Awe-Inspiring Examples Of Info About Monthly Cash Flow Budget

Businesses need to monitor and.

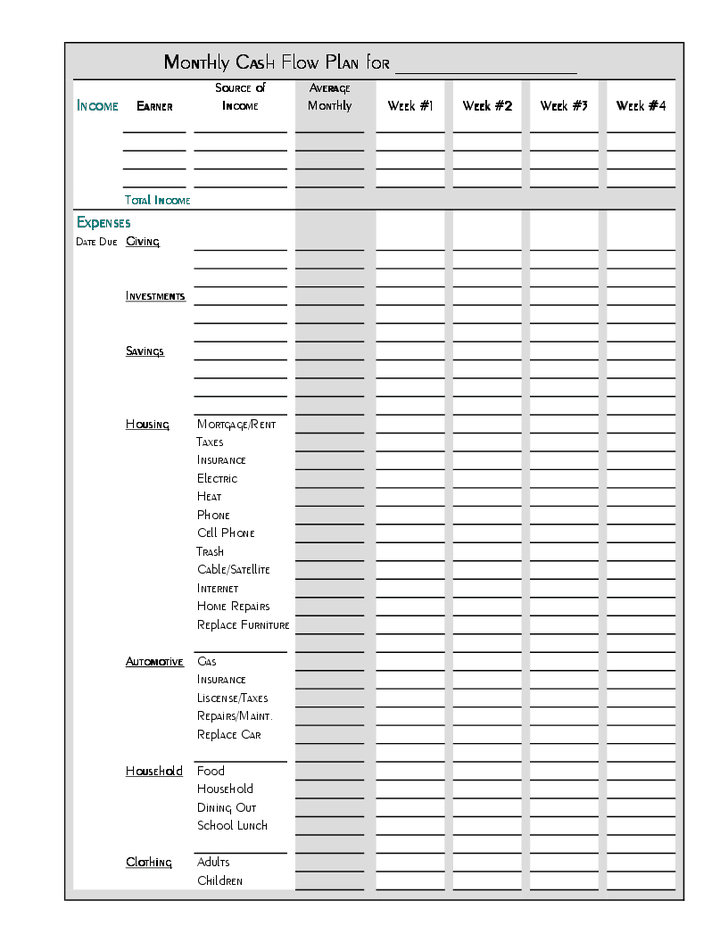

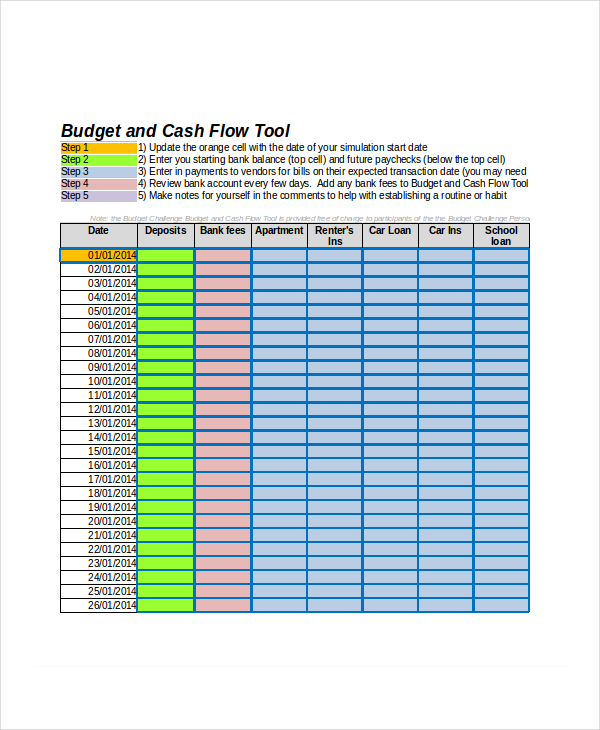

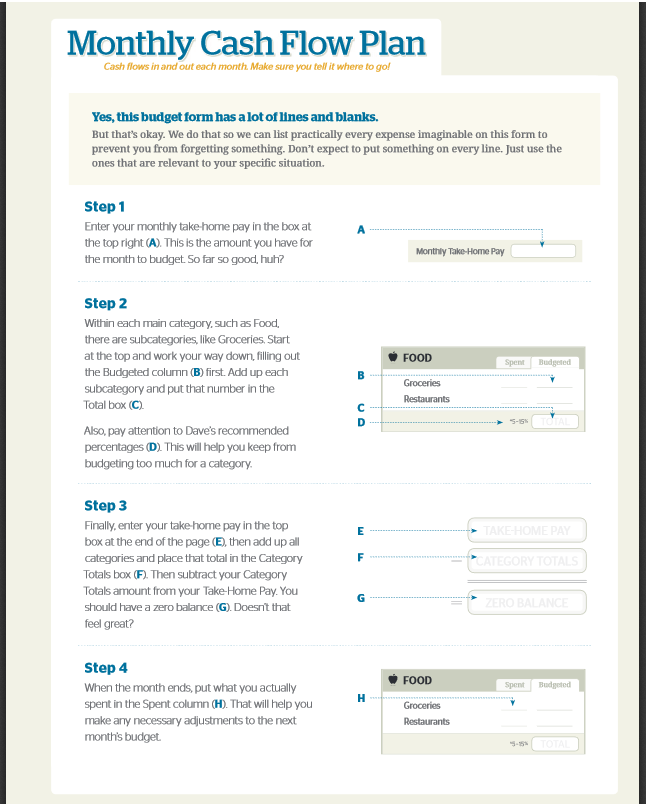

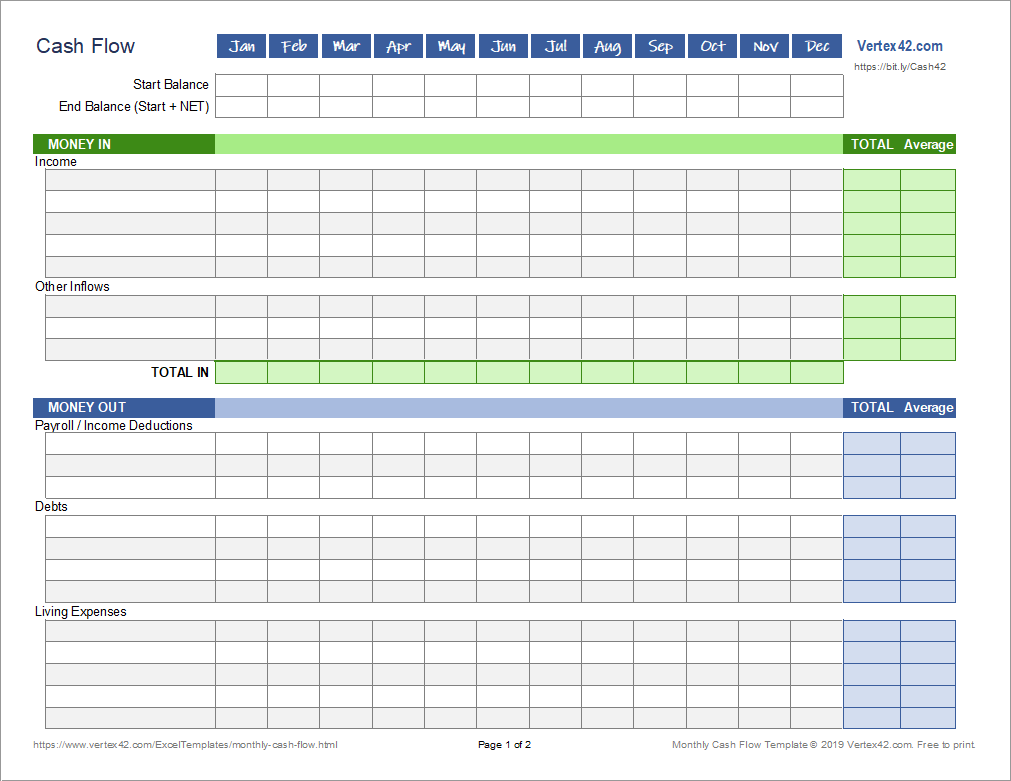

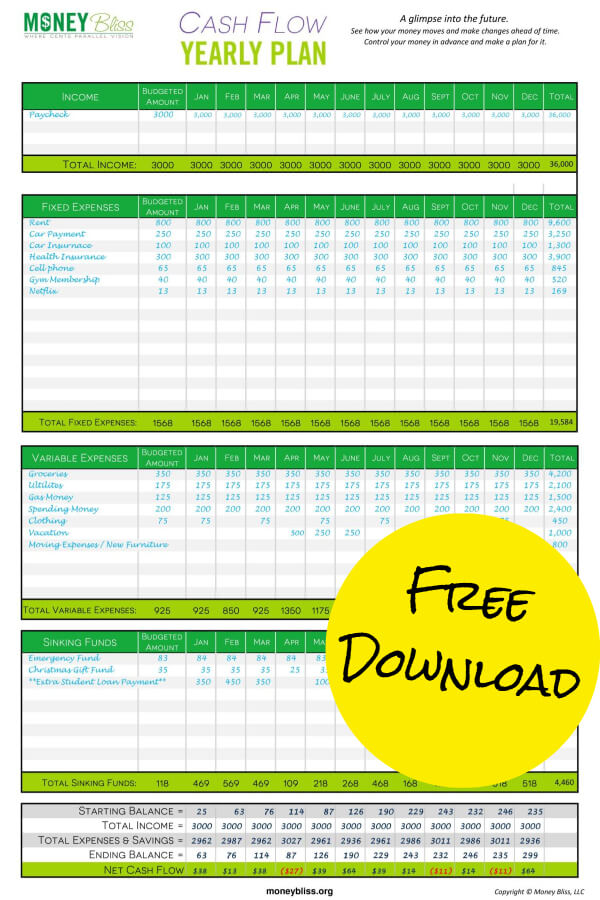

Monthly cash flow budget. Use the monthly cash flow form to set up your basic monthly budget. How to do cash flow budgeting? You can use the information to see if you have enough cash.

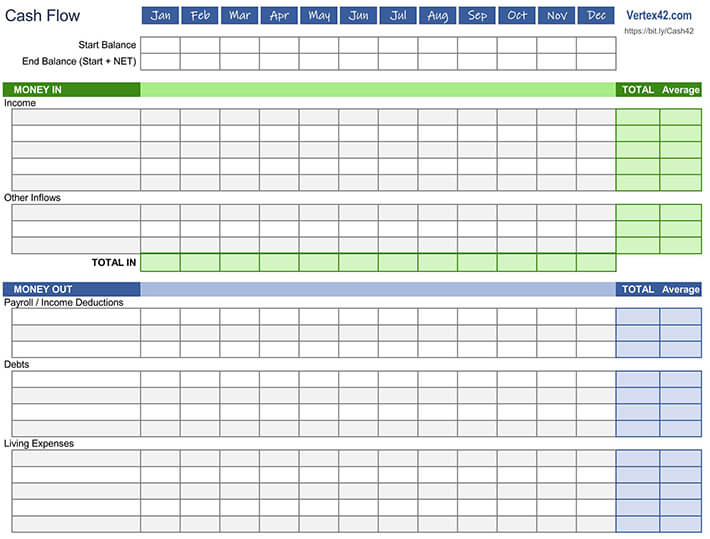

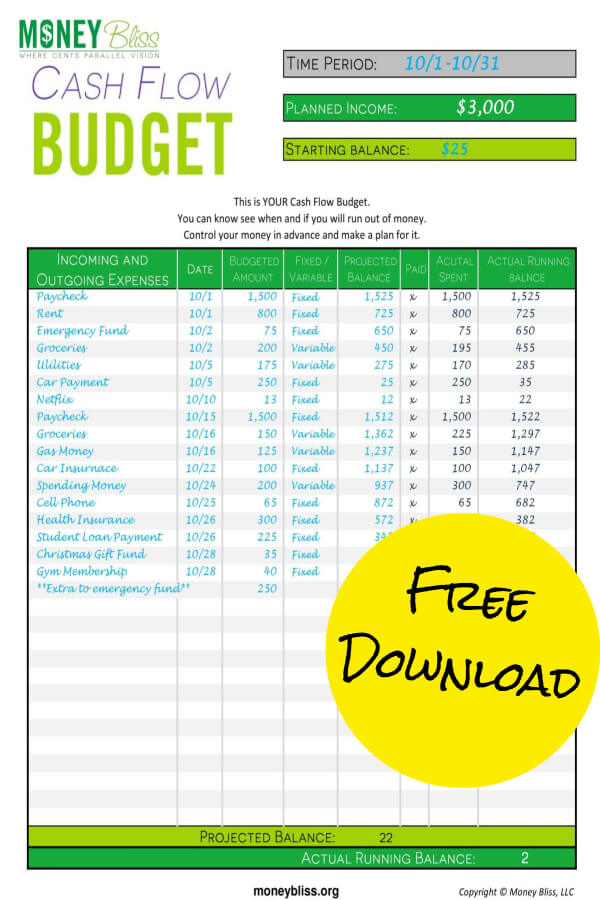

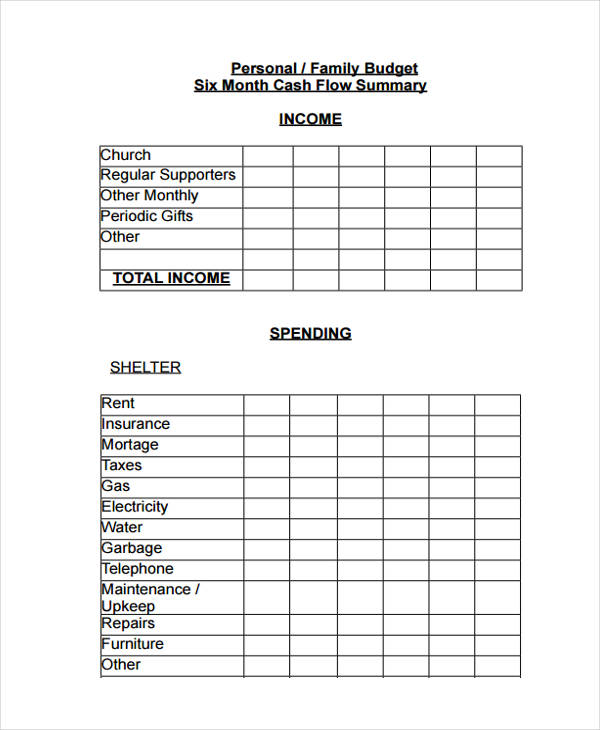

A cash flow budget is a financial plan that predicts cash inflows and outflows over a specific period, usually a month, quarterly, or yearly. Here's the meaning of each term and learn how they're different. Your timeframe can be monthly,.

Cash flow is the heartbeat of your. Managing your monthly cashflow balance your budget. A cash flow budget estimates your business’s cash flow over a specific time period.

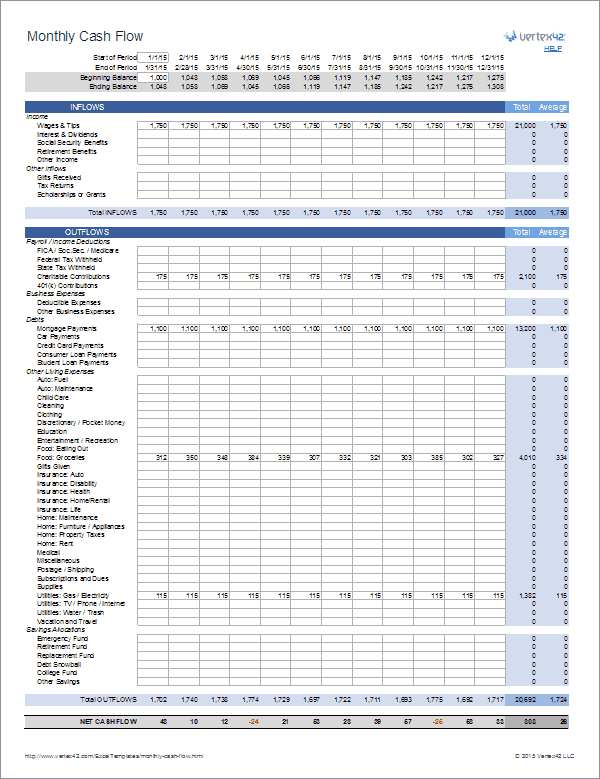

The key to making great decisions is found in managing your future budgets and forecasting future cash flow. It ensures the firm’s cash sufficiency for operations and expenses while identifying and resolving cash flow issues. Before you can build a cash flow budget,.

The gfecra captures valuation gains on south africa’s foreign exchange reserves as the rand has moved from r10/us$1 in 2014 to r19/us$1 currently. Depending on your income, this can. When you decide to make a new.

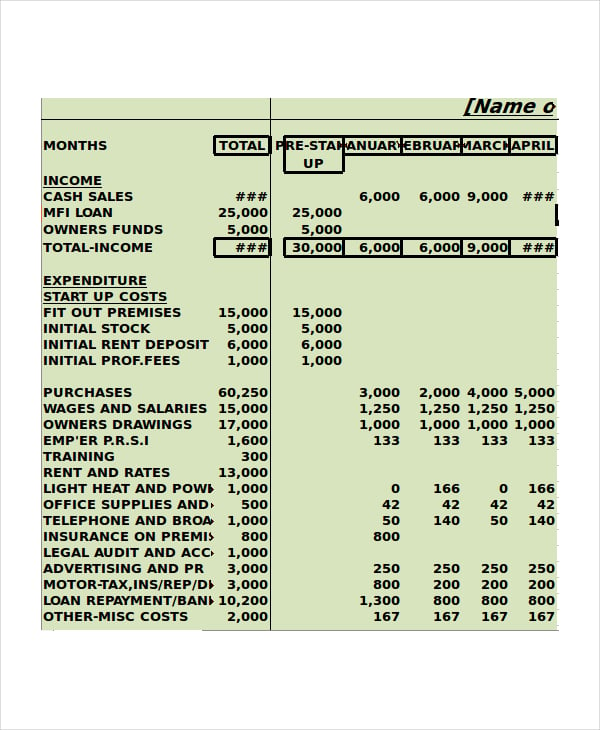

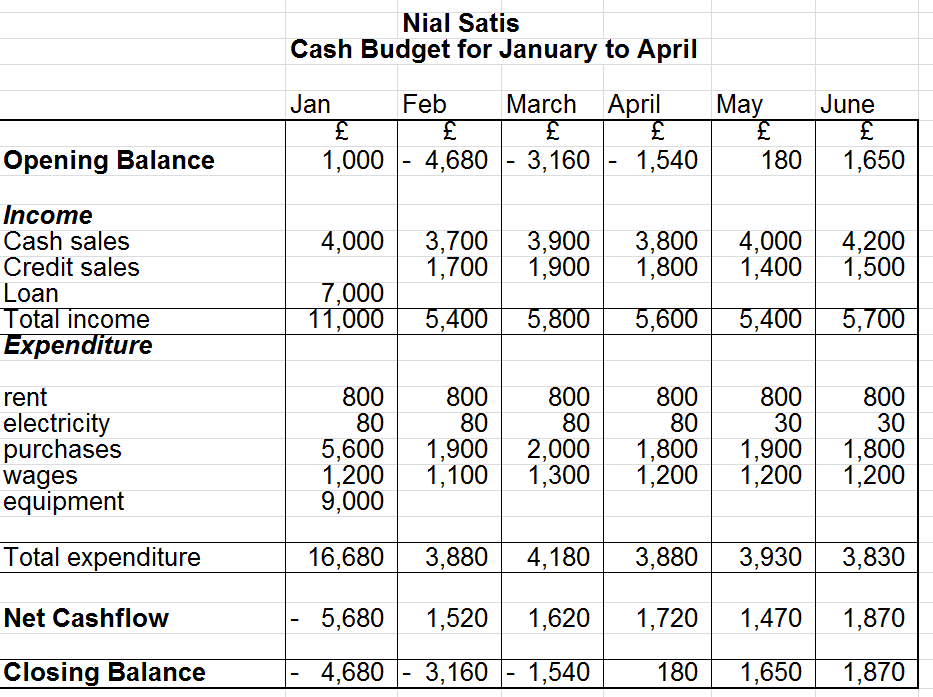

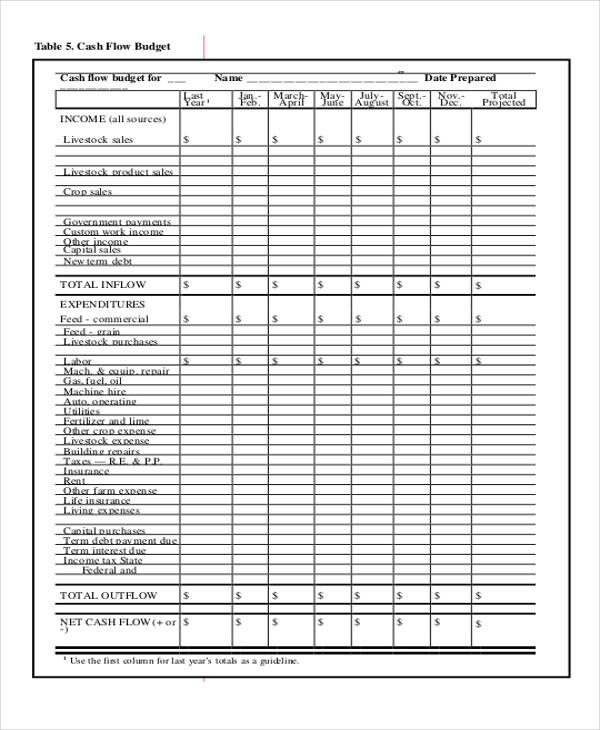

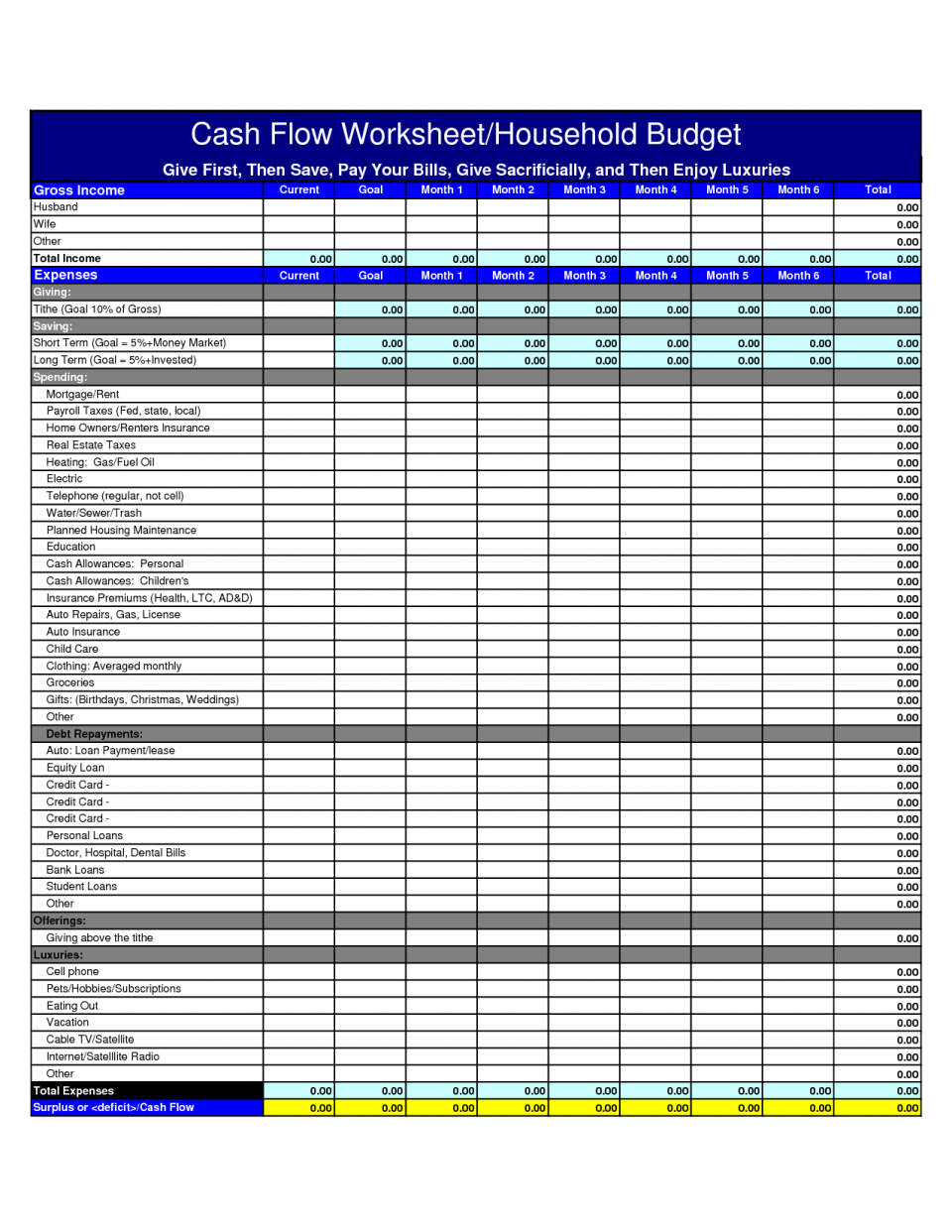

Creating a monthly cash budget helps you, the business owner, estimate how much income your business will take in during the coming month, as well as how much the. A cash flow budget is an estimation of the flow of cash into and out of a business over a set period of time. The template includes several sections:

A cash flow statement, also referred to as a statement of cash flows, shows the flow of funds to and from a business, organization, or individual. Remember, adaptability is a must in budget management, as business conditions are rarely static. This worksheet is for people who don't like the.

Download your free worksheet and forecast your monthly bills. Cash flow budgeting 101. Department of agriculture, americans spent between $424 and $1,309 on food each month in 2022.

According to the u.s. A cash flow budget is all about tracking the timing of your income and expenses to make sure you have enough from week to week. This form helps you prioritize while giving every dollar a name.

There are really only two things to consider when creating any budget: A cash budget is the written financial plan made by the business related to their cash receipts and payments in a given period. They can be weekly, monthly, quarterly or an annual.