Fine Beautiful Info About Goodwill Impairment For Dummies

The goodwill and all other assets), which can lead to differences in the measurement of.

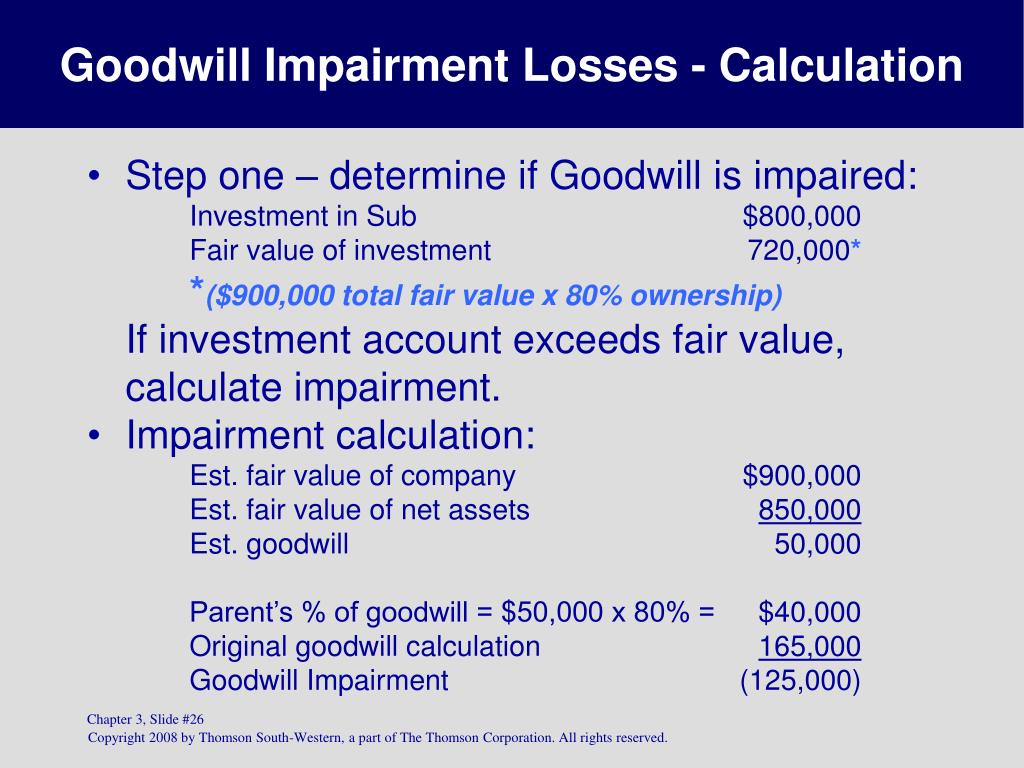

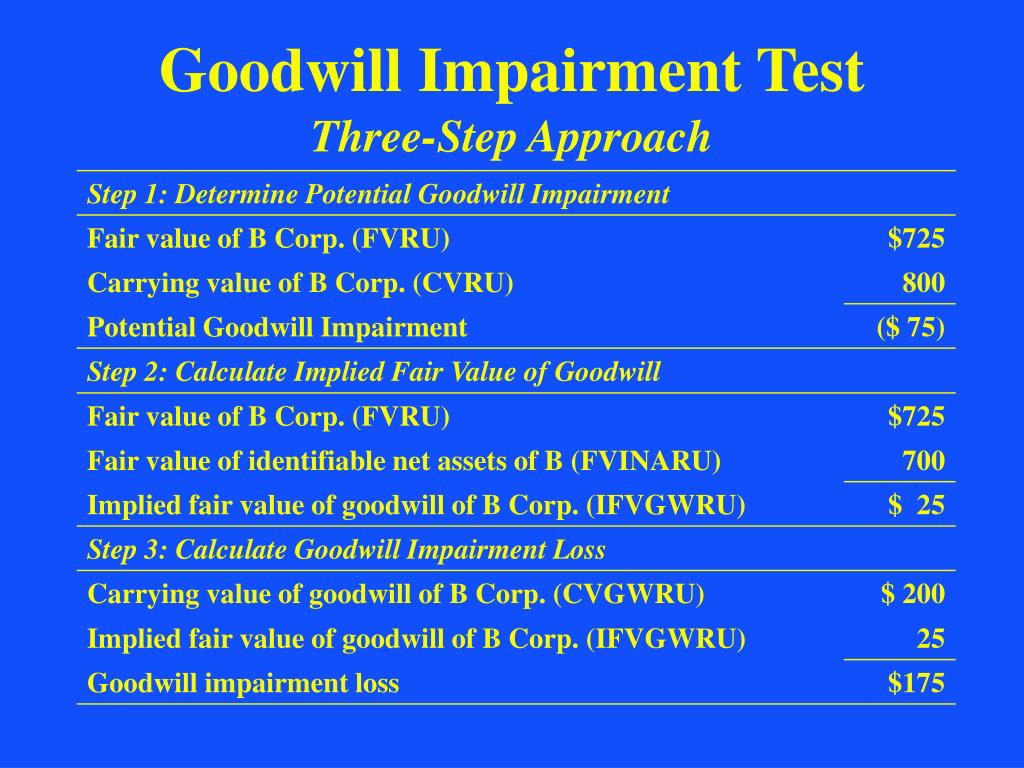

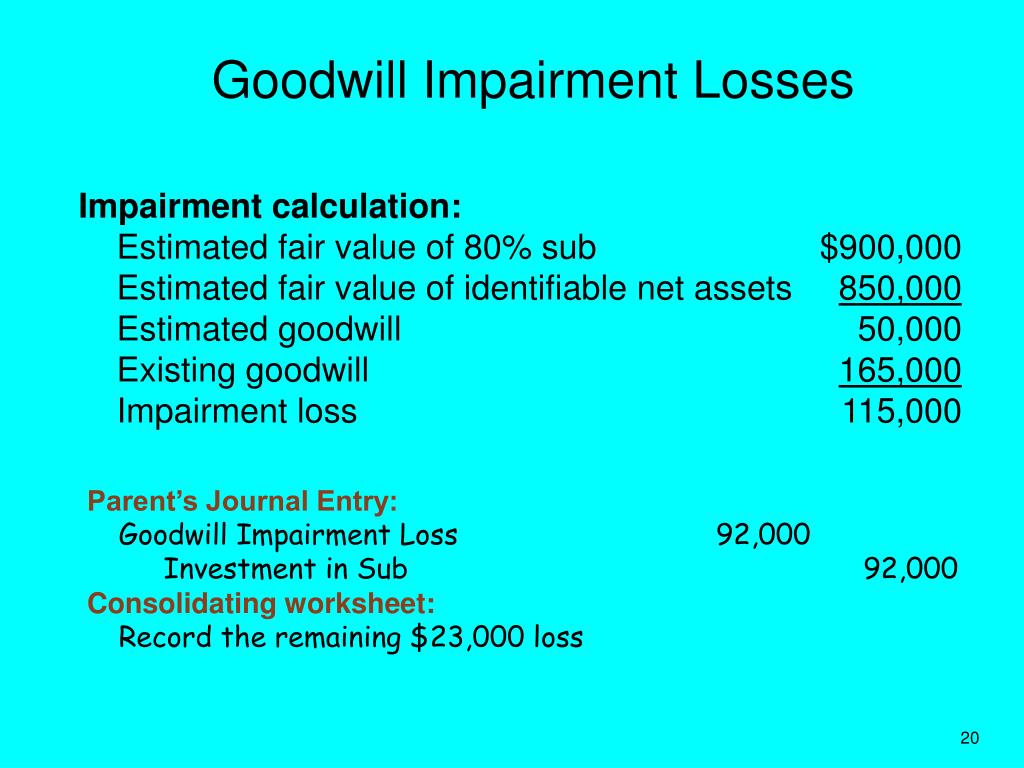

Goodwill impairment for dummies. Ineffectiveness of the impairment testing model for goodwill •acquired goodwill: An impairment loss takes place when a company makes a judgment call that the carrying value of an intangible asset on the company balance sheet is less than. If the value of goodwill declines, an impairment loss is recognized on the financial statements, impacting the company’s net income and equity.

Goodwill is tested for impairment only when there is a triggering event indicating impairment. The process of impairing or writing off goodwill is simply to remove the goodwill asset from the balance sheet, with the offsetting entry recorded in retained. If a company has goodwill, which comes into play during business combinations when one business purchases another for a price greater than the fair.

As a result, the recorded amount of a reporting. Current guidance under the current guidance, companies can first choose to assess any impairment based on qualitative factors (step 0). The recoverable amount of an asset.

The valuation is calculated as £2.5m turnover multiplied by 1.0 = £2.5m goodwill. Goodwill impairment occurs when the recorded value of goodwill on a company’s balance sheet exceeds its fair market value. Impairment of goodwill in accounting, impairment refers to the value by which the book value of an asset exceeds its recoverable amount.

Impairment of goodwill according to ifrs® 3, business combinations, there are two ways to measure the goodwill that arises on the acquisition of a subsidiary and each has a. Under ind as goodwill is no longer amortised but tested for impairment. How goodwill accounting has evolved.

You have to discount back the 1.4 multiple as this applies to a firm that is. Goodwill impairment occurs when a company decides to pay more than book value for the acquisition of an asset, and then the value of that asset declines. And •can be shielded from.

While entities have been required to test goodwill for.

.jpg?width=1194&name=GoodwillImpairmentTestingTables-03 (1).jpg)