Outstanding Info About Trial Balance Transactions

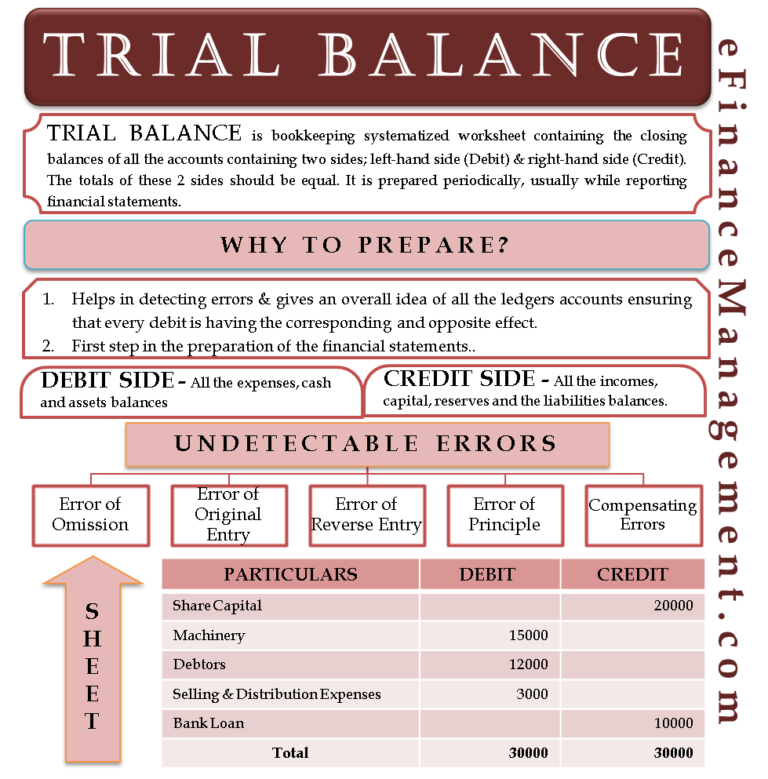

Let’s define a trial balance.

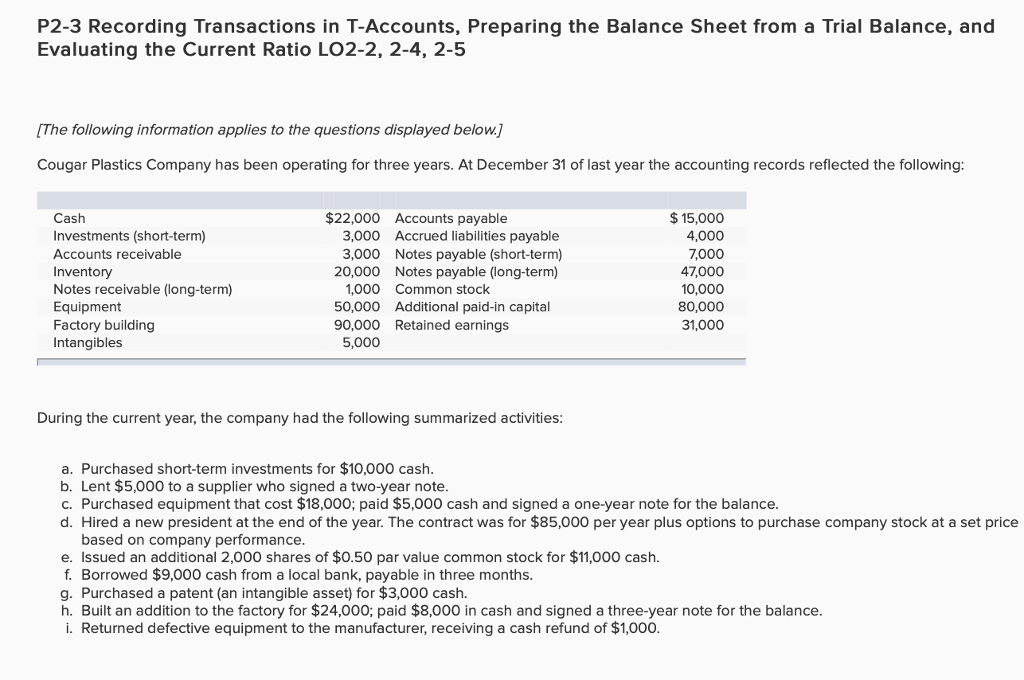

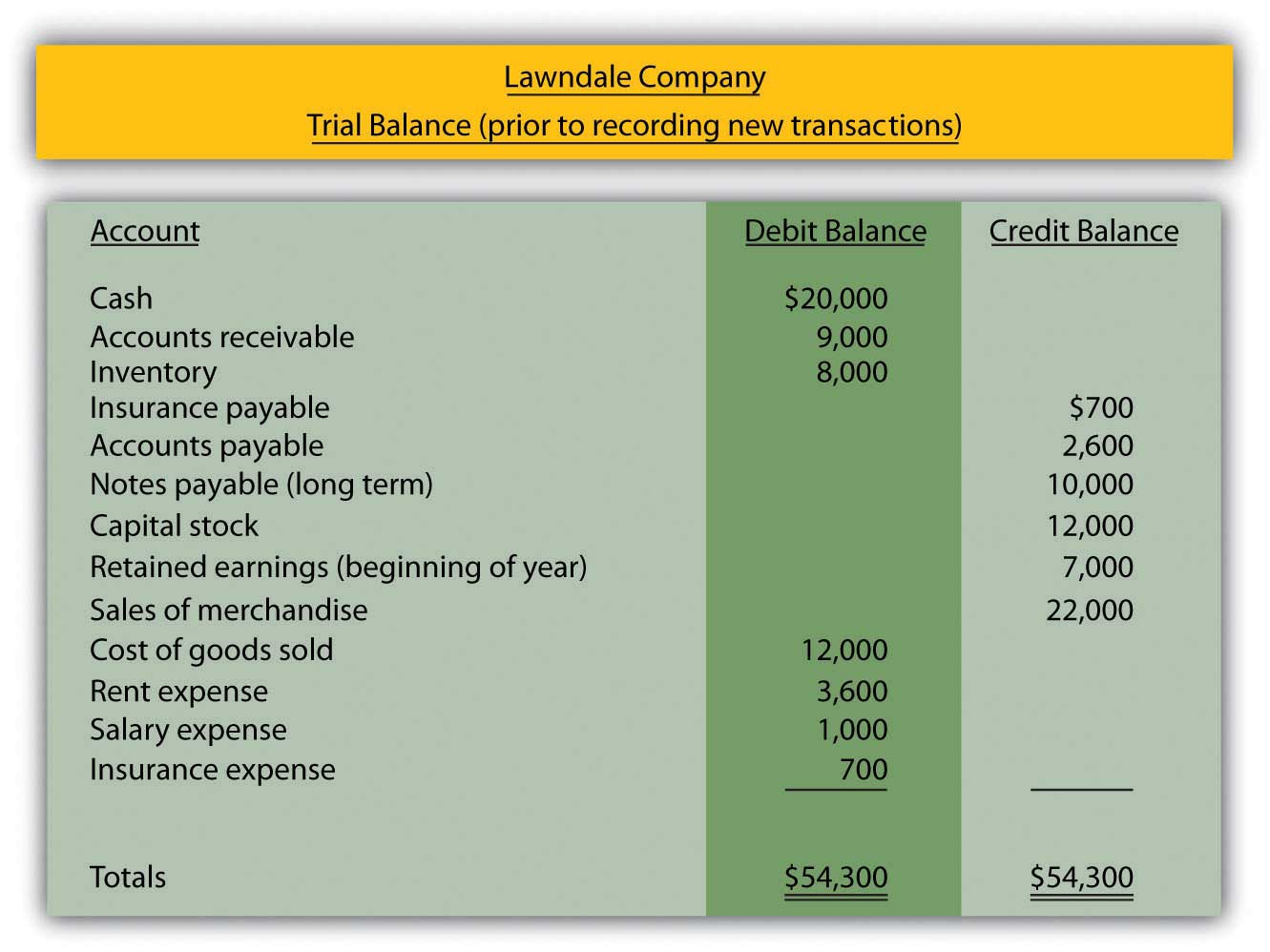

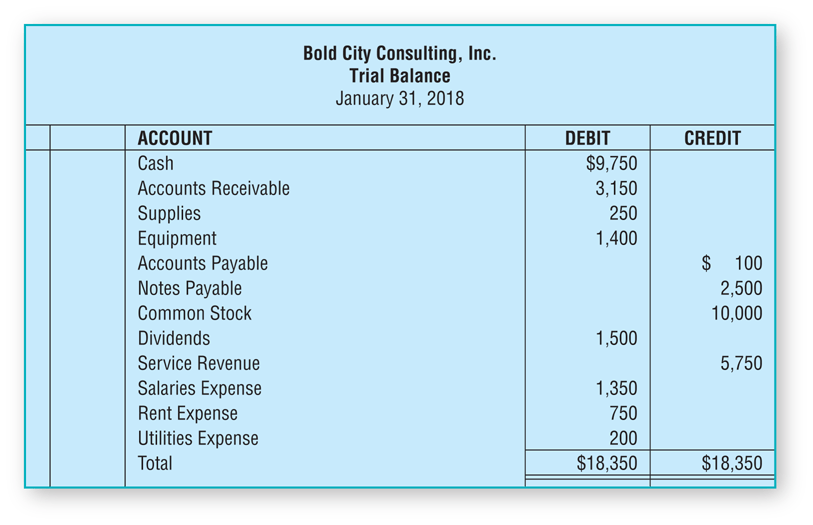

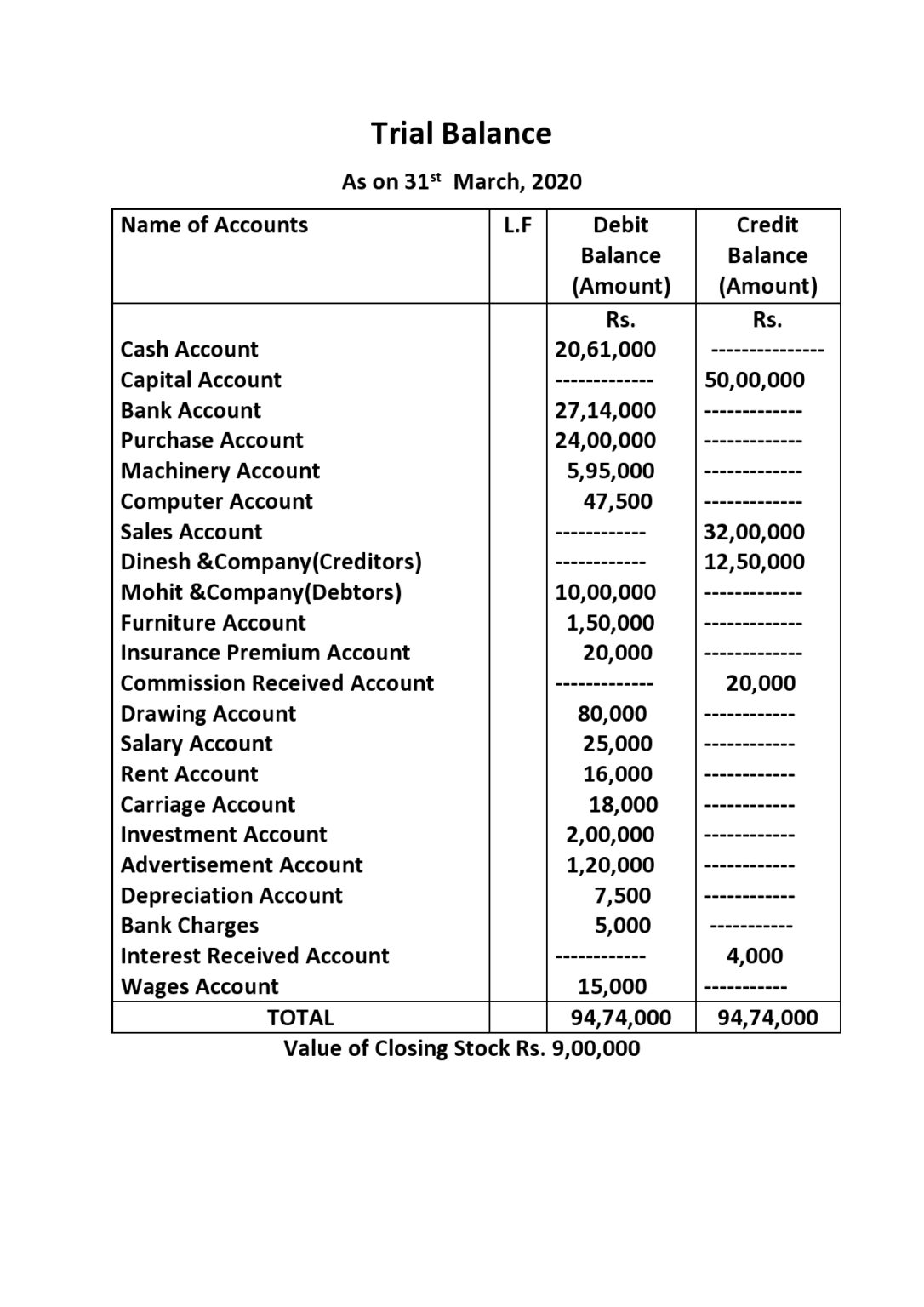

Trial balance transactions. Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company. A trial balance is simply a financial statement which depicts the. Suppose if the total of both debit and credit sides is not matching, then we have to check the journal.

A trial balance is a bookkeeping worksheet in which the balances of all ledgersare compiled into debit and credit account column totals that are equal. A trial balance is a financial report that lists a company's general ledger accounts closing balances at a certain period. A trial balance is a summary of all the transactions which took place within a specified financial period.

Understanding trial balance trial balance is a statement that lists all the general ledger accounts and their respective debit or credit balances. Trial balance is the first step in preparing the financial statements of any firm. A trial balance is a list of all accounts in the general ledger that have nonzero balances.

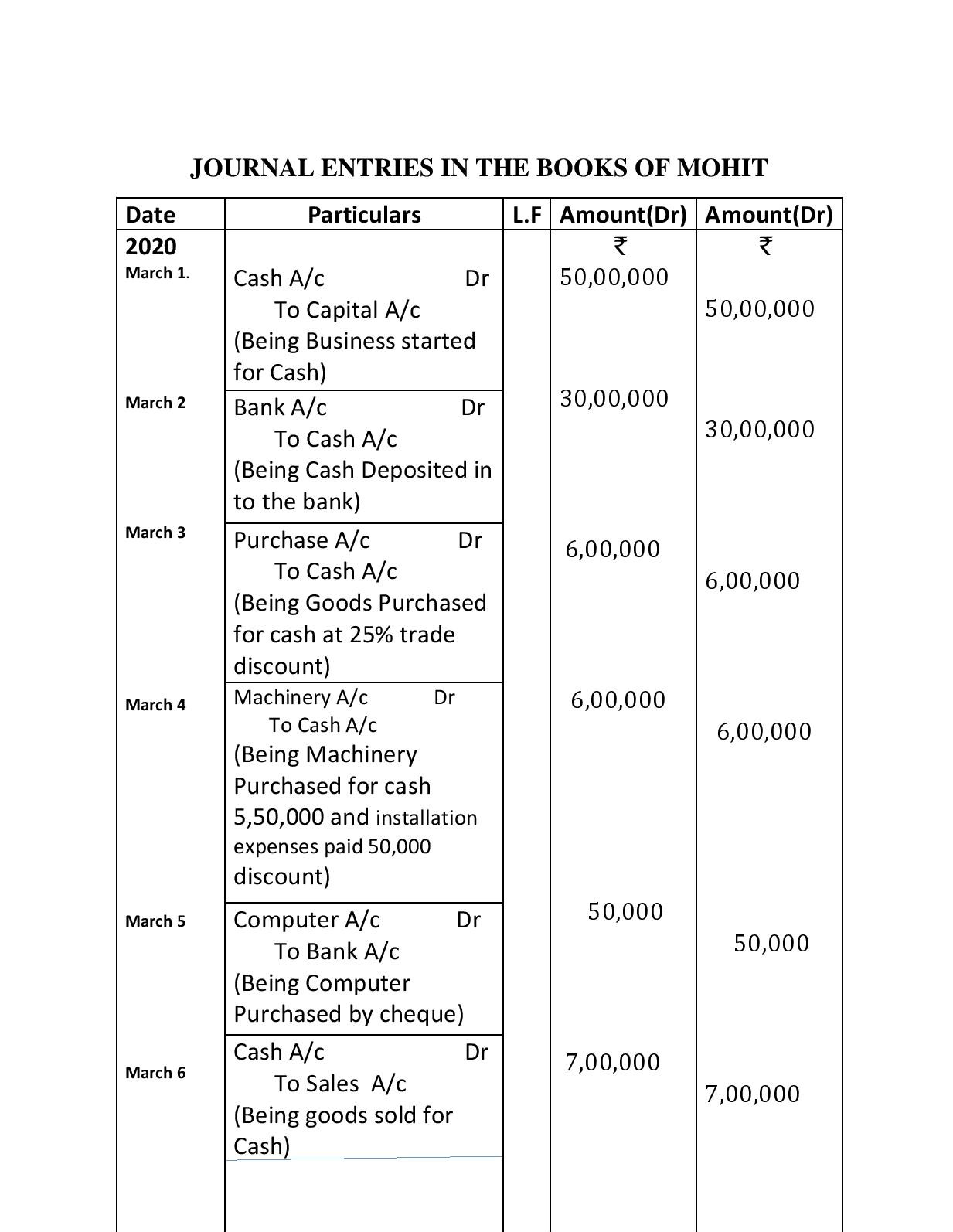

The general purpose of producing a trial balance is to. A trial balance contains accounts that. The trial balance with transactional detail report generates a trial balance and includes the detailed transactions that were posted to each ledger account.

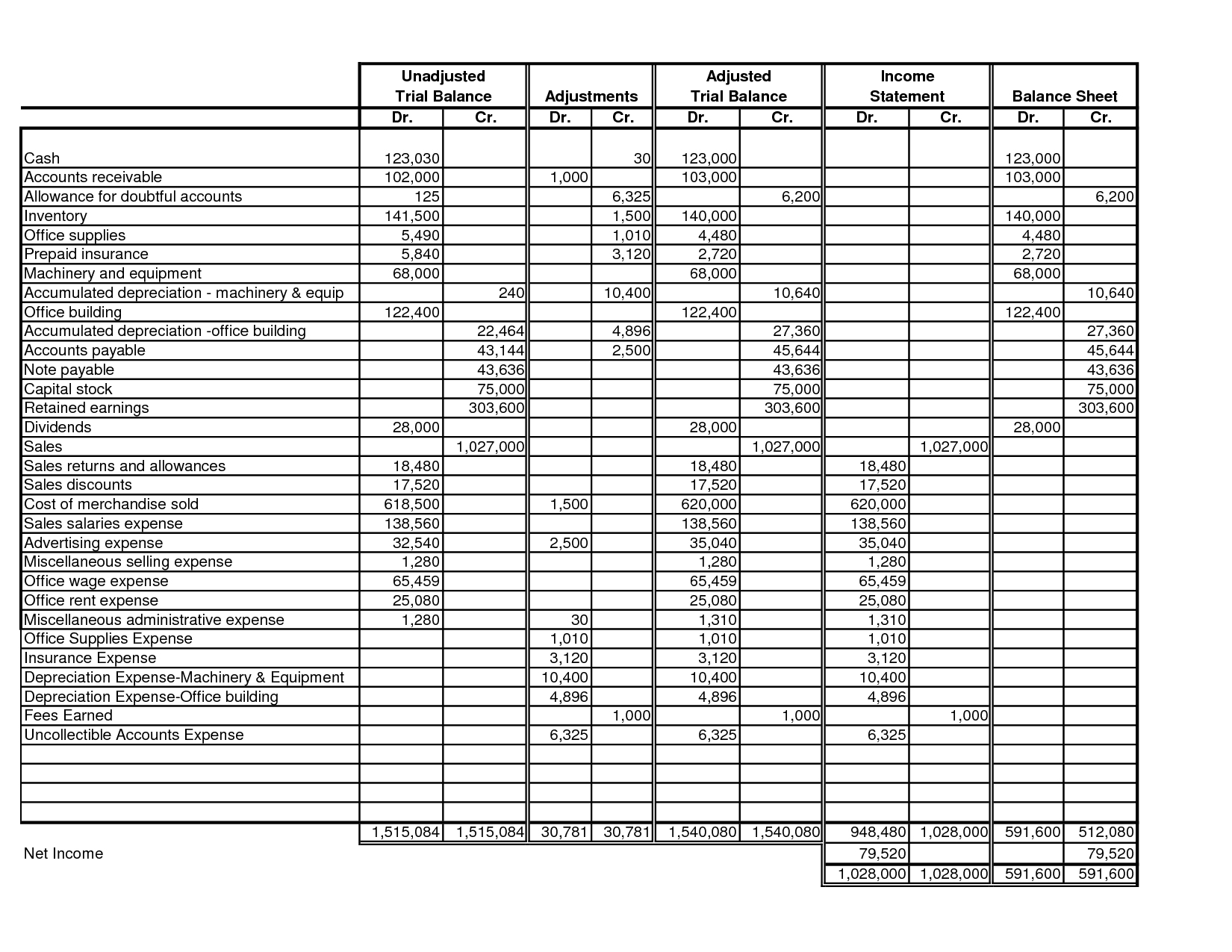

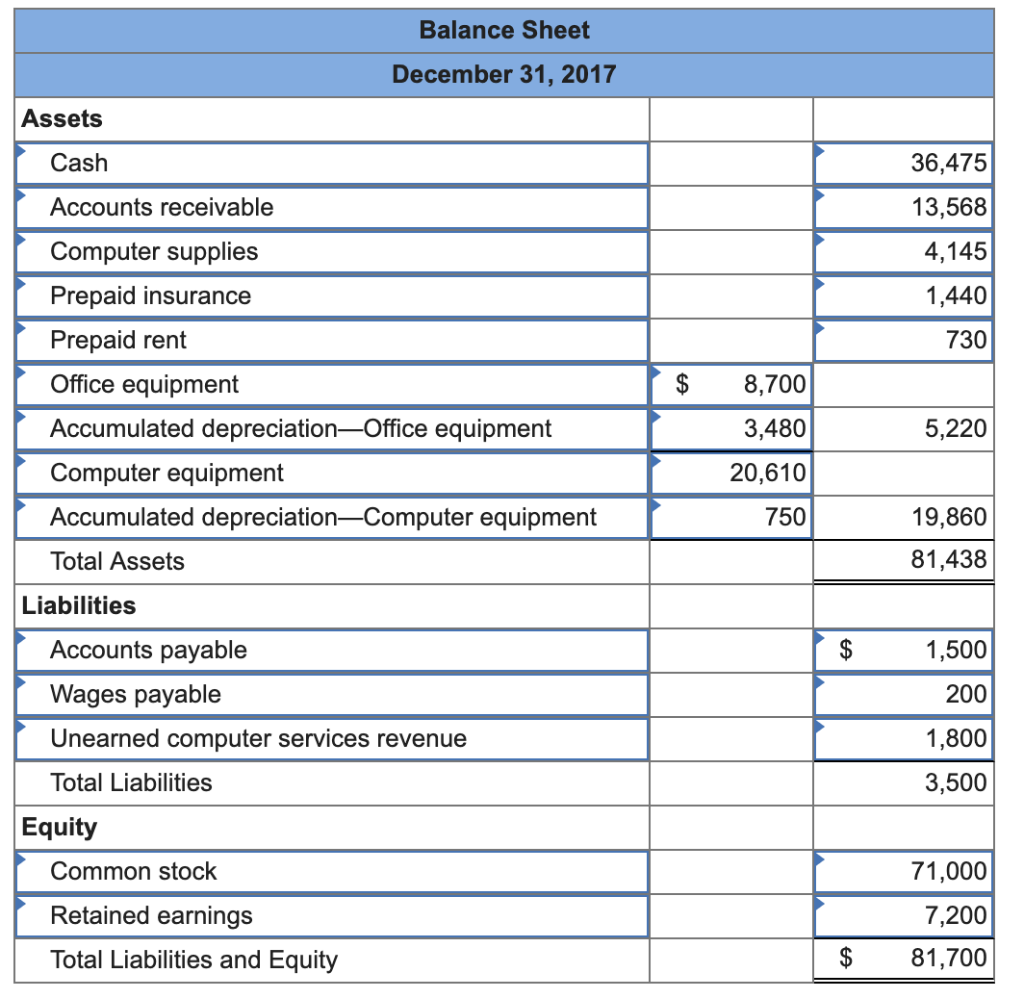

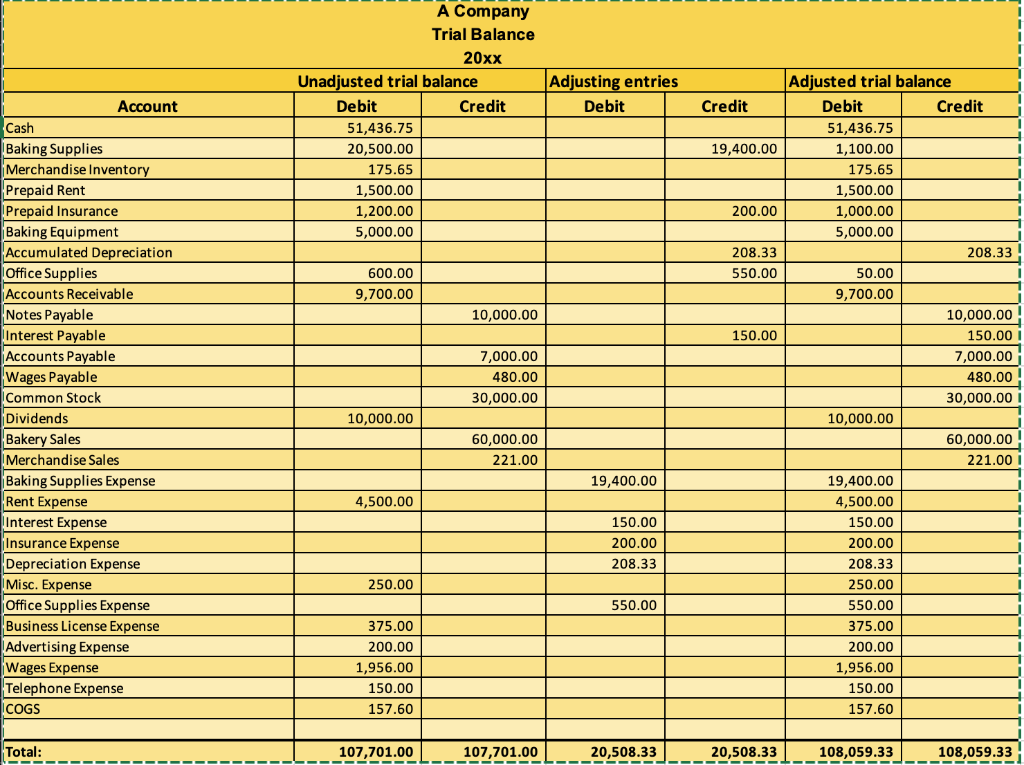

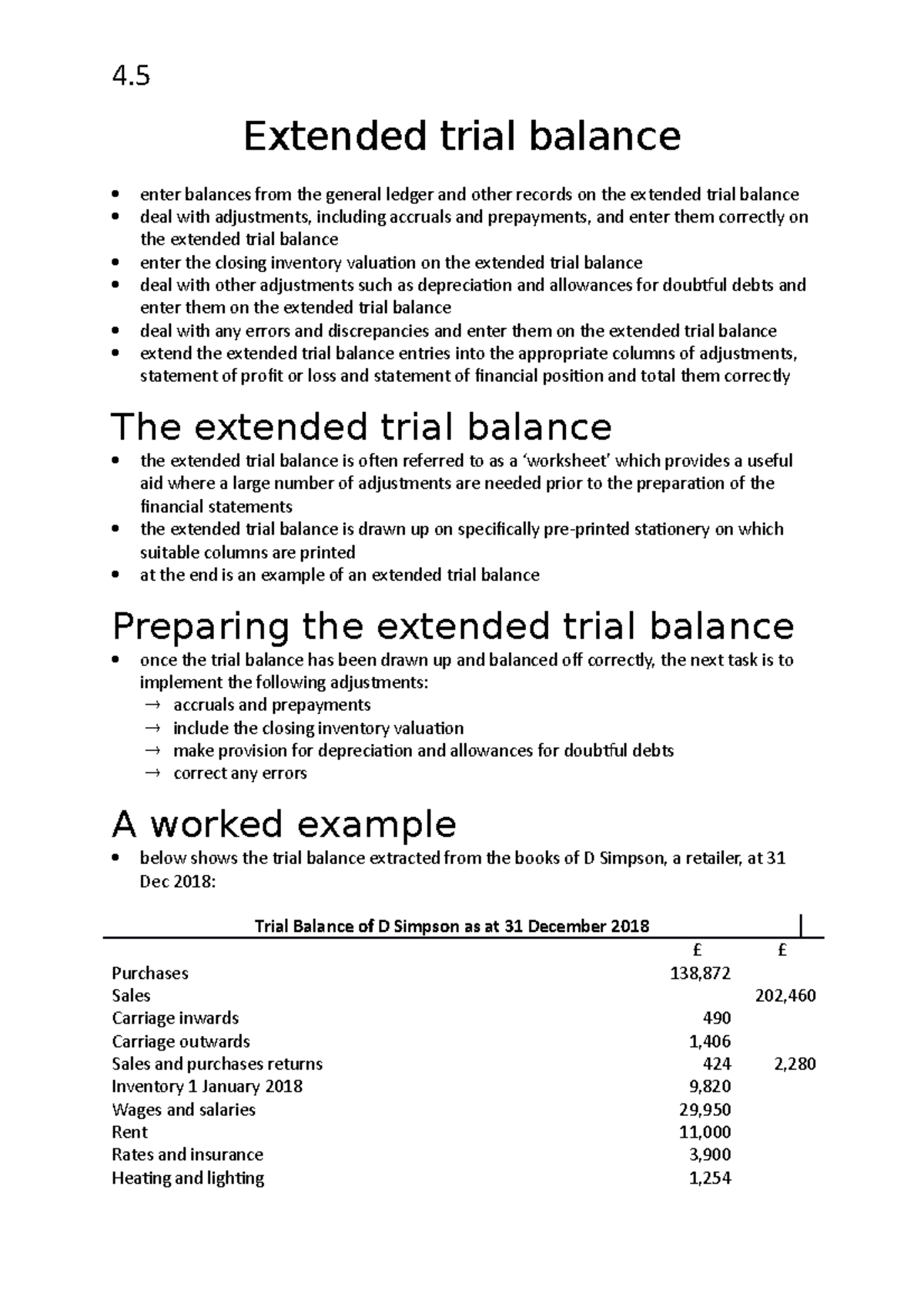

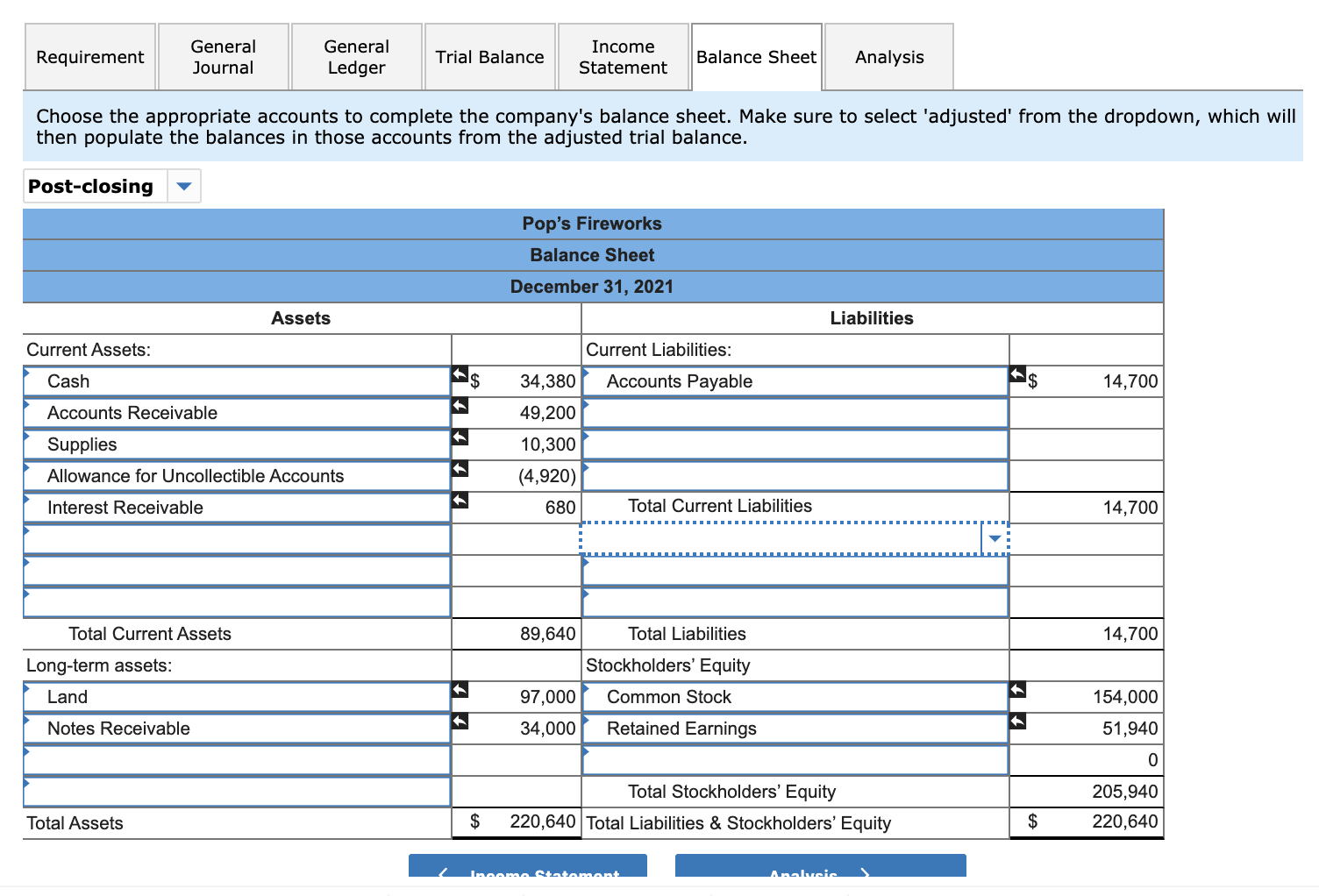

It is primarily used to. The five column sets are the trial balance, adjustments, adjusted trial balance, income statement, and the balance sheet. Let’s start with defining a trial balance and why it’s needed in accounting.

As discussed in the previous section, a trial balance is a list of all accounts in the general ledger that have balances. Preparing a trial balance is an important step in the. A company prepares a trial balance periodically, usually at the end of every reporting period.

A trial balance is a listing of the ledger accounts and their debit or credit balances to determine that debits equal credits in the recording process. The trial balance is not an account. It is simply a list of debit and credit balances assembled by the bookkeeper to prove the arithmetical accuracy of.

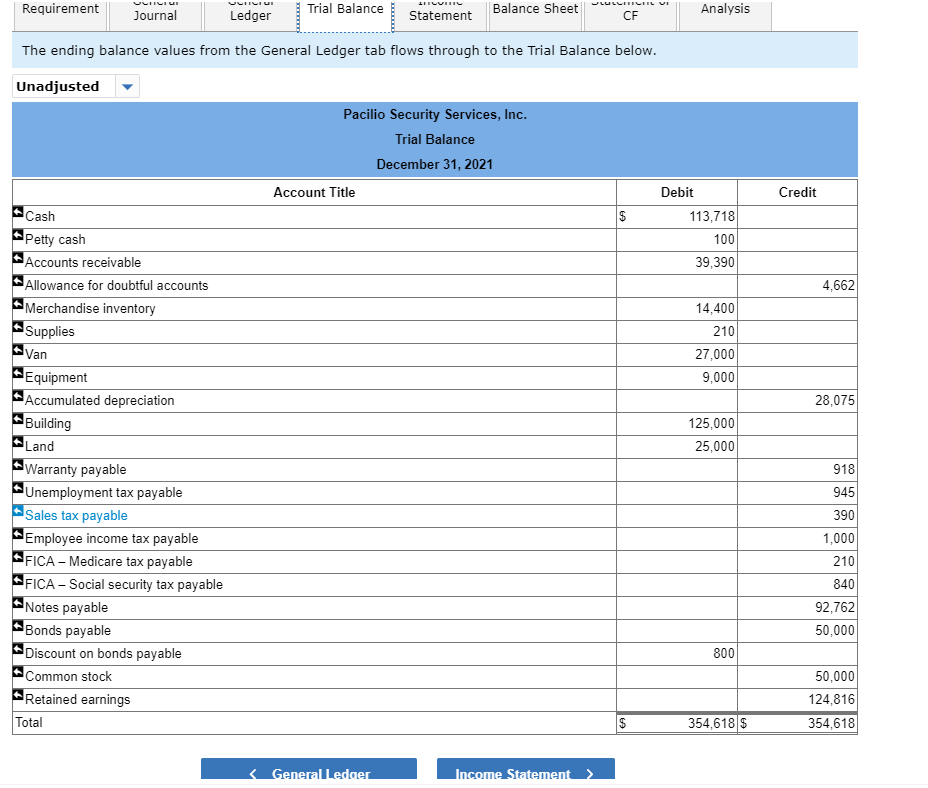

Preparing an unadjusted trial balance is the fourth step in the accounting cycle. A trial balance is a financial accounting document that lists. This statement comprises two columns:.

A trial balance is an accounting report used by business accountants during the accounting close process to ensure that all general ledger accounts have equal debit and credit.