Ideal Tips About Purchase Of Equipment Investing Activity

Tesla listed purchases of property and equipment (highlighted in blue) for.

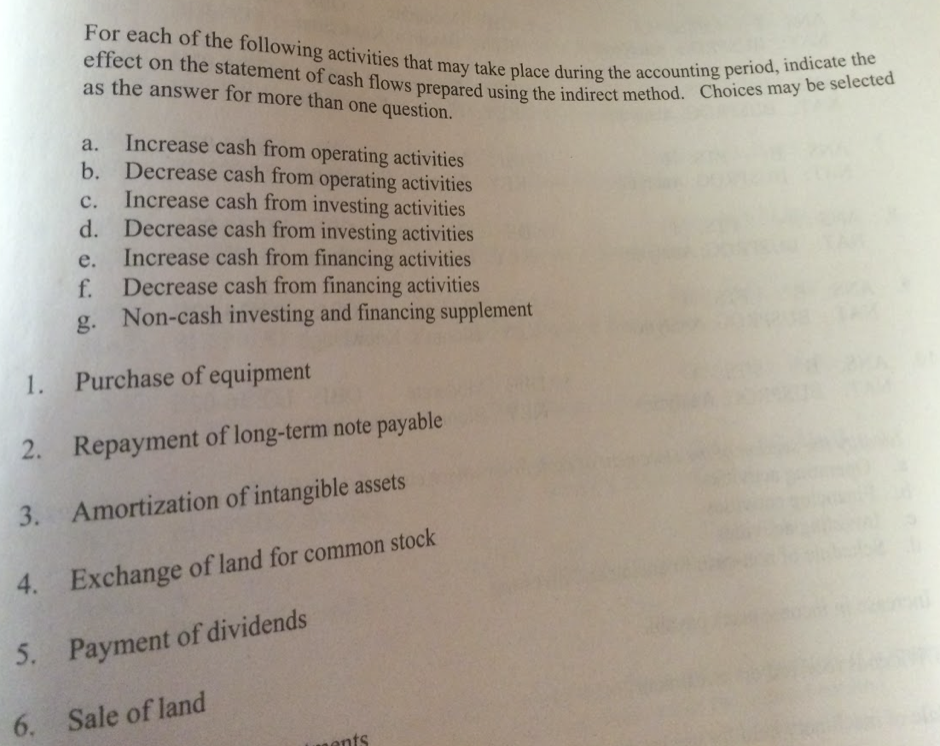

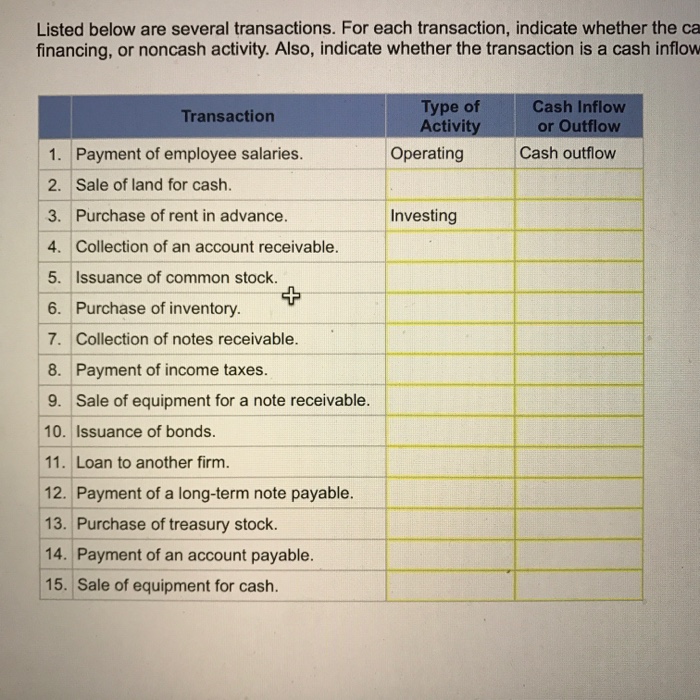

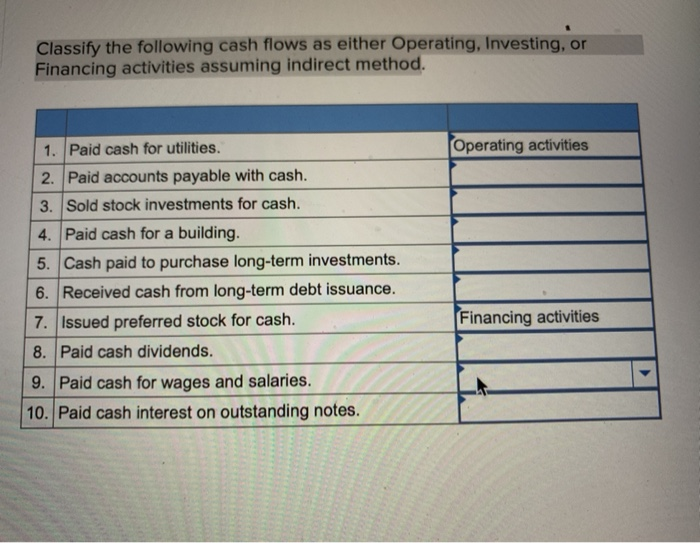

Purchase of equipment investing activity. The following activities are involved in the investing activities: Cash flows from operating activities, cash flows from investing activities, cash flows from financing activities, reconciling the increase in cash from the scf with the.

The purchase or sale of a fixed asset like property, plant, or equipment would be an. Capital expenditures are shown as (negative numbers) under investing activities. Classify each item as an operating, investing, or financing activity.

The $100 cash payment should be reported as an investing activity outflow and included with purchases of property, plant, and equipment. Let’s look at an example of what investing activities include. This can include the purchase of a company vehicle, the sale of a building, or the purchase.

Money obtained from the selling of property,. Capital expenditures such as property, plant and equipment. When a company acquires fixed assets like new property, machinery, land, or equipment (ppe) to support its operations or expand its.

Purchase of property plant, and. Assume all items involve cash unless there is information to the. In this section of the cash flow statement, there can be a wide range of items listed and included, so it’s important to know how investing activities are handled in accounting.

Cash flow types what is cash. Some examples of investing cash flows are payments for the purchase of land, buildings, equipment, and other investment assets and cash receipts from the sale of land,.

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)