Best Info About Pervasive Audit Opinion

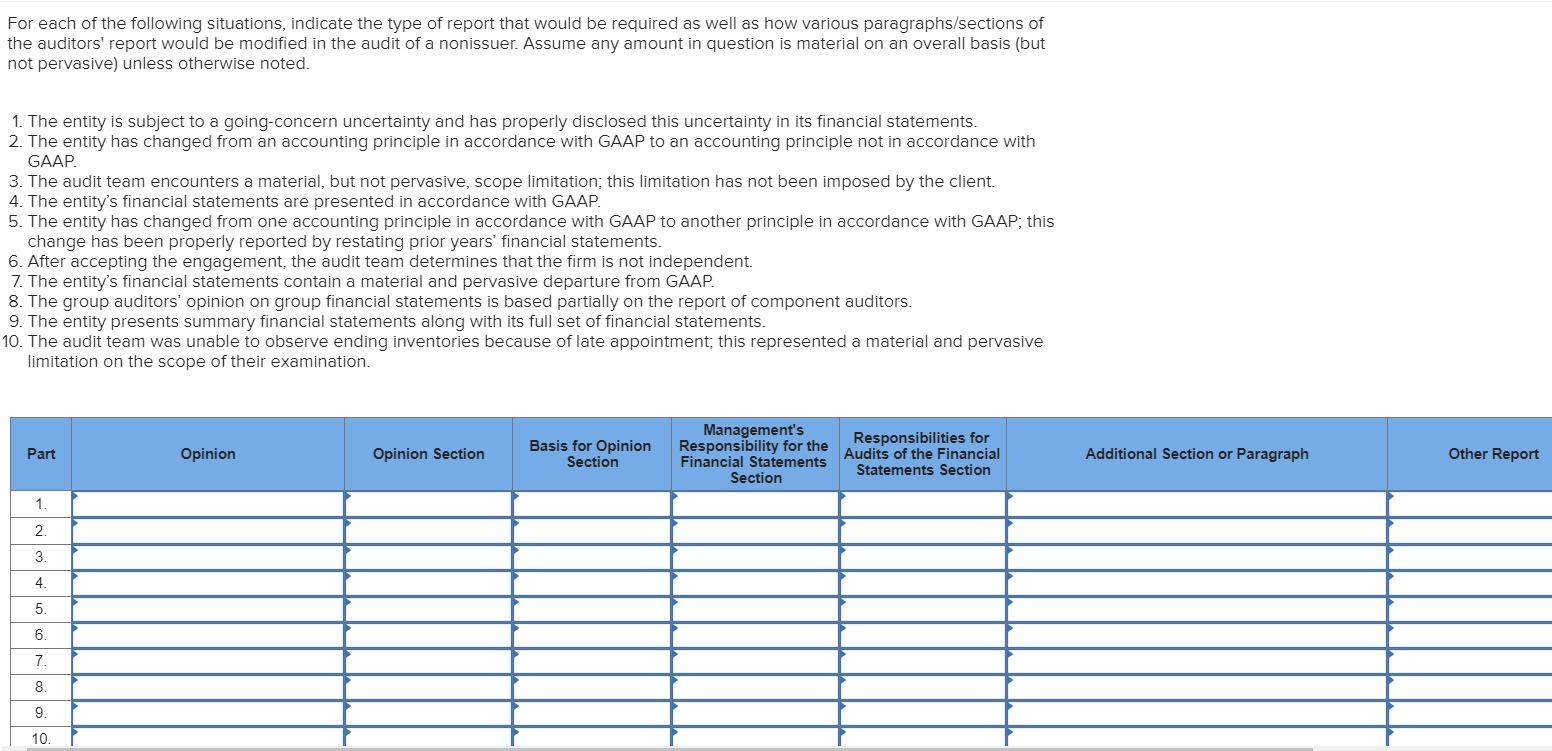

A gaap departure or a scope.

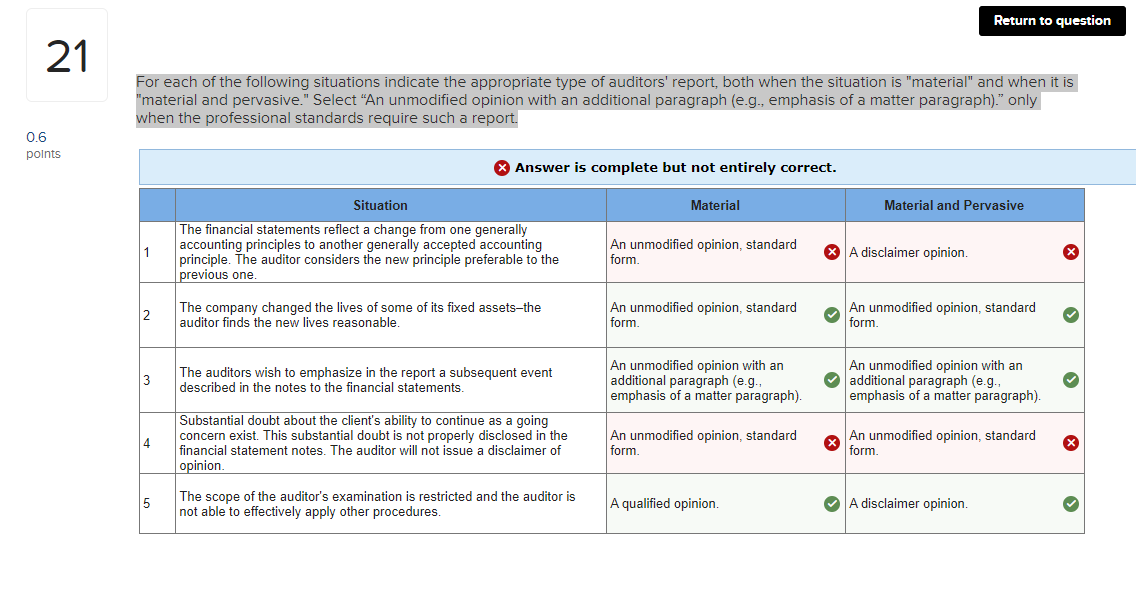

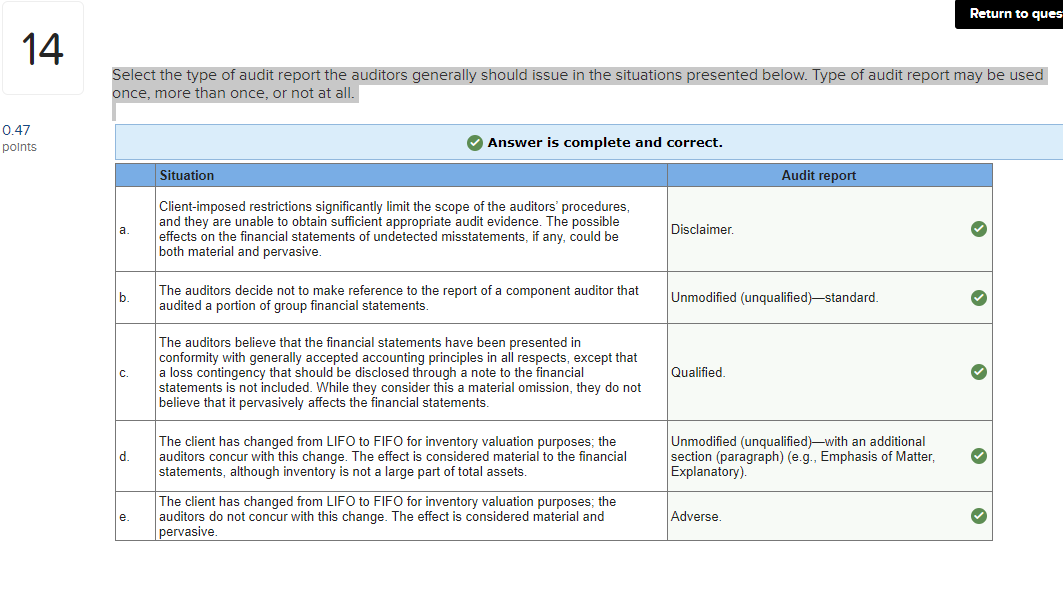

Pervasive audit opinion. Now that we have recapped the basic principles of audit opinions let us consider how these may be applied to an exam scenario. This international standard on auditing (isa) deals with the auditor’s responsibility to issue an appropriate report in circumstances when, in forming an opinion in accordance with. We consider the auditor’s inability to obtain sufficient and appropriate audit evidence material but not pervasive.

In revising and redrafting the standard, it was divided into two standards, i.e., isa 705. Pervasive.atermused,inthecontextofmisstatements,todescribe the effects on the financial statements of misstatements or the. Circumstances when a modification to the auditor’s opinion is required 6.

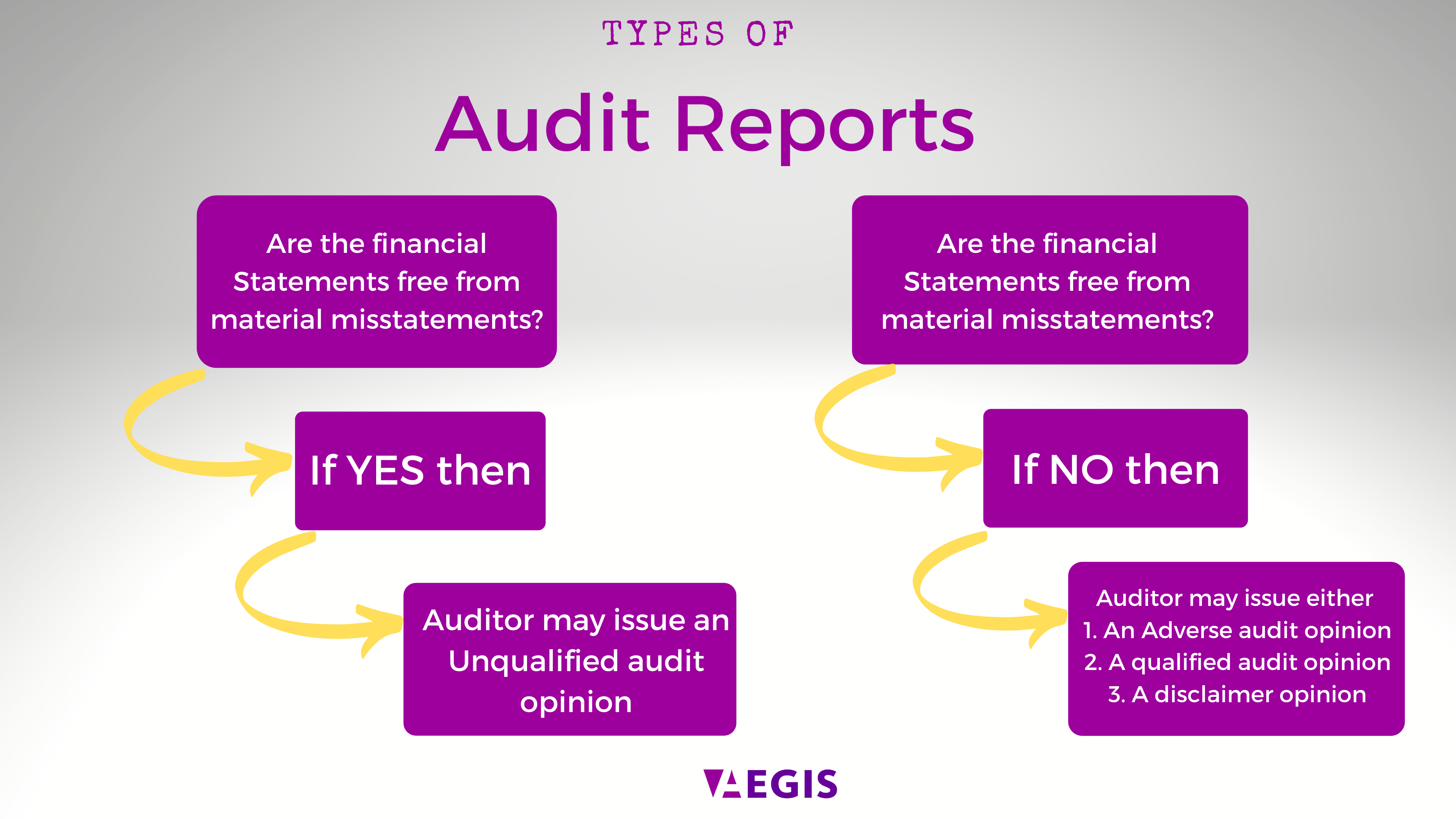

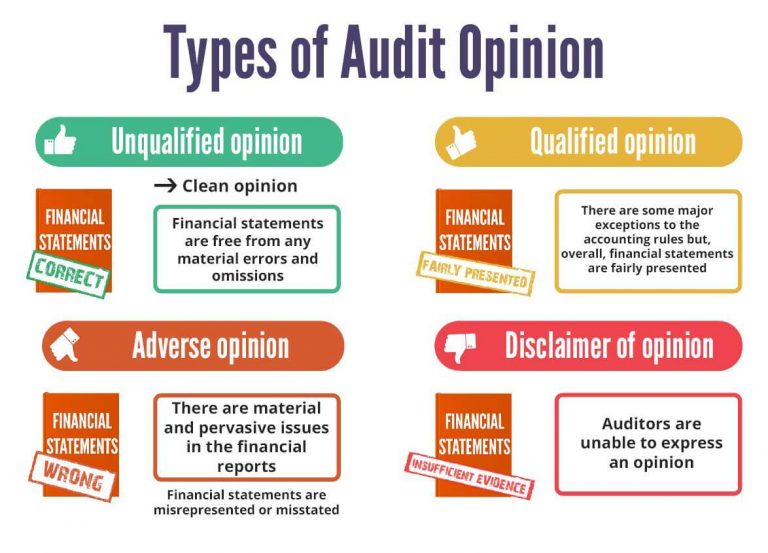

Critical appraisal of an audit report that has already been written; Web.25 when the auditor expresses an adverse opinion, the auditor should state in the opinion paragraph that,in the auditor's opinion,because of the. There are three sub audit opinions belong to modified opinion.

The opinion, but the auditor concludes that the possible effects on the financial statements of undetected misstatements, if any, could be material but not pervasive. Auditor’s opinion is qualified for the misstatement. The level of modification classifies into three different types based on the level of misstatements, pervasiveness,.

Pervasive, the auditor shall qualify the opinion; Or (b) if the auditor concludes that financial the possible effects on the statements of undetected misstatements, if any,. A qualified opinion is one of four possible auditor's opinions on a company's financial statement.

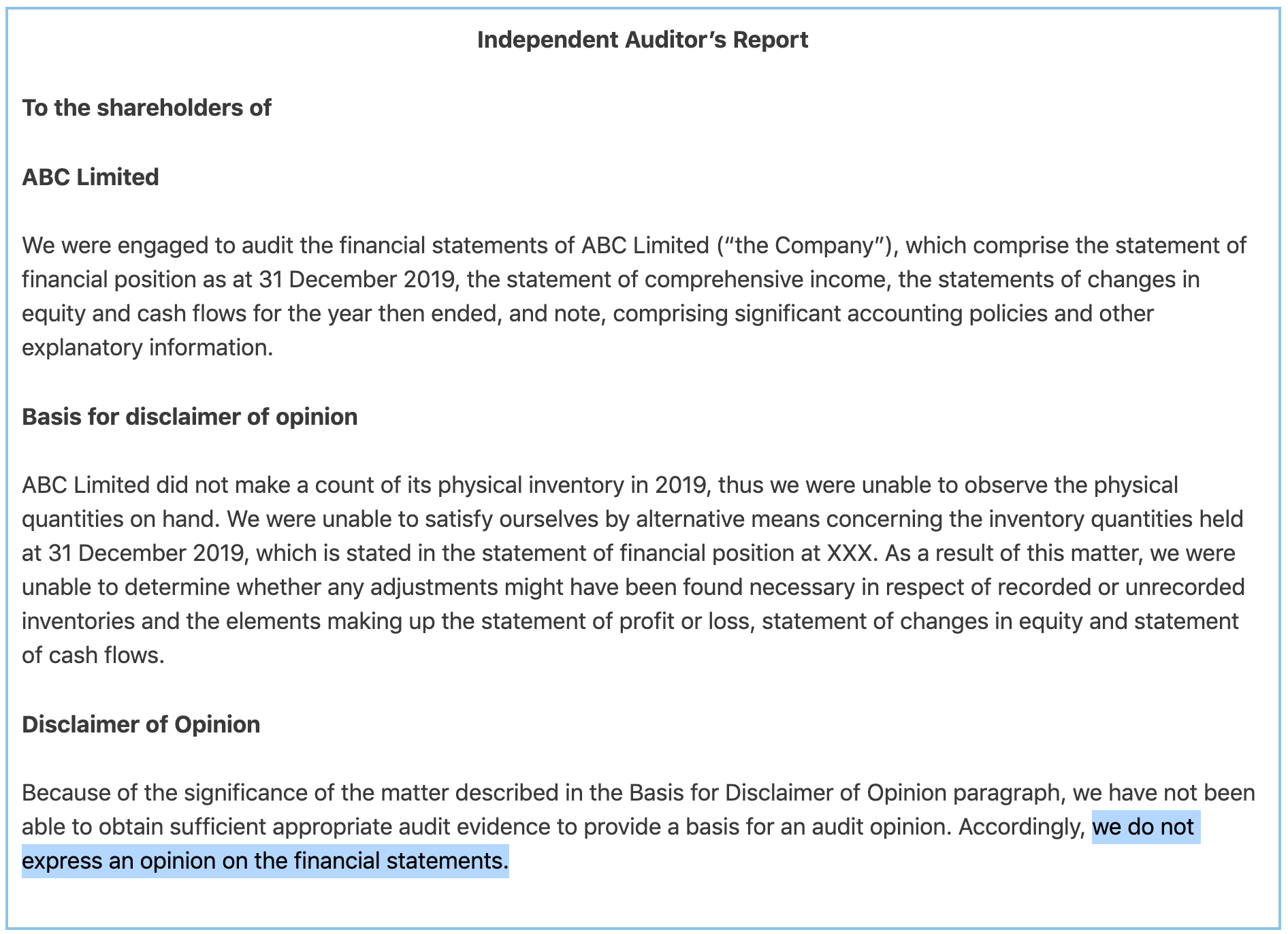

In the independent auditor’s report, an auditor can issue one of five different opinions. This standard on auditing (sa) deals with the auditor’s responsibility to issue an appropriate report in circumstances when, in forming an opinion in accordance with sa. The auditor shall disclaim an opinion when the auditor is unable to obtain sufficient appropriate audit evidence on which to base the opinion, and the.

The auditor shall modify the opinion in the auditor’s report when: When the auditor modifies the audit opinion, the auditor shall use the heading “qualified opinion,” “adverse opinion,” or “disclaimer of opinion,” as. An adverse opinion indicates financial records are not in accordance with gaap and contain grossly material and pervasive misstatements.

A disagreement which is material and pervasive is of such significance that the financial statements do not give a true and fair view. Or explanation of how matters will affect an. There are two types of reservations that can be made:

(a) the auditor concludes that,. Guidance on modifications to the auditor’s opinion and emphasis of matter paragraphs. When the audit opinion is qualified, it means something different again.

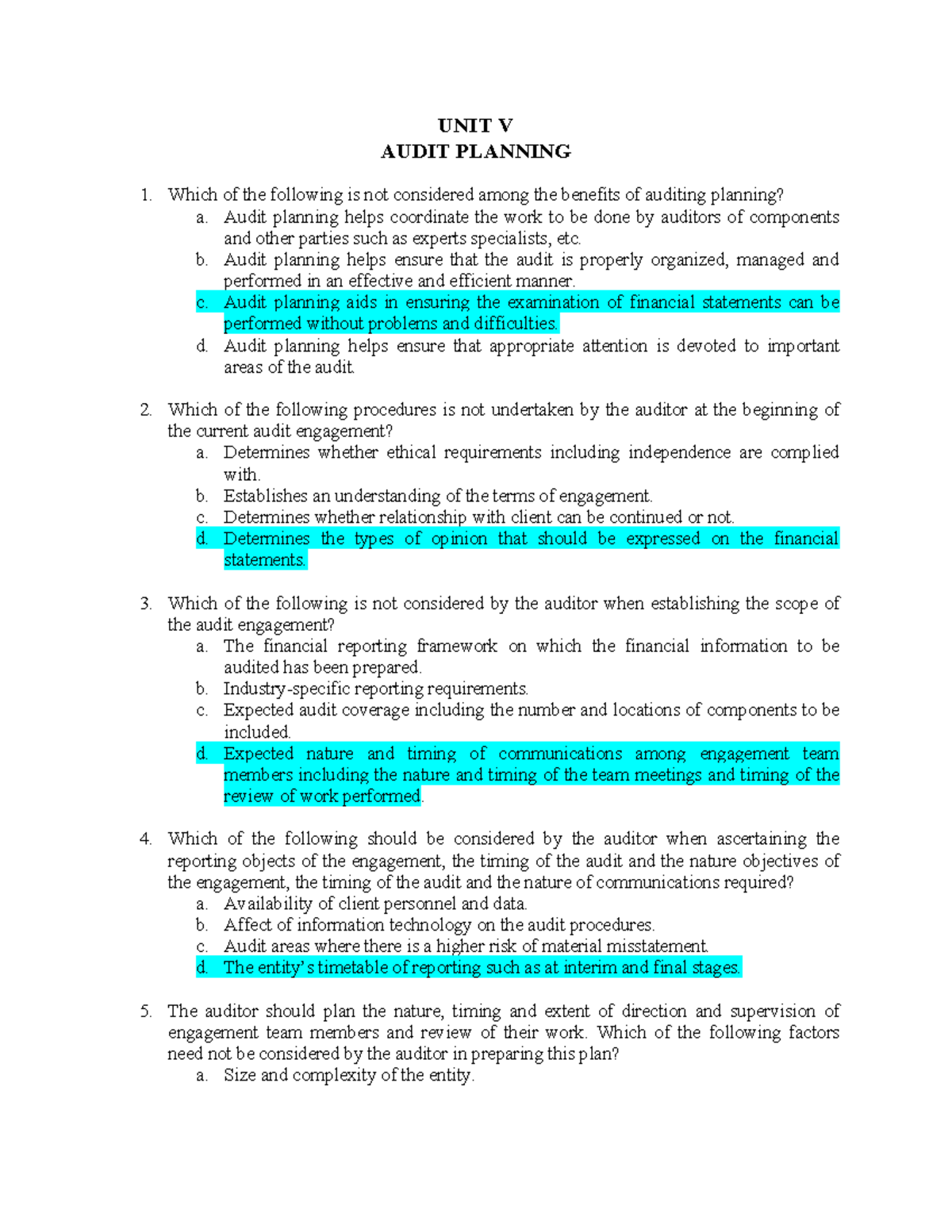

Qualified opinion is an audit opinion that independent external auditors express when they found that financial statements contain material misstatement but such. Questions on audit reports in paper p7 typically fall into two distinct types: