Stunning Tips About Pro Forma Cash Flow Is

Learn the difference between cash flow projections and pro forma statements.

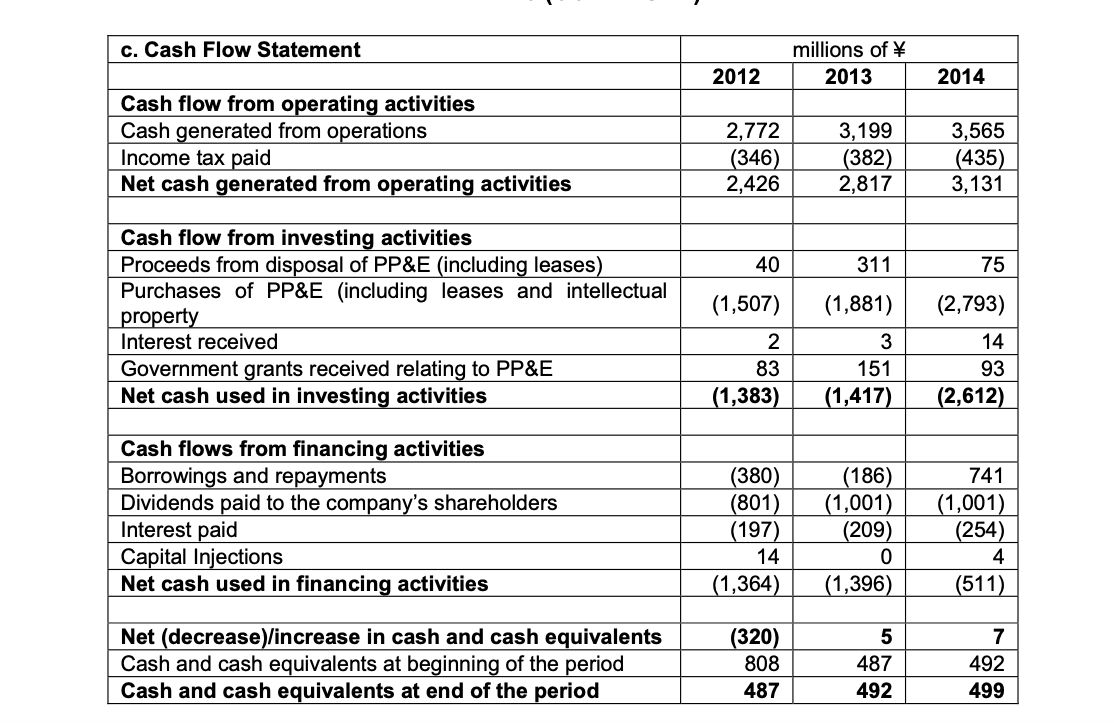

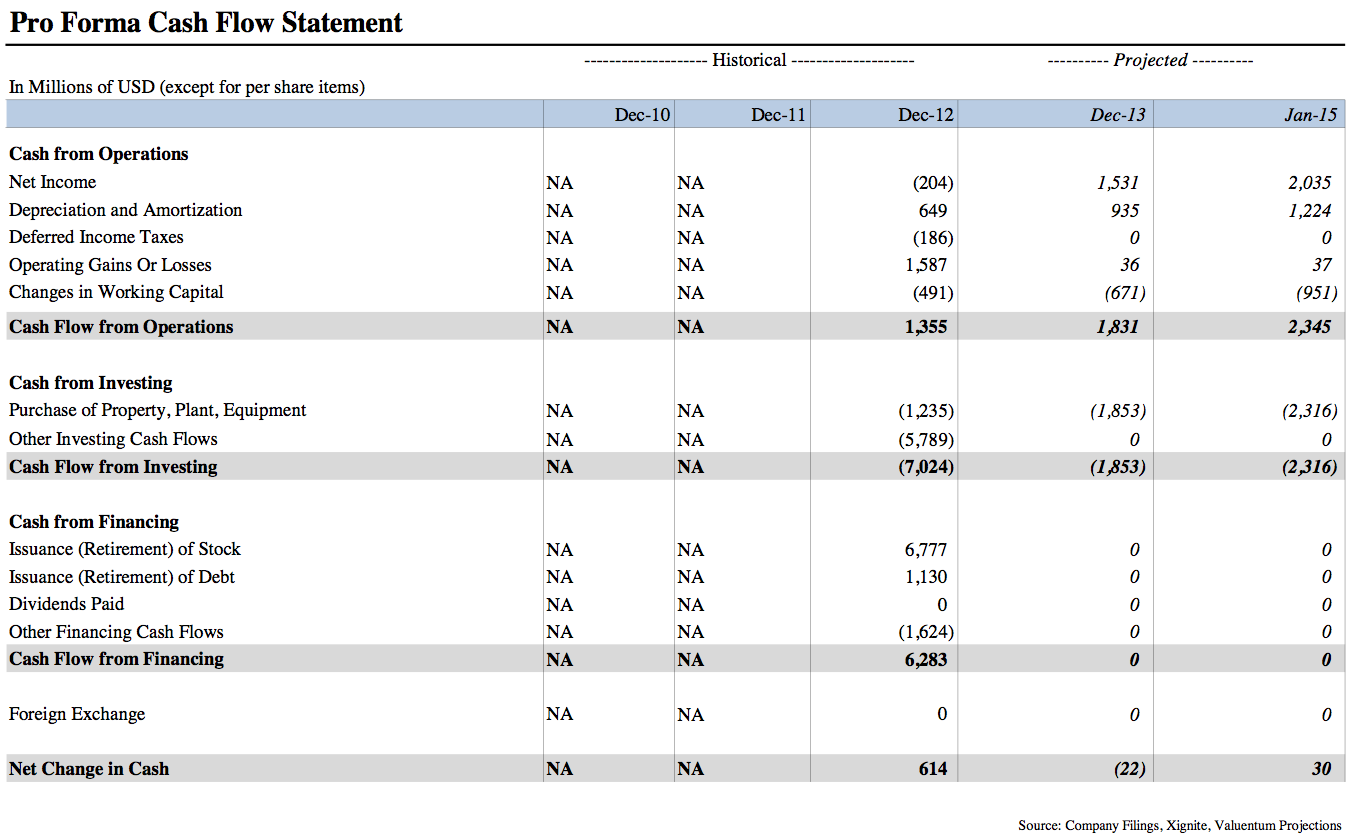

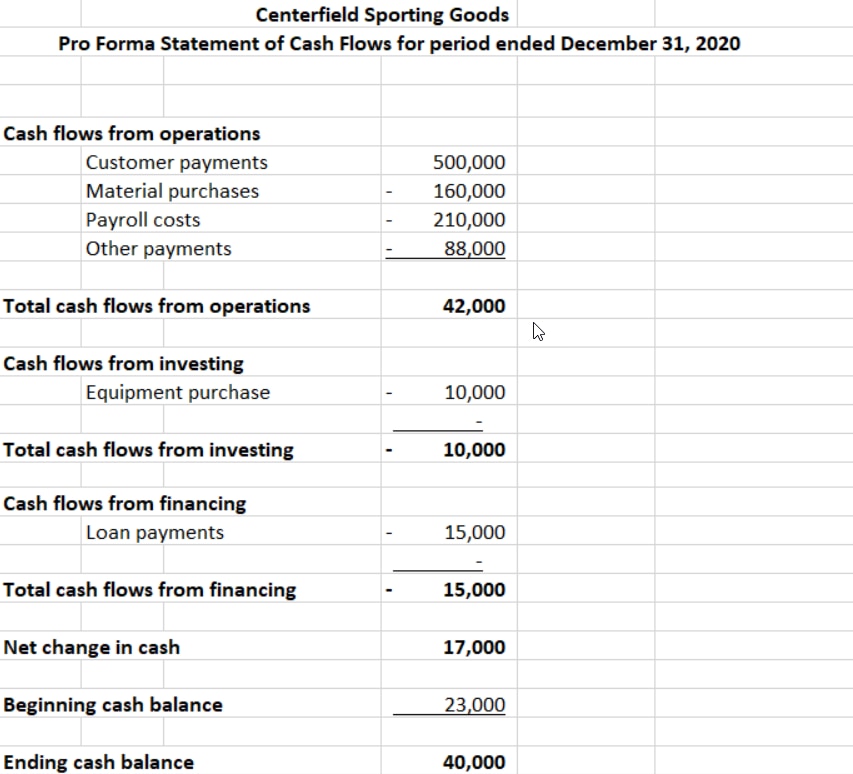

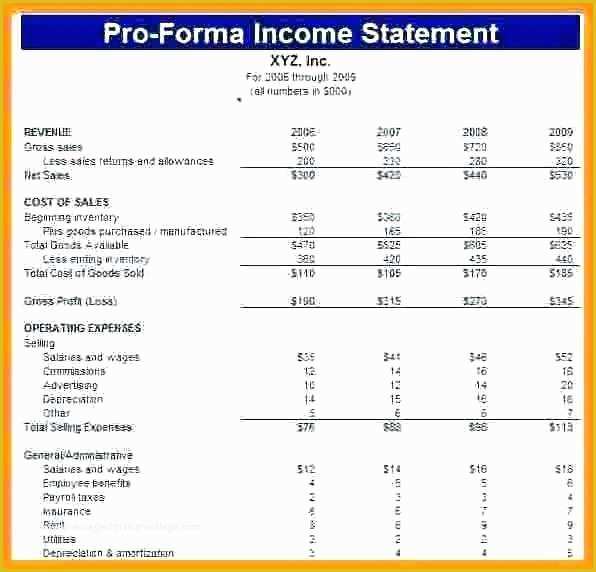

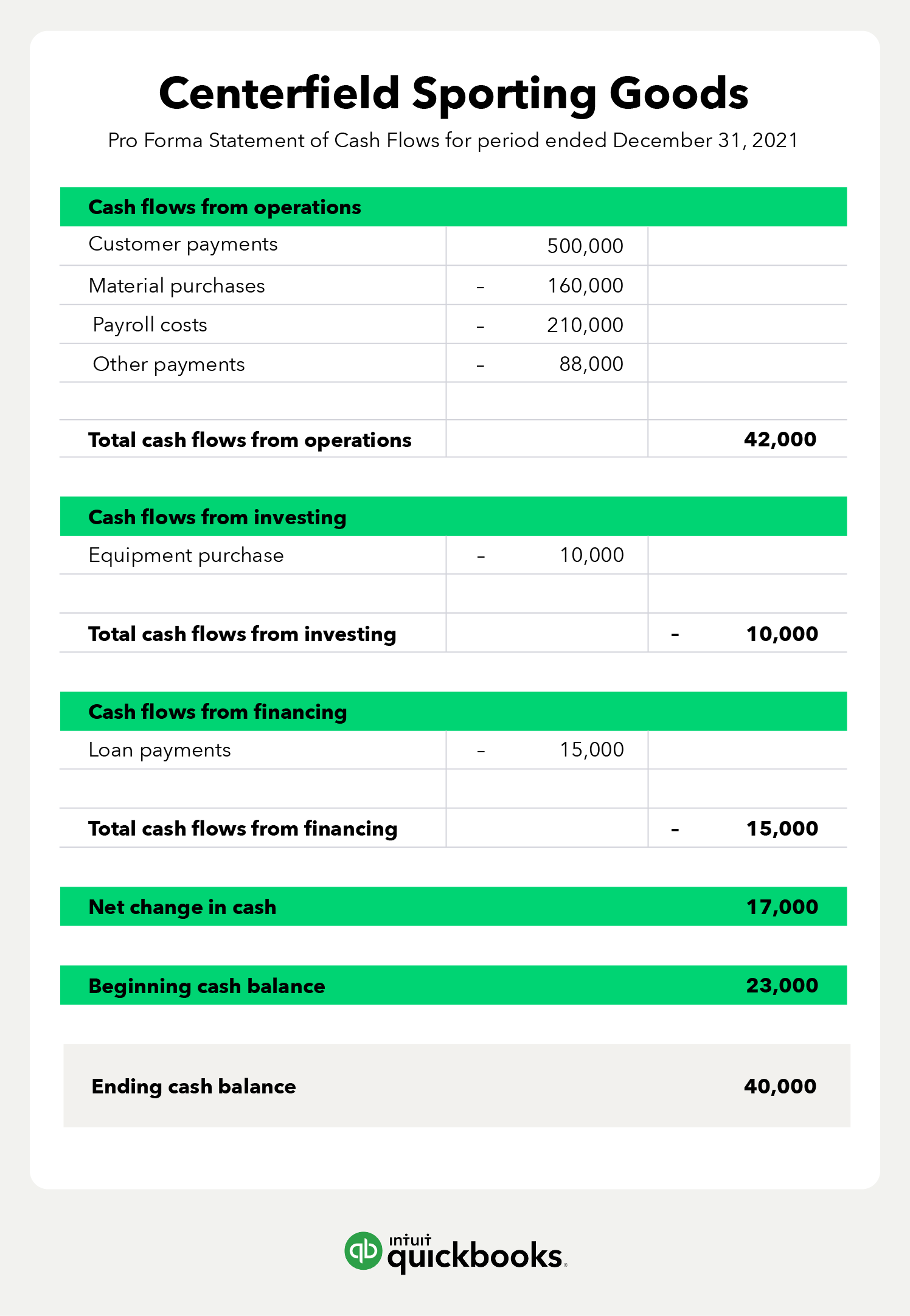

Pro forma cash flow is. A pro forma cash flow statement is a tool used to gain insight into a business's expected cash flows over a set period of time. Occasionally investors will ask for more or less, but we recommend starting. Pro forma cash flow is the estimated amount of cash inflows and outflows expected in one or more future periods.

Pro forma cash flow statements. What is pro forma cash flow? A pro forma cash flow is a statement which predicts the rate at which money will flow into and out of a company in the future.

To create a pro forma cash flow statement: A pro forma cash flow is an estimate of the size of cash inflows and outflows that a business expects in a particular timeframe. Net debt to ebitda was 2.3 (2.8).

Cash flow from operations for the year was sek 332.4 million (114.3). Pro forma, latin for “as a matter of form” or “for the sake of form”, is a method of calculating financial results using certain projections or presumptions. Pro forma financial statements often include several years of financial projections.

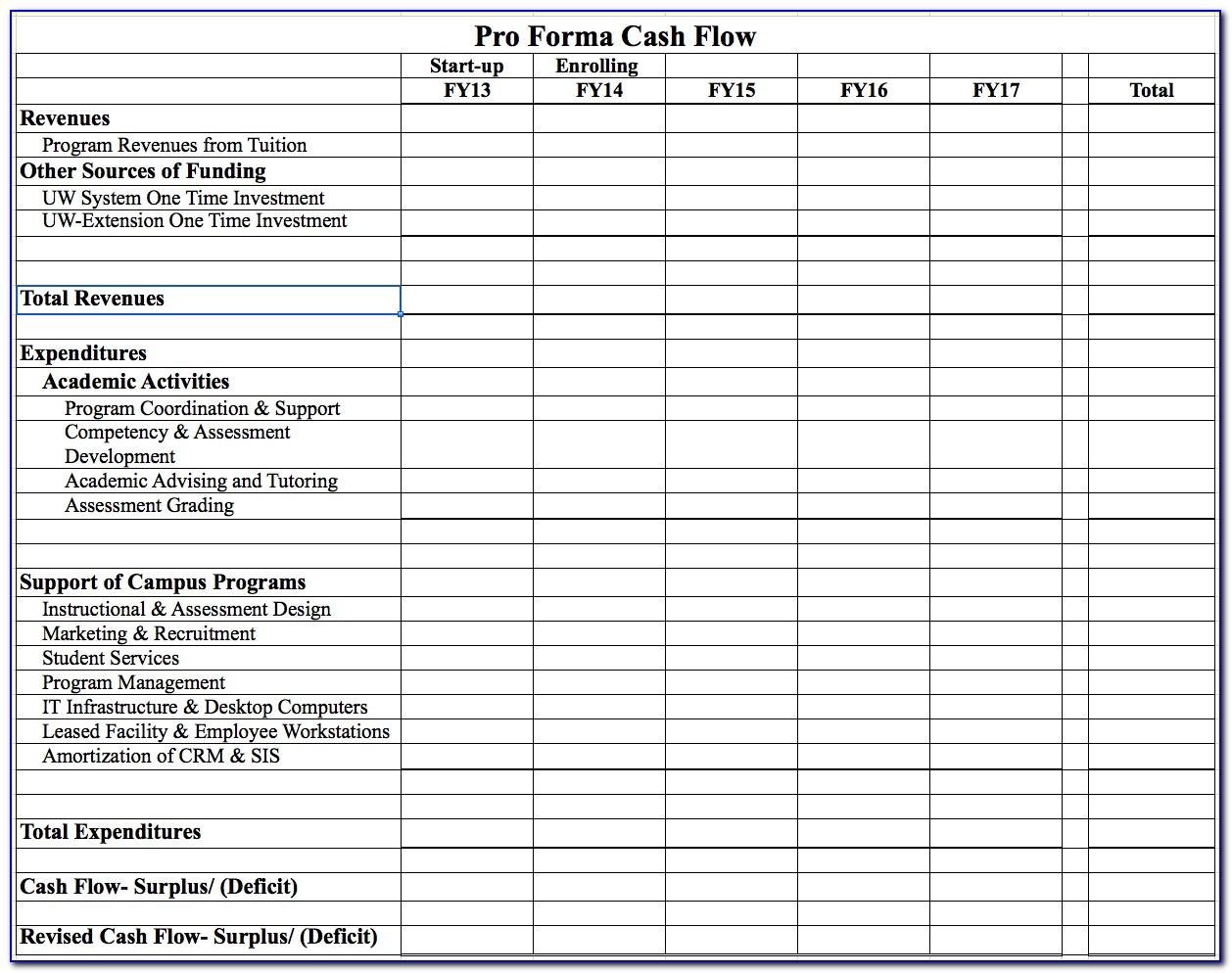

Efficiently manage your business finances with our pro forma cash flow statement template, guiding you through cash analysis, statement preparation, and approvals. Pro forma cash flow is a method by which companies calculate potential cash flows for future periods, typically under a specific set of conditions or assumptions. This pro forma statement can be part of a larger cash flow forecast used for decision making.

There's an issue and the page could not be loaded. This information may be developed as part of the annual budgeting or forecasting process, or. Projected future cash flow, which may also be called “pro forma cash flow,” or simply “cash flow,” is created to predict inflow and outflow of cash to your business.

Another type of pro forma document is a pro forma cash flow that shows both you and potential investors the outflows and inflows of your. Then, list your outgoing cash flows, such as the cost of. Page couldn't load • instagram.

Pro forma cash flow: Examine what would be a better choice than another to use during forecasting. Cash inflows refer to the.

Using pro forma cash flow to make predictions. A pro forma cash flow statement refers to a type of cash flow statement. A pro forma cash flow statement is a way to project expected cash inflow and outflow over a set period, which is similar to a typical.

Your projected cash flow can give you a few different insights. The board of directors proposes that no dividend be paid. When drafting this statement, businesses project the cash inflow and outflow expected.