Great Tips About Calculate Net Income On Balance Sheet

Alternately, you can use this formula:

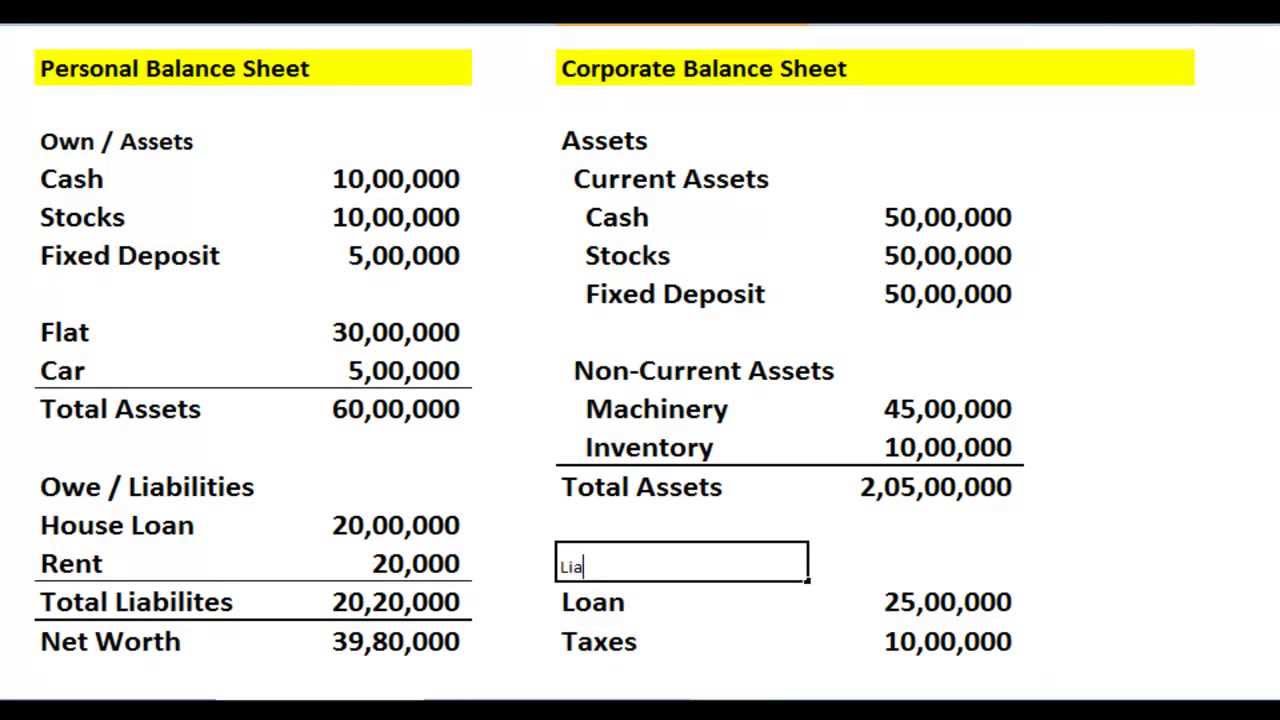

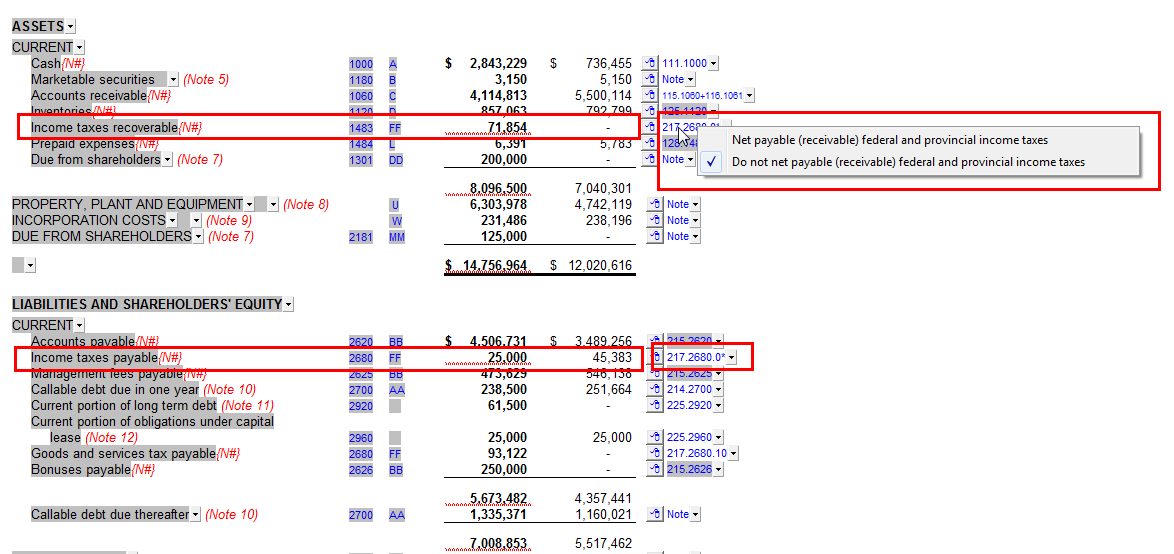

Calculate net income on balance sheet. Cfi’s financial analysis course as such, the balance sheet is divided into two sides (or sections). The balance sheet shows the cumulative effect of the income statement over time. To start with, go to the bottom of the company's balance sheet and look for a line called total equity.

First, locate the following figures: Net income, however, affects the shareholder’s equity on the balance sheet. The difference between them is the starting point for determining the company's net income.

A balance sheet, on the other hand, shows a snapshot of a company’s financial position at any given moment. Key components of net income. In its simplest form, you calculate net income as:

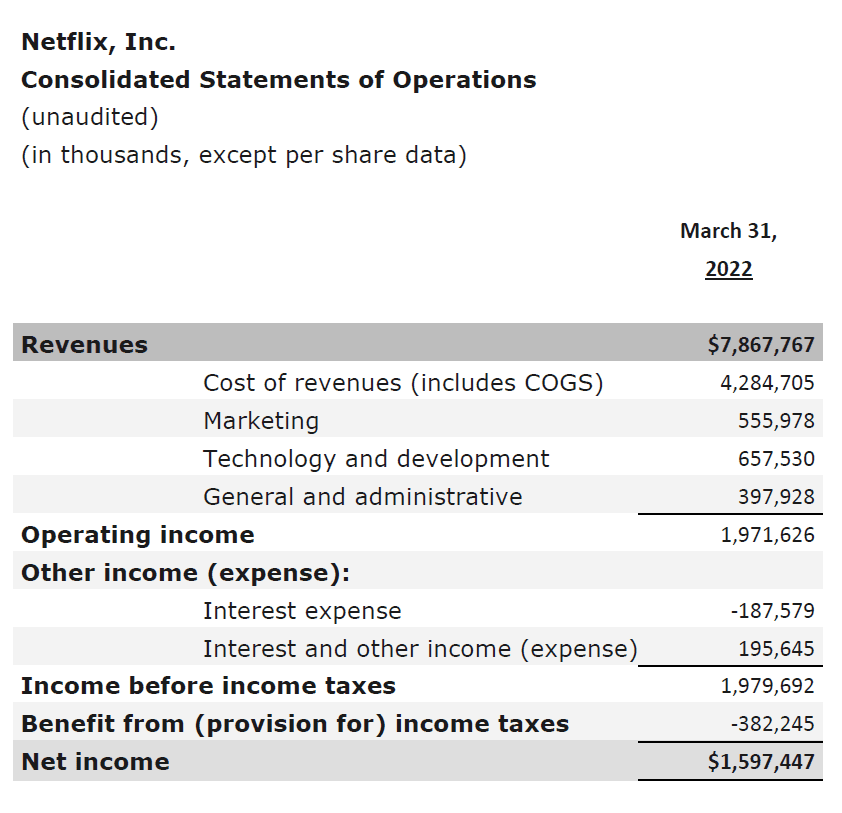

Profit taxes = 30% × 35,000 = $10,500 usd A year) by adding up all the net sales including income from other resources. Depreciation is a financial accounting method used to allocate the cost of tangible assets over t.

Normally, a small business such as a sole proprietorship uses a simple format for an income statement, which may also be referred to as a profit and loss statement. Gather financial data required to calculate net income from a balance sheet, you’ll need information about revenues and expenses that are recorded on the company’s income statement. How can you improve net income on the balance sheet?

To calculate income using the information on the balance sheet, you need to calculate the company’s total income for the given period of time (example: The balance sheet is based on the fundamental equation: For example, let’s say that we are trying to calculate the net income of a company for the year 2021.

Here's how to calculate net income. You will need certain minimum items from the balance sheet to calculate the net income of your business. The resulting number represents the net income, a key indicator of a company’s financial health and profitability.

Net income (profit after taxes or net profit) is the residual amount on an income statement after subtracting costs and expenses from net revenues for the accounting period. How to calculate net income (ni) to calculate net income, start with sales revenue. When the company earns money and keeps it, it gets added to the balance sheet.

These will typically be listed under the equity section of the balance sheet. Now compare that to the same line from the previous quarter's or previous year's balance sheet. That's because a company has to pay for all the things it.

It shows the amount of money left after deducting expenses. In its simplest form the income statement can be expressed in this equation: Net income is an important metric for assessing a company’s profitability and valuation.

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)