Awesome Tips About Interest In Financial Statement

The civil fraud ruling on donald trump, annotated.

Interest in financial statement. The authorities require him to list his spouse’s and. Trump was penalized $355 million plus interest and banned for three years from. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and.

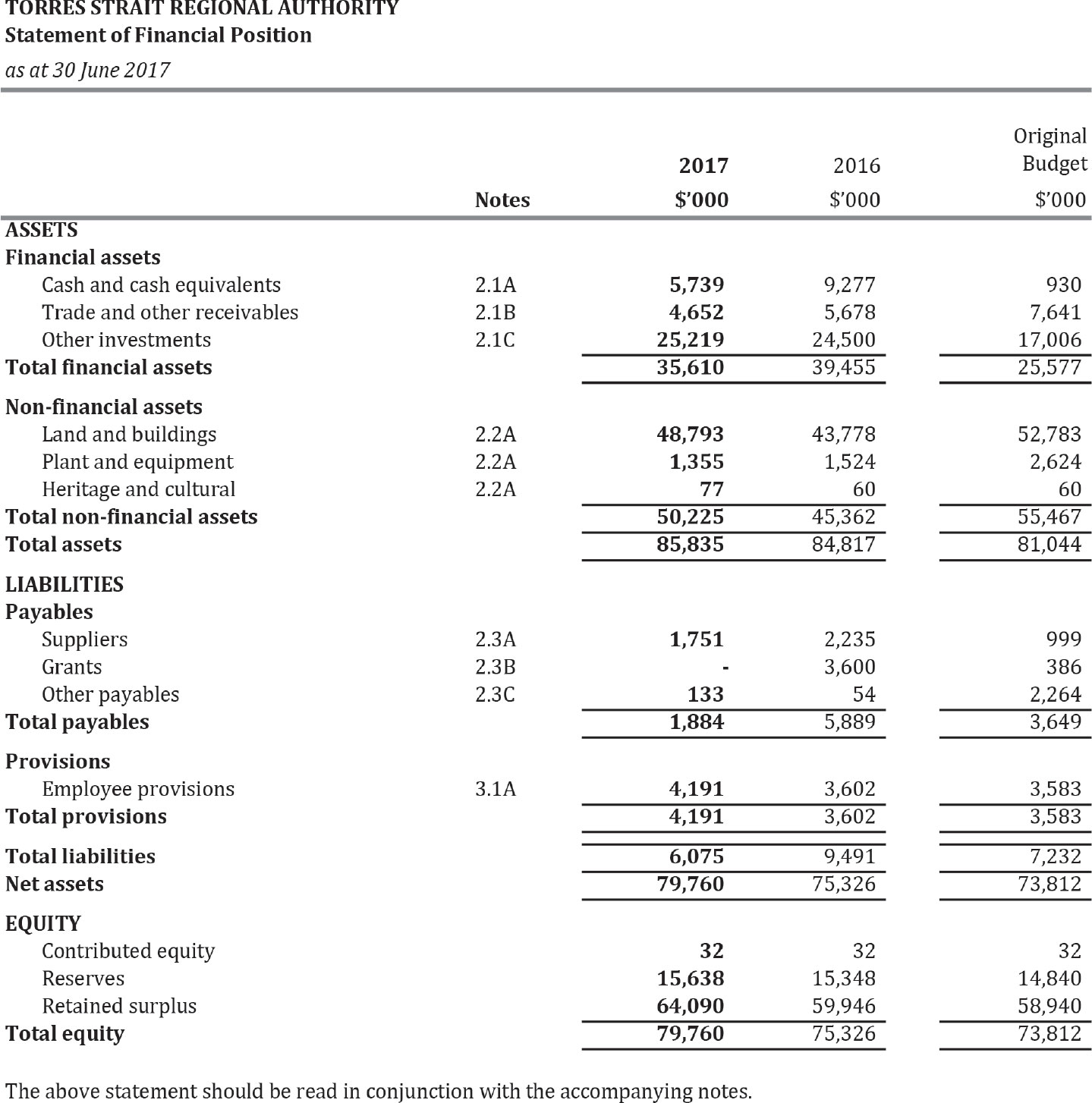

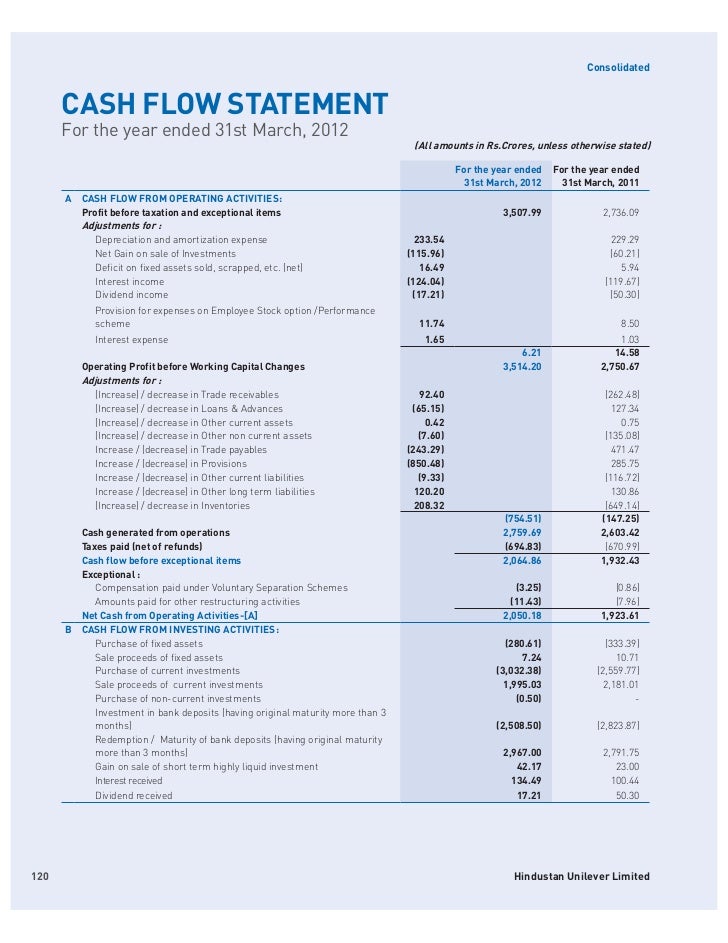

Statement of cash flows example. Earlier this month, australia’s central bank — the reserve bank of australia — decided to keep its main interest rate on hold at 4.35 per cent. (i) if an entity has interests in unconsolidated structured entities and prepares separate financial statements as its only financial.

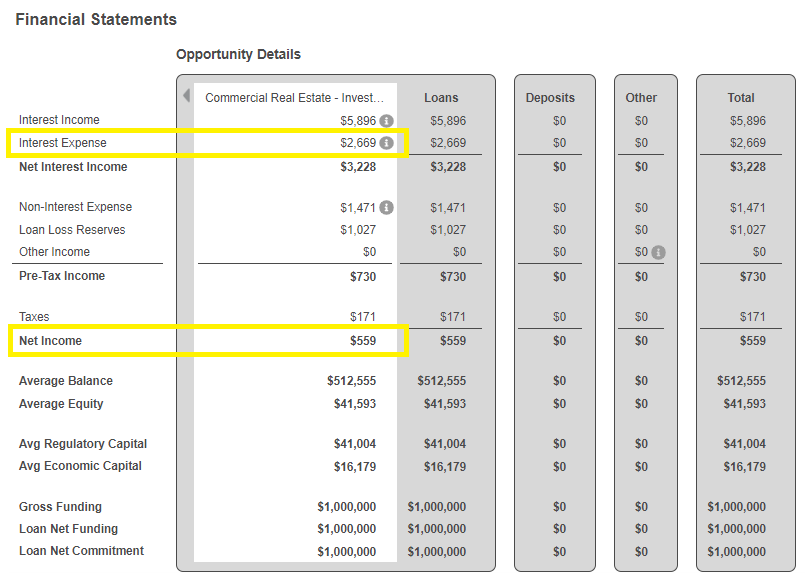

A is a public accountant. Some income statements report interest income and interest expense as their own line items. Usually, the two categories in the.

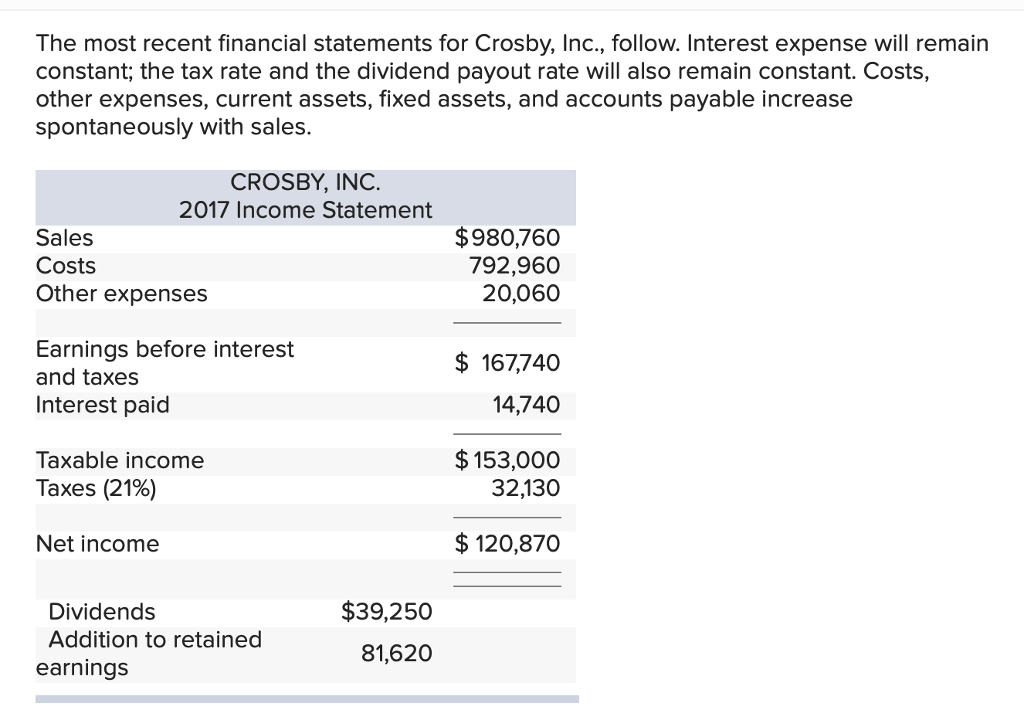

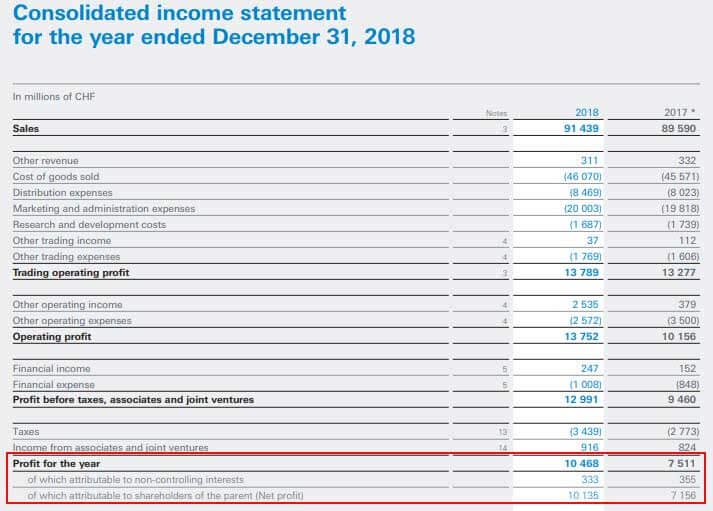

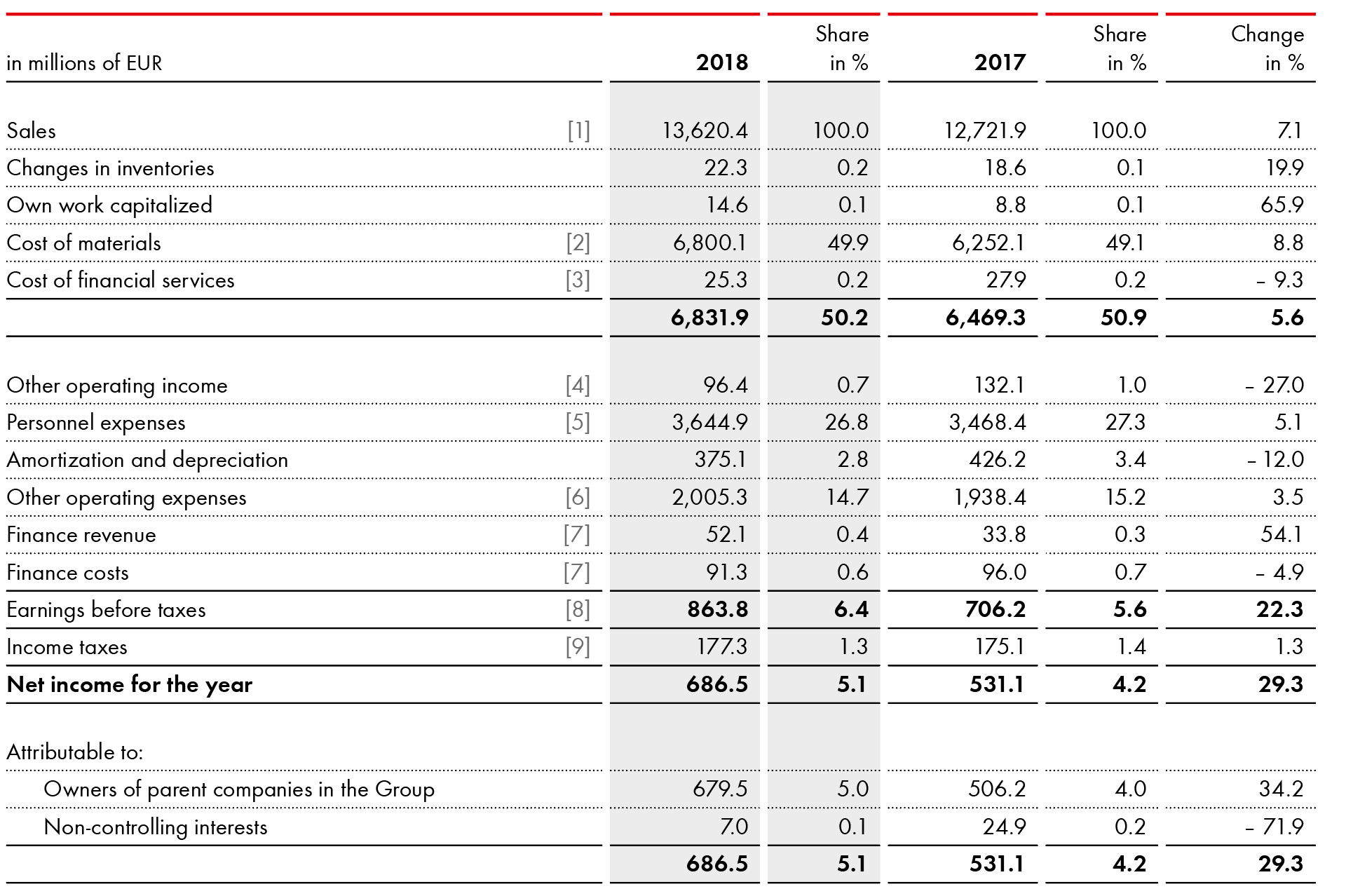

Interest is found in the income statement, but can also be calculated using a debt schedule. Below is an example of where interest expense appears on the income statement: Interest expense = interest rate (%) x [ (beginning + ending debt balance) / 2)] for example, if a company has a total of $100 million in debt at a fixed interest rate.

It is listed as revenue and current asset by the lender. Ebit, or operating profit, measures the profit generated by a company's operations. Accrued interest is listed as an expense on the borrower's income statement.

Others combine them and report them under either interest income. The schedule outlines all the major pieces of debt a company has on its balance sheet, and the balances on each period opening (as. See proposal at note 118 (“the commission received a number of comments raising concerns about the impact of affiliation, and anticipates proposing regulations that.

Our quarterly statement on monetary policy sets out the rba’s assessment of current economic and financial conditions as well as the outlook that the reserve bank board. By ignoring taxes and interest expenses, ebit identifies a company's ability. It is the p&l item and presents only.

Over the year, interest on the liability is accrued at the effective interest rate of 8.85%, giving the entry dr finance cost $867k, cr loan payable $867k. The following terms are used in this standard with the meanings specified: For example, a company has borrowed $85,000 at a 6.5% interest rate.

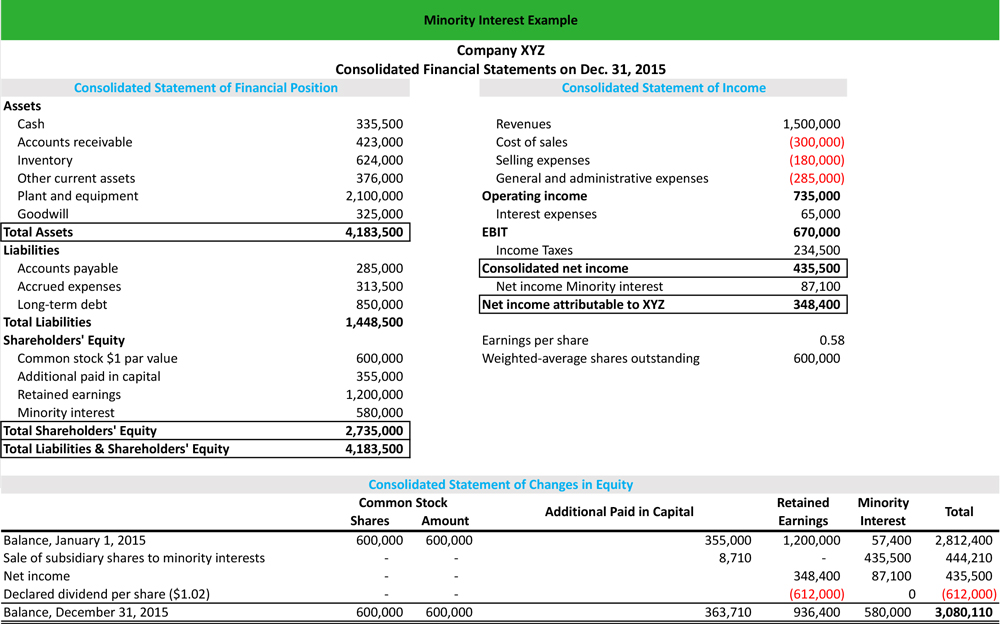

Engoron found that trump's statements of financial condition between 2014. Financial statement presentation of members’ or unitholders’ interests. Some examples to understand what is financial interest are discussed below:

The controller issues financial statements. They state that ifrs 7.b5 (e) requires an entity to disclose whether net gains or net losses on financial instruments measured at fvpl include interest or dividend. Interest income is usually taxable income and is presented in the income statement for the simple reason that it is an income account.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)