Perfect Info About Payroll Liabilities On Balance Sheet

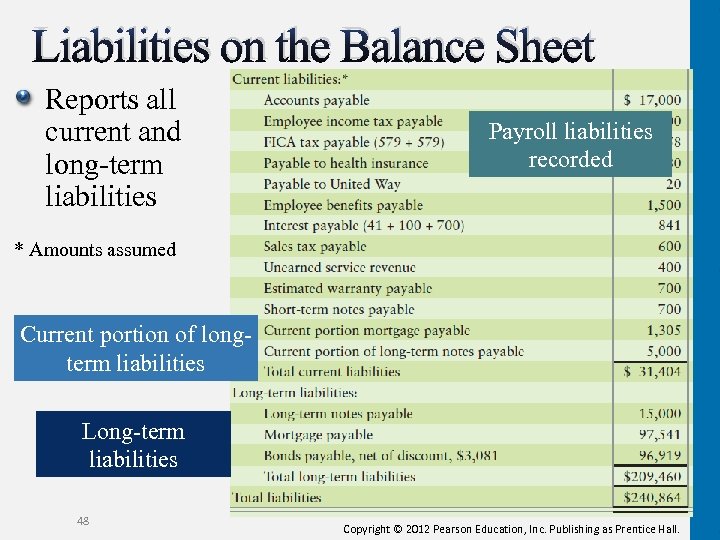

Account for current liabilities that must be estimated.

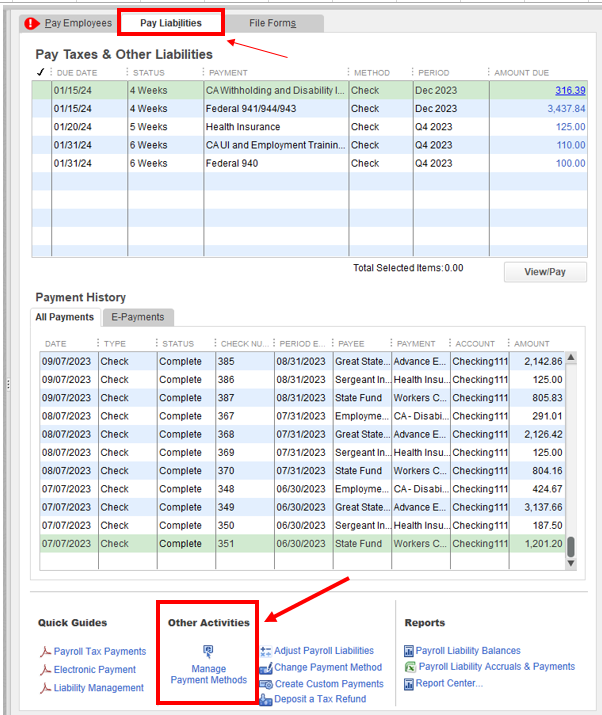

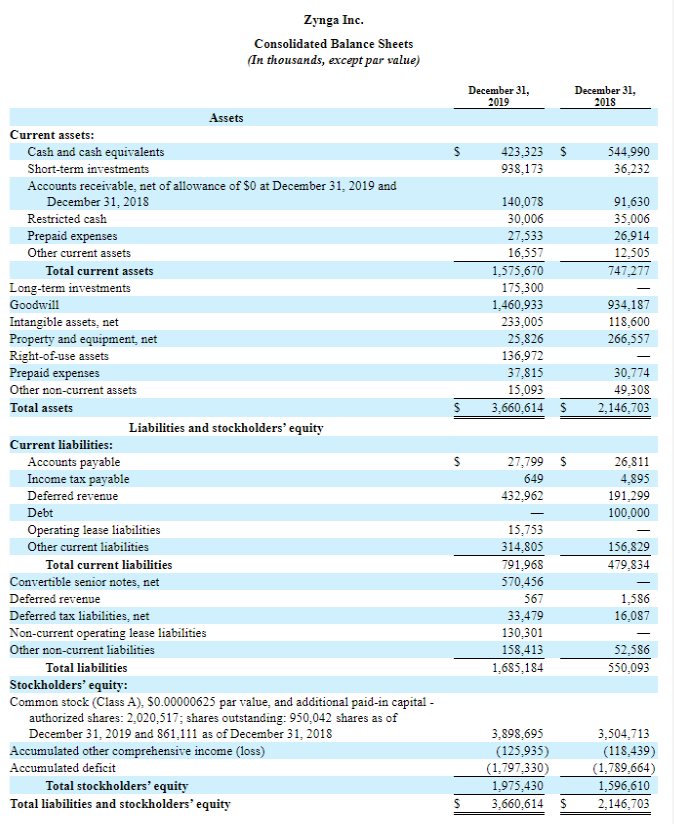

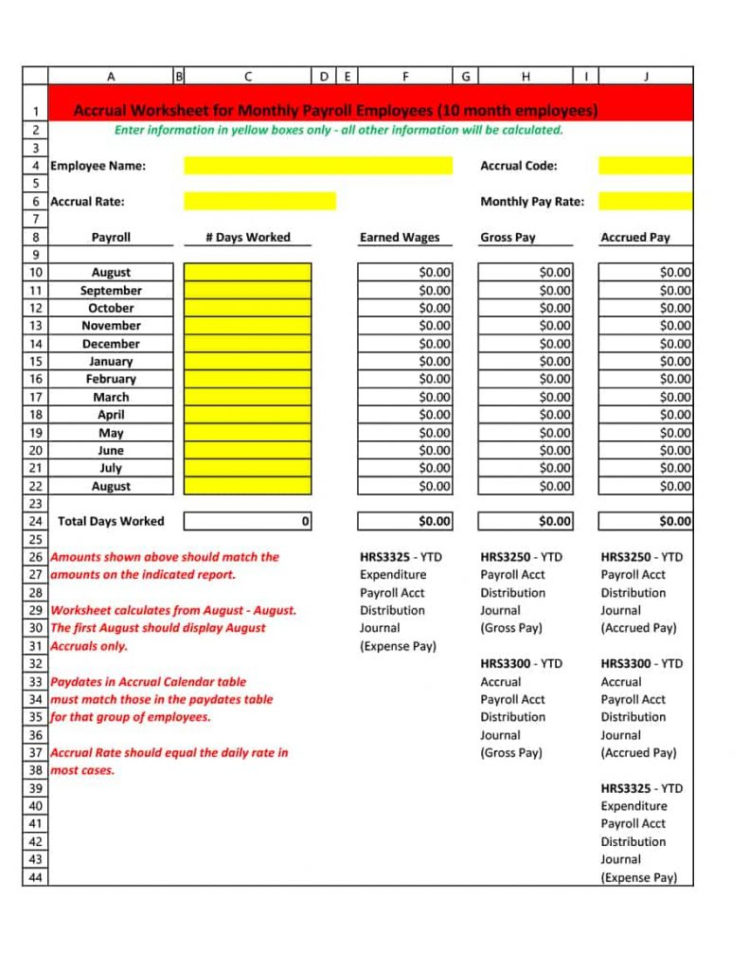

Payroll liabilities on balance sheet. Go to the employees menu. This step is crucial, as you’ll use these pay rates to determine your employee’s gross wages. Where does the balance sheet get the figure for payroll liabilities? open the payroll liability balances report.

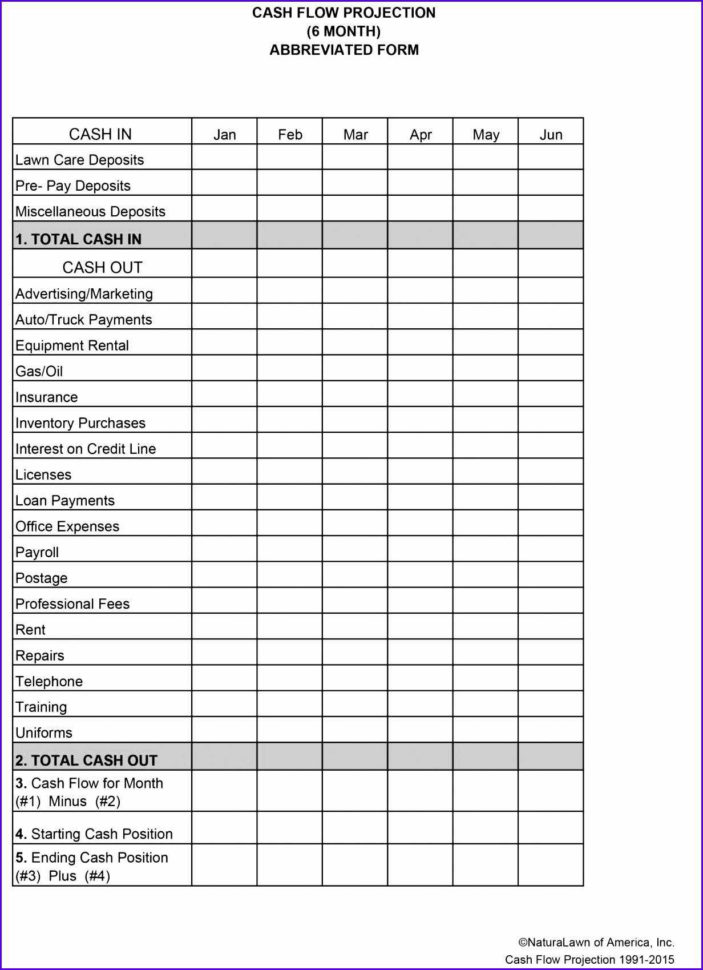

Fica taxes) submit amounts to each third party using the proper forms; Assets = liabilities + equity. Until paid, these expenditures are known as payroll liabilities.

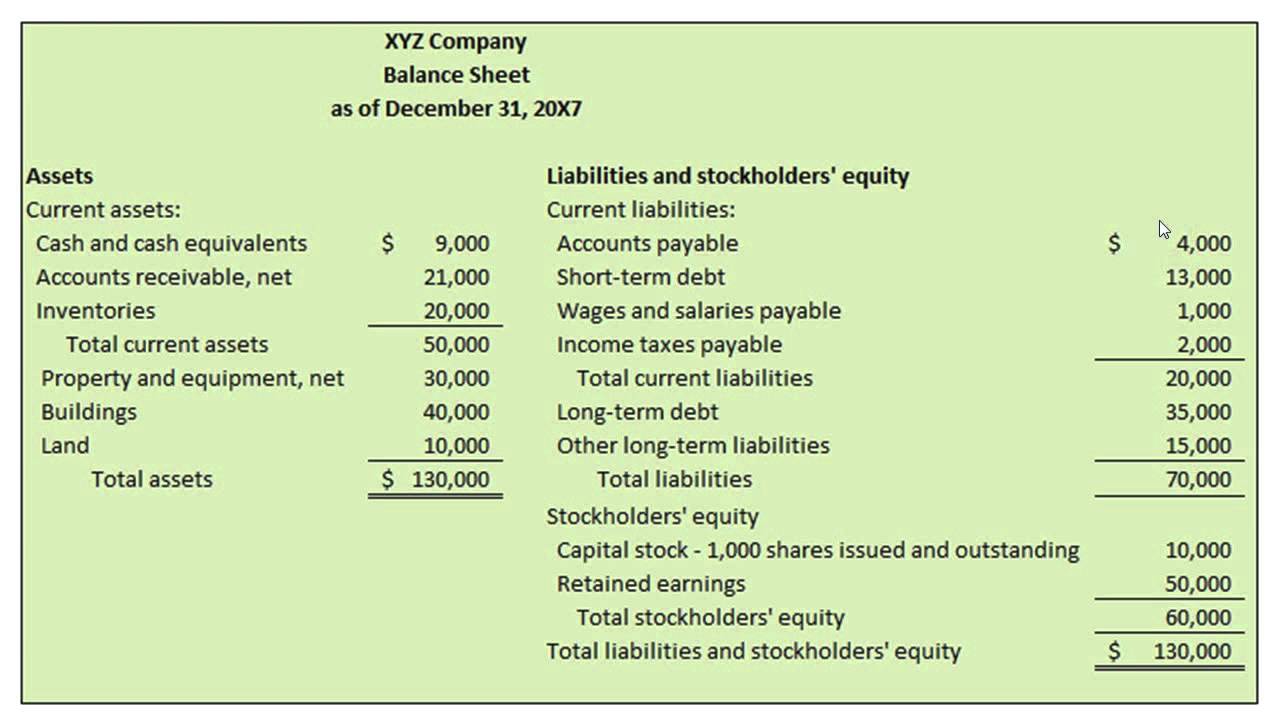

In the date field, enter the date for which you. Go to reports, then employees and payroll. The balance sheet is based on the fundamental equation:

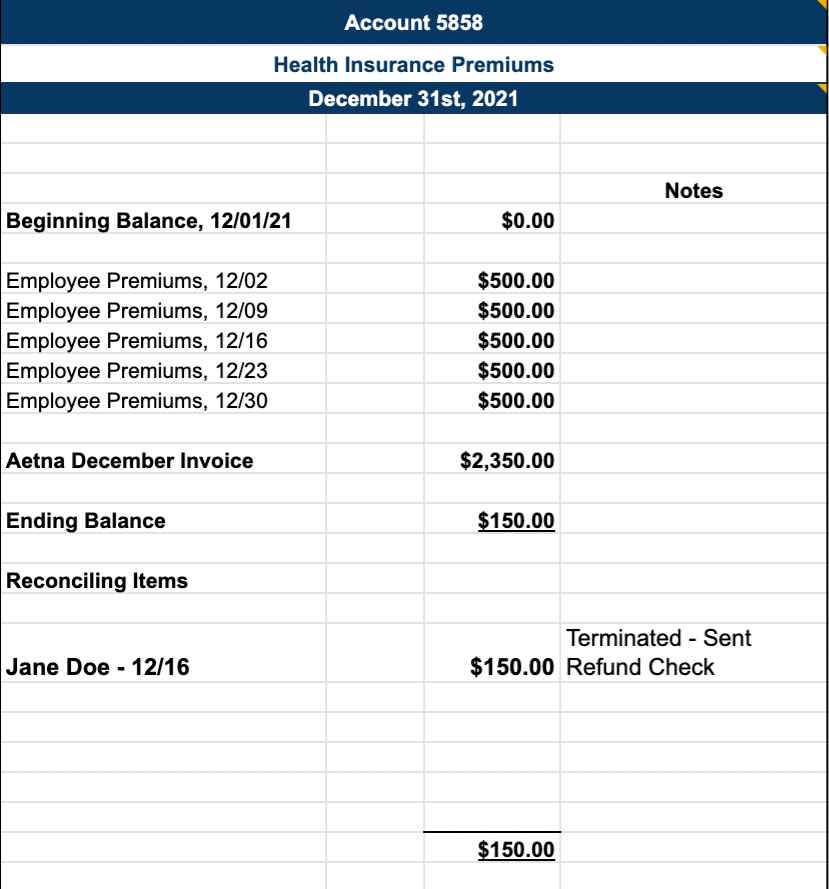

During payroll processing, employers incur expenses, such as taxes and employee compensation. The balance sheet reports the assets, liabilities and shareholder equity at a specific point in time, while a p&l statement summarizes a. This liability is comprised of all the taxes just noted.

Payroll withholdings include required and voluntary deductions authorized by each employee. Here is how to understand this: Here's the main one:

Cfi’s financial analysis course as such, the balance sheet is divided into two. Record payroll liabilities for the amounts that represent a business expense (ex. Accrued payroll is a liability on your balance sheet, or an amount that you owe, which offsets your cumulative assets when calculating your net worth.

Payroll liabilities are deductions that are payable by the employer, but not yet due. As of september 30, 2023: They are also known as current.

When i run my balance sheet my payroll liabilities are showing negative. Chart 4 summarizes the assets and liabilities that the government reports on its balance sheet. The terms “payroll liability” and “payroll expense” sound similar, but they have some key differences.

Select payroll taxes and liabilities, then adjust payroll liabilities. Withheld amounts represent liabilities, as. Payroll liabilities vs.

Wages payable are an example of a current payroll liability that shows up as a. Payroll liabilities should be posted to a liability account in your chart of accounts. Under liabiilities and equity my payroll liabilities are showing negative, my child.