Impressive Tips About Most Common Financial Ratios

Price to earnings ratio (p/e) p/e ratio falls under the category of price ratio.

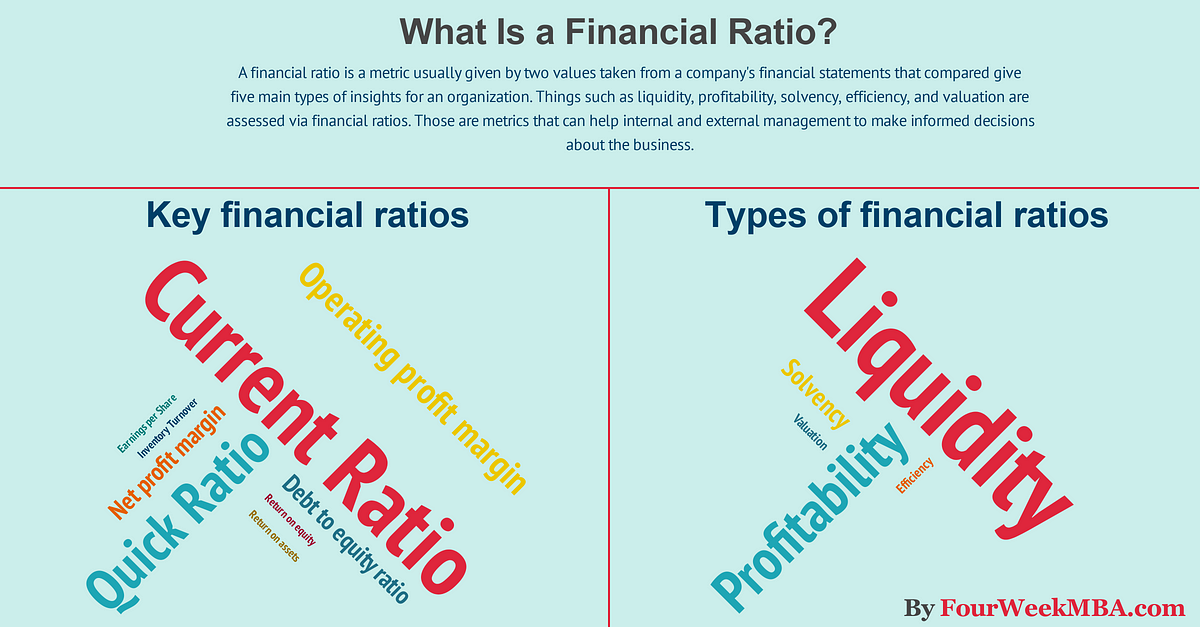

Most common financial ratios. They can also be used to compare different companies in different industries. Ratio analysis is a quantitative method of gaining insight into a company's liquidity, operational efficiency, and profitability by. 2) return on equity (roe) return on equity measures a company’s ability to generate earnings in relation to its.

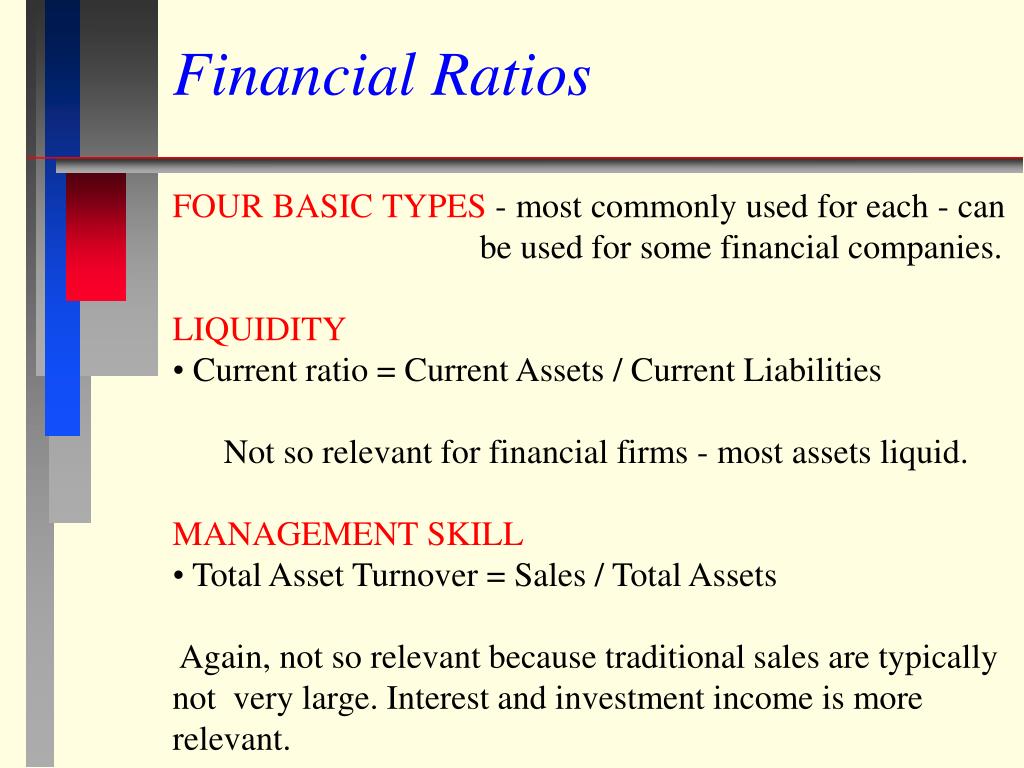

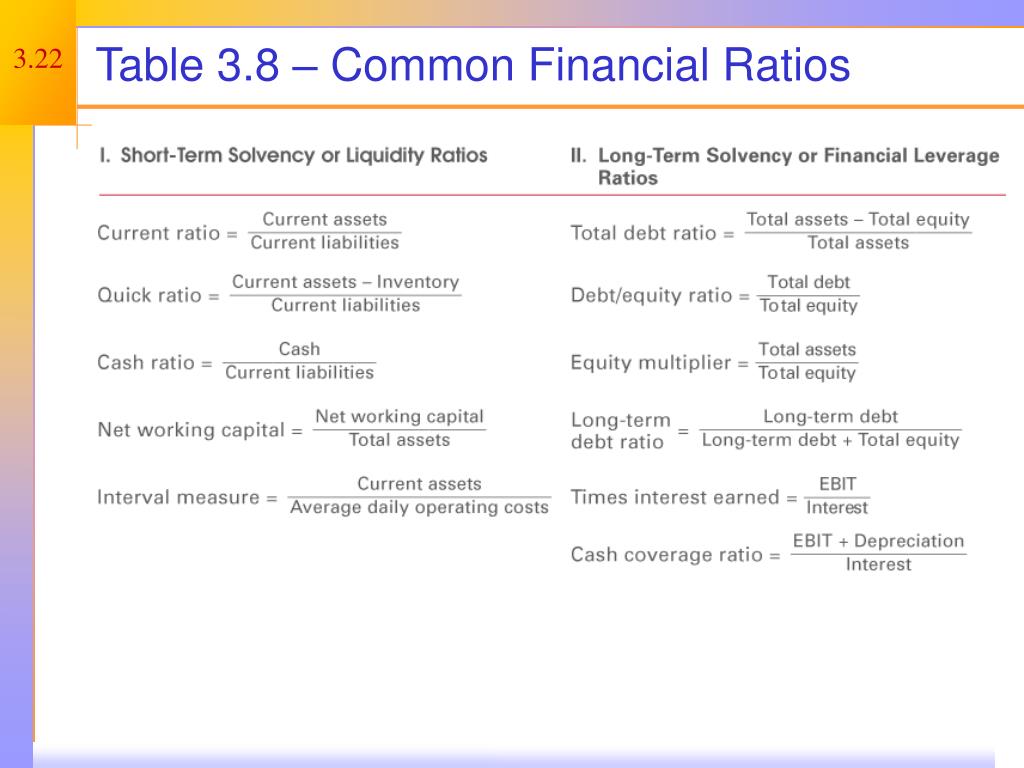

It's another measure of liquidity. Total asset turnover. 6 basic financial ratios and what they reveal 1.

The quick ratio is also called the acid test. Efficiency ratios measure how well the business is utilizing its assets and liabilities to create deals and earn profits. Financial ratios are common in accounting.

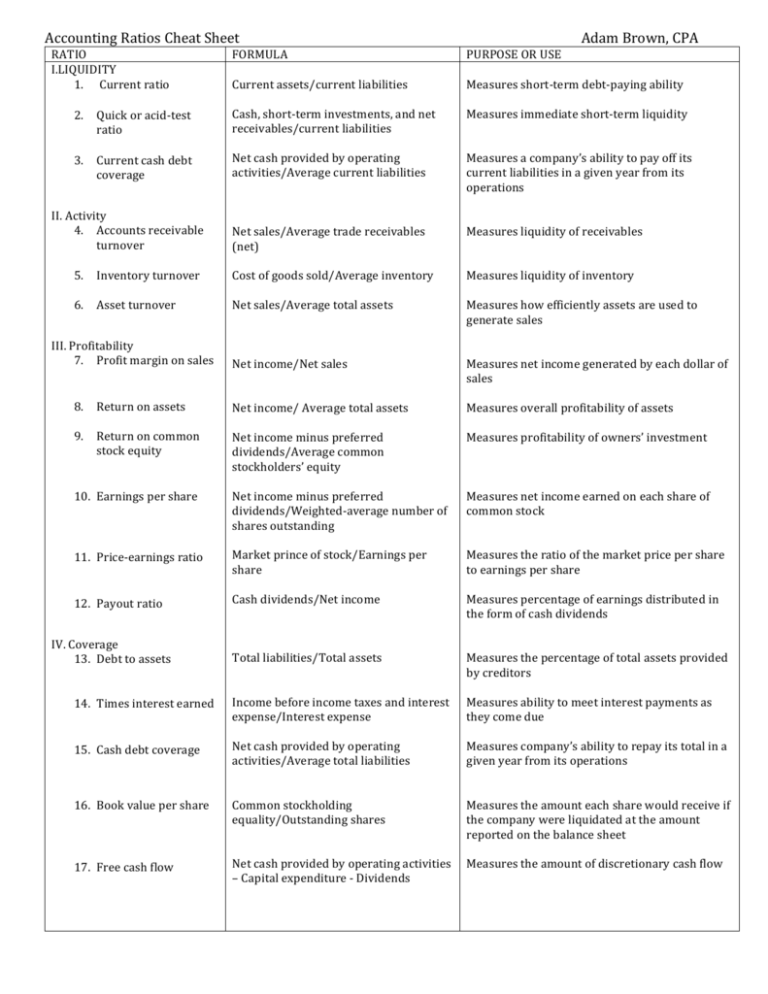

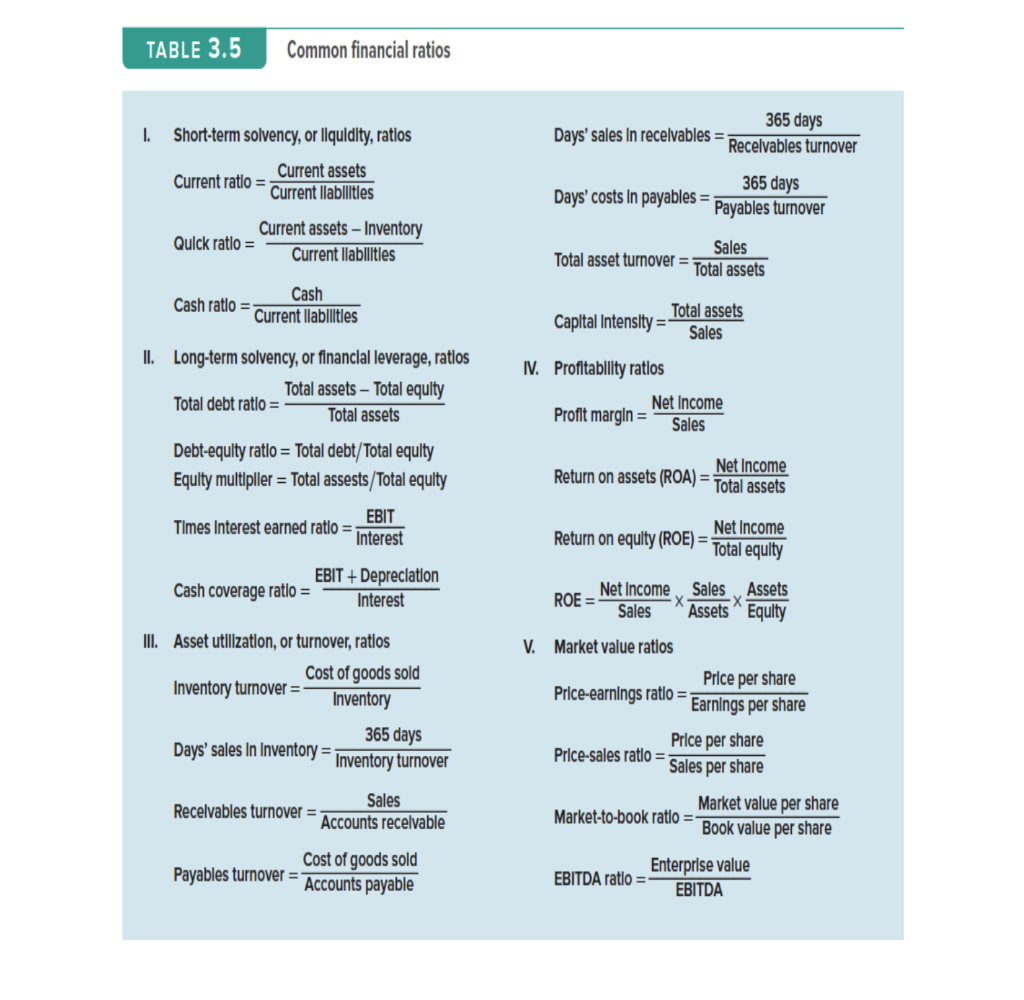

If you see too much, it's easy to. (investors might also refer to net profit as net income.) eps example: Here we discuss the top 5 financial ratios, including liquidity ratios, leverage ratios, activity ratios, profitability ratios, and market value ratios.

Total asset turnover is an efficiency ratio that measures how efficiently a company uses its assets to generate revenue. Different financial ratios indicate the company’s results, financial risks, and working efficiency, like the liquidity ratio, asset turnover ratio, operating profitability ratios, business risk ratios, financial risk ratios, stability ratios, etc. Financial ratios compare different line items in the financial statements to yield insights into the condition and results of a business.

Now that we have discussed the main types of ratios, let’s dive into the top 10 most popular financial ratios. The price per earnings ratio can help investors determine how much they need to. The handy financial ratios guide is organized by 6 types of financial ratios:

These ratios are used to compare a company to its peers and to the benchmark of an industry. The higher the turnover ratio, the better the performance of the company. 3) leverage, and 4) operating or efficiency—with several.

Financial ratios are the most common and widespread tools used to analyze a business’ financial standing. What financial ratio measures risk?. The p/e ratio is the price of a stock divided by its earnings and tells you the price you pay for every $1 of earnings.

These ratios are most commonly employed by individuals outside of a business, since employees typically have more detailed information available to them. List of financial ratios here is a list of various financial ratios. There are several standard ratios people use to evaluate the overall financial condition of a company.

Fact checked by michael logan what is ratio analysis? Assessing the health of a company in which you want to invest involves measuring its liquidity. Ratio definitions, calculations, interpretation, industry benchmarks, and.