Breathtaking Info About Valuation Balance Sheet Of Insurance Company

Find important definitions, questions, notes, meanings, examples, exercises and tests below.

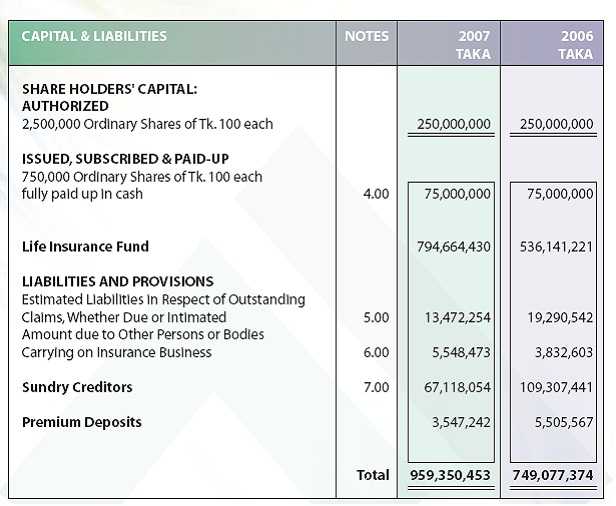

Valuation balance sheet of insurance company. Understanding the value attributed to certain activities of the insurance company, such as new sales and asset management. (a) the valuation balance sheet, (b) the net profit for the valuation period; Balance sheet as at 31 st march, 20….

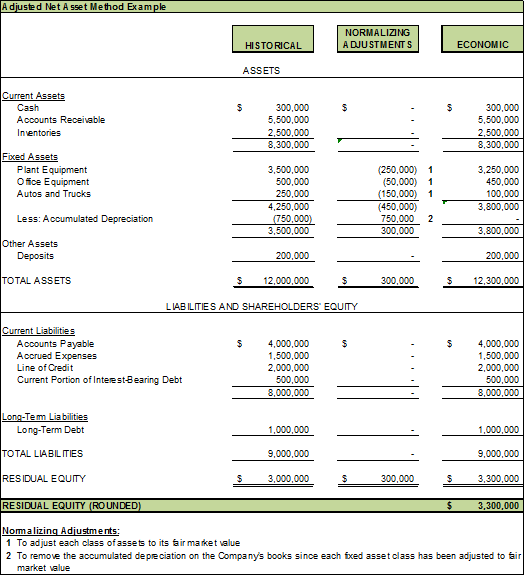

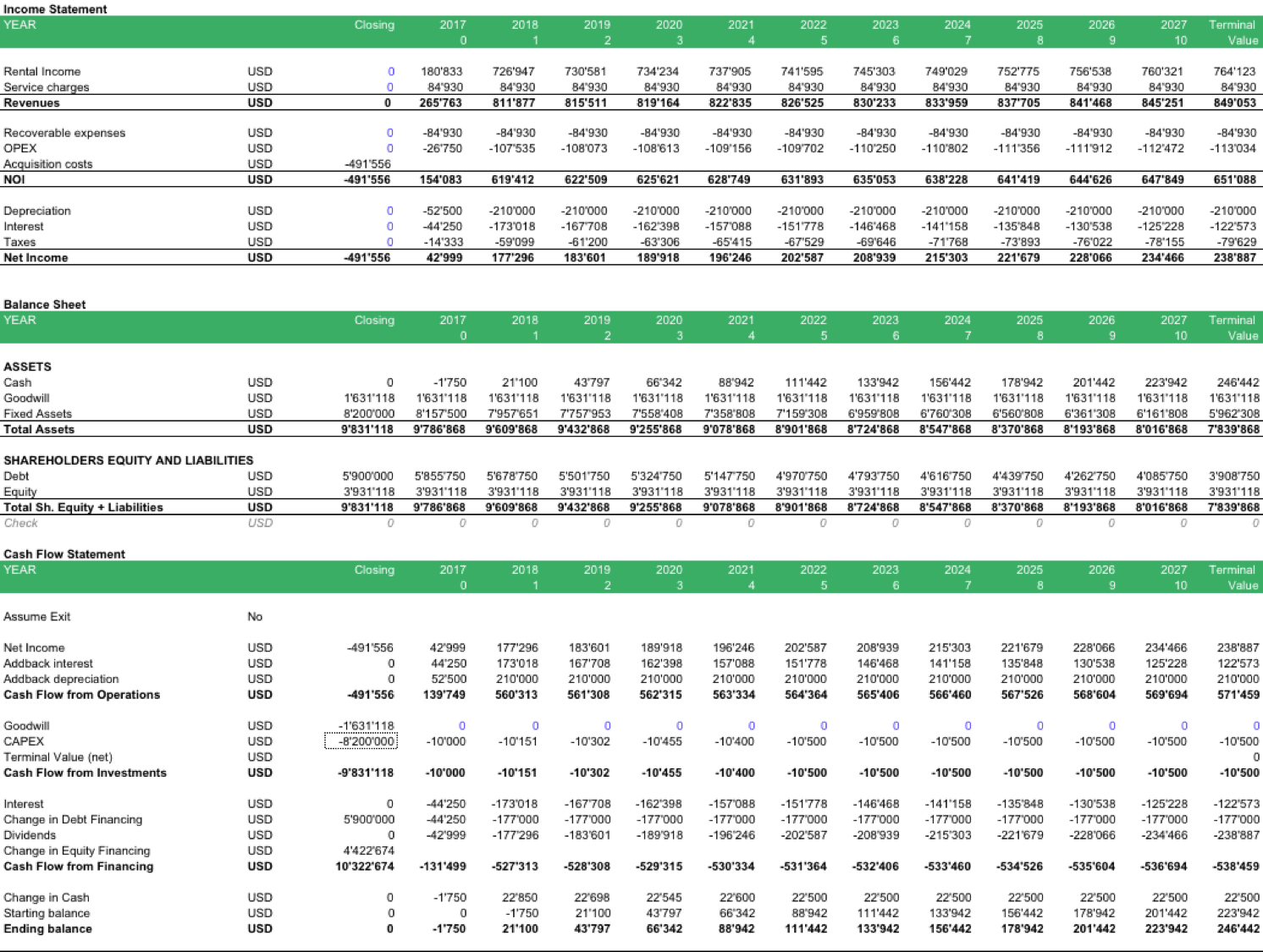

This is the net asset value (nav). Share save 8.8k views 2 years ago insurance company accounts this video deals with the computation of of profit in life insurance business which involves the preparation of valuation. A key multiple used in valuing insurance companies is the market value of equity (mve) / book value (bv) multiple (mve/bv).

Financial market movements not only impact income from invested assets, but also the value of assets carried at fair value on an insurer’s balance sheet. Got its valuation made once in every two. This article addresses the relevance of the balance sheet when conducting business.

Former president donald j. In case of insurance business, the valuation balance sheet is mostly prepared in case of life insurance business. Building block approach (bba) ifrs 17 :

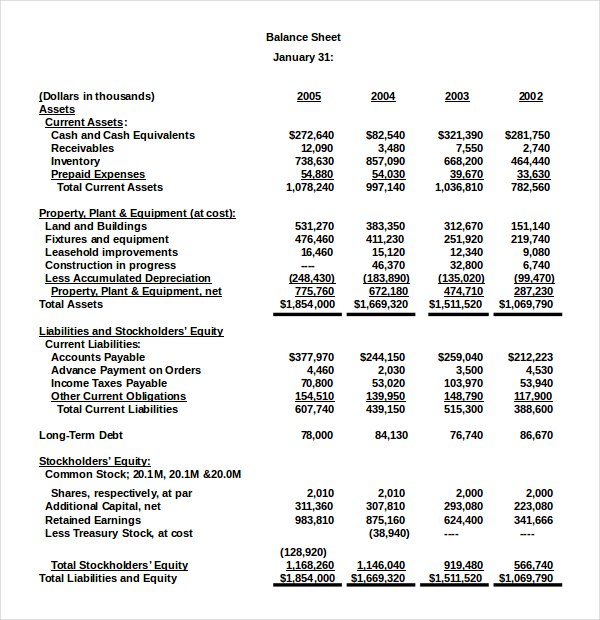

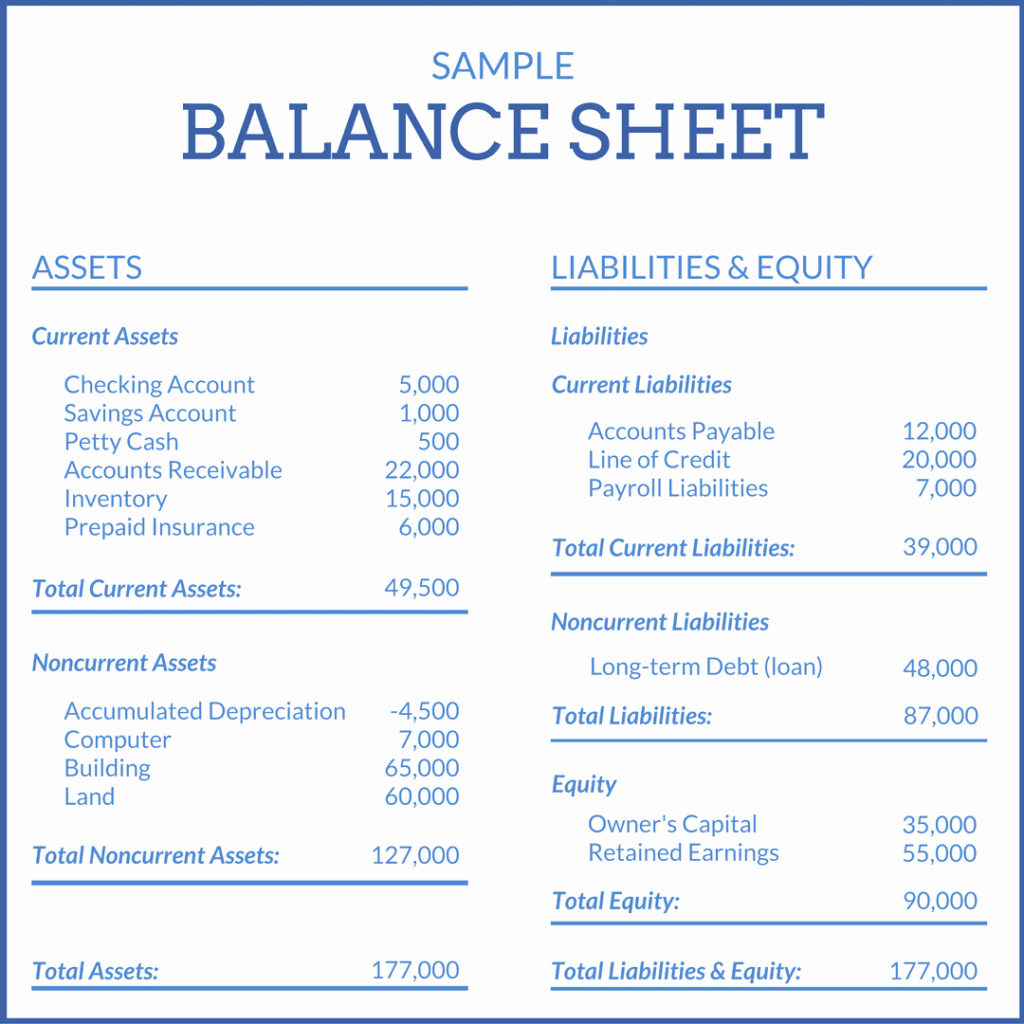

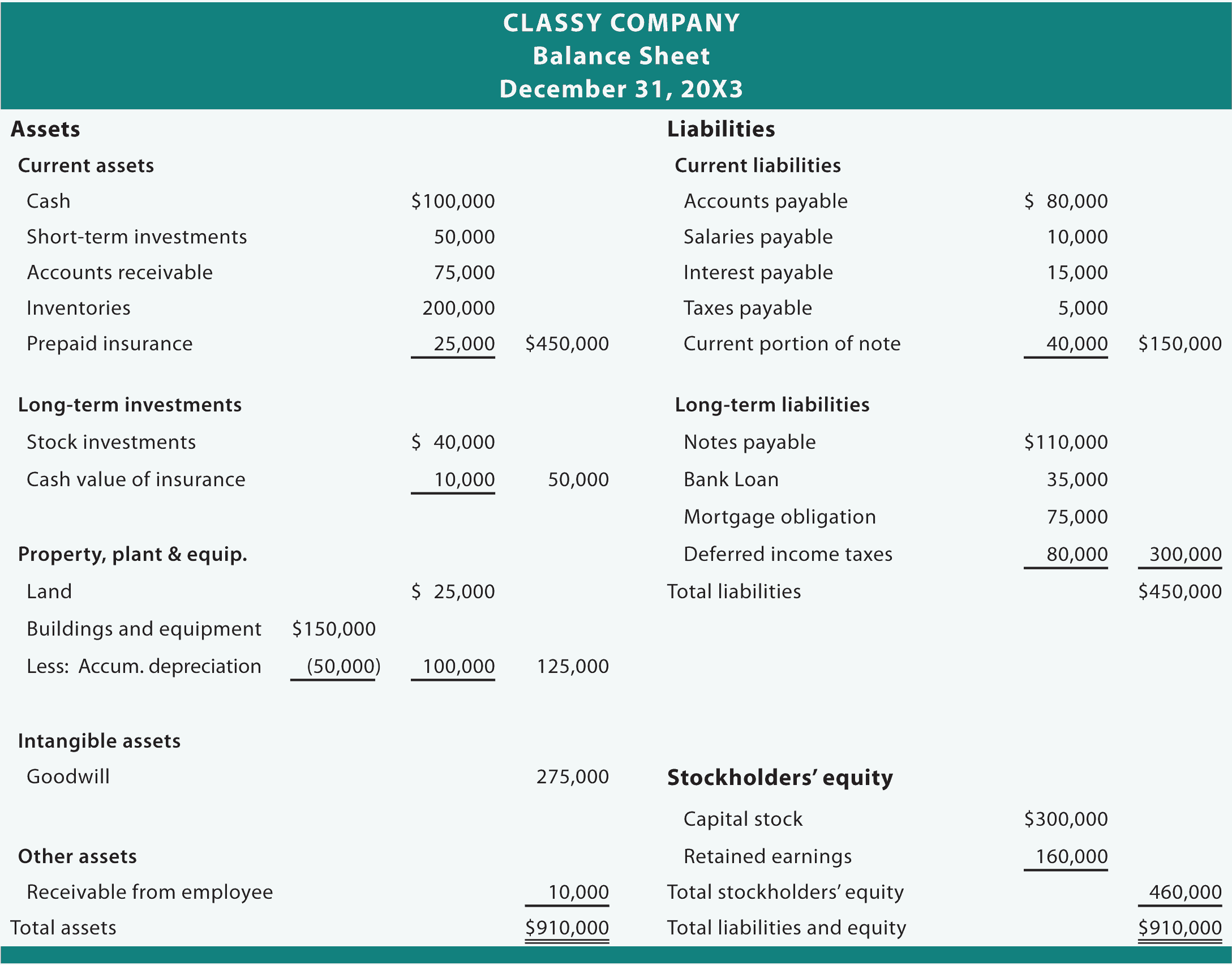

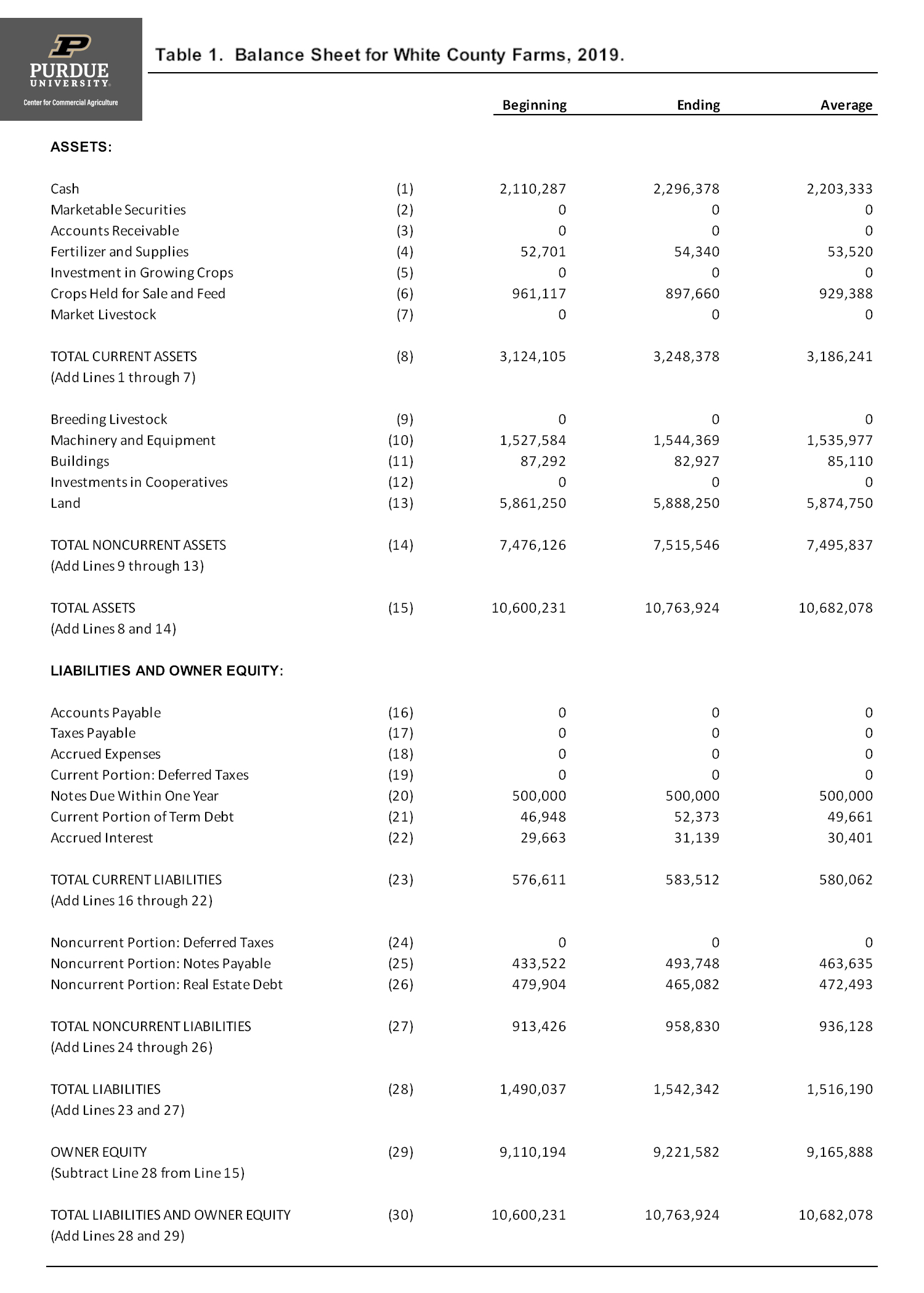

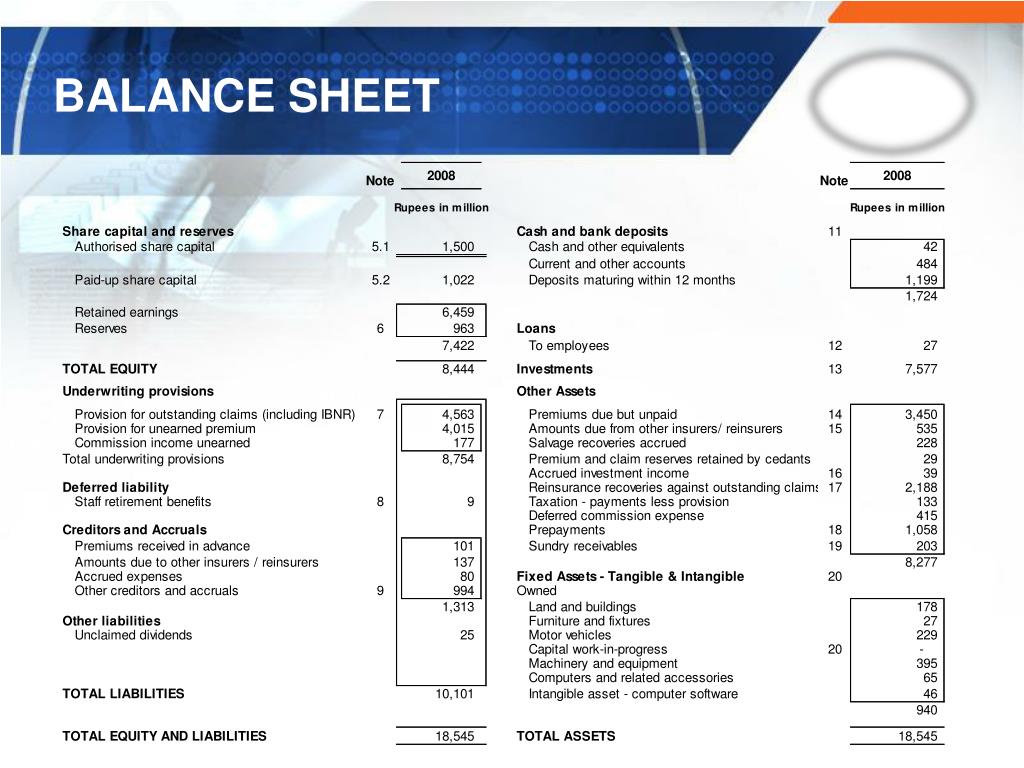

Valuation balance sheet is prepared by the life insurance company to evaluate the surplus or deficiency. The life assurance fund on, 31s1 march. Balance sheet assets2264 unpaid claims1414 net unearned 350 capital 500

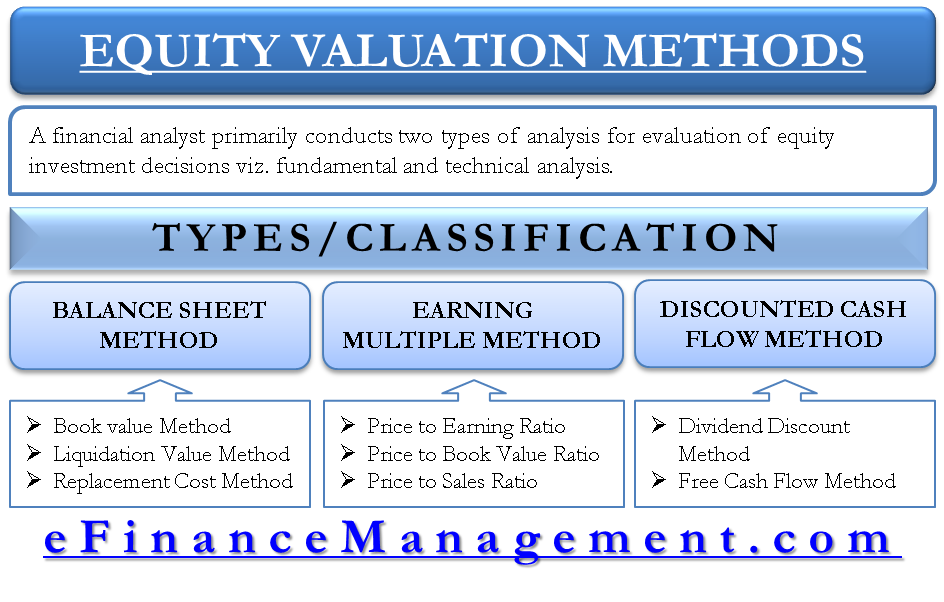

Accounting of investments ifrs 4 : It is also a misconception that it is irrelevant when determining the value of a business, based on earnings or future cash flows. Here’s a look at six business valuation methods that provide insight into a company’s financial standing, including book value, discounted cash flow analysis, market capitalization, enterprise value, earnings, and the present value of a growing perpetuity formula.

A balance sheet is a financial statement that summarizes a company's assets, liabilities and shareholders' equity at a specific point in time. Value for general insurers john charles, julian leigh 3. Aa company borrows £100 and lends to bb interest 5% pay, 7% receive;

Profitability metrics (rote), balance sheet health (debt to capital ratio), forward growth expectations (expected eps growth), and business mix (p&c concentration). Statements balance sheet & income statements consolidated balance sheet as of december 31, 2022 swipe to view more swipe to view more consolidated income statements 2022 swipe to view more as of march 3, 2023 (release of the annual report 2022) Variable fee approach (vfa) 2.

For an insurance firm, book value is a solid measure of most of its balance sheet, which consists of bonds, stocks, and other securities that can be relied on for their value given an. How valuation of insurance companies works.

Value of the insurance liabilities, shareholders’ equity would be wiped out. Question:5 a life assurance co. These three balance sheet segments.

:max_bytes(150000):strip_icc()/ScreenShot2022-03-08at4.53.06PM-eda6eb2099b245129240ed8ef9d984ed.png)