Brilliant Strategies Of Info About Statement Of Functional Expenses Quickbooks

As a workaround, you can run the statement of cash flows to view the different classification of expenses.

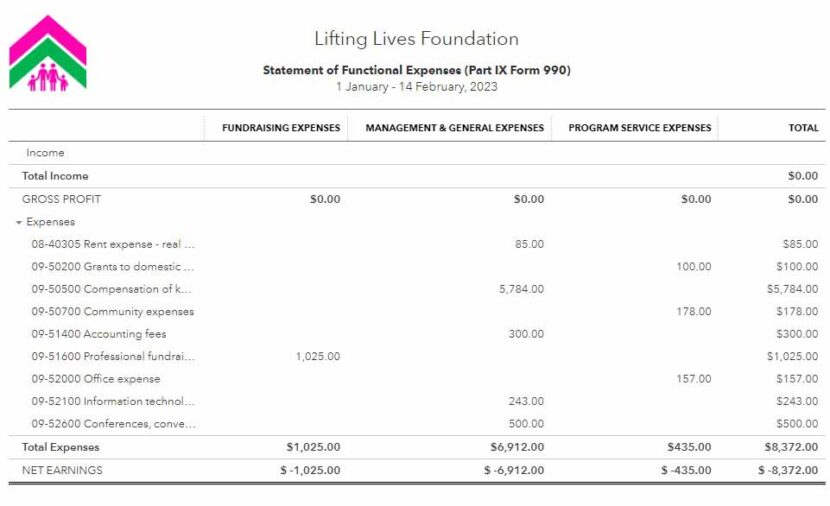

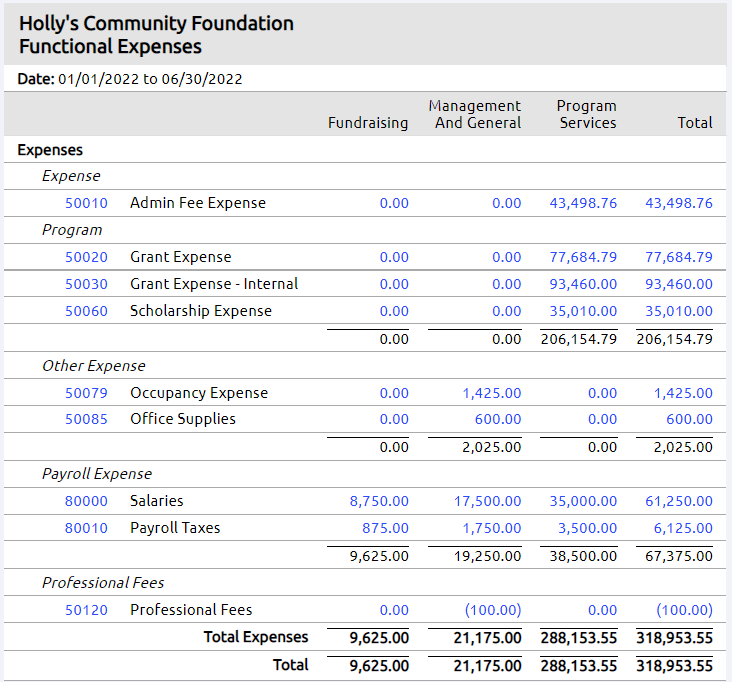

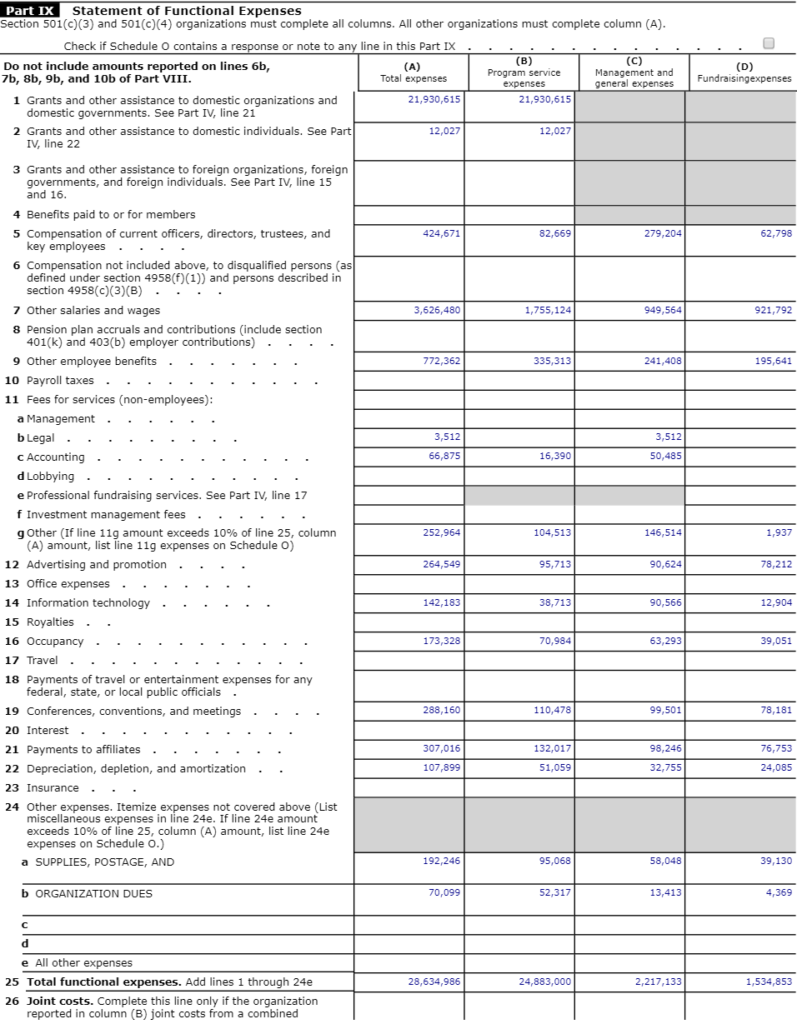

Statement of functional expenses quickbooks. If sfas #117 applies to your organization, you will see the statement of functional expenses. We bet you can’t wait! Simply put, a statement of functional expenses offers a detailed view of how a nonprofit organization’s funds are allocated across different functional categories.

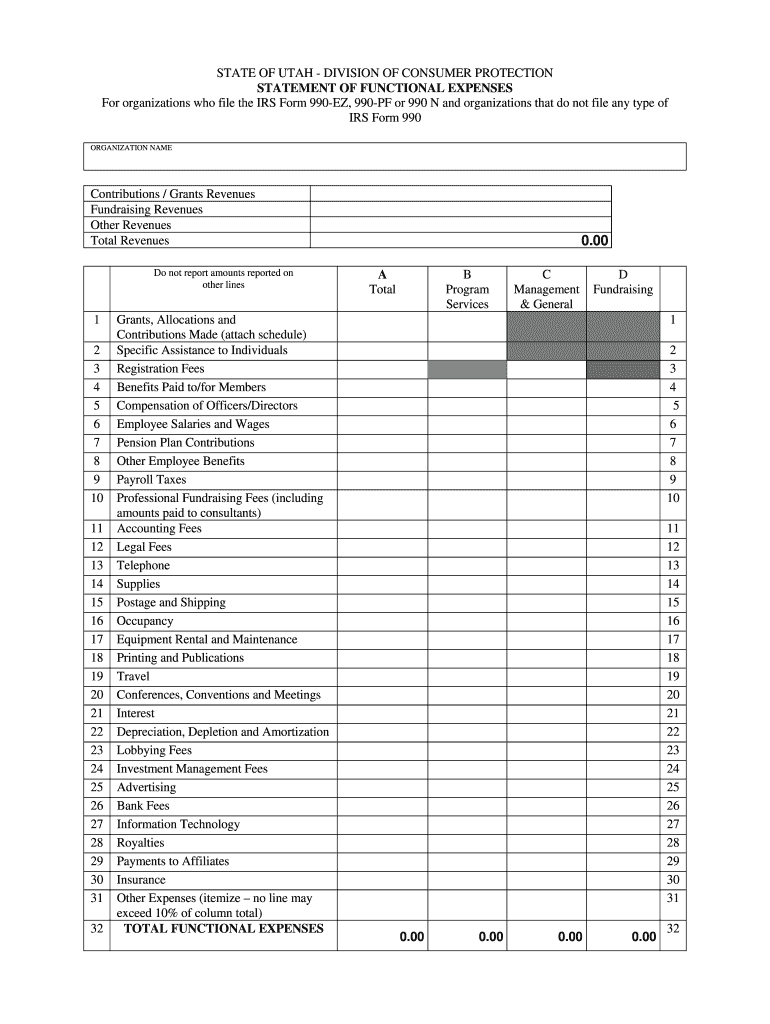

Statement of functional expenses. You can pull up and run the. Go to filter and tick “distribution account.

The statement of functional expenses is currently unavailable in quickbooks online. The statement of functional expenses is one of four financial reports that your nonprofit should compile annually. For the statement of functional expenses, the process is the same.

The statement of functional expenses explains the costs incurred for each functional area of the organization. The statement of functional expenses is a key component of a nonprofit organization's financial reporting. One of the big reasons to use classes to track functional expenses is to produce financial statements that clearly and cleanly align with the organization’s 990,.

As a subsidiary report to your financial statements, the statement of functional expenses is a detailed list of the nature of each expense (salaries, payroll taxes, rent, professional. We’ll also cover approaches to tracking functional expenses in quickbooks. It provides a detailed breakdown of expenses.

Thus, it is not necessary. The 4 allocation methods for functional expenses while you can allocate expenses as needed, the following allocation methods are the ones most frequently. The other three statements are the:

The easiest approach to breaking down functional expenses is to. The statement of functional expenses is considered an ancillary report that can be added to the primary set of financial statements. Yes, quickbooks online has a report that is equivalent to the income and expense detail report in quickbooks desktop, sandie7.

Using the chart of accounts to classify functional expenses in quickbooks online. The ratio between program and total expenses and the. This will allow for your quickbooks software to generate the required statement of functional expenses and provide more useable management reports.

We’ll even have a cheat sheet for you to help with bookkeeping.