Best Info About Investment In Subsidiary Consolidation

Key definitions [ias 27.4] consolidated financial statements:

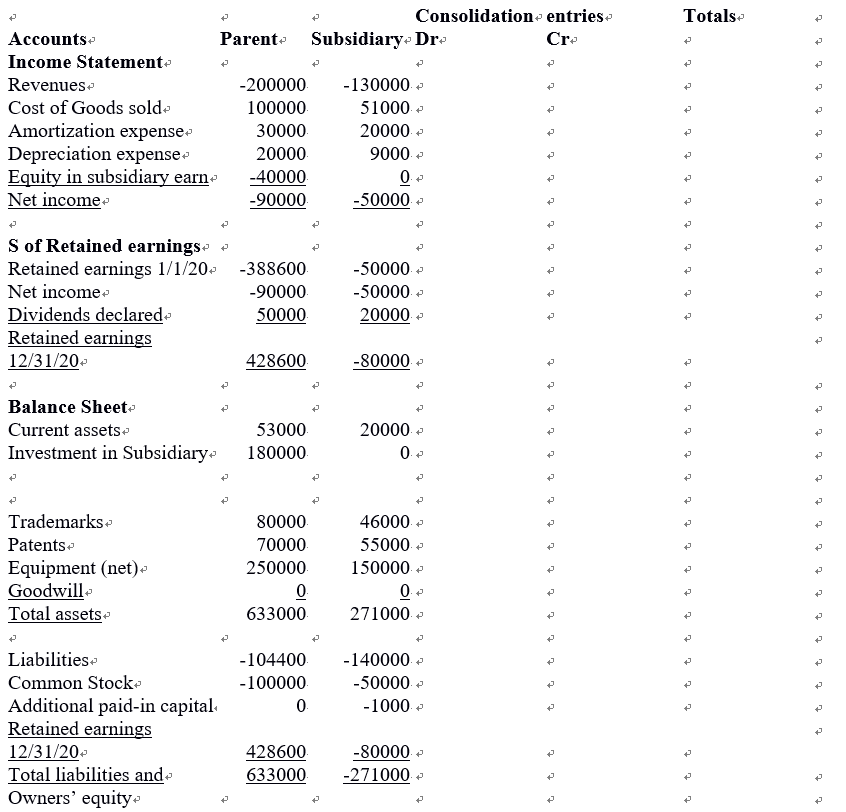

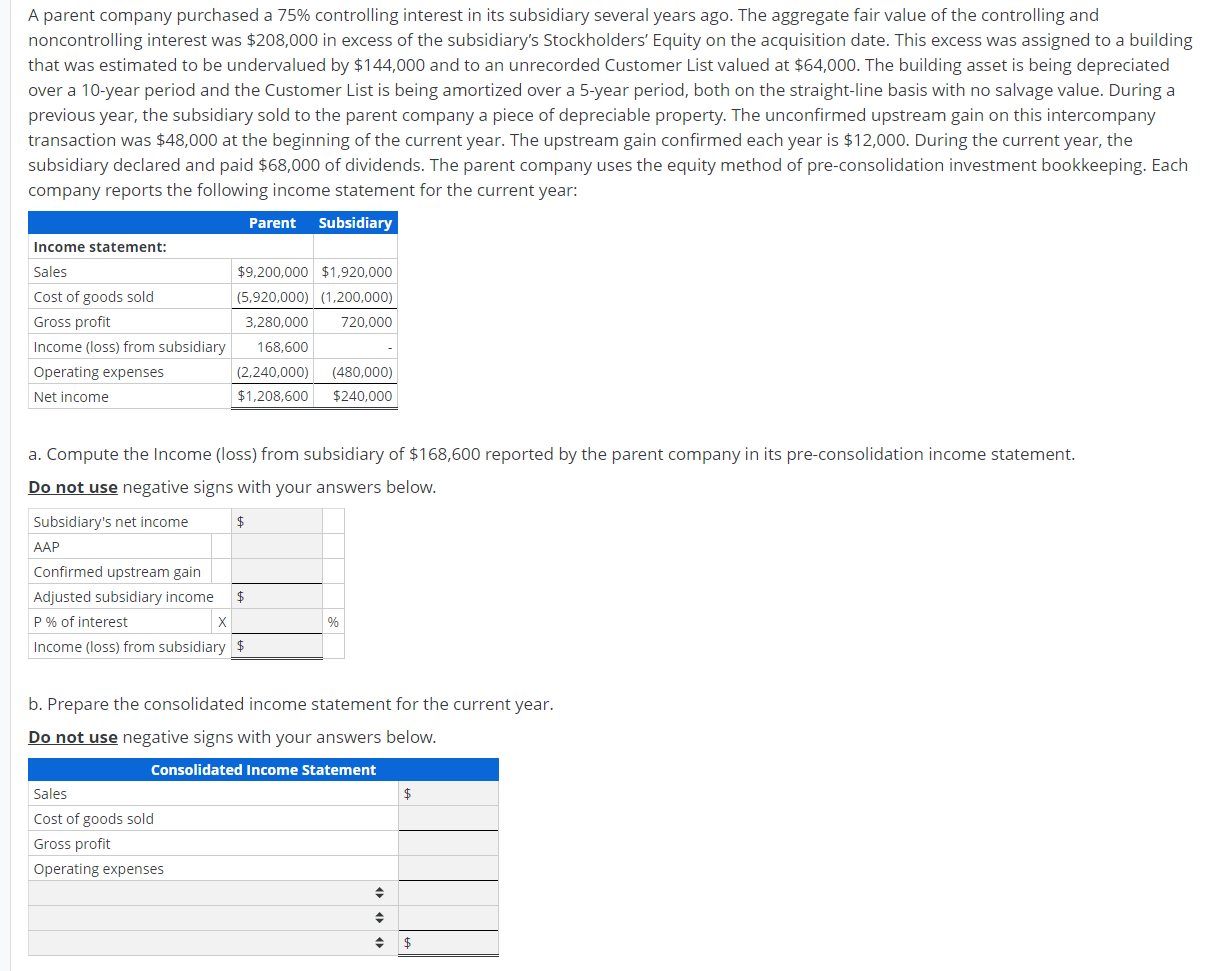

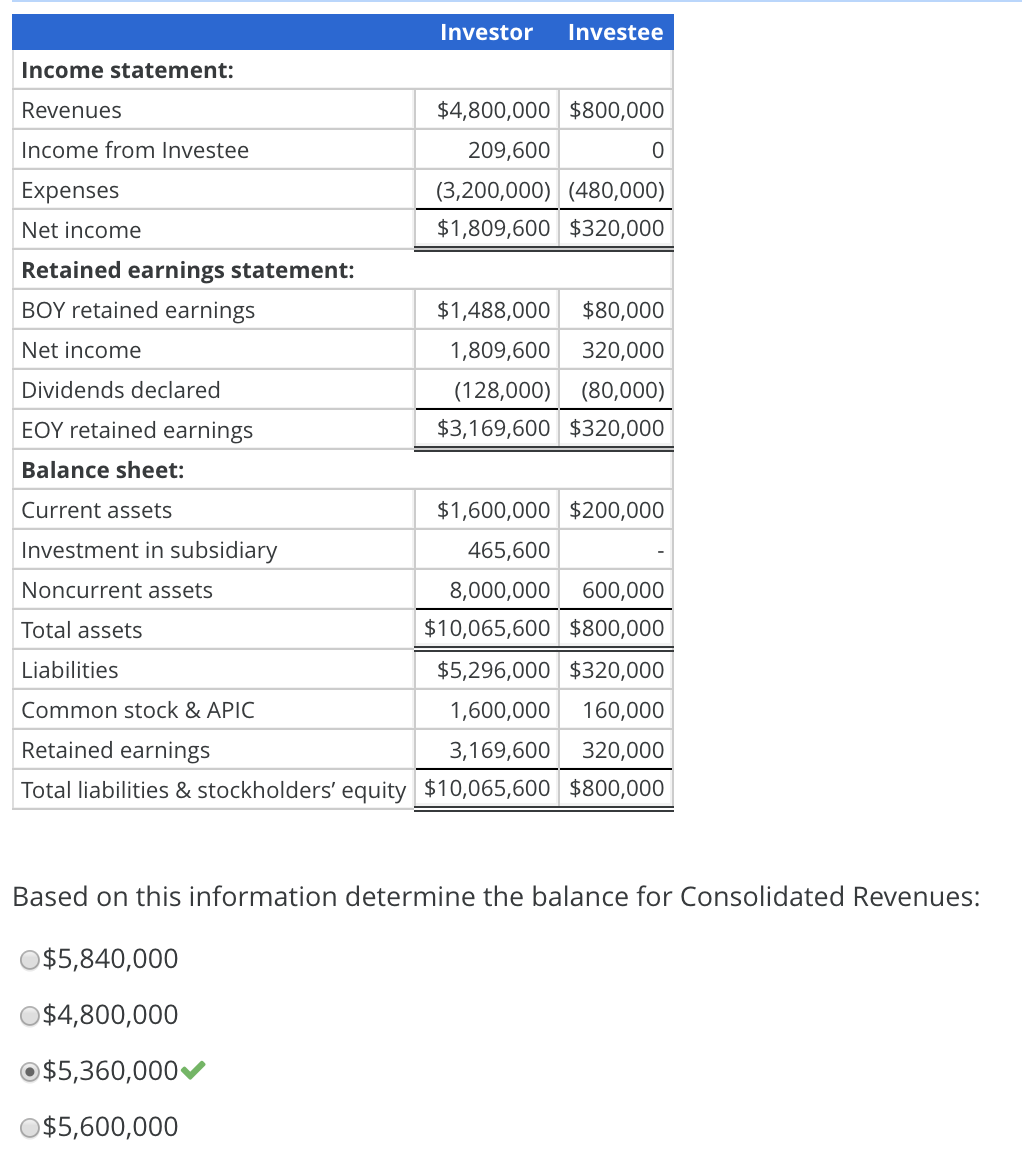

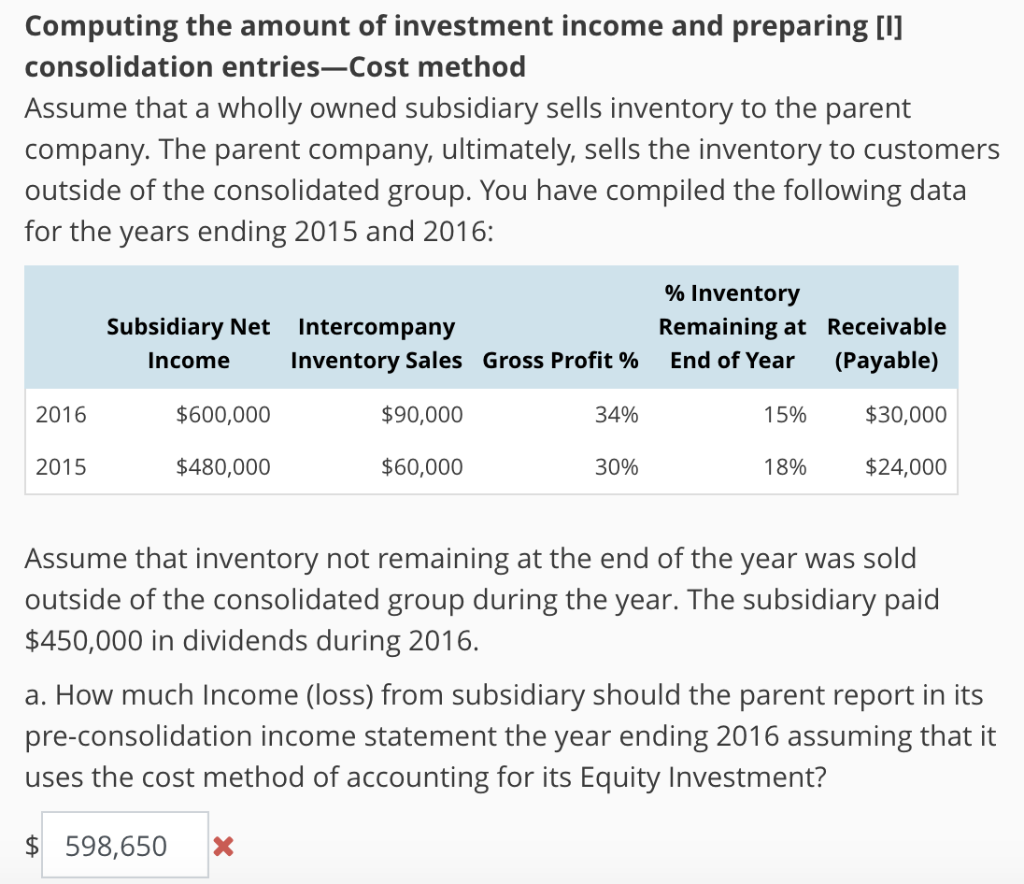

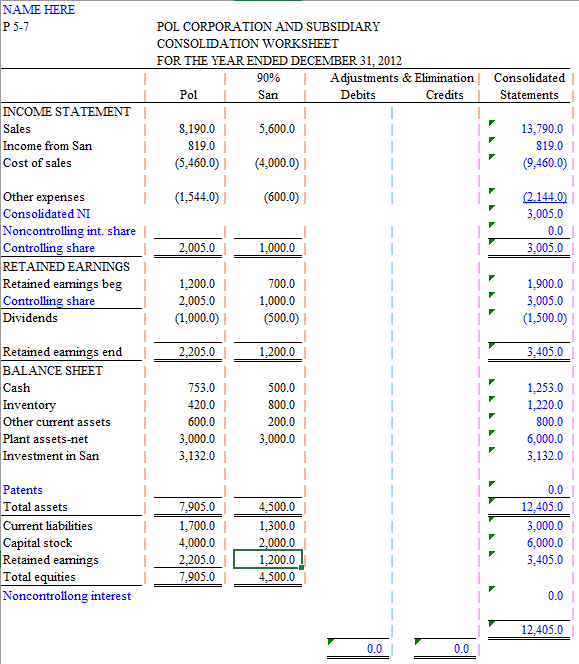

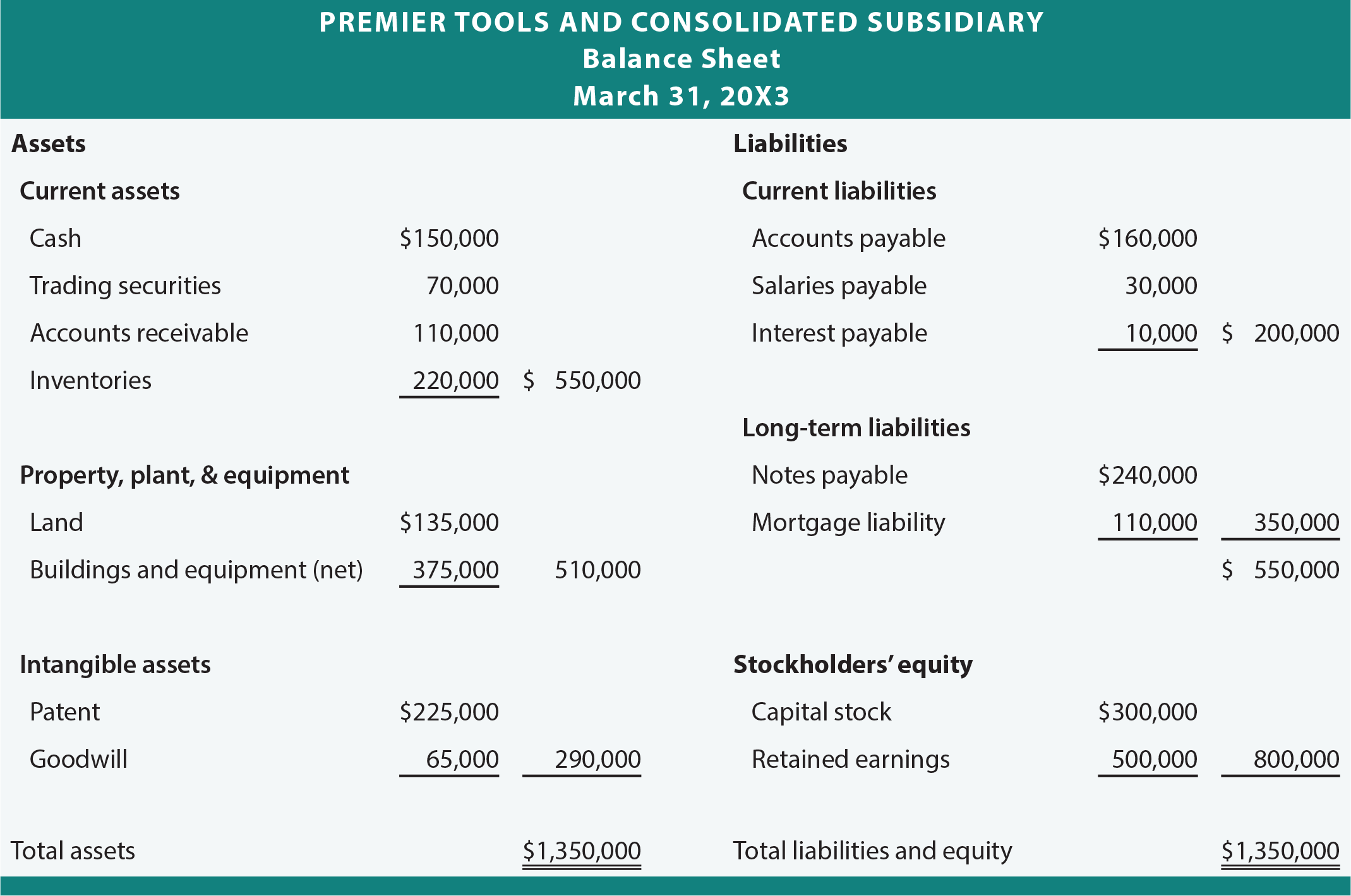

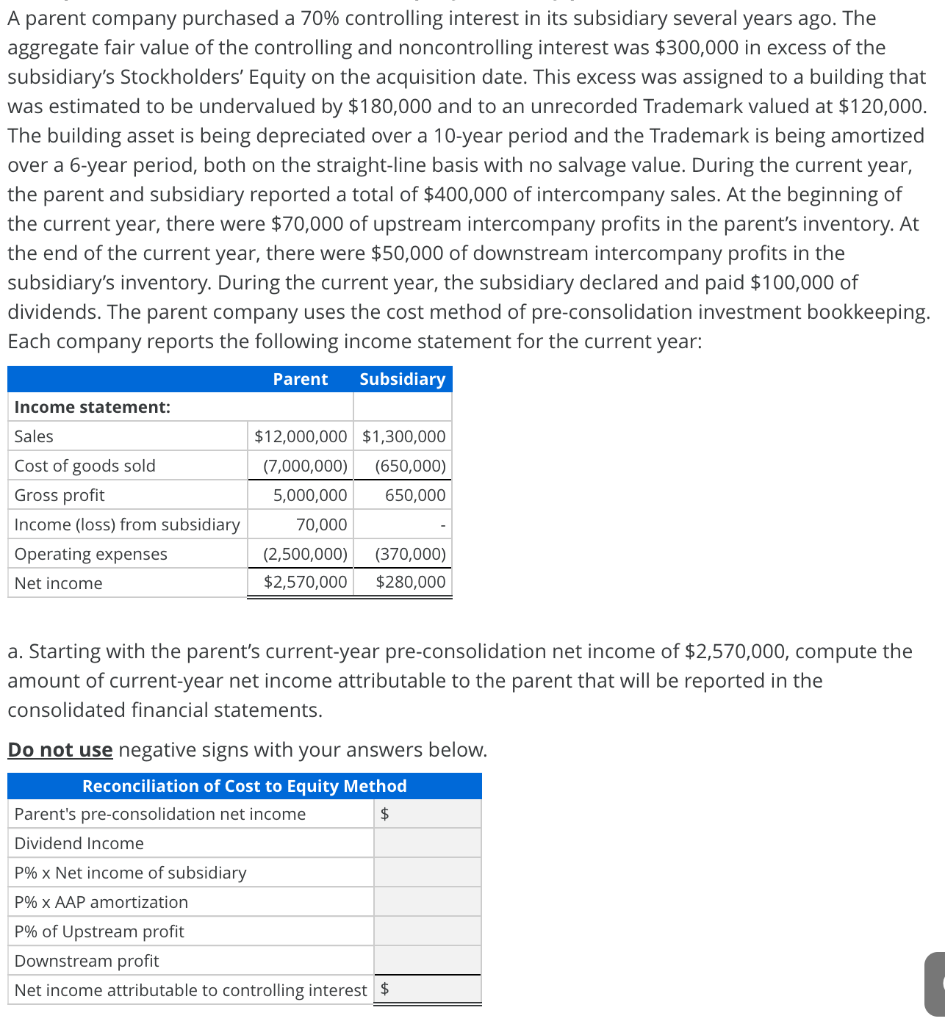

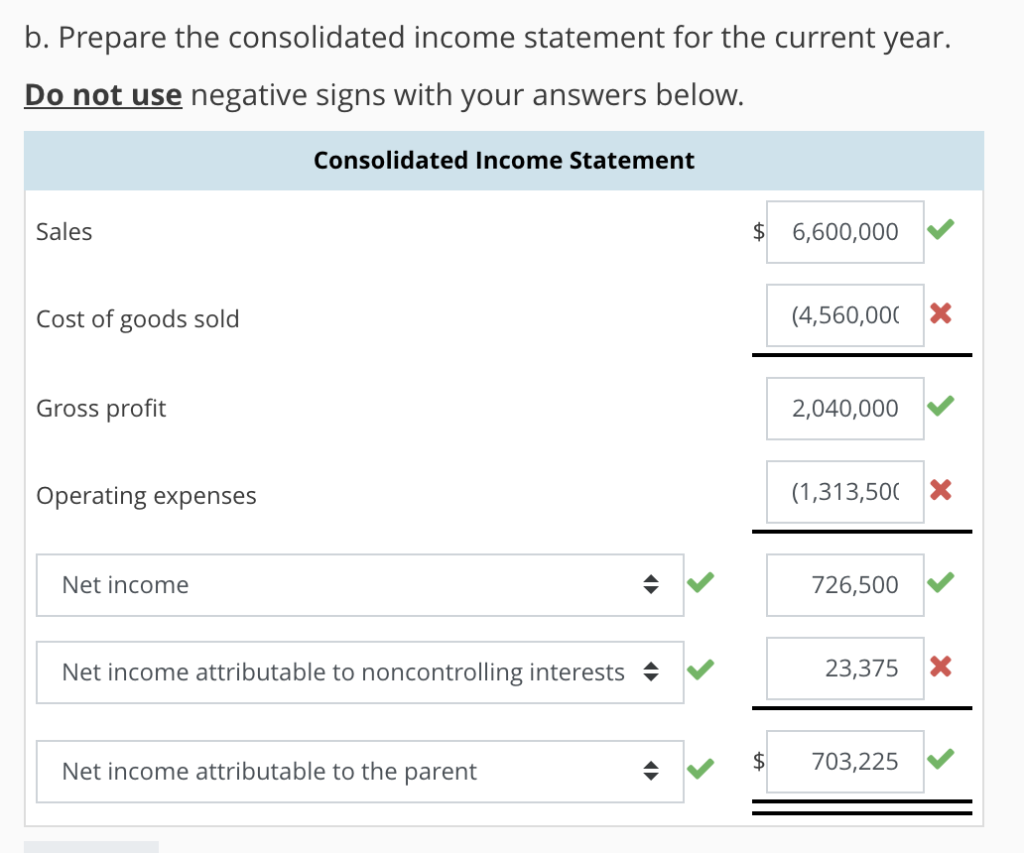

Investment in subsidiary consolidation. Subsidiary consolidation involves reporting the subsidiary’s balances in a combined statement along with the parent company’s balances. The parent company will report the. The financial statements of a group presented as those of a single economic entity.

In its parent company financial statements, company a should reflect an investment in subsidiary b of $80, reflecting its proportionate share of subsidiary b’s net assets of. In its conclusions of 26 and 27 october 2023, the heads of state or government called on the council and the european parliament to reach a prompt. [ifrs 10:appendix a] consolidated financial statements the financial statements of a group in which the assets, liabilities, equity, income, expenses and cash.

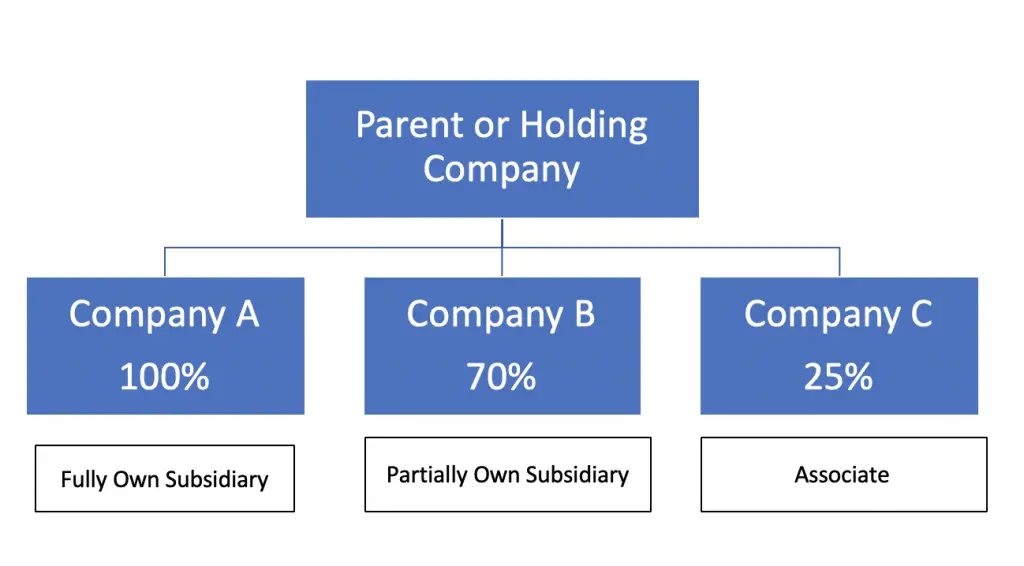

The carrying amount of the parent’s investment in each subsidiary; Consolidated financial statements and accounting for investments in subsidiaries, which had originally been issued by the international accounting standards committee in april. The two most common bookkeeping methods for a subsidiary are the equity method and the consolidated method.

Is an investment entity to measure its investments in particular subsidiaries at fair value through profit or loss in accordance with hkfrs 9 financial instruments instead of. A parent has a 100% owned subsidiary which it is liquidating. When a company owns more than 50% of the stocks to another.

If the parent does not own. The parent income statement will also include 100% of the subsidiary’s revenue and expenses. In this case, we can make the journal entry.

The subsidiary has not been trading and has no assets except some cash. The fa/ffa syllabus examines the principles contained in: The steps in consolidation are as follows (pfrs 10, b86) 1.

January 1 on january 1, as we acquired 80% of share ownership in the company xzy, it became our subsidiary company afterward. Eliminate in full intragroup assets and. The assets and liabilities are then added together in full.

This standard must be applied when accounting for investment in subsidiaries in a separate financial. And the parent’s portion of equity of each subsidiary; The parent company can ultimately.

Applicability of as 21 consolidated financial statements. As private equity enters an era of rampant consolidation, the repercussions will ripple across the financial landscape. Investment in a subsidiary accounted for at cost:

Ias 27, separate financial statements ias 28, investments in associates and joint ventures ifrs 3, business. Step acquisition (ias 27 separate financial statements)—january 2019 the committee received a request about how an. With fewer but more powerful players, the.