Unbelievable Info About Is Depreciation Expense On The Income Statement

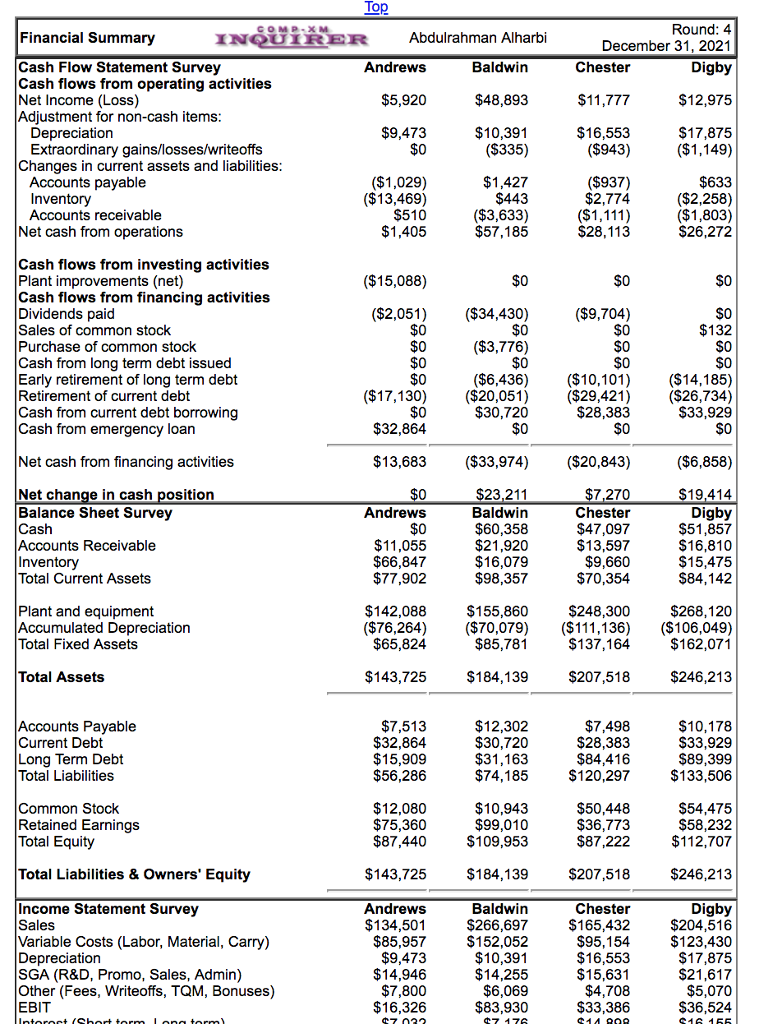

Depreciation expense is an accounting method that allocates the cost of a tangible or fixed asset over its useful life or to the period it is expected to be used.

Is depreciation expense on the income statement. It facilitates tax deductions, provides insights into cash flow, aids in asset replacement planning, and supports financial analysis by investors and creditors. Physical assets, such as machines, equipment, or vehicles, degrade over time and reduce in value incrementally. Fixed assets lose value over time.

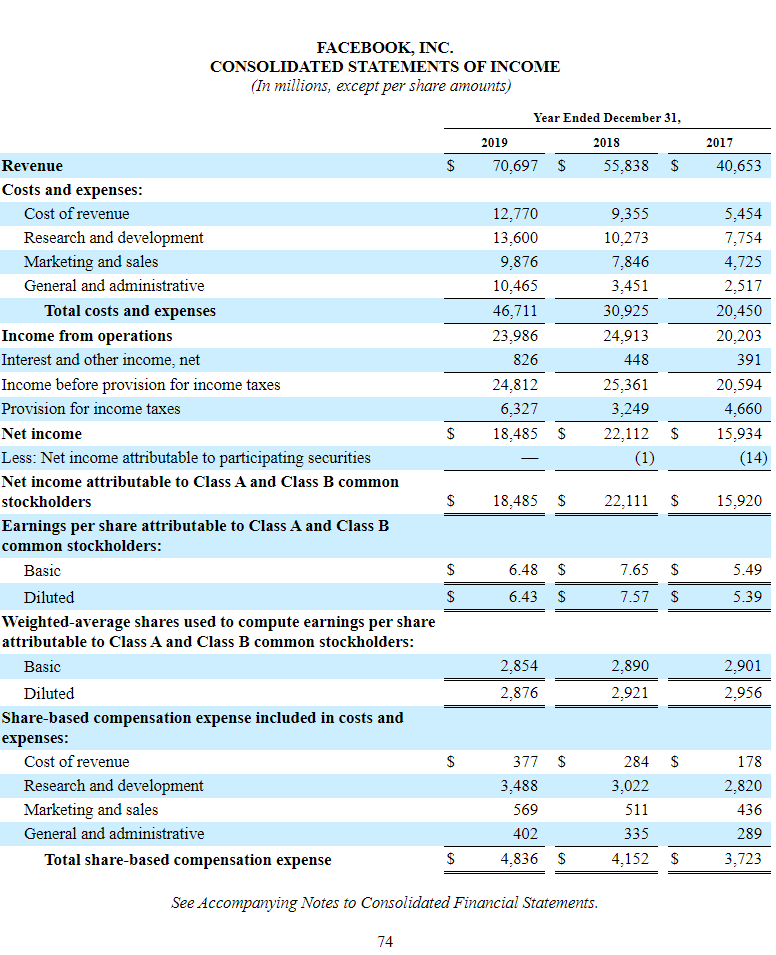

A higher depreciation expense reduces the company's net income, leading to a potential. Lo 5.1 identify whether each of the following accounts would be considered a permanent account (yes/no) and which financial statement it would be reported on (balance sheet; Written by masterclass last updated:

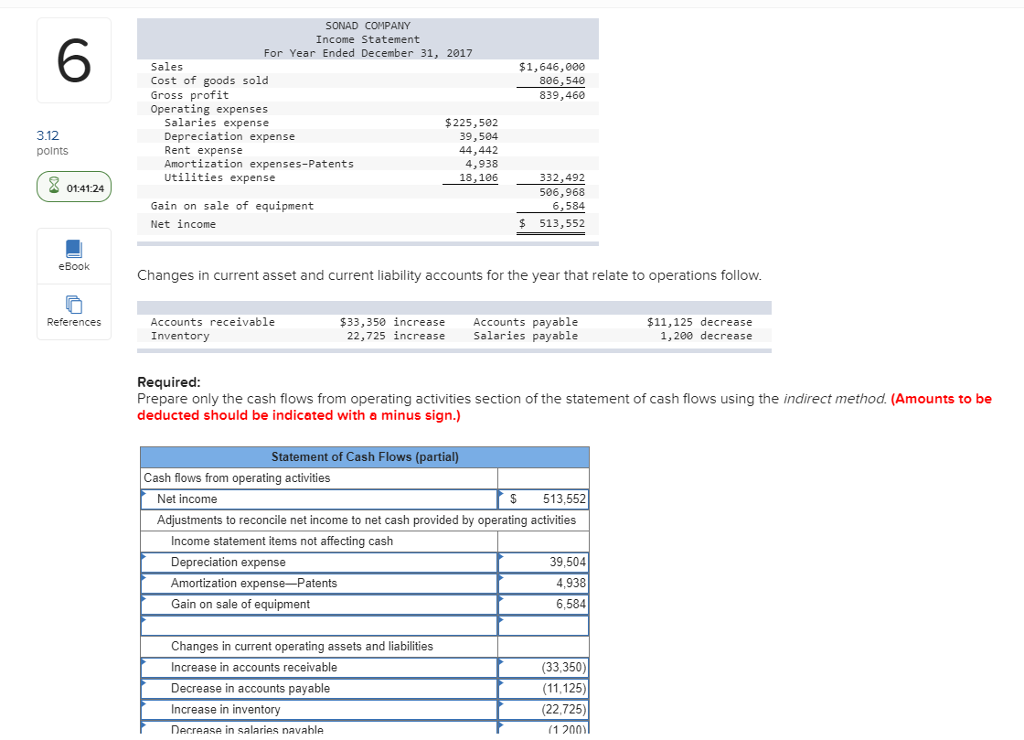

Despite its complex nature, it’s essential to comprehend how depreciation works as it affects the overall financial health of any business or organization. From an accounting standpoint, the depreciation expense is debited, while the accumulated. Depreciation expense is an income statement item.

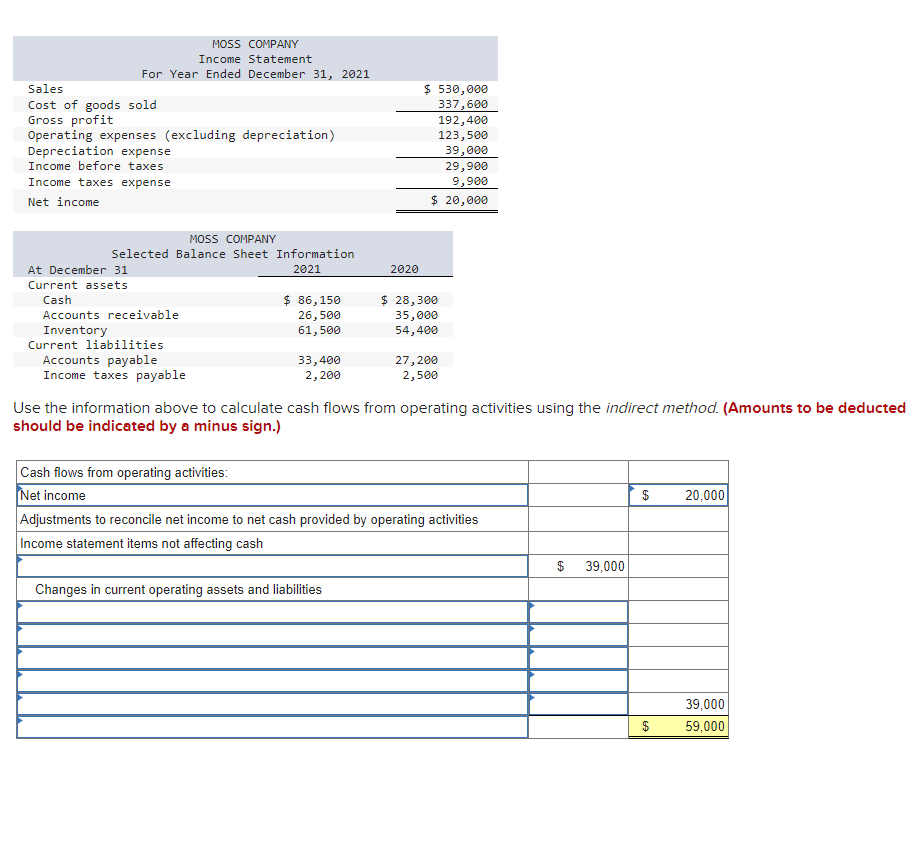

Depreciation is entered as a debit on the income statement as an expense and a credit to asset value (so actual cash flows are not exchanged). The income statement books a depreciation expense of $9,000 during the initial year. Understanding the basics of depreciation expense

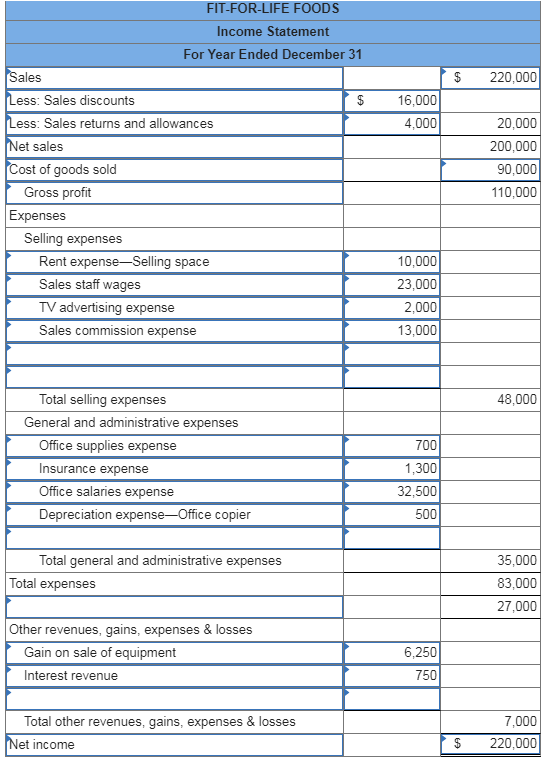

The income statement is a useful way to see how a company makes money and how it spends it. Sep 14, 2021 • 4 min read fixed assets lose value over time. $\begingroup$ although if there are interest expenses as well, they are also probably 'hidden' in other items.

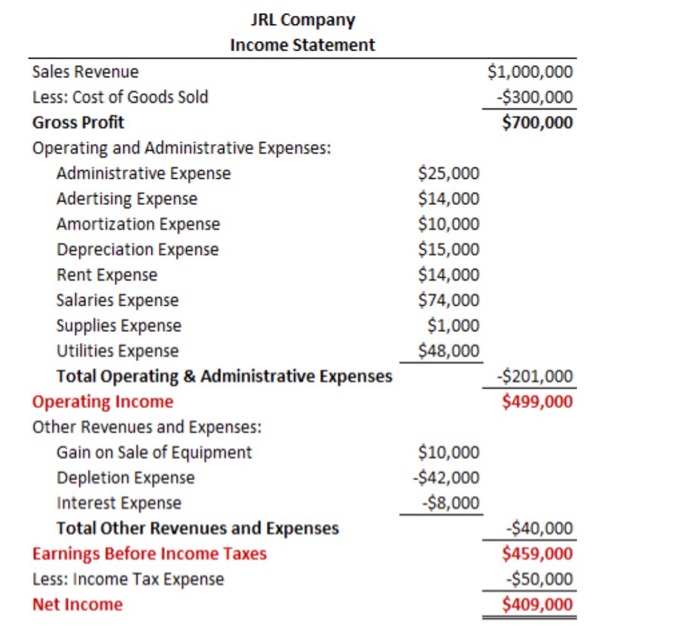

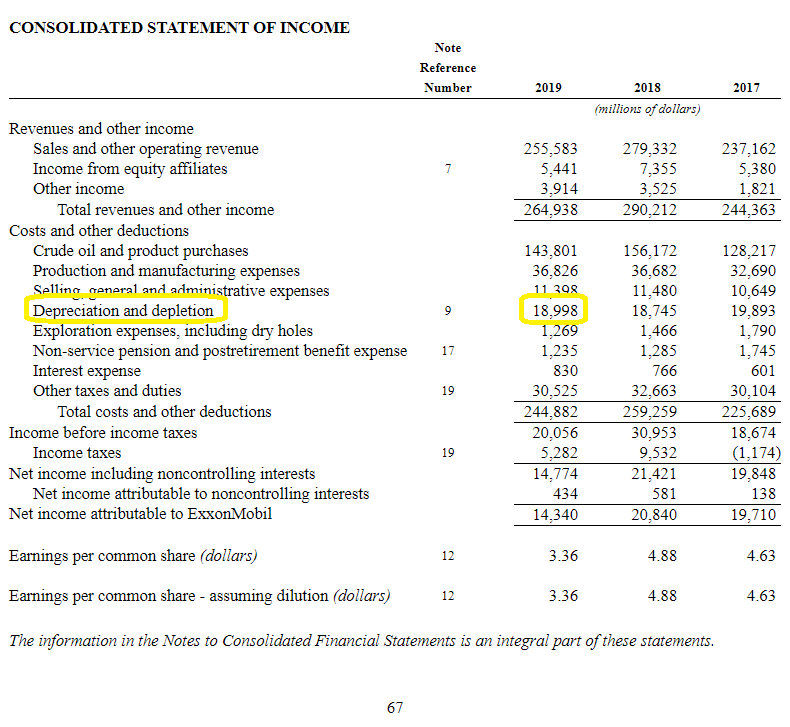

On the income statement, it is listed as depreciation expense, and refers to the amount of depreciation that was charged to expense only in that reporting period. The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20. So if interest expenses are present in the cash flow statement, those should be added to the income before income taxes item as well to get ebitda (earnings before interest, taxes, depreciation and amortization).

An income statement might use the cash basis or the accrual basis. Did you get it ⬇️樂 question: This is known as depreciation, and it is the source of depreciation expenses that appear on corporate income statements and balance sheets.

Depreciation is used to account for declines in the value of a fixed asset over. Depreciation expense is the appropriate portion of a company's fixed asset's cost that is being used up during the accounting period shown in the heading of the company's income statement. The answer is yes.

The depreciation reported on the income statement is the amount of depreciation expense that is appropriate for the period of time indicated in the heading of the income statement. Depreciation depreciation is a type of. You can look at an income.

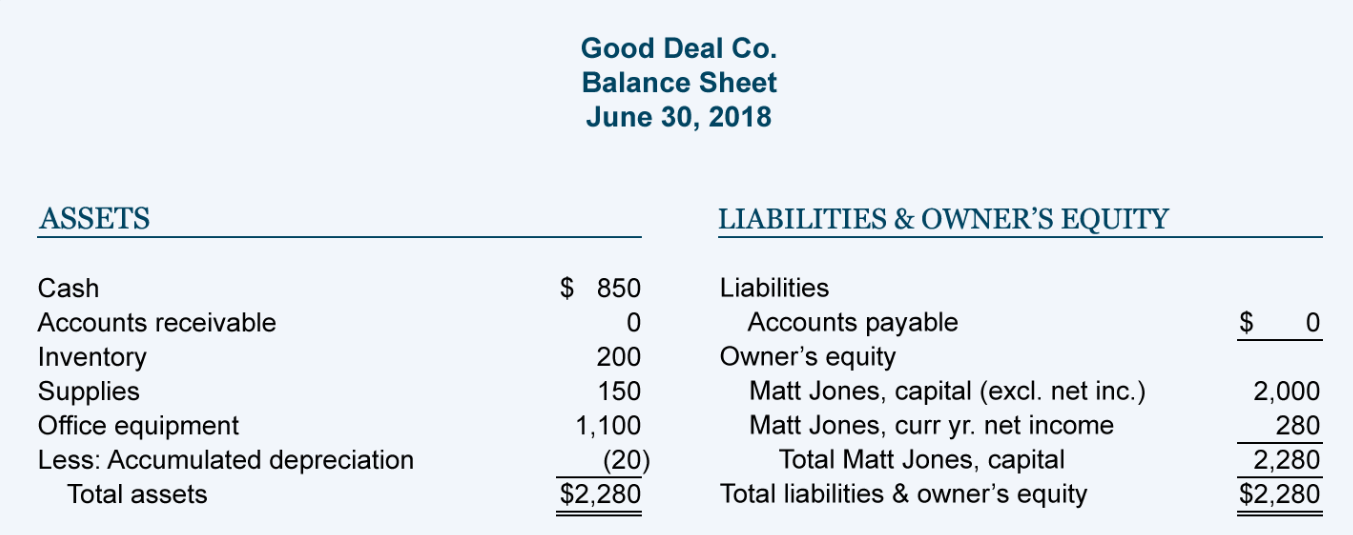

Debit to depreciation expense, which flows through to the income statement credit to accumulated depreciation, which is reported on the balance sheet depreciation and taxes as noted. Depreciation is a financial accounting method used to allocate the cost of tangible assets over t. clearias on instagram: Or retained earnings statement)_ accumulated depreciation insurance expense buildings prepaid insurance depreciation expense supplies.

![[Solved] MOSS COMPANY Statement For Year Ended Dec](https://media.cheggcdn.com/media/c50/c50cca1f-cfa5-4c81-a37f-2810754a3a83/phpTzrprB)

:max_bytes(150000):strip_icc()/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)

:max_bytes(150000):strip_icc()/Amazon3-88916bd66a244178b1f977a1d758dda0.JPG)

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)