Brilliant Strategies Of Tips About Capital Lease Cash Flow Statement

The payment of the related.

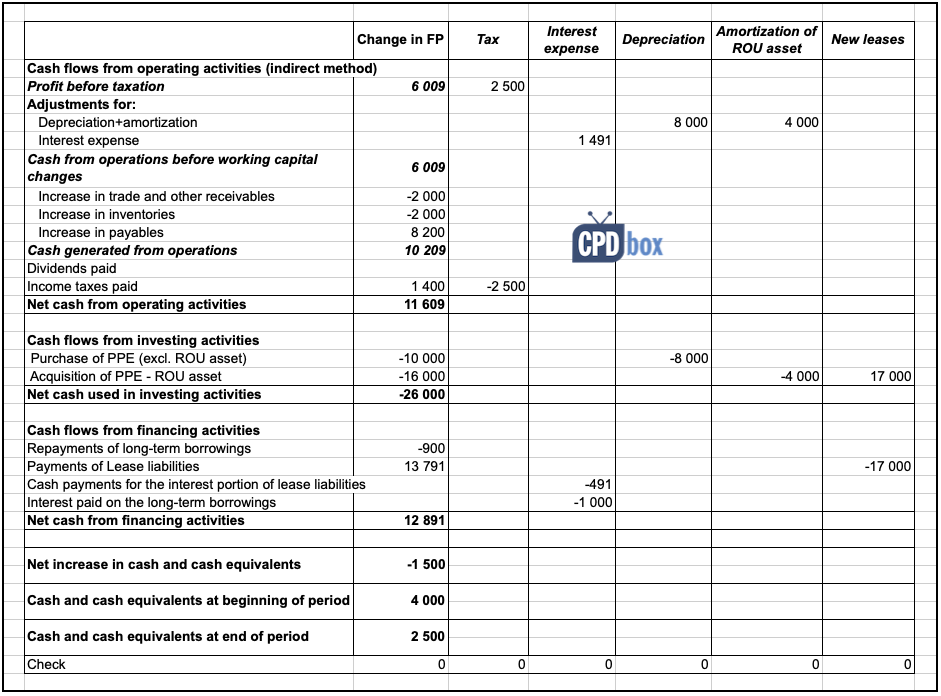

Capital lease cash flow statement. Small business | finances & taxes | financial statements by john cromwell reporting the effects of capital leases can be complicated regardless of whether you are renting out or using rented. Payment of lease liabilities ( 90) dividends paid [1] ( 1,200) [1] this could also be shown as an operating cash flow. The repayment of the lease liability was cu 3 209;

A cash flow statement is a summary of a company's cash inflows. The cash flow statement shows the sources and uses of a company's cash. January 1, 2019 is the date of our first.

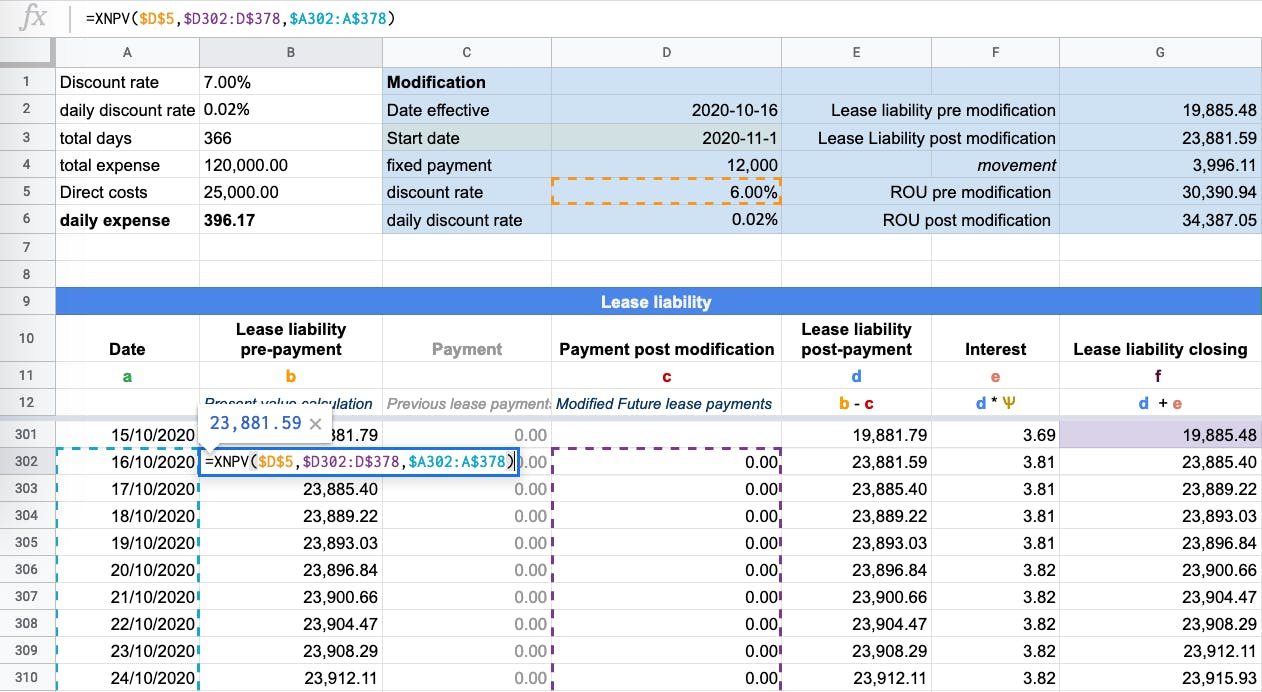

Most changes from ias 17/ifric 4 to ifrs 16 relate to lessees, the companies renting a car, office or warehouse. Calculate the total amount of principal lease payments. Ias 7 statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements, which had originally been issued by the international accounting standards committee in december 1992.

Learn how to comply with the disclosure objective, presentation requirements, and classification of lease income and expenses. Key takeaways a capital lease. Initial direct costs paid in cash are cu 3 000.

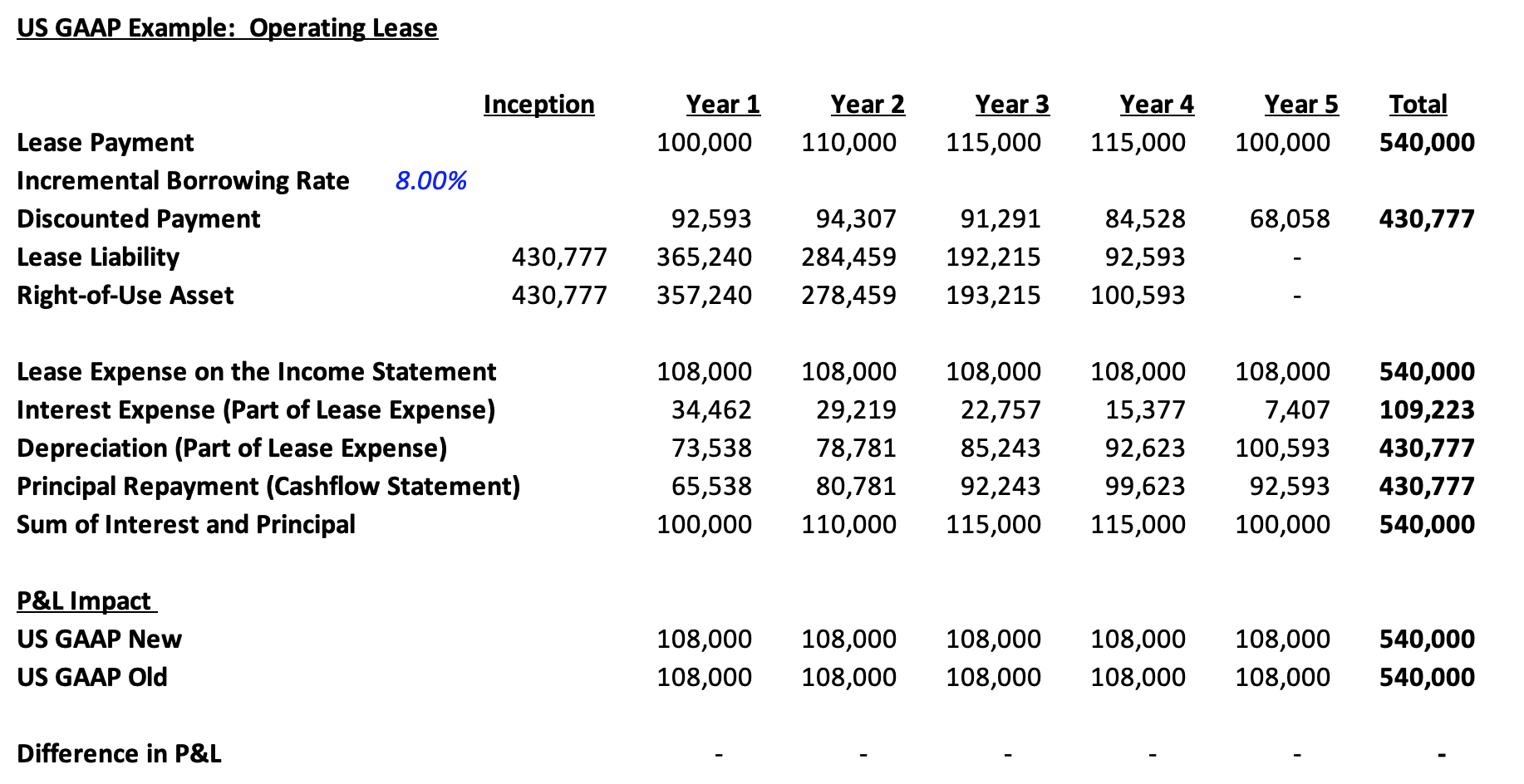

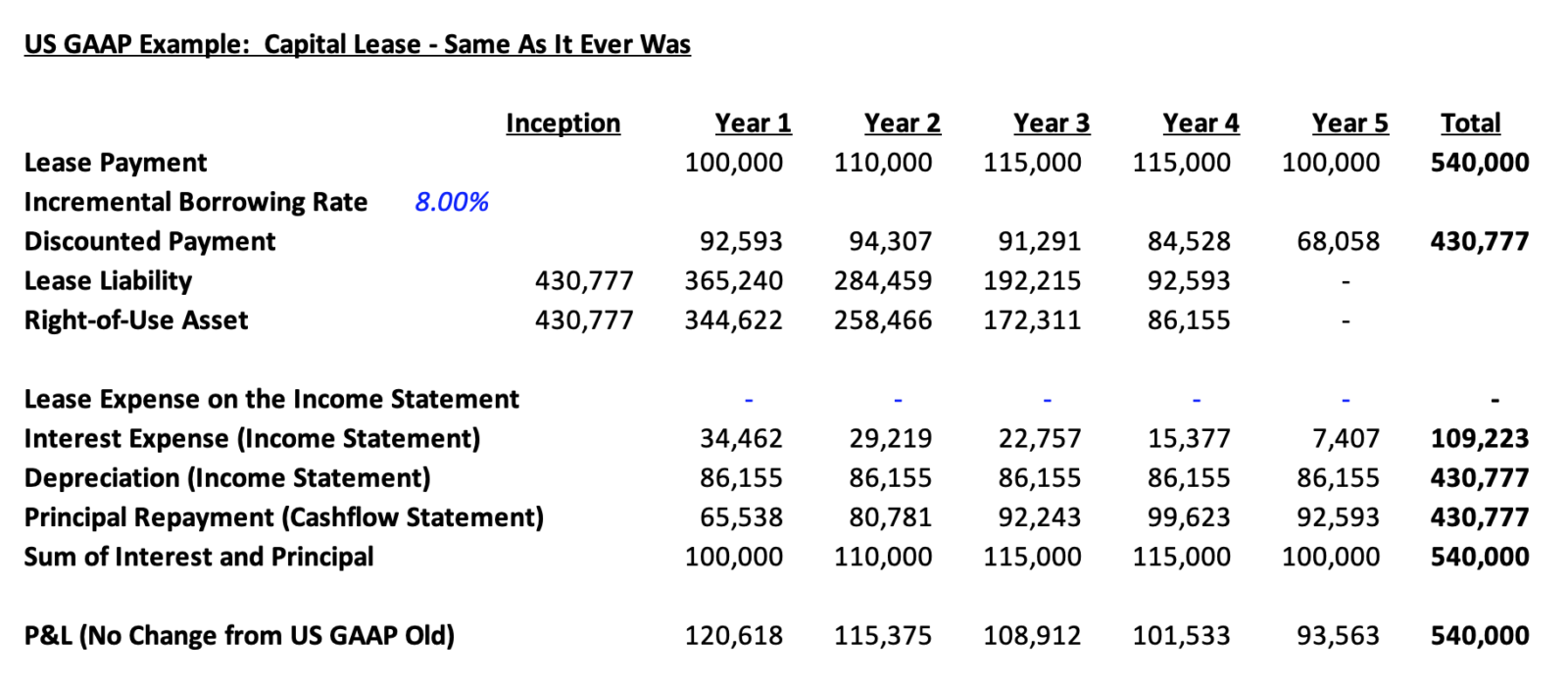

And, at lease inception, there is no transfer of cash, so therefore the cash flow statement remains unchanged. The capital lease accounting journal entries are adversely different from their counterparts’ accounting. Cash flows from financing activities.

During 20x4, abc paid the lease payments in total amount of cu 3 700, thereof: For an operating lease, the full lease payment is shown as an operating cash outflow on the lessee’s statement of cash flows. Now, let's go to the payment dates.

Unless you have an event such as a finder’s fee, no part. Intermediate accounting for dummies intermediate accounting for dummies explore book buy on amazon financial statement presentation for operating leases is a snap. Finance leases aka capital leases

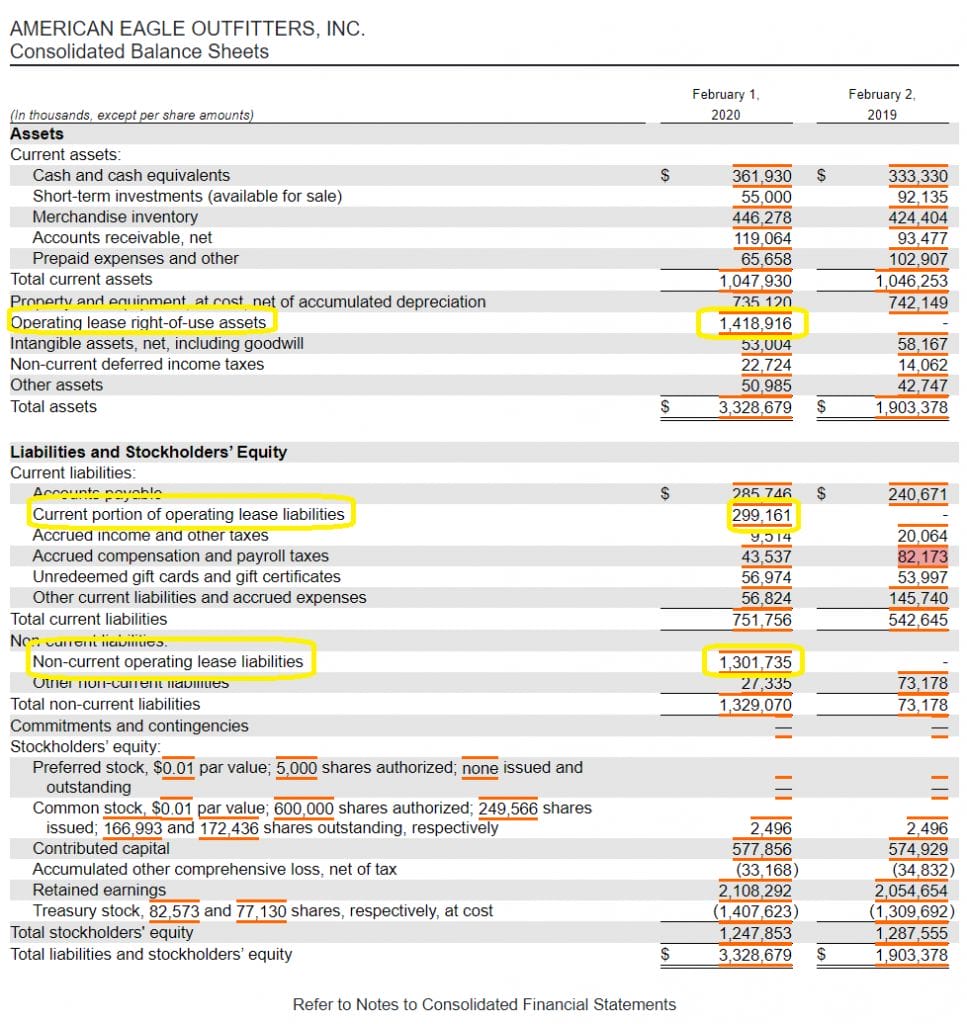

The new fasb standard asc 842 requires lessees and lessors to present and disclose the cash flow statement of leases. Adjustments for noncash items in the reconciliation of net income to net cash flows from operating activities may include items such as: When leases are accounted for as.

Ifrs 16 leases presentation in cash flows. The lease payment is shown as a cash inflow on the lessor's cash flow statement. Let us understand each of them in detail.

Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet or disclosed in the notes to the financial statements along with the balance sheet line items in which those liabilities are included. Cash flow from investment activities shows the flow of cash from activity in financial markets, operating. They have an adverse impact on the balance sheet, income statement, and cash flow statement.