Exemplary Tips About Disclosure Of Dividends In Financial Statements

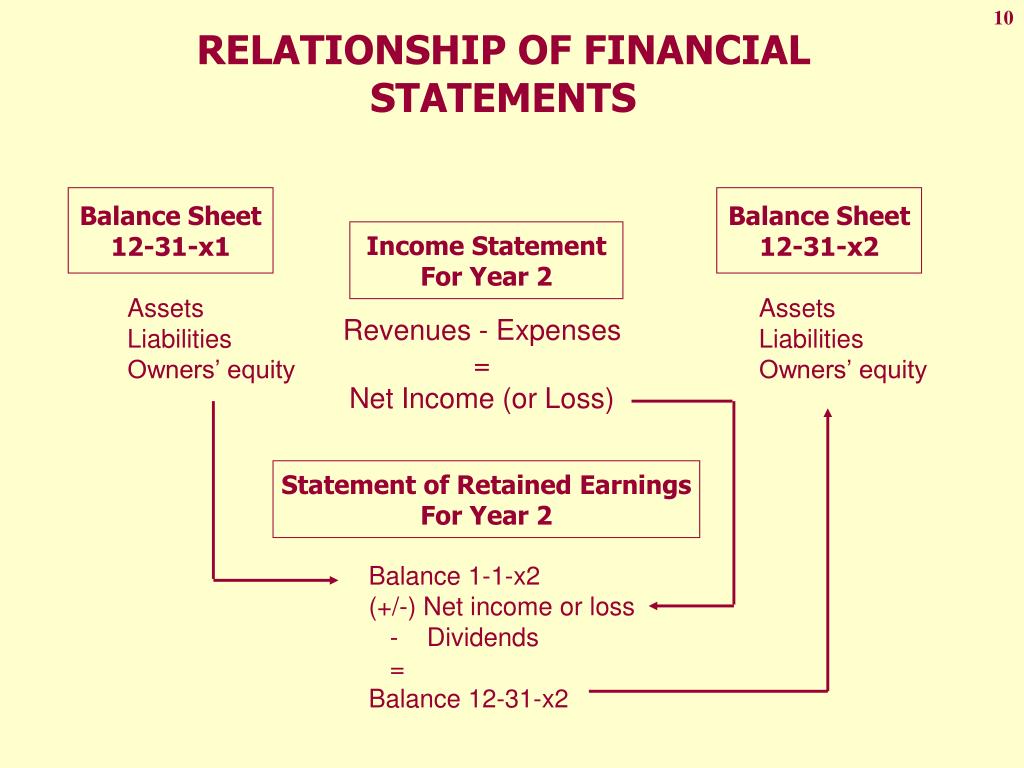

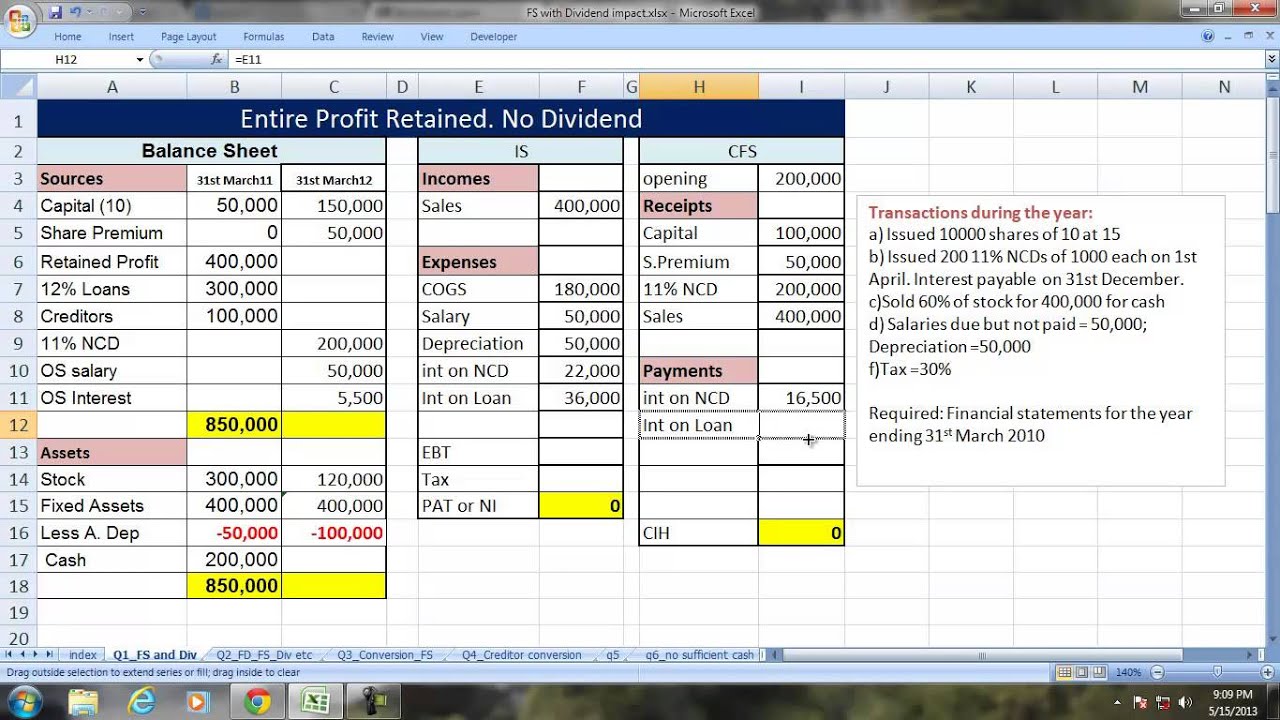

Before dividends are paid, there is no impact on the balance sheet.

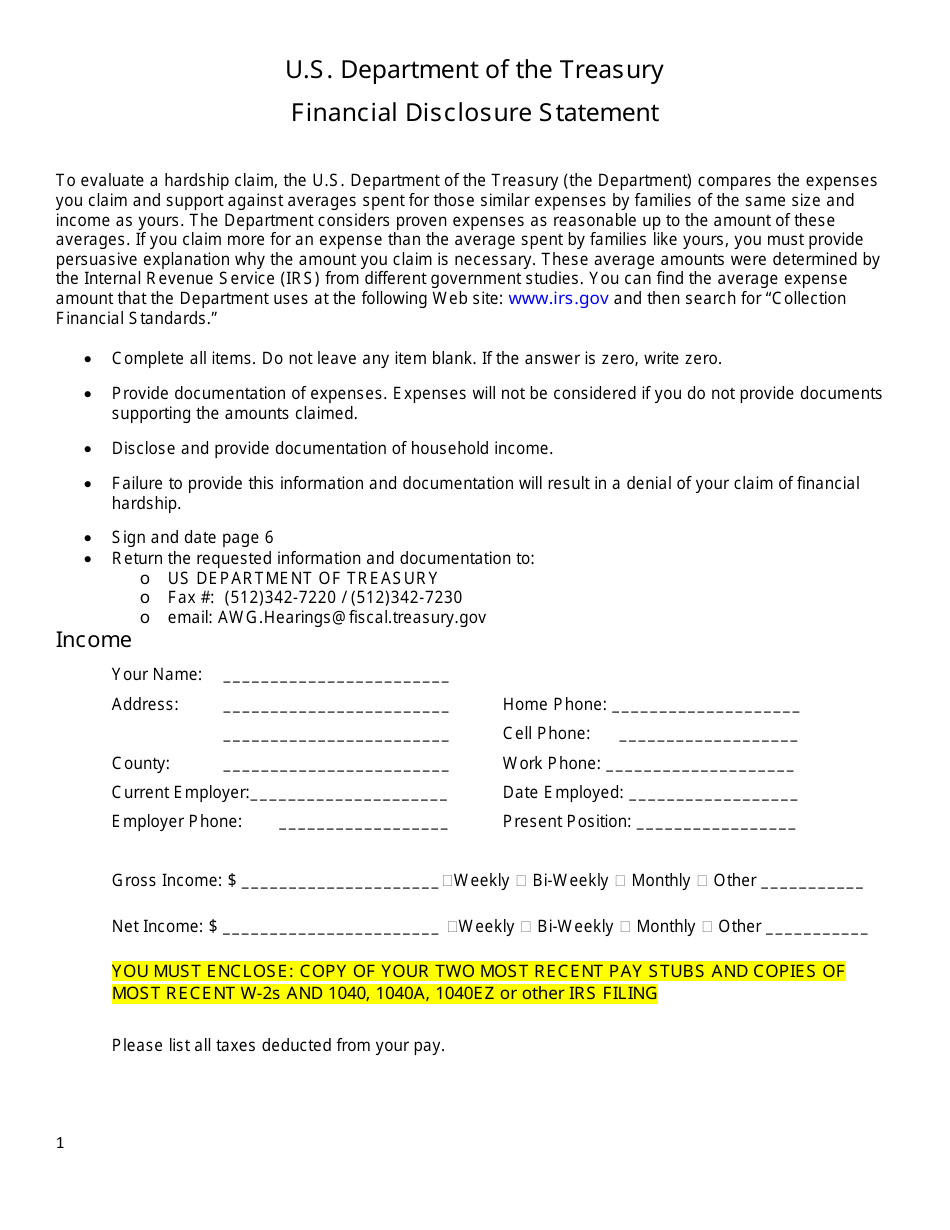

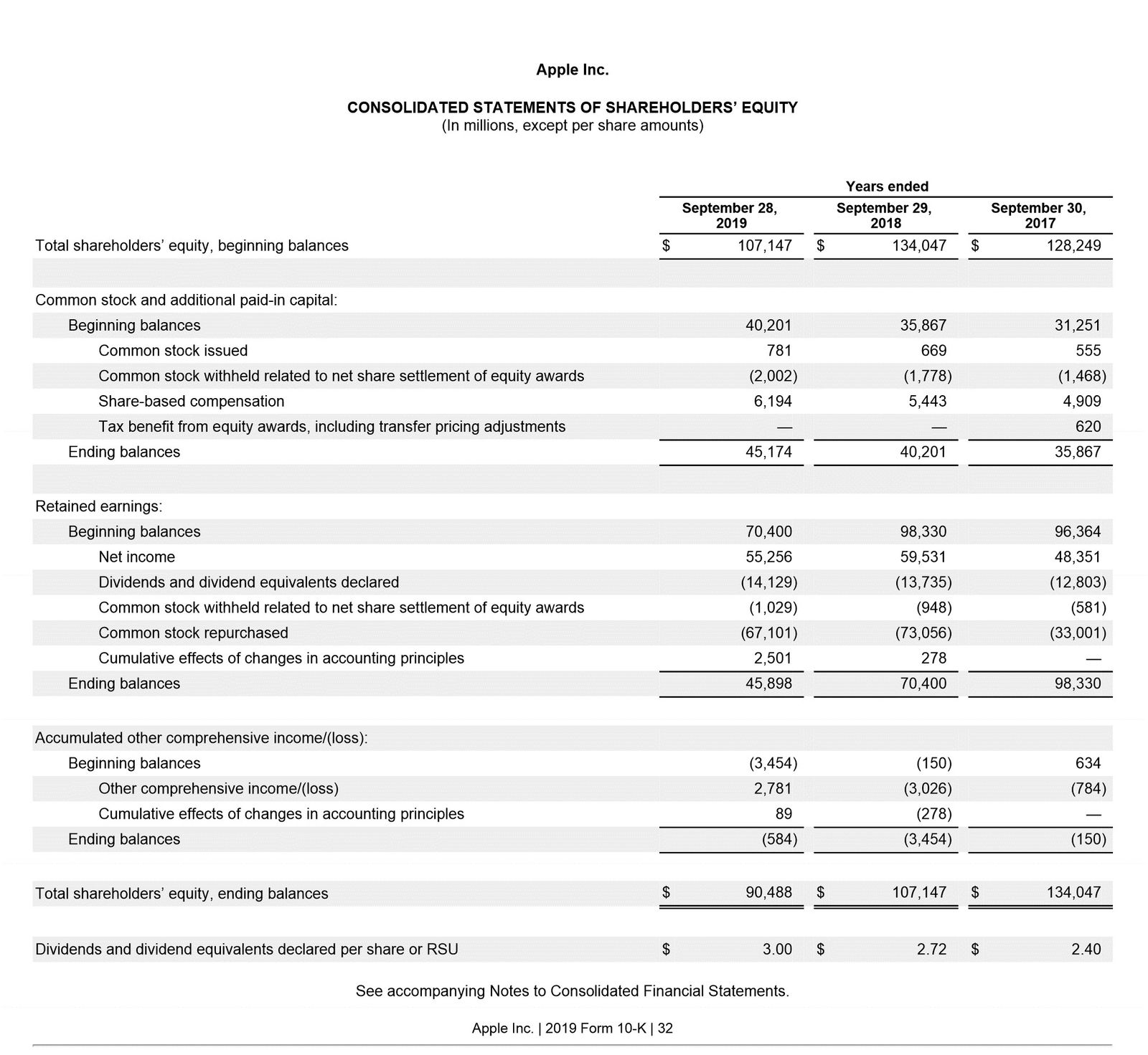

Disclosure of dividends in financial statements. Free cash flow before m&a and customer financing € 4.4 billion; A) today announced a quarterly dividend of 23.6 cents per share of common stock will. The substantial disclosure requirements for equity accounts result from the need to serve one of the primary user groups of financial statements:

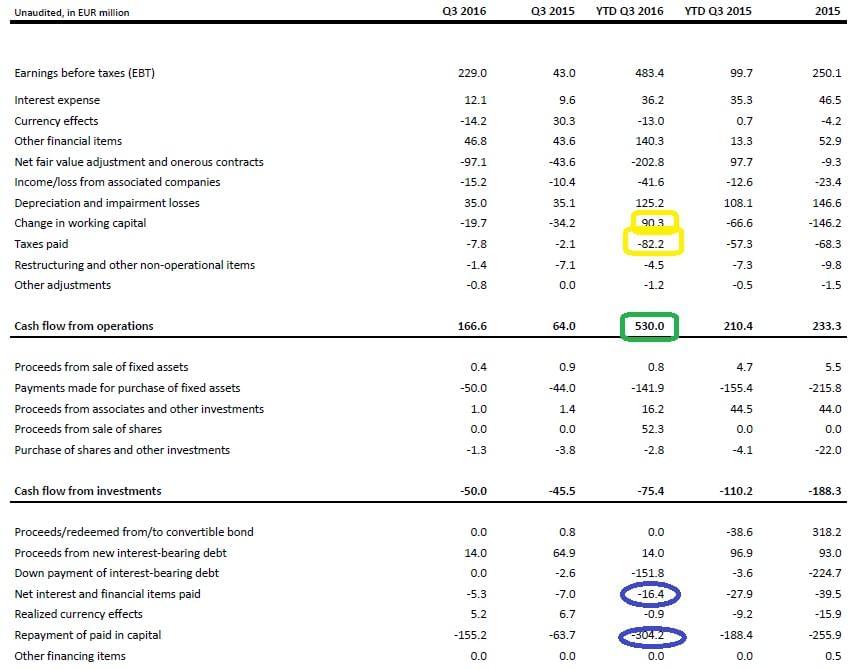

Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements. Record quarterly revenue of $22.1 billion, up 22% from q3, up 265%. Ias 1 requires that comparative information to be disclosed in respect of the previous period for all amounts reported in the financial statements, both on the face of the.

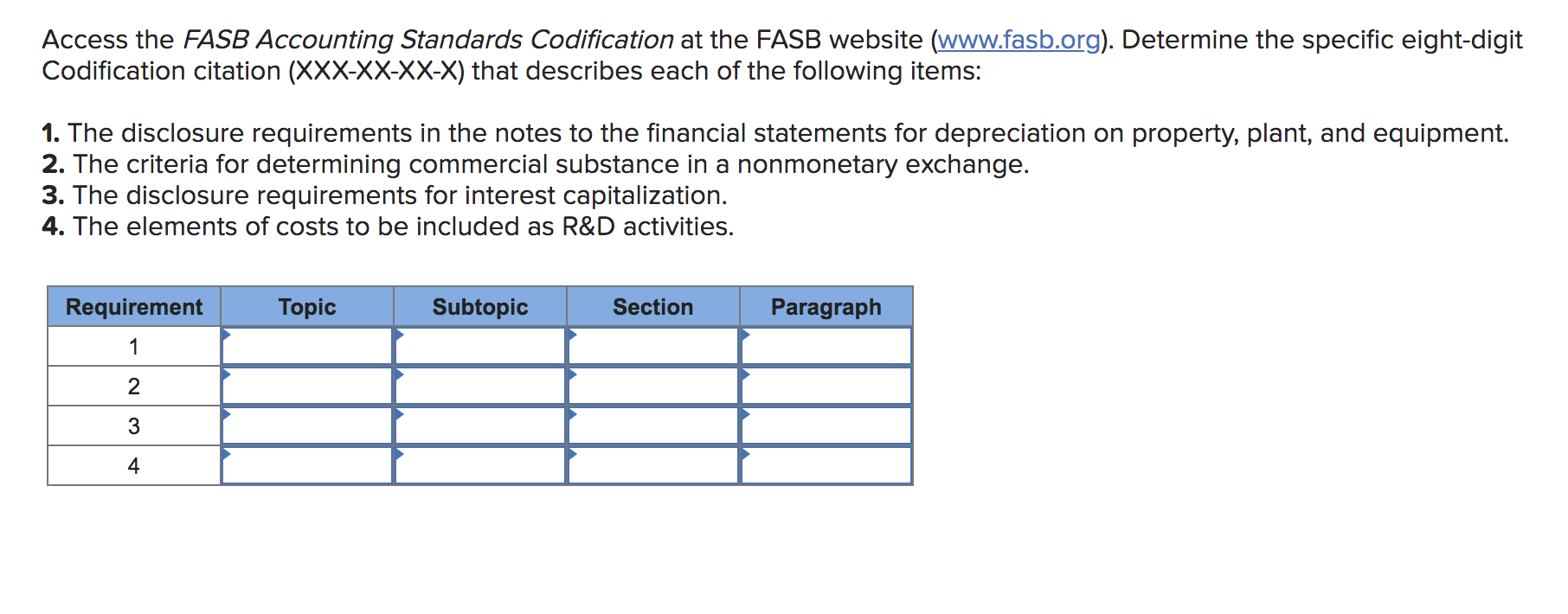

The objective of this standard is to prescribe: Separate financial statements, governed by ias 27, are distinct type of financial statements where investments in subsidiaries, joint ventures, and associates. These amendments introduced new disclosure requirements for investment entities.

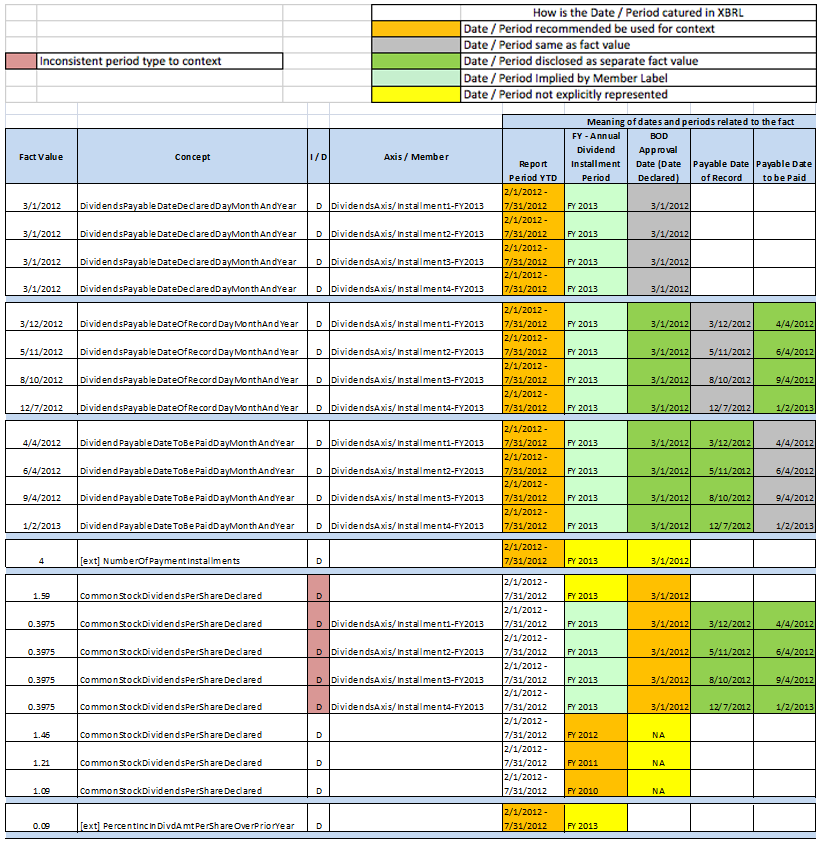

Cash flows from financing activities dividends paid (217.0) (232.3) proceeds from borrowings c6 77.0 226.5 repayment of borrowings c6 (77.0) (176.5) payment of lease. Statement of cash flows as a use of. How dividend is recorded and presented in the financial statements the dividends that a company pays out are recorded and presented in its financial statements in two.

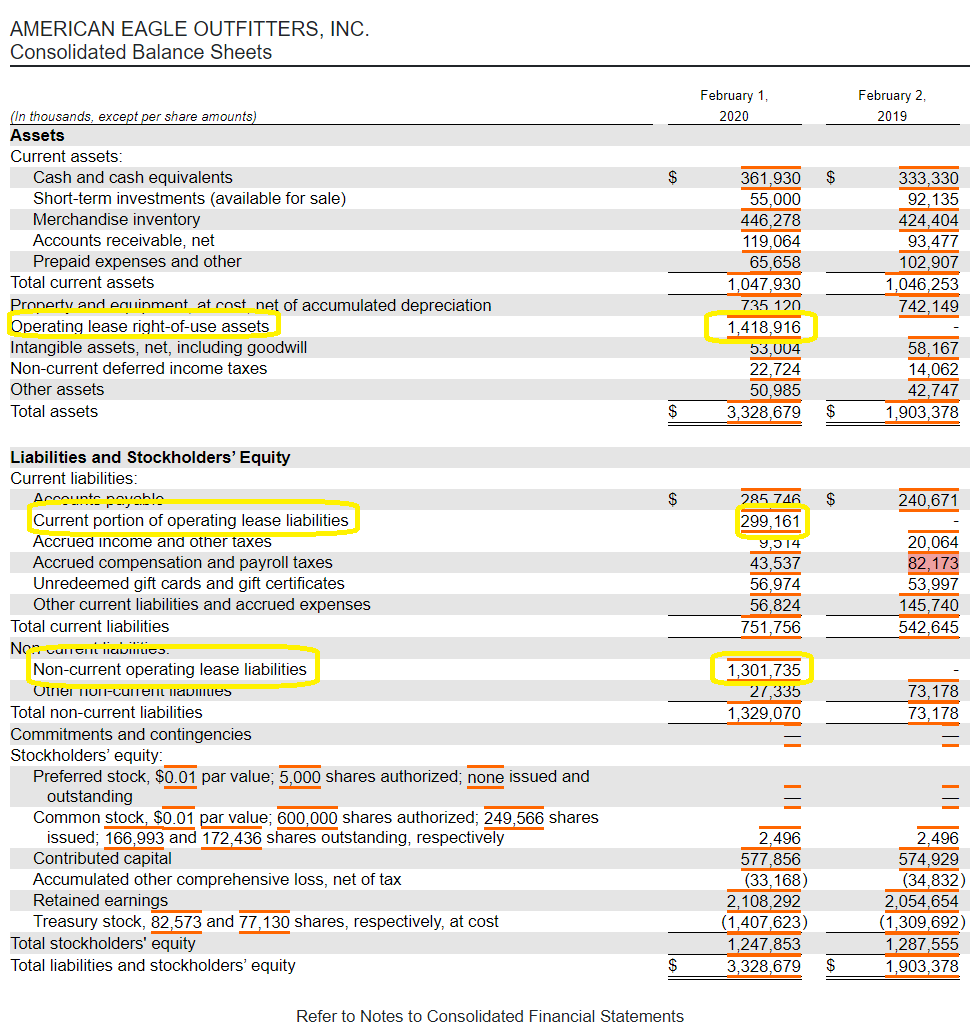

Be disclosed in financial statements (originally approved in 1977) and ias 13 presentation of current assets and current liabilities (approved in 1979). A regular quarterly cash dividend declared after the balance sheet. Paying the dividends reduces the amount of retained earnings stated in the balance sheet.

This chapter introduces the general concepts of financial statement presentation and disclosure that. The following news release should be read in conjunction with management's discussion and analysis (md&a), the consolidated financial statements and related. Ias 1 presentation of financial statements requires the following in respect of dividends:

Ias 27 (as amended in 2011) outlines the accounting and disclosure requirements for 'separate financial statements', which are financial statements. When an entity should adjust its financial statements for events after the reporting period; Dividends in the balance sheet.

Simply reserving cash for a future dividend payment has no. Paragraph 33 of ias 7 states that interest paid and interest and dividends received are normally classified as operating cash flows by a financial institution. Santa clara, calif., february 22, 2024.

Without disclosure of it, the financial statements would be misleading. When a reporting entity pays such a dividend, usually on partial or complete dissolution, it should advise the shareholders and disclose the facts in the financial statements. Annual audited disclosure of a company’s distributable profits (that is, the company’s.

Usfinancial statement presentation guide 1.1. Nvidia announces financial results for fourth quarter and fiscal 2024. The disclosures relating to the statement on distributions are:

![Disclosure initiative — Primary Financial Statements [ED]](https://www.iasplus.com/en-ca/images/publications/september-2017-iasb-update)

:max_bytes(150000):strip_icc()/Clipboard02-5c6ecfab46e0fb0001b6815b.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)