Out Of This World Info About Income Tax Website 26as

The rollover provision took effect beginning in 2024.

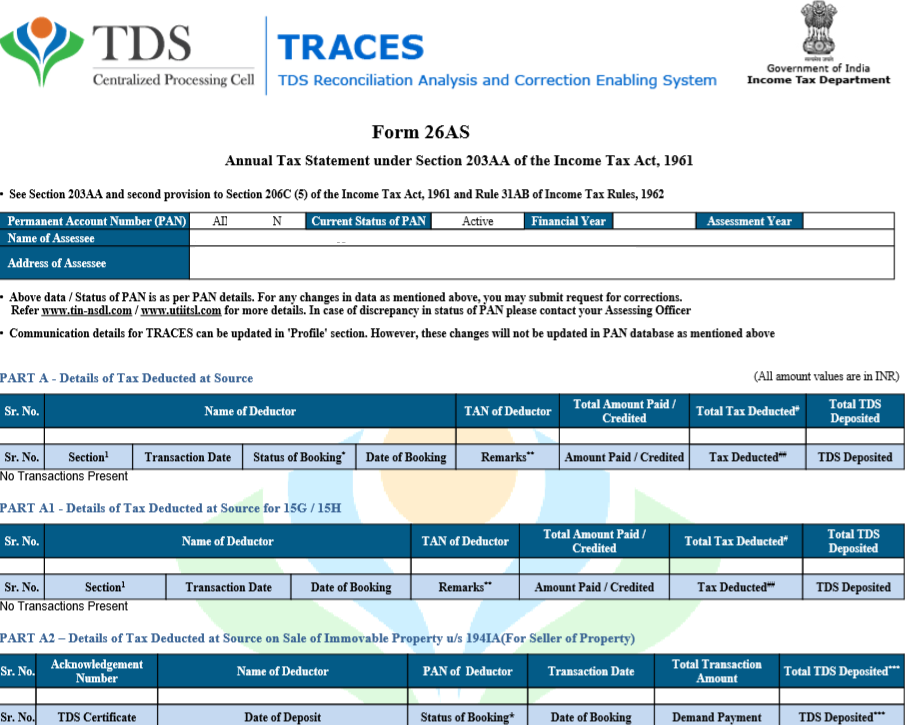

Income tax website 26as. The tax credit statement (form 26as) is an annual statement that consolidates information about tds, advance tax paid by the assessees, and tcs. Jeremy hunt’s plan to cut taxes has been given a boost after official figures revealed the government borrowed £9.2bn. Continue to the next step.

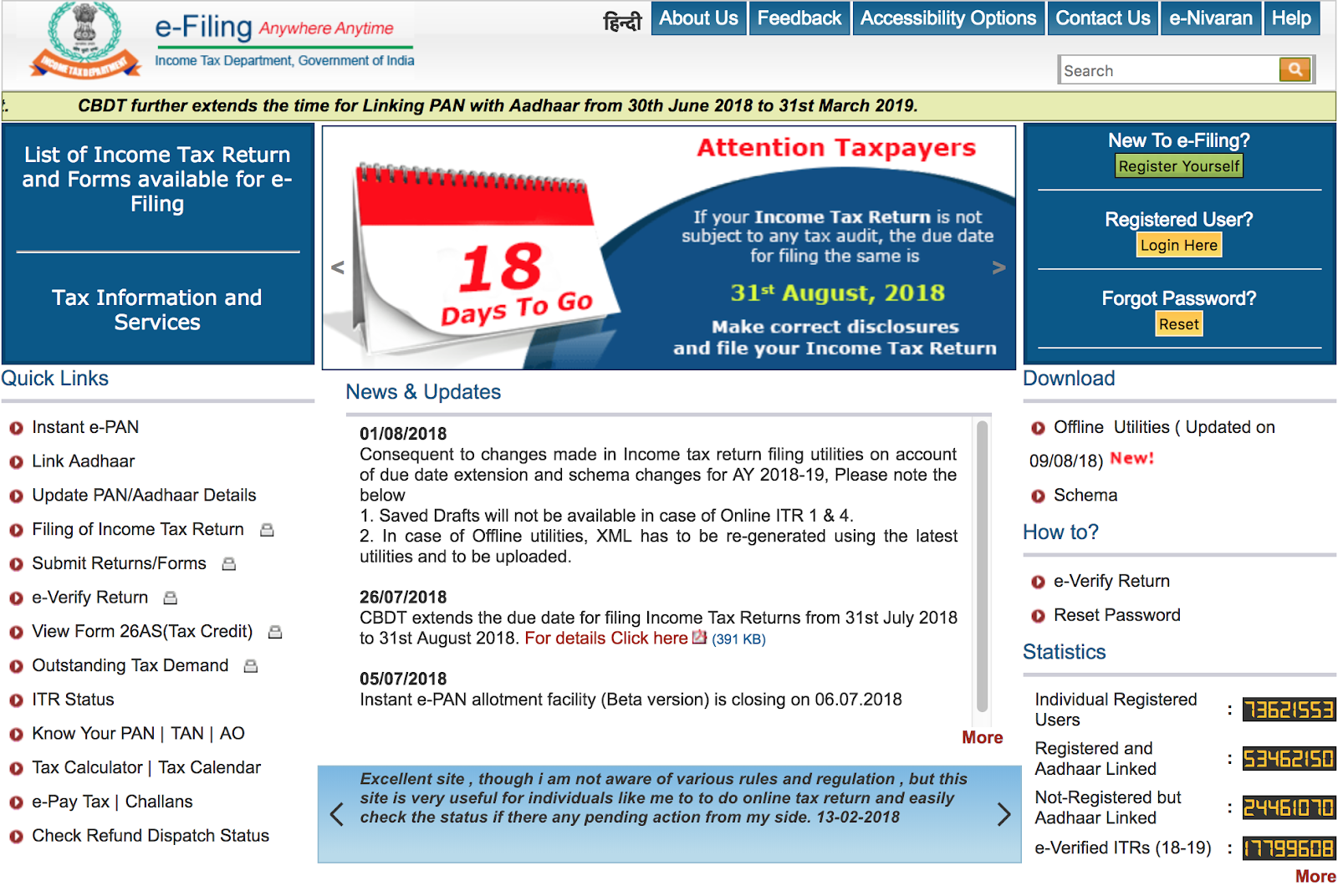

Visit the new income tax website. The following is a list of what form 26as includes: Yow will get redirected to traces website.

Form 26as is a consolidated tax statement that contains details of tax deducted at source (tds), tax collected at source (tcs), advance tax, and self. Select the box on the screen and click on ‘proceed’. The website provides access to the pan holders to view the details of tax credits in form 26as.

Click ‘confirm’ on the disclaimer to be. Form 26as can be viewed online. Szu ping chan 21 february 2024 • 11:11am.

Click on the link view tax credit (form 26as) at the bottom of the. If you are not registered with traces, please refer to our e. Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series.

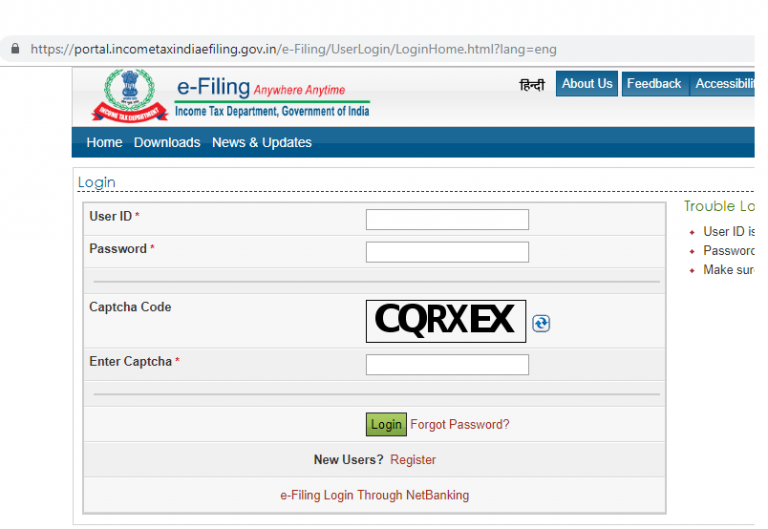

After logging into your account, the following screen will appear. Then click at the 'login' button at. The income tax website offers a download for this form.

Eligible outstanding direct tax demands have been remitted and extinguished. To download one's form 26as, the income taxpayer needs to log in at the new income tax website — www.incometax.gov.in. Form 26as is an annual consolidated credit statement that provides the details of the taxes deposited with the government by a taxpayer.

From the income tax website, this form can be downloaded. Here are some steps to easily download form 26as on the new income tax portal. Do not forget to check status of pan of the deductee.

The secure act 2.0 adds an option to roll over excess 529 funds to a roth ira tax free.