Awesome Info About Significant Audit Findings

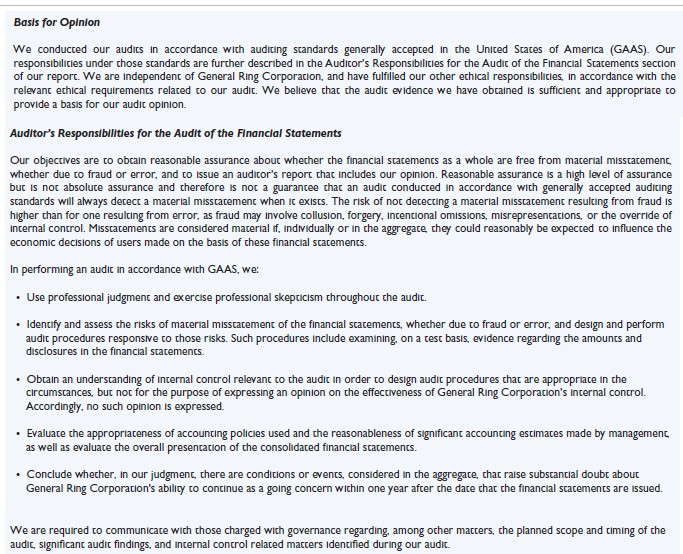

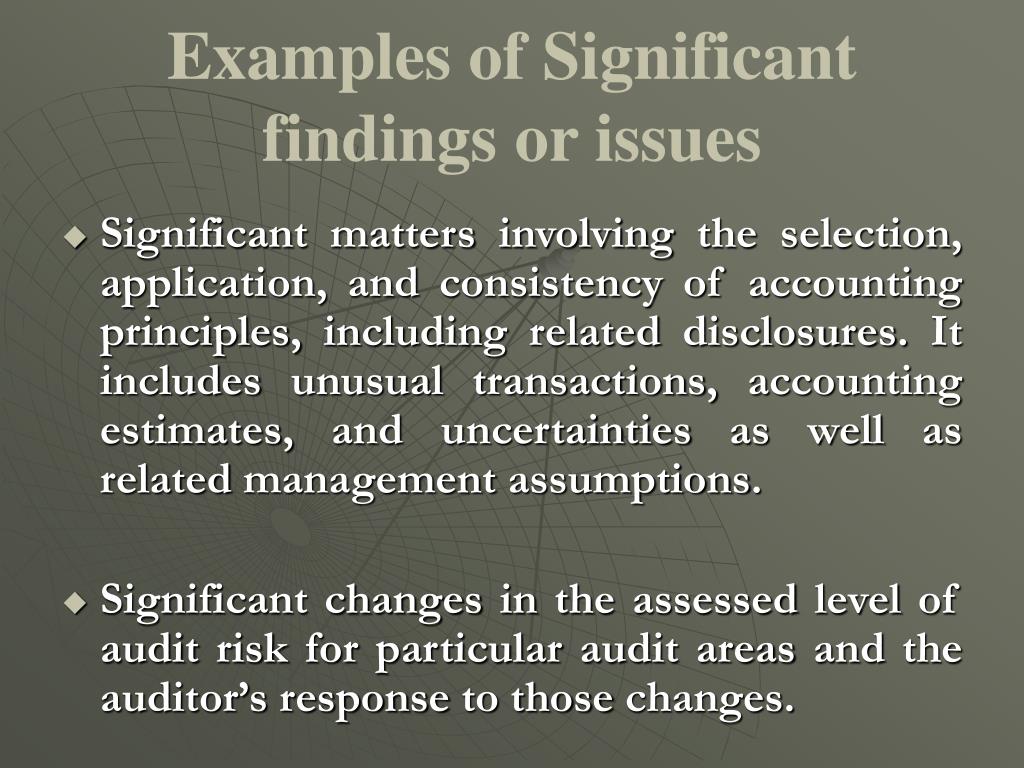

Significant audit findings qualitative aspects of accounting practices management is responsible for the selection and use of appropriate accounting policies.

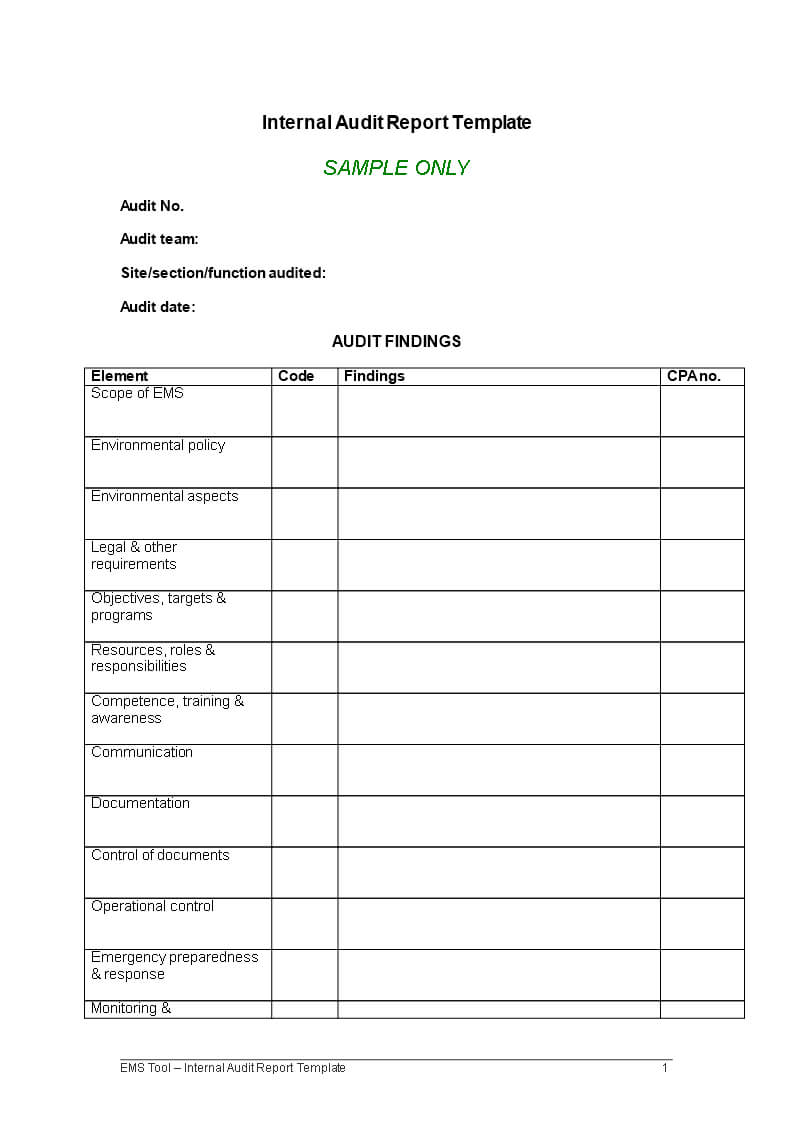

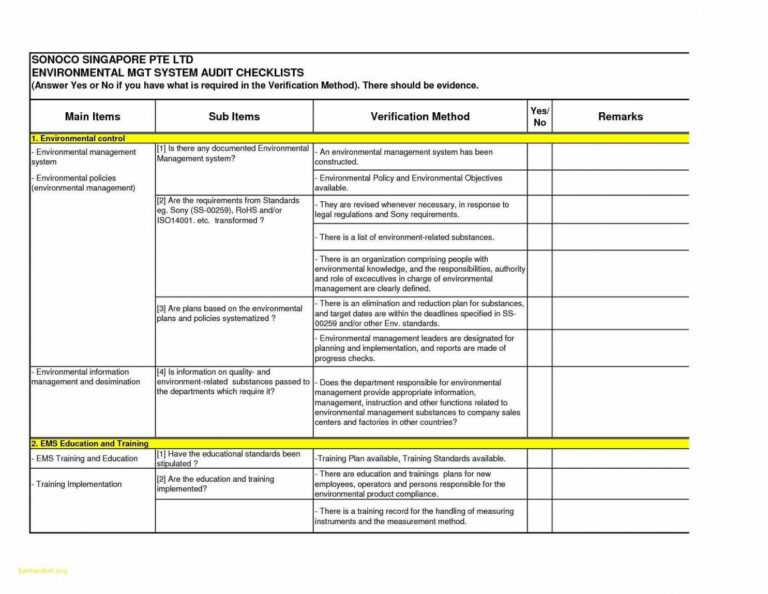

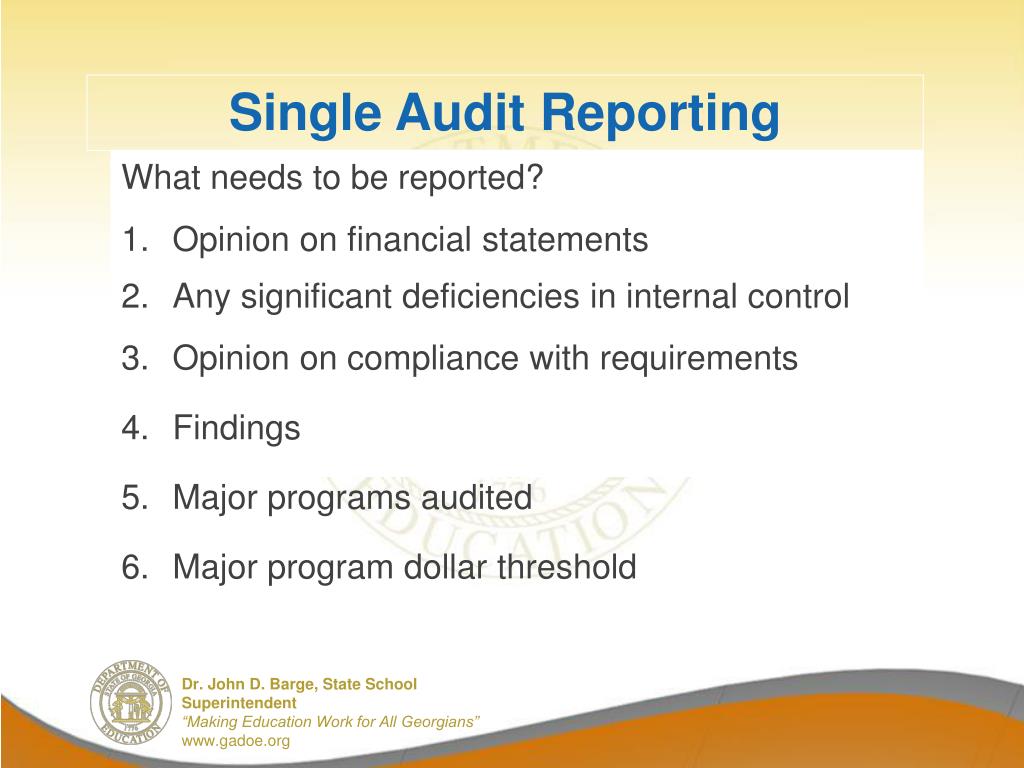

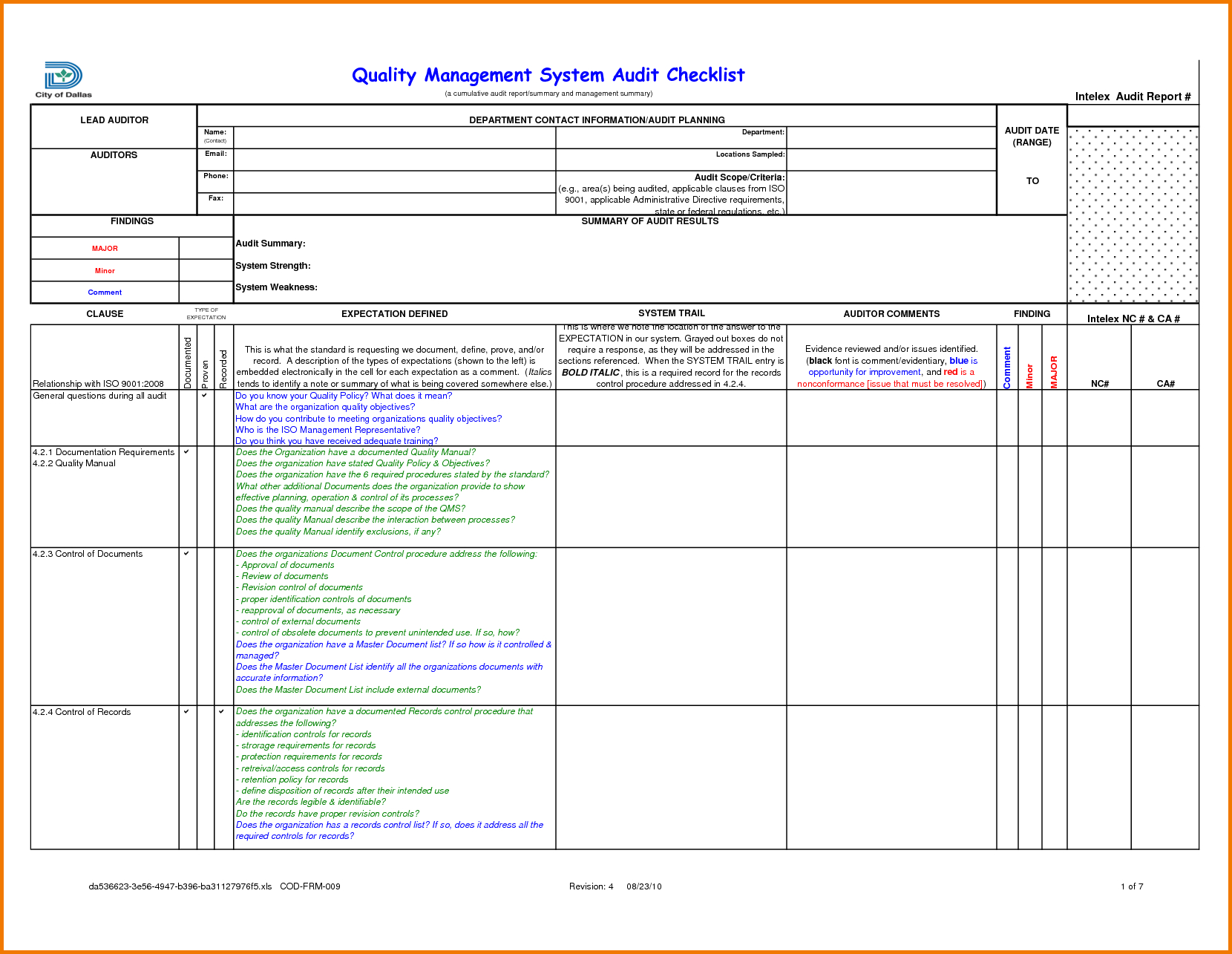

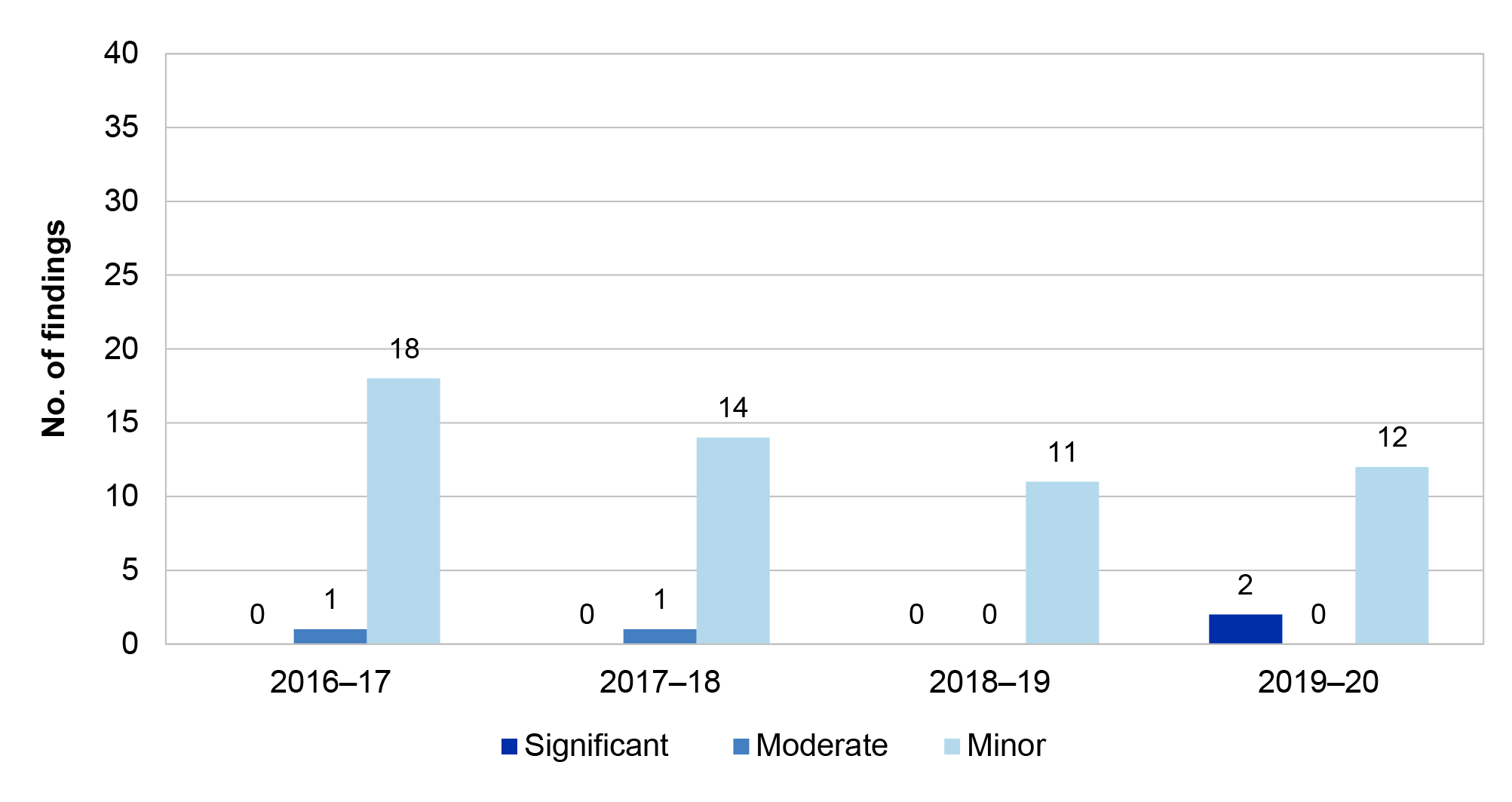

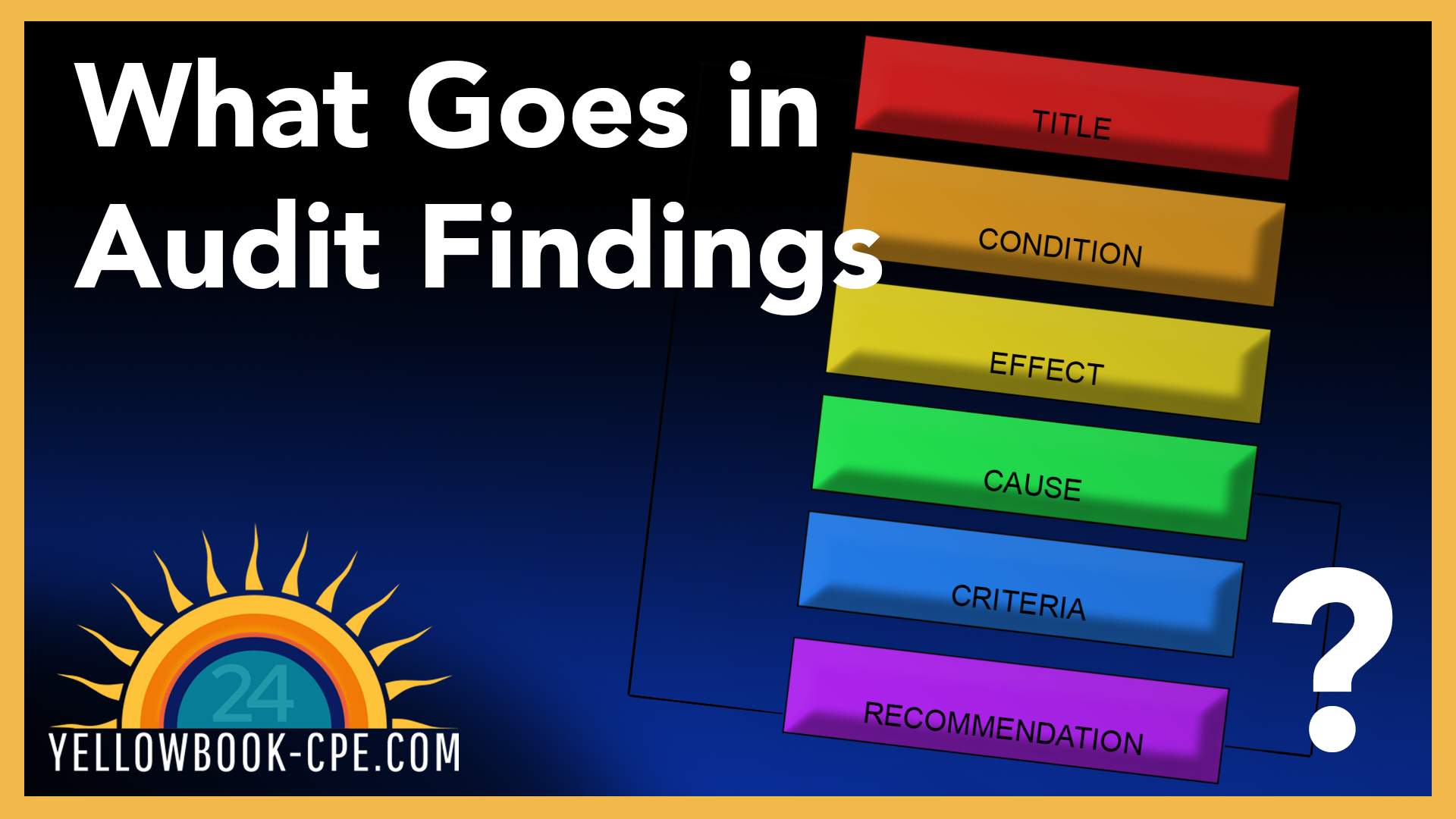

Significant audit findings. Audit findings are the means by which internal audit communicates audit results. (1) significant deficiencies and material weaknesses in internal control over major programs and significant instances. What does each finding mean.

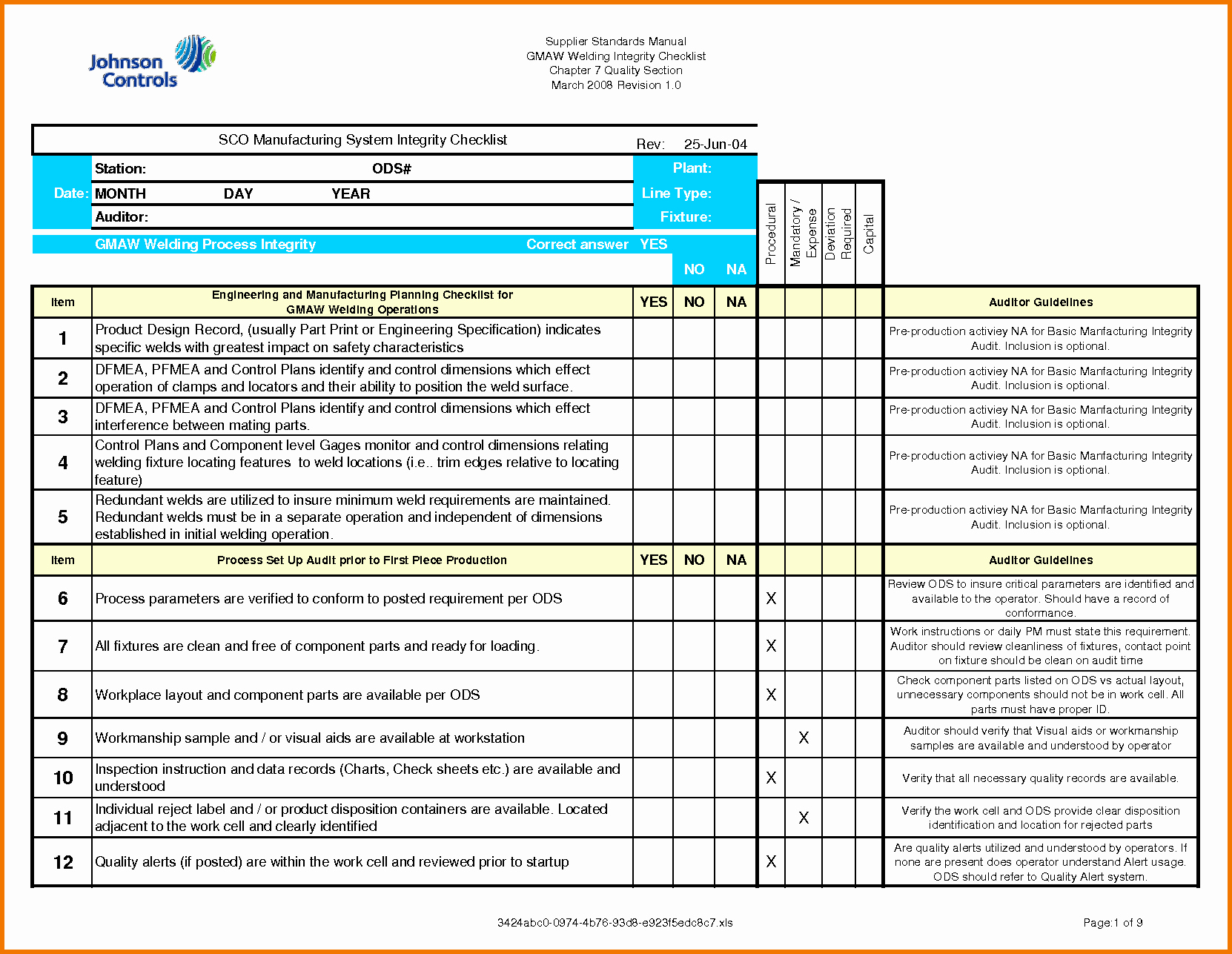

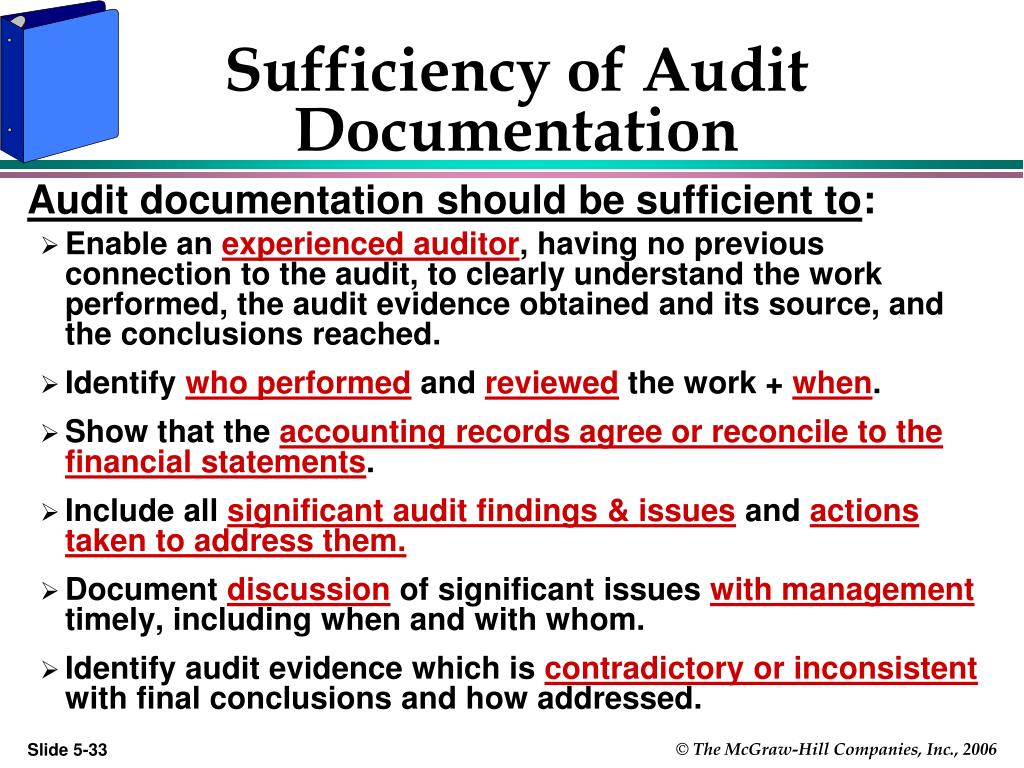

Monitoring the resolution of internal audit findings and recommendations should be included in your organization’s internal audit plan, and it should be thought of as a significant control step in any internal audit activity. Chartered institute of internal auditors. Definition audit findings are the specific evidence gathered by the audit team to answer the audit questions and verify the stated hypothesis.

Significant matters either are, or could be, important to our audit opinion/report, or to the support for the assurance engagement opinion/conclusion (s). Delivering audit findings with greater impact is a proven way for internal audit to provide assurance, aid governance, enhance risk management and prompt improvements. 11 all participants read the following statement:

Annual impairment test was significant to our audit because the balance of xx as of december 31, 20x1 is material to the financial statements. Qualitative aspects of accounting practices management is responsible for the selection and use of appropriate accounting policies. Management responses should include their action plan for correction.

The global internal audit standards. While a major audit finding may make the audit client uncomfortable, it certainly gives the auditor pleasure in knowing that the audit work. In addition, management’s assessment process is.

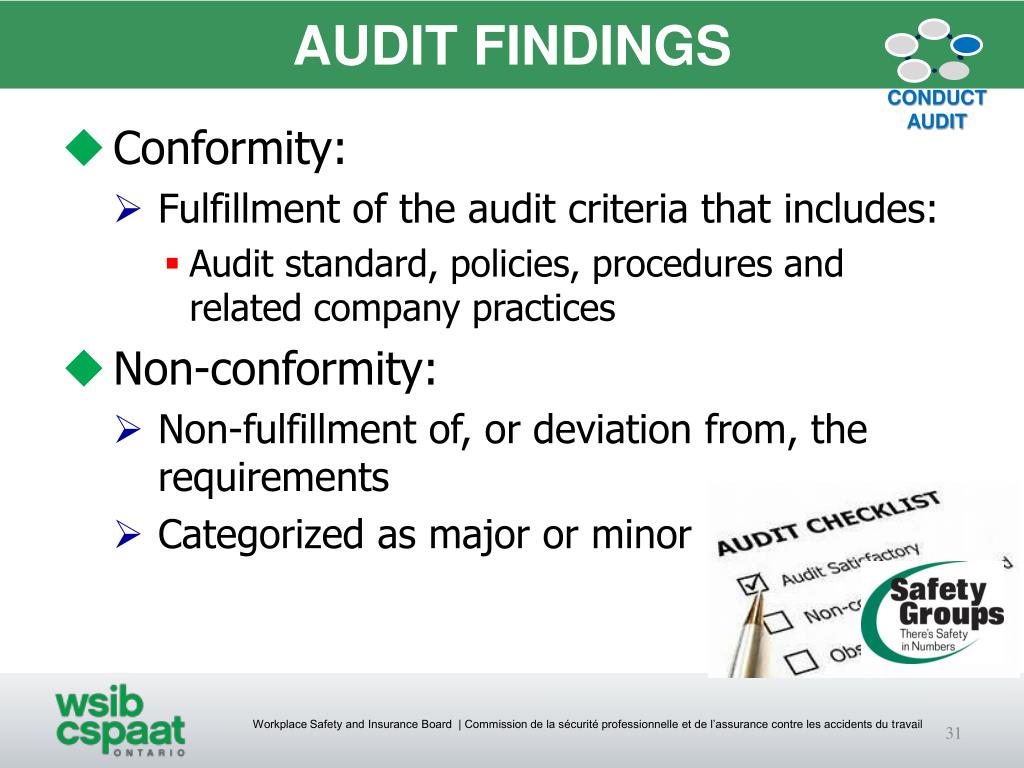

In addition to classifying the audit findings as conformity or nonconformity, audit findings can also be classified as observations or opportunity for improvements. A significant matter is a finding or issue that, in the auditor’s judgment, is significant to the procedures performed, evidence obtained, or conclusions reached. If any of the current deficiencies or significant deficiencies were also noted in the firm’s previous peer review(s), whether in the prior report or ffc, in either case, that fact should be identified by stating, “this deficiency was noted in the firm’s previous peer review.”.

Certification in risk management assurance. (2013) , cohen and laventis (2013) and setyaningrum (2017). The requirement in isa 701 relating to the description.

Significant audit findings are those conditions which in the judgment of the head of the audit could adversely affect the organization. (2) material noncompliance with the provisions of federal statutes,. The audit committee should also encourage a positive relationship

It demonstrates that the auditor is skilled, and the audit procedures and methods are sound, at least to some extent. Furthermore, participants were informed about matters that had been discussed internally in the management letter. Inadequate documentation one of the most frequent audit findings is insufficient documentation to support financial transactions and account balances.

These are all the possible approach to classifying audit findings i.e., conformity, nonconformity, observation and opportunity for improvement. Based on the company's compliance with the regulatory requirements and the accuracy of the data submitted, the findings of an audit can be classified into four. A good audit finding says a lot about the auditor and their audit process.