Fabulous Tips About Trial Balance Of Accounting

The trial balance format is easy to read because of its clean layout.

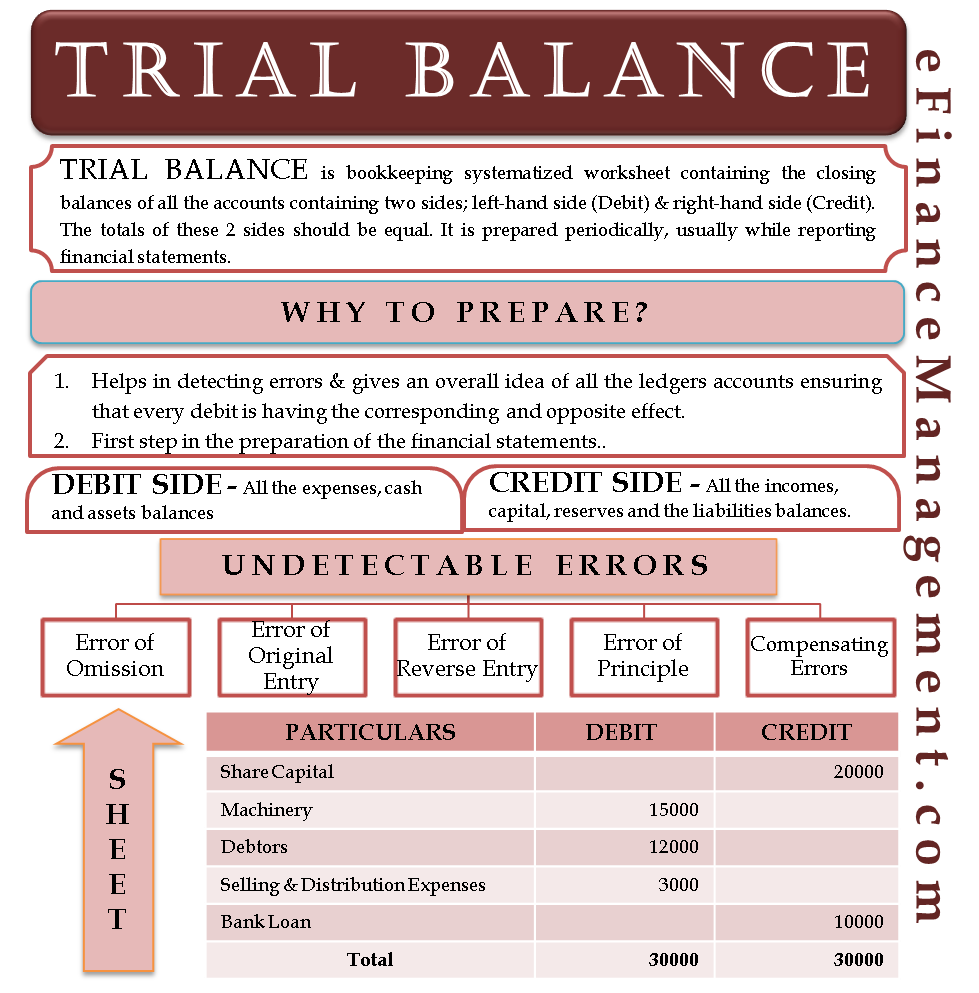

Trial balance of accounting. The form and content of a trial balance is illustrated. A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle. When the totals are same, you may close the trial balance.

The role of a trial balance in accounting is to help accountants detect some errors when total debits don’t equal total credits for all balance sheet accounts and income statement accounts (including revenues, costs, expenses, gains, and losses). Trial balance ensures that for every debit entry recorded, a corresponding credit entry has been recorded in the books. Preparing an unadjusted trial balance is the fourth step in the accounting cycle.

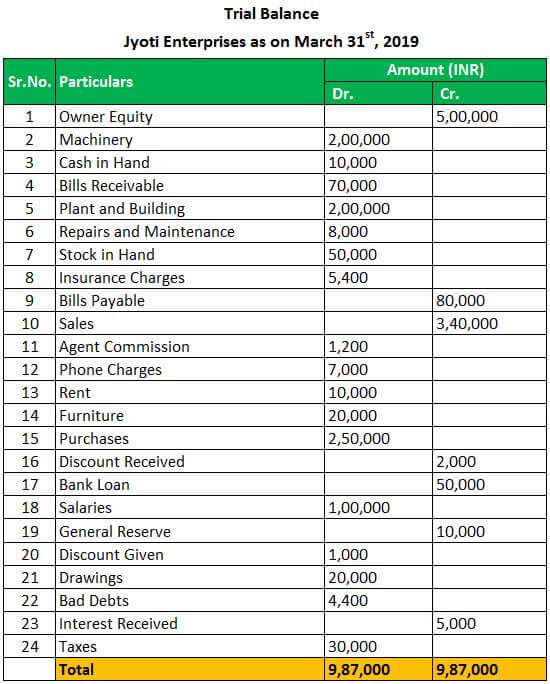

An organisation prepares a trial balance at the end of the accounting year to ensure all entries in the bookkeeping system are accurate. This statement comprises two columns: It is typically prepared at the end of an accounting period, such as a month or a year, to ensure that the total debit balances equal the total credit balances in the company’s ledger.

The result is a report that shows the total debit or credit balance for each account, where the grand total of the debits and credits stated in the report sum to zero. A trial balance in accounting is a foundational tool that validates the accuracy of financial records. This article is a guide to the format of trial balance.

A trial balance is a financial accounting document that lists the balances of all the general ledger accounts of a company at a specific point in time. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that should equal each other. A trial balance is a summarization of all journal entries made, aggregated by account.

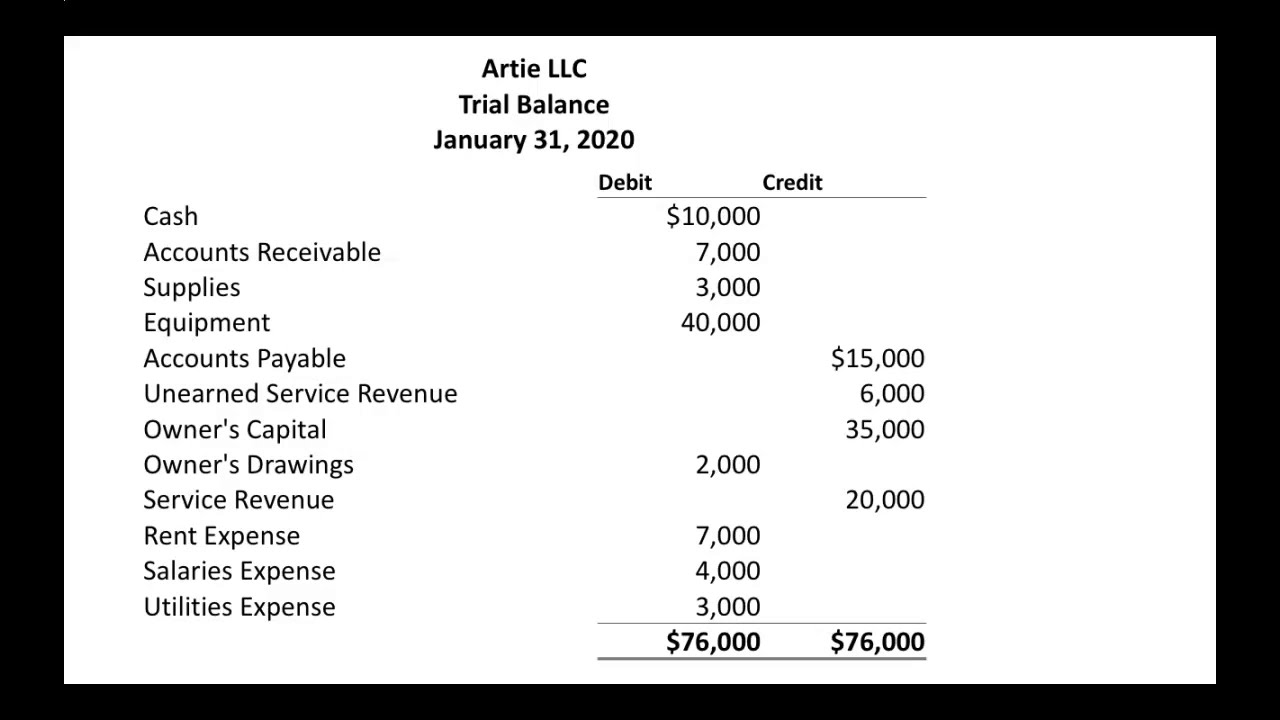

As per the accounting cycle, preparing a trial balance is the next step after. A trial balance is a bookkeeping or accounting report that lists the balances in each of an organization's general ledger accounts. Here’s an example trial balance.

It is the first step in the end of the accounting period process. Here are some instances of errors in the trial balance. A trial balance is a list of all accounts in the general ledger that have nonzero balances.

What is a trial balance? The trial balance is an accounting report that lists the ending balance in each general ledger account. Here, we discuss trial balance examples in excel and their purpose with a detailed explanation.

When the accounting system creates the initial report, it is. Trial balance trial balance format. Add up the amounts of the debit column and the credit column.

A trial balance, sometimes abbreviated to tb, is a list of all the account balances in the accounting records on a particular date. The trial balance is useful for checking the arithmetic accuracy and correctness of the bookkeeping entries. For example, utility expenses during a period include the payments of four different bills amounting to $ 1,000, $ 3,000, $ 2,500, and $ 1,500, so in the trial balance, single utility expenses account will be shown.