Stunning Tips About Profit And Loss Form 2020

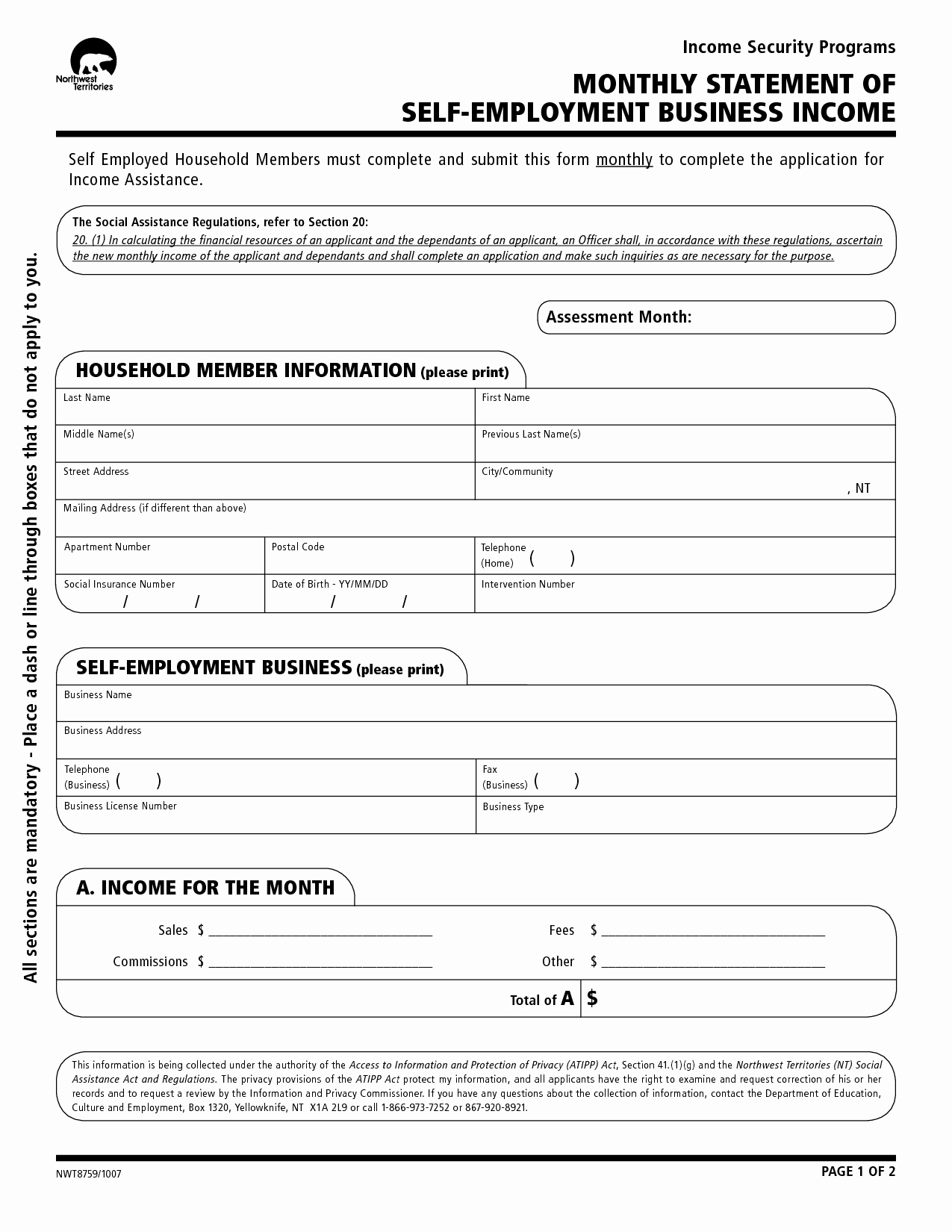

Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor.

Profit and loss form 2020. (if you checked the box on line 1, see instructions). If a profit, enter on both schedule 1 (form 1040), line 3, and on schedule se, line 2. (if you checked the box on line 1, see instructions).

An activity qualifies as a business if your. An activity qualifies as a business if your. Fillable and printable profit and loss statement form 2024.

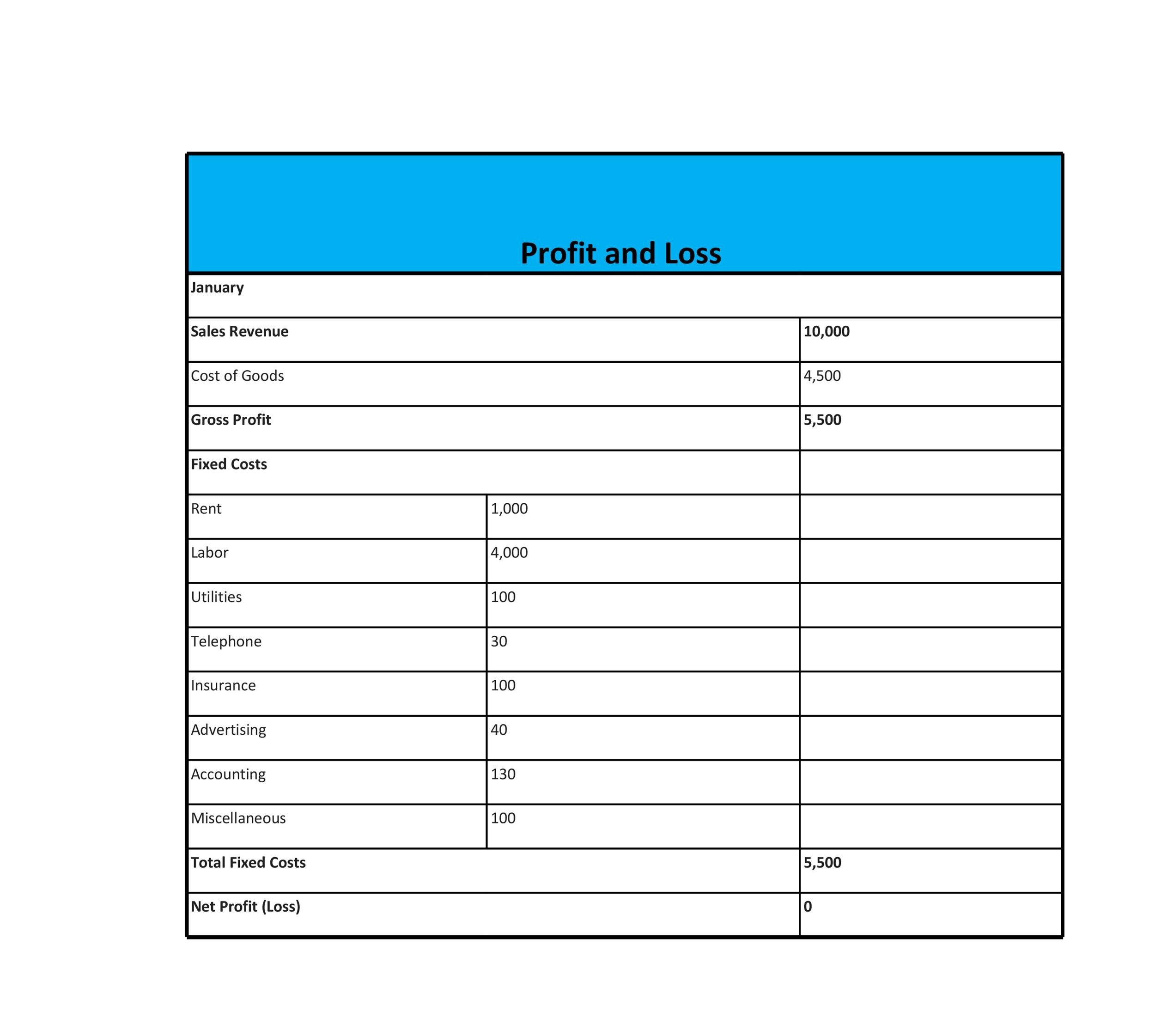

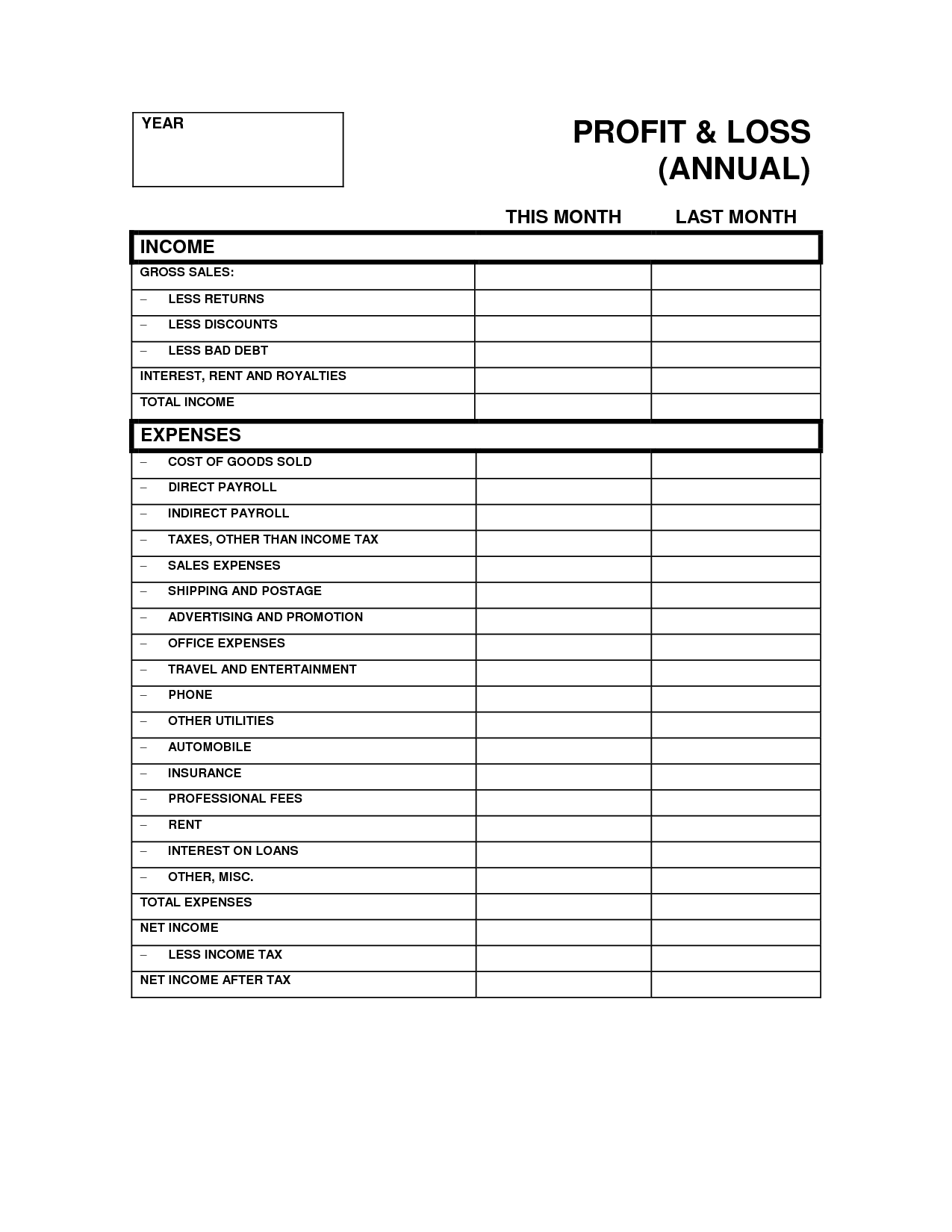

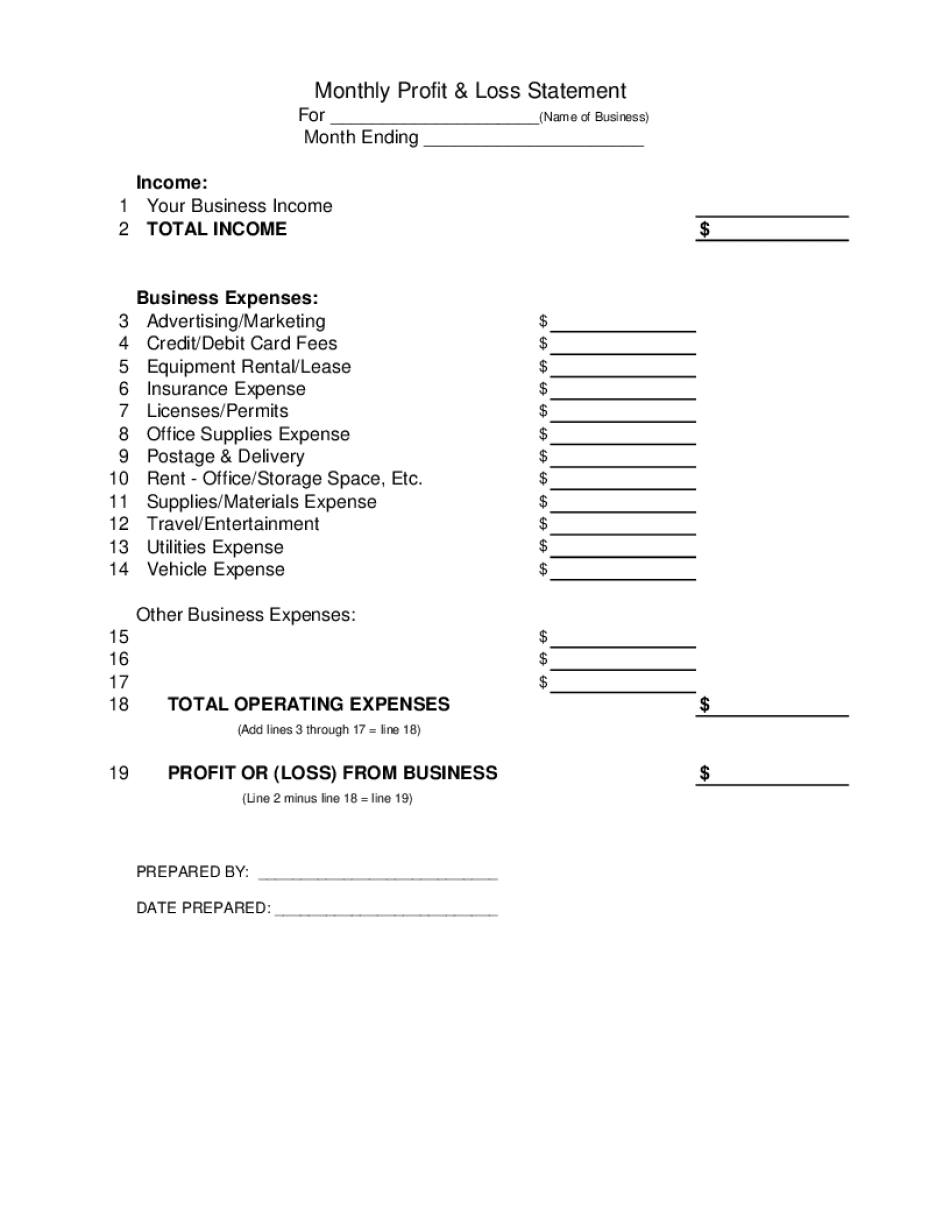

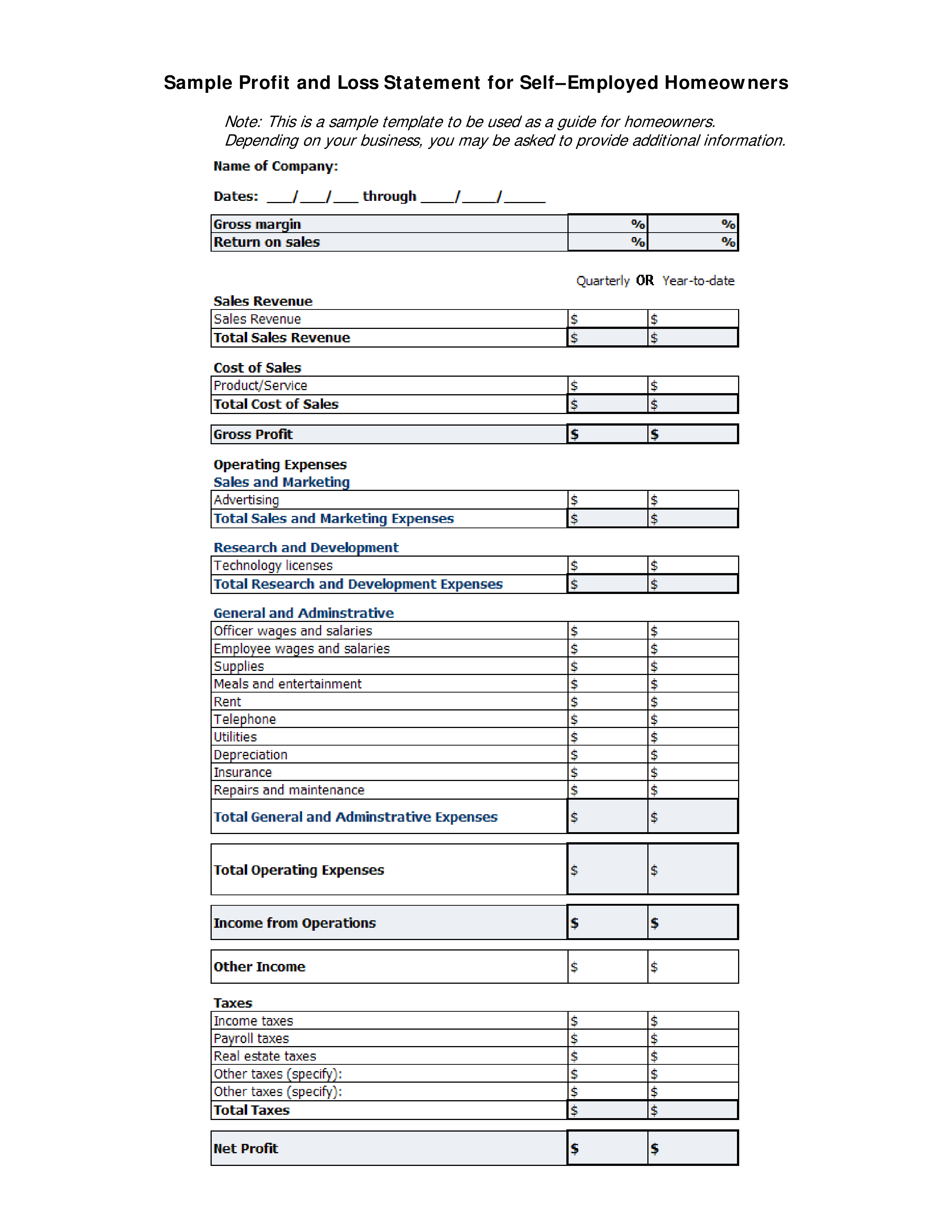

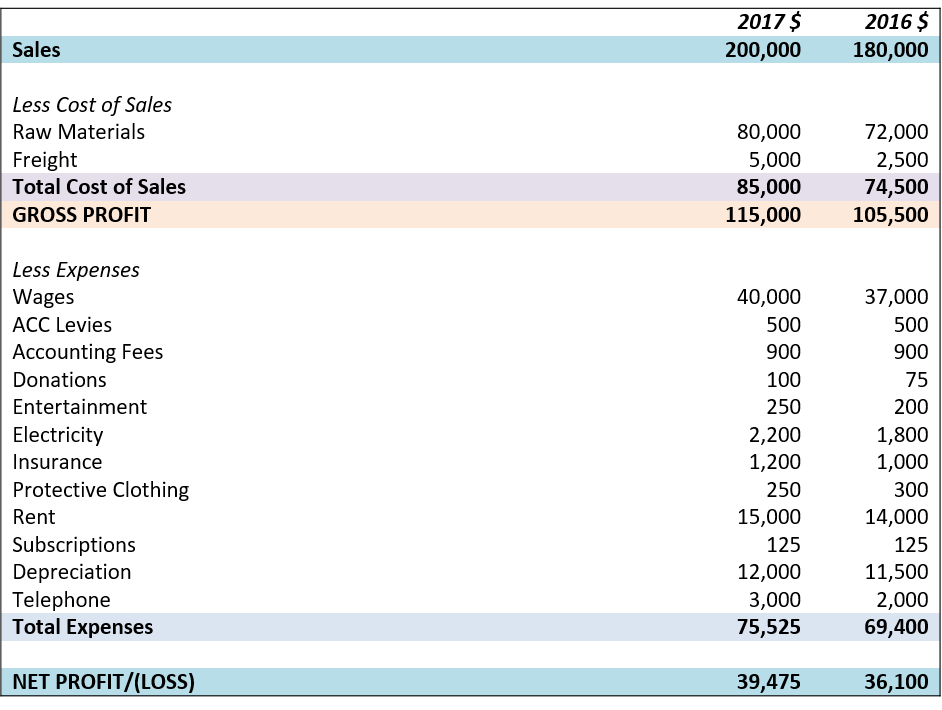

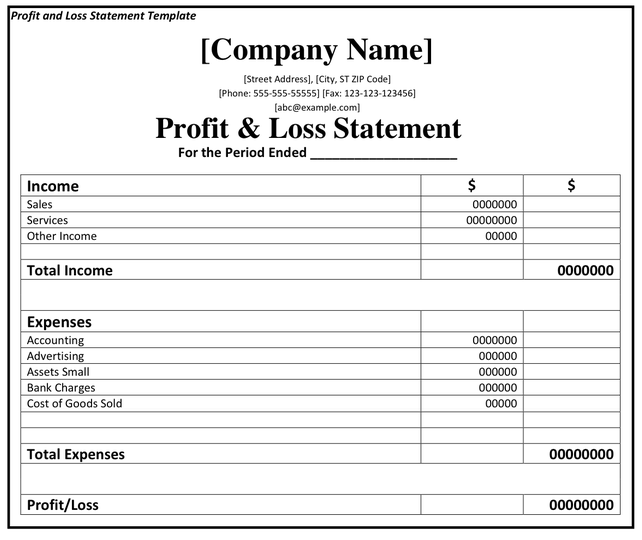

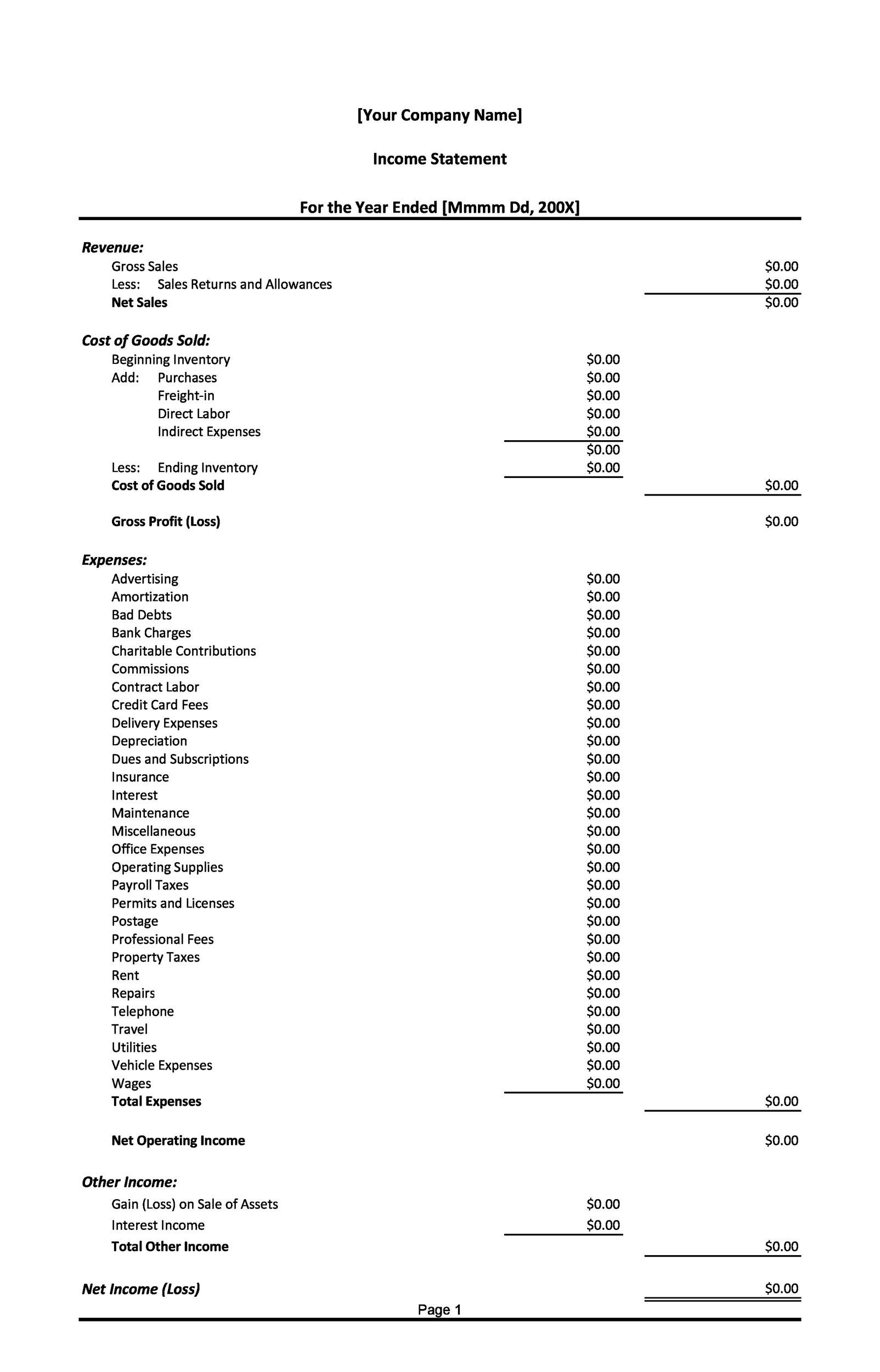

Profit or loss from business (irs) form is 2 pages long and contains: A profit and loss statement is a financial document that details your business’s revenue, expenses, and net income over a month, quarter, or year.it captures. Estates and trusts, enter on form 1041,.

Profit and loss statement form (su580) use this form if you are a sole trader, subcontractor or a partner in a partnership that has started new employment or a. Go to www.irs.gov/schedulef for instructions and the latest. Estates and trusts, enter on form 1041, line.

Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Profit & loss account. Fill, sign and download profit and loss statement form.

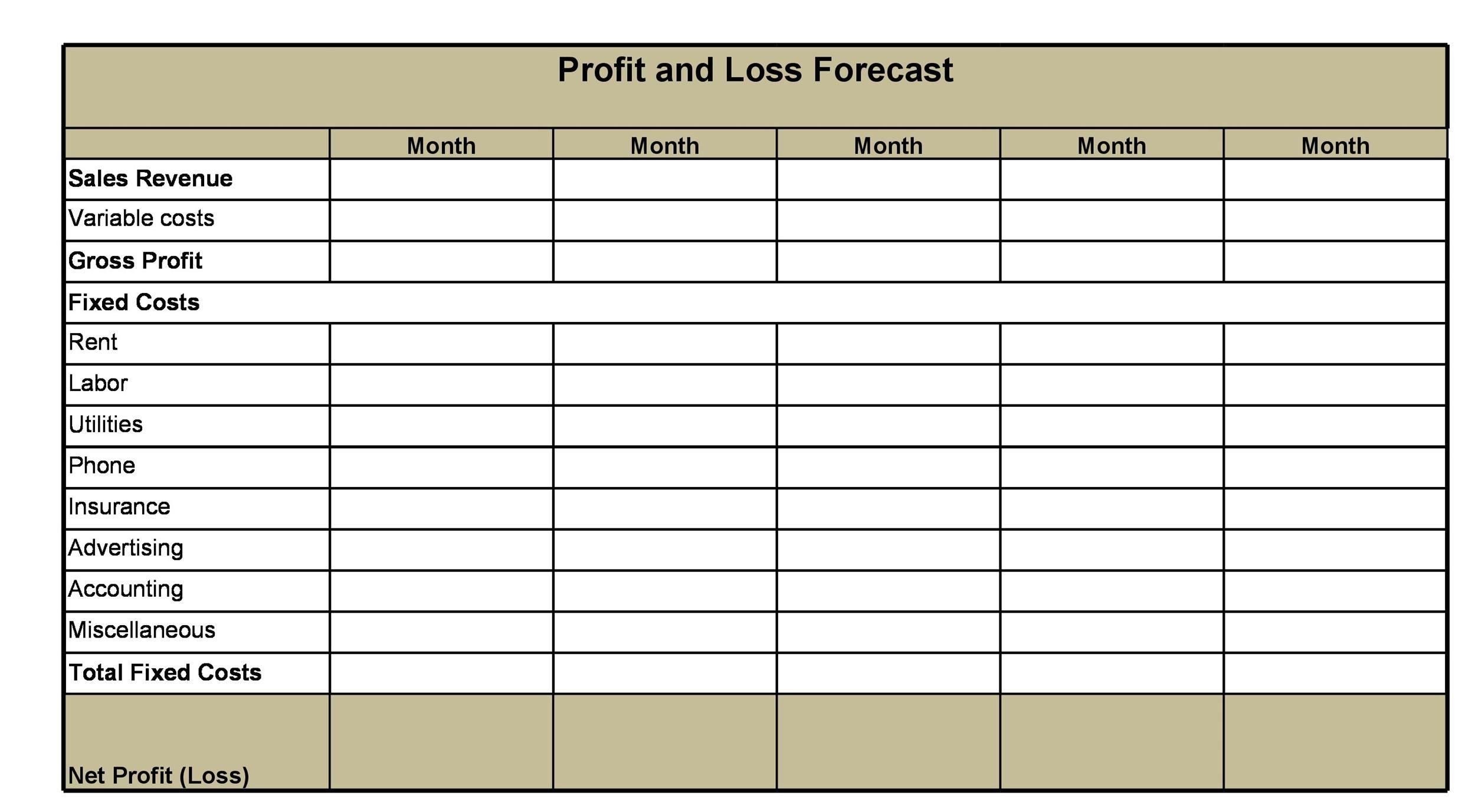

The template layout is simple and intuitive, including sections for. The form 2020: This blank profit and loss statement allows you to record quarterly financial data over one year.

(if you checked the box on line 1, see instructions). What is the profit and loss statement (p&l)? Estates and trusts, enter on form 1041, line.

This sample form from monmouth university. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor.

A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. An activity qualifies as a business if your. Trusted by millionsmoney back guaranteeedit on any device