Lessons I Learned From Tips About Estimated And Projected Balance Sheet

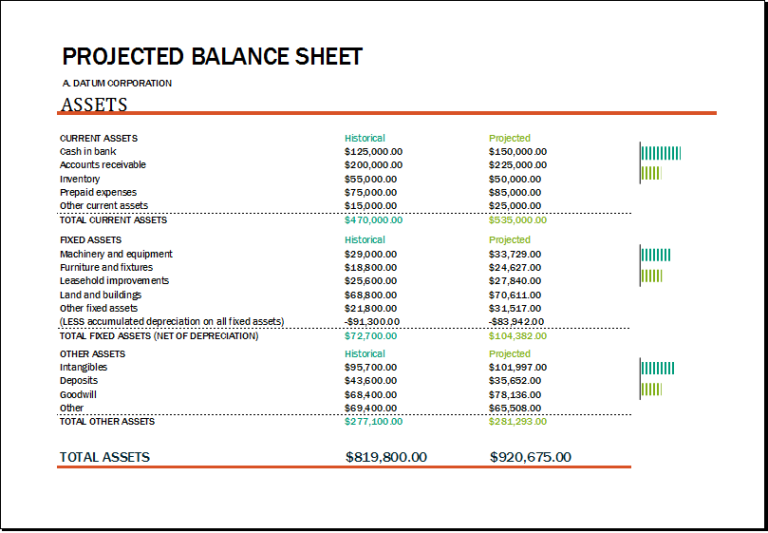

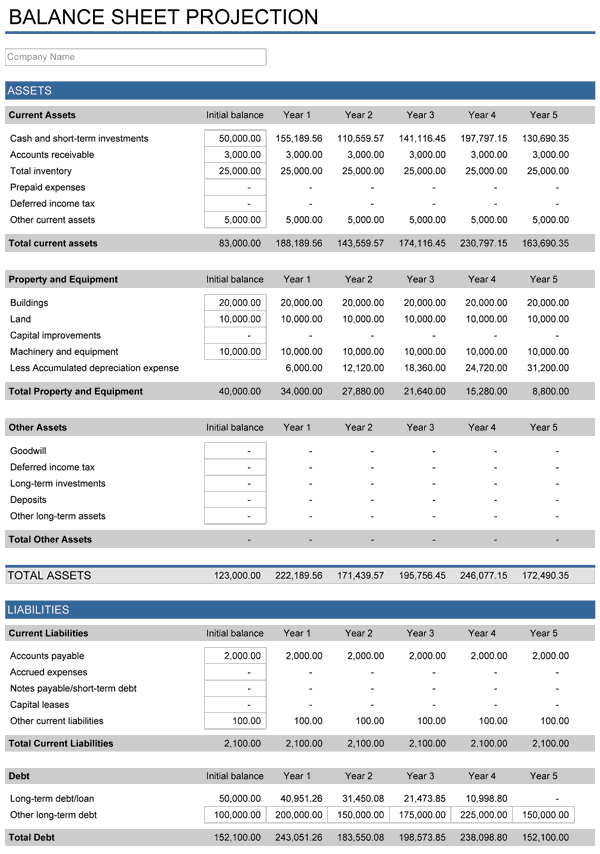

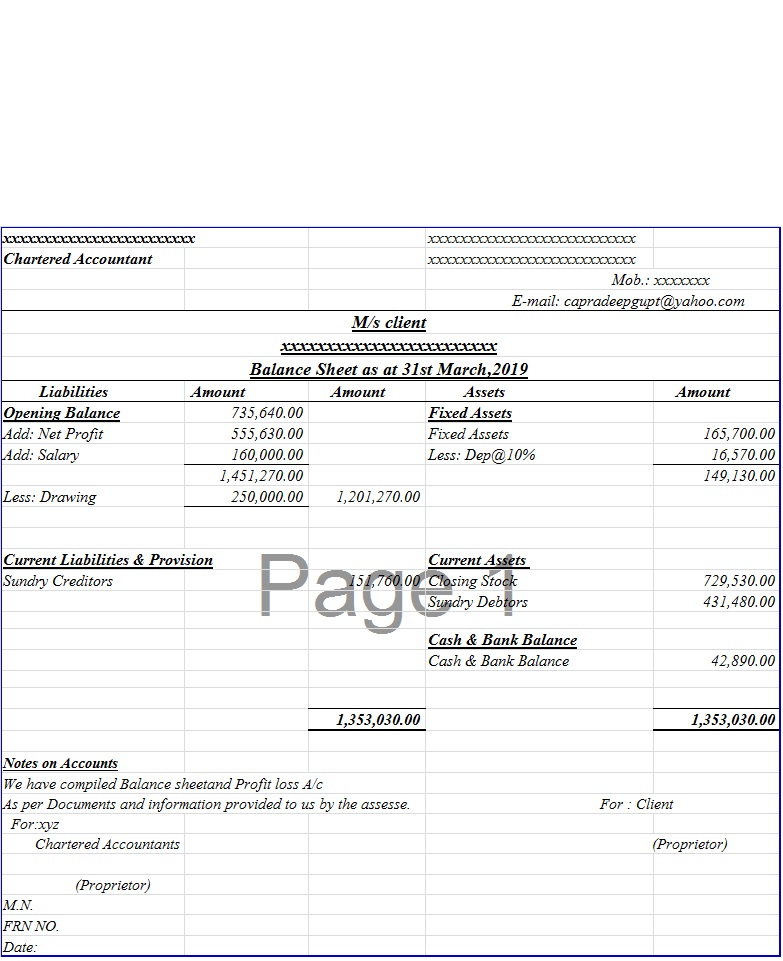

Projected balance sheets, or pro forma balance sheets, are the statements that show estimated changes to a company’s financial status, including investments, other assets, liabilities and financing for equity.

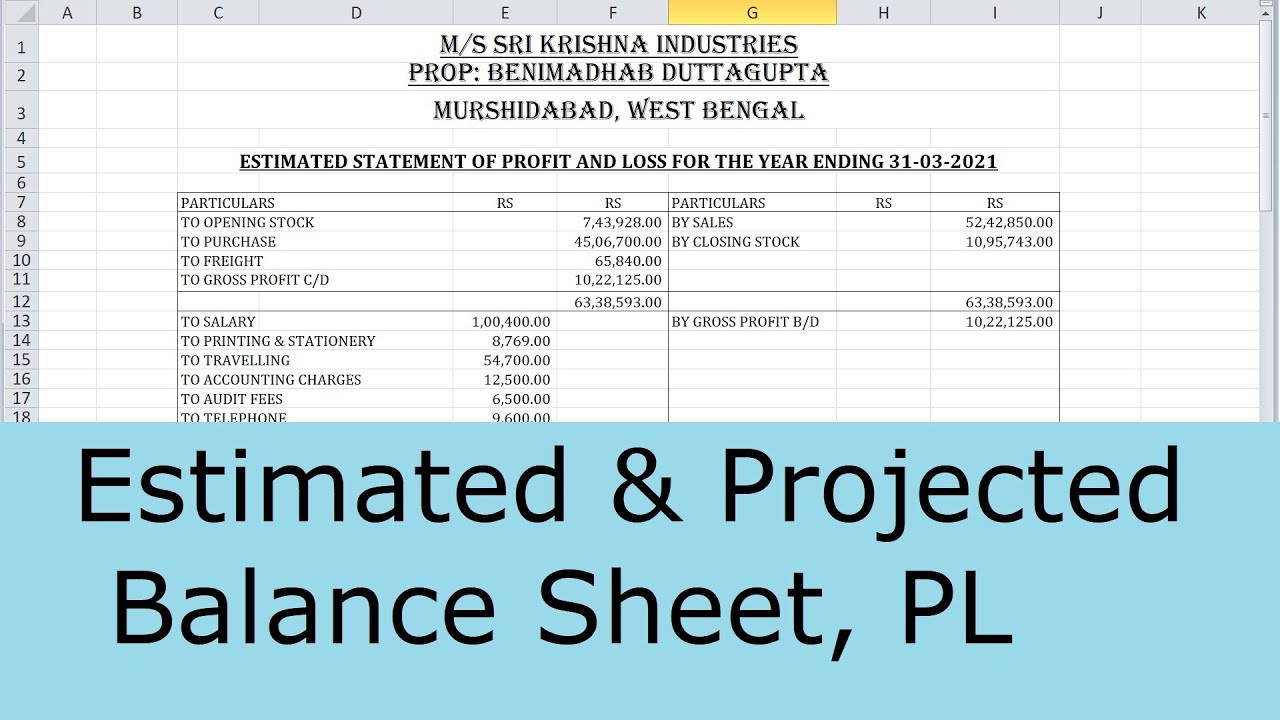

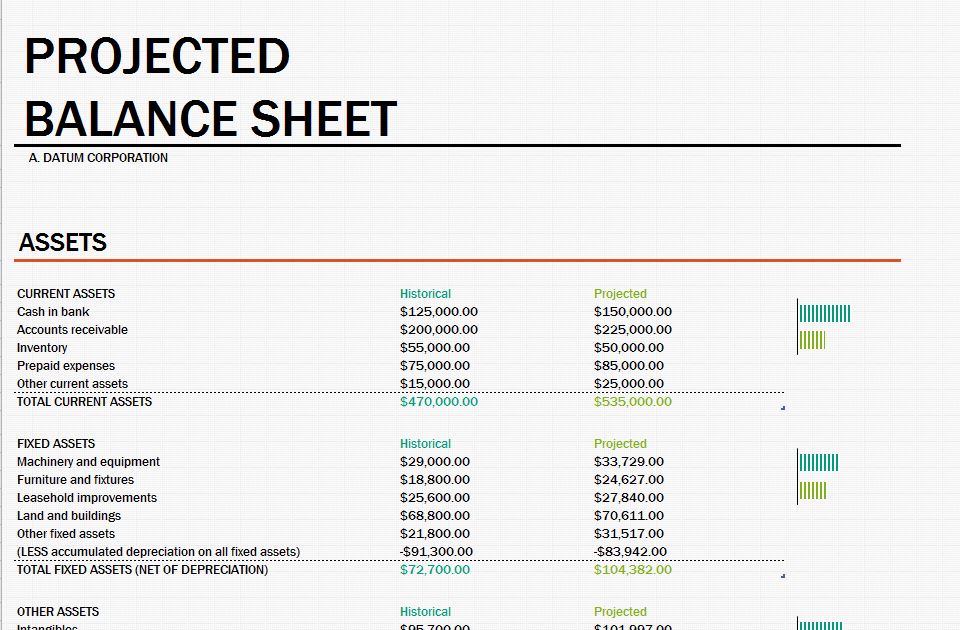

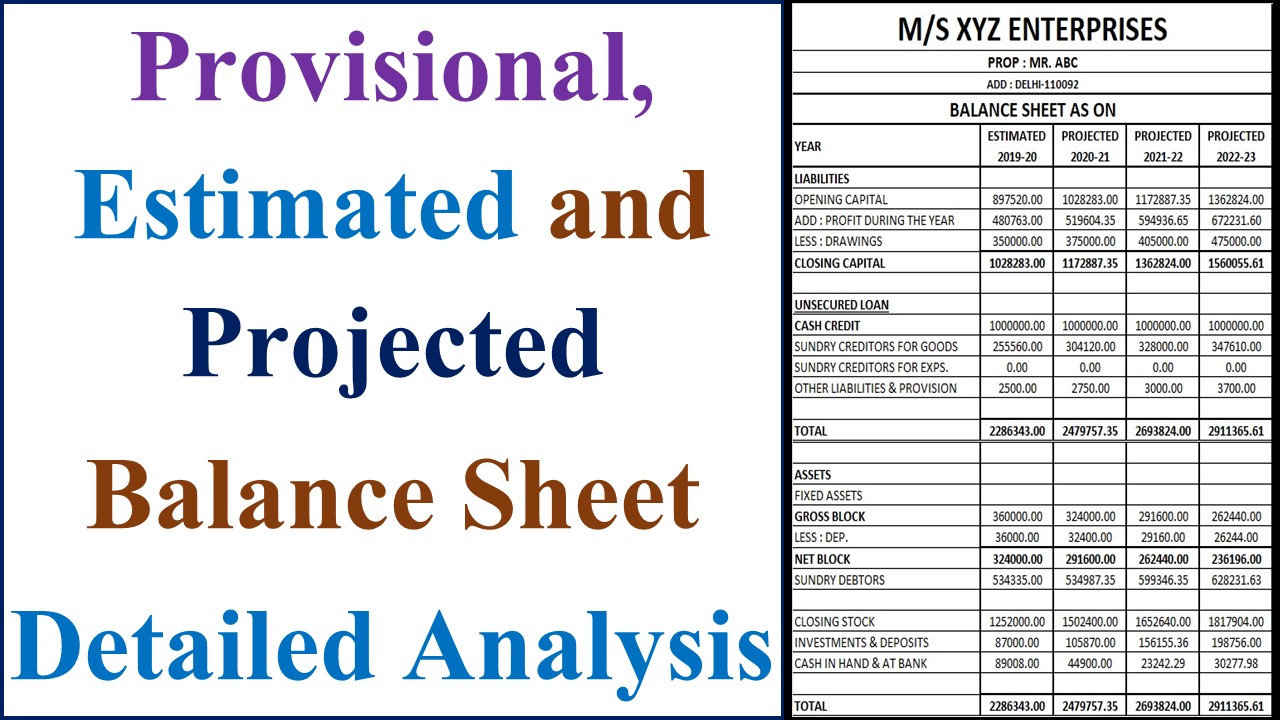

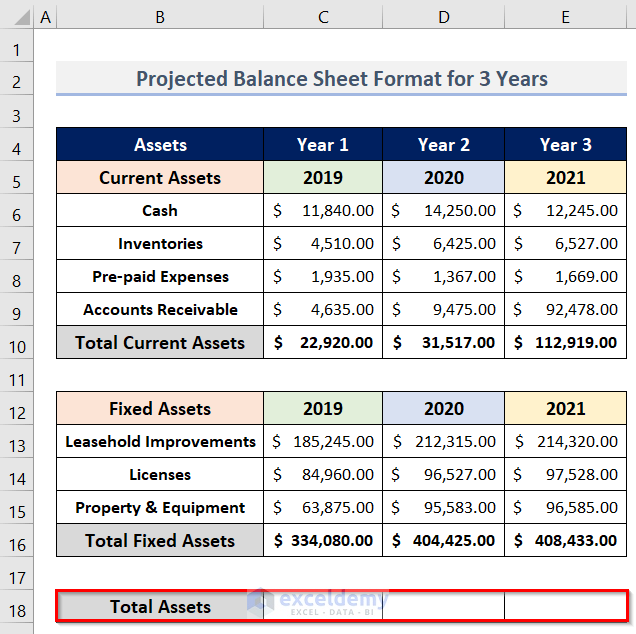

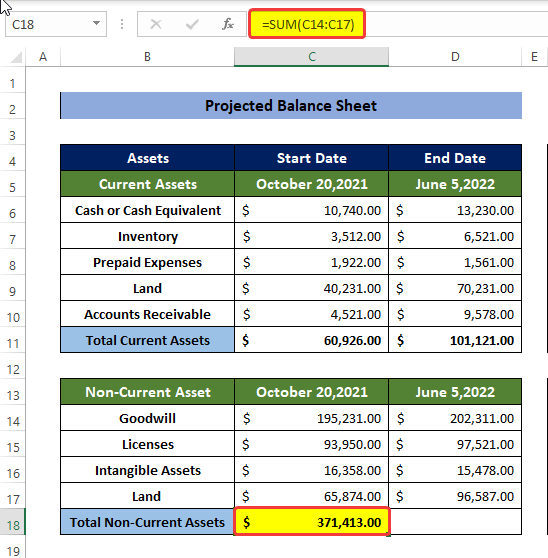

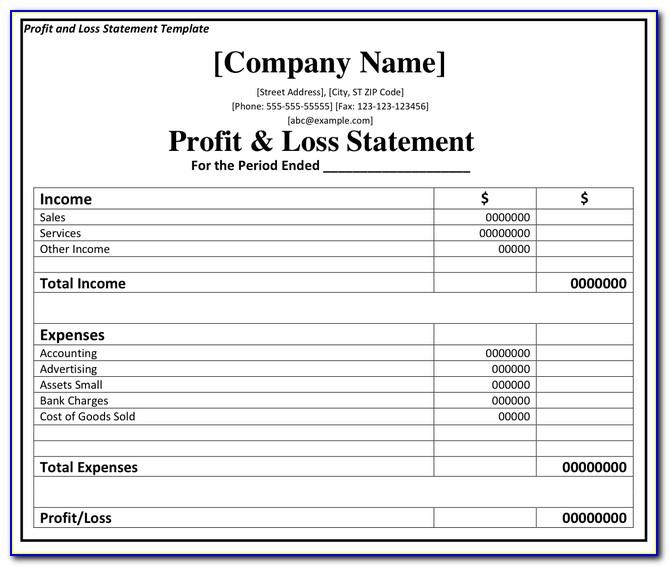

Estimated and projected balance sheet. Estimated balance sheet is prepared for future data (for which the period is started but not completed) on the basis of projection i.e. Projected balance sheet in excel #xls. The above screenshot is from cfi’s financial modeling course.

Depreciation is a financial accounting method used to allocate the cost of tangible assets over t. Total assets = total liabilities + total equity. For which period is not started.

Benefits of projected balance sheets. Calculate cash in hand and cash at the bank. Preparing a projected balance sheet, or financial budget, involves analyzing every balance sheet account.

For which period is not started. What are projected balance sheets? Here are the steps to prepare a projected and estimated balance sheet:

Projected balance sheets offer several advantages for businesses that are planning for. Assets = liabilities + capital. The beginning balance for each account is the amount on the balance sheet prepared at the end of the preceding period.

Watch the video again and again to understand the fundamentals of ratio. How to prepare projected balance sheet. In this video, you will find the perfect ratio analysis in case of preparation of estimate or projected balance sheet.

A projected balance sheet shows the estimated changes to a company’s financial status, including assets, liabilities, investments, and financing for equity. A balance sheet is a financial document that gives a summary of your business’s financial position on a. For example, cash, inventories, prepaid expenses, accounts receivable, licenses, etc.

Ownership, stock, investment, retained earnings. Other files by the user. This mass balance has been negative for both the antarctic ice sheet (ais) and greenland ice sheet (gris) for several decades, with individual rates estimated at −127 ± 23 gt year − 1 and −.

The balance sheet adheres to an equation that equates assets with the sum of liabilities and shareholder equity. 7.6 budgeted balance sheet. A current balance sheet is a snapshot of your company’s assets, liabilities, and equity as of a specific date.

Collect historical financial statements, including balance sheets, income statements, and cash flow statements. Projected balance sheet: Debts, notes payable, accounts payable, amounts of money owed to be paid back.