Simple Info About Financial Statement For Bank Loan

Liabilities represent what the bank owes to others, such as.

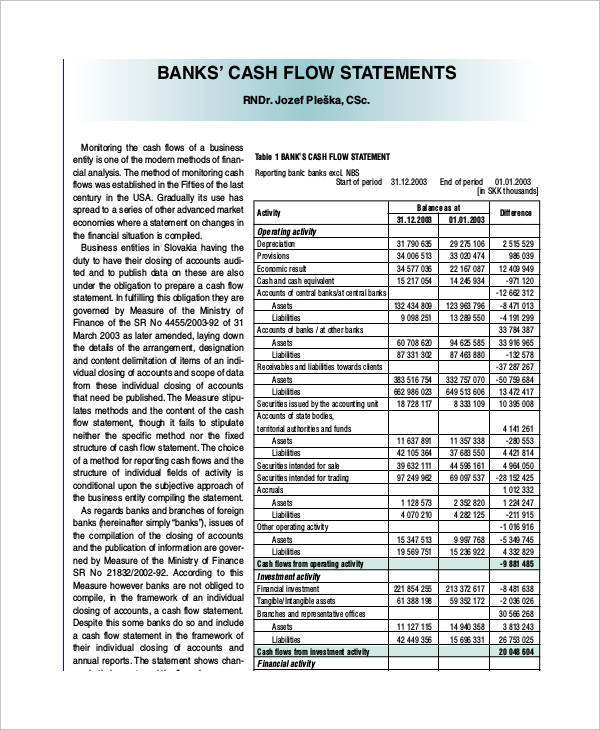

Financial statement for bank loan. Property and equipment 145 27. Banks are classified into three types: Credit analysis ratios are tools that assist the credit analysis process.

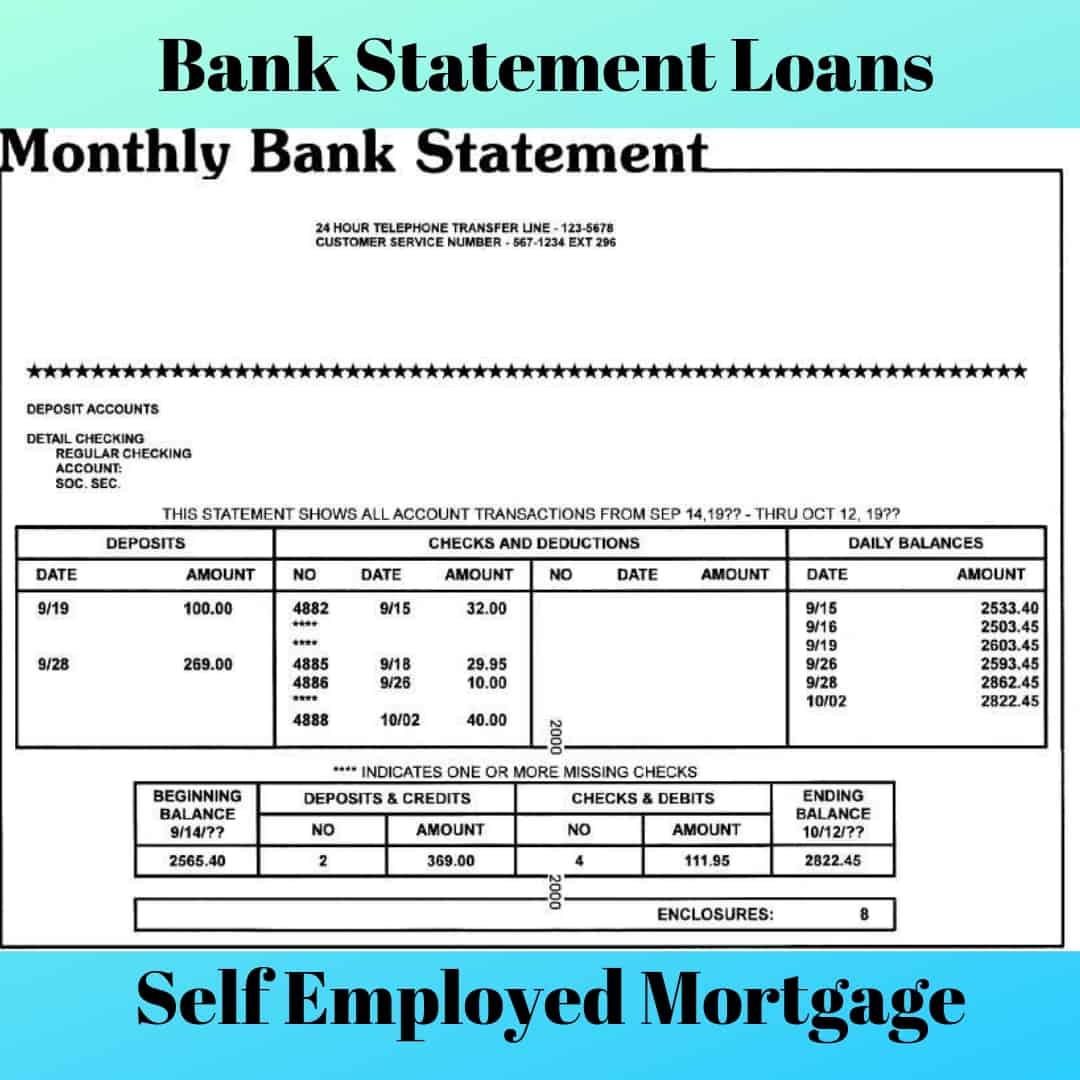

Financial statements by obscuring material information with immaterial : Balances with banks, security investments and loans: What are the financial statements for banks?

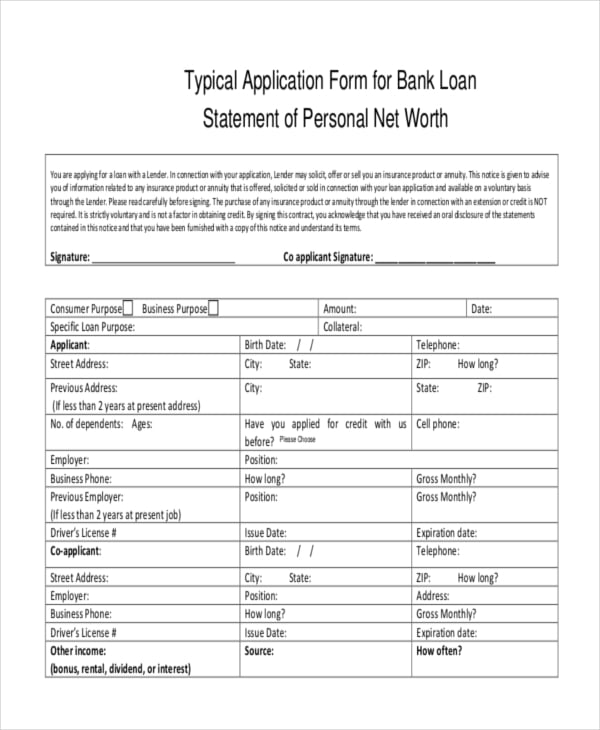

James to win an enormous victory against mr. By marquis codjia published on 26 sep 2017 a bank goes through a series of thorough analyses before approving a loan, extending a credit line or increasing a customer's credit profile. Capital one to acquire discover.

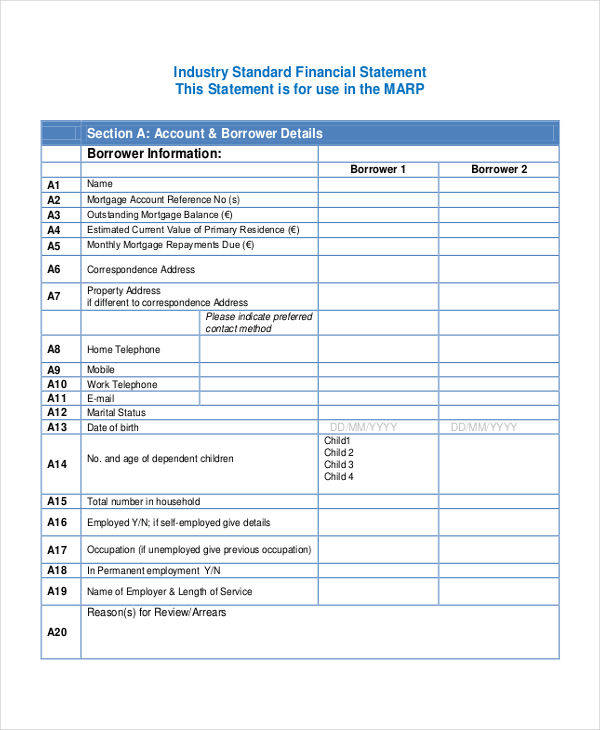

As a result, investors and financial analysts must use specific financial ratios when analyzing the profitability of retail banks. Specifically, using the unique setting green manufacturing (gm) program in china, we examine whether and how green manufacturing certification (gmc) endorsed by the government could lead to an increase in firms' bank. Small business administration uses to assess the creditworthiness and repayment ability of its loan.

Loans and advances to banks 141 24. The transaction brings together two companies with long. What do banks look for in financial statements?

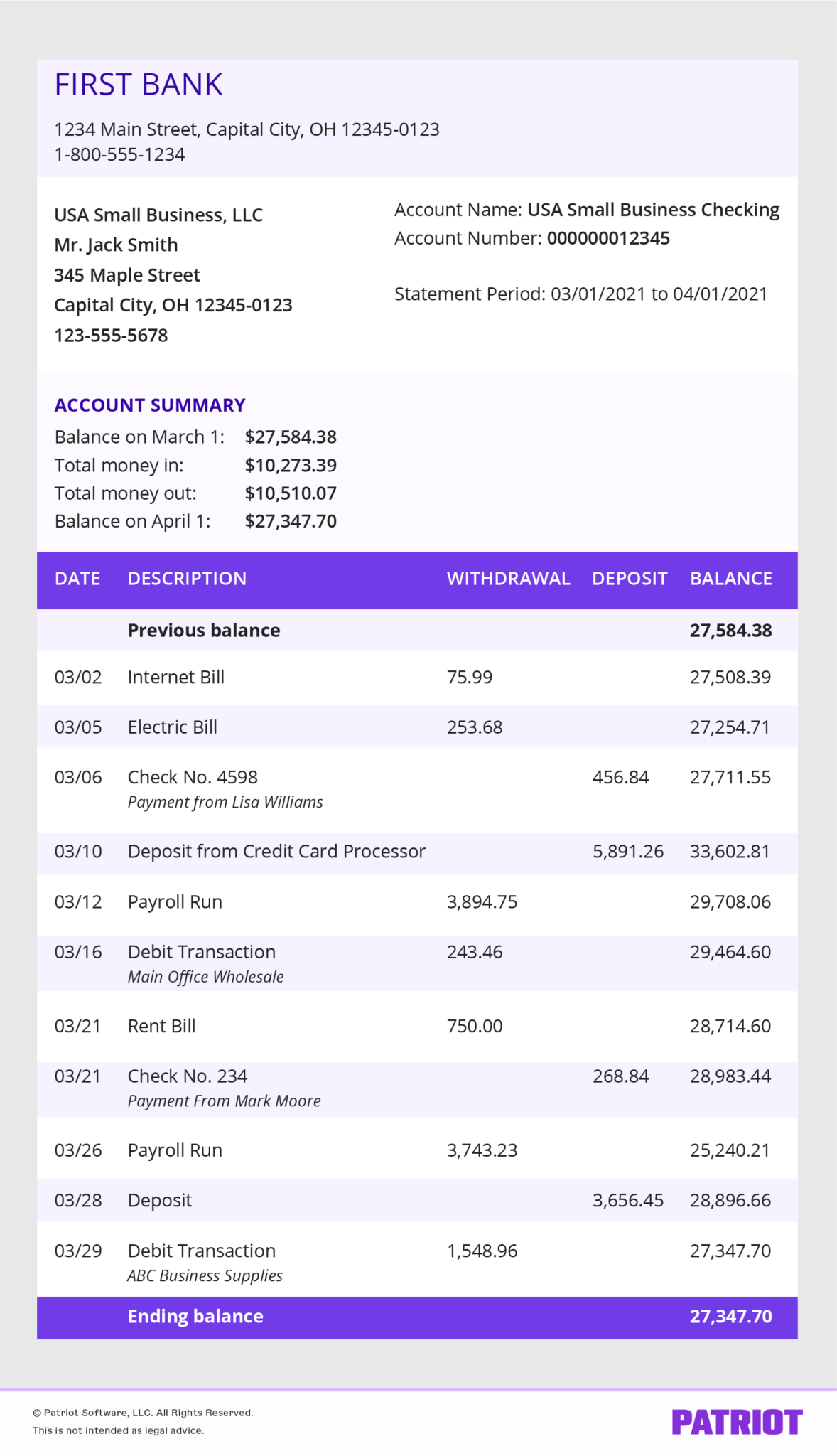

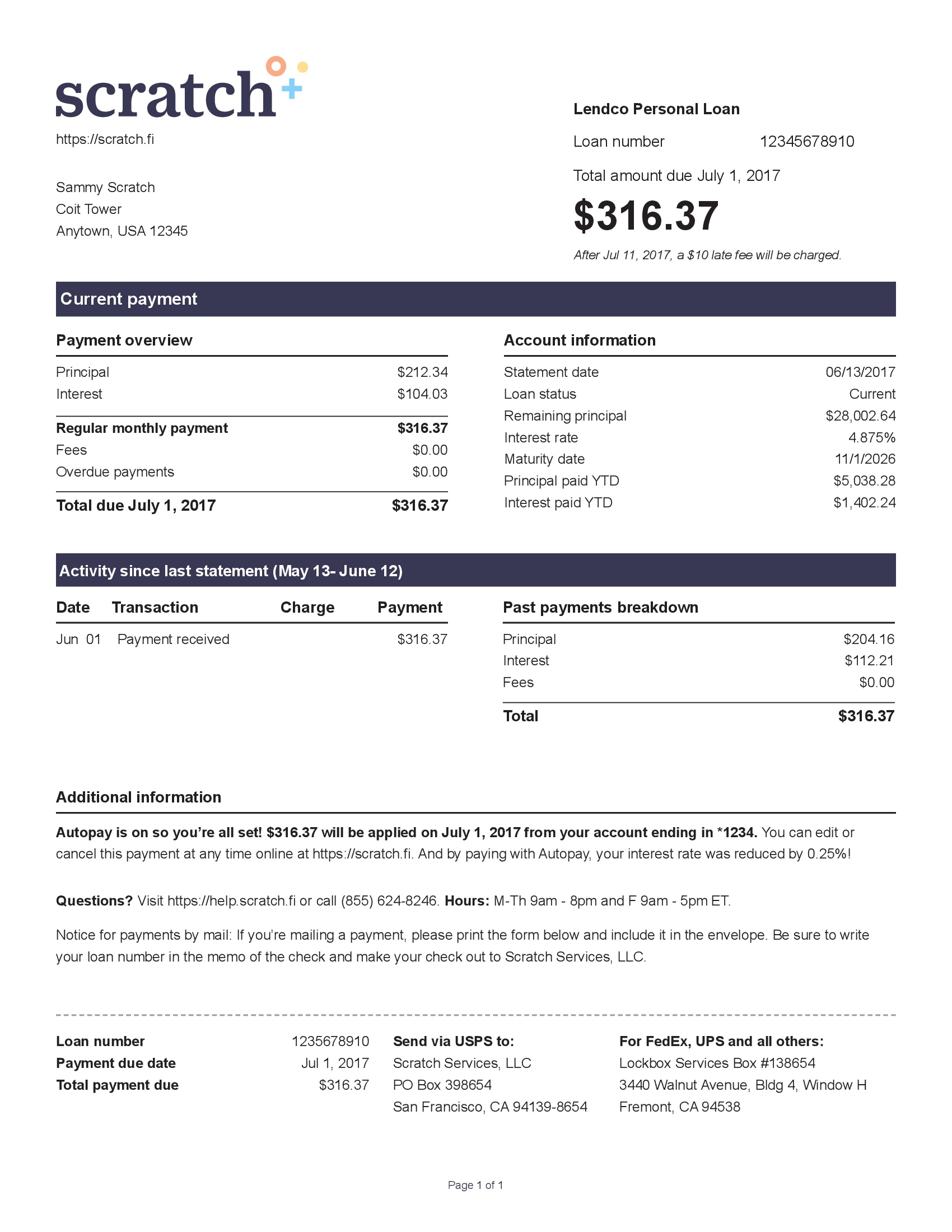

Financial statements for banks: It shows the bank’s assets, liabilities, and equity. Financial statements are written records that convey the financial activities of a company.

The us federal reserve fined deutsche bank $186mn last year for a “material failure” to fix “unsafe and unsound banking practices” that the bank had promised to resolve as long ago as 2015. Balances with banks and security investments, external loans and other external assets: A bank is a financial entity that is permitted to accept deposits and provide loans.

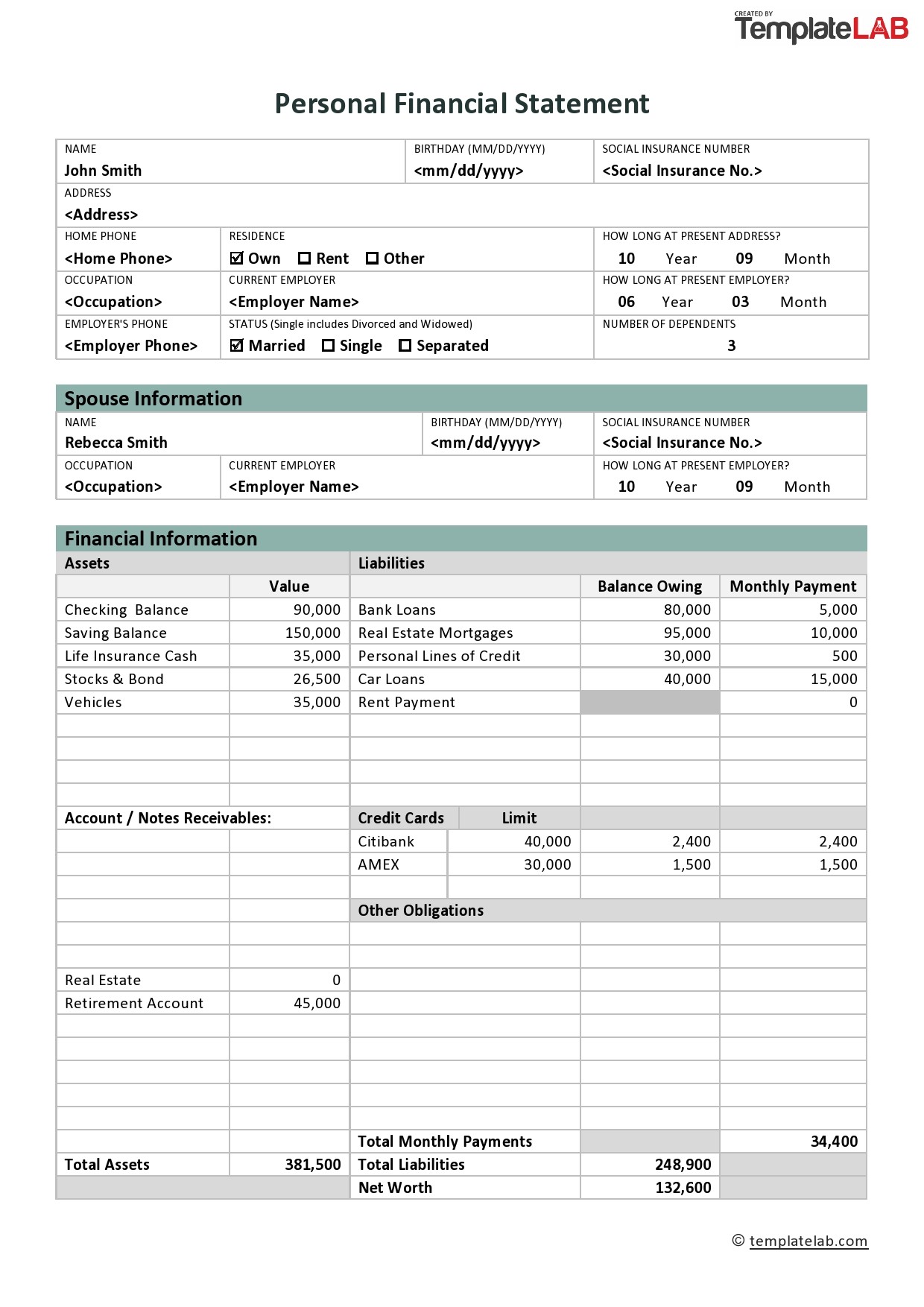

They’ll also ask for a current balance sheet and an interim income statement. Trump from running a business in new york for three years. Assets represent what the bank owns or controls, such as cash, loans, and securities.

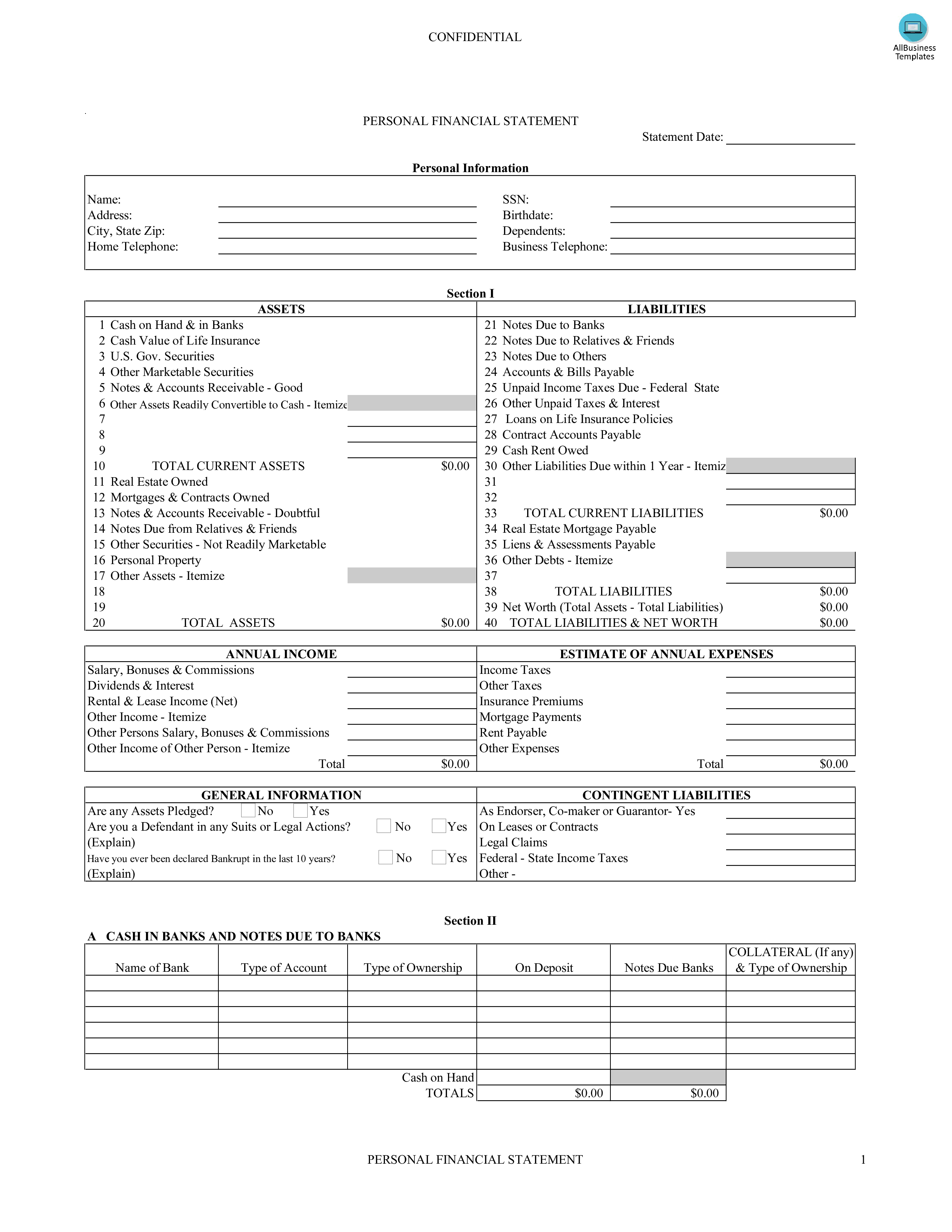

It shows its assets, liabilities, and owners’ equity (essentially, what it owes, owns, and the amount invested by shareholders). The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements. A personal financial statement is needed if.

Under the terms of the agreement, discover shareholders will receive 1.0192 capital one shares for each discover share, representing a premium of 26.6% based on discover's closing price of february 16, 2024. The intention is to provide users with appropriate information to assist them in eval. Loans and advances to customers 142 25.

![23 Editable Bank Statement Templates [FREE] ᐅ TemplateLab](http://templatelab.com/wp-content/uploads/2019/02/bank-statement-template-11.jpg?w=320)

![35 Editable Bank Statement Templates [FREE] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2019/02/bank-statement-template-08.jpg)

![35 Editable Bank Statement Templates [FREE] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2021/03/TD-Bank-Statement-TemplateLab.com_.jpg)

![35 Editable Bank Statement Templates [FREE] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2021/03/Commonweath-Bank-Statement-TemplateLab.com_.jpg)