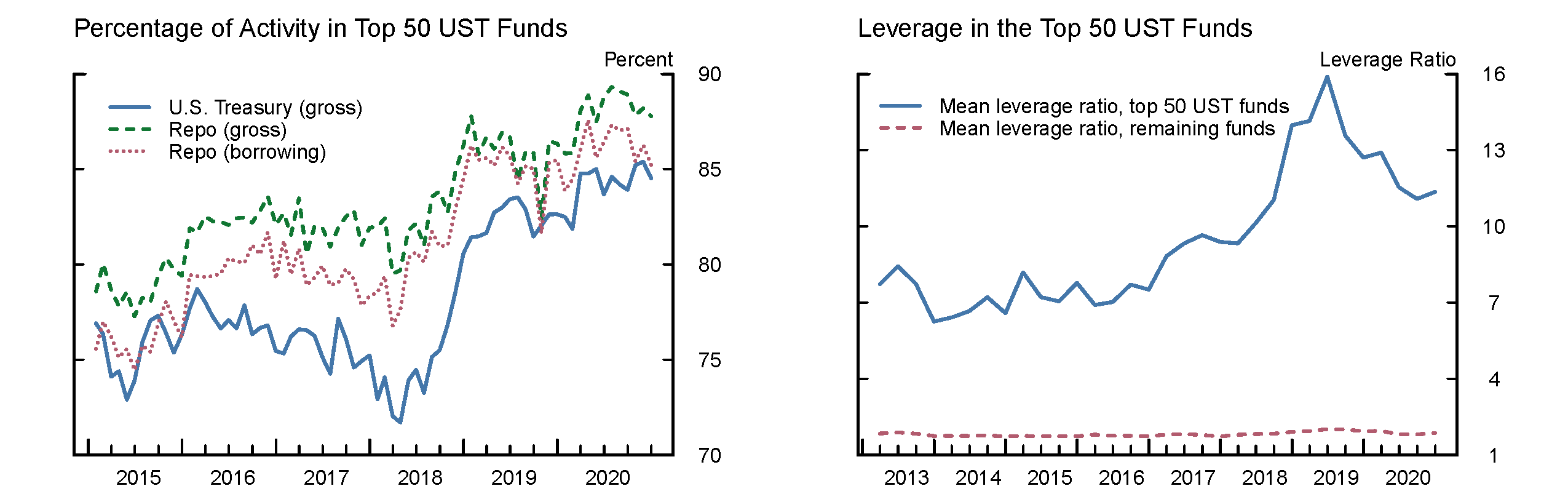

Includes only hedge funds domiciled in the united states as reported on sec forms adv and pf. Get the annual and quarterly balance sheet of betashares geared short australian government bond fund (hedge fund) (bbab.ax) including details of assets, liabilities and shareholders' equity. Amounts outstanding end of period, not seasonally adjusted make full screen notes data begin 2012:q4.

We'll start first with defining the. Best cash back credit cards. Includes only hedge funds domiciled in the united states as reported on sec forms adv and pf.

Hedge accounting attempts to reduce the volatility created by. The balance sheet is one of the key financials statements that investors need to analyze as part of research. About announcements b.101.f balance sheet of domestic hedge funds (1) billions of dollars;

About announcements b.101.f balance sheet of domestic hedge funds (1) billions of dollars; They purchase securities on margin, meaning. Once a niche equity, hedge funds have grown to more over $3.6 trillion in assets down managerial.

Hedge accounting 101. Amounts outstanding end of period, not seasonally adjusted. A balance sheet is a financial statement that shows a snapshot of a company or fund's assets and liabilities.

The balance sheet functions under the accounting formula: Mastering balance sheet analysis for hedge fund analysts this article is a summary of a youtube video how to analyze a balance sheet like a hedge fund analyst by investor center tldr understanding a company's balance sheet is crucial for investing success as it reveals the company's financial health and can determine the risk of bankruptcy. B.101.f balance sheet of domestic hedge funds (1) billions of dollars;