Breathtaking Info About Income Statement And Profit Loss

Sales on credit) or cash.

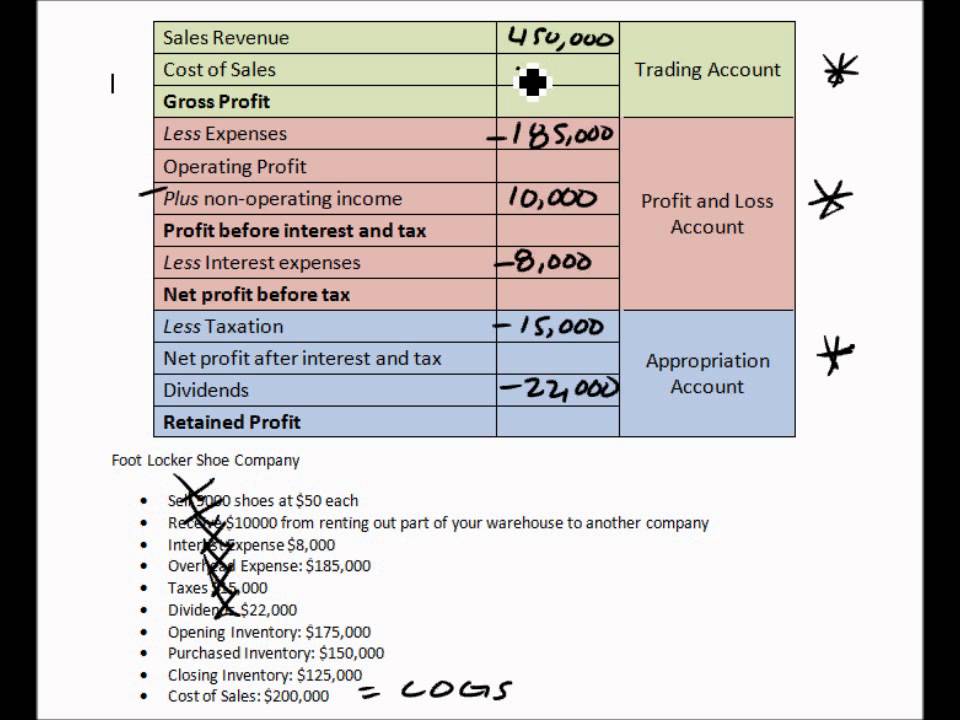

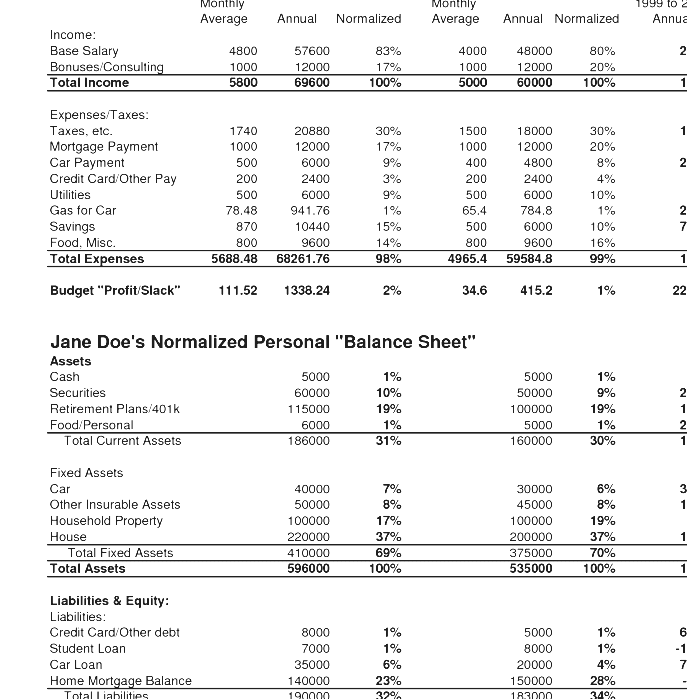

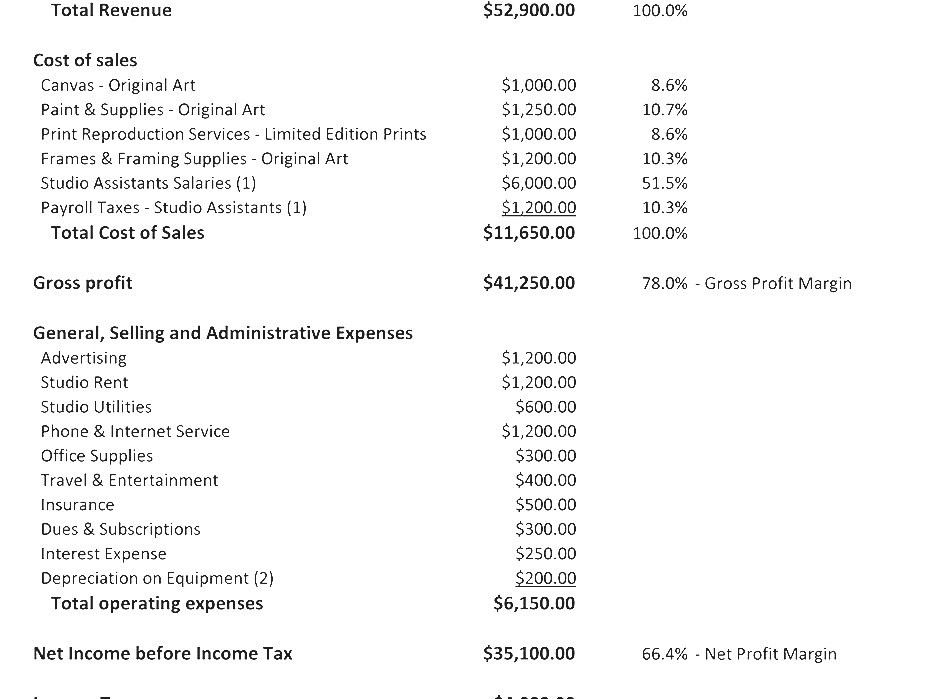

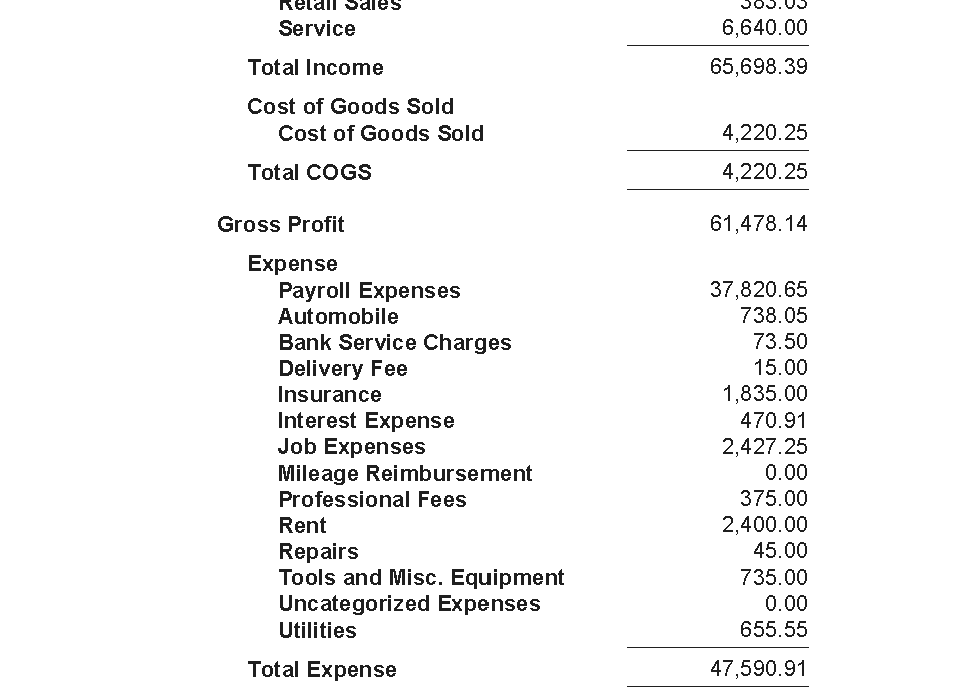

Income statement and profit and loss. Then, it subtracts the costs of making those goods or providing those services, like. Add up all your gains then deduct your losses. Tips for preparing income statement vs profit and loss keep organized records of all your earnings and expenses so you can input them into your financial documents easily.

It tells you how much profit you're making, or how much you’re losing. A business profit and loss statement shows you how much money your business earned and lost within a period of time. The income statement focuses on four key items:

An income statement is one of the most common, and critical, of the financial statements you’re likely to encounter. Use your profit and loss statement to help develop sales targets and an appropriate price for your goods or. The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period.

The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. Net income was $273 million, or $1.04 a share, compared with a loss of $557 million, or $2.46, a year earlier, coinbase said in a shareholder letter thursday. A profit and loss statement is also called an income statement, a statement of profit, or a profit and loss report.

An income statement might use the cash basis or the accrual basis. The income statement, also called the profit and loss statement, is a report that shows the income, expenses, and resulting profits or losses of a company during a specific time period.the income statement is the first financial statement typically prepared during the accounting cycle because the net income or. This is a very informative article.

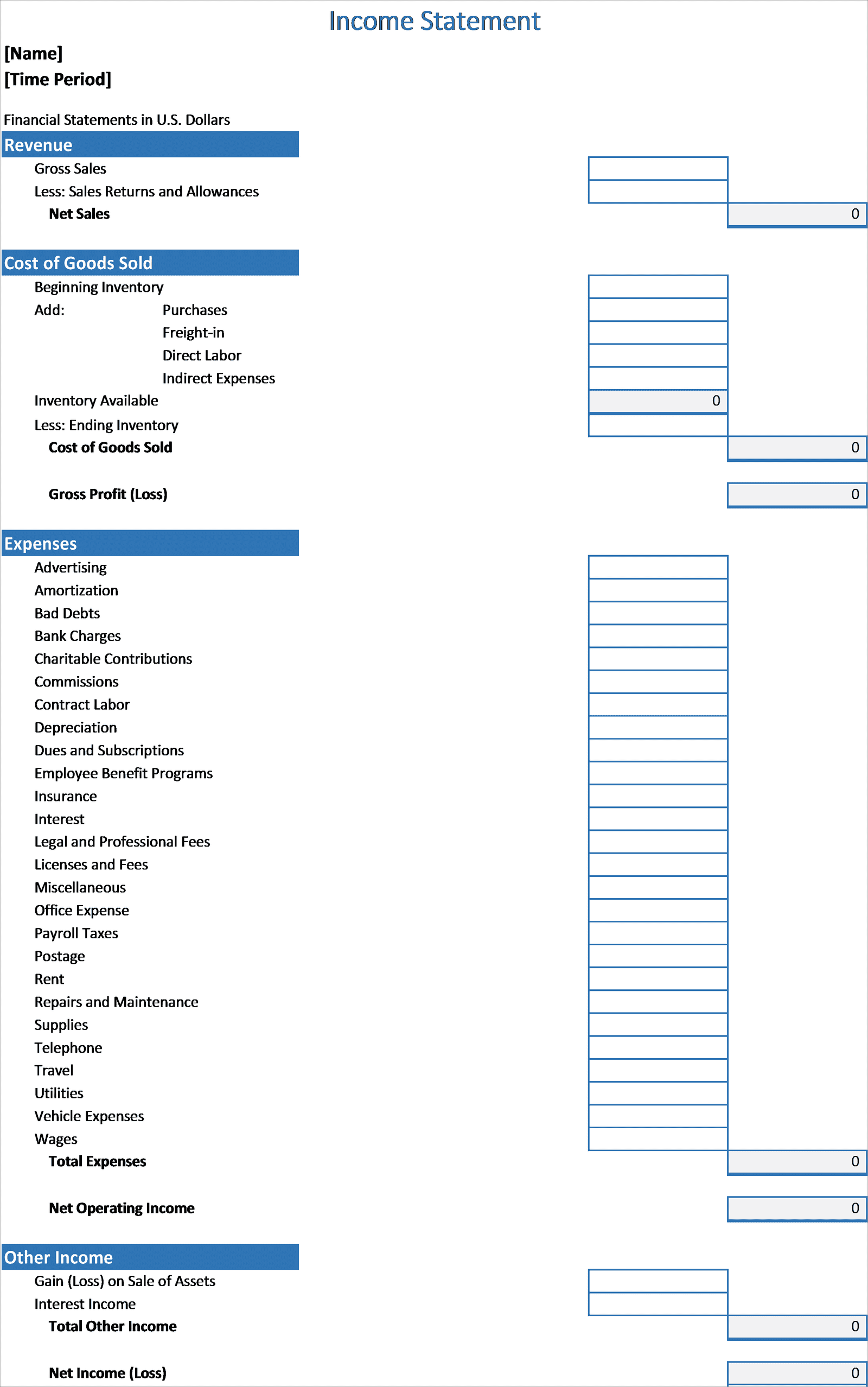

You usually complete a profit and loss statement every month, quarter or year. What is an income statement? The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income statement, begins by showing how much money your business made from selling goods or services.

The rising costs overshadowed a decent holiday quarter. It captures how money flows in and out of your business. There is no difference between income statement and profit and loss.

The profit and loss (p&l) statement (also known as an income statement) is one of the four basic financial statements that presents the revenues, expenses, and net income of a business. P&l is short for profit and loss statement. You can look at an income.

Also known as profit and loss (p&l) statements , income statements summarize all income and expenses over a given period, including the cumulative impact of revenue, gain, expense, and loss transactions. Properly analyzing your profit and loss statement is vital to business growth. It measures the performance and.

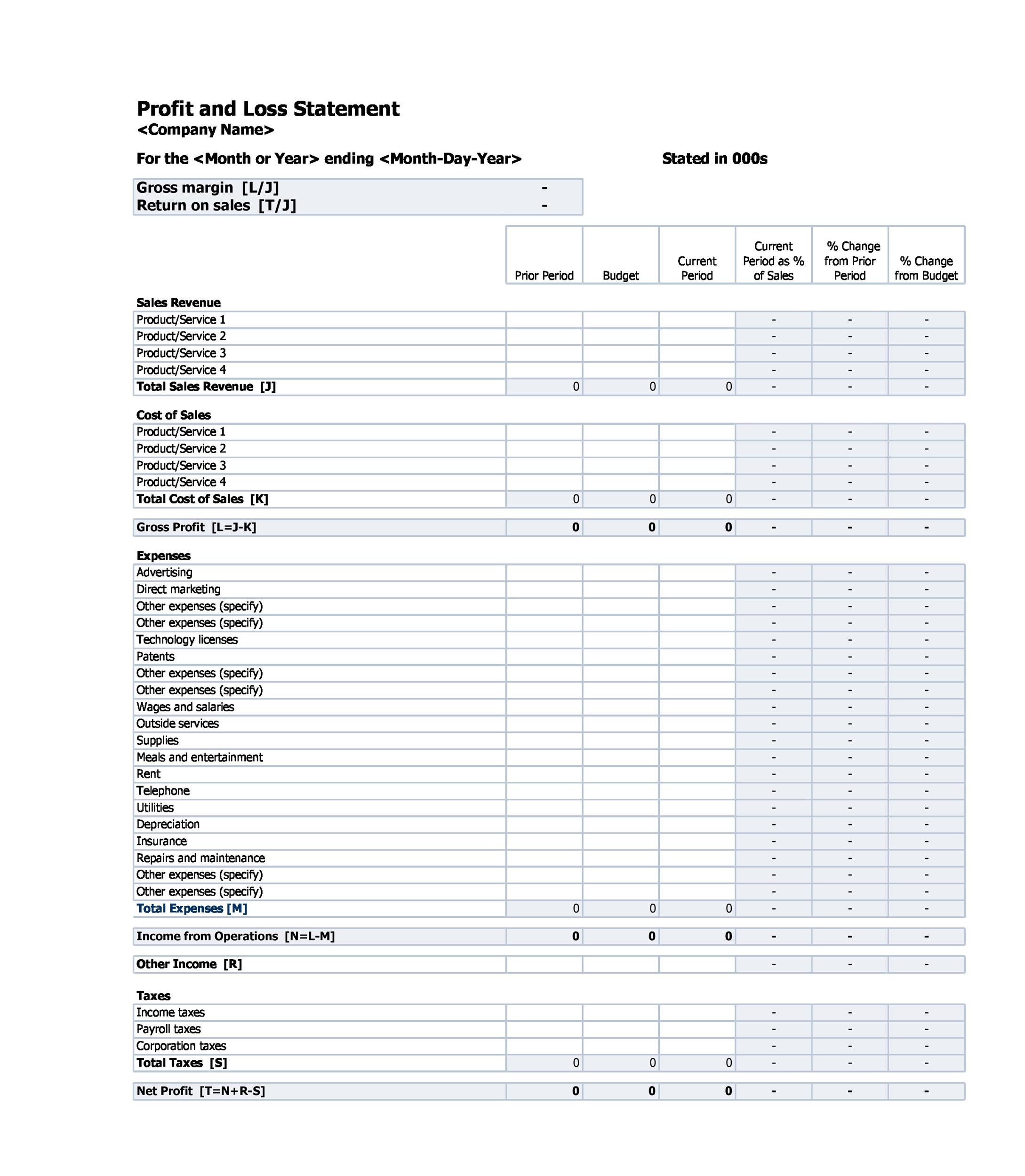

The profit and loss statement (p&l) is a financial statement that starts with revenue and deducts costs and expenses to arrive at net income, the profitability of a company, in a specified period. What is profit and loss statement? Example of a p&l statement.

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Rental-Property-Profit-and-Loss-Statement-Template-TemplateLab.com_-scaled.jpg)