Top Notch Info About Comprehensive Income Accounting

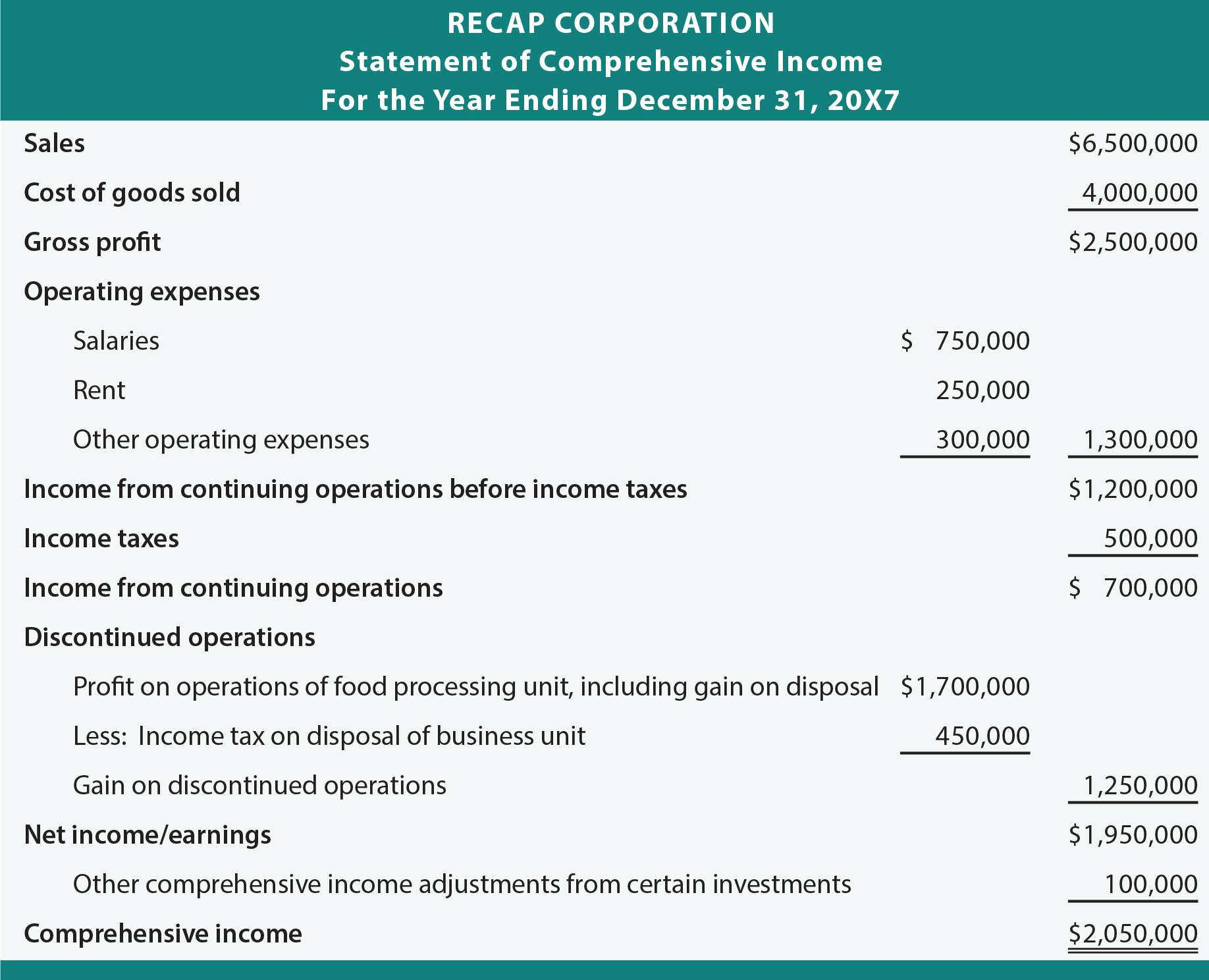

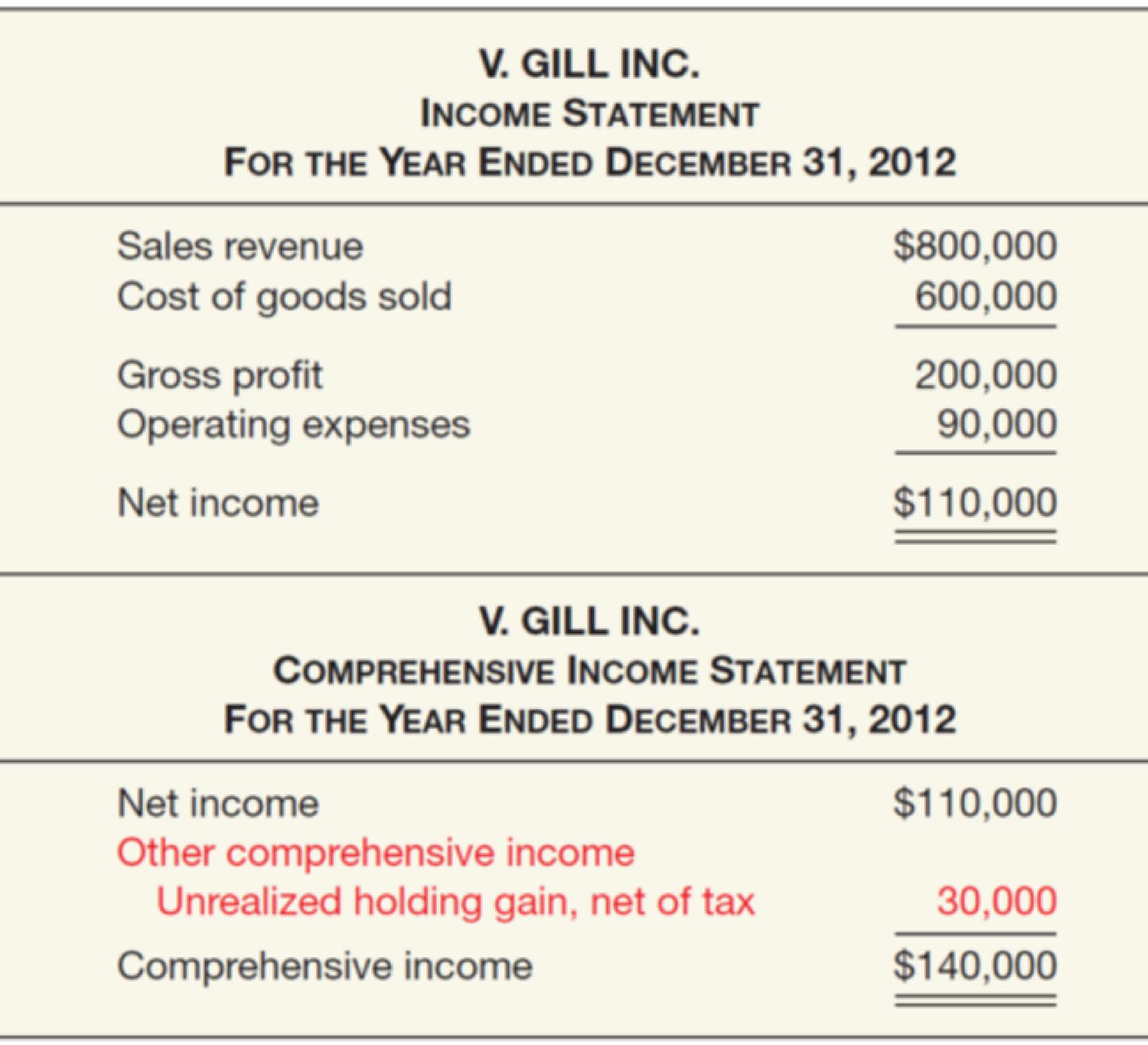

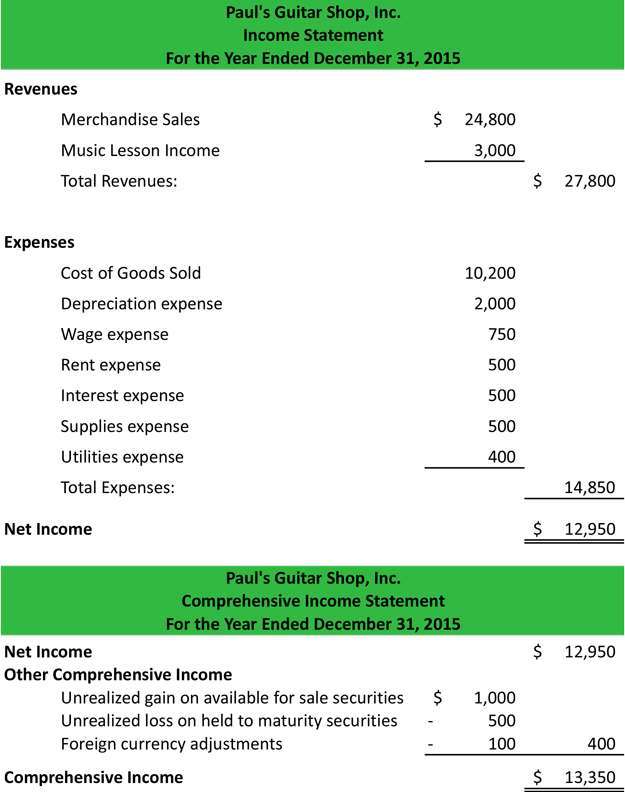

One of the most important components of the statement of comprehensive income is the income statement.

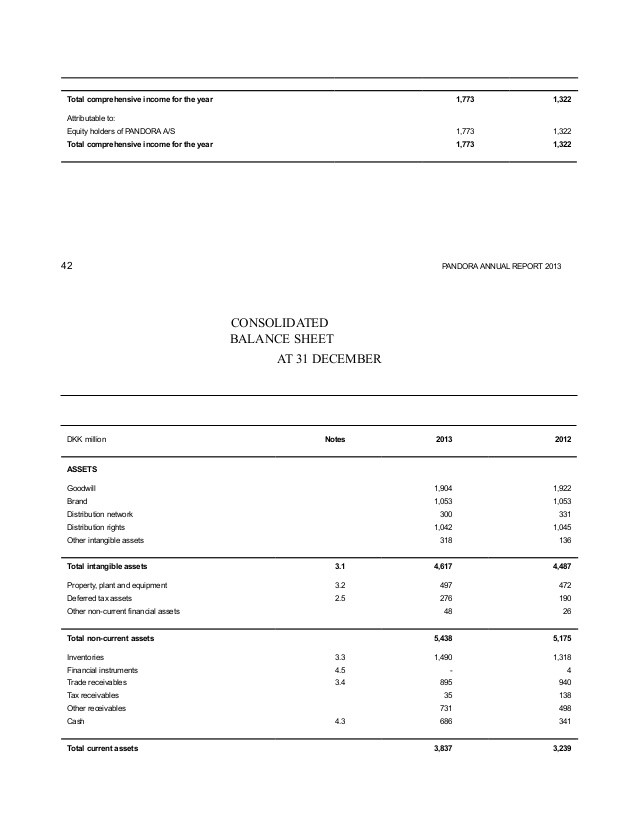

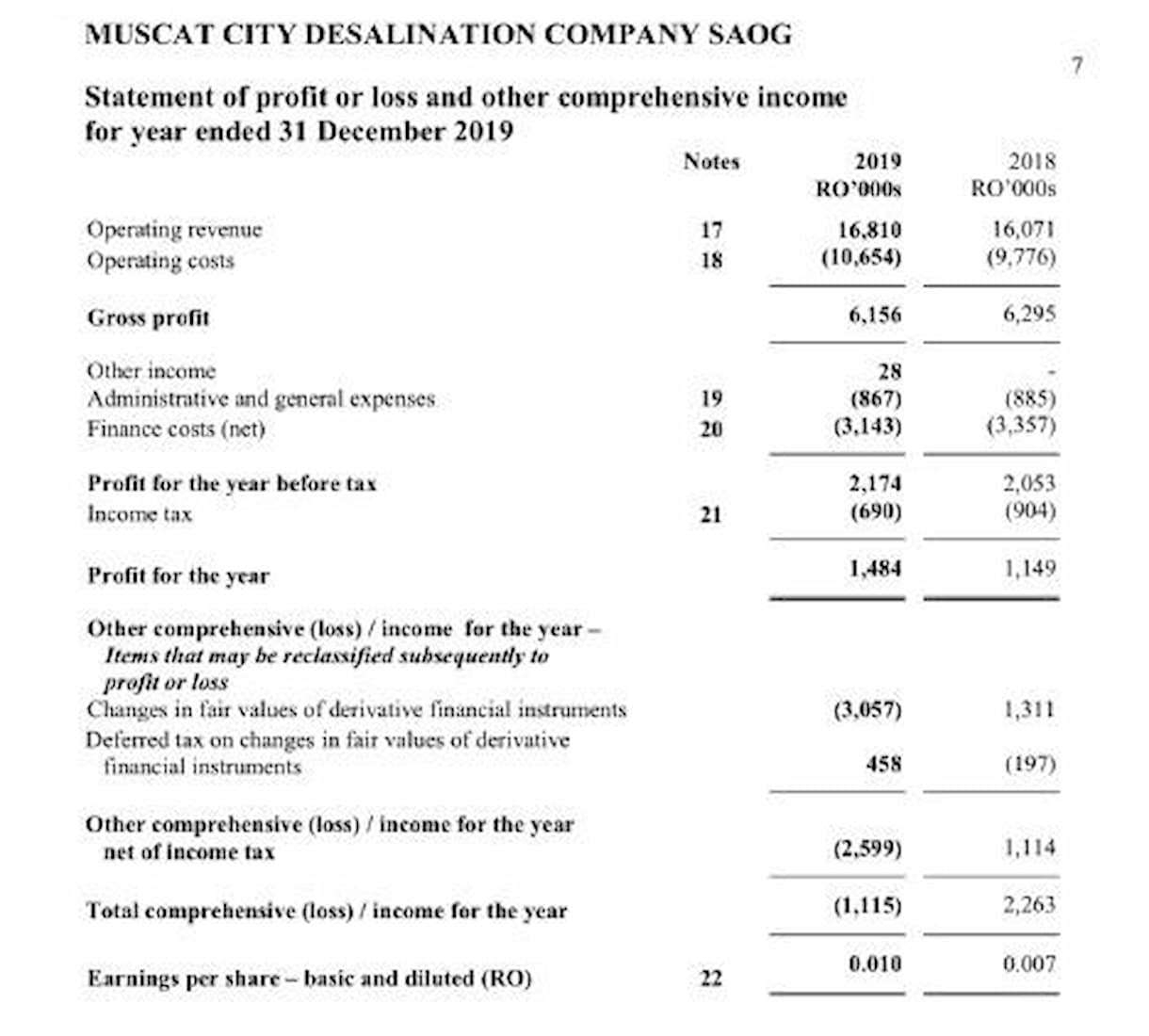

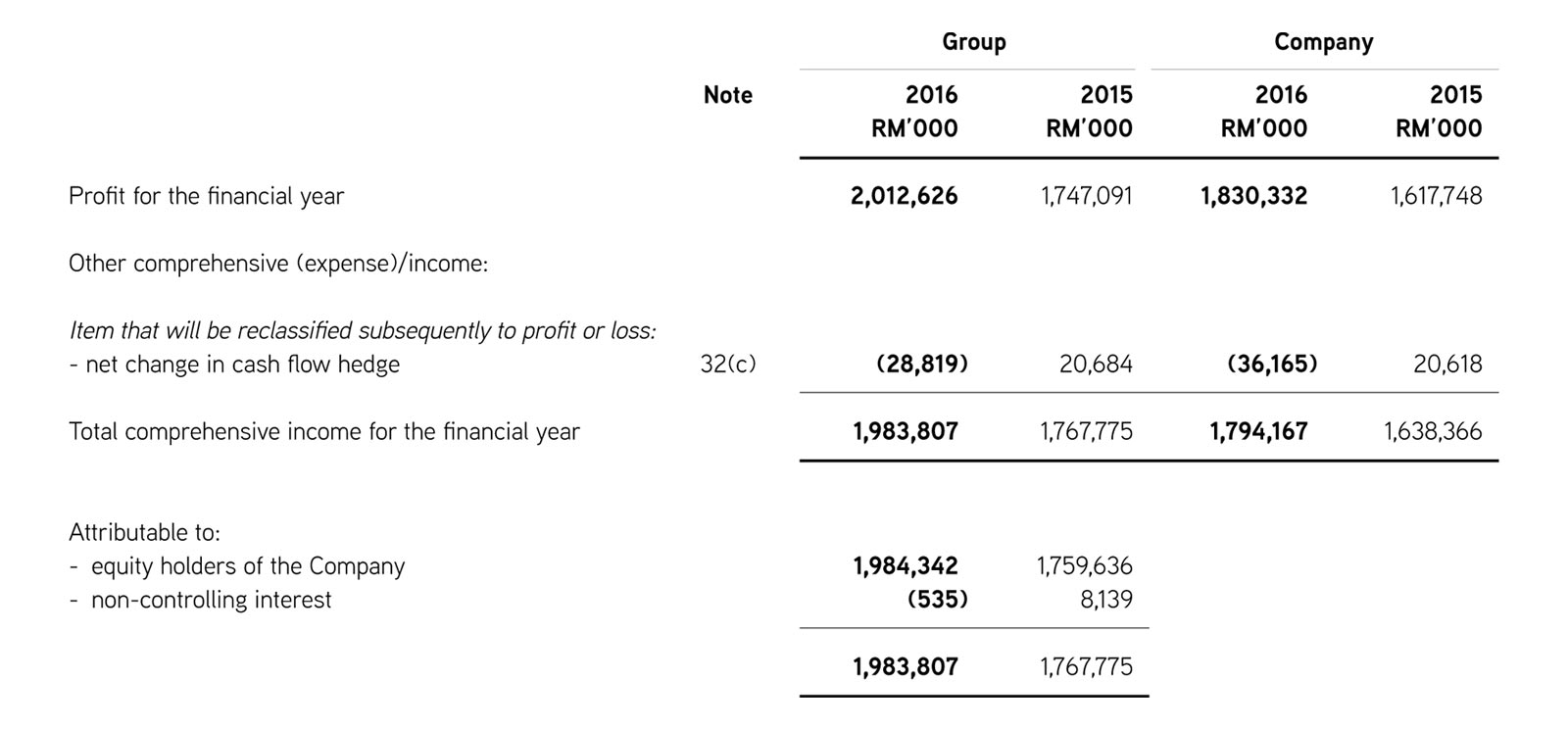

Comprehensive income accounting. It includes net income and unrealized income. The board made limited amendments to the classification and measurement requirements for financial assets by addressing a narrow range of application questions and by introducing a ‘fair value through other comprehensive income’ measurement category for particular simple debt instruments. Unfortunately, net income only accounts for the earned income and incurred expenses.

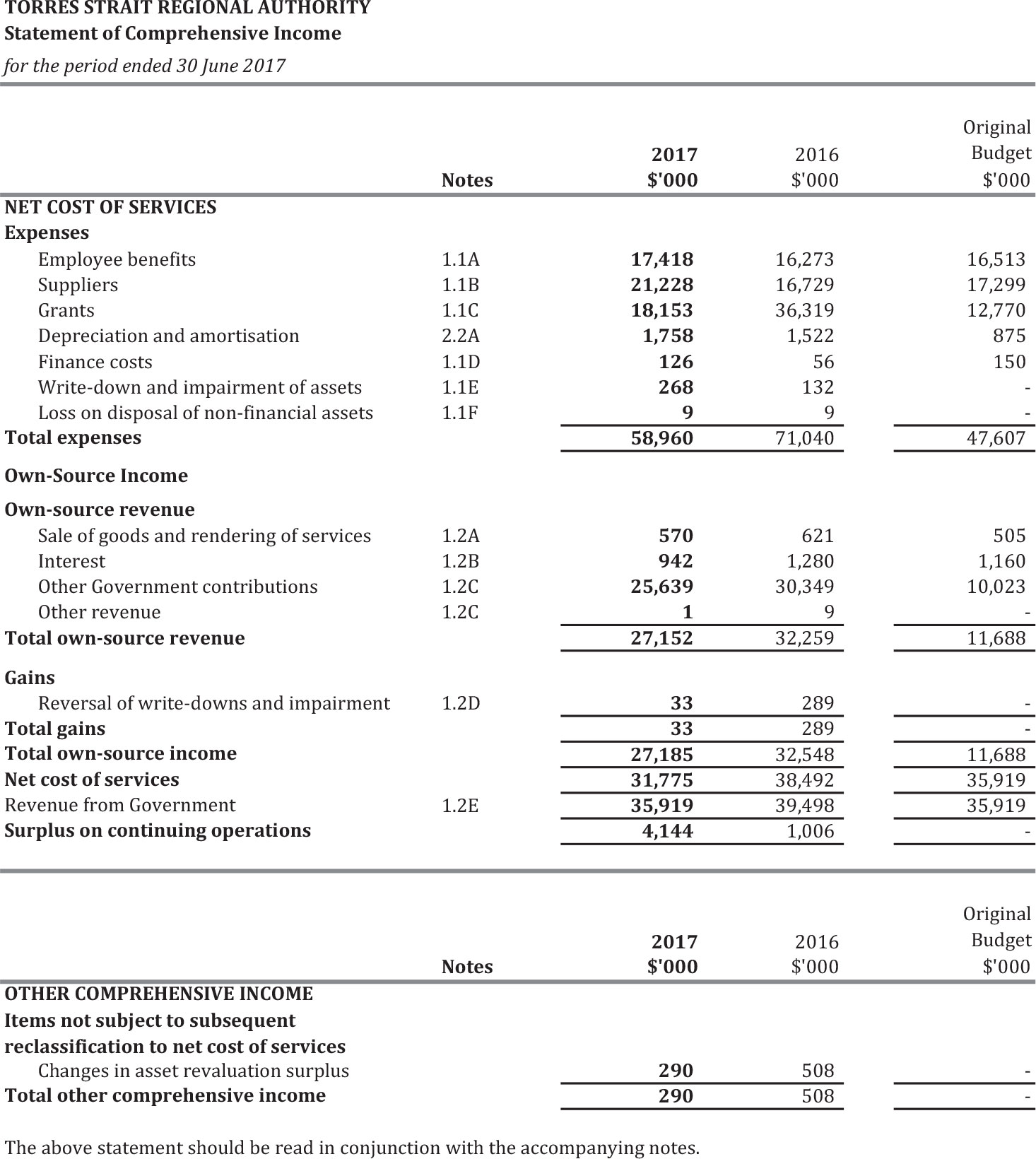

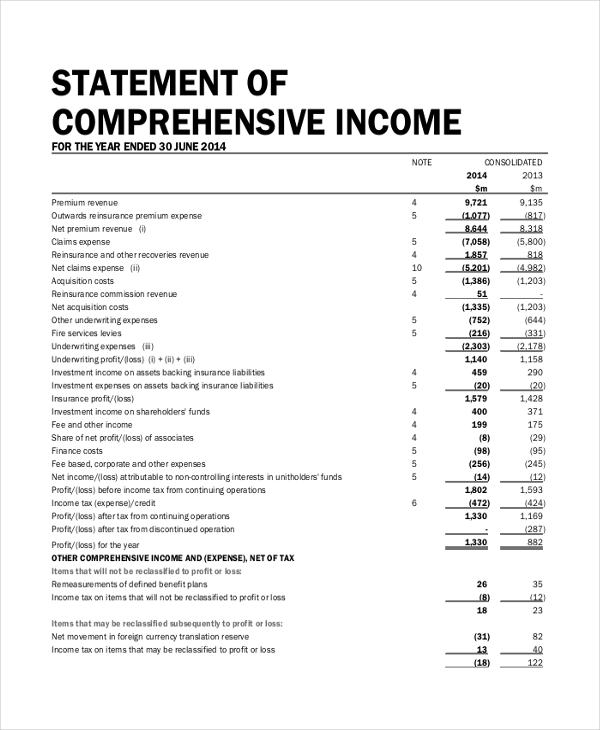

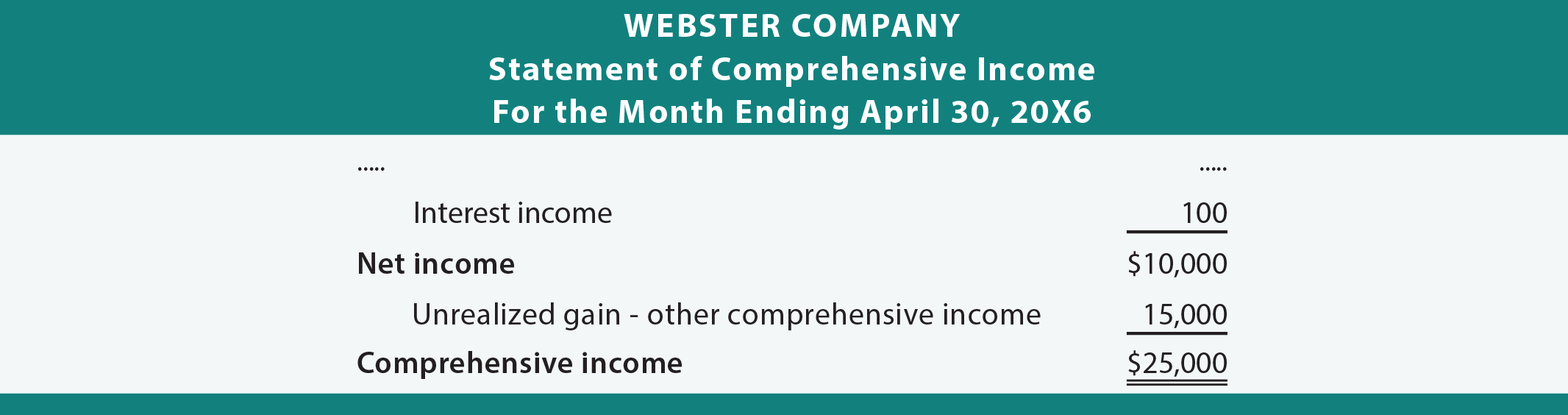

Basically, comprehensive income consists of all of the revenues, gains, expenses, and losses that caused stockholders' equity to change during the accounting period. The change in equity (net assets) of a business entity during a period from transactions and other events and circumstances from nonowner sources. The net income is obtained from your business income statement for your accounting period.

In other words, it includes all revenues, gains, expenses, and losses incurred during a period as well as unrealized gains and losses during an accounting period. The company might have paid $10 for the stock and now it’s worth $100 making the balance sheet misleading as to the true value of the company’s assets. It summarizes all the sources of revenue and expenses, including taxes and interest charges.

In comparison, oci consists of gains or losses that aren't realized in the income statement. These amounts cannot be included on a company’s income statement because the investments are still in play. Reporting entities should present each of the components of other comprehensive income separately, based on their nature, in the statement of.

4.5 accumulated other comprehensive income and reclassification adjustments. A more complete view of a company's income and revenues is shown by comprehensive income. It accompanies an organization’s income statement , and is intended to present a more complete picture of the financial results of.

Accumulated other comprehensive income (aoci) are special gains and losses that are listed as special items in the shareholder equity section of a company’s balance sheet. Comprehensive income includes net income and oci. Comprehensive income is the sum of regular income and other comprehensive income.

The aoci account is the designated space for unrealized profits or losses on items that are placed in the other comprehensive income category. Other comprehensive income (oci) is an accounting item for firms that includes revenues, expenses, gains, and losses that have yet to be realized. Unrealized gains or losses on other financial.

Statement of comprehensive income refers to the statement which contains the details of the revenue, income, expenses, or loss of the company that is not realized when a company prepares the financial statements of the accounting period, and the same is presented after net income on the company’s income statement. In business accounting, other comprehensive income (oci) includes revenues, expenses, gains, and losses that have yet to be realized and are excluded from net income on an income statement. It includes all changes in equity during a period except those resulting from investments by owners and distributions to owners.

The statement of comprehensive income is a financial statement that highlights your business's net income and other comprehensive income (oci). This change is comprised of net income or net loss, and other comprehensive income. Written by caroline grimm in intermediate accounting.

Incomes and expenses as stated earlier in level two of this accounting tutorials. Written by cfi team what is other comprehensive income? Knowing these figures allows a company to measure changes in the businesses it has interests in.