Looking Good Tips About Cash Receipts From Customers Calculation

![[Solved] P73B The cash receipts journal below contains five entries](https://i.pinimg.com/originals/26/67/ea/2667ea55c7baab8c540e938e7a52f7a1.jpg)

You obtain the cash received.

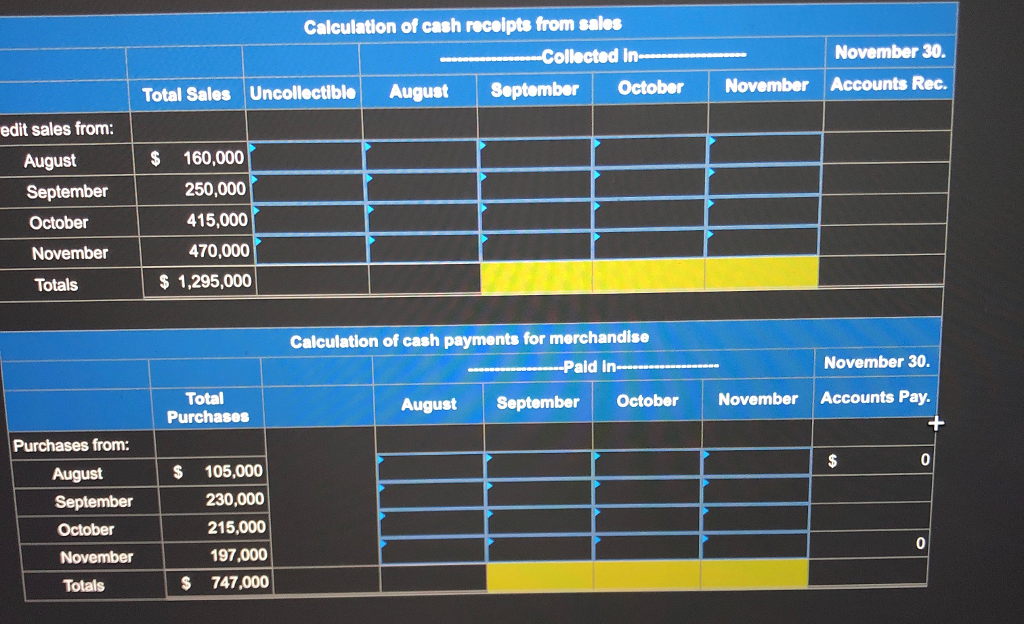

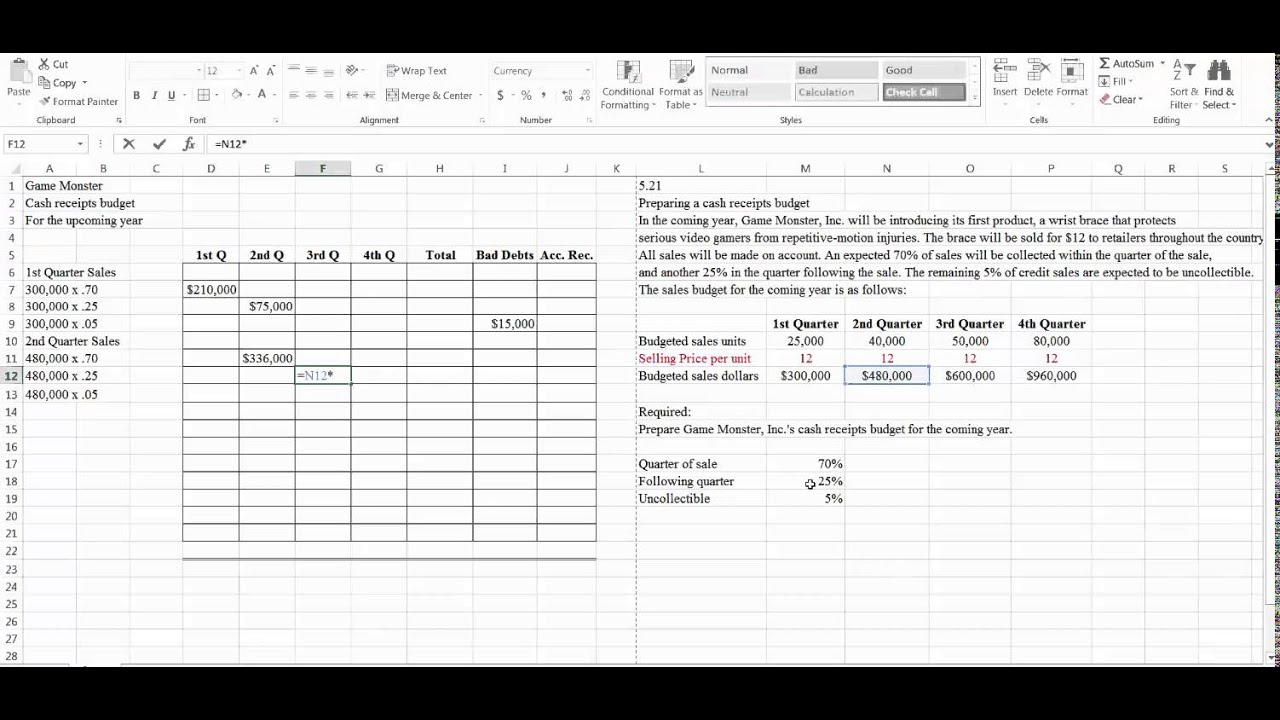

Cash receipts from customers calculation. Business checking account record the completed transaction of a sale on a cash receipt. Cash receipts from customers = + net sales + beginning accounts receivable − ending accounts receivable cash payments to suppliers = + purchases + ending inventory − beginning inventory + beginning accounts payable − ending accounts payable cash payments to employees = + beginning salaries payable − ending. The cash flow direct method formula is as follows.

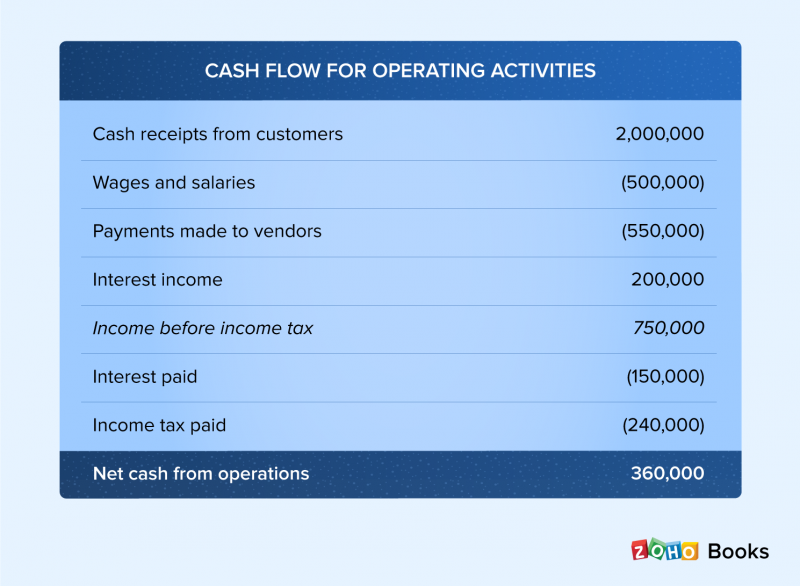

Direct method statement of cash flows. Generally most cash receipts are from credit sale customers, and the subsidiary ledger updated is the accounts receivable ledger. Cash paid to suppliers (29,800,000) cash paid to employees (11,200,000) cash generated from operations:

Cash receipts are the collection of money (cash) from your customers. Before you can record cash receipts, you need to make a cash sale. In this accounting lesson, we explain the cash received from customers and how it is accounted for.

Cash flows are usually calculated as a missing figure. This video shows how to calculate the cash received from customers for the operating section of the statement of cash flows when a company uses the direct method. When posting to the accounts receivable ledger, a reference to the relevant page of the.

You can estimate cash sales from the year’s previous trends. Key takeaways cash receipts are proof that your business has made a sale. Each cash receipt should have its own invoice number.

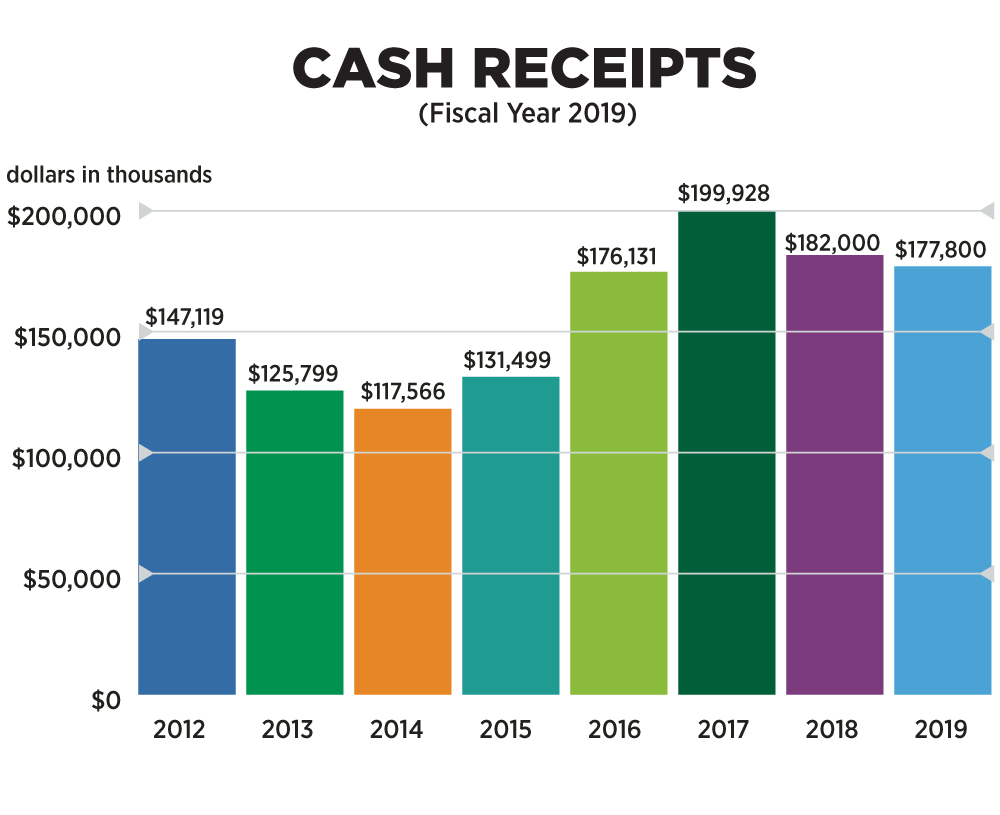

Uk government finances saw a record surplus in january due in part to a big rise in income tax receipts, with more britons forced into paying tax. Use the steps below to properly account for cash receipts in your small business books: You can calculate your budgeted cash receipts to help determine how.

Your budgeted cash receipts are the amounts of cash you expect to collect based on the forecasted sales in your sales budget. Record the cash receipt transaction. Cash received from customers.

These increase the cash balance recognized on a company’s balance sheet. Accordingly, you add the $10,000 to the $100,000 income statement sales revenue to arrive at the amount of cash you received during the latest quarter, $100,000 + $10,000, or $110,000. Cash flows from operating activities :

Calculate net cash receipts: Cash receipt from customers $1,500,000 wages and salaries (450,000) cash paid to vendors (525,000) interest income 175,000 income before income taxes $700,000 interest paid (125,000) Enter each cash receipt's information into your cash receipts journal.

Start by identifying the total sales revenue. Payments september 29, 2021 do you know what cash receipts are? Expected cash collections = cash sales + projected collections from accounts receivable to calculate your total expected cash collections, you’ll add the revenue you anticipate will come from cash sales to the revenue you anticipate will come from accounts receivable.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)